El Capitan Updates 2015 Guidance to Reflect Dockworker Strike and Resulting Delays

March 23 2015 - 6:15AM

Business Wire

El Capitan Precious Metals, Inc. (OTCQB: ECPN) today reported a

revised financial outlook for the fiscal year ending September 30,

2015. The revised outlook reflects a downward revision to the

Company’s financial outlook and is, in large part, a result of the

protracted labor disputes involving 13,600 unionized dockworkers

that have snarled trade at international seaports on the West

Coast.

ECPN Board Chairman John F. Stapleton stated that the West Coast

port problems have made it impossible to complete scheduled

shipments of ECPN ore. According to terms of the Company’s contract

with its Chinese buyer, title changes hands from the Company to the

buyer when the ore is loaded onto the shipping vessel. It is at

that point in the transaction process that revenue can be

recognized. The Company has not been able to complete this

requirement.

All available alternatives are being pursued to complete

shipments to the overseas buyer. In addition, the Company is

negotiating with North American buyers for the sale of precious

metals concentrates that do not require transport through ocean

ports.

The impact of the disruption will delay revenue into the quarter

beginning in April 2015, with the result that Projected Pre-Tax

Profit for 2015 booked on an accrual basis in accordance with

Generally Accepted Accounting Principles (GAAP) is revised to $2.4

– 3.0 million, with positive cash flow occurring in the quarter

ending June 30.

About El Capitan Precious Metals,

Inc.:

El Capitan Precious Metals, Inc. is a mining company based in

Scottsdale, Arizona, that is principally engaged in the mining of

precious metals and other minerals. The Company’s primary asset is

its wholly owned subsidiary El Capitan, Ltd., an Arizona

corporation, which holds the 100% equity interest in the El Capitan

property located near Capitan, New Mexico. www.elcapitanpmi.com

Forward-Looking Safe Harbor Statement:

The statements included in this press release concerning

predictions of economic performance and management’s plans and

objectives constitute forward-looking statements made pursuant to

the safe harbor provisions of Section 21E of the Securities

Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. Forward-looking statements are statements

that are not historical facts. Words such as “expect(s),”

“feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar

expressions are intended to identify forward-looking statements.

These statements include, but are not limited to, statements

regarding the expected completion, timing and results of

metallurgical testing, interpretation of drill results, the

geology, grade and continuity of mineral deposits, results of

initial feasibility, pre-feasibility and feasibility studies and

expectations with respect to the engaging in strategic

transactions. All of such statements are subject to risks and

uncertainties, many of which are difficult to predict and generally

beyond the control of the Company, that could cause actual results

to differ materially from those expressed in, or implied or

projected by, the forward-looking information and statements.

Specifically, there can be no assurance regarding the timing and

terms of any transaction involving the Company or its El Capitan

property, or that such a transaction will be completed at all. In

addition, there can be no assurance that periodic updates to the

Company’s geological technical reports will support the Company’s

prior claims regarding the metallurgical value and make-up of the

ore on the New Mexico property. Additional risks and uncertainties

affecting the Company include, but are not limited to, the

possibility that future exploration, development, testing or mining

results will not be consistent with past results and/or the

Company’s expectations; discrepancies between different types of

testing methods, some or all of which may not be industry standard;

the ability to mine precious and other minerals on a cost effective

basis; the Company’s ability to successfully complete contracts for

the sale of its products; fluctuations in world market prices for

the Company’s products; the Company’s ability to obtain and

maintain regulatory approvals; the Company’s ability to obtain

financing for continued operations and/or the commencement of

mining activities on satisfactory terms; the Company’s ability to

enter into and meet all the conditions to consummate contracts to

sell its mining properties that it chooses to list for sale; and

other risks and uncertainties described in the Company’s filings

from time to time with the Securities and Exchange Commission.

Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date hereof,

and we do not undertake any obligation to revise and disseminate

forward-looking statements to reflect events or circumstances after

the date hereof, or to reflect the occurrence of or non-occurrence

of any events.

El Capitan Precious Metals, Inc.John Stapleton, 480-440-1449

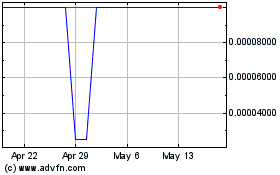

El Capitan Precious Metals (CE) (USOTC:ECPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

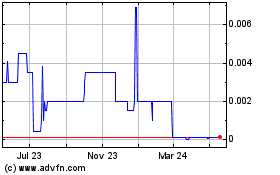

El Capitan Precious Metals (CE) (USOTC:ECPN)

Historical Stock Chart

From Nov 2023 to Nov 2024