SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO ' 240.13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO ' 240.13d-2(a)

(Amendment No. )*

Hypertension Diagnostics, Inc.

(Name of Issuer)

Common Stock, $.01 par value

(Title of Class of Securities)

44914V 10 4

(CUSIP Number)

Kenneth W. Brimmer

Hypertension Diagnostics, Inc.

10275 Wayzata Blvd Suite 310

Minnetonka, MN 55305

Phone: (651-687-9999)

With a copy to:

Douglas T. Holod, Esq.

Maslon Edelman Borman & Brand, LLP

3300 Wells Fargo Center

90 South Seventh Street

Minneapolis, MN 55402-4140

Phone: (612) 672-8200

(Name, Address and Telephone Number of Person

Authorized to

Receive Notices and Communications)

February 10, 2012

(Date of Event which Requires Filing of this

Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box

£

.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Section

240.13d-7 for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page.

The information required

on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 44914V 10 4

|

Page 2 of 5

|

1 NAMES OF REPORTING PERSONS

Kenneth W. Brimmer

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (See Instructions)

(a)

£

(b)

£

3 SEC USE ONLY

4 SOURCE OF FUNDS (See Instructions)

Not applicable

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

£

6 CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH

|

7 SOLE VOTING POWER

|

|

|

|

10,240,428

|

|

8 SHARED VOTING POWER

|

|

|

|

0

|

|

9 SOLE DISPOSITIVE POWER

|

|

|

|

10,240,428

|

|

10 SHARED DISPOSITIVE POWER

|

|

|

|

0

|

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

10,240,428 (see explanation

in Item 5)

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions)

S

(See exhibit 99.1)

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN

ROW (11)

16.7%

14 TYPE OF REPORTING PERSON (See Instructions)

IN

ITEM 1. SECURITY AND ISSUER

This statement relates to the common stock,

$.01 par value, of Hypertension Diagnostics, Inc., a Minnesota corporation (the "Company" or the “Issuer”).

The address of the Company’s principal executive offices is 10275 Wayzata Blvd., Suite 310, Minnetonka, MN 55305.

ITEM 2. IDENTITY AND BACKGROUND

(a) This Schedule 13D is

being filed by Kenneth W. Brimmer.

(b) The principal office

of Mr. Brimmer is 10275 Wayzata Blvd., Suite 310, Minnetonka, MN 55305.

(c) Mr. Brimmer is Chief

Executive Officer, Chief Financial Officer and a director of the Issuer.

(d) - (e) During the last

five years, Mr. Brimmer has not been convicted in a criminal proceeding, been a party to a civil proceeding of a judicial or administrative

body of competent jurisdiction as a result of which such individual was or is subject to a judgment, decree, or final order enjoining

future violations of, or prohibiting, or mandating activity subject to, federal or state securities laws or finding any violation

with respect to such laws.

(f) The Reporting Person

is a citizen of the United States.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER

CONSIDERATION

NOT APPLICABLE.

ITEM 4. PURPOSE OF TRANSACTION

The Reporting Person has no present plans or

proposal or specific knowledge that relates to or would result in any of the actions specified in clauses (a) through (j) of Item

4 of Schedule 13D.

ITEM 5. INTEREST IN THE SECURITIES OF THE ISSUER

(a) Mr. Brimmer beneficially

owns 10,240,428 shares of common stock on as “as converted basis”, representing approximately 16.7% of the outstanding

and convertible shares of Common Stock of the Issuer. The calculation of the foregoing percentage is based on a total of 52,388,750

shares of Common Stock outstanding and 611,390 shares of convertible preferred stock (convertible at the rate of 12 for one) of

the Issuer outstanding on February 10, 2012.

(b) Mr. Brimmer has sole

voting and dispositive power with respect to 10,057,644 shares of the Common Stock (including 1,303,745 shares issuable upon exercise

of options and warrants to purchase common stock) and 15,232 shares of Preferred Stock (convertible to common stock at the rate

of 12 for one) (including warrants to purchase 6,272 shares of preferred stock) of the Issuer.

(c) TRANSACTIONS WITHIN

THE LAST 60 DAYS OR SINCE THE LAST FILING.

On February 10, 2012, the

Board of Directors of the Issuer granted to the Reporting Person 9,062,907 shares of restricted stock, 500,000 shares of which

were simultaneously gifted. The restrictions lapse on February 10, 2015.

(d) Not applicable.

(e) Not applicable.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS

WITH RESPECT TO

SECURITIES OF THE ISSUER

None

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Exhibit 99.1 – Excluded

Shares

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: February 21, 2012

|

|

|

|

|

|

|

|

|

|

/s/ Kenneth W. Brimmer

|

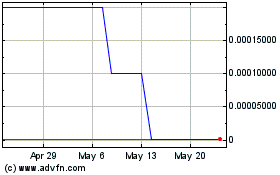

Hypertension Diagnositc (CE) (USOTC:HDII)

Historical Stock Chart

From Jan 2025 to Feb 2025

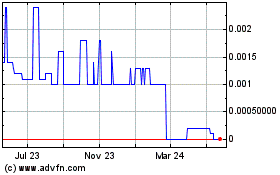

Hypertension Diagnositc (CE) (USOTC:HDII)

Historical Stock Chart

From Feb 2024 to Feb 2025