Consolidated Uranium Inc. (“CUR” or the “Company”) (TSXV:

CUR) (OTCQB: CURUF) is pleased to announce that its has

closed the previously announced acquisition (the

“

Acquisition”) of a 100% undivided interest in the

Milo Uranium, Copper, Gold, Rare Earth Project

(“

Milo” or the “

Project”)

pursuant to the definitive sale and purchase agreement (the

“

Agreement”) dated November 10, 2021 between CUR

and Isa Brightlands Pty Ltd (the “

Vendor”), a

wholly owned subsidiary of GBM Resources (“

GBM”)

(ASX: GBZ). The Project consists of Exploration Permit – Minerals

(EPM) 14416, which includes 20 sub blocks or approximately 34

square kilometres located within The Mt Isa Inlier, approximately

40 kilometres west of Cloncurry in Northwestern Queensland,

Australia.

The Company is also pleased to advise that it

has been granted three contiguous EPMs located approximately 65 km

north of the town of Mount Isa in Queensland Australia, by the

Department of Natural Resources, Mines and Energy (Figure 1). This

new project called Gidyea Creek, covers an area of 785 kilometres2

and is located immediately adjacent to Paladin Energy Ltd.’s

Valhalla Project, which ranks as the largest uranium deposit in the

state.

Philip Williams, CEO commented, “Australia

remains an important jurisdiction for CUR, and we are pleased to

have closed the Milo Acquisition and established a foothold in the

Mt Isa region with the granting of the Gidyea Creek project

tenements. Increasingly, end users of uranium and investors are

recognizing the importance of projects domiciled in geopolitically

stable and mining friendly jurisdictions. The CUR global portfolio

was constructed with this in mind, with the bulk of our projects

located in Australia, Canada and the U.S. and we will look to

continue to add projects in these and other top tier jurisdictions.

Like many of our other projects, we believe that both Milo and

Gidyea Creek boast strong exploration potential which we intend to

pursue in short order. Our team is busy reviewing historic data

from these and our other Australian projects and we look forward to

providing more details on planned work programs in the coming

months.”

In connection with closing of the Acquisition,

CUR issued to GBM 750,000 common shares of the Company

(“Common Shares”), at a deemed price of $2.85 per

share which is based on the seven-day volume-weight average price

of the CUR Shares on the TSX Venture Exchange

(“TSXV”) up to the date immediately prior to

signing of the Agreement. In addition, CUR has assumed GBM’s

obligations pursuant an existing 2% NSR royalty on the value of

gold or other mineral derived from ore produced from the Project

payable to Newcrest Mining Limited

The Common Shares issued in connection with the

Acquisition are subject to final approval of the TSXV and subject a

statutory hold period under Canadian securities legislation ending

on August 21, 2022.

The Milo Uranium, Copper, Gold, Rare

Earth Project

The Milo deposit is a large IOCG breccia style

system where base and precious metal mineralization occurs as

moderate to steeply north-east dipping, sulphide rich breccia zones

which are enclosed by a zone of TREEYO-P2O5 enrichment forming a

halo to the base metal mineralization. Drilling by GBM from 2010 to

2012 totalled 32 drillholes with each phase of drilling extending

the mineralization to the north and south. The drilling has

delineated continuous Uranium, Cu and REE mineralization over a

strike length of 1 kilometre and up to 200 metres wide. The 2012

drilling program intersected some high-grade Cu mineralization

including 2 metres @ 6.19% Cu at 163 m downhole in MIL015, one of

the most southerly drilled holes.

Exploration potential at Milo is considered to

be good. Much of the previous work at Milo, including the bulk of

drilling, has been directed at the Milo Gossan. A similar gossan

occurs immediately to the west (Milo Western Gossan) and is over 1

kilometre long. It has a similar Radiometric signature to Milo. In

addition, a further large untested radiometric anomaly occurs

approximately 1 kilometre to the North (Milo North) which has the

largest radiometric anomaly on the tenement. Previous work has

focused on the rare earth potential of the project rather than the

Uranium potential.

Mining One Consultants (“Mining One”), an

independent consulting company, prepared a technical report on the

Project in accordance with the disclosure standards of JORC, 2004

entitled “Milo Project Scoping Study” dated March 2013.

Geomodelling Ltd. was contracted by GBM to generate a block model

resource estimate for the deposit for inclusion in the Mining One

report., which was detailed in a CUR news release dated November

10, 2021. This mineral resource estimate is considered to be a

“historical estimate” for CUR as defined under National Instrument

43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) and is not considered by the Company to

be current and the Company is not treating it as such. A Qualified

Person has not done sufficient work to classify the historical

estimate as current mineral resources. CUR would need to review and

verify the previous drill hole data and conduct an exploration

program, including twinning of historical drill holes in order to

verify the historical estimate as a current mineral resource.

The Gidyea Creek Project

The Gidyea Creek Project tenure is located

within the highly prospective Leichhardt River Fault Trough (LRFT),

part of the Western Succession of the Mount Isa Basin. The Western

Succession has a long history of Uranium exploration (over 50

years) and is associated with over 100 recorded uranium occurrences

hosted within the Paleoproterozoic metasediments and mafic volcanic

rocks (Polito et al., 2007) that belong to the Eastern Creek

Volcanics (ECV). The majority of known uranium occurrences in the

ECV occur to the east by the Gorge Creek Fault and the Quilalar

Fault Zone, to the north by the Crystal Creek Fault, to the west by

the eastern margin of the Sybella Granite and the Twenty-nine Mile

Fault and to the south by a zone coincident with the Mount Isa

township (Polito et al, 2007). The mineral occurrences are observed

as ironstone gossans some associated with small historic uranium

workings, generally co-incident with large radiometric, magnetic

and geochemical anomalies. The most significant of these

occurrences is the Valhalla group of deposits (Valhalla, Odin,

Skal) which occur just to the south of the Gidyea Creek Tenement

boundary.

Figure 1: Gidyea Creek Project Location Map is

available

at: https://www.globenewswire.com/NewsRoom/AttachmentNg/39599457-6245-4237-873e-2f0b88cb7d00

The Valhalla deposit is an epigenetic,

hydrothermal, structurally controlled and albitite-hosted deposit

of uranium. It is located within a NNW-striking sequence of

intercalated metabasalt, laminated meta-shales and meta-siltstone

units of the Eastern Creek Volcanics, which form a thick rift/sag

sequence within the Leichhardt River Domain of the Mount Isa

western succession (Cover Sequence 2) thought to have occurred

between 1740 and 1680 Ma within the latest Paleoproterozoic. The

Valhalla and Skal mineralisation are hosted by

hematite-magnetite–carbonate breccias associated with a zone of

intense mylonitic/cataclastic shearing and hydraulic

brecciation.

The presence of significant zones of uranium and

copper mineralisation, the proximity to the regional Mt Isa Fault

zone, the proximity to granite intrusives and the mineralogy of the

known deposits have been taken to imply that the mineralisation has

an IOCG association (Hitzman and Valenta, 2005), however others

hypothesize that the uranium deposits are metamorphosed equivalents

of Proterozoic unconformity-type uranium deposits (Gregory et al,

2005).

The primary exploration target at Gidyea Creek

is potential uranium occurrences with the ECV sequences which

extend through the Gidyea Creek project tenure. Initial exploration

activity will consist of data integration and review, in

conjunction with development and refinement of the mineralization

models to define first-order targets within the project tenure.

Technical Disclosure and Qualified

Person

The scientific and technical information

contained in this news release was reviewed and approved by Peter

Mullens (FAusIMM), CUR’s VP Business Development, who is a

“Qualified Person” (as defined in NI 43-101).

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures and

attractive characteristics for development. Most recently, the

Company completed a transformational strategic acquisition and

alliance with Energy Fuels Inc., a leading U.S.-based uranium

mining company, and acquired a portfolio of permitted,

past-producing conventional uranium and vanadium mines in Utah and

Colorado. These mines are currently on stand-by, ready for rapid

restart as market conditions permit, positioning CUR as a near-term

uranium producer.For More Information, Please

Contact

Philip

WilliamsPresident and

CEOpwilliams@consolidateduranium.com

Mars Investor Relations+1 647

557 6640cur@marsinvestorrelations.com

Twitter:

@ConsolidatedUrwww.consolidateduranium.com

Neither the TSXV nor its Regulations Services

Provider (as that term is defined in policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including, but not limited to, the Company’s

ongoing business plan, exploration and work programs. Generally,

but not always, forward-looking information and statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or the negative connotation

thereof or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved” or the negative

connotation thereof. Such forward-looking information and

statements are based on numerous assumptions, including that

general business and economic conditions will not change in a

material adverse manner, that financing will be available if and

when needed and on reasonable terms, and that third party

contractors, equipment and supplies and governmental and other

approvals required to conduct the Company’s planned exploration

activities will be available on reasonable terms and in a timely

manner. Although the assumptions made by the Company in providing

forward-looking information or making forward-looking statements

are considered reasonable by management at the time, there can be

no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves or resources, reliance on key

management and other personnel, potential downturns in economic

conditions, actual results of exploration activities being

different than anticipated, changes in exploration programs based

upon results, and risks generally associated with the mineral

exploration industry, environmental risks, changes in laws and

regulations, community relations and delays in obtaining

governmental or other approvals and the risk factors with respect

to Consolidated Uranium set out in CUR’s annual information form in

respect of the year ended December 31, 2020 filed with the Canadian

securities regulators and available under CUR’s profile on SEDAR at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

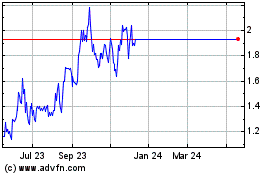

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024