TSX VENTURE COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: May 11, 2010

TSX Venture Tier 2 Companies

A Cease Trade Order has been issued by the British Columbia Securities

Commission on May 11, 2010, against the following Companies for failing to

file the documents indicated within the required time period:

Period

Ending

Symbol Company Failure to File (Y/M/D)

("CMM") Century Mining Corporation Comparative financial 09/12/31

statements

management's discussion 09/12/31

& analysis

("ELT") Electra Gold Ltd. Comparative financial 09/12/31

statements

management's discussion 09/12/31

& analysis

("SPG") StonePoint Global Comparative financial 09/12/31

Brands Inc. statements

management's discussion 09/12/31

& analysis

("VQE") VisionQuest Energy Comparative financial 09/12/31

Group Inc. statements

management's discussion 09/12/31

& analysis

Upon revocation of the Cease Trade Order, the Company's shares will remain

suspended until the Company meets TSX Venture Exchange requirements.

Members are prohibited from trading in the securities of the company during

the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

BULLETIN TYPE: Sustaining Fees, Halt

BULLETIN DATE: May 12, 2010

Further to the TSX Venture Exchange Notice to Issuers Bulletin of March 15,

2010 announcing the due date for payment of outstanding Sustaining fees, as

March 31, 2010, the Exchange has not received payment from the following

trading issuers of their annual sustaining fees. A copy of the March 15,

2010 Bulletin is posted in the News Archive, Market Information and

Statistics section of the home page of the Exchange website at www.tsx.com.

At the opening of business Thursday, May 13, 2010, the securities of these

issuers will be halted from trading for failure to pay their annual

sustaining fees. In addition, an issuer halted for failure to pay the

sustaining fee will be subject to a processing fee of $250.00 + GST and the

5% Late Payment Fee outlined in the March 15, 2010 bulletin to be brought

back to trade.

If payment is not made within 10 business days of being halted, the issuer

will be suspended from trading without further notice. Once an issuer is

suspended from trading, it will be subject to a reinstatement review, which

must be accompanied by the applicable fee of $500.00 + GST and the 5% Late

Payment Fee.

In May 2010, suspended issuers should expect to be sent a notice to delist.

If issuers have any questions regarding this halt, please contact:

Joanne Butz

Team Manager, Compliance & Disclosure

Phone: 403-218-2820

Fax: 403-234-4323

e-mail: joanne.butz@tsxventure.com

--------------------------------------------------------------

ACCESS INTERNATIONAL EDUCATION LTD. AOE Tier2

--------------------------------------------------------------

WEST HAWK DEVELOPMENT CORP. WHD Tier2

--------------------------------------------------------------

TSX-X

---------------------------------------------------------------------------

ACME RESOURCES INC. ("ARI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 12, 2010:

Number of Shares: 3,000,000 shares

Purchase Price: $0.12 per share

Warrants: 3,000,000 share purchase warrants to

purchase 3,000,000 shares

Warrant Exercise Price: $0.16 for a five year period

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Seamus Young Y 450,000

Tim Young Y 450,000

Matt Mason Y 700,000

Brian Edgar Y 700,000

William A. Rand Y 700,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

---------------------------------------------------------------------------

AMERIPLAS HOLDINGS LTD. ("AHL")

BULLETIN TYPE: Reinstated for Trading

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated April 14, 2010, the Exchange

has been advised that the Cease Trade Order issued by the British Columbia

Securities Commission on April 14, 2010 has been revoked.

Effective at the opening Thursday, May 13, 2010, trading will be reinstated

in the securities of the Company.

TSX-X

---------------------------------------------------------------------------

ARGONAUT EXPLORATION INC. ("AGA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 23, 2010:

Number of Shares: 4,166,665 flow-through shares

Purchase Price: $0.24 per share

Warrants: 4,166,665 share purchase warrants to

purchase 4,166,665 shares

Warrant Exercise Price: $0.35 for a one year period

$0.45 in the second year

Number of Placees: 7 placees

Finder's Fee: $50,000 in cash and 208,333 finders'

warrants payable to Limited Market

Dealer Inc. Each finder's warrant

entitles the holder to acquire one

unit for a two year period.

Note that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

For further details, please refer to the Company's news release dated April

29, 2010.

TSX-X

---------------------------------------------------------------------------

AXIOTRON CORP. ("AXO")

BULLETIN TYPE: Halt

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

Effective at the opening, May 12, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

BROWNSTONE VENTURES INC. ("BWN")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

assignment agreement dated January 20, 2010, between Brownstone Ventures

Inc. (the "Company"), Quetzal Energy Ltd. - a TSX Venture-listed company

("Quetzal"), and Fenix Energy Inc. (the "Assignor") and the participation

agreement dated March 10, 2010 (collectively, the "Agreements"), between

the Company, Quetzal, Condor Exploration Inc. and Consorcio Canaguaro

("Consorcio") governing their interests in the Canaguaro Block in the

Llanos basin, Columbia (the "Property"). Pursuant to the Agreements, the

Company has been assigned 50% of the Assignor's interests in the Property,

resulting in a 25% interest in the Property.

As consideration for the assignment, the Company must issue the Assignor

500,000 shares. To earn the 25% interest, the Company must pay an aggregate

of US$1,250,000 to the underlying vendors, contribute US$3,125,000 to the

Canaguay 1 exploration work well and also cover 25% of the balance of the

cost to drill the well.

The Company will pay a 6% overriding royalty and a one-time success fee

based on the first year's average production of the Canaguay well to

Consorcio.

For further information, please refer to the Company's press release dated

January 20, 2010.

TSX-X

---------------------------------------------------------------------------

CANACOL ENERGY LTD. ("CNE")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced September 23 and October 15, 2009:

Number of Shares: 142,858,000 shares

Purchase Price: $0.28 per share

Number of Placees: 37 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Robyn Hemminger P 125,000

Shane Helwer P 100,000

Agent's Fee: $1,500,009 payable to Canaccord

Capital Corporation

$500,003 payable to FirstEnergy

Capital Corp.

TSX-X

---------------------------------------------------------------------------

CATALINA ENERGY CORP. ("CEA.H")

(formerly Catalina Energy Corp. ("CEA"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.5, the Company has not maintained

the requirements for a TSX Venture Tier 2 company. Therefore, effective the

opening Thursday, May 13, 2010, the Company's listing will transfer to NEX,

the Company's Tier classification will change from Tier 2 to NEX, and the

Filing and Service Office will change from Vancouver to NEX.

As of May 13, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from CEA to CEA.H. There is

no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the Exchange Bulletin dated August 7, 2009, trading in the

shares of the Company will remain suspended.

Members are prohibited from trading in the securities of the Company during

the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

DIAMCOR MINING INC. ("DMI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 15, 2009, December 7,

2009, January 26, 2010 and March 30, 2010:

Second Tranche:

Number of Shares: 5,505,155 shares

Purchase Price: $0.30 per share

Warrants: 2,752,572 share purchase warrants to

purchase 2,752,572 shares

Warrant Exercise Price: $0.50 for a two year period

Number of Placees: 57 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Darren Vucurevich Y 66,667

Peter Traves P 50,000

Finders' Fees: $30,441.60 cash and 218,139 warrants

payable to Canaccord Financial Ltd.

$23,139.75 cash and 77,133 warrants

payable to 565423 BC Ltd. (Gary J.

Monaghan)

$5,355.00 cash and 17,850 warrants

payable to CIBC Wood Gundy Inc.

$15,960.00 cash and 53,200 warrants

payable to Intrynsyc Capital Corp.

(Beng Lai)

$6,586.65 cash payable to QIS Capital

Corporation (Dorin Quinton)

$1,092.00 cash and 3,640 warrants

payable to Global Securities Inc.

$44,999.98 cash payable to Canada-Asia

Business Network

- Finder's fee warrants are

exercisable at $0.50 per share for one

year.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

---------------------------------------------------------------------------

ERIN VENTURES INC. ("EV")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to a

purchase agreement dated April 26, 2010 between Erin Ventures Inc. (the

'Company') and an arm's-length vendor (the 'Vendor') wherein the Company

has agreed to acquire 36 quartz claims located in the Yukon Territory. In

consideration, the Company will pay the Vendor $25,000 in cash along with

1,500,000 common shares at a deemed price of $0.07 per share and 1,500,000

warrants ('Warrants'). Each Warrant will be exercisable for one common

share at a price of $0.10 per share expiring on June 1, 2012. The Vendor

will also receive a 3% net smelter royalty.

This transaction was announced in the Company's news release dated May 4,

2010.

TSX-X

---------------------------------------------------------------------------

FIRE RIVER GOLD CORP. ("FAU")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 19, 2010 and May 4, 2010:

First Tranche:

Number of Shares: 9,063,750 shares

Purchase Price: $0.40 per share

Warrants: 4,531,875 share purchase warrants to

purchase 4,531,875 shares

Warrant Exercise Price: $0.60 for an eighteen month period

Number of Placees: 56 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Robert Griffith P 30,000

John R. Griffith P 25,000

Leann Paulger P 20,000

Pacific North West Capital Corp. Y 1,825,000

Finders' Fees: $8,900 cash payable to Jones Gable &

Company Ltd.

$250 cash payable to Union Securities

$46,900 cash payable to Longwave

Strategies Inc.

$8,020 cash payable to Canaccord

Financial Ltd.

$57,000 cash payable to Loewen,

Ondaatje, McCutcheon Limited

$9,605 cash payable to Leede Financial

Market Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

---------------------------------------------------------------------------

FIRST POINT MINERALS CORP. ("FPX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced March 29, April 6, and April 26,

2010:

Number of Shares: 15,000,000 Units

(Each Unit consists of one common

share and one-half of one share

purchase warrant.)

Purchase Price: $0.50 per Unit

Warrants: 7,500,000 share purchase warrants to

purchase 7,500,000 shares

Warrant Exercise Price: $0.65 for a one year period

$0.80 in the second year

Number of Placees: 46 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Units

Cliffs Natural Resources Y 2,250,000

Exploration Inc.

William Myckatyn Y 80,000

Thomas W. Beattie Y 50,000

Peter M.D. Bradshaw Y 40,000

Ronald Matthew Britten Y 40,000

John Angus McDonald Y 30,000

J. Christopher Mitchell Y 20,000

Jill Anglin P 340,000

Bill Anglin P 200,000

John Wheeler P 250,000

Greg McKenzie P 100,000

Kerry Smith P 50,000

Desiree Kranendijk P 20,000

Douglas J. McDonald P 15,000

Shari Ventures P 10,000

(Douglas J. McDonald)

Alex Heath P 10,000

Stephanie Weterings P 5,000

Finder's Fee: $216,000 and 432,000 Finder's Warrants

payable to MacDougall, MacDougall &

MacTier, Inc.

$20,850 and 41,700 Finder's Warrants

payable to Haywood Securities Inc.

$18,000 and 36,000 Finder's Warrants

payable to Leede Financial Markets

Inc.

$15,000 and 30,000 Finder's Warrants

payable to D&D Securities Company

$6,000 and 12,000 Finder's Warrants

payable to BMO Nesbitt Burns Inc.

$2,400 and 12,000 Finder's Warrants

payable to Odlum Brown Limited

Each Finder's Warrant is exercisable

for one common share at a price of

$0.65 for a one year period or at

$0.80 in the second year.

TSX-X

---------------------------------------------------------------------------

FORTRESS MINERALS CORP. ("FST")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 492,610 bonus shares to the following insider in consideration of

$500,000 loan.

Shares Warrants

Zebra Holdings and Investments S.a.r.l. 492,610 0

(Adolf H. Lundin)

TSX-X

---------------------------------------------------------------------------

FLYING A PETROLEUM LTD. ("FAB")

BULLETIN TYPE: Consolidation

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

Pursuant to a special resolution passed by shareholders April 20, 2010, the

Company has consolidated its capital on a 10 old for 1 new basis and has

subsequently increased its authorized capital. The name of the Company has

not been changed.

Effective at the opening Thursday, May 13, 2010 shares of Flying A

Petroleum Ltd. will commence trading on TSX Venture Exchange on a

consolidated basis. The Company is classified as a 'Junior Natural Resource

- oil and gas' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of

which 8,824,956 shares are issued and

outstanding

Escrow 56 shares are subject to escrow

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: FAB (UNCHANGED)

CUSIP Number: 34407R 20 7 (new)

TSX-X

---------------------------------------------------------------------------

GENIUS WORLD INVESTMENTS LIMITED ("GNW.H")

(formerly Genius World Investments Limited ("GNW.P))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Reinstated

for Trading

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Exchange Policy 2.4, Capital Pool Companies,

the Company has not completed a qualifying transaction within the

prescribed time frame. Therefore, effective at the opening Thursday May 13,

2010, the Company's listing will transfer to NEX, the Company's Tier

classification will change from Tier 2 to NEX, and the Filing and Service

Office will change from Vancouver to NEX.

As of May 13, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from GNW.P to GNW.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture Exchange.

Effective at the opening Thursday, May 13, 2010, trading in the shares of

the Company will be reinstated.

TSX-X

---------------------------------------------------------------------------

GOLDBANK MINING CORPORATION ("GLB")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced March 5, 2010:

Number of Shares: 13,333,333 shares

Purchase Price: $0.06 per share

Warrants: 13,333,333 share purchase warrants to

purchase 13,333,333 shares

Warrant Exercise Price: $0.15 (first six months)

$0.25 in the remaining three years

The warrants are subject to an accelerated expiry, wherein the expiry

period of the warrants may be reduced, upon notice to the holders and at

the election of the Company, if the closing price of the shares is equal to

or greater than $0.25 per share for 10 consecutive trading days after any

applicable hold periods. If this condition is met and the Company elects to

accelerate all or a portion of the warrants, at its option, the exercise

period will be reduced to 25 business days from the date notice is provided

by the Company to the warrant holders.

Number of Placees: 10 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

437312 BC Ltd. (James Boyce) Y 5,500,000

Sean Fahy P 116,667

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

---------------------------------------------------------------------------

GOLDEN CHALICE RESOURCES INC. ("GCR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

option agreement between Golden Chalice Resources Inc. (the "Company"),

Frederick Rios and Garry Windsor (collectively the "Vendors"), whereby the

Company has the option to acquire a 100% undivided interest in the

Kenogaming South Extension Property located in Kenogaming Township,

Porcupine Mining Division, Ontario. In consideration, the Company will

issue a total of 325,000 common shares and pay a total of $65,000 over a

four year period ($15,000 and 75,000 shares in the first year) to the

Vendors.

The property is subject to a 2% net smelter return, of which 1% may be

purchased by the Company for $1,000,000.

Insider / Pro Group Participation: N/A

TSX-X

---------------------------------------------------------------------------

GOLDEN CHALICE RESOURCES INC. ("GCR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

option agreement between Golden Chalice Resources Inc. (the "Company"),

1571925 Ontario Ltd., Norm Collins and Chad Gloster (collectively the

"Vendors"), whereby the Company has the option to acquire a 100% undivided

interest in the Kenogaming Central Property located in Kenogaming Township,

Porcupine Mining Division, Ontario. In consideration, the Company will

issue a total of 250,000 common shares and pay a total of $70,000 over a

four year period ($15,000 and 50,000 shares in the first year) to the

Vendors.

The property is subject to a 2% net smelter return, of which 1% may be

purchased by the Company for $1,000,000.

Insider / Pro Group Participation: N/A

TSX-X

---------------------------------------------------------------------------

HABANERO RESOURCES INC. ("HAO")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

option agreement between Habanero Resources Inc. (the "Company") and Leslie

Ann Satkevich (the "Vendor"), as Executor of the Estate of John Peter Ross,

whereby the Company has the option to acquire a 100% interest in and to

forty-four contiguous mineral claims located in the Mayo Mining District,

Yukon. In consideration, the Company will pay a total of 925,000 common

shares and $92,500 over a five year period (50,000 shares and $5,000 in the

first year) to the Vendor.

The option agreement is subject to a 1.5% net smelter returns royalty, of

which the Company may purchase 1% at any time, for a payment of $1,000,000.

Insider / Pro Group Participation: N/A

TSX-X

---------------------------------------------------------------------------

INTERNATIONAL MONTORO RESOURCES INC. ("IMT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the second tranche of a Non-Brokered Private Placement announced February

24, 2010 and amended on April 22, 2010:

Number of Shares: 250,000 shares

Purchase Price: $0.06 per share

Warrants: 250,000 share purchase warrants to

purchase 250,000 shares if exercised

in the first year, otherwise it will

decrease to 125,000 share purchase

warrants to purchase 125,000 shares

Warrant Exercise Price: $0.12 for a one year period

$0.15 in the second year

Number of Placees: 2 placees

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

TSX-X

---------------------------------------------------------------------------

KELSO TECHNOLOGIES INC. ("KLS")

BULLETIN TYPE: Consolidation

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

Pursuant to a special resolution passed by shareholders February 5, 2010,

the Company has consolidated its capital on a seven old for one new basis.

The name of the Company has not been changed.

Effective at the opening Thursday, May 13, 2010, shares of Kelso

Technologies Inc. will commence trading on TSX Venture Exchange on a

consolidated basis.

Post - Consolidation

Capitalization: unlimited shares with no par value of

which 12,354,869 shares are issued and

outstanding

Escrow nil shares are subject to escrow

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: KLS (unchanged)

CUSIP Number: 48826D 20 1 (new)

TSX-X

---------------------------------------------------------------------------

KNIGHT RESOURCES LTD. ("KNP")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 14, 2010:

Number of Shares: 6,742,357 flow-through shares

Purchase Price: $0.11 per share for non-Quebec

residents

$0.115 per share for Quebec residents

Warrants: 3,371,179 share purchase warrants to

purchase 3,371,179 shares

Warrant Exercise Price: $0.15 for a one year period

$0.20 in the second year

Number of Placees: 6 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Mavrix A/C 242 P 1,500,000

Finder's Fee: $26,503.47 payable to Secutor Capital

Management Corporation

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

TSX-X

---------------------------------------------------------------------------

KWG RESOURCES INC. ("KWG")

BULLETIN TYPE: Private Placement-Non-Brokered, Correction

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange's bulletin dated May 11, 2010 with respect

to a Non-Brokered Private Placement, the expiry period relating to both the

Private Placement warrants and the finders' fee warrants should have read

as 24 rather than five years. The other information in our bulletin dated

May 11, 2010 remains unchanged.

RESSOURCES KWG INC. ("KWG")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier, corrige

DATE DU BULLETIN : Le 11 mai 2010

Societe du groupe 2 de TSX Croissance

Suite au bulletin de Bourse de croissance TSX date du 11 mai 2010

relativement a un placement prive sans l'entremise d'un courtier, la

periode d'expiration concernant les bons de souscription du placement

prive ainsi que ceux payes aux intermediaires aurait du se lire 24 mois et

non cinq ans. Les autres informations de notre bulletin du 11 mai 2010

demeurent inchangees.

TSX-X

---------------------------------------------------------------------------

LUCKY STRIKE RESOURCES LTD. ("LKY")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 8, 2010:

Number of Shares: 4,000,000 shares

Purchase Price: $0.14 per share

Warrants: 2,000,000 share purchase warrants to

purchase 2,000,000 shares

Warrant Exercise Price: $0.185 for a one year period

Number of Placees: 56 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P # of Shares

Kaitech Financial Corp. Y 225,000

(Patricia Wilson, Kevin

Taylor, Julia Wilson)

Rae Warburton Y 50,000

Rick Langer P 50,000

Morquest Trading Company P 75,000

(Al Morishita &

Shayne Nvquvest)

Matthew Mikulic Y 100,000

Kevin Taylor Y 25,000

Li Zhu P 25,000

Finder's Fee: 253,125 shares payable to SWR

Marketing Inc. (Monty C. Ritchings)

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

---------------------------------------------------------------------------

MILL CITY GOLD CORP. ("MC")

BULLETIN TYPE: Warrant Price Amendment, Warrant Term Extension

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the reduction in the exercise price

of the following warrants:

Private Placement:

# of Warrants: 5,354,162

Original Expiry Date of Warrants: June 5, 2010

New Expiry Date of Warrants: June 5, 2011

Original Exercise Price of Warrants: $0.40

New Exercise Price of Warrants: $0.20

These warrants were issued pursuant to a private placement of 3,750,000

flow-through shares and 3,750,000 non flow-through shares with 5,624,999

share purchase warrants attached, which was accepted for filing by the

Exchange effective June 5, 2008.

There are an additional 270,837 warrants outstanding which expiry date is

also extended to June 5, 2011, but which price will remain $0.40. These

warrants were purchased by an Insider.

TSX-X

---------------------------------------------------------------------------

MILLROCK RESOURCES INC. ("MRO")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing, a Letter Agreement dated May

3, 2010 between the Company and Teck American Inc. ("TAI"), a subsidiary of

Teck Resources Limited, where TAI may exercise an option to earn up to a

65% interest in the Company's Estelle Property following completion of an

initial 2010 exploration program by the Company. TAI can earn an initial

55% interest in the property by incurring US$3.6 Million in expenditures

over two years and earn and additional 10% interest by spending an

additional US$5 Million in property expenditures and making cash payments

of US$400,000 prior to the end of 2014.

Insider / Pro Group Participation: N/A

TSX-X

---------------------------------------------------------------------------

MOLYCOR GOLD CORP. ("MOR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced March 29,

2010 and amended April 30, 2010:

Number of Shares: 5,585,714 shares

Purchase Price: $0.07 per share

Warrants: 5,585,714 share purchase warrants to

purchase 5,585,714 shares

Warrant Exercise Price: $0.12 for a two year period

Number of Placees: 32 placees

Finders' Fees: $12,490 cash payable to James Elbert

$4,025 cash payable to Caliber Capital

Partners, Inc. (Doug Robb)

$2,240 cash payable to Mosam Ventures

Inc. (Marc Levy)

$1,260 cash payable to Conrad

Nunweiler

$1,200 cash payable to VIC Partners

Ltd. (Vadim Degan)

$1,200 cash payable to Ken Reser

$157.50 cash payable to Carol Morgan

$157.50 cash payable to Leanna Morgan

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

---------------------------------------------------------------------------

NXA INC. ("NXI")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 1,931,980 shares at a deemed price of $0.05 per share to settle

outstanding debt for $96,599.00.

Number of Creditors: 1 Creditor

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

---------------------------------------------------------------------------

PRO MINERALS INC. ("PRM")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to the following:

A purchase agreement dated March 15, 2010 between Pro Minerals Inc. (the

'Company') and the vendors, Sandra Slater-Possamai, Sharon Barill, Roger

Slater, Garry Slater and Mary Speers, pursuant to which the Company may

acquire a 100% interest in one mineral claim located in the Disco Lake area

of Ontario. In consideration, the Company will pay $10,000 and issue

250,000 shares. The acquisition is subject to a 2% net smelter return

royalty, of which the Company may purchase 1% for $1,000,000.

A purchase agreement dated March 15, 2010 between the Company and the

vendors, Garry Slater and Dave Cartmill, pursuant to which the Company may

acquire a 100% interest in one mineral claim located in the Disco Lake area

of Ontario. In consideration, the Company will pay $8,000 and issue 200,000

shares. The acquisition is subject to a 2% net smelter return royalty, of

which the Company may purchase 1% for $1,000,000.

A purchase agreement dated March 15, 2010 between the Company and the

vendor, Shaun Parent, pursuant to which the Company may acquire a 100%

interest in 18 mineral claims located in the Disco Lake area of Ontario. In

consideration, the Company will pay $45,000 and issue 400,000 shares. The

acquisition is subject to a 2% net smelter return royalty, of which the

Company may purchase 1% for $1,000,000.

TSX-X

---------------------------------------------------------------------------

REGENT VENTURES LTD. ("REV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced March 26, 2010:

Number of Shares: 6,000,000 flow through shares

Purchase Price: $0.06 per share

Warrants: 6,000,000 share purchase warrants to

purchase 6,000,000 shares

Warrant Exercise Price: $0.15 for a one year period. The

warrants are subject to acceleration

of the expiry date if the shares of

the Company trade at or above $0.20

per share for a period of twenty

consecutive trading days. In which

case, the Company can issue written

notice that the warrants will expire

30 days from the date of the notice.

Number of Placees: 16 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

John Rybinski P 750,000

Harold Hodgson P 500,000

Peter Ross P 500,000

Court Moore P 333,333

John Tognetti P 750,000

Richard Wilson Y 170,000

Douglas Eacrett Y 166,667

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

TSX-X

---------------------------------------------------------------------------

SAN ANTON CAPITAL INC. ("TON.P")

BULLETIN TYPE: CPC-Filing Statement

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's CPC Filing

Statement dated May 4, 2010, for the purpose of filing on SEDAR.

SAN ANTON CAPITAL INC. ("TON.P")

TYPE DE BULLETIN : SCD - Declaration de changement d'inscription

DATE DU BULLETIN : Le 12 mai 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot par la societe, d'une

declaration de changement d'inscription de SCD datee du 4 mai 2010, pour

les fins de depot sur SEDAR.

TSX-X

---------------------------------------------------------------------------

SANDSTORM METALS & ENERGY LTD. ("SND")

BULLETIN TYPE: New Listing-Shares

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

Effective at the opening May 13, 2010, the common shares of the Company

will commence trading on TSX Venture Exchange. The Company is classified as

a 'Mineral Exploration' company.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par

value of which 6,836,811 common shares

are issued and outstanding

Escrowed Shares: NIL common shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: SND

CUSIP Number: 80013L 10 0

For further information, please refer to the Company's Listing Application

dated April 29, 2010.

Company Contact: Nolan Watson

Company Address: Suite 1050, 625 Howe Street

Vancouver, BC V6C 2T6

Company Phone Number: (604) 689-0234

Company Fax Number: (604) 688-0094

TSX-X

---------------------------------------------------------------------------

SERENO CAPITAL CORPORATION ("SZZ.P")

BULLETIN TYPE: CPC-Filing Statement, Remain Suspended

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's Filing Statement

dated May 6, 2010, for the purpose of filing on SEDAR.

Further to TSX Venture Exchange's bulletin dated February 23, 2010, trading

in the shares of the Company will remain suspended.

TSX-X

---------------------------------------------------------------------------

UNITECH ENERGY RESOURCES INC. ("URX")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated May 5, 2010, effective at

6:41 a.m. PST, May 12, 2010 trading in the shares of the Company will

remain halted pending receipt and review by the TSX Venture Exchange of

acceptable documentation regarding the company following completion of the

Transaction.

TSX-X

---------------------------------------------------------------------------

WHITE TIGER MINING CORP. ("WTC")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 1,409,764

Original Expiry Date of Warrants: May 22, 2010

New Expiry Date of Warrants: May 22, 2011

Exercise Price of Warrants: $0.50

These warrants were issued pursuant to a private placement of 2,819,528

shares (1,306,250 flow-through units and 1,513,278 non-flow-through units)

with 1,409,764 share purchase warrants attached, which was accepted for

filing by the Exchange effective May 25, 2009.

TSX-X

---------------------------------------------------------------------------

ZAPATA ENERGY CORPORATION ("ZCO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 12, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced March 25 and April 13, 2010:

Number of Shares: 1,787,500 shares

1,394,317 Units

681,819 flow-through units ("FT

Units")

Each Unit consists of one common share

and one performance warrant

("Warrant"). Each FT Unit consists of

one flow-through share and one

Warrant.

Purchase Price: $4.40 per share, Unit and FT Unit

Warrants: 2,076,136 share purchase Warrants to

purchase 2,076,136 shares

Warrants will vest and become

exercisable under specific criteria as

outlined in the April 13, 2010 press

release by the Company.

Warrant Exercise Price: $5.17 for up to 60 months from date of

issuance

Number of Placees: 213 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Securities

Peter Bannister Y 109,214 Units

61,241 FT Units

Malcolm Adams Y 72,809 Units

40,827 FT Units

Paul Colborne Y 182,022 Units

61,241 FT Units

Keith Macdonald Y 65,528 Units

36,745 FT Units

James Pasieka Y 65,528 Units

36,745 FT Units

P. Dan O'Neil Y 160,179 Units

89,821 FT Units

Margaret Elekes Y 72,809 Units

40,827 FT Units

Maxwell Lof Y 160,178 Units

89,822 FT Units

Tim Sweeney Y 10,921 Units

6,124 FT Units

Dan Brown Y 109,213 Units

61,242 FT Units

Rob Leach Y 101,933 Units

57,158 FT Units

Jeff Farmer P 4,545 shares

Janice Clarke P 9,091 shares

Jim Davidson P 13,636 shares

Trent D. Boehm P 11,364 shares

Jeff Lawson P 11,364 shares

John Peltier P 4,545 shares

Grant Daunheimer P 2,273 shares

Ryan Shay P 4,545 shares

Ali Bhojani P 4,545 shares

Cody Kwong P 5,682 shares

Christopher Theal P 5,682 shares

Dan Cristall P 22,727 shares

Chris Burchell P 2,273 shares

Dan Tsubouchi P 14,773 shares

Doug Bartole P 5,682 shares

Wayne McNeill P 2,274 shares

Christopher Graham P 5,682 shares

James Buchanan P 6,984 shares

Tammi Christopher P 13,253 shares

Lois Palmer P 4,545 shares

Michelle Bertshmann Khalili P 3,408 shares

Bryan Trudel P 3,408 shares

Nirvaan Meharchand P 5,682 shares

No Finder's Fee.

TSX-X

---------------------------------------------------------------------------

NEX COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: May 11, 2010

NEX Company

A Cease Trade Order has been issued by the British Columbia Securities

Commission on May 11, 2010, against the following Company for failing to

file the documents indicated within the required time period:

Period

Ending

Symbol Company Failure to File (Y/M/D)

("LPI.H") Landstar Properties Inc. Comparative financial 09/12/31

statements

management's discussion 09/12/31

& analysis

Upon revocation of the Cease Trade Order, the Company's shares will remain

suspended until the Company meets TSX Venture Exchange requirements.

Members are prohibited from trading in the securities of the company during

the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: May 12, 2010

NEX Company

A Temporary Cease Trade Order has been issued by the Ontario Securities

Commission on May 12, 2010, against the following Company for failing to

file the documents indicated within the required time period:

Period

Ending

Symbol Company Failure to File (Y/M/D)

("CHP.H") Champion Communication audited annual financial 09/12/31

Services, Inc. statements

audited annual management's 09/12/31

discussion & analysis

certification of annual and

interim filings

Upon revocation of the Temporary Cease Trade Order, the Company's shares

will remain suspended until the Company meets TSX Venture Exchange

requirements. Members are prohibited from trading in the securities of the

company during the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

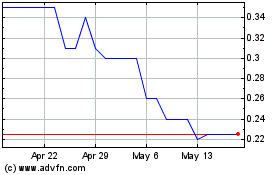

Goldbank Mining (TSXV:GLB)

Historical Stock Chart

From Apr 2024 to May 2024

Goldbank Mining (TSXV:GLB)

Historical Stock Chart

From May 2023 to May 2024