Carmen Energy Inc. announces filing of preliminary prospectus

December 01 2011 - 6:49PM

PR Newswire (Canada)

CALGARY, Dec. 5, 2011 /CNW/ - Carmen Energy Inc. ("Carmen" or the

"Corporation") is pleased to announce that it has filed a

preliminary short form prospectus in the provinces of Alberta,

British Columbia, Saskatchewan and Ontario, and obtained a receipt

therefor, with respect to a public offering of up to $3,000,000

worth of common shares issued as "flow through shares" pursuant to

the Income Tax Act (Canada) ("Flow-Through Shares") and up to

$3,000,000 worth of units ("Units") (collectively, the "Offering").

Each Unit will be comprised of one common share of the Corporation

(a "Common Share") and one half of one Common Share purchase

warrant (each whole warrant a "Warrant"). The Common Shares and the

Warrants comprising the Units will separate immediately upon the

closing of the Offering. The Units and the Flow-Through Shares, are

collectively referred to herein as the "Offered Securities". The

Units and the Flow-Through Shares are offered separately from each

other. The issued and outstanding Common Shares are listed on the

TSX Venture Exchange ("TSXV") under the symbol "CEI". The

Corporation has applied to the TSXV to list the Common Shares and

the Common Shares issuable upon exercise of the Warrants to be

distributed under this short form prospectus. Listing of such

Common Shares will be subject to the Corporation fulfilling all of

the listing requirements of the TSXV. In connection with the

Offering, the Corporation has appointed Macquarie Private Wealth

Inc. as sole and exclusive agent (the "Agent"). The price of the

Units and Flow-Through Shares will be determined by negotiation

between the Corporation and the Agent. The Offering is not

underwritten or guaranteed by any person. The Corporation has

agreed to pay the Agent a cash fee equal to 6% of the gross

proceeds of the Offering. In addition, the Corporation shall also

grant the Agent and its designated sub-agents, if any, that number

of non-transferable options (the "Agent's Options") equal to 6% of

the number of Offered Securities sold under the Offering.

Each Agent's Option will entitle the Agent or its designated

sub-agent, if any, as applicable, to purchase one Unit exercisable

for twenty four months at the same offering price of as the Units.

The Corporation will also reimburse the Agent for reasonable

out-of-pocket expenses incurred by the Agent in connection with the

Offering, including the Agent's legal fees and expenses. In

addition, concurrently with the Offering, Carmen will complete a

private placement (the "Concurrent Private Placement") up to $0.5

million worth of units (the "Placement Units"). The price per

Placement Unit shall be the same as the price per Unit when

determined by the Corporation and the Agent. Each Placement Unit

shall be comprised of one Common Share (a "Placement Common Share")

and one half of one Common Share purchase warrant (each whole

warrant, a "Placement Warrant"). The Placement Warrants shall have

the same terms and conditions of exercise as the Warrants issued

pursuant to the Offering. The Placement Common Shares and Placement

Warrants comprising the Placement Units issued pursuant to the

Concurrent Private Placement will be subject to a statutory hold

period. The Concurrent Private Placement is subject to a number of

conditions including completion of definitive documentation, the

concurrent closing of the Offering and the approval of the TSXV.

The Corporation has applied to the TSXV to list the Placement

Common Shares (including any Common Shares issuable upon exercise

of the Placement Warrants). Listing of such Common Shares will be

subject to the Corporation fulfilling all of the listing

requirements of the TSXV. The securities being offered have not

been, nor will be, registered under the United States Securities

Act of 1933, as amended, and may not be offered or sold in the

United States absent registration or applicable exemption from the

registration requirement of such Act. This release does not

constitute an offer for sale of the Offered Securities. About

Carmen Energy Inc. Carmen is based in Calgary, Alberta and a

publicly traded oil and gas exploration and production company. The

focus is on exploration and development of Western Canadian

Sedimentary Basin based oil and gas properties. The current

projects are the Jumpbush properties in south eastern Alberta, the

Ferrybank properties in central Alberta, the Sylvan Lake area

properties in Southern Alberta, the Viking-Kinsella properties in

Alberta and the Hamburg properties in northern western Alberta. ON

BEHALF OF THE BOARD OF DIRECTORS Mr. Brian Doherty, President, CEO

and Director Contact: brian.doherty@carmenenergy.ca; (403) 537-5590

Advisory Regarding Forward-Looking Information and Statements This

press release contains forward-looking statements and

forward-looking information within the meaning of applicable

securities laws. The use of any of the words "will", "expects",

"believe", "plans", "potential" and similar expressions are

intended to identify forward-looking statements or information.

More particularly and without limitation, this press release

contains statements relating to "reserves" which are deemed to be

forward-looking statements as they involve the implied assessment,

based on certain estimates and assumptions, which the reserves

described, can be profitably produced in the future. Readers should

be cautioned that the forgoing list of forward-looking statements

and information contained herein should not be considered

exhaustive. Specifically, this news release contains forward

looking statements relating Offering and the Concurrent Private

Placement. The closing of the Offering and Concurrent Private

Placement could be delayed if the Corporation is not able to obtain

the required subscriptions to complete the Offering and Concurrent

Private Placement and the necessary regulatory approvals required

for completion of the Offering and Concurrent Private Placement and

on the timeframes contemplated. The Offering and Concurrent Private

Placement will not be completed at all if the subscriptions to

complete the Offering and Concurrent Private Placement are not

obtained or if the necessary regulatory approvals are not obtained

or, unless waived, some other condition to closing is not

satisfied. Accordingly there is a risk that the Offering and

Concurrent Private Placement will not be completed within the

anticipated time or at all. Management has included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

securityholders with a more complete perspective on Carmen's future

operations and such information may not be appropriate for other

purposes. The forward-looking statements and information in this

press release are based on certain key expectations and assumptions

made by Carmen. Although Carmen believes that the expectations and

assumptions on which such forward looking statements and

information are based are reasonable, undue reliance should not be

placed on the forward-looking statements and information because

Carmen can give no assurance that they will prove to be correct.

The forward-looking statements and information contained in this

press release are made as of the date hereof and Carmen undertakes

no obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws. Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release. Carmen Energy Inc

CONTACT: Mr. Brian Doherty, President, CEO and DirectorContact:

brian.doherty@carmenenergy.ca; (403) 537-5590

Copyright

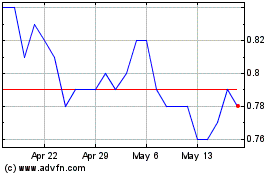

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From Apr 2024 to May 2024

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From May 2023 to May 2024