TSX VENTURE COMPANIES:

AAER INC. ("AAE")

BULLETIN TYPE: Delist

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

The common shares of AAER Inc. Inc. (the "Company") will be delisted from

TSX Venture Exchange effective at the close of business on August 19,

2010. The Company has confirmed that the plan of reorganization and

compromise of the Company dated July 12, 2010 (the "Plan") under the

Companies' Creditors Arrangement Act, as amended, and section 191 of the

Canada Business Corporation Act has been sanctioned by the Superior Court

of Quebec by an order dated August 11, 2010. Under the Plan, the shares of

the Company have been cancelled.

AAER INC. ("AAE")

TYPE DE BULLETIN : Retrait de la cote

DATE DU BULLETIN : Le 19 aout 2010

Societe du groupe 2 de TSX Croissance

Les actions ordinaires de AAER inc. (la "societe") seront retirees de la

cote de Bourse de croissance TSX a la fermeture des affaires le 19 aout

2010. La societe a confirme que le plan de reorganisation et de compromis

de la societe date du 12 juillet 2010 (le "plan") en vertu de la Loi sur

les arrangements avec les creanciers, tel que modifie, et l'article 191 de

la Loi canadienne sur les societes a ete approuve par la Cour superieure

du Quebec le 11 aout 2010. En vertu du plan, les actions de la societe ont

ete annulees.

TSX-X

-------------------------------------------------------------------------

ADVANCED PRIMARY MINERALS CORPORATION ("APD")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 2,527,340 shares at a deemed value of $0.15 per share to settle

outstanding debt for CDN$379,101.

Number of Creditors: 1 Creditor

Insider / Pro Group Participation:

Insider=Y / Amount Deemed Price

Creditor Progroup=P Owing per Share # of Shares

Erdene Resource

Development Corporation Y CDN$379,101 $0.15 2,527,340

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

-------------------------------------------------------------------------

ARCTIC STAR DIAMOND CORP. ("ADD")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced August 10, 2010:

Number of Shares: 3,060,000 flow-through shares

Purchase Price: $0.05 per share

Warrants: 3,060,000 share purchase warrants to

purchase 3,060,000 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 10 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Buddy Doyle Y 1,020,000

0800025 BC Ltd. (Patrick Power) Y 400,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

-------------------------------------------------------------------------

BRAVADA GOLD CORPORATION ("BVA")

BULLETIN TYPE: Private Placement-Non-Brokered, Correction

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange bulletin dated August 18, 2010 with

respect to the second and final tranche of the private placement of

900,000 units at a price of $0.15 per unit, Haywood Securities Inc. will

also be receiving a finder's fee in the amount of $7,380 and 82,000

Finder's Warrants that are exercisable into common shares at $0.20 per

share for a two year period.

TSX-X

-------------------------------------------------------------------------

CAP-EX VENTURES LTD. ("CEV")

(formerly Cap-Ex Ventures Ltd. ("CEV.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Property-Asset

or Share Purchase Agreement, Private Placement-Non-Brokered, Reinstated

for Trading

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. (the "Exchange") has accepted for filing Cap-Ex

Ventures Ltd.'s (the "Company") Qualifying Transaction described in its

filing statement (the "Filing Statement") dated August 6, 2010. As a

result, effective at the opening Friday, August 20, 2010, the trading

symbol for the Company will change from CEV.P to CEV and the Company will

no longer be considered a Capital Pool Company. The Qualifying Transaction

includes the following matters, all of which have been accepted by the

Exchange.

1. Acquisition of a 50% interest in the Tay-LP Property:

The Exchange has accepted for filing an option agreement (the "Option

Agreement") dated March 22, 2010 between the Company and Canarc Resource

Corp. ("Canarc"), pursuant to which the Company has an option to acquire

up to a 50% interest in and to the TAY-LP Property. The TAY-LP Property is

located in south central Yukon.

Under the Option Agreement the Company may exercise the option by making

the following cash payments, royalty payments, share issuances and

exploration expenditures:

Completion Date Cash Payment (CDN$)Share IssuancesExploration

ExpenditureRoyalty PaymentsOn Signing Option Agreement$25,000 (paid)On or

Before April 27, 2010 $30,000 (paid)On Exchange Approval100,000On or

Before September 30, 2010$50,000$25,000By October 31, 2010$225,000On or

Before September 30, 2011$50,000$25,000By October 31,

2011$75,000100,000Additional $450,000TOTAL $230,000200,000$675,000$50,000

The Exchange has been advised that the above transactions, that did not

require Shareholder approval, have been completed.

In addition, the Exchange has accepted for filing the following:

2. Private Placement-Non-Brokered

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced March 31, 2010:

Number of Shares: 4,772,727 shares

Purchase Price: $0.11 per share

Warrants: 4,772,727 share purchase warrants to

purchase 4,772,727 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 6 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Andrew Bowering Y 1,022,727

Graham Harris Y 1,022,727

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

3. Reinstated for Trading:

Effective at the opening Friday, August 20, 2010, trading in the shares of

the Company will be reinstated.

Capitalization: Unlimited common shares with no par value of

which 14,872,727 common shares are issued

and outstanding

Escrow: 2,000,000 common shares are subject to the

CPC Escrow Agreement with a 36-month staged

release escrow, of which 200,000 are

authorized to be released on issuance of

this Bulletin. 5,565,454 common shares

issued to Principals are subject to a Tier 2

Value Security Escrow Agreement with a 36-

month staged release escrow, of which

556,545 are authorized to be released on

issuance of this Bulletin.

Symbol: CEV same symbol as CPC but with .P removed

Insider / Pro Group Participation: The QT is an arm's length transaction.

The Company is classified as a "Mineral Exploration & Development"

company.

Company Contact: Andrew Bowering, President

Company Address: Suite 2000 - 1177 West Hastings Street,

Vancouver, BC V6E 2K9

Company Phone Number: 604 681-0710

Company Fax Number: 604 602-1606

Company Email Address: awb@decaderesources.ca

TSX-X

-------------------------------------------------------------------------

GASFRAC ENERGY SERVICES INC. ("GFS")

BULLETIN TYPE: Shares for Services

BULLETIN DATE: August 19, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 100,000 restricted shares at a deemed price of $5.00 per share, to

an employee of the Company pursuant to its US Stock Incentive Plan.

TSX-X

-------------------------------------------------------------------------

GITENNES EXPLORATION INC. ("GIT")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of an

Option Agreement dated June 23, 2010 between the Company and Neil

Blackburn (80%), Frederic Bergeron (10%) and Roger Ouellet (10%)

(Collectively, the Optionors") whereby the Company may acquire a 100%

interest in and to the Blue Ice Property (the "Property"), comprising of

15 claims totaling 700 hectares located in the Province of Quebec.

The aggregate consideration payable to the Optionors is cash payments

totaling $110,000, shares issuances totaling 200,000 common shares of the

Company and exploration or other work commitments on the Property totaling

$400,000 all payable over a three year period.

The Optionors will retain a 2% net smelter returns royalty of which the

Company may purchase 1% for $1,000,000 anytime.

TSX-X

-------------------------------------------------------------------------

GOLDBANK MINING CORPORATION ("GLB")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a property option agreement

(the "Agreement") between Goldbank Mining Corporation ("Goldbank") and two

arm's length individuals (Mr. Mark Pocklington and Mr. Ross Weitzel)

(collectively the "Vendors"), pursuant to which Goldbank has the right to

acquire up to a 100% right, title and interest in and to the Leota Gold

Property located on the Klondike Goldfields in the Dawson Mining District,

Yukon Territory. The Leota Gold Property is currently comprised of 836

hard rock mining claims covering an area of 176 square kilometers or

44,000 acres.

Under the terms of the Agreement, Goldbank can acquire up to a 100%

interest in the Leota Gold Property by issuing a total of twelve million

common shares to the Vendors in six tranches by October 15, 2014. In the

first year of the Agreement, upon Goldbank receiving a positive NI 43-101

compliant report on the 2010 exploration season and issuing a total of six

million common shares in two tranches, Goldbank will have acquired a 51%

interest in the Leota Gold Property. Goldbank can acquire an aggregate 75%

interest in the Leota Gold Property by issuing a further three million

shares in two tranches by October 15, 2012.

Upon Goldbank issuing a further three million shares in two tranches by

October 15, 2014, Goldbank will have acquired a 100% interest in the Leota

Gold Property. The share issuances can be accelerated at any time by

Goldbank to acquire a 100% interest.

The Leota Gold Property is subject to a net smelter royalty of 3% ("NSR"),

up to half of which may be bought out by Goldbank at any time for one or

more payments of $500,000 for each 0.5% of the NSR totaling $1,500,000.

Goldbank is the Operator.

Upon Goldbank receiving a positive feasibility study confirming more than

4 million ounces of gold or gold equivalent reserve on the Leota Gold

Property, or if Goldbank produces more than 4 million ounces of gold from

the Leota Gold Property, then Goldbank will, after regulatory approval,

allot and issue a further 2,000,000 fully paid and non-assessable common

shares in its capital stock to the Vendors.

Insider / Pro Group Participation: N/A

For further information please read Goldbank's news release dated June 9,

2010 available on SEDAR for further information.

TSX-X

-------------------------------------------------------------------------

GOLDEN BAND RSOURCES INC. ("GBN")

BULLETIN TYPE: Private Placement-Non-Brokered, Correction

BULLETIN DATE: August 19, 2010

TSX Venture Tier 1 Company

Further to the TSX Venture Exchange bulletin dated August 18, 2010 with

respect to the first tranche of the private placement announced June 22,

2010 and June 25, 2010, the 9,395,000 flow-through units should have been

comprised of 9,395,000 flow-through common shares and 4,697,500 share

purchase warrants to purchase 4,697,500 shares at a price of $0.50 per

share to December 31, 2010 and at $0.55 per share to August 31, 2011, not

4,696,250 share purchase warrants.

Also, Mark Thiel should have been identified as an Insider of the Company,

not ProGroup.

TSX-X

-------------------------------------------------------------------------

HIGH DESERT GOLD CORPORATION ("HDG")

BULLETIN TYPE: Halt

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Effective at 10:03 a.m. PST, August 19, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

-------------------------------------------------------------------------

HIGH DESERT GOLD CORPORATION ("HDG")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Effective at 11:15 a.m., PST, August 19, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

TSX-X

-------------------------------------------------------------------------

IFL INVESTMENT FOUNDATION (CANADA) LIMITED ("IF")

BULLETIN TYPE: Declaration of Dividend

BULLETIN DATE: August 19, 2010

TSX Venture Tier 1 Company

The Issuer has declared the following dividend:

Dividend per Share: $3.50 (Capital Gains Dividend)

Payable Date: September 15, 2010

Record Date: September 8, 2010

Ex-Dividend Date: September 3, 2010

TSX-X

-------------------------------------------------------------------------

LEBOLDUS CAPITAL INC. ("LEB")

(formerly LeBoldus Capital Inc. ("LEB.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Resume

Trading, Private Placement-Non-Brokered

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated August 5, 2010 which

has been filed on SEDAR. As a result, at the opening Friday, August 20,

2010, the Company will no longer be considered a Capital Pool Company. The

Qualifying Transaction includes the following:

Qualifying Transaction - Completed:

Pursuant to an arm's length Option Agreement dated March 17, 2010,

effective March 10, 2010, and as amended on June 22, 2010 and August 5,

2010, the Company has acquired an option to acquire a 50% interest in the

Corongo Property in Peru from Duran Ventures Inc. ("Duran").

Pursuant to the terms of the Option Agreement the Corporation has made an

initial required payment to Duran of $25,000, and has issued 300,000

common shares at a deemed price of $0.20 per share in the capital of the

Company ("Common Shares").

The option can be fully exercised by the Company in the following manner:

(i) the issuance to Duran of a further 700,000 Common Shares at a deemed

price of $0.20 per share over a period of two (2) years; and (ii) the

Corporation incurring Exploration Expenditures of US$1,000,000 prior to

March 10, 2012.

The Exchange has been advised that the above transaction, which did not

require shareholder approval under Exchange Policies, was completed August

17, 2010.

Resume Trading:

Trading in the shares of the Company has been halted since March 18, 2010.

In conjunction with the completion of the Qualifying Transaction, trading

will resume effective at the opening Friday, August 20, 2010.

In addition, the Exchange has accepted for filing the following:

Private Placement- Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced on March 17, 2010, June 1, 2010

and July 6, 2010.

Number of Shares: 1,750,000 common shares

Purchase Price: $0.20 per common share

Warrants: 1,750,000 share purchase warrants to

purchase 1,750,000 common shares

Warrant Exercise Price: $0.40 for a one year period

$0.40 in the second year, subject to

acceleration clause

Number of Placees: 16 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Melanie Blair Y 50,000

Paul Davis Y 100,000

Joseph Del Campo Y 50,000

Gregory Jerome Y 50,000

Chris Wolfenberg Y 50,000

Finder's Fees: A total of $20,800 cash and 104,000 Finder's

Warrants, payable as follows:

Yvon Collin - $14,400 and 72,000 warrants

John O'Donohue - $2,400 and 12,000 warrants

John Jakolev - $800 and 4,000 warrants

Leede Financial Markets Inc - $800 and 4,000

warrants

Philip Beaudoin - $2,400 and 12,000 warrants

Each Finder's Warrant is exercisable at $0.20 per share for twelve months

from date of issuance.

For a complete description of the Qualifying Transaction, the related

transactions, and the business of the Company please refer to the Filing

statement of the Company dated August 5, 2010, as filed on SEDAR.

Capitalization: Unlimited common shares with no par value of

which 6,550,000 shares are issued and

outstanding

Escrow: 2,065,000 shares

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: LEB (same symbol as CPC but with .P removed)

The Company is classified as a 'Gold and Silver Ore Mining' company.

TSX-X

-------------------------------------------------------------------------

LEGION RESOURCES CORP. ("LR")

BULLETIN TYPE: Halt

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Effective at the opening, August 19, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

-------------------------------------------------------------------------

MILLROCK RESOURCES INC. ("MRO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced August 11, 2010:

Number of Shares: 2,500,000 shares

Purchase Price: $0.40 per share

Warrants: 2,500,000 share purchase warrants to

purchase 2,500,000 shares

Warrant Exercise Price: $0.55 for a two year period

Number of Placees: 8 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P # of Shares

Dain Currie P 125,000

Roland Butler Y 250,000

Finders' Fees: $56,000 cash and 140,000 options exercisable

into units at $0.40 for two years (each unit

comprised of one share and one warrant,

which is exercisable at $0.55 for two years

from closing) payable to Global Market

Development LLC.

$7,000 cash and 17,500 warrants exercisable

at $0.55 for two years payable to Bolder

Investment Partners, Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

-------------------------------------------------------------------------

MINDORO RESOURCES LTD. ("MIO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 19, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 8, July 14, and July 23,

2010:

Number of Shares: 19,047,225 Units

(Each Unit consists of one common share and

one share purchase warrant.)

Purchase Price: $0.208 per Unit

Warrants: 19,047,225 share purchase warrants to

purchase 19,047,225 shares

Warrant Exercise Price: $0.31 expiring on July 21, 2015

Number of Placees: 20 placees

No Insider / Pro Group Participation

Finder's Fee: $1,560 and 7,500 Finder's Warrants payable

to Northern Securities Inc.

- Each Finder's Warrant is exercisable for

one common share at a price of $0.31 for a

period of two years.

TSX-X

-------------------------------------------------------------------------

NEW HORIZON URANIUM CORPORATION ("NHU.H")

(formerly New Horizon Uranium Corporation ("NHU"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Suspended

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.5, the Company has not maintained

the requirements for a TSX Venture Tier 2 company. Therefore, effective

the opening Friday, August 20, 2010, the Company's listing will transfer

to NEX, the Company's Tier classification will change from Tier 2 to NEX,

and the Filing and Service Office will change from Vancouver to NEX.

As of August 20, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from NHU to NHU.H. There is

no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to TSX Venture Exchange bulletin dated August 3, 2010, in

accordance with Exchange Policy 2.9, trading in the shares of the Company

will be suspended effective at the close of trading August 19, 2010, for

failure to maintain Exchange Requirements. The Company has failed to have

a minimum of three directors as required by Exchange Policy 3.1.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

-------------------------------------------------------------------------

NORTHERN STAR MINING CORP. ("NSM")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: August 19, 2010

TSX Venture Tier 1 Company

Effective at the opening, August 19, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

-------------------------------------------------------------------------

OUTLOOK RESOURCES INC. ("OLR")

BULLETIN TYPE: Halt

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Effective at 6:05 a.m. PST, August 19, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

-------------------------------------------------------------------------

OUTLOOK RESOURCES INC. ("OLR")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Effective at 8:30 a.m., PST, August 19, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

TSX-X

-------------------------------------------------------------------------

PINECREST ENERGY INC. ("PRY")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 26, 2010, May 7, 2010 and

May 25, 2010:

Number of Shares: 16,063,864 Units

(Each Unit consists of one common share and

one share purchase warrant.)

13,364,666 FT Units

(Each FT Unit consists of one flow-through

common share and one share purchase

warrant.)

23,613,810 common shares

Purchase Price: $0.375 per Unit

$0.375 per FT Unit

$0.375 per common share

Warrants: 29,428,530 share purchase warrants to

purchase 29,428,530 shares

Warrant Exercise Price: $0.50 for a five year period

Number of Placees: 258 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Lane Mosby P 282,500 common shares

Christopher Graham P 55,000 common shares

Jamie Clements P 15,000 common shares

Peter Dunham P 132,500 common shares

Amy Dunham P 150,000 common shares

Craig Bishop P 200,000 common shares

Richard McDonald P 200,000 common shares

Ryan Knie P 93,333 common shares

Shane Jones P 40,000 common shares

Charlie Lew P 40,000 common shares

Bill Turko Y 2,010,000 FT Units

1,990,000 Units

159,999 common shares

Korby Zimmerman Y 2,010,000 FT Units

1,990,000 Units

Daniel Toews Y 2,010,000 FT Units

2,190,000 Units

Wade Becker Y 2,010,000 FT Units

2,150,000 Units

Brent Gough Y 2,010,000 FT Units

1,990,000 Units

79,833 common shares

Jay Reid Y 210,000 FT Units

190,000 Units

John Brussa Y 600,000 FT Units

600,000 Units

David Daniel Johnson Y 563,200 FT Units

583,200 Units

David Fitzpatrick Y 600,000 FT Units

600,000 Units

Rob Zakresky Y 610,000 FT Units

590,000 Units

RC Capital Inc. (David

Morrison) P 40,000 common shares

John Esteireiro P 40,000 common shares

Loria Capital Corporation

(Tony Loria) P 150,000 common shares

Kevin Leonard P 53,332 common shares

Brian McKenzie P 27,000 common shares

Peters & Co. Limited P 333,500 common shares

Clarus Securities Inc. P 333,500 common shares

Cormark Securities Inc. P 333,500 common shares

Colin Chovin P 28,000 common shares

Mary Chapuis P 39,000 common shares

TSX-X

-------------------------------------------------------------------------

PLEXMAR RESOURCES INC. ("PLE")

BULLETIN TYPE: Shares for Debt, Correction

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange's bulletin dated August 11, 2010 with

respect to a Shares for Debt, the text of the bulletin should have

referred to the news release of the Company dated August 10, 2010 rather

than August 3, 2010. The other information in our bulletin dated August

11, 2010 remains unchanged.

RESSOURCES PLEXMAR INC. ("PLE")

TYPE DE BULLETIN : Emission d'actions en reglement d'une dette, Correction

DATE DU BULLETIN : Le 19 aout 2010

Societe du groupe 2 de TSX Croissance

Suite au bulletin de Bourse de croissance TSX date du 11 aout 2010

relativement a une emission d'actions en reglement d'une dette, le texte

du bulletin aurait du referer au communique de presse de la societe date

du 10 aout 2010 et non le 3 aout 2010. Les autres informations de notre

bulletin du 11 aout 2010 demeurent inchangees.

TSX-X

-------------------------------------------------------------------------

PORTIA EXPLORATION LTD. ("PEL.H")

(formerly Portia Exploration Ltd. ("PEL.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening Friday, August 20, 2010,

the Company's listing will transfer to NEX, the Company's Tier

classification will change from Tier 2 to NEX, and the Filing and Service

Office will change from Vancouver to NEX.

As of August 20, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from PEL.P to PEL.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture Exchange Bulletin dated May 11, 2010, trading

in the Company's securities will remain suspended.

TSX-X

-------------------------------------------------------------------------

POWER TECH CORPORATION INC. ("PWB")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated August 13, 2010, effective

at the opening Friday, August 20, 2010, trading in the shares of the

Company will remain halted for failure to maintain Exchange Requirements.

Please refer to the Company's press release dated August 13, 2010 for

further information.

TSX-X

-------------------------------------------------------------------------

REGENT VENTURES LTD. ("REV")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced August 17, 2010:

Convertible Debenture US$1,000,000

Conversion Price: Convertible into shares at $0.095 of

principal outstanding

Maturity date: August 18, 2011

Interest rate: 8% per annum, payable monthly

Number of Placees: 2 placees

Finder's Fee: $25,885 cash and 272,474 shares payable to

Ken Lee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

-------------------------------------------------------------------------

SKYWEST ENERGY CORP. ("SKW")

BULLETIN TYPE: Private Placement- Brokered

BULLETIN DATE: August 19, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced July 28 and August 17, 2010:

Number of Shares: 18,520,000 flow-through shares ("FT Shares")

Purchase Price: $0.54 per FT Share

Number of Placees: 23 placees

No Insider / Pro Group Participation

Agents' Fees: $270,022 cash payable to Wellington West

Capital Markets Inc.

$180,014 cash payable to Haywood Securities

Inc.

$90,007 cash payable to FirstEnergy Capital

Corp.

$270,022 cash payable to PI Financial Corp.

TSX-X

-------------------------------------------------------------------------

SOLITAIRE MINERALS CORP. ("SLT")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to a Mineral Property Option Agreement dated July 13, 2010

between Ken Smith and Solitaire Minerals Corp. (the 'Company'), pursuant

to which the Company has an option to acquire a 100% interest in 25 claims

totalling 3,181 acres in north-western Quebec, known as the Windfall Lake

Project. In consideration, the Company will pay a total of $85,000 and

issue a total of 1,000,000 shares as follows:

DATE CASH SHARES CUMMULATIVE

WORK EXPENDITURES

Year 1 $25,000 300,000 nil

Year 2 $30,000 300,000 nil

Year 3 $30,000 400,000 nil

In addition, there is a 2% net smelter return relating to the acquisition.

The Company may, purchase 1% of the net smelter return for $1,000,000 at

any time up to when a production decision is made.

TSX-X

-------------------------------------------------------------------------

Z-GOLD EXPLORATION INC. ("ZGG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 19, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement, announced on August 13, 2010:

Number of Shares: 666,667 common shares

Purchase Price: $0.18 per common share

Warrants: 333,333 warrants to purchase 333,333 common

shares

Warrant Exercise Price: $0.26 over the 24 months following the

closing of the Private Placement

Number of Placees: One placee

Finder's Commission: Limited Market Dealer received $6,000 in cash

and an option to purchase 66,666 units at the

price of $0.18 per unit during two years,

each unit comprised of one common share and

one-half of one warrant. Each warrant allows

its holder to purchase one common share at

$0.26 per share over the 24-month period

following the closing of the Private

Placement.

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release dated August 13, 2010.

EXPLORATION Z-GOLD INC. ("ZGG")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 19 aout 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 13

aout 2010 :

Nombre d'actions : 666 667 actions ordinaires

Prix : 0,18 $ par action ordinaire

Bons de souscription : 333 333 bons de souscription permettant de

souscrire a 333 333 actions ordinaires.

Prix d'exercice des bons : 0,26 $ pendant les 24 mois suivant la cloture

du placement prive

Nombre de souscripteurs : Un souscripteur

Commission de

l'intermediaire : Limited Market Dealer Inc. a recu 6 000 $

comptant et une option permettant de

souscrire a 66 666 unites au prix de 0,18 $

l'unite pendant une periode de deux ans.

Chaque unite comprend une action ordinaire et

un demi-bon de souscription, un bon etant

requis pour acheter une action ordinaire au

prix d'exercice de 0,26 $ l'action pendant

une periode de 24 mois suivant la date de

cloture.

La societe a confirme la cloture du present placement prive par voie de

communique de presse date du 13 aout 2010.

TSX-X

-------------------------------------------------------------------------

NEX COMPANY:

DOWNTOWN INDUSTRIES LTD. ("DWN.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 19, 2010

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced on August 3 & 4, 2010:

Number of Shares: 4,836,661 shares

Purchase Price: $0.105 per share

Warrants: 4,836,661 share purchase warrants to purchase

4,836,661 shares

Warrant Exercise Price: $0.14 for a one year period

Number of Placees: 18 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Marc Blythe Y 10,000

Finder's Fee: N/A

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

-------------------------------------------------------------------------

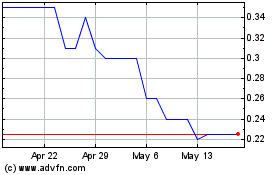

Goldbank Mining (TSXV:GLB)

Historical Stock Chart

From Apr 2024 to May 2024

Goldbank Mining (TSXV:GLB)

Historical Stock Chart

From May 2023 to May 2024