Tudor Gold Corp. (TSXV: TUD) (the “

Company”) is

pleased to announce that, due to strong investor demand, it has

entered into an amended agreement with Research Capital

Corporation, as the lead underwriter and sole bookrunner (the

“

Lead Underwriter”), on behalf of a syndicate of

underwriters, including Red Cloud Securities Inc. and Roth Canada,

ULC (collectively, the “

Underwriters”), to

increase the size of its previously announced bought-deal, private

placement offering from $10,000,000 to approximately $16,000,000 in

aggregate gross proceeds to the Company (the

“

Offering”). Mr. Eric Sprott, through 2176423

Ontario Ltd., has indicated his intention to subscribe in the

Offering.

The Offering consists of securities of the

Company (the “Offered Securities”) in a

combination of:

a) flow-through units

of the Company (the “FT Units”) at a price of

$1.28 per FT Unit. Each FT Unit will consist of one common share of

the Company (a “Common Share”) that will qualify

as “flow-through shares” within the meaning of subsection 66(15) of

the Income Tax Act (Canada) (the “Tax Act”) and

one-half of one Common Share purchase warrant (each whole warrant,

a “Warrant”); and

b) flow-through units

of the Company to be sold to charitable purchasers (the

“Charity FT Units”) at a price of

$1.60 per Charity FT Unit. Each Charity FT Unit will consist of one

Common Share that will qualify as “flow-through shares” within the

meaning of subsection 66(15) of the Tax Act that will be issued as

part of a charity arrangement and one-half of one Warrant.

Each Warrant shall entitle the holder thereof to

purchase one Common Share (a “Warrant Share”) at

an exercise price of $1.60 per Warrant Share at any time up to 24

months following the closing of the Offering.

The entire gross proceeds from the issue and

sale of the FT Units and Charity FT Units will be used for Canadian

Exploration Expenses as defined in paragraph (f) of the definition

of “Canadian exploration expense” in subsection 66.1(6) of the Tax

Act and "flow through mining expenditures" as defined in subsection

127(9) of the Tax Act that will qualify as "flow-through mining

expenditures", and “BC flow-through mining expenditures” as defined

in subsection 4.721(1) of the Income Tax Act (British Columbia)

(the "Qualifying Expenditures"), which will be

incurred on or before December 31, 2024 and renounced

with an effective date no later than December 31, 2023 to the

initial purchasers of FT Units and Charity FT Units.

The Underwriters will have an option (the

“Underwriters’ Option”) to offer for sale up to an

additional 15% of the number of Offered Securities sold in the

Offering, which Underwriters’ Option is exercisable, in whole or in

part, at any time up to 48 hours prior to the closing of the

Offering.

The Offered Securities to be issued under the

Offering will be offered by way of private placement in each of the

provinces of Canada. The Offering is scheduled to close on or about

the week of April 12, 2023, or such other date as agreed upon

between the Company and the Lead Underwriter (the

“Closing”) and is subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals including the approval of the TSX Venture Exchange. The

Offered Securities and securities underlying the Compensation

Warrants (as defined herein) to be issued under the Offering will

have a hold period of four months and one day from Closing.

In connection with the Offering, the

Underwriters will receive an aggregate cash fee equal to 6.0% of

the gross proceeds from the Offering (including in respect of any

exercise of the Underwriters’ Option) and the Company will grant

the Underwriters, on date of Closing, non-transferable compensation

warrants (the “Compensation Warrants”) equal to

6.0% of the total number of Offered Securities sold under the

Offering (including in respect of any exercise of the Underwriters’

Option), other than proceeds from the Company’s president’s list in

which the cash commission and Compensation Warrants will be reduced

to 3.0%. Each Compensation Warrant will entitle the holder thereof

to purchase one Common Share at an exercise price of $1.28 per

Common Share for a period of 24 months following the Closing.

The securities described herein have not been,

and will not be, registered under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”),

or any state securities laws, and accordingly, may not be offered

or sold within the United States except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

About Tudor Gold Corp.

Tudor Gold Corp. is a precious and base metals

exploration and development company with properties in British

Columbia's Golden Triangle (Canada), an area that hosts producing

and past-producing mines and several large deposits that are

approaching potential development. The 17,913 hectare Treaty Creek

project (in which TUDOR GOLD has a 60% interest) borders Seabridge

Gold Inc.'s KSM property to the southwest and borders Newcrest

Mining's Brucejack Mine property to the southeast.

ON BEHALF OF THE BOARD OF DIRECTORS OF TUDOR GOLD

CORP.“Ken Konkin”

Ken KonkinPresident and Chief Executive

Officer

For further information, please visit the Company’s website at

www.tudor-gold.com or contact:Chris CurranHead of

Corporate Development and CommunicationsPhone: (604) 559

8092E-Mail: chris.curran@tudor-gold.com

or

Carsten RinglerHead of Investor Relations and

CommunicationsPhone: +49 151 55362000E-Mail:

carsten.ringler@tudor-gold.com

Cautionary Note Regarding

Forward-looking Information

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to the activities, events or

developments that the Company expects or anticipates will or may

occur in the future, including the expectation that the Offering

will close in the timeframe and on the terms as anticipated by

management. Generally, but not always, forward-looking information

and statements can be identified by the use of words such as

“plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connation thereof. These forward‐looking

statements or information relate to, among other things: the

completion of the Offering; the expected closing date of the

Offering; the intended use of proceeds from the Offering; the

Company’s ability to incur Canadian Exploration Expenses and BC

flow-through mining expenditures as anticipated by management; and

the receipt of all necessary approvals for the completion of the

Offering, including the approval of the TSX Venture Exchange.

Such forward-looking information and statements

are based on numerous assumptions, including among others, that the

Company will complete Offering in the timeframe and on the terms as

anticipated by management; that the Company will be able to incur

Canadian Exploration Expenses and BC flow-through mining

expenditures as anticipated by management, and that the Company

will receive all necessary approvals for the completion of the

Offering, including the approval of the TSX Venture Exchange.

Although the assumptions made by the Company in providing

forward-looking information or making forward-looking statements

are considered reasonable by management at the time, there can be

no assurance that such assumptions will prove to be accurate and

actual results and future events could differ materially from those

anticipated in such statements.

Important factors that could cause actual

results to differ materially from the Company’s plans or

expectations include risks relating to the failure to complete the

Offering in the timeframe and on the terms as anticipated by

management, risks relating to the Company’s inability to incur

Canadian Exploration Expenses and BC flow-through mining

expenditures as anticipated by management, and risks relating to

the Company not receiving all necessary approvals for the

completion of the Offering, including the approval of the TSX

Venture Exchange, market conditions and timeliness regulatory

approvals. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in the forward-looking information or implied by

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that forward-looking information and statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated, estimated or

intended. Accordingly, readers should not place undue reliance on

forward-looking statements or information.

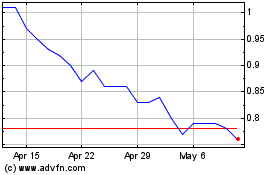

Tudor Gold (TSXV:TUD)

Historical Stock Chart

From Nov 2024 to Dec 2024

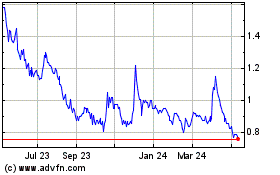

Tudor Gold (TSXV:TUD)

Historical Stock Chart

From Dec 2023 to Dec 2024