Current Report Filing (8-k)

October 26 2016 - 5:26AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 24, 2016

ONCOLOGIX

TECH, INC.

(Name

of Small Business Issuer as Specified in Its Charter)

|

Nevada

|

|

0-15482

|

|

86-1006416

|

|

(State

or other jurisdiction of

|

|

(Commission

|

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

|

File

Number)

|

|

Identification

No.)

|

1604

W. Pinhook Rd. #200

Lafayette,

LA 70508

(Address

of principal executive offices)

(616)

977-9933

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

[ ] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The

Registrant’s Form 10-K, any Form 10-Q or any Form 8-K of the Registrant or any other written or oral statements made by

or on behalf of the Registrant may contain forward-looking statements that are based on management’s beliefs, assumptions,

current expectations, estimates and projections about the medical device business, and the Company itself. Statements, including

without limitation, those related to: future revenue, earnings, margins, growth, cash flows, operating measurements, tax rates

and tax benefits; expected economic returns; projected operating results, future strength of the Company; future brand positioning;

achievement of the Company vision; future marketing investments; the introduction of new lines or categories of products; future

growth or success in specific countries, categories or market sectors; capital resources and market risk are forward-looking statements.

In addition, words such as “anticipates,” “believes,” “estimates,” “expects,”

“forecasts,” “intends,” “is likely,” “plans,” “predicts,” “projects,”

“should,” “will,” variations of such words and similar expressions are intended to identify forward-looking

statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions

(“Risk Factors”) that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence.

Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking

statements.

Readers

are cautioned not to place undue reliance on such forward-looking statements as they speak only of the Registrant’s views

as of the date the statement was made. The Registrant undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

ITEM

1.01 – Entry into a Material Definitive Agreement

ITEM

5.01 – Changes in Control of Registrant

Series

B Convertible Preferred Stock Series.

On August 28, 2016, the Board of Directors of Oncologix Tech, Inc. (the “Company”)

approved the designation of 68,000 shares of a new series of preferred stock. The Series B Convertible Preferred Shares (“Preferred

Share(s)”) with the following rights and privileges: (i) Each Preferred Share shall have a par value of $0.001; (ii) each

Preferred Share shall not be entitled to receive any dividends; (iii) Each Preferred Share shall have the voting power of 0.1%

of the shares of common stock and Preferred Shares taken together; (iv) Each Preferred Share shall be convertible into .001% of

the number of the issued and outstanding shares of Common Stock at that time. The complete designations are included in Exhibit

99.1.

Series

B Convertible Preferred Stock Purchase Agreement.

On August 31, 2016, Oncologix Tech, Inc. (the “Company”), entered

into a Series B Convertible Preferred Stock Purchase Agreement (“Agreement”) with Diversified Innovative Marketing

Enterprises, Ltd. (DIMEVC) for the purchase of up to 53,000 shares of its Series B Convertible Preferred Stock for a total investment

of up to ten million dollars ($10,000,000) to be utilized for debt restructuring, working capital, and acquisition capital. The

ten million dollar investment is to be issued to the Company in three (3) tranches in the amounts of four million dollars, one

million dollars and five million dollars, respectively. The tranches are to be delivered over a period of ninety (90) days. The

initial tranche of four million dollars was to be delivered on September 2, 2016. As of the filing of this report, no funds have

been received by Oncologix pursuant to the executed contracts and DIMEVS is in default. The CEO of DIMEVC stated that the funds

were stolen by an offshore party that has not been disclosed to the Company and that they are seeking to recover the funds. Further,

the CEO of DIMEVS stated that when the funds are recovered the Company will be funded within thirty (30) days. No shares of Preferred

Stock have been, or will be, conferred until successful funding. Upon the successful funding of the ten million dollars, DIME

would have effective control of 53% of the Company’s voting and outstanding shares of stock. The Series B Convertible Preferred

Stock Purchase Agreement is attached in Exhibit 99.2.

Senior

Secured Credit Agreement Amendment Payoff.

During August 2016, the Company, together with the participation of the CEO at

DIMEVC, negotiated in good faith with its senior secured lender, TCA Global Fund (TCA) for a final settlement of its Senior Secured

Credit Agreement. The Company, together with DIMEVC executed all legal documents, with a final Settlement payment to TCA of $2,169,972.54.

This payoff amount was valid and binding through September 2, 2016. At this time, due to the lapse of time and failure of DMIVES

to execute, the Company remains in default under the terms of the TCA Credit Agreement.

Extension

of Series B Convertible Preferred Stock Purchase Agreement.

On September 5, 2016, Oncologix Tech, Inc. (the “Company”)

and DIMEVC verbally agreed to an extension of the Stock Purchase Agreement to October 31, 2016. The Company agreed to a thirty

(30) extension of the Agreement but has agreed to modify terms to include two (2) separate five million dollar tranches. Based

on the Stock Purchase Agreement and DIMEVC representations, the Company believes it will be able to settle with TCA at the previous

mutually agreed upon payoff amounts.

ITEM

9.01 – Financial Statements and Exhibits

99.1

Series B Convertible Preferred Stock Designations

99.2

Series B Convertible Preferred Stock Purchase Agreement

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

Dated:

October 26, 2016

|

|

|

|

|

|

|

|

|

ONCOLOGIX

TECH, INC.

|

|

|

|

|

|

|

By:

|

/s/

Roy Wayne Erwin

|

|

|

|

Roy

Wayne Erwin, Chief Executive Officer

|

|

|

|

|

|

|

By:

|

/s/

Michael A. Kramarz

|

|

|

|

Michael

A. Kramarz, Chief Financial Officer,

|

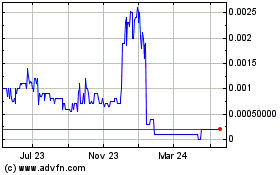

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Dec 2023 to Dec 2024