Hanstone Gold Corp. (TSXV: HANS) (FSE: HGO) ("Hanstone" or the

"Company"), is pleased to announce that it has closed the second

and final tranche of its previously announced non-brokered private

placement (the “Offering”). In the second tranche, the Company

raised gross proceeds of $438,210, issuing 972,500 units of the

Company (the “Units”) at a price of $0.40 per Unit and 111,841

flow-through units of the Company (the “FT Units”) at a price of

$0.44 per FT Unit.

Each Unit consists of one common share of the

Company (a “Common Share”) and one Common Share purchase warrant (a

“Warrant”). Each FT Unit consists of one common share of the

Company (a “Common Share”) which qualifies as a “flow-through

share” (within the meaning of the Income Tax Act (Canada)) and one

Warrant. Each Warrant is exercisable to acquire one Common Share (a

“Warrant Share”) at a price of $0.47 per Warrant Share for a period

of 24 months.

In connection with closing, the Company paid

finder’s fees of $16,032 and issued 39,800 non-transferable

compensation options, each entitling the holder thereof to purchase

one Unit at an exercise price of $0.40 for 24 months.

The securities issued under the closing of the

second tranche of the Offering are subject to a hold period of four

months and a day, expiring January 1, 2022.

The Company intends to use the net proceeds from

the Offering for its ongoing exploration drilling program, working

capital requirements and other general corporate purposes. The

gross proceeds received by the Company from the sale of the FT

Units will be used to incur eligible "Canadian exploration

expenses" (“CEE”) that are "flow-through mining expenditures" (as

such term is defined in the Income Tax Act (Canada)) related to the

Company’s Doc and Snip North projects. The Company will renounce

such CEE to the purchasers of the FT Units with an effective date

of no later than December 31, 2021.

The securities described herein have not been,

and will not be, registered under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”), or any state

securities laws, and accordingly, may not be offered or sold within

the United States except in compliance with the registration

requirements of the U.S. Securities Act and applicable state

securities requirements or pursuant to exemptions therefrom. This

press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

Investor Relations Agreements

In addition, Hanstone is pleased to announce

that it has retained Hybrid Financial Ltd. (“Hybrid”) to provide

marketing services to the Company. Hybrid has been engaged to

heighten market and brand awareness for Hanstone and to broaden the

Company's reach within the investment community. Hybrid has agreed

to comply with all applicable securities laws and the policies of

the TSX Venture Exchange (the “TSXV”) in providing the Services.

Hybrid has been re-engaged by the Company for an initial period of

12 months (the “Initial Term”) and then shall be renewed

automatically for successive three month periods thereafter, unless

terminated by the Company in accordance with the Agreement. Hybrid

will be paid a monthly fee of $22,500, plus applicable taxes,

during the Initial Term and will be paid a monthly fee of $15,000,

plus applicable taxes, thereafter.

Hybrid is a sales and distribution company that

actively connects issuers to the investment community across North

America. Using a data driven approach, Hybrid provides its clients

with comprehensive coverage of both American and Canadian markets.

Hybrid Financial has offices in Toronto and Montreal.

The Company and Hybrid act at arm's length, and Hybrid has no

present interest, directly or indirectly, in the Company or its

securities. The fee to be paid by the Company to Hybrid under the

Hybrid Agreement is for services only.

The Company has also renewed its agreement with

Rayleigh Capital Ltd. (“Rayleigh Capital”), which will provide

investor relations and communication services to the Hanstone,

subject to TSX Venture Exchange and all other required regulatory

approvals. Rayleigh Capital focuses on global investor relations

for junior and small cap companies specializing at exposing

companies to a wide audience of investment professionals.

Under a consulting services agreement dated as

of August 18, 2021 between the Company and Rayleigh Capital (the

“Rayleigh Agreement”), Rayleigh Capital has been retained for a

term of 12 months, from September 1, 2021 to August 31, 2022,

provided that either party may terminate the Agreement by providing

30 days’ written notice to the other party. Under the Rayleigh

Agreement, the Company will pay $8,500 per month (plus GST) during

the term of the Rayleigh Agreement. In addition, the Company will

issue 100,000 stock options to Rayleigh Capital, with 25,000

options vesting on each of November 30, 2021, February 28, 2022,

May 31, 2022 and August 31, 2022, each option having an exercise

price of $0.40, and expiring five years from the date of issuance.

The grant of the options is subject to the terms of the Company’s

Stock Option Plan and the approval of the TSX Venture Exchange.

The Company and Rayleigh Capital act at arm's

length, and Rayleigh Capital has no present interest, directly or

indirectly, in the Company or its securities, except for an

aggregate of 200,000 stock options of the Company (including the

100,000 stock options disclosed herein). The fee to be paid by the

Company to Rayleigh Capital under the Rayleigh Agreement is for

services only.

About Hanstone Gold

Hanstone is a precious and base metals explorer

with its current focus on the Doc and Snip North Projects optimally

located in the heart of the prolific mineralized area of British

Columbia known as the Golden Triangle. The Golden Triangle is an

area which hosts numerous producing and past-producing mines and

several large deposits that are approaching potential development.

The Company holds a 100% earn in option in the 1,704-hectare Doc

Project and owns a 100% interest in the 3,336-hectare Snip North

Project. Hanstone has a highly experienced team of industry

professionals with a successful track record in the discovery of

gold deposits and in developing mineral exploration projects

through discovery to production.

Ray Marks, President and Chief Executive

Officer

For Further Information

Contact:Carrie Howes, Director of

Communications,

+1-(778)-551-8488, carrie@hanstonegold.comOr visit

the Company’s website at www.hanstonegold.com

Cautionary Statement Regarding Forward

Looking Information:

The information contained herein contains

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

“forward-looking information” within the meaning of applicable

Canadian securities legislation. “Forward-looking information”

includes, but is not limited to, statements with respect to the

activities, events, or developments that the Company expects or

anticipates will or may occur in the future. Generally, but not

always, forward-looking information and statements can be

identified using words such as “plans”, “expects”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, or “believes” or the negative connotation thereof or

variations of such words and phrases or state that certain actions,

events, or results “may”, “could”, “would”, “might” or “will be

taken”, “occur” or “be achieved” or the negative connotation

thereof.

Forward-looking information and statements are

based on the then current expectations, beliefs, assumptions,

estimates and forecasts about Hanstone’s business and the industry

and markets in which it operates and will operate. Forward-looking

information and statements are made based upon numerous

assumptions, including among others, the results of planned

exploration activities are as anticipated, the price of gold, the

cost of planned exploration activities, that financing will be

available if needed and on reasonable terms, that third party

contractors, equipment, supplies and governmental and other

approvals required to conduct Hanstone’s planned exploration

activities will be available on reasonable terms and in a timely

manner and that general business and economic conditions will not

change in a material adverse manner. Although the assumptions made

by the Company in providing forward-looking information or making

forward-looking statements are considered reasonable by management

at the time, there can be no assurance that such assumptions will

prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual results, performances, and

achievements of Hanstone to differ materially from any projections

of results, performances, and achievements of Hanstone expressed or

implied by such forward-looking information or statements,

including, among others, negative operating cash flow and

dependence on third party financing, uncertainty of the

availability of additional financing, the risk that future assay

results will not confirm previous results, imprecision of mineral

resource estimates, the uncertainty of commodity prices, aboriginal

title and consultation issues, exploration risks, reliance upon key

management and other personnel, deficiencies in the Company’s title

to its properties, uninsurable risks, failure to manage conflicts

of interest, failure to obtain or maintain required permits and

licenses, changes in laws, regulations and policy, competition for

resources and financing, or other approvals

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended.

There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information because of new information or events

except as required by applicable securities laws

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

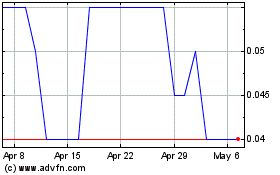

Hanstone Gold (TSXV:HANS)

Historical Stock Chart

From Oct 2024 to Nov 2024

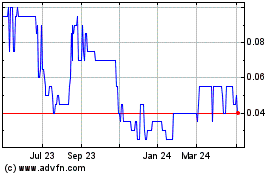

Hanstone Gold (TSXV:HANS)

Historical Stock Chart

From Nov 2023 to Nov 2024