Gold Bull Resources Corp. (TSX-V: GBRC) (“

Gold

Bull” or the “

Company”) is pleased to

report minor modifications to its Sandman Preliminary Economic

Assessment (PEA or Scoping) which was previously announced on April

25th, 2023, and filed on June 9, 2023, titled Phase 2 Study at its

100% owned Sandman Project (“

Sandman” or the

“

Project”) located in Humboldt County, Nevada,

USA.

The modifications provided include the addition

of post-tax financial analysis (previously only pre-tax was

reported) and the addition of an independent metallurgical

qualified person review, which resulted in the previously assumed

recoveries increasing from 70% to 75% with multi-phase

crushing.

The Sandman Scoping Phase 2

Study has identified a stand-alone, low pre-production capital

USD31.5M, conventional heap leach gold project producing circa

35,000 to 40,000 ounces (average 38,000) of gold per year for 9

years. The project boasts an excellent pre-tax Internal Rate of

Return (IRR) at 102% and a pre-tax payback period of 1.1 years,

using a gold price of US$1800. The results from the Phase 2 study

have Identified a post-tax IRR of 81% with payback period of 1.3

years.

The Scoping Phase 2 Study

focused on mining gold mineralized material within optimized pit

shells in two phases: Phase 1 mines all

mineralized material within the pit shell above the water table and

is dry (refer Phase 1 Study1), followed by Phase 2

which is focused on mineralized material below the water table and

within the pit shell, and is wet, after completion of additional

monitoring, permitting and dewatering efforts paid for by mine

cashflow from Phase 1.

The Phase 1 and Phase

2 approach is designed to preserve initial pre-production

capital during the Phase 1 mining process. The

benefit of this two-phase approach is to enable further definition

of the existing Mineral Resources, discover additional Mineral

Resources, and enable sufficient time to conduct the below water

table mine studies and permitting, all paid from the Phase

1 revenues. The proposed model has the potential to

deliver strong organic growth with minimal initial dilution to

existing shareholders.

|

|

Pre-Tax Results |

Post-Tax Results

(2) |

|

IRR |

102% |

81% |

|

Cash Flow (Undiscounted) |

$229,585,644 |

$174,743,379 |

|

Cash Flow 6% Discount Rate |

$161,092,882 |

$121,009,339 |

|

Payback (Years) |

1.1 |

1.3 |

| |

The Study highlights :

- Production rate average of

2.2 Mtpa for a 9-year

operation

- 35,000-40,000

ounces of gold per annum produced from conventional

heap leach, average 38,000 ounces per year

- At US$1,800/oz gold

price:

- IRR of 81%

(post-tax)

- NPV

6% US$121M (post-tax)

- Payback period of 1.3

years (post-tax)

- Average grade 0.73g/t

gold

- LOM low strip ratio of

2.2:1

- Phase 1 Initial

pre-production Capital $31.5M and Phase 2 Capital,

US$19.7M paid by Phase 1 mining revenues. Total LOM capital

US$51.3M, including pre-production working capital US$4.5M

- LOM Operating cost of

US$20.85 per tonne (post tax)

- All in Sustaining

Cost (AISC) of $1,337 (post-tax) per

ounce

This Scoping Phase 2 Study focused on the

efficient extraction of all mineralized material within an

optimized pit shell in a sequence that facilitates effective use of

initial pre-production capital and a more rapid mine commissioning.

This Scoping Phase 2 Study is a Preliminary Economic Assessment PEA

(PEA), under NI 43-101 requirements.

Gold Bull CEO, Cherie Leeden, commented:

Sandman

provides Gold Bull with a low-cost and moderate mine life start-up

with the opportunity to grow the asset via additional exploration

using mine revenues. This is a practical approach to epithermal

gold mining and has historically produced longer life

assets.

In our Phase

1 PEA we only examined the oxide material located above the water

table (5yrs), to enable a rapid timeline for mine commissioning and

limited the initial pre-production capital. This Phase 2 scoping

study focussed on extending the mine life from 5 years to 9 years

while utilizing mine cashflow for Phase 2 development. The intent

is to be mining, developing, and discovering additional ounces at

the project utilizing mining cashflow and avoid shareholder

dilution. Excellent exploration potential exists at Sandman and not

all deposits are closed off.

Three gold

resources at Sandman remain open, therefore this PEA is the most

conservative base case done using only our pit constrained ounces

at a gold price of US$1800. If we were to use today's gold price of

circa <$2000, it dramatically increases the projected economics

because Sandman is most sensitive to the gold price.

Economic analysis is provided in Table

1 and compares Pre-Tax and Post-Tax analysis.

|

Metric |

Pre-Tax |

Post-Tax |

|

Economic Analysis |

|

|

|

|

|

Internal Rate of Return (IRR) |

102% |

|

|

81% |

|

|

|

NPV @ 6% |

$161,092,882 |

|

USD |

$121,009,339 |

|

USD |

|

Average Annual Cashflow |

$29,017,072 |

|

USD |

$22,923,487 |

|

USD |

|

Undiscounted Cumulative Cashflow |

$229,585,644 |

|

USD |

$174,743,379 |

|

USD |

|

Pay-Back Period |

1.1 |

|

years |

1.3 |

|

years |

|

Gold Price Assumption |

$1,800 |

|

per ounce |

$1,800 |

|

per ounce |

|

All-in Sustaining Cost |

$1,176 |

|

per ounce |

$1,337 |

|

per ounce |

|

Capital Costs |

|

|

|

|

|

Initial Capital |

$31,568,000 |

|

USD |

$31,568,000 |

|

USD |

|

Working Capital (included in above) |

$4,500,000 |

|

USD |

$4,500,000 |

|

USD |

|

LOM Sustaining Capital |

$19,739,240 |

|

USD |

$19,739,240 |

|

USD |

|

Total LOM Capital |

$51,307,240 |

|

USD |

$51,307,240 |

|

USD |

|

Contingency (Included in Total) |

$9,980,000 |

|

USD |

$9,980,000 |

|

USD |

|

Operating Costs (Average LOM) |

|

|

|

|

|

Mining |

$7.80 |

|

per ore tonne |

$7.80 |

|

per ore tonne |

|

Processing & Support |

$5.65 |

|

per ore tonne |

$5.65 |

|

per ore tonne |

|

General & Administration (G&A) |

$2.99 |

|

per ore tonne |

$2.99 |

|

per ore tonne |

|

Other Costs |

$1.57 |

|

per ore tonne |

$4.40 |

|

per ore tonne |

|

Total Operating Cost |

$18.03 |

|

per ore tonne |

$20.85 |

|

per ore tonne |

|

Production Data |

|

|

|

|

|

Life of Mine |

9 |

|

years |

9 |

|

years |

|

Annual Processing Rate |

2,157,667 |

|

tonnes per annum |

2,157,667 |

|

tonnes per annum |

|

Total Tonnes Processed |

19,419,000 |

|

tonnes |

19,419,000 |

|

tonnes |

|

Grade Au (Average) |

0.73 |

|

g/t Au |

0.73 |

|

g/t Au |

|

Contained Gold |

455,000 |

|

ounces |

455,000 |

|

ounces |

|

Metallurgical Recovery Au (Overall) |

75% |

|

|

75% |

|

|

|

Average Annual Gold Production |

37,917 |

|

ounces per annum |

37,917 |

|

ounces per annum |

|

Total Gold Produced |

341,250 |

|

ounces |

341,250 |

|

ounces |

|

LOM Strip Ratio |

2.2 |

|

: 1 |

2.2 |

|

: 1 |

Table

1. Scoping Study economic analysis summary

of Sandman Project for both Pre-Tax and Post-Tax

results.

STUDY HIGHLIGHTS

The Study has demonstrated potential for

positive financial metrics for the Sandman Project based on a

proposed stand-alone low-cost start-up heap leach gold mine project

located approximately 25 km from the mining town of Winnemucca

(Figure 1 and 2) in central Northern Nevada, USA.

This PEA Phase 2 Study investigated an expansion

to the previously announced Phase 1 five-year mine plan of above

water table mineralized material processed onsite via conventional

Heap Leach processing AND includes the Phase 2 plan to mine the

mineralized material below the water table after Phase 1 is

finalized and after the necessary permitting and dewatering efforts

have been completed. Gold Bull considers Sandman to be technically

low risk, given the low strip ratio due to gold at surface and the

majority of Mineral Resource classified as Indicated. Both Scoping

Studies were completed to an overall +/- 30% accuracy using the key

parameters and assumptions set out in Tables 1 and 2.

The calculations in this Phase 2 Study focus on

the full project (prior Phase 1 plus this Phase 2) mining scenario.

The Phase 1 mine scenario targeted low initial pre-production

capital and near-term cash flow to then later fund Phase 2 below

water table oxide mine dewatering studies and development. The

strategy is to preserve initial pre-production cashflow and pay for

future studies when producing revenue from the asset. The deferred

work includes below water table permitting & dewatering,

additional metallurgical optimization studies for product

processing and infill resource to reserve drilling.

The Sandman Project Phase 2 Scoping Study

includes Life of Mine (LOM) plan and reports a post-tax IRR

of 81%, post-tax

NPV6% of

US$121M (post-tax), annual post-tax cashflow of estimated

US$23Mpa, and a payback period of 1.3

years when applying presumed tax and a gold price

of US$1,800/oz of gold. The initial pre-production capital

cost is US$31.5M, which includes working capital

of US$4.5M, and a further

US$19.7M will be required as sustaining capital

for additional mine studies, dewatering, and leach pad expansions.

Total operating cost is $20.85 per tonne post tax

(and all in sustaining cost of $1,337/oz gold

(post-tax)). Royalty is low at 1.2% of

product.

The Project is based on 455,000 gold

ounces contained within the pit shells, with a

head grade of 0.73 g/t gold spread across four

known gold deposits. The four gold resources (see Figure 3: North

Hill, Silica Ridge, South East Pediment, Abel Knoll) shall be mined

via conventional open pit mining methods, with an average life of

mine waste to ore ratio of 2.2:1, annual

production is 35-40K oz gold (38,000 average),

with 2.2Mt feed production rate. Refer Table 1 and

Table 2 for further details and estimated financial metrics.

|

Metric |

Pre-Tax |

Post-Tax |

|

Economic Analysis |

|

|

|

|

|

Internal Rate of Return (IRR) |

102% |

|

|

81% |

|

|

|

NPV @ 6% |

$161,092,882 |

|

USD |

$121,009,339 |

|

USD |

|

Average Annual Cashflow |

$29,017,072 |

|

USD |

$22,923,487 |

|

USD |

|

Undiscounted Cumulative Cashflow |

$229,585,644 |

|

USD |

$174,743,379 |

|

USD |

|

Pay-Back Period |

1.1 |

|

years |

1.3 |

|

years |

|

Gold Price Assumption |

$1,800 |

|

per ounce |

$1,800 |

|

per ounce |

|

All-in Sustaining Cost |

$1,176 |

|

per ounce |

$1,337 |

|

per ounce |

|

Capital Costs |

|

|

|

|

|

Initial Capital |

$31,568,000 |

|

USD |

$31,568,000 |

|

USD |

|

Working Capital (included in above) |

$4,500,000 |

|

USD |

$4,500,000 |

|

USD |

|

LOM Sustaining Capital |

$19,739,240 |

|

USD |

$19,739,240 |

|

USD |

|

Total LOM Capital |

$51,307,240 |

|

USD |

$51,307,240 |

|

USD |

|

Contingency (Included in Total) |

$9,980,000 |

|

USD |

$9,980,000 |

|

USD |

|

Operating Costs (Average LOM) |

|

|

|

|

|

Mining |

$7.80 |

|

per ore tonne |

$7.80 |

|

per ore tonne |

|

Processing & Support |

$5.65 |

|

per ore tonne |

$5.65 |

|

per ore tonne |

|

General & Administration (G&A) |

$2.99 |

|

per ore tonne |

$2.99 |

|

per ore tonne |

|

Other Costs |

$1.57 |

|

per ore tonne |

$4.40 |

|

per ore tonne |

|

Total Operating Cost |

$18.03 |

|

per ore tonne |

$20.85 |

|

per ore tonne |

|

Production Data |

|

|

|

|

|

Life of Mine |

9 |

|

years |

9 |

|

years |

|

Annual Processing Rate |

2,157,667 |

|

tonnes per annum |

2,157,667 |

|

tonnes per annum |

|

Total Tonnes Processed |

19,419,000 |

|

tonnes |

19,419,000 |

|

tonnes |

|

Grade Au (Average) |

0.73 |

|

g/t Au |

0.73 |

|

g/t Au |

|

Contained Gold |

455,000 |

|

ounces |

455,000 |

|

ounces |

|

Metallurgical Recovery Au (Overall) |

75% |

|

|

75% |

|

|

|

Average Annual Gold Production |

37,917 |

|

ounces per annum |

37,917 |

|

ounces per annum |

|

Total Gold Produced |

341,250 |

|

ounces |

341,250 |

|

ounces |

|

LOM Strip Ratio |

2.2 |

|

: 1 |

2.2 |

|

: 1 |

Table 2. Scoping Study economic analysis summary of Sandman

Project with Pre-Tax and Post-Tax figures reported

Figure 1. Sandman Project location map of Northern Nevada

relative to the surrounding operating gold mines and mineral

resources. Reference to the nearby projects is for information

purposes only and there are no assurances the Company will achieve

the same results.

Figure 2. Sandman Project location relative to infrastructure

and nearby regional mine servicing town of Winnemucca, Nevada. The

project is located on Jungo Road 20-30 kms from Winnemucca.

Figure 3. Sandman Scoping Study proposed mine design. This has

not changed from the prior Phase 1 study.

EXECUTIVE SUMMARY

The Sandman Project presents strong financial

results and a compelling mine opportunity for a stand-alone open

pit gold mine, with Phase 1 mining above water table (for five

years) commencing at the North Hill deposit, followed by Silica

Ridge, Southeast Pediment and Abel Knoll deposits. Upon completion

of Phase 1, and the required below water table permitting and

dewatering efforts, Phase 2 mining (over four years) is expected to

commence immediately in the same order as Phase 1 commencing at

North Hill and heading southwards to the Abel Knoll deposit. The

two-phase approach is designed to conserve initial pre-production

capital while enabling rapid mine commissioning to achieve cashflow

and to fund the below water table permit for Phase 2 mining, and

also fund further exploration to increase the mine resources.

The mine proposal includes an onsite multi-stage

crushing plant, which is mobile and will move progressively from

each pit location, with separate dumps and two localized leach

pads. The first leach pad will be constructed for North Hill and

Silica Ridge, and the second leach pad will be constructed in year

3 and will receive mineralized material feed from Southeast

Pediment and Abel Knoll. Leach Pad expansions will be required in

years 5 and 6 to accommodate the additional tonnage from Phase 2

mining.

Economics are based upon contract mining,

crushing and heap leach as the main processing method. It is

planned to load the gold onto activated carbon and then transport

the loaded carbon to off-site stripping and refining plants for

final gold doré recovery. A simplified mining schedule is

anticipated to produce 35,000-40,000 ounces of gold per annum.

Given the North Hill and Silica Ridge deposits

outcrop on hill tops at surface, these deposits present the best

strip ratio starter pit mine scenarios3. Phase 1 is targeting these

low-strip ratio resources to enable rapid permitting (above water

table) for mine start-up and initial cash flow. Initial mine

production revenue will be used to fund further mine studies,

permitting and dewatering efforts to allow the Phase 2 mining below

the water table and this is expected be included in future

studies.

Table 3. Sandman Project Scoping Study mine

factors applied to the economic evaluation

Comments

- This scenario includes all material

within an optimized pit shell

- Recoveries assumed at 75% for heap

leaching. Opportunity exists to optimize recoveries after further

metallurgical test work is completed

- Optimized pit shells were applied,

not a refined pit design

- Future opportunity exists to

increase mine production, as this schedule assumes dayshift-only

mining to meet the planned material movement requirements

- Cashflow model includes a 1.2%

Royalty

Capital Categories

- Contingency added to capital to

cover unknown/unrecognized categories

- Working capital is sufficient to

cover 2 months of operating costs

- Capital estimates are based on

current quotes and/or information from previous projects (within

the past two years) and inflated to 2023 levels

- Engineering Procurement

Construction Management (EPCM)

- Earthworks – roads, stockpiles, and

yard construction

- Crushing/stacking equipment,

multi-stage crushing for 6-8Kt per day, cost estimate includes

installation and commissioning, entire system to be mobile and

follow mining from pit to pit

- Leach pad and ponds, 5-8Kt per day,

cost estimate includes installation and commissioning. Initial pad

built near North Hill and Silica Ridge with a second pad built near

Southeast Pediment and Abel Knoll in year 3.

- Carbon columns, cost estimate

includes installation and commissioning. One set of columns for the

initial leach pad and second set to be constructed for the second

leach pad

- Sustaining capital includes

temporary construction facilities, construction services, supplies,

quality control, survey support, construction equipment and

safety

- Sample preparation conducted on

site with off site gold analysis

- Infrastructure includes portable

office, warehouse/parts storage, and a workshop

- Initial purchase or lease of water

rights necessary to operate the mine

- Option to purchase additional

surface rights included

Operational Categories

- Mining contractor mobilisation for

12-15 equipment units, office space and other resources.

- Contract mining comprises:

- Drilling

- Blasting

- In-pit loading

- Waste haulage to near-pit waste

rock stockpile

- Product feed haulage to near-pit

stockpile location (for feed to crusher)

- Loader feed into a portable

(movable) crusher

- Loading of crushed material into

trucks

- Truck haulage to heap leach

pad

- Roads/dumps/stockpile

maintenance

- Company shall maintain small

workforce for project management, administration, SHE

permitting-training-compliance, general labor, crushing/heap leach

operations, supply chain etc.

- Contractor demobilization at the

end of the project life

- Centralised location for diesel,

gasoline, lubes, and oils

- Power Generation and Distribution

with mobile generators for crushing, pumping and other

infrastructure requirements, includes a back-up generator, power

poles, transformers for on-site distribution

- Further studies for alternative

power solutions are needed as this scenario uses diesel

generators

- Water supply and distribution,

water well construction and extraction, pumping and piping to

supply water for the project. Water usage 3,900 gallons per minute

with make-up water consumption rate of 285 gallons per minute

- Additional environmental and

hydrogeological baseline studies are required

- Initial purchase or lease of water

rights necessary to operate the mine

- Indirect owners’ costs include

temporary construction facilities, construction services, supplies,

quality control, survey support, construction equipment, safety

etc.

Operating CostsAn operating

cost estimate has been calculated at US$20.85 per tonne of

mineralized material mined and processed for the Project. The

estimate relates to all costs to allow production of gold doré,

capturing the processing plant facilities, contractor mining,

product refining and general and administration (G&A)

costs.

|

Functional Area |

Post-tax Cost per

Tonne Processed

(US$) |

|

Mining |

$7.80 |

|

Processing |

$5.66 |

|

G&A |

$2.99 |

|

Other Costs (Royalty, Taxes, etc.) |

$4.40 |

|

Total Site

Operating

Cost1 |

$20.85 |

Table 4. Sandman Project operating cost

summary.

Basis for Economic calculations

(tonnage/grades)The Company announced its Mineral Resource

Estimate on February 2, 2021 with combined Indicated and Inferred

ounces totaling 494K ounces of gold and summarized below. Refer to

Table 8 for the prior published summary of the Sandman Mineral

Resource Estimate in which the majority of the Mineral Resource is

Indicated a small amount is Inferred.

- Indicated Mineral Resource of 18,550kt @ 0.73g/t gold for

433kozs of gold

- Inferred Mineral Resource of 3,246kt @ 0.58g/t gold for 61kozs

of gold

The Scoping Studies are preliminary in

nature, include a small amount of inferred mineral resources that

are considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

Scoping Studies will be realized.

A further grade model was created for the Phase

2 Scoping Study to include the 2021 and 2022 drill results and

estimate an above water table tonnage and grade model. This was

applied to the Scoping Phase 2 Study pit optimization work and the

resulting tonnes and grade used In the Phase 2 Study are summarised

in Table 5. The water table surface was conservatively defined by

first intercept of water in the exploration drill holes. Detailed

hydrogeological studies accurately defining the water table are yet

to be conducted and will be included in future Studies.

Table 5. Scoping Study tonnes and grade depicting 455K oz

contained gold within the pit optimisation

Mining MethodsThe Sandman Project is planned to

be mined using conventional open pit mining methods on the four (4)

separate deposits in the order listed in Table 6. The mining

operation schedule is dayshift only with a roster of two production

crews on a 4-days on and 4-days off, 12 hours per day.

Pre-production stripping is expected to be

minimal as mineralized material is located at or near surface on

hill tops where mining is anticipated to begin at the North Hill

and Silica Ridge deposits. The pit areas have small shrubs and

grasses that can be cleared with planned mining equipment.

Open pit mining is currently envisaged to be by

diesel-powered equipment, utilizing a combination of one rotary

blasthole rig drilling blastholes, one 8m3 front-end loader (or

similar size excavator), and five to six, 70-tonne capacity trucks

to handle mineralized material and waste. The mining fleet has

sufficient capacity to move up to approximately 6.0Mtpa of total

material on a dayshift-only schedule. Support equipment comprising

a grader, track dozer(s) and water truck will aid in the mining.

Mineralized material will be hauled to the crushing area for

stockpiling before being rehandled later for primary crushing.

Initially, waste rock will be stored in the waste rock dumps close

to the pit to reduce haulage costs. As space and design allows,

waste will be backfilled into the pit to reduce haulage costs and

surface disturbance.

Haul roads are contemplated to be 9-10m widths

for one-way traffic and 18-20m widths for two-way traffic. The

final location of the ramps is expected to be optimized to reduce

the overall pit slopes and to aid in efficient haulage to various

stockpile locations. The pit is considered dry in Phase 1 and wet

in Phase 2.

The mine plan was designed to deliver ~2.2Mt of

mineralized material per year to the processing facility. The mine

plan was based on efficient extraction of mineralized material

above the water table in Phase 1 and started at the North Hill

deposit (predicted higher-grade and low strip ratio) and then

working the deposits in a southerly direction without regard to

majority Indicated, and minority Inferred, Mineral Resource

categories. Phase 2 mining will continue below the water table also

starting at North Hill and working in a southerly direction towards

Abel Knoll.

The total estimated mining workforce is 55-60

people, comprising a team of 22 Gold Bull personnel and 30-35

mining contractors (20 production operators, 8 maintenance techs, 5

supervisory staff).

|

Period |

MineralizedMaterial |

GoldGrade |

ContainedGold |

TotalWaste |

TotalMaterial |

StripRatio |

|

|

tonnes |

g/t |

ounces |

tonnes |

tonnes |

w:o |

|

Year 1 |

1,633,000 |

0.82 |

42,857 |

3,120,000 |

4,753,000 |

1.9 |

|

Year 2 |

2,306,000 |

0.77 |

57,143 |

3,833,000 |

6,139,000 |

1.7 |

|

Year 3 |

2,685,000 |

0.66 |

57,143 |

2,799,000 |

5,484,000 |

1.0 |

|

Year 4 |

2,247,000 |

0.79 |

57,143 |

3,077,000 |

5,324,000 |

1.4 |

|

Year 5 |

2,844,000 |

0.57 |

51,714 |

5,371,000 |

8,215,000 |

1.9 |

|

Year 6 |

3,195,000 |

0.56 |

57,143 |

7,564,000 |

10,759,000 |

2.4 |

|

Year 7 |

2,042,000 |

0.87 |

57,143 |

7,678,000 |

9,720,000 |

3.8 |

|

Year 8 |

1,887,000 |

0.94 |

57,143 |

6,608,000 |

8,495,000 |

3.5 |

|

Year 9 |

580,000 |

0.94 |

17,571 |

2,031,000 |

2,611,000 |

3.5 |

|

Totals |

19,419,000 |

0.73 |

455,000 |

42,081,000 |

61,500,000 |

2.2 |

Table 6. Sandman Project annual mining production schedule for 9

years for the four Sandman deposits.

Recovery MethodsPrecious metal

recovery from this Scoping Phase 2 Study is through conventional

heap leaching and adsorption, desorption, regeneration (ADR)

technology for metal extraction from crushed product using industry

standard equipment. Processing will involve mineralized material

passing through multiple stages of crushing, which will allow for

haulage transport and end-dump stacking of the mineralized material

onto a heap leach pad. The processing facilities accommodate a

leachable tonnage of approximately 19.4Mt of product at a gold

grade of 0.73g/t and a process rate of 5,900tpd or 2.2Mtpa. The

heap leach pad facilities have been located and designed with

expandability for a LOM production increase.

Mineralized material will be delivered to the

crushing plant from the open pit and placed in the stockpile

adjacent to the crushing plant. The mineralized material will be

fed to the crushing plant using a front-end loader and will be

crushed and then transported to the heap leach pad via haul trucks.

The mineralized material will be stacked onto the heap using

industry standard end-dumping and dozer pushing and then leached

with a weak cyanide solution to extract the precious metal values.

The gold will then be recovered from the pregnant solution in the

carbon columns by adsorbing the dissolved gold onto activated

carbon, which will be bagged and transported off-site to an

external facility to extract gold from the loaded carbon. The

stripped carbon will be returned from the external treatment

facility to site for continuous reuse in the process plant. The

doré will be sent to a contract refiner for final refining.

Mineral ProcessingHistorical

metallurgical test work has been completed over several stages,

predominantly from the Silica Ridge, North Hill and Southeast

Pediment deposits, mostly by Newmont and Kappes, Cassiday and

Associates (KCA) in Reno, Nevada. Recent test work on samples from

Abel Knoll were completed by KCA for Gold Bull in 2021.

Historically, relatively extensive bottle roll

leach programs were conducted while only limited column leach tests

were completed for three of the four deposits. Further test work is

required to adequately determine the optimal processing circuit and

resulting gold recoveries for the gold mineralization at Sandman.

At this stage it is considered likely that a conventional

three-stage crush followed by heap leach processing could achieve

gold recoveries of 75%. Additional work is required to confirm the

crush size and gold recoveries from heap leaching.

Sensitivity AnalysisHigh level

sensitivity analysis of the Sandman Project economics was

conducted, indicating the project is most sensitive towards gold

price and less sensitive towards operating cost and least sensitive

to capital cost. Figure 4 and 5 and Table 7 demonstrate the range

of NPV in million dollars over a range of gold prices and include

Pre and Post Tax analysis.

Figure 4. Sandman sensitivity analysis evaluating gold price,

capital costs and operating costs both Pre-Tax and Post-Tax

analysis.

Figure 5. Sandman sensitivity analysis is most

sensitive to the gold price

Table 7. Gold price impact on Post-Tax NPV 6% and

IRR.

Table 8. January 2021 NI 43-101 Sandman Gold Resource Estimate.

Full report available: Sandman-NI-43-101_2021-01-20.pdf

(goldbull.ca) Please note that the Sandman 2021 NI 43-101 Resource

Estimate does not include drilling conducted by Gold Bull in 2021

and 2022.

NEXT STEPS

Further drilling and metallurgical, geotechnical

and hydrogeological studies are required for inclusion in a

Preliminary Feasibility Study and for use in mine permitting.

Baseline hydrogeological, cultural, and

biological surveys have previously been conducted at Sandman,

however, may need to be updated for mine permitting. Additional

technical and design optimization studies will also be required for

inclusion in a Preliminary Feasibility Study. Infill resource and

reserve drilling is required ahead of the mine schedule.

Optional additional exploration is warranted and

recommended to expand the current mineral resource base.

CAUTIONARY STATEMENT

This Scoping Study is a preliminary technical

and economic study investigating the potential viability of

commissioning and running a gold mine at the Sandman Project. The

Scoping Study includes a smaller amount of inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorized as mineral reserves, and there is no certainty

that the Scoping Study will be realized.

The Scoping Study in this announcement is based

on technical and economic assumptions and assessments which could

be further refined and evaluated in a preliminary feasibility

study. If the Company were to attempt to bring the Sandman Project

into production without established mineral reserves on the project

supported by a full feasibility study, the Company cautions that

this could result in a higher risk of economic or technical failure

of the operation than if a full feasibility study had been prepared

demonstrating economic and technical viability.

The Scoping Study is based on material

assumptions outlined in this announcement. These include

assumptions about the availability of funding and other parameters.

While the Company considers all the material assumptions are based

on reasonable grounds, there is no certainty they will prove to be

correct or that the range of outcomes indicated in this Scoping

Study announcement can be achieved or realised. There are no

assurances that the Sandman Project will be found to be

economic.

To achieve the potential mine development

outcomes indicated in the Phase 1 and Phase 2 Scoping Study,

significant funding is required as well as further drilling and

metallurgical, hydrogeological, and environmental assessments and

permits received prior to confirming mining can take place. The

Study has focussed only on Phase 1 initial oxide mining of

mineralized material above the water table, then Phase 2 mining of

material below the water table, using conventional heap leach

processing. Investors should note there is no certainty that the

Company will be able to raise the required funding when needed,

however the Company has concluded that it has a reasonable basis

for providing the forward-looking statements included in this

announcement and believes that it has a “reasonable basis” to

expect it will be able to fund the gold development project upon

receiving satisfactory and favourable results for further

metallurgical, hydrogeological and environmental studies and

permits enabling economic ore extraction. Further studies are

required to confirm the proposed mine scenario and confirm

assumptions made in this Scoping Study.

It is also possible that such funding may only

be available on terms that may be dilutive, or otherwise affect the

value of the Company’s existing shares. It is also possible that

the Company could pursue other strategies to provide alternative

funding options including project finance.

Given the uncertainties involved for the

metallurgical, hydrogeological and environmental assessments and

permits, investors should not make any investment decision based

solely on the results of the Scoping Studies and assume a mine will

be developed, however every effort will be made by the Company to

progress towards mine development.

ABOUT SANDMAN

In December 2020, Gold Bull purchased the

Sandman Project from Newmont. Gold mineralization was first

discovered at Sandman in 1987 by Kennecott and the project has been

intermittently explored since then. There are four known pit

constrained gold resources located within the Sandman Project,

consisting of 21.8Mt at 0.7g/t gold for 494,000 ounces of gold;

comprising of an Indicated Resource of 18,550kt at 0.73g/t gold for

433kozs of gold plus an Inferred Resource of 3,246kt at 0.58g/t

gold for 61kozs of gold. Several of the resources remain open in

multiple directions and the bulk of the historical drilling has

been conducted to a depth of less than 100m. Sandman is

conveniently located circa 25-30 km northwest of the mining town of

Winnemucca, Nevada.

QUALIFIED PERSON

The technical information in this news release

has been reviewed and approved by Mr. Jerod Eastman, Mr. Steven

Olsen, and Mr. Carl E. Defilippi for only the sections which they

are responsible.

Mr. Eastman is a Qualified Person under National

Instrument 43-101. Mr. Eastman is a Registered Member (#00885850)

of the Society for Mining, Metallurgy and Exploration, Inc. and is

completely independent of Gold Bull Resources Corp. The information

in this news release that relates to mining and cost estimation is

based on, and fairly reflects, information compiled and approved by

Mr. Eastman.

Mr. Steven Olsen is a Qualified Person under

National Instrument 43-101. Mr. Olsen Is a Registered member of the

Australian Institute of Geoscientists (#7014) and is completely

independent of Gold Bull Resources Corp. The Information in this

public announcement that relates to Mineral Resource estimation was

produced and approved by Mr. Steven Olsen.

Mr. Carl E. Defilippi is a Qualified Person

under National Instrument 43-101. Mr. Defilippi is a Registered

Member (#775870) of the Society for Mining, Metallurgy and

Exploration, Inc. and is completely independent of Gold Bull

Resources Corp. The Information in this new release that only

relates to Metallurgy was approved by Mr. Defilippi.

ABOUT GOLD BULL RESOURCES CORP.

Gold Bull’s mission is to grow into a US focused

mid-tier gold development Company via rapidly discovering,

developing and acquiring additional ounces. The Company’s

exploration hub is based in Nevada, USA, a top-tier mineral

district that contains significant historical production, existing

mining infrastructure and an established mining culture. Gold Bull

is led by a Board and Management team with a track record of

exploration and acquisition success.

Gold Bull’s core asset is the Sandman Project,

located in Nevada which has a 494,000 oz gold

resource as per 2021 NI 43-101 Resource Estimate. Sandman is

located 23 km south of the Sleeper Mine and boasts excellent

large-scale exploration potential.

Gold Bull is driven by its core values and

purpose which includes a commitment to safety, communication &

transparency, environmental responsibility, community, and

integrity.

Cherie LeedenPresident and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull

Resources Corp., please visit our website at www.goldbull.ca or

email admin@goldbull.ca or phone 778.401.8545.

Cautionary Note Regarding Forward-Looking

StatementsNeither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Gold

Bull believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

planned activities at the Sandman Project; the timing and costs of

future activities on the Company’s properties; maintaining its

mineral tenures and concessions in good standing, to explore and

develop its projects, to repay its debt and for general working

capital purposes; changes in economic conditions or financial

markets; the inherent hazards associates with mineral exploration

and mining operations, future prices of gold and other metals,

changes in general economic conditions, accuracy of mineral

resource and reserve estimates, the potential for new discoveries,

the ability of the Company to obtain the necessary permits and

consents required to explore, drill and develop the projects and if

obtained, to obtain such permits and consents in a timely fashion

relative to the Company’s plans and business objectives for the

projects; the general ability of the Company to monetize its

mineral resources; and changes in environmental and other laws or

regulations that could have an impact on the Company’s operations,

compliance with environmental laws and regulations, dependence on

key management personnel and general competition in the mining

industry. Forward-looking statements are based on the reasonable

beliefs, estimates and opinions of the Company’s management on the

date the statements are made. Except as required by law, the

Company undertakes no obligation to update these forward-looking

statements in the event that management’s beliefs, estimates or

opinions, or other factors, should change.

_________________1 announced September 12 2022 titled “Gold

Bull’s Sandman Project Scoping Study points to near-term production

potential” with report filed on October 27, 20222 applied Federal

Income Tax, NV Excise Tax, Net Proceeds Tax 3 Note both

Southeast Pediment and Silica Ridge also have mineralisation at

surface but a not on hill tops, these two deposits are at planar

level so the strip ratio is slightly higher.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/bdf7ff79-65be-41ed-957b-5120f906e44e

https://www.globenewswire.com/NewsRoom/AttachmentNg/bdc78d90-08e6-4a8e-912c-ec1ab5f40b68

https://www.globenewswire.com/NewsRoom/AttachmentNg/fce71dec-498f-4b4d-9562-3c7af21e217e

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ec7882d-b9b5-471e-a63a-baf0d00eb247

https://www.globenewswire.com/NewsRoom/AttachmentNg/058cf20b-a2b8-40d6-8a95-b57e5423c5b8

https://www.globenewswire.com/NewsRoom/AttachmentNg/d669e692-a1ff-4714-9431-cf78d7c633a2

https://www.globenewswire.com/NewsRoom/AttachmentNg/301d87bd-5e67-413a-a862-63ffa66ffb31

https://www.globenewswire.com/NewsRoom/AttachmentNg/d64daa49-9898-4f06-a46b-d521d0541e4d

https://www.globenewswire.com/NewsRoom/AttachmentNg/a8cad12f-0555-4353-8b0c-9628796d7909

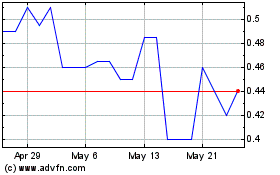

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

From Dec 2023 to Dec 2024