Eli Lilly Revenue Rise Helped by New Products

July 26 2016 - 7:00AM

Dow Jones News

Eli Lilly & Co. reported Tuesday that revenue rose more than

expected in the most recent quarter, as sales of new drugs padded

increases in established products.

"Lilly is in the midst of one of the most productive periods of

new product launches in our company's history, with new medicines

making a substantial contribution to our revenue growth for the

first half of the year," Chief Executive John Lechleiter said.

Recently released drugs, including diabetes treatment Trulicity

and cancer drug Cyramza, helped push 10% volume growth in the

quarter.

Meanwhile, sales of Humalog, Lilly's biggest product by revenue,

rose 7% to $701.9 million. Revenue for the fast-acting form of

insulin in the U.S. advanced 5% on higher demand despite lower

realized prices. Sales abroad increased 11% on higher volume,

partially dented by unfavorable foreign exchange rates.

Blockbuster erectile-dysfunction drug Cialis sales shot up 11%

to $630.5 million. U.S. revenue jumped 24% on higher pricing, while

revenue outside the U.S. fell 4% on currency challenges and lower

volume.

Sales in its animal-health division, which Lilly bought from

Novartis AG for about $5.4 billion in 2014, rose 2.3% to $859.8

million.

In all for the June quarter, Lilly reported a profit of $747.7

million, or 71 cents a share, up from $600.8 million a share, or 56

cents, a year prior. Excluding charges related to the Venezuelan

financial crisis and other items, earnings per share fell to 86

cents from 90 cents.

Revenue grew 8.6% to $5.4 billion, driven by an 8% rise in

volume as realized prices and the impact of foreign exchange

rates—which recently had chipped away at the top line, as Lilly

does significant business abroad—remained relatively flat from a

year ago.

Analysts projected 86 cents in adjusted per-share profit on

$5.15 billion in sales.

Gross margin fell 2.6 percentage points to 72.9%, mostly owing

to a lower benefit from foreign exchange rates.

Lilly backed its earnings guidance for the year, which it had

cut down in the previous quarter, citing the Venezuelan financial

crisis. The company expects annual earnings per share of $2.68 to

$2.78. Revenue is still anticipated to come in at $20.6 billion to

$21.1 billion.

Shares, inactive premarket, have risen 7.5% over the past three

months.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 26, 2016 07:45 ET (11:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

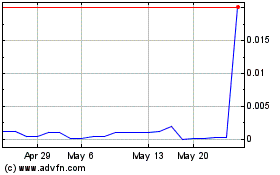

BB Liquidating (CE) (USOTC:BLIAQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

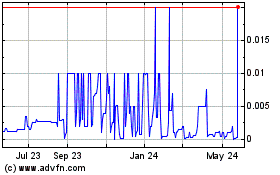

BB Liquidating (CE) (USOTC:BLIAQ)

Historical Stock Chart

From Dec 2023 to Dec 2024