GoviEx Uranium Inc. ("

GoviEx" or the

"

Company") (TSXV: GXU; OTCQB: GVXXF) is pleased to

announce that it has entered into an amended agreement with Eight

Capital, pursuant to which Eight Capital will now purchase

75,000,000 units of the Company (the “

Units”) on a

“bought deal” basis pursuant to the filing of a short form

prospectus, subject to all required regulatory approvals, at a

price per Unit of $0.16 (the “

Issue Price”) for

aggregate gross proceeds of $12,000,000 (the

"

Offering").

Each Unit will be comprised of one common share

of the Company (each, a "Common Share") and one

common share purchase warrant (each, a "Warrant"),

with each Warrant entitling the holder thereof to purchase one

additional Common Share at an exercise price equal to the United

States dollar equivalent of $0.21 (the foreign exchange rate to be

set based on the Bank of Canada daily exchange rate for United

States dollars one business day prior to the Closing Date (as

defined below)) for a period of 36 months following the closing

date of the Offering.

The Company has agreed to grant the Underwriters

an over-allotment option to purchase up to an additional 15% of the

Units at the Issue Price, and/or the components thereof,

exercisable in whole or in part, at any time on or prior to the

date that is 30 days following the closing of the Offering.

The Company intends to use the net proceeds of

the Offering for exploration, engineering and general corporate and

working capital purposes.

The closing of the Offering is expected to occur

on or about December 22, 2023 (the “Closing

Date”), and is subject to certain conditions including,

but not limited to, the receipt of all necessary approvals,

including the conditional approval from the TSX Venture

Exchange.

This news release does not constitute an

offer to sell or a solicitation of an offer to buy any securities

in the United States or any other jurisdiction. No securities may

be offered or sold in the United States or in any other

jurisdiction in which such offer or sale would be unlawful absent

registration under the U.S. Securities Act of 1933, as amended, or

an exemption therefrom or qualification under the securities laws

of such other jurisdiction or an exemption therefrom.

About GoviEx Uranium

Inc.

GoviEx is a mineral resource company focused on

the exploration and development of uranium properties in Africa.

GoviEx’s principal objective is to become a significant uranium

producer through the continued exploration and development of its

mine-permitted Mutanga project in Zambia and its mine-permitted

Madaouela project in Niger.

Contact Information

Isabel Vilela Head of Investor Relations and

Corporate Communications Tel: +1-604-681-5529 Email:

info@goviex.com Web: www.goviex.com

Cautionary Note Regarding

Forward-Looking InformationThis news release may

contain forward-looking information within the meaning of

applicable securities laws. All information and statements other

than statements of current or historical facts contained in this

news release are forward-looking information.

Forward-looking statements are subject to

various risks and uncertainties concerning the specific factors

disclosed here and elsewhere in GoviEx’s periodic filings with

Canadian securities regulators. When used in this news release,

words such as "will", "could", "plan", "estimate", "expect",

"intend", "may", "potential", "should," and similar expressions,

are forward- looking statements. Information provided in this

document is necessarily summarized and may not contain all

available material information.

Forward-looking statements include those with

respect to the anticipated quantum, timing and completion of the

bought deal; receipt of TSX Venture Exchange acceptance of the

offering; and the proposed use of the proceeds of the offering.

Although the Company believes the expectations

reflected in such forward-looking statements are based on

reasonable assumptions, it can give no assurances that its

expectations will be achieved. Such assumptions, which may prove

incorrect, include the following: (i) receipt of TSX Venture

Exchange acceptance of the offering will be obtained; (ii)

sufficient subscriptions will be received to complete the entirety

of the Offering; (iii) the price of uranium will remain

sufficiently high and the costs of advancing the Company’s mining

projects sufficiently low so as to permit GoviEx to implement its

business plans in a profitable manner.

Factors that could cause actual results to

differ materially from expectations include (i) the Company’s

failure to complete the offering in-part or in-full; (ii) inability

to make effective use of the proceeds of the offering; (iii) the

failure of the Company’s projects, for technical, logistical,

labour-relations, or other reasons; (iv) the Company’s inability to

obtain TSX Venture Exchange acceptance of the offering; (v) a

decrease in the price of uranium below what is necessary to sustain

the Company’s operations; (vi) an increase in the Company’s

operating costs above what is necessary to sustain its operations;

(vii) accidents, labour disputes, or the materialization of similar

risks; (viii) a deterioration in capital market conditions that

prevents the Company from raising the funds it requires on a timely

basis; and (ix) generally, the Company’s inability to develop and

implement a successful business plan for any reason.

In addition, the factors described or referred

to in the section entitled “Risk Factors” in the MD&A for the

year ended December 31, 2022, of GoviEx, which is available on the

SEDAR website at www.sedar.com, should be reviewed in conjunction

with the information found in this news release.

Although GoviEx has attempted to identify

important factors that could cause actual results, performance, or

achievements to differ materially from those contained in the

forward-looking statements, there can be other factors that cause

results, performance, or achievements not to be as anticipated,

estimated, or intended. There can be no assurance that such

information will prove to be accurate or that management's

expectations or estimates of future developments, circumstances, or

results will materialize. As a result of these risks and

uncertainties, no assurance can be given that any events

anticipated by the forward-looking information in this news release

will transpire or occur, or, if any of them do so, what benefits

that GoviEx will derive therefrom. Accordingly, readers should not

place undue reliance on forward-looking statements. The

forward-looking statements in this news release are made as of the

date of this news release, and GoviEx disclaims any intention or

obligation to update or revise such information, except as required

by applicable law.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy, nor shall there be

any sale of any of the securities in any jurisdiction in which such

offer, solicitation, or sale would be unlawful, including any of

the securities in the United States of America. The securities have

not been and will not be registered under the United States

Securities Act of 1933 (the “1933 Act”) or any state securities

laws and may not be offered or sold within the United States or to,

or for account or benefit of, U.S. Persons (as defined in

Regulation S under the 1933 Act) unless registered under the 1933

Act and applicable state securities laws, or an exemption from such

registration requirements is available

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein.

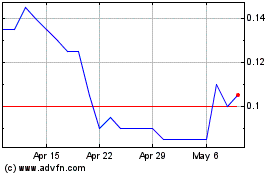

GoviEx Uranium (TSXV:GXU)

Historical Stock Chart

From Nov 2024 to Dec 2024

GoviEx Uranium (TSXV:GXU)

Historical Stock Chart

From Dec 2023 to Dec 2024