Carmen Energy Inc. Announces Asset Sale Transaction, Filing of Reserves Information and Proposed Name Change

December 17 2012 - 4:08PM

Marketwired Canada

Carmen Energy Inc. (TSX VENTURE:CEI) ("Carmen" or the "Corporation") announces

that it has entered into a purchase and sale agreement ("PSA") to sell the

Corporation's 60% non-operated working interest in certain oil and gas assets

(the "Assets") in the Viking-Kinsella area of Alberta, namely the Corporation's

16-17-049-12 W4 well.

The PSA has been entered into with two companies, both of which are considerate

"related parties" to the Corporation under applicable securities laws. R & D

Asset Management Ltd. and Red Mountain Resources Ltd. are owned or controlled by

Mr. Tyler Rice, the Corporation's President and by Mr. Randy Harrison, a

director of the Corporation, respectively. As the sale will constitute a

"related party transaction" under applicable securities laws, the Corporation

intends to call an annual and special meeting of the Corporation's shareholders

prior to February 28, 2013 to approve the sale of the Assets.

The Corporation has been searching for a purchaser for these Assets for several

months, with the aim of selling these Assets to reduce Carmen's working capital

deficiency (unaudited at June 30, 2012 of approximately $140,000), outstanding

notes payable (unaudited at June 30, 2012 of approximately $350,000) and other

obligations (consisting primarily of unaudited asset retirement obligations of

approximately $98,000). The independent board members of the Corporation have

approved the PSA after the Corporation unsuccessfully canvassed a number of

parties to find a purchaser for the Assets.

The purchase price for the Assets of $678,600 was agreed to by the parties based

on the net present value of proved and probable reserves, as calculated in the

independent reserve report prepared for the Corporation for the year ended

September 30, 2012, and will be adjusted for actual production to the effective

date of January 1, 2013. The purchase price will be comprised of cash,

forgiveness of the notes payable held by each of the Purchasers, assumption of

the remaining note payable owing by the Corporation by the Purchasers and

termination of all Gross Overriding Royalties ("GORRs") held by the Purchasers

as well terminating the balance of the GORRs associated with the note payable on

the remaining lands held by the Corporation.

Archie Nesbitt, an independent member of the Board of Directors (the "Board")

stated that, "the execution of the PSA is crucial to rectifying the

Corporation's working capital deficiency as well as to ensure the viability of

the Corporation as we rebrand and rebuild after the drilling of three dry

wells".

Completion of the asset sale transaction will be conditional upon receipt of

approval from the transaction from the TSX Venture Exchange (the "Exchange") as

well as approval of the Corporation's shareholders.

The Corporation is also pleased to announce that it has filed its reports under

section 2.1 of National Instrument 51-101 - Standards of Disclosure for Oil &

Gas Activities for the year ending September 30, 2012, on the Corporation's

SEDAR profile at www.sedar.com.

The Corporation also announces that the Board has approved a resolution to

change the Corporations' name to "Margaux Resources Ltd.", subject to Exchange

and shareholder approval at the forthcoming Annual Special Meeting of the

Corporation.

Additionally, the Corporation is pleased to announce the appointment of Randy

Harrison as a member of the Corporation's audit committee, effective

immediately.

About Carmen Energy Inc.: Carmen is based in Calgary, Alberta and a publicly

traded oil and gas exploration and production company. The focus is on

exploration and development of Western Canadian Sedimentary Basin based oil and

gas properties. The current projects are the Jumpbush properties in south

eastern Alberta.

FORWARD LOOKING INFORMATION

Certain information in this news release is forward-looking within the meaning

of certain securities laws, and is subject to important risks, uncertainties and

assumptions. This forward-looking information includes, among other things, the

approval of shareholders' with at the forthcoming AGM for both the change of

name and conditions relating to the related party transaction and information

with respect to the Corporation's beliefs, plans, expectations, anticipations,

estimates and intentions and the activities of the Corporation. The words "may",

"could", "should", "would", "suspect", "outlook", "believe", "anticipate",

"estimate", "expect", "intend", "plan", "target" and similar words and

expressions are used to identify forward-looking information. . The

forward-looking information in this news release describes the Corporation's

expectations as of the date of this news release.

The results or events anticipated or predicted in such forward-looking

information may differ materially from actual results or events. Material

factors which could cause actual results or events to differ materially from

such forward-looking information include, among others, the risks associated

with the oil and gas industry in general, risks arising from general economic

conditions and adverse industry events, risks arising from operations generally,

reliance on contractual rights such as licences and leases in the conduct of its

business, the uncertainty of reserve and resource estimates; the uncertainty of

estimates and projections relating to reserves, resources, production, costs and

expenses; reliance on third parties, reliance on key personnel, possible failure

of the business model or business plan or the inability to implement the

business model or business plan as planned, competition, environmental matters,

and insurance or lack thereof; failure to realize the anticipated benefits of

acquisitions including the Acquisition; ability to access sufficient capital

from internal and external sources; changes in legislation, including but not

limited to tax laws, royalties and environmental regulations.

The Corporation cautions that the foregoing list of material factors is not

exhaustive. When relying on the Corporation's forward-looking information to

make decisions, investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. The Corporation has

assumed a certain progression, which may not be realized. It has also assumed

that the material factors referred to in the previous paragraph will not cause

such forward-looking information to differ materially from actual results or

events. However, the list of these factors is not exhaustive and is subject to

change and there can be no assurance that such assumptions will reflect the

actual outcome of such items or factors.

Completion of the transaction is subject to a number of conditions, including

Exchange acceptance and disinterested Shareholder approval. The transaction

cannot close until the required Shareholder approval is obtained. There can be

no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the Management Information

Circular to be prepared in connection with the transaction, any information

released or received with respect to the transaction may not be accurate or

complete and should not be relied upon. Trading in the securities of the

Corporation should be considered highly speculative.

The TSX Venture Exchange has in no way passed upon the merits of the proposed

transaction and has neither approved nor disapproved the contents of this press

release.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE

EXPECTATIONS OF THE CORPORATION AS OF THE DATE OF THIS NEWS RELEASE AND,

ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE

UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS

INFORMATION AS OF ANY OTHER DATE. WHILE THE CORPORATION MAY ELECT TO, IT DOES

NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME.

FOR FURTHER INFORMATION PLEASE CONTACT:

Carmen Energy Inc.

Tyler Rice

President

(403) 537-5590

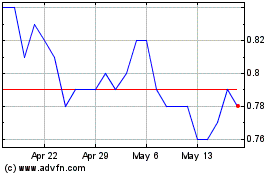

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From Apr 2024 to May 2024

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From May 2023 to May 2024