FAX Capital Corp. Reports Second Quarter 2021 Results

August 04 2021 - 4:00PM

FAX Capital Corp. (

FAX Capital or the

Company) (TSX: FXC and FXC.WT) today announced its

results for the quarter ended June 30, 2021. All currency figures

are Canadian dollars.

The Company performed well during the period,

and these results support the strategy of our focused business

model and disciplined approach to investing.

Operating Highlights:

- Book value of

$5.45 per subordinate voting share and multiple voting share

(collectively, the shares) at June 30, 2021, an

increase of 6.4% in the quarter and 28.2% year-over-year.

- Deployed $19.2

million of capital during the quarter into four investments: $6.8

million into BioSyent Inc. (TSXV: RX), $5 million into Quisitive

Technology Solutions, Inc. (Quisitive) (TSXV:

QUIS), $1.8 million into Hamilton Thorne Ltd. (TSXV: HTL) and $5.6

million into an undisclosed Canadian public company that we are in

the process of accumulating.

- The Company’s $5

million investment in Quisitive was via a private placement, which

followed our original $20 million private placement in the company

during the first quarter of 2021. In both transactions, the Company

earned a capital commitment fee of 3.5% on the aggregate $25

million subscription amount.

- Quisitive announced that Laurie

Goldberg, the Company’s nominee under the Investor Rights

Agreement, was elected to its board of directors.

- Bought back and cancelled

approximately 65,000 shares in the first six months of 2021 at an

average cost of $3.89 per share, pursuant to FAX Capital’s Normal

Course Issuer Bid.

- Held a cash

balance available to be invested of approximately $80 million, or

$1.87 per share at June 30, 2021.

"We are pleased with our continued execution in

the second quarter," said Blair Driscoll, CEO of FAX Capital. "Our

diligent investment process continues to result in consistent

growth in our book value per share, which grew more than 6% in the

quarter and 28% over the past year driven by strong returns on our

deployed capital."

"Armed with a healthy cash balance, we continue

to assess a robust pipeline of potential new investments and

acquisitions, including those to complement our recently formed

property technology and services platform, which we believe will

help us generate strong returns for our shareholders.”

Results for the Three and Six Months

Ended June 30, 2021

The Company’s book value per share increased

6.4% from $5.12 per share at March 31, 2021 to $5.45 per share as

at June 30, 2021. The 6.4% increase in the book value per share is

primarily attributed to the Company recording a net unrealized gain

on its public company investments of $15.6 million in the period.

Net income for the quarter ended June 30, 2021 was $14.1 million,

compared to $5.1 million in the comparative quarter last year.

The Company’s book value per share increased

12.8% from $4.83 per share at December 31, 2020 to $5.45 per share

as at June 30, 2021. The 12.8% increase in the book value per share

is primarily attributed to the Company recording realized and

unrealized gains on its investments of $30.2 million in the period.

Net income for the six months ended June 30, 2021 was $26.5

million, compared to a net loss of $4.1 million in the comparative

period last year.

Other Information

Further information about FAX Capital, including

FAX Capital’s Financial Statements and Management’s Discussion

& Analysis for the six months ended June 30, 2021 and the year

ended December 31, 2020, are available under the Company’s profile

at www.sedar.com and www.faxcapitalcorp.com. The Company’s updated

investor presentation and factsheet in respect of the second

quarter of 2021 contain further information on FAX Capital’s

strategy and operations and can be accessed on the Company’s

website. Shareholders are encouraged to read these documents.

About FAX Capital Corp.

The Company is an investment holding company

with a business objective to maximize its intrinsic value on a per

share basis over the long-term by seeking to achieve superior

investment performance commensurate with reasonable risk. The

Company intends to invest in equity, debt and/or hybrid securities

of high-quality businesses. The Company initially intends to invest

in approximately 10 to 15 high-quality small cap public and private

businesses located primarily in Canada and, to a lesser extent, the

United States.

For additional information

please contact:

Investor RelationsTim Foran

Email: IR@faxcapitalcorp.comWebsite: www.faxcapitalcorp.com

Media RelationsKieran Lawler

Telephone: (416) 303-0799 Email:

Kieran.lawler@loderockadvisors.com

Cautionary Statement Regarding Use of

Non-IFRS Accounting Measures

This press release makes reference to the

following financial measure which is not recognized under

International Financial Reporting Standards (IFRS)

and which does not have a standard meaning prescribed by IFRS:

“book value per share”. The Company’s book value per share is a

measure of the performance of the Company as a whole. Book value

per share is measured by dividing shareholders’ equity of the

Company at the date of the statement of financial position by the

number of subordinate voting shares and multiple voting shares

outstanding at that date. The Company’s method of determining this

financial measure may differ from other companies’ methods and,

accordingly, this amount may not be comparable to measures used by

other companies. This financial measure is not a performance

measure as defined under IFRS and should not be considered either

in isolation of, or as a substitute for, net earnings prepared in

accordance with IFRS.

Cautionary Note Regarding

Forward-Looking Information

This press release contains forward-looking

information. Such forward-looking information or statements

(FLS) are provided for the purpose of providing

information about management's current expectations and plans

relating to the future. Readers are cautioned that reliance on such

information may not be appropriate for other purposes. Any such FLS

may be identified by words such as “proposed”, “expects”,

“intends”, “may”, “will”, and similar expressions or variations

thereof. FLS contained or referred to in this press release

includes, but is not limited to, the future or expected performance

of the Company’s portfolio companies; the Company’s continuing

investment thesis in respect of such portfolio companies; the

Company’s investment approach, objectives and strategy, including

investment selection and pace of continued capital deployment; the

ability to realize on further potential investment opportunities;

the structuring of its future investments and its plans to manage

those investments; the Company’s ability to utilize its Normal

Course Issuer Bid; and the Company’s financial performance.

FLS involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. The Company believes that the

expectations reflected in the FLS are reasonable but no assurance

can be given that these expectations will prove to be correct. Some

of the risks and other factors which could cause results to differ

materially from those expressed in FLS contained in this press

release include, but are not limited to: the continued impact of

COVID-19 on targeted investments, the economy and markets

generally, as well as the identified risk factors included in the

Company’s public disclosure, including the Annual Information Form

dated March 25, 2021, which is available on SEDAR at www.sedar.com

and on the Company’s website at www.faxcapitalcorp.com. The FLS in

this press release reflect the current expectations, assumptions,

judgements and/or beliefs of the Company based on information

currently available to the Company, and are subject to change

without notice. Any FLS speaks only as of the date on which it is

made and, except as may be required by applicable securities laws,

the Company disclaims any intent or obligation to update any FLS,

whether as a result of new information, future events or results or

otherwise. The FLS contained in this press release are expressly

qualified by this cautionary statement. For more information on the

Company, please review the Company's continuous disclosure filings

that are available at www.sedar.com.

No securities regulatory authority has either

approved or disapproved of the contents of this press release. The

Toronto Stock Exchange accepts no responsibility for the adequacy

or accuracy of this release.

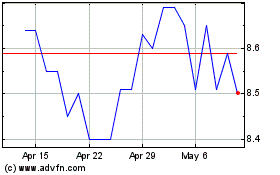

Biosyent (TSXV:RX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Biosyent (TSXV:RX)

Historical Stock Chart

From Nov 2023 to Nov 2024