By AnnaMaria Andriotis and Ben Eisen

U.S. consumers are facing what could become the biggest credit

crunch since the Great Depression. Lenders and credit-reporting

firms aren't sure what to do about it.

As coronavirus spreads, thousands of wait staff, bartenders and

airline employees are out of work and could be on the brink of

missing payments on mortgages, credit cards and other loans.

Lenders have yet to report a spike in missed payments, but the

impact could be considerable. If borrowers start defaulting, they

could lose homes and cars. In the longer term, those delinquencies

could get factored into their credit reports, hurting their ability

to borrow for many years.

Some lenders already have announced programs meant to help.

Citigroup Inc., for example, is increasing spending limits for

certain cardholders on a case-by-case basis, including those with

rising out-of-pocket medical expenses. JPMorgan Chase & Co. is

delaying due dates for some borrowers on cards, auto loans and

mortgages. Goldman Sachs Group Inc. is allowing borrowers who have

personal loans from its consumer bank, Marcus, to sign up to delay

their payments for a month.

Still, the expected economic slowdown could devastate many U.S.

consumers, who already were overstretched before the coronavirus

pandemic. Americans have been falling deeper into debt over the

past decade as costs have climbed but incomes have largely failed

to keep pace. Consumer debt balances, including credit cards, auto

loans and student loans, are around record levels.

Lenders and credit-reporting firms are still reviewing what they

might do for consumers. Some think relief should be offered to all

borrowers, or all who ask for it. Another option, requiring people

to prove they were directly affected by the coronavirus, could be

impractical given the virus's far-reaching economic effects. That

also would become logistically harder if companies have to move

customer-service representatives from call centers to work from

home.

Lawmakers and others have asked the main U.S. credit-reporting

firms, Equifax Inc., Experian PLC and TransUnion, what they can do

to limit the damage to consumers' credit standing if they miss loan

payments. Representatives from the White House National Economic

Council have been in touch with credit-reporting firms, according

to people familiar with the matter. So have staffers representing

Sen. Mike Crapo (R., Idaho), Rep. Maxine Waters (D., Calif.) and

Sen. Mitt Romney (R., Utah).

Generally, lenders submit information about their borrowers,

including missed payments, to the credit-reporting firms. Those

firms in turn compile and sell that information back to lenders to

help them decide whom to lend to. That information also is used to

help calculate people's credit scores.

Most lenders haven't said if they will avoid reporting missed

payments to the credit-reporting firms as the pandemic spreads. And

the credit-reporting firms as of now plan to continue including

missed payment information they receive on credit reports.

An exception is Discover Financial Services, which said it won't

report missed payments to credit-reporting firms for some borrowers

for at least two months. That will cover loans including credit

cards, personal loans and private student loans, and will mainly

apply to consumers who have previously been on time with

payments.

The Consumer Data Industry Association, which represents

credit-reporting firms, says it is evaluating ways to serve

consumers and the economy. Consumers who have concerns should

contact their lenders, it says.

Government officials also have been in talks with mortgage

companies about how they can help consumers, according to people

familiar with the matter. In response, the industry has been

working on plans tailored to the current crisis that could be

enacted quickly.

Mortgage companies already offer so-called forbearance plans in

certain situations, in which borrowers can temporarily stop making

mortgage payments and make them up later.

Federal regulators can require mortgage companies to consider

this option for consumers who can show they are facing some sort of

hardship, such as a lost job, if the loan is backed by the

government. The Federal Housing Finance Agency, which regulates

Fannie Mae and Freddie Mac, and the Federal Housing Administration

highlighted this option to servicers last week.

Regulators also can require mortgage companies to consider

letting borrowers pause payments when a natural disaster hits. The

policy typically applies within a defined geographic area.

Fannie and Freddie said Wednesday they would expand forbearance

options so that borrowers affected by the coronavirus can request

to pause payments. The two mortgage giants and the FHA will also

suspend foreclosures for 60 days.

Many housing experts say the current set of tools to help

struggling homeowners is ill equipped for the coronavirus. For

example, some homeowners say that accepting pause-payment plans

after a natural disaster left them worse off, The Wall Street

Journal has reported.

Mortgage industry players say they want a plan that would

streamline approval for offering relief to borrowers hurt by the

pandemic, and in a way that doesn't hurt borrowers' credit

scores.

"This shouldn't be involving a credit hit for people," said Ed

DeMarco, president of the Housing Policy Council and the former

head of the FHFA. "Everyone was living their lives and doing their

jobs and this is a health emergency."

The industry is also suggesting a liquidity facility that would

allow servicers to bridge the gap between borrowers who aren't

making payments and mortgage investors who still expect to be paid,

according to Bob Broeksmit, president and chief executive of the

Mortgage Bankers Association.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

March 19, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

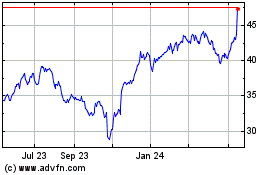

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Oct 2024 to Oct 2024

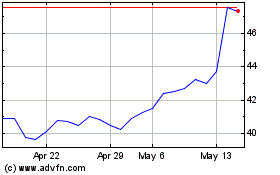

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Oct 2023 to Oct 2024