Digihost Reports Positive Year Over Year Revenue Growth and 49% Increase in EBITDA* for Q3 2023

November 14 2023 - 5:00AM

Digihost Technology Inc. (“

Digihost” or the

“

Company”) (Nasdaq: DGHI; TSXV: DGHI), an

innovative U.S. based blockchain technology and computer

infrastructure company is pleased to provide a summary of the

Company’s unaudited financial results for the third quarter ended

September 30, 2023 (all amounts in U.S. dollars, unless otherwise

indicated). The Company’s unaudited consolidated financial

statements and management’s discussion and analysis

(“

MD&A”) for the three and nine month period

ended September 30, 2023 have been filed and made accessible under

the Company’s continuous disclosure profile on SEDAR at

www.sedar.com and are also accessible on the U.S. Securities and

Exchange Commission’s (the “

SEC”) EDGAR website at

www.sec.gov/EDGAR.

Comparative Financial Highlights for the

Three-Month Period Ended September 30, 2023

- Revenue from digital currency

mining and sale of energy of $5.4 million reported for the

three-month period ended September 30, 2023, compared to $3.7

million for the three-month period ended September 30, 2022, an

increase of 46%. The increase in revenue is primarily driven by the

period over period increase in the price of Bitcoin

(“BTC”) and recognition of approximately $1

million due to the sale of energy;

- The Company mined approximately 217

BTC for the three-month period ended September 30, 2023, at an

average BTC price of approximately $28,091 (calculated from BTC

prices per CoinMarketCap), compared to the three-month period ended

September 30, 2022, where the Company mined approximately 203 BTC

at an average price of Bitcoin of approximately $21,252 (calculated

from BTC prices per CoinMarketCap);

- EBITDA* for three-month period

ended September 30, 2023 of $3.6 million, an increase of

approximately 49% from the Company’s Q3 2022 reported EBITDA*;

- Net income for three-month period

ended September 30, 2023 of $0.1 million as compared to a net loss

of $1.7 million for the period ended Q3 2022;

- Total assets of $47.3 million as at

September 30, 2023;

- Cash and cash equivalents of $3.3

million as at September 30, 2023;

- Property, plant, and equipment

consisting primarily of the Company’s BTC miners and mining

infrastructure of $37 million;

- During Q3, the Company spent

approximately $1.2 million on capital expenditure and mining

infrastructure support equipment. Digihost continues to monitor its

capital expenditures closely with self-funding in an effort to

avoid equity dilution for its shareholders.

|

(U.S.$ in thousands except per share data) |

Nine Months Ended |

|

|

September 302023 |

September 302022 |

|

Revenue from digital currency mining |

13,552 |

|

18,508 |

|

|

Revenue from sale of energy |

1,779 |

|

- |

|

|

Cost of sales |

(9,096 |

) |

(7,571 |

) |

|

Cost of power plant operations |

(1,418 |

) |

- |

|

|

Miner lease and hosting |

(791 |

) |

(6,379 |

) |

|

Depreciation and amortization |

(9,732 |

) |

(6,877 |

) |

|

Gross profit (loss) |

(5,706 |

) |

(2,319 |

) |

|

General and administrative and other expenses |

(3,728 |

) |

(3,841 |

) |

|

Gain on sale of property, plant, and equipment |

- |

|

2,341 |

|

|

Foreign exchange gain (loss) |

(102 |

) |

4,772 |

|

|

Gain on disposition of cryptocurrencies |

802 |

|

(11,574 |

) |

|

Change in FV of loan payable |

(144 |

) |

- |

|

|

Other Income |

90 |

|

168 |

|

|

Change in fair value - Miner Lease Agreement |

(268 |

) |

540 |

|

|

Gain (Loss) on revaluation of digital currencies |

23 |

|

(5,060 |

) |

|

Share based compensation |

(1,217 |

) |

(2,484 |

) |

|

Operating (loss) |

(10,250 |

) |

(17,457 |

) |

|

Revaluation of warrant liabilities |

(1,756 |

) |

30,229 |

|

|

Net financial expenses |

(195 |

) |

(238 |

) |

|

Net income (loss) before income taxes |

(12,200 |

) |

12,534 |

|

|

Deferred tax recovery |

- |

|

1,537 |

|

|

Net income (loss) for the year |

(12,200 |

) |

14,071 |

|

|

Foreign currency translation adjustment |

104 |

|

(4,433 |

) |

|

Revaluation of digital currency, net of tax |

- |

|

(3,707 |

) |

|

Total comprehensive income (loss) for the year |

(12,096 |

) |

5,932 |

|

|

Basic and diluted income (loss) per share |

(0.43 |

) |

0.52 |

|

|

Weighted average number of subordinate voting shares outstanding –

diluted |

28,525,059 |

|

27,022,331 |

|

* EBITDA is a non-IFRS financial measure and

should be read in conjunction with and should not be viewed as

alternatives to or replacements of measures of operating results

and liquidity presented in accordance with IFRS. Readers are

referred to the reconciliations of non-IFRS measures included in

the Company’s MD&A and at the end of this press release.

The Company achieved significant milestones

year-to-date 2023:

- Digihost has acquired approximately

2,000 high performance BTC miners;

- The Company completed an all-cash

acquisition of a 60 MW power plant in North Tonawanda, NY;

- The Company is currently mining at

a rate of approximately 1 EH;

- Consistent with management’s

ongoing commitment to minimize equity dilution for its

shareholders, the Company has continued to monetize a portion of

its BTC production to fully fund its energy costs.

At-the-Market Financing

Update

On March 4, 2022, the Company entered into an

offering agreement with H.C. Wainwright & Co., LLC as agent

(the “Agent”), pursuant to which the Company

established an at-the-market equity program (the “ATM

Program”). From the commencement of the ATM Program

through September 30, 2023, the Company issued 386,463 subordinate

voting shares in exchange for gross proceeds of $701,316, at an

average share price of $1.81, and received net proceeds of $673,855

after paying commissions of $21,040 to the Agent and incurring

$6,421 of other transaction fees.

During the quarter ended September 30, 2023, the

Company issued 107,418 subordinate voting shares in exchange for

gross proceeds of $240,245, at an average share price of $2.11, and

received net proceeds of $231,714 after paying commissions of

$7,207 to the Agent and incurring $1,324 of other transaction

fees.

About Digihost

Digihost is a growth-oriented technology company

focused on the blockchain industry. The Company operates from three

sites in the U.S. and, in addition to managing its own operations,

provides hosting arrangements at its facilities.

For further information, please contact:

Digihost Technology

Inc.www.digihost.caMichel Amar, Chief Executive

Officer T: 1-818-280-9758Email: michel@digihost.ca

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking StatementsExcept for the

statements of historical fact, this news release contains

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. Forward-looking information in this news

release includes information about the Company’s plans to finance

its operations, potential further improvements to profitability and

efficiency across mining operations including, as a result of the

Company’s expansion efforts, potential for the Company’s long-term

growth, and the business goals and objectives of the Company.

Factors that could cause actual results to differ materially from

those described in such forward-looking information include, but

are not limited to: future capital needs and uncertainty of

additional financing, including the Company’s ability to utilize

the Company’s at-the-market offering program (the “ATM Program”)

and the prices at which the Company may sell securities in the ATM

Program, as well as capital market conditions in general; share

dilution resulting from the ATM Program and from other equity

issuances; risks relating to the strategy of maintaining Bitcoin

holdings and the impact of depreciating Bitcoin prices on working

capital; regulatory and other unanticipated issues that prohibit us

from declaring or paying dividends to our shareholders that are

payable in Bitcoin; development of additional facilities to expand

operations may not be completed on the timelines anticipated by the

Company; ability to access additional power from the local power

grid; an increase in natural gas prices may negatively affect the

profitability of the Company’s power plant; a decrease in

cryptocurrency pricing, volume of transaction activity or

generally, the profitability of cryptocurrency mining; further

improvements to profitability and efficiency may not be realized;

the digital currency market; the Company’s ability to successfully

mine digital currency on the cloud; the Company may not be able to

profitably liquidate its current digital currency inventory, or at

all; a decline in digital currency prices may have a significant

negative impact on the Company’s operations; the volatility of

digital currency prices; and other related risks as more fully set

out in the Annual Information Form of the Company and other

documents disclosed under the Company’s filings at www.sedar.com.

The forward-looking information in this news release reflects the

current expectations, assumptions and/or beliefs of the Company

based on information currently available to the Company. In

connection with the forward-looking information contained in this

news release, the Company has made assumptions about: the current

profitability in mining cryptocurrency (including pricing and

volume of current transaction activity); profitable use of the

Company’s assets going forward; the Company’s ability to profitably

liquidate its digital currency inventory as required; historical

prices of digital currencies and the ability of the Company to mine

digital currencies on the cloud will be consistent with historical

prices; the ability to maintain reliable and economical sources of

power to run its cryptocurrency mining assets; the negative impact

of regulatory changes in the energy regimes in the jurisdictions in

which the Company operates; the ability to adhere to Digihost’s

dividend policy and the timing and quantum of dividends based on,

among other things, the Company’s operating results, cash flow and

financial condition, Digihost’s current and anticipated capital

requirements, and general business conditions; and there will be no

regulation or law that will prevent the Company from operating its

business. The Company has also assumed that no significant events

occur outside of the Company's normal course of business. Although

the Company believes that the assumptions inherent in the

forward-looking information are reasonable, forward-looking

information is not a guarantee of future performance and

accordingly undue reliance should not be put on such information

due to the inherent uncertainties therein.

The table below provides a reconciliation of

income to EBITDA for the three months ended September 30, 2023 and

2022.

|

Three months ended |

|

|

|

2023 |

2022 |

|

|

|

$ (thousands) |

$(thousands) |

|

Income (loss) before other items |

136 |

(1,677 |

) |

|

Taxes and Interest |

11 |

1,409 |

|

|

Depreciation |

3,444 |

2,673 |

|

|

EBITDA |

3,591 |

2,405 |

|

|

|

|

|

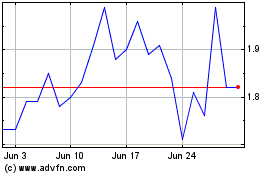

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

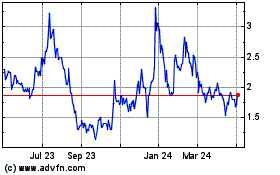

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Apr 2023 to Apr 2024