Gowest Gold Ltd. (“

Gowest” or the

“

Company”) (TSX VENTURE: GWA) is pleased to

provide an update on its previously announced investment by

Greenwater Investment Hong Kong Limited

(“

Greenwater”) of up to $19,000,000 (see Gowest

news releases dated January 24, March 10, and March 31, 2022).

In accordance with the terms and conditions of

the subscription agreement between Gowest and Greenwater dated

January 24, 2022 (the “Subscription Agreement”),

Gowest has issued to Greenwater an aggregate of 84,615,383 Units

(the “Offering”). Specifically, Gowest has

issued:

(i) an

aggregate of 57,692,307 Units, at a conversion price of $0.13 per

Unit, pursuant to the conversion of certain outstanding promissory

notes issued by the Company in an aggregate principal amount of

$7,500,000; and

(ii) an aggregate of 26,923,076

Units on a private placement basis, at a purchase price of $0.13

per Unit, for gross proceeds to the Company of $3,500,000.

Subject to the terms and conditions of the

Subscription Agreement, Greenwater may invest up to an additional

$8,000,000 in the Company. Additional closings are subject to

certain conditions as set out in the Subscription Agreement,

including the approval of the TSX Venture Exchange (the

“TSXV”).

Each unit (“Unit”) issued to

Greenwater pursuant to the Offering comprises one common share of

the Company and one common share purchase warrant (a “Warrant”),

with each Warrant (subject to adjustment) being exercisable to

purchase one additional common share of the Company at a price of

$0.16 until March 31, 2023, and thereafter at a price of $0.17

until March 31, 2024.

Following the completion of the Offering,

Greenwater becomes a “Control Person” of the Company pursuant to

the applicable policies of the TSXV. The requisite approval of

shareholders for the Offering, in accordance with Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions and the applicable policies of the TSXV, was

previously obtained by the Company at a special meeting of

shareholders held on March 31, 2022.

The proceeds of the Offering will be principally

used by the Company for the continued development of the Company’s

100% owned Bradshaw Gold Deposit and the repayment of certain

bridge loans incurred by the Company for such purpose in accordance

with their terms. The Company has further agreed to use a

portion of the proceeds of the Offering to accelerate certain

payments due to Greenwater under the Credit Agreement between such

parties, thereby reducing interest charges that would otherwise

payable to Greenwater thereunder.

Early Warning Disclosure

Prior to the Offering, Greenwater held

25,140,774 common shares, representing approximately 16.1% of the

issued and outstanding common shares of Gowest.

Following the completion of the Offering,

Greenwater now holds 109,756,157 common shares, representing

approximately 45.7% of the issued and outstanding common shares of

Gowest.

Other than the Warrants (exercisable to acquire

an aggregate of 84,615,383 common shares of Gowest), Greenwater

holds no additional options, warrants or other securities

convertible into or exchangeable for common shares of Gowest.

Assuming the exercise of all outstanding Warrants, Greenwater would

hold 194,371,540 common shares, representing approximately 59.8% of

the issued and outstanding common shares of Gowest.

All securities of the Company held by Greenwater

are held for investment purposes and, except in accordance with the

terms and conditions of the Subscription Agreement, Greenwater has

no present intention to dispose of or acquire further common shares

of Gowest.

In the future, Greenwater may, from time to

time, increase or decrease its ownership, control or direction over

securities of Gowest held by it through market transactions,

private agreements or otherwise, depending on market conditions,

the business and prospects of Gowest and other relevant

factors.

A copy of the early warning report filed by

Greenwater in connection with completion of the Offering may be

obtained from Greenwater by contacting Ms. Gerile at

+86-13847635568 and will be available under Gowest’s profile on

SEDAR at www.sedar.com. The head office of Greenwater is located at

Room 3306, Shui On Centre, 6-8 Harbour Road, Wanchai, Hong

Kong.

About Gowest

Gowest is a Canadian gold exploration and

development company focused on the delineation and development of

its 100% owned Bradshaw Gold Deposit (Bradshaw) on the Frankfield

Property, part of the Company’s North Timmins Gold Project (NTGP).

Gowest is exploring additional gold targets on its

+100‐square‐kilometre NTGP land package and continues to evaluate

the area, which is part of the prolific Timmins, Ontario gold camp.

Currently, Bradshaw contains a National Instrument 43‐101 Indicated

Resource estimated at 2.1 million tonnes (“t”) grading 6.19 grams

per tonne gold (g/t Au) containing 422 thousand ounces (oz) Au and

an Inferred Resource of 3.6 million t grading 6.47 g/t Au

containing 755 thousand oz Au. Further, based on the

Pre‐Feasibility Study produced by Stantec Mining and announced on

June 9, 2015, Bradshaw contains Mineral Reserves (Mineral Resources

are inclusive of Mineral Reserves) in the probable category, using

a 3 g/t Au cut‐off and utilizing a gold price of US$1,200 / oz,

totaling 1.8 million t grading 4.82 g/t Au for 277 thousand oz

Au.

Forward-Looking Statements

Certain statements in this release constitute

forward-looking statements within the meaning of applicable

securities laws. Forward-looking statements in this press release

include, without limitation, statements relating to future closings

of the private placement under the Subscription Agreement, the

exercise of the Warrants and the proposed use of proceeds of the

Offering. Words such as “may”, “would”, “could”, “should”, “will”,

“anticipate”, “believe”, “plan”, “expect”, “intend”, “potential”

and similar expressions may be used to identify these

forward-looking statements although not all forward-looking

statements contain such words.

Forward-looking statements involve significant

risks, uncertainties and assumptions. Many factors could cause

actual results, performance or achievements to be materially

different from any future results, performance or achievements that

may be expressed or implied by such forward-looking statements,

including risks associated with the Offering and financing

transactions generally. Additional risk factors are also set forth

in the Company’s management’s discussion and analysis and other

filings available via the System for Electronic Document Analysis

and Retrieval (SEDAR) under the Company’s profile at www.sedar.com.

Should one or more of these risks or uncertainties materialize, or

should assumptions underlying the forward-looking statements prove

incorrect, actual results, performance or achievements may vary

materially from those expressed or implied by this press release.

These factors should be considered carefully and reader should not

place undue reliance on the forward-looking statements. These

forward-looking statements are made as of the date of this press

release and, other than as required by law, the Company does not

intend to or assume any obligation to update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

For further information please

contact:

|

Dan Gagnon |

Greg Taylor |

|

President & CEO |

Investor Relations |

|

Tel: (416) 363-1210 |

Tel: (416) 605-5120 |

|

Email: info@gowestgold.com |

Email: gregt@gowestgold.com |

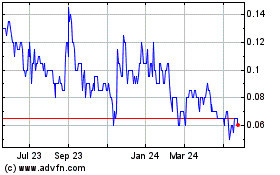

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Nov 2024 to Dec 2024

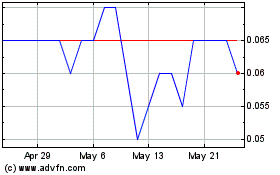

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Dec 2023 to Dec 2024