Current Report Filing (8-k)

September 06 2016 - 7:49AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

September

2, 2016

Date of Report (Date of earliest event reported)

NOVUS

ROBOTICS INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

333-140396

|

|

20-3061959

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

7669

Kimbal Street

Mississauga,

Ontario

Canda

|

|

L5S

1A7

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(905)

672-7669

Registrant’s telephone number, including area

code

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SECTION

1. REGISTRANT’S BUSINESS AND OPERATIONS

Item

8.01. Other Events

On

August 26, 2016, Berardino Paolucci, the President/Chief Executive Officer of Novus Robotics, Inc., a Nevada corporation (the

“Company”) entered into those certain debt purchase agreements dated August 26, 2016 (each, the “Debt Purchase

Agreement”), which Debt Purchase Agreement was consummated on September 2, 2016 with payment of consideration.

It

was previously reported and disclosed that the Company had issued: (i) that certain convertible promissory note dated December

15, 2006 in the principal amount of $60,000.00 (the “Treanor Convertible Note”), to Stephen Treanor (“Treanor”),

which a portion of the principal and accrued interest in the amount of $36,000 was subsequently settled pursuant to the terms

and provisions of that certain settlement agreement dated December 15, 2009 between the Company and Treanor (the “Treanor

Settlement Agreement”); (ii) that certain convertible promissory note dated April 15, 2008 in the principal amount of $40,000.00

(the “Boyle Convertible Note”), to Donna Boyle (“Boyle”), which all the principal and accrued interest

in the amount of $41,600.00 was subsequently settled pursuant to the terms and provisions of that certain settlement agreement

dated December 15, 2009 between the Company and Boyle (the “Boyle Settlement Agreement”); and (iii) that certain convertible

promissory note dated December 15, 2006 in the principal amount of $60,000.00 (the “Russell Convertible Note”), to

Raymond Russell (“Russell”), which a portion of the principal and accrued interest in the amount of $36,000 was subsequently

settled pursuant to the terms and provisions of that certain settlement agreement dated December 15, 2009 between the Company

and Russell (the “Russell Settlement Agreement”).

It

was further previously disclosed that in accordance with the terms and provisions of that certain share exchange agreement dated

January 27, 2012 (the “Share Exchange Agreement”) between the Company and D Mecatronics Inc., a private corporation

(“D Mecatronics”) and the shareholders of D Mecatronics (the “D Mecatronics Shareholders”), the Company

acquired all of the total issued and outstanding shares of D Mecatronics in exchange for the issuance of shares of its common

stock to the D Mecatronic Shareholders and the assignment the Treanor Convertible Note, the Boyle Convertible Note and the Russell

Convertible Note to Mr. Paolucci.

Debt

Purchase Agreements

As

of the date of the Debt Purchase Agreements, the aggregate amount that remained due and owing under the Treanor Convertible Note,

the Boyle Convertible Note and the Russell Convertible Note was $39,864.00 (the “Debt”). Mr. Paolucci was the holder

of all right, title and interest in and to the Debt due and owing by the Company, which Debt is evidenced on the audited and reviewed

financial statements of the Company commencing as filed with the Securities and Exchange Commission.Therefore, two separate unrelated

parties entered into a separate Debt Purchase Agreement with Mr. Paolucci for payment of consideration each in the amount of $12,500.00

(each, the “Purchase Price”) and Mr. Paolucci sold and transferred all of his repsecitve right, title and interest,

including conversion rights of $0.005 per share, in and to the Debt.

As

of the date of this Current Report, the Debt has not been converted.

SECTION

9 – FINANCIAL STATEMENTS AND EXHIBITS

Item

9.01 Financial Statements and Exhibits

(a)

Financial Statements of Business Acquired.

Not

applicable.

(b)

Pro forma Financial Information

.

Not

applicable.

(c)

Shell Company Transaction.

Not

applicable.

(d)

Exhibits.

Not

applicable.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

NOVUS

ROBOTICS INC.

|

|

DATE:

September 6, 2016

|

|

|

|

By:

|

/s/

Berardino Paolucci

|

|

|

Name:

|

Berardino

Paolucci

|

|

|

Title:

|

President/Chief

Executive Officer

|

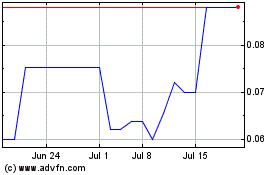

Novus Robotics (PK) (USOTC:NRBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

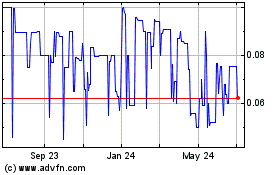

Novus Robotics (PK) (USOTC:NRBT)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Novus Robotics Inc (PK) (OTCMarkets): 0 recent articles

More Novus Robotics Inc. News Articles