American Leisure Holdings, Inc. Enters into Commitment Letters for Construction Financing for The Sonesta Orlando Resort at Tier

August 18 2005 - 8:57AM

Business Wire

American Leisure Holdings, Inc. (OTCBB:AMLH), announced today that

it has obtained commitments for two credit facilities to be used in

the development of The Sonesta Orlando Resort at Tierra del Sol

(the "Project"). KeyBank, N.A. issued the commitment wherein it is

the lead lender in a $96,600,000 development and construction

facility for Phase I of the Resort which consists of a luxury

vacation home community comprised of 250 town homes and 180

mid-rise condominiums. In addition, KeyBank, N.A. has committed to

fund a second loan in the amount of $14,850,000 as a land loan on

Phase II of the Resort. KeyBank plans to hold approximately $50

million of the combined commitments with the balance syndicated to

other banking organizations. Both loans are expected to close

within 60 to 90 days. Both loans are part of a comprehensive

finance plan for the development of the project that also includes

a Community Development District ("CDD"), which will be used to pay

for the Project's sitework. The Sonesta Orlando Resort is designed

to be constructed in two phases. Phase I is scheduled to include

430 vacation units, a 126,000 square foot Clubhouse (84,000

approximate square footage under air), and one of Central Florida's

largest swimming and recreation complexes which includes a

combination pool and lazy river swimming feature, an outdoor sports

bar and food service, restroom facilities, showers, water-slides,

beach volleyball and extensive sundecks. Phase II is expected to

start during the construction phase of Phase I during 2006 with

full Project completion for all 972 units scheduled during 2007.

Phase II is scheduled to include 542 vacation units and additional

resort amenities. The planned amenities for Phase II include

miniature golf, a flow rider water attraction, a wave pool, a rapid

river, and a children's multilevel interactive water park. The

additional Clubhouse improvements in Phase II are expected to

include the finishing, equipping and furnishing of banquet and

meeting rooms, casual and fine dining restaurants, a full service

spa, a sales center and an owners' club. Phase I has been fully

pre-sold for $166,000,000. Total sales to date on both phases now

total $255,000,000. The estimated costs to complete the

construction of Phase I are $73,000,000 for vertical construction

and $57,000,000 be for other costs such as sales commissions,

permits, developer fees, contingencies, closing costs, bank fees

and interest, and soft costs such as architectural, engineering,

and legal costs. The Company is projecting to spend $24,900,000 in

Phase I for the first phase of its clubhouse and resort amenities

and an additional $21,100,000 in the second phase. The Company

expects that the first phase of sitework for 600 units at an

estimated cost of $19,200,000 will be funded by the Westridge

Community Development District ("District") via the sale by the

District of bonds issued on a non-recourse basis to the Company

("CDD Bonds"). The District was initially created by the Company

and enabled by an order of a Florida State District Court. The CDD

Bond issue is being underwritten by KeyBank Capital Markets. The

Project will occupy 122 acres and fronts US Route 27 approximately

three miles south of US Highway 192 and two miles north of the

intersection of Interstate 4 and US Route 27, between Osceola and

Polk Counties in Central Florida. Malcolm Wright, AMLH President

and CEO said, "The Company is creating a unique development for the

Greater Orlando Community that combines quality construction with

spectacular resort amenities that reflect the entertainment focus

of our area. This is designed to provide both our vacation home

owners and our future resort guests the opportunity to enjoy a

world class resort facility operated by expert management with

special advantages also available from our resort operator, Sonesta

International Hotels Corporation. The Company will continue to

concentrate on growing its vacation resort development projects for

management and distribution through its travel companies, Hickory

Travel Systems, Inc. of Saddle Brook, NJ, an international travel

consortium and travel services provider, and, TraveLeaders of Coral

Gables, Florida, a travel management firm with fourteen offices in

nine states from Florida to California." The Sonesta Orlando Resort

at Tierra Del Sol is Sonesta's first Orlando resort property.

"Orlando is the second largest hotel market in the U.S. and we

believe this extraordinary resort, with its oversized guest

accommodations, location and sensational amenities, will be an

attractive destination for visitors," noted Sonesta President

Stephanie Sonnabend. Sonesta's other Florida properties are in the

South Florida area, specifically Key Biscayne, Coconut Grove and

Sunny Isles Beach. Recently, Sonesta announced plans for a major

renovation to the Sonesta Beach Resort Key Biscayne to take place

over the next three to four years. "We're very excited about

participating in this outstanding project," said Robert Carmichael,

Senior Vice President and Team Sales Leader of KeyBank Real Estate

Capital's Orlando Office. He added, "American Leisure presents a

compelling combination of development expertise coupled with the

synergy of an extensive travel agency network. KeyBank has taken

the lead in underwriting both the conventional construction loans

and the bond financing for this innovative financial model." About

American Leisure Holdings, Inc. American Leisure Holdings Inc.

(OTCBB:AMLH) is an integrated travel services distribution and

travel destination development company. The Travel Division is

comprised of TraveLeaders, and Hickory Travel Systems, Inc., a

travel distribution network whose members produce multi-billion

dollar gross annual sales. The Company's plan is to acquire travel

companies and expand its affiliated travel network within AMLH's

business model for an integrated distribution channel while

continuing its web based and e-commerce solutions development. The

Company is actively working to develop innovative travel and

communication technology to enhance its competitive position in the

travel management and vacation home development arenas. The Company

intends to take advantage of the natural synergy between travel

distribution and the management and development of travel

destinations. This synergy will enhance the performance of the AMLH

Vacation Home Resort Development Division that develops high

quality vacation home resort properties. About KeyBank Real Estate

Capital KeyBank Real Estate Capital is the nation's third-largest

commercial real estate capital provider with nearly $19 billion in

annual financings. It provides construction and interim loans,

mezzanine financing, private equity, commercial mortgages,

investment banking and loan sales and syndications services

nationwide for virtually all property types. Its 800 financing

professionals serve a national client base through 36 locations in

major U.S. markets. KeyBank Real Estate Capital is a business unit

of KeyBank National Association, a subsidiary of Cleveland-based

KeyCorp, one of the nation's largest bank-based financial services

companies, with assets of approximately $91 billion. About Sonesta

International Hotels Corporation Sonesta Hotels, Resorts & Nile

Cruises, based in Boston, represents a collection of 25 upscale

hotels and resorts and 3 Nile Cruise ships. Founded in the 1940's,

Sonesta has a long-standing reputation in the hotel industry for

offering properties that are designed to deliver uncompromising

personal service, reflect the culture and history of their location

and provide a memorable experience unique to each hotel. Sonesta's

properties are located in Boston, New Orleans (2), Miami (3),

Orlando (opening 2006), St. Maarten, Brazil, Peru (7), Tuscany (3),

and Egypt (9). For more information about Sonesta Hotels, Resorts

& Nile Cruises, call 1-800-SONESTA (800-766-3782), or visit

Sonesta's website at http://www.sonesta.com. Forward Looking

Statement: This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The statements regarding AMLH in this release that are not

historical in nature, particularly those that utilize terminology

such as "may," "will," "should," "likely," "expects,"

"anticipates," "estimates," "believes" or "plans," or comparable

terminology, are forward-looking statements based on current

expectations about future events, which AMLH has derived from the

information currently available to it. These forward-looking

statements involve known and unknown risks and uncertainties that

may cause AMLH's results to be materially different from results

implied in such forward-looking statements. Important factors known

to AMLH that could cause forward-looking statements to turn out to

be incorrect are identified and discussed from time to time in

AMLH's filings with the Securities and Exchange Commission. The

forward-looking statements contained in this release speak only as

of the date hereof, and AMLH undertakes no obligation to correct or

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

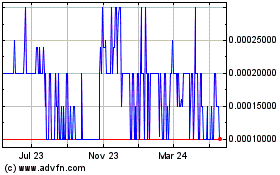

American Leisure (PK) (USOTC:AMLH)

Historical Stock Chart

From Dec 2024 to Jan 2025

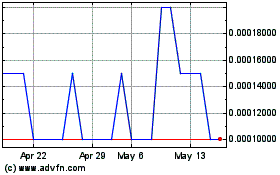

American Leisure (PK) (USOTC:AMLH)

Historical Stock Chart

From Jan 2024 to Jan 2025