Pender Growth Fund Announces Acquisition of Four Technology Companies from Pluribus Technologies

October 11 2024 - 3:46PM

(TSXV: PTF) Pender Growth Fund Inc. (“Pender”

or the “Company”) is pleased to announce the completed acquisition

of four technology companies from Pluribus Technologies Corp.

(“Pluribus”) (TSXV:PLRB). The acquisition is being made by a

majority owned subsidiary, to be named Pender Software Holdings

Ltd., held approximately 85% by Pender and 15% by Acorn Partners

Inc.

The total cash consideration for the transaction

is C$17.0 million, subject to working capital adjustments,

performance and other customary holdbacks. All four companies are

currently cash flow positive.

The four technology companies acquired are:

- POWR Inc.

(www.powr.io) – Founded in 2014 and headquartered in San Francisco

(US), POWR is one of the web’s leading plugin libraries that helps

eCommerce businesses convert website visitors into customers on

platforms including Wix and Shopify.

- Rowanwood Professional

Services Ltd. (www.rowanwood.ltd) – Founded in 2017 and

headquartered in London (UK), Rowanwood provides housing asset

management and energy management software solutions specially

designed around the needs of housing providers in England, Scotland

and Wales.

- Cranham Haig Ltd. dba CHL

Software (www.docmoto.com) – Founded in 1996 and

headquartered in Gloucestershire (UK), DocMoto provides secure

document and email management solutions primarily for law firms and

legal departments in various industries.

- Assured Software

Ltd. (www.assuredsoftware.com) – Founded in 1997 and

headquartered in Vancouver (CA), Assured provides design workflow

and job management software solutions for the restoration

industry.

Following the acquisition, all four entities

will continue to be led by their existing management teams. All

parties will prioritize a seamless transition with minimal

disruption to customers, employees and business operations. The new

holding company structure will facilitate a focus on operational

excellence with strategic support and access to capital from Pender

and Acorn.

Pender and Acorn were advised on the transaction

by Fasken Martineau DuMoulin LLP, Loeb & Loeb LLP, and BDO

Canada LLP.

About Pender Growth Fund

Inc.

Pender Growth Fund Inc. is an investment firm.

Its investment objective is to achieve long-term capital growth.

Pender utilizes its capital base and long-term horizon to invest in

unique situations, primarily small cap, special situations, and

illiquid public and private companies. The firm invests in public

and private companies, principally in the technology sector. It

trades on the TSX Venture Exchange under the symbol “PTF” and posts

its NAV on its website, generally within five business days of each

month end. For additional information, please

visit www.pendergrowthfund.com.

About Acorn Partners Inc.

Acorn Partners Inc. is an investment and

advisory firm based in Vancouver, BC. Acorn invests in profitable

technology companies by deploying permanent capital alongside

trusted capital partners. Acorn supports portfolio companies with

strategic decisions and oversight while management continues to

make operational decisions. For additional information, please

visit www.acorncappartners.com.

For further information, please contact:

Tony Rautava

Corporate SecretaryPender Growth Fund Inc.(604)

653-9625Toll Free: (866) 377-4743

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of the Company and the environment in

which it operates. Forward-looking statements are identified by

words such as “believe”, “anticipate”, “project”, “expect”,

“intend”, “plan”, “will”, “may”, “estimate” and other similar

expressions. These statements are based on the Company's

expectations, estimates, forecasts and projections and include,

without limitation, statements regarding the Company’s decreased

portfolio risk and future investment opportunities. The

forward-looking statements in this news release are based on

certain assumptions; they are not guarantees of future performance

and involve risks and uncertainties that are difficult to control

or predict. A number of factors could cause actual results to

differ materially from the results discussed in the forward-looking

statements, including, but not limited to, the factors discussed

under the heading “Risk Factors” in the Company's annual

information form available at www.sedarplus.ca. There can be no

assurance that forward-looking statements will prove to be accurate

as actual outcomes and results may differ materially from those

expressed in these forward-looking statements. Readers, therefore,

should not place undue reliance on any such forward-looking

statements. Further, these forward-looking statements are made as

of the date of this news release and, except as expressly required

by applicable law, the Company assumes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

Pluribus Technologies (TSXV:PLRB)

Historical Stock Chart

From Oct 2024 to Nov 2024

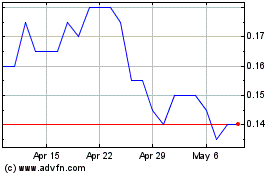

Pluribus Technologies (TSXV:PLRB)

Historical Stock Chart

From Nov 2023 to Nov 2024