Clear Blue Technologies International Inc. (TSXV: CBLU) (FRANKFURT:

OYA) (OTCQB: CBUTF) announces its financial results for the quarter

ended September 30, 2023 (“Q3 F2023”). A complete set of Financial

Statements and Management’s Discussion & Analysis (“MD&A”)

has been filed at www.sedarplus.ca. All dollar amounts are

denominated in Canadian dollars.

Q3 F2023 Financial

Highlights:

- Revenue was

$2,273,377, a 404% increase from $451,421 for the quarter ended

September 30, 2022 (“Q3 2022”), and up 202% from $752,325 in

the prior quarter (“Q2 2023”). Revenue was in-line with the

Company's October 5th, 2023 pre-announcement.

- Q3 revenue

represents a record level of quarterly revenue since Q1 2021,

notwithstanding the seasonality in the Company's business.

-

Recurring revenue was $195,315, a 37% increase from $142,940 in Q3

2022.

-

Gross Margin was 37%, up from 30% in Q3 2022.

-

Gross Profit for Q3 2023 was $850,588 compared to $135,575 for Q3

2022, a 527% increase.

-

Adjusted EBITDA was $33,187 versus $(987,427) in Q3 2022, a 103%

improvement from Q3 2022, and a record in the Company’s entire

operating history.

-

As of September 30, 2023, bookings were $2,914,882, an increase of

46%, when compared to $1,991,275 as of December 31, 2022, with

delivery anticipated over the next three years in the case of

Illumience/EaaS and typically in the next four to six months in the

case of production orders. Additionally, the Company booked another

$417,739 of sales in Q3 2023 that were also delivered in Q3

2023.

-

Cash at September 30, 2023 was $1,086,050 versus $853,330 at

December 31, 2022.

-

As of September 30, 2023, the Company has $3,900,304 millions of

available government funding, with $3,337,057 million receivables

in government grants, and $563,247 million receivables in the form

of a 10-year interest free loan to fund its plans going forward

over the next 3 years.

The third quarter of 2023 saw the Company’s

quarterly performance return to its pre-COVID trajectory of a

seasonally stronger second half,” said Miriam Tuerk, CEO of Clear

Blue. “These results were in line with our October 5

pre-announcement and we reported our first quarter of positive

EBITDA. We see similar demand building in Q4 2023 and beyond and we

have the balance sheet to continue our growth resumption.”

Trailing Four Quarter (“TFQ”) Financial

Highlights:

-

TFQ revenue was $3,466,183, a 15% decrease from $4,090,017 in the

corresponding previous period. The current period was impacted by

the economic downturn triggered by the macro-economic events of

early 2022.

-

TFQ recurring revenue was $751,351, a 2% increase from $736,969 in

the corresponding previous period.

-

TFQ Gross Profit increased 7% to $1,321,021 from $1,238,245 in the

comparable period.

-

Gross margin percentage increased to 38%, compared to 30 % in the

same TFQ period of 2022.

-

TFQ Adjusted EBITDA was $(2,618,881), a 31% reduction from

$(3,792,410) in the previous period.

Q3 F2023 Operational

Highlights

- In the quarter

the Company shipped 920 power control devices across 18 orders, a

quarterly record for units shipped;

- Further to its

September 20, 2023 news release, Clear Blue has completed its

previously announced amendments to certain of its unsecured

convertible debentures in the aggregate principal amount of

$4,334,000 and additionally completed its shares for debt

transaction with an arm's length lender;

- Opened a new

manufacturing facility in Sweden for our Esite product;

Subsequent Events

- On November 21,

2023, the Company announced an alliance partnership with Watt

Renewable. As part of this alliance, Clear Blue received an initial

order for 160 systems for a total purchase price of $1.58 million.

This order is expected to ship in Q4 2023 and Q1 2024.

Outlook

Management expects Q4 2023 revenue to be between

$1.8 million to $2 million, with the low end of this range

occurring in the event that some suppliers slip their scheduled

shipments from Q4 2023 into Q1 2024. Gross Margin, expenses, and

net income will generally be in line with previous quarters.

Heading into 2024, the Company sees several

exciting market trends that support continuing strength in the

Company’s sales funnel. Some of our existing partners have solid

volumes forecasted for next year with supportive financing – which

bodes well for our forecasted sales volumes of our Nano-Grid

product in 2024. Supporting our strongest ever sales funnel is

management’s cash-centric focus. Revenue growth, net-zero cash burn

and positive EBITDA are still our objectives for the rest of the

year.

Of the $2,914,882 in bookings as at the end of

Q3, we expect to recognize 76% as revenue over the next 12 months.

The large order announced with Watt Renewable will now be mostly

delivered in Q1 2024 due to timelines of supply chain and the

Christmas shutdown. Some of the order will also be delivered in Q4

2023.

Operationally, our product line has never been

more robust due to the eSite acquisition as well as bringing to

market three new products in the last 12 months, which

significantly expands our addressable market. The sales funnel

shows strength in all markets, with all our products, and we expect

this to contribute to the Company’s revenue for the remainder of

2023 and for 2024. Our Illumient lighting product is seeing solid

demand and growth. CBT regularly undertakes detailed design and

engineering prior to orders being received, and while annual

budgets need to be confirmed by the buyers, the slate of projects

for 2024 is quite strong, giving us comfort that we will see strong

growth for the product next year.

Esite-Micro is also going to strongly contribute

in 2024 and could contribute over 50% of our total revenue for the

year. We have 8 large customers who have adopted the new

Esite-Micro product which integrates Esite’s unparalleled power

electronics with Clear Blue’s industry leading Smart Power

management services. As the telecom industry aggressively moves

their install base away from diesel generators and towards solar,

investments being made are significant and Clear Blue’s leadership

in Smart Power solar and hybrid systems allows us to deliver

unparalleled performance for these migrations. Indeed, there are

some large conversion programs being planned for 2024 within the

market and Clear Blue is in a strong position to win a good portion

of this business. While nothing is assured at this point, the

opportunity is maturing in our sales funnel and could have a large

impact on 2024 and 2025 revenue.

In summary, management is pleased with our

progress since the start of fiscal 2023. The remainder of 2023 is

expected to deliver solid results, and we look forward to showing

strong growth into 2024.

Conference Call

Clear Blue will host a conference

call Thursday at 11:00 a.m. Eastern Time, to review the

Company's performance and answer questions. Those interested can

register here.

For more information, contact:

Miriam Tuerk, Co-Founder and CEO+1 416 433

3952investors@clearbluetechnologies.com

www.clearbluetechnologies.com/en/investors

Nikhil Thadani, Sophic Capital+1 437 836

9669Nik@SophicCapital.com

About Clear Blue Technologies

International

Clear Blue Technologies International, the Smart

Off-Grid™ company, was founded on a vision of delivering clean,

managed, “wireless power” to meet the global need for reliable,

low-cost, solar and hybrid power for lighting, telecom, security,

Internet of Things devices, and other mission-critical systems.

Today, Clear Blue has thousands of systems under management across

37 countries, including the U.S. and Canada. (TSXV: CBLU) (FRA:

0YA) (OTCQB: CBUTF)

Legal Disclaimer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this news release. Such securities have not been, and

will not be, registered under the U.S. Securities Act, or any state

securities laws, and, accordingly, may not be offered or sold

within the United States, or to or for the account or benefit of

persons in the United States or “U.S. Persons”, as such term is

defined in Regulation S promulgated under the U.S. Securities Act,

unless registered under the U.S. Securities Act and applicable

state securities laws or pursuant to an exemption from such

registration requirements.

Forward-Looking Statement

This press release contains certain

"forward-looking information" and/or "forward-looking statements"

within the meaning of applicable securities laws. Such

forward-looking information and forward-looking statements are not

representative of historical facts or information or current

condition, but instead represent only Clear Blue’s beliefs

regarding future events, plans or objectives, many of which, by

their nature, are inherently uncertain and outside of Clear Blue's

control. Generally, such forward-looking information or

forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or may contain

statements that certain actions, events or results "may", "could",

"would", "might" or "will be taken", "will continue", "will occur"

or "will be achieved". The forward-looking information contained

herein may include, but is not limited to, information concerning

financial results and future upcoming contracts.

By identifying such information and statements

in this manner, Clear Blue is alerting the reader that such

information and statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Clear Blue to be

materially different from those expressed or implied by such

information and statements.

An investment in securities of Clear Blue is

speculative and subject to several risks including, without

limitation, the risks discussed under the heading "Risk Factors" in

Clear Blue's listing application dated July 12, 2018. Although

Clear Blue has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information and forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended.

In connection with the forward-looking

information and forward-looking statements contained in this press

release, Clear Blue has made certain assumptions. Although Clear

Blue believes that the assumptions and factors used in preparing,

and the expectations contained in, the forward-looking information

and statements are reasonable, undue reliance should not be placed

on such information and statements, and no assurance or guarantee

can be given that such forward-looking information and statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information

and statements. The forward-looking information and forward-looking

statements contained in this press release are made as of the date

of this press release. All subsequent written and oral forward-

looking information and statements attributable to Clear Blue or

persons acting on its behalf is expressly qualified in its entirety

by this notice.”

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this news release. Such securities have not been, and

will not be, registered under the U.S. Securities Act, or any state

securities laws, and, accordingly, may not be offered or sold

within the United States, or to or for the account or benefit of

persons in the United States or “U.S. Persons”, as such term is

defined in Regulation S promulgated under the U.S. Securities Act,

unless registered under the U.S. Securities Act and applicable

state securities laws or pursuant to an exemption from such

registration requirements.

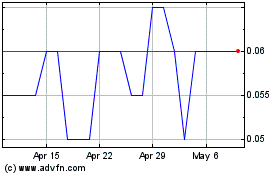

Clear Blue Technologies (TSXV:CBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clear Blue Technologies (TSXV:CBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024