Alpha Deal Group: Lomiko Metals Inc. Initiation of Coverage Report

October 01 2014 - 6:00AM

InvestorsHub NewsWire

Breaking

News UPTICK Newswire

Ready to benefit from the commercialization of

Graphene

New York, NY - October 01, 2014 - InvestorsHub

NewsWire - Alpha Deal Group considers Lomiko Metals Inc. (TSXV:

LMR) (OTCQX:

LMRMF) as a uniquely positioned junior graphite resource

company and graphene technology incubator company with a current

equity market price inefficiency at a significant discount to its

intrinsic value. Lomiko Metals holds the Quatre Milles Graphite

property and the Vines Lake property. The company holds 11.23%

interest in Graphene 3D Lab (TSXV:

GGG). In the September 17, 2013 press release to the market,

Lomiko Metals announced confirmation of their ability to turn

graphite into graphene which represents tangible value creation and

market sustainability. The company has a Strategic Alliance

Agreement with Graphene 3D Lab (Graphene 3D) to access technology.

This will give access to over 7,000 customers of Graphene 3D, and a

potential to increase production from the company’s Quatre Milles

property. We think the intrinsic value of the company is C$0.200

per share; this is an upside of 166% from the current market price

of C$0.075 per share.

Valuation: Notable disparity between current price and intrinsic

value

Lomiko Metals (TSXV:

LMR) is currently trading at C$0.075 per share, with a market

capitalization of C$9.56 million. The company holds 4.4 million

shares of Graphene 3D (TSXV:

GGG). The closing price of Graphene 3D (TSXV:

GGG) on September 18, 2014 was C$ 1.33 per share. Lomiko Metals

shares are worth C$5.85 million. As of April 30, 2014 the company

had cash and liquid investments of C$ 4.86 million. Based on the

current market capitalization of the company, there is a penalty of

C$ 0.47 million on the company for holding mine

properties.

We have valued the company at C$0.200 per share

based on the potential to exploit the lithium-ion batteries, 3D

printing solutions, and natural graphite market. We consider Lomiko

Metals at current pricing and current timing a high Alpha

opportunity.

Key drivers

The key drivers that could positively influence the share price are

the results of Preliminary Economic Assessment for the resource

estimation for Quatre-Milles, and commercialization of 3D print

solutions. These events will help the street get a clear view on

the business and can see the stock re-rated.

Contacts:

Sreedhar NN

Senior Analyst

+1 (212) 332-3290

Analysts@alphadealgroup.com

Prashanth Vempa, CFA

Senior Analyst

+1 (212) 332-3290

Analysts@alphadealgroup.com

Uptick Newswire

480-207-2760

www.upticknewswire.com

Forward-Looking Statements

Certain statements in this news release may contain forward-looking

information within the meaning of Rule 175 under the Securities Act

of 1933, and are subject to Rule 3B-6 under the Securities Exchange

Act of 1934, and are subject to the safe harbor created by those

rules. All statements, other than statements of fact, included in

this release, including, without limitation, statements regarding

potential future plans and objectives of the company, are

forward-looking statements that involve risks and uncertainties.

There can be no assurance that such statements will prove to be

accurate and other results and further events could differ

materially from those anticipated in such statements. Future events

and actual results could differ materially from those set forth in,

contemplated by, or underlying the forward-looking

statements.

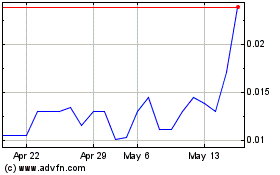

Lomiko Metals (QB) (USOTC:LMRMF)

Historical Stock Chart

From May 2024 to Jun 2024

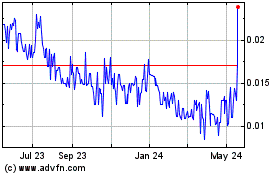

Lomiko Metals (QB) (USOTC:LMRMF)

Historical Stock Chart

From Jun 2023 to Jun 2024

Real-Time news about Lomiko Metals Inc (QB) (OTCMarkets): 0 recent articles

More Lomiko Metals Inc. (QX) News Articles