SFL’s GRESB Rating Upgraded

October 06 2023 - 12:20PM

Business Wire

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231006642741/en/

Cézanne Saint-Honoré (Paris 8e) - SFL ©

Studio2Terre

With a score of 93/100 in the Standing Investments Benchmark, a

two point increase versus last year, SFL (Paris:FLY) was once again

awarded the “5 Star” label by the Global Real Estate Sustainability

Benchmark (GRESB).

GRESB assesses real estate companies’ environmental, social and

governance (ESG) practices, with a particular focus on improving

buildings’ environmental footprints (energy, greenhouse gas

emissions, water and waste) and on actions aimed at employees

and/or occupants.

With over 2,000 participants worldwide in 2023, GRESB remains

the industry’s leading ESG benchmark.

SFL also scored 97/100 in the Development Benchmark and achieved

the highest score of 100/100 in the GRESB Public Disclosure Report,

which assesses the quality of external ESG communications.

Dimitri Boulte, SFL’s Chief Executive Officer, commented: “SFL's

commitment to CSR dates as far back as 2012. It is now one of the

top-rated companies in this area based on the GRESB framework. This

recognition demonstrates the effectiveness of the steps taken to

improve our properties’ environmental performance and provide our

tenants with purposefully designed, environmentally friendly

workplaces.”

This achievement is the fruit of more than 10 years of extensive

work by SFL's teams to design living and working environments that

meet end-users' expectations. “We have carried out work programmes

to align our portfolio with the highest standards, through

restructuring projects and projects to upgrade tenanted properties,

in order to offset the increasingly rapid pace of obsolescence,”

adds Eric Oudard, SFL’s Technical and Development Director. “This

is the strength of our model along with the know-how developed by

our teams, who are experts in the Paris prime office property

segment, our core market.”

About SFL

Leader in the prime segment of the Parisian commercial real

estate market, Société Foncière Lyonnaise stands out for the

quality of its property portfolio, which is valued at €7.9 billion

and is focused on the Central Business District of Paris

(#cloud.paris, Edouard VII, Washington Plaza, etc.), and for the

quality of its client portfolio, which is composed of prestigious

companies. As France’s oldest property company, SFL demonstrates

year after year an unwavering commitment to its strategy focused on

creating a high value in use for users and, ultimately, substantial

appraisal values for its properties. With its sights firmly set on

the future, SFL is committed to sustainable real estate with the

aim of building the city of tomorrow and helping to reduce carbon

emissions in its sector.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA

S&P rating: BBB+ stable outlook

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231006642741/en/

SFL – Thomas Fareng – +33 (0)1 42 97 27 00 –

t.fareng@fonciere-lyonnaise.com www.fonciere-lyonnaise.com

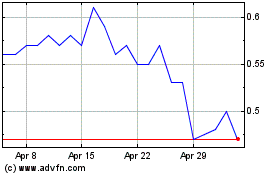

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

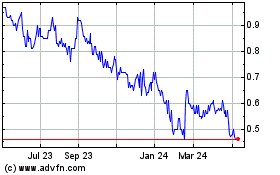

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Apr 2023 to Apr 2024