Rugby Resources Ltd. Closes Oversubscribed Non-brokered Private Placement

August 02 2023 - 5:53PM

Rugby

Resources Ltd.

(“Rugby” or the

“Company”) (TSX-V:

RUG) is pleased to announce that further to the

news release dated June 22 2023, it has closed an oversubscribed

non-brokered private placement and issued 23,496,667 units (the

“

Units”) of the Company at a price of $0.05 per

Unit for gross proceeds of $1,174,833.35 (the

“

Offering”).

Each Unit consists of one (1) common share and

one common share purchase warrant (a “Warrant”).

Each Warrant will entitle the holder thereof to purchase one (1)

additional common share of the Company at an exercise price of

$0.15 for a period of two (2) years from the Closing Date.

Finder’s fees in an aggregate amount of $23,400

were paid to qualified parties in connection with the Offering.

All securities issued pursuant to the Offering

are subject to a statutory hold period of four months plus a day

from issuance in accordance with applicable securities laws of

Canada. Closing of the Offering is subject to receipt of all

necessary regulatory approvals and final acceptance by the TSX

Venture Exchange.

Proceeds of the Offering will be used for exploration and

general expenses. MI 61-101 Disclosure

Certain insiders of the Company participated in

the Offering for an aggregate total of 4,700,000 Units. The

participation by such insiders is considered a “related-party

transaction” within the meaning of Multilateral Instrument 61-101 -

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). The Company has relied on exemptions from the formal

valuation and minority shareholder approval requirements of MI

61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in

respect of related party participation in the Offering as neither

the fair market value (as determined under MI 61-101) of the

subject matter of, nor the fair market value of the consideration

for, the transaction, insofar as it involved the related parties,

exceeded 25% of the Company’s market capitalization (as determined

under MI 61- 101).

Early Warning Disclosure

Rowen Company Limited (“Rowen”) a company

controlled by Bryce Roxburgh, a director and officer of the

Company, acquired 3,000,000 Units under the Offering. Prior to the

Offering, Rowen and Bryce Roxburgh held 10.72% of the Company's

issued and outstanding common shares on a non-diluted and 13.56% on

a fully diluted basis. After giving effect to the Private

Placement, Rowen and Bryce Roxburgh beneficially own and control

collectively 10.91% of the Company's issued and outstanding common

shares on a non-diluted and 14.43% on a fully diluted basis. Rowen

Company and Bryce Roxburgh acquired the Units for investment

purposes. Rowen Company and Bryce Roxburgh intend to evaluate their

investment in the

Company and to increase or decrease their

shareholdings from time to time as they may determine appropriate.

A copy of the early warning report being filed by Rowen and Bryce

Roxburgh may be obtained by contacting the Company at

604-687-2038.

For additional information you are invited to visit the Rugby

Resources Ltd. website at www.rugbyresourcesltd.com

| Rob Grey, VP, Corporate

Communications Tel: 604-688-4941 Fax: 604-688-9532Toll-free:

1.855.688.4941 |

Suite 810, 789 West Pender St. Vancouver, BC Canada. V6C

1H2info@rugbyresourcesltd.com |

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX

VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE

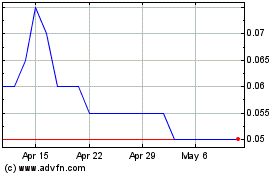

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From Apr 2024 to May 2024

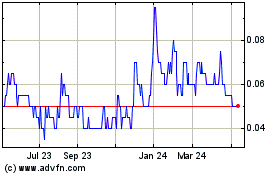

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From May 2023 to May 2024