Fannie Mae, Freddie Mac Third-Quarter Earnings Rise on Mortgage Refinance Boom

October 29 2020 - 11:09AM

Dow Jones News

By Andrew Ackerman

WASHINGTON -- Government-controlled mortgage giants Fannie Mae

and Freddie Mac reported improved earnings in the third quarter, as

record-low interest rates fueled a refinancing boom that buoyed the

companies' results.

The earnings are the latest evidence that the housing market

remains a bright spot in the coronavirus-stricken economy. Sales of

previously owned homes, which make up the bulk of the housing

market, rose 2% in August from a month earlier, according to the

National Association of Realtors.

Fannie Mae, the larger of the two companies, said Thursday its

net income rose to $4.23 billion from $2.55 billion in the previous

three months. Net income in the same quarter of 2019 was $3.96

billion. Fannie's smaller sister company, Freddie Mac, reported net

income of $2.46 billion, up from $1.78 billion in the second

quarter.

The two companies reap fees from the mortgages they guarantee.

As mortgages are refinanced, fees normally booked over the life of

a loan can be booked immediately. The companies said their

third-quarter earnings were boosted by their ability to book those

fees more quickly.

At the same time, the companies reported a steady decline in the

number of borrowers who have suspended payments as the labor market

began to recover, suggesting reduced strain on their businesses.

Some 4.1% of Fannie's single-family loans were in forbearance as of

Sept. 30, down from 5.7% at the end of June.

Jim Vogel, executive vice president at FHN Financial, said in a

note that Fannie's results reflect "one of the better bottom lines

in recent years," and show "acceleration in organic business with

an improving single-family market."

He said Freddie produced "a strong quarter as well, with a

little less zip than seen in Fannie's numbers."

The news wasn't all rosy. For the year as a whole, Fannie said

it expects net income to be lower compared with 2019 because of the

economic fallout from the coronavirus pandemic. And it warned that

the outlook remains cloudy.

"Given the unprecedented nature of the Covid-19 pandemic and the

fast pace at which new developments relating to the pandemic are

occurring, it is difficult to assess or predict the long-term

effects of the pandemic on our financial performance," the company

said.

To recoup coronavirus-related costs, the companies are scheduled

to impose a 0.5% surcharge on most on most refinanced mortgages

that they back beginning Dec. 1.

Fannie and Freddie run the plumbing that makes U.S. mortgages

more readily available and affordable. The 30-year fixed-rate

mortgage, by far the most popular in the U.S., wouldn't be as

widely available without them.

The companies don't make mortgages but buy them from lenders and

package them into securities to sell to investors, and they provide

guarantees to investors in case the mortgages go bad. They

guarantee nearly half of the $11 trillion U.S. mortgage market.

The 30-year fixed rate mortgage averaged 2.81% in the week ended

on Thursday, down from 3.78 percent a year ago, according to

Freddie Mac.

The firms were taken over by the government after they came

close to collapse during the financial crisis of 2008. The Trump

administration wants to return them to private hands, though they

must raise tens of billions of dollars in additional capital before

they will be able to operate fully independently -- a process that

could involve years of accumulated earnings and potential new share

sales.

Write to Andrew Ackerman at andrew.ackerman@wsj.com

(END) Dow Jones Newswires

October 29, 2020 11:54 ET (15:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

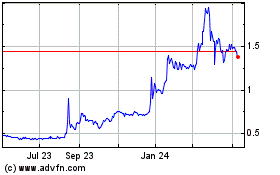

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

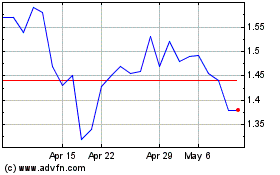

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Jan 2024 to Jan 2025