CF Energy Corp. (TSX-V: CFY) (“CF Energy” or the “Company”,

together with its subsidiaries, the “Group”), an energy provider in

the People’s Republic of China (the ”PRC” or “China”), announces

that the Company has filed its unaudited condensed interim

consolidated financial results for the three-month and nine-month

periods ended September 30, 2022 (“Q3 2022” and “Nine Months in

2022” respectively).

Q3 2022 financial highlights

Continuing Operations

| |

|

|

|

|

|

|

|

|

In millions |

Q3 2022 |

Q3 2021 |

Change |

% |

Q3 2022 |

Q3 2021 |

Change |

|

(except for % figures) |

RMB |

RMB |

RMB |

|

CAD |

CAD |

CAD |

|

Continuing Operations |

|

|

|

|

|

|

|

|

Revenue |

61.6 |

|

82.6 |

|

(21.0) |

|

-25 |

% |

12.0 |

|

16.0 |

|

(4.0) |

|

| Gross

Profit |

17.9 |

|

33.8 |

|

(15.9) |

|

-47 |

% |

3.5 |

|

6.5 |

|

(3.0) |

|

| Gross

Profit Margin |

29.0% |

|

40.9% |

|

-11.9% |

|

|

29.0% |

|

40.9% |

|

-11.9% |

|

| Net

Profit (Loss) |

(0.4) |

|

9.5 |

|

(9.9) |

|

-104 |

% |

(0.1) |

|

1.8 |

|

(1.9) |

|

| Adjusted

Net Profit (Loss) |

(2.3) |

|

7.0 |

|

(9.3) |

|

-132 |

% |

(0.4) |

|

1.3 |

|

(1.7) |

|

|

EBITDA |

14.9 |

|

21.9 |

|

(7.0) |

|

-32 |

% |

2.9 |

|

4.2 |

|

(1.3) |

|

|

Adjusted EBITDA |

13.0 |

|

19.4 |

|

(6.4) |

|

-33 |

% |

2.6 |

|

3.7 |

|

(1.1) |

|

| |

|

|

|

|

|

|

|

Revenue in Q3 2022 was RMB61.6 million (approx.

CAD12.0 million), a decrease of RMB21.0 million (approx. CAD4.0

million), or 25%, from RMB82.6 million (approx. CAD16.0 million)

for the three-month period ended September 30, 2021 (“Q3 2021”). To

stem the outbreak of COVID-19 in August 2022, Sanya City was under

static management from 6 August 2022 to September 16, 2022. Public

transportation was suspended, people’s movements inside the city

were restricted to emergency services, and transport links were

halted. These factors have resulted in the decrease in demand of

natural gas across all revenue segments of the Company.

Gross profit in Q3 2022 was RMB17.9 million

(approx. CAD3.5 million), a decrease of RMB15.9 million (CAD3.0

million) or 47% from RMB33.8 million (approx. CAD6.5 million) in Q3

2021. Overall Gross margin in Q3 2022 was 29.0%, a

decrease of 11.9 percentage point from 40.9% in Q3 2021.

| |

|

|

|

|

|

|

|

|

In millions |

Q3 2022 |

Q3 2021 |

Change |

% |

Q3 2022 |

Q3 2021 |

Change |

|

(except for % figures) |

RMB |

RMB |

RMB |

|

CAD |

CAD |

CAD |

|

Continuing Operations |

|

|

|

|

|

|

|

|

Net profit (loss) for the period |

(0.4) |

|

9.5 |

|

(9.9) |

|

-104 |

% |

(0.1) |

|

1.8 |

|

(1.9) |

|

|

Non-recurring items |

|

|

|

|

|

|

|

| Fair

value change on derivative financial instrument |

(2.1) |

|

(3.0) |

|

0.9 |

|

-30 |

% |

(0.4) |

|

(0.6) |

|

0.2 |

|

|

Recognition of share-based payment expenses |

0.2 |

|

0.5 |

|

(0.3) |

|

-60 |

% |

0.1 |

|

0.1 |

|

0.0 |

|

|

Adjusted net profit (loss) for the period

(non-IFRS) |

(2.3) |

|

7.0 |

|

(9.3) |

|

-132 |

% |

(0.4) |

|

1.3 |

|

(1.7) |

|

| |

|

|

|

|

|

|

|

Net loss in Q3 2022 was RMB0.4 million (approx.

CAD0.1 million), a decrease of RMB9.9 million (approx. CAD1.9

million), or 104%, from net profit of RMB9.5 million (approx.

CAD1.8 million) in Q3 2021. Net loss in Q3 2022 included

non-recurring items. On a comparable basis, after excluding the

non-recurring items: the fair value change on derivative financial

instrument of RMB2.1 million (approx. CAD0.4 million) and the

recognition of share-based payments of RMB0.2 million (approx.

CAD0.1 million), the adjusted net loss in Q3 2022 (non-IFRS) was

RMB2.3 million (approx. CAD0.4 million), a decrease of RMB9.3

million (approx. CAD1.7 million) or 132% from adjusted net profit

of RMB7.0 million (approx. CAD1.3 million) in Q3 2021.

Basic earnings per share (“EPS”) in Q3 2022 was

RMB0.03 (CAD0.01) per share. Adjusted loss per share in Q3 2022 was

RMB0.04 (CAD0.01) per share (non-IFRS).

| |

|

|

|

|

|

|

|

|

In millions |

Q3 2022 |

Q3 2021 |

Change |

% |

Q3 2022 |

Q3 2021 |

Change |

|

(except for % figures) |

RMB |

RMB |

RMB |

|

CAD |

CAD |

CAD |

|

Continuing Operations |

|

|

|

|

|

|

|

|

EBITDA for the period |

14.9 |

|

21.9 |

|

(7.0) |

|

-32 |

% |

2.9 |

|

4.2 |

|

(1.3) |

|

|

Non-recurring items |

|

|

|

|

|

|

|

| Fair

value change on derivative financial instrument |

(2.1) |

|

(3.0) |

|

0.9 |

|

-30 |

% |

(0.4) |

|

(0.6) |

|

0.2 |

|

|

Recognition of share-based payment expenses |

0.2 |

|

0.5 |

|

(0.3) |

|

-60 |

% |

0.1 |

|

0.1 |

|

0.0 |

|

|

Adjusted EBITDA for the period |

13.0 |

|

19.4 |

|

(6.4) |

|

-33 |

% |

2.6 |

|

3.7 |

|

(1.1) |

|

| |

|

|

|

|

|

|

|

EBITDA (Non-IFRS measure) in Q3 2022 was RMB14.9

million (approx. CAD2.9 million), a decrease of RMB7.0 million

(approx. CAD1.3 million), or 32%, from RMB21.9 million (approx.

CAD4.2 million) in Q3 2021. EBITDA in Q3 2022 included

non-recurring items. On a comparable basis, after excluding the

non-recurring items: the fair value change on derivative financial

instrument of RMB2.1 million (approx. CAD0.4 million) and the

recognition of share-based payments of RMB0.2 million (approx.

CAD0.1 million), the adjusted EBITDA in Q3 2022 (non-IFRS) was

RMB13.0 million (approx. CAD2.6 million), a decrease of RMB6.4

million (approx. CAD1.1 million), or 33%, from RMB19.4 million

(approx. CAD3.7 million) in Q3 2021.

Nine Months 2022 financial highlights

Continuing Operations

| |

|

|

|

|

|

|

|

|

In millions |

1-9 2022 |

1-9 2021 |

Change |

% |

1-9 2022 |

1-9 2021 |

Change |

|

(except for % figures) |

RMB |

RMB |

RMB |

|

CAD |

CAD |

CAD |

|

Continuing Operations |

|

|

|

|

|

|

|

|

Revenue |

241.0 |

|

250.0 |

|

(9.0) |

|

-4 |

% |

46.8 |

|

48.3 |

|

(1.5) |

|

| Gross

Profit |

78.4 |

|

101.9 |

|

(23.5) |

|

-23 |

% |

15.2 |

|

19.7 |

|

(4.5) |

|

| Gross

Profit Margin |

32.5% |

|

40.7% |

|

-8.2% |

|

|

32.5% |

|

40.7% |

|

-8.2% |

|

| Net

Profit |

11.0 |

|

27.4 |

|

(16.4) |

|

-60 |

% |

2.1 |

|

5.3 |

|

(3.2) |

|

| Adjusted

Net Profit (Loss) |

(1.3) |

|

28.9 |

|

(30.2) |

|

-104 |

% |

(0.3) |

|

5.6 |

|

(5.9) |

|

|

EBITDA |

61.9 |

|

64.8 |

|

(2.9) |

|

-4 |

% |

12.0 |

|

12.5 |

|

(0.5) |

|

|

Adjusted EBITDA |

49.6 |

|

66.3 |

|

(16.7) |

|

-25 |

% |

9.6 |

|

12.8 |

|

(3.2) |

|

| |

|

|

|

|

|

|

|

Revenue of Nine Months in 2022 was RMB241.0

million (approx. CAD46.8 million), a decrease of RMB9.0 million

(approx. CAD1.5 million), or 4%, from RMB250.0 million (approx.

CAD48.3 million) for the nine-month period ended September 30, 2021

(“Nine Months in 2021”). Restriction and lockdown measures came at

the height of the summer tourism season which have heavily affected

the demand for natural gas in the Sanya City. Despite demand

for natural gas in Sanya City from commercial customers gradually

recovered in the month of July 2022 after the first outbreak in

April/May 2022 but demand got hit again in the month of August 2022

with the second city lockdown. The increase in total revenue for

the Nine Months in 2022 was mainly attributed to the increase in

revenue from residential customers of pipeline installation and

connection as the activities of construction of temporary housing

under activation of city redevelopment plan was not affected during

the static management period in the Sanya City.

Gross profit for the Nine Months in 2022 was

RMB78.4 million (approx. CAD15.2 million), a decrease of RMB23.5

million (CAD4.5 million) or 23% from RMB101.9 million (approx.

CAD19.7 million) for the Nine Months in 2021. Overall Gross margin

for the Nine Months in 2022 was 32.5%, a decrease of 8.2 percentage

point from 40.7% for the Nine Months in 2021.

| |

|

|

|

|

|

|

|

|

In millions |

1-9 2022 |

1-9 2021 |

Change |

% |

1-9 2022 |

1-9 2021 |

Change |

|

(except for % figures) |

RMB |

RMB |

RMB |

|

CAD |

CAD |

CAD |

|

Continuing Operations |

|

|

|

|

|

|

|

|

Net profit for the period |

11.0 |

|

27.4 |

(16.4) |

|

-60 |

% |

2.1 |

|

5.3 |

(3.2) |

|

|

Non-recurring items |

|

|

|

|

|

|

|

|

|

|

|

|

| Fair

value change on derivative financial instrument |

(12.9) |

|

- |

(12.9) |

|

100 |

% |

(2.5) |

|

- |

(2.5) |

|

|

Recognition of share-based payment expenses |

0.6 |

|

1.5 |

(0.9) |

|

-60 |

% |

0.1 |

|

0.3 |

(0.2) |

|

|

Adjusted net profit (loss) for the period

(non-IFRS) |

(1.3) |

|

28.9 |

(30.2) |

|

-104 |

% |

(0.3) |

|

5.6 |

(5.9) |

|

| |

|

|

|

|

|

|

|

Net profit for the Nine Months in 2022 was

RMB11.0 million (approx. CAD2.1 million), a decrease of RMB16.4

million (approx. CAD3.2 million), or 60%, from RMB27.4 million

(approx. CAD5.3 million) for the Nine Months in 2021. Net profit

for the Nine Months in 2022 included non-recurring items. On a

comparable basis, after excluding the non-recurring items: the fair

value change on derivative financial instrument of RMB12.9 million

(approx. CAD2.5 million) and the recognition of share-based

payments of RMB0.6 million (approx. CAD0.1 million), the adjusted

net loss in for the Nine Months in 2022 (non-IFRS) was RMB1.3

million (approx. CAD0.3 million), a decrease of RMB30.2 million

(approx. CAD5.9 million) or 104% from adjusted net profit of

RMB28.9 million (approx. CAD5.6 million) for the Nine Months in

2021.

EPS for the Nine Months in 2022 was RMB0.28

(CAD0.06) per share. Adjusted loss per share for the Nine Months in

2022 was RMB0.02 (CAD0.01) per share (non-IFRS).

| |

|

|

|

|

|

|

|

|

In millions |

1-9 2022 |

1-9 2021 |

Change |

% |

1-9 2022 |

1-9 2021 |

Change |

|

(except for % figures) |

RMB |

RMB |

RMB |

|

CAD |

CAD |

CAD |

|

Continuing Operations |

|

|

|

|

|

|

|

|

EBITDA for the period |

61.9 |

|

64.8 |

(2.9) |

|

-4 |

% |

12.0 |

|

12.5 |

(0.5) |

|

|

Non-recurring items |

|

|

|

|

|

|

|

| Fair

value change on derivative financial instrument |

(12.9) |

|

- |

(12.9) |

|

100 |

% |

(2.5) |

|

- |

(2.5) |

|

|

Recognition of share-based payment expenses |

0.6 |

|

1.5 |

(0.9) |

|

-60 |

% |

0.1 |

|

0.3 |

(0.2) |

|

|

Adjusted EBITDA for the period |

49.6 |

|

66.3 |

(16.7) |

|

-25 |

% |

9.6 |

|

12.8 |

(3.2) |

|

| |

|

|

|

|

|

|

|

EBITDA (Non-IFRS measure) for the Nine Months in

2022 was RMB61.9 million (approx. CAD12.0 million), a decrease of

RMB2.9 million (approx. CAD0.5 million), or 4%, from RMB64.8

million (approx. CAD12.5 million) for the Nine Months in 2022.

EBITDA for the Nine Months in 2022 included non-recurring items. On

a comparable basis, after excluding the effects of non-recurring

items: the fair value change on derivative financial instrument of

RMB12.9 million (approx. CAD2.5 million) and the recognition of

share-based payments of RMB0.6 million (approx. CAD0.1 million),

adjusted EBITDA for the Nine Months in 2022 was RMB49.6 million

(approx. CAD9.6 million), a decrease of RMB16.7 million (approx.

CAD3.2 million), or 25%, from RMB66.3 million (approx. CAD12.8

million) for the Nine Months in 2021.

As the Company forewarned when released its

interim results for the six months ended June 30, 2022 that the

citywide lockdown controls implemented by the government due to

COVID-19 infections in the Hainan Province had extended their

impact to the third quarter of 2022. The lockdown lasted for less

than two months and residents were obligated to stay home for the

entire lockdown period. This has negatively impacted all our

business segments. The COVID-19 controls eased up near the end of

September 2022 and we began to see recovery and our electric

vehicle (“EV”) battery swap station in Sanya City had started

construction immediately in order to serve the upcoming 119 BAIC

EU5 taxis, which were expected to be operational starting by the

end of 2022. We have also taken the initiative to expand our EV

battery swap business footprint to Beihai City through acquisition.

Despite the ever-changing and difficult operating environment

experienced, the Company is determined to charter through such

obstacles and remain on our strategic directions and development

going forward.

The unaudited condensed interim consolidated

financial results and Management’s Discussion and Analysis

(MD&A) can be downloaded from www.SEDAR.com or from the

Company's website at www.cfenergy.com.

About CF Energy Corp. (Previously known

as: Changfeng Energy Inc.)

CF Energy Corp. is a Canadian public company

currently traded on the Toronto Venture Exchange (“TSX-V”) under

the stock symbol “CFY”. It is an integrated energy provider and

natural gas distribution company (or natural gas utility) in the

PRC. CF Energy strives to combine leading clean energy technology

with natural gas usage to provide sustainable energy to its

customer base in the PRC.

CONTACT INFORMATION

Corporate Investment

RelationsInvestor.relations@changfengenergy.cn 647

313-0066

Charles Wang Executive Assistant to CEO & Chair of the

Board zhaoyu.wang@changfengenergy.cn

Frederick Wong Director of the

Board fred.wong@changfengenergy.cn

Mike Liu VP Capital Market mike.liu@changfengenergy.cn

Forward-Looking Statements

Certain statements contained in this news

release constitute forward-looking statements and forward-looking

information (collectively, “Forward-Looking Statements”). All

statements, other than statements of historical fact, included or

incorporated by reference in this document are Forward-Looking

Statements, including statements regarding activities, events or

developments that the Company expects or anticipates may occur in

the future (including, without limitation, no significant

adjustments to the gas selling price and charges for related

services imposed by the relevant PRC government, the tourism

industry continues to recover from COVID-19 impact and no delay in

the development of the electric vehicle battery swap stations or

the Haitang Bay Integrated Smart Energy Project). These

Forward-Looking Statements can be identified by the use of

forward-looking words such as “will”, “expect”, “intend”, “plan”,

“estimate”, “anticipate”, “believe” or “continue” or similar words

or the negative thereof. No assurance can be given that the plans,

intentions or expectations or assumptions upon which these

Forward-Looking Statements are based will prove to be correct and

such Forward-Looking Statements included in this news release

should not be unduly relied upon. Although management believes that

the expectations represented in such Forward-Looking Statements are

reasonable, there can be no assurance that such expectations will

prove to be correct. Such Forward-Looking Statements are not a

guarantee of performance and involve known and unknown risks,

uncertainties, assumptions and other factors that may cause the

actual results, performance or achievements to differ materially

from the anticipated results, performance or achievements or

developments expressed or implied by such Forward-Looking

Statements. These factors include, without limitation, no

significant and continuing adverse changes in general economic

conditions or conditions in the financial, tourism, and gas

distribution and electric vehicle markets or delays in the

development of key projects. Readers are cautioned that all

Forward-Looking Statements involve risks and uncertainties,

including those risks and uncertainties detailed in the Company’s

filings with applicable Canadian securities regulatory authorities,

copies of which are available at www.sedar.com. The Company urges

readers to carefully consider those factors. The Forward-Looking

Statements included in this news release are made as of the date of

this document and the Company disclaims any intention or obligation

to update or revise any Forward-Looking Statements, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities legislation. This news

release does not constitute an offer to sell or solicitation of an

offer to buy any of the securities described herein and accordingly

undue reliance should not be put on such. This news release

contains future oriented financial information and financial

outlook information (collectively, "FOFI") (including, without

limitation, statements regarding expected average production), and

are subject to the same assumptions, risk factors, limitations and

qualifications as set forth in the above paragraph. The FOFI has

been prepared by management to provide an outlook of the Company's

activities and results, and such information may not be appropriate

for other purposes. The Company and management believe that the

FOFI has been prepared on a reasonable basis, reflecting

management's reasonable estimates and judgments, however, actual

results of operations of the Company and the resulting financial

results may vary from the amounts set forth herein. Any FOFI speaks

only as of the date on which it is made, and the Company disclaims

any intent or obligation to update any FOFI, whether as a result of

new information, future events or results or otherwise, unless

required by applicable laws.

Non-IFRS Financial

Measures.

This news release contains financial terms that

are not considered in the International Financial Reporting

Standards ("IFRS"): EBITDA, Adjusted EBITDA and Adjusted Net

Profit. These financial measures, together with measures prepared

in accordance with IFRS, provide useful information to investors

and shareholders, as management uses them to evaluate the operating

performance of the Company. The Company's determination of these

non-IFRS measures may differ from other reporting issuers, and

therefore are unlikely to be comparable to similar measures

presented by other companies. Further, these non-IFRS measures

should not be considered in isolation or as a substitute for

measures of performance or cash flows prepared in accordance with

IFRS. These financial measures are included because management uses

this information to analyze operating performance and liquidity.

Neither TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release

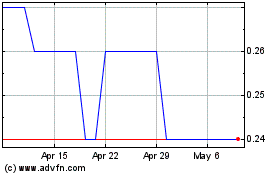

CF Energy (TSXV:CFY)

Historical Stock Chart

From Dec 2024 to Jan 2025

CF Energy (TSXV:CFY)

Historical Stock Chart

From Jan 2024 to Jan 2025