Mirasol Resources Ltd. (TSX-V:

MRZ) (OTC:

MRZLF) (the “

Company” or

“

Mirasol”) is pleased to announce an increase to

the independent Mineral Resource Estimate (the

“

Resource”) for its 100% owned Virginia Silver

Deposit (“

Virginia” or the

“

Deposit”) located in the Santa Cruz Province,

Argentina. Discovered by Mirasol in 2009, Virginia hosts a

high-grade, intermediate sulfidation epithermal style

mineralization in a series of prominent outcropping vein-breccias.

The updated Resource builds on the previous amended Resource

estimate released on March 29, 2016.

The Resource contained within nine outcropping

veins of high-grade silver mineralization (Table 1) consists

of:

- An Indicated

Resource totaling 11.7 million ounces silver, average grade of 357

g/t

- An Inferred

Resource totaling 7.9 million ounces silver, average grade of 184

g/t

- Based on a

silver price of US$25 per ounce and a 65 g/t silver cut-off grade

(Table 2). The Resource is reported using a new constraining

resource pit focused on the Vein/Breccia high-grade component of

the mineralization.

“The Virginia Silver Project is a cornerstone

asset within Mirasol’s large portfolio of advanced stage

exploration projects in Chile and Argentina. The overall 30%

increase in silver ounces in the updated Resource estimate from

limited new drilling underscores the project's potential,”

Mirasol’s President, Tim Heenan, commented. “High-grade silver grab

samples collected along strike and also from prospecting multiple

nearby parallel exposed veins highlight the significant upside

potential outside the current Resource.”

Table 1: Vein/Breccia, Diluted Indicated

and Inferred Mineral Resource Tabulation

|

|

Indicated |

Inferred |

|

Deposit |

Vein/Breccia |

Vein/Breccia |

|

Tonnes (000) |

Silver (g/t) |

Silver Oz (000) |

Tonnes (000) |

Silver (g/t) |

Silver Oz (000) |

|

Julia South |

93 |

420 |

1,250 |

29 |

162 |

153 |

|

Julia Central |

247 |

278 |

2,207 |

105 |

158 |

532 |

|

Julia North |

432 |

478 |

6,644 |

4 |

286 |

38 |

|

Naty |

31 |

165 |

166 |

219 |

166 |

1,169 |

|

Ely North |

73 |

132 |

310 |

254 |

105 |

861 |

|

Ely Central |

57 |

302 |

558 |

336 |

253 |

2,975 |

|

Ely South |

70 |

201 |

451 |

171 |

152 |

833 |

|

Margarita |

--- |

--- |

--- |

84 |

318 |

861 |

|

Martina SE |

12 |

188 |

72 |

94 |

143 |

431 |

|

TOTAL |

1,016 |

357 |

11,659 |

1,326 |

184 |

7,853 |

Notes:

- Mineral resource estimates were

prepared following with the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) Estimation of Mineral Resources and

Mineral Reserves Best Practice Guidelines (CIM, 2019) and reported

in accordance with the CIM Definition Standards for Mineral

Resources and Mineral Reserves (CIM Definition Standards, 2014).

Mineral Resources are estimated at a cut-off grade of 65 g/t silver

for Vein/Breccia and 250 g/t silver for Halo/Undefined.

- Mineral Resources are estimated

using a silver price of US$25 per ounce. Mineral Resources are

estimated using an average recovery of 80% for silver hosted in

Vein/Breccia and 22% for silver hosted in Halo/Undefined from

preliminary metallurgical studies.

- A dry bulk density was estimated

from the samples using ID3 into 2 m x 2 m x 2 m & minimum

subcell 0.5 m x 0.5 m x 0.5 m blocks coded by domain, and the

non-estimated blocks were assigned a density value of 2.44 t/m3 and

2.09 t/m3 for Halo/Undefined.

- There are no Mineral Reserves

stated or calculated in this report.

- Mineral Resources are reported

within conceptual pit shells with Pit Walls at 50-degree

angles.

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.

- Rounding as required by reporting

guidelines may result in apparent discrepancies between tonnes,

grades, and contain silver content.

- The effective date of the Mineral

Resource is October 30th, 2023.

- This estimate of mineral resources

may be materially affected by geology, environment, permitting,

legal, title, taxation, sociopolitical, marketing or other relevant

issues.

The nine silver deposits considered in this

mineral resource estimate are mineralized from surface and are

highly oxidized to the lower limit of drilling, at 150m vertical

depth. The primary silver mineral in the vein/breccia is acanthite,

a silver sulphide favourable to conventional metallurgical

processes.

The database for the estimation of mineral

resources consists of the initial 223 drill holes for 23,116.55m,

drilled from 2010 to 2012, and 191 channel samples with 95.67m

reported on SEDAR+ (Earnest & Lechner, 2016). The current

resource estimate incorporates 70 new drill holes from 2020 to

2022, totalling an additional 10,247m. This update was based on a

geological model delivered by Mirasol Resources.

Figure 1: The Location of the Nine Defined

Vein-Breccia Hosted Silver Deposits including the Six New Pits in

the Current Resource Estimate. Other Highly Prospective Vein Zones

to be Drill Tested are also shown

The Mineral Resources estimate is constrained to

pit shells (optimized using the Lerchs-Grossman algorithm) using

parameters outlined in Table 2 below.

Table 2: Conceptual Pit

Parameters

|

Parameter |

Value |

|

ORE: 1 (Vein/Breccia) |

|

|

Silver price (US$/oz) |

25 |

|

Silver recovery (%) |

80 |

|

Mining cost (US$/tonne) |

5 |

|

G&A cost (US$/tonne) |

30 |

|

G&A cost (US$/tonne) |

4 |

|

Pit slope angle (degrees) |

50 |

|

ORE: 2-3 (Halo/Undefined) |

|

|

Silver recovery (%) |

22 |

Table 3: Mirasol Virginia Silver Project

Resource Statement including the Halo/Undefined Zone

|

Category |

Tonnes (000) |

Silver Grade (g/t) |

Contained Metal Silver Oz (000) |

|

Indicated |

1,016 |

357 |

11,659 |

|

Inferred |

1,370 |

190 |

8,389 |

In the Halo/Undefined zone with a recovery of

22%, the Resource pit declared in this report uses the conceptual

pit parameters, assuming that the Halo/Undefined silver

mineralization can be recovered with a cut-off grade greater than

or equal to 250 g/t silver, increasing the Inferred Resource by 0.5

million ounces to 8.4 million ounces.

These Halo/Undefined Inferred Resources

primarily exist adjacent to the Vein/Breccia bodies in form of a

halo, supporting the importance to continue metallurgical testing

to increase the confidence of the Virgina Resource and to evaluate

the metallurgical behavior in the recovery of silver across the

Deposit.

The Company has filed an independent technical

report prepared in accordance with National Instrument 43-101 –

Standards of Disclosure for Mineral Projects (“NI 43-101”), “NI

43-101 Technical Report and Updated Mineral Resource Estimate for

the Virginia Silver Project in Santa Cruz Province, Argentina”,

with the effective date of 30 October 2023, supporting an increase

to the Resource on www.sedarplus.ca and the report can be found on

the Company’s website at

https://mirasolresources.com/projects/mirasol-exploration/virginia/.

The updated mineral resource estimate was

completed by Julio B. Novillo, Ph.D., PGeo., Principal Geologist,

and José A. Bassan, MSc., PGeo., Principal Geologist, located in

Rio Negro and Córdoba, Argentina respectively and both are

Directors of Patagonia GEOSCIENCES. They are both Independent

Qualified Persons’ as defined by National Instrument 43-101

Standard Disclosure for Mineral Projects who reviewed and validated

the resource model previously prepared (original Virginia Mineral

Resource Report dated January 23, 2015 and the Amended Resource

Report dated February 29, 2016). The resource estimates were

prepared following with the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) Estimation of Mineral Resources and

Mineral Reserves Best Practice Guidelines (CIM, 2019) and reported

in accordance with the CIM Definition Standards for Mineral

Resources and Mineral Reserves (CIM Definition Standards,

2014).

Exploration Potential Beyond the Defined

Resource to Expand Mineralized Footprint

Future drilling at Virginia will focus on

increasing the inferred silver resources. The potential exists to

increase the overall deposit by continuing to drill along strike

and at depth of the silver veins included in the current

resource.

In addition, Mirasol’s plans to advance

exploration of new and proximal vein prospects, which are already

known to host high-grade silver from previously collected surface

samples (news release dated May 10, 2018). These new vein

occurrences located within close proximity to the east, south and

north with limited or no drilling are considered to have the

highest potential to add significantly to the Inferred Resource.

and are. Focused geological mapping, detailed geochemical sampling

and geophysics will guide future drilling for the potential

discovery of new mineralized zones.

Metallurgical Testing to Integrate

Significant Surrounding Halo Mineralization

Halo/Undefined mineralization adjacent to

Virginia's veins-breccias, which host the current Resource,

represent a significant volume of material with an average grade of

55 g/t silver. This Halo/undefined silver mineralization with low

recoveries from the initial metallurgical test work completed to

date (≤22%). However, because of the significant volume of this

Halo/Undefined material metallurgical testing looking to improve

and increase the silver recoveries is currently ongoing with the

goal of developing a suitable processing method for this

material.

Technical Reports Notes

The original Mineral Resources referenced in

this press release regarding the Virginia Project refers to the

technical report: "Virginia Project, Santa Cruz Province, Argentina

- Initial Silver Mineral Resource Estimate", with an effective date

of January 23, 2015, and authored by Donald F. Earnest P. Geo.

(Independent Qualified Person) and Michael J. Lechner, P.Geo.

(Independent Qualified Person).

The amended Mineral Resources referenced in this

press release regarding the Virginia Project refers to the

technical report: "Amended Technical Report, Virginia Project,

Santa Cruz Province, Argentina - Initial Silver Mineral Resource

Estimate", with an effective date of February 29, 2016, and

authored by Donald F. Earnest P. Geo. (Independent Qualified

Person) and Michael J. Lechner, P.Geo. (Independent Qualified

Person).

About Mirasol Resources Ltd

Mirasol is a well-funded exploration company

with 19 years of operating, permitting and community relations

experience in the mineral rich regions of Chile and Argentina.

Mirasol is currently self-funding exploration at two flagship

projects, Sobek and Inca, both located in Chile and controls 100%

of the high-grade Virginia Silver Deposit in Argentina. Mirasol

also continues to advance a strong pipeline of highly prospective

early and mid-stage projects.

For further information,

contact:Tim Heenan, PresidentorTroy Shultz, Vice President

Investor Relations

Tel: +1 (604) 602-9989Email:

contact@mirasolresources.comWebsite: www.mirasolresources.com

QAQC: Mirasol applies

industry-standard exploration sampling methodologies and

techniques. All geochemical rock and drill samples are collected

under the supervision of the company’s geologists following

industry practice. Geochemical assays are obtained and reported

under a quality assurance and quality control (QA/QC) program with

insertions of controls (standards, blanks and duplicates,

representing 5%, 4% and 5% of the samples, respectively).

Drill composites were calculated using a cut-off

of 65 g/t Ag. Drill intersections are reported as true thicknesses.

Drill samples were assayed by Alex Stewart Laboratories ALS Limited

in Mendoza, Argentina, which complies with certification ISO

9001:2015 and accreditation ISO 17025:2017, for silver by Fire

Assay of a 30-gram (1 assay ton) charge with an AA finish, or if

over 100 g/t Ag were re-assayed and completed with a gravimetric

finish. For these samples, the gravimetric data were utilized in

calculating silver intersections.

Fire Assay analyzes samples for both Au and Ag

and also by ICP MS, including a package of 48 elements.

Drill core samples have an average 1.2m length

before composite and 1.9m in length after composite of Vein/Breccia

and Halo/Undefined, and the core diameter is generally HQ/HQ3. The

samples are delivered to the laboratory by Mirasol personnel, a

private courier, or a dedicated laboratory

pick-up service.

Qualified Person Statement:

Mirasol’s disclosure of technical and scientific information in

this press release has been reviewed and approved by Tim Heenan

(MAIG), the President for the Company, who serves as a Qualified

Person under the definition of National Instrument 43-101.

Forward Looking Statements: The

information in this news release contains forward looking

statements that are subject to a number of known and unknown risks,

uncertainties and other factors that may cause actual results to

differ materially from those anticipated in our forward-looking

statements. Factors that could cause such differences include:

changes in world commodity markets, equity markets, costs and

supply of materials relevant to the mining industry, change in

government and changes to regulations affecting the mining industry

and to policies linked to pandemics, social and environmental

related matters. Forward-looking statements in this release include

statements regarding future exploration programs, operation plans,

geological interpretations, mineral tenure issues and mineral

recovery processes. Although we believe the expectations reflected

in our forward-looking statements are reasonable, results may vary,

and we cannot guarantee future results, levels of activity,

performance or achievements. Mirasol disclaims any obligations to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as may be

required by applicable law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

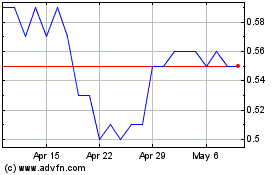

Mirasol Resources (TSXV:MRZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

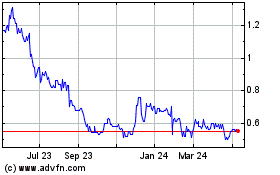

Mirasol Resources (TSXV:MRZ)

Historical Stock Chart

From Apr 2023 to Apr 2024