VIOR INC. (“Vior” or the “Company”) (TSXV: VIO; OTC: VIORF

and FRANKFURT: VL51) is pleased to announce that it has

entered into an agreement with Eight Capital to act as lead agent

and sole bookrunner (together with a syndicate of agents, the

“

Agents”) in connection with a “best efforts”

private placement offering by the Company of securities for

aggregate gross proceeds of up to $20,000,000 (the

“

Offering”). Pursuant to the Offering, Vior may

issue any combination of: (i) units of the Company (the

“

Hard Units”) and/or subscription receipts (the

“

Subscription Receipts”); and (ii) flow-through

units of the Company (the “

FT Units” and, together

with the Hard Units and the Subscription Receipts, the

“

Offered Securities”). It is expected that

approximately $13 million will be raised from FT Units and $7

million from Hard Units and Subscription Receipts.

Each Hard Unit and Subscription Receipt will

have an issue price of $0.125 and each FT Unit will have an issue

price of $0.2225. Each Hard Unit will be comprised of one common

share of the Company (each, a “Share”) and

one-half of one common share purchase warrant of the Company (each

whole warrant, a “Warrant”). Each Warrant will

entitle the holder thereof to purchase one Share at an exercise

price of $0.21 for a period of twenty-four (24) months following

the closing date of the Offering (the “Closing

Date”).

Each FT Unit will consist of (i) one Share, each

of which will qualify as a “flow-through share” within the meaning

of subsection 66(15) of the Income Tax Act (Canada) and Section

359.1 of the Taxation Act (Québec), and (ii) one-half of one

Warrant, each of which will qualify as a “flow-through share”

within the meaning of subsection 66(15) of the Income Tax Act

(Canada) and Section 359.1 of the Taxation Act (Québec).

Each Subscription Receipt will be automatically

exchanged, without any action on the part of the holder thereof,

for one Hard Unit upon satisfaction of the Escrow Release

Conditions (as defined below). The only subscriber of Subscription

Receipts will be Osisko Mining Inc. (the “Osisko

Mining”) insofar as the Company must obtain, following the

Closing Date, approvals of the TSX Venture Exchange (the

“Exchange”) and the shareholders of the Company to

authorize the creation of Osisko Mining as a new Control Person (as

defined in the Corporate Finance Policy of the Exchange) of the

Company resulting from Osisko Mining’s participation in the

Offering.

The Company has granted the Agents an option to

offer for sale up to an additional 15% of the Hard Units and

Subscription Receipts, in any combination, at their respective

issue price (the “Over-Allotment Option”). The

Over-Allotment Option will be exercisable, in whole or in part, up

to 48 hours prior to the Closing Date.

The net proceeds from the sale of Hard Units and

Subscription Receipts (assuming the satisfaction of the Escrow

Release Conditions) will be used by the Company for exploration on

its Belleterre Gold Project and for working capital and general

corporate purposes.

The gross proceeds from the sale of FT Units

will be used by the Company to incur expenses described in

paragraph (f) of the definition of “Canadian exploration expense”

(“CEE”) in subsection 66.1(6) of the Income Tax

Act (Canada) (the “Tax Act”) and paragraph (c) of

the definition of CEE in section 395 of the Taxation Act (Québec)

(the “QTA”), and will be renounced in favour of

the relevant purchaser for both federal and Québec tax purposes no

later than December 31, 2024, pursuant to the terms of the

subscription agreement to be entered into between the Company and

such purchaser of FT Units. Such expenses will also qualify as

“flow-through mining expenditures” as defined in subsection 127(9)

of the Tax Act for the purposes of the federal tax credit described

in paragraph (a.2) of the definition of “investment tax credit” in

subsection 127(9) of the Tax Act.

For purchasers of FT Units resident in the

Province of Québec, 10% of the amount of the CEE will be eligible

for inclusion in the deductible “exploration base relating to

certain Québec exploration expenses” and 10% of the amount of the

CEE will be eligible for inclusion in the deductible “exploration

base relating to certain Québec surface mining exploration

expenses” (as such terms are defined in sections 726.4.10 and

726.4.17.2 of the QTA, respectively, for the purposes of the

deductions described in section 726.4.9 and 726.4.17.1 of the QTA),

giving rise to an additional 20% deduction for Québec tax

purposes.

In the event that the Escrow Release Conditions

are not satisfied on or before June 30, 2024, then the Escrowed

Funds together with accrued interest earned thereon (if any) will

be returned to the holder of the Subscription Receipts and the

Subscription Receipts will be cancelled.

The Offering is scheduled to close on or about

March 28, 2024, and is subject to certain conditions, including,

but not limited to, the receipt of all necessary regulatory and

other approvals, including the approval of the Exchange. The

Offered Securities will be subject to a hold period of four-months

and one day from the Closing Date.

Shortly following the Closing Date, the Company

intends to complete a consolidation of its common shares on the

basis of one (1) post-consolidation share of the Company for every

three (3) pre-consolidation common shares of the Company.

None of the securities to be issued pursuant to

the Offering have been or will be registered under the United

States Securities Act of 1933, as amended, and such securities may

not be offered or sold within the United States absent U.S.

registration or an applicable exemption from U.S. registration

requirements. This news release does not constitute an offer to

sell or the solicitation of an offer to buy any securities.

Certain insiders of the Company (the

“Purchasing Insiders”) are expected to participate

in the Offering. Pursuant to Multilateral Instrument 61-101 -

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”), a purchase by the Purchasing

Insiders would be a "related party transaction". The Company

expects to be exempt from the requirements to obtain a formal

valuation or minority shareholder approval in connection with the

Offering in reliance on sections 5.5(a) and 5.7(a), respectively,

of MI 61-101, as neither the fair market value of the securities

received by such parties nor the proceeds for such securities

received by the Company will exceed 25% of the Company’s market

capitalization as calculated in accordance with MI 61-101. More

specifically, it is anticipated that Osisko Mining will be

subscribing to that number of Hard Units that shall result in

Osisko Mining holding not more than 19.9% of the then issued and

outstanding common shares of the Company. On March 22, 2021, the

Company and Osisko Mining entered into an investor rights agreement

(the “Original IRA”) pursuant to which Osisko

Mining was granted, among other things: (i) the right to nominate a

representative to the board of directors of the Company; (ii) the

right to participate in future equity financings (as defined in the

Original IRA) of the Company; and (iii) certain other rights as

described in the Original IRA. In connection with the Offering, the

Company and Osisko Mining will enter into an amended investor

rights agreement (the “Amended IRA”) pursuant to

which Osisko Mining will be granted the right to nominate an

additional representative to the board of directors of the Company.

Moreover, it is anticipated that the aforementioned rights granted

under the Original IRA will be maintained under the Amended

IRA.

Moreover, it is anticipated that Osisko Mining

will purchase that number of Subscription Receipts that, if and

when converted into common shares of the Company, would result in

Osisko Mining holding greater than 20.0% of the then issued and

outstanding common shares of the Company thereby making Osisko

Mining a new Control Person (as defined in the Corporate Finance

Policy of the Exchange) of the Company under applicable securities

laws. Pursuant to the policies of the Exchange, the creation of a

new Control Person of the Company requires shareholder approval.

Consequently, following the closing of the Offering, the Company

intends to hold a special meeting of its shareholders to approve

the creation of a new Control Person, among other things.

The gross proceeds from the sale of the

Subscription Receipts (the “Escrowed Funds”) shall

be held in escrow by an escrow agent determined by the Company and

Osisko Mining. The Escrowed Funds will be released from escrow to

the Company upon satisfaction of the following conditions (the

“Escrow Release Conditions”):

- the receipt of the required

shareholder and Exchange approvals to authorize of the creation of

Osisko Mining as a new Control Person (as defined in the Corporate

Finance Policy of the Exchange) of the Company resulting from

Osisko Mining’s participation in the Offering;

- the receipt of the required

shareholder and Exchange approvals to permit the Company and Osisko

Mining to enter into (i) the Amended IRA, and (ii) the Royalty

Option Agreement (as defined below);

- the delivery by the Company and

Osisko Mining of signed copies, in escrow, of the Amended IRA and

the Royalty Option Agreement, with the release of such documents

being automatic and subject only to the delivery of the joint

direction in IV; and

- the Company and Eight Capital (on

its own behalf and on behalf of the syndicate) having delivered a

joint notice to the escrow agent confirming that the condition set

forth in (I)-(III) above have been met.

The Company and Osisko Mining have entered into

a binding term sheet pertaining to the grant by the Company to

Osisko Mining of an option to acquire a royalty in exchange for

cash consideration of $250,000, which option shall provide Osisko

Mining with an exclusive option, exercisable for a period of five

(5) years following the effective date (subject to acceleration in

the case that the Company publishes a milestone resource report on

the Belleterre Gold Property), at an exercise price of $5.0 million

in cash, to, inter alia, acquire the following exclusive royalty

rights and privileges: (i) a 2.0% net smelter returns royalty on

the Belleterre Gold Property (subject to a 3.0% limit on all

royalties); and (ii) a right in favour of Osisko Mining to cause

the Company to fully exercise all buy-back rights associated with

existing royalties on the Belleterre Gold Property and regrant or

transfer such royalties to Osisko Mining. The parties are expected

to enter into a definitive royalty option agreement (the

“Royalty Option Agreement”).

About VIOR

Vior is a junior mineral exploration corporation

based in the province of Québec, Canada, whose corporate strategy

is to generate, explore, and develop high-quality mineral projects

in the proven and favourable mining jurisdiction of Québec. Through

the years, Vior’s management and technical teams have demonstrated

their ability to discover several gold deposits and many

high-quality mineral prospects.

Vior is rapidly advancing its flagship

Belleterre Gold Project with the strategic support of Osisko Mining

Inc. The Belleterre Gold Project is an exciting district-scale

property that includes Québec’s past-producing high-grade

Belleterre gold mine. Vior has conducted extensive exploration at

the Belleterre property and is finalizing plans for a +50,000m

drill program. Vior is also actively developing its promising

Skyfall Project in partnership with SOQUEM Inc., as well as several

other properties with multi-mineral potential.

For More Information, Please

Contact:

| Mark FedosiewichPresident and CEO

613-898-5052mfedosiewich@vior.ca |

Laurent EustacheExecutive

Vice-President514-442-7707leustache@vior.ca

|

Neither the Exchange nor its Regulations

Services Provider (as that term is defined in the policies of the

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Forward-Looking Information

The information contained herein contains

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

“forward-looking information” within the meaning of applicable

Canadian securities legislation. “Forward-looking information”

includes, but is not limited to, statements with respect to the

activities, events or developments that the Company expects or

anticipates will or may occur in the future, including, without

limitation, statements with respect to, the completion of the

Offering; the expected gross proceeds of the Offering; the receipt

of all necessary regulatory and other approvals, including approval

of the Exchange; the satisfaction of the Escrow Release Conditions;

the expected incurrence by the Company of eligible Canadian

exploration expenses that will qualify as flow-through mineral

mining expenditures; the renunciation by the Company of the

Canadian exploration expenses (on a pro rata basis) to each

subscriber of FT Units by no later than December 31, 2024; and the

use of proceeds from the Offering; the anticipated date for closing

of the Offering. Generally, but not always, forward-looking

information and statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connotation thereof.

Such forward-looking information and statements

are based on numerous assumptions, including among others, that the

results of planned exploration activities are as anticipated, the

price of gold, the anticipated cost of planned exploration

activities, that general business and economic conditions will not

change in a material adverse manner, that financing will be

available if and when needed and on reasonable terms, that third

party contractors, equipment and supplies and governmental and

other approvals required to conduct the Company’s planned

exploration activities will be available on reasonable terms and in

a timely manner. Although the assumptions made by the Company in

providing forward-looking information or making forward-looking

statements are considered reasonable by management at the time,

there can be no assurance that such assumptions will prove to be

accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves, the limited operating history

of the Company, the influence of a large shareholder, aboriginal

title and consultation issues, reliance on key management and other

personnel, actual results of exploration activities being different

than anticipated, changes in exploration programs based upon

results, availability of third party contractors, availability of

equipment and supplies, failure of equipment to operate as

anticipated; accidents, effects of weather and other natural

phenomena and other risks associated with the mineral exploration

industry, environmental risks, changes in laws and regulations,

community relations and delays in obtaining governmental or other

approvals and the risk factors with respect to the Company set out

in the Company’s filings with the Canadian securities regulators

and available under Vior’s profile on SEDAR+ at

www.sedarplus.ca.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

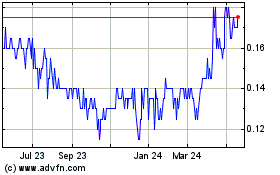

Vior (TSXV:VIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

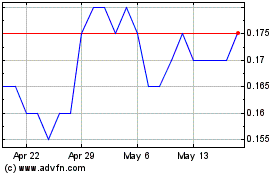

Vior (TSXV:VIO)

Historical Stock Chart

From Jan 2024 to Jan 2025