UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

(Name of Issuer)

|

|

|

COMMON STOCK, $0.50 PAR VALUE

|

(Title of Class of Securities)

(CUSIP Number)

|

|

|

RICHARD T. SPURZEM, 810 CATALPA COURT

CHARLOTTESVILLE, VIRGINIA 22903 (434) 923-8900

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box.

¨

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits.

See

Rule 13d-7 for other parties to whom copies are to be sent.

|

*

|

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

CUSIP NO. 723618104

|

|

SCHEDULE 13D

|

|

PAGE

2

OF 7

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION

NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Richard T.

Spurzem

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A

MEMBER OF A GROUP (See Instructions)

(a)

¨

(b)

¨

Not

Applicable

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See

Instructions)

PF

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

Not Applicable

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

90,620

|

|

|

8

|

|

SHARED VOTING POWER

-0-

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

90,620

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

-0-

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY

OWNED BY EACH REPORTING PERSON

90,620

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

¨

Not Applicable

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY

AMOUNT IN ROW (11)

8.70

%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

IN

|

|

|

|

|

|

|

|

CUSIP NO. 723618104

|

|

SCHEDULE 13D

|

|

PAGE

3

OF 7

|

AMENDMENT NO. 4

TO

SCHEDULE 13D

Item 1.

Security and Issuer

This Amendment No. 4 to Schedule 13D relates to the common stock, $0.50 par value per share (the “Common Stock”), of Pioneer Bankshares,

Inc., a Virginia corporation (the “Issuer”). The address of the principal executive offices of the Issuer is 263 East Main Street, P.O. Box 10, Stanley, Virginia 22851.

Item 2.

Identity and Background

|

(B)

|

The business address of Mr. Spurzem is 810 Catalpa Court, Charlottesville, Virginia 22903.

|

|

(C)

|

Mr. Spurzem is a private investor and owner of Neighborhood Properties, Inc., a real estate development and management company.

|

|

(D)

|

During the last five years, Mr. Spurzem has not been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors.

|

|

(E)

|

During the last five years, Mr. Spurzem has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction that resulted in

his being subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

(F)

|

Mr. Spurzem is a citizen of the United States of America.

|

Item 3.

Source and Amount of Funds or Other Consideration

The

source and amount of funds or other consideration used by Mr. Spurzem in acquiring beneficial ownership of shares of Common Stock are as follows:

|

|

•

|

|

From June 21, 2005 to January 25, 2008, he purchased an aggregate of 102,156 shares of Common Stock, at per share prices ranging from $17.52

to $30.99. The total price that he paid for such shares was $2,241,647.

|

|

|

•

|

|

From October 26, 2005 to November 15, 2007, he sold an aggregate of 1,100 shares of Common Stock, at per share prices ranging from $18.24 to

$27.77. The total price that he received for such shares was $24,197.

|

|

|

•

|

|

From February 25, 2009 to March 4, 2009 he purchased an aggregate of 400 shares of Common Stock, at per share prices ranging from $15 to $17

on behalf of Sandbox, LLC (“Sandbox”). Mr. Spurzem is the manager of Sandbox, and the sole member is the Spurzem Family Trust (the “Trust”) and Mr. Spurzem’s minor children are the beneficiaries of the Trust. The

total price that he paid for such shares was $6,300. Trust funds were used for these purchases.

|

|

|

•

|

|

From April 1, 2008 to May 29, 2009 he purchased an aggregate of 2,700 shares of Common Stock, at per share prices ranging from $13.75 to

$28.17. The total price that he paid for such shares was $47,765.

|

|

|

•

|

|

From May 12, 2008 to May 17, 2012 he sold an aggregate of 8,968 shares of Common Stock, at per share prices ranging from $14.41 to $18.31.

The total price that he received for such shares was $144,628.

|

|

|

•

|

|

On June 4, 2012 he entered into a transaction with the Issuer in which he exchanged 4,568 shares of Common Stock for 7,830 shares of Blue Ridge

Bankshares, Inc.

|

|

|

|

|

|

|

|

CUSIP NO. 723618104

|

|

SCHEDULE 13D

|

|

PAGE

4

OF 7

|

The purchases described in this Item 3 were made with a combination of

personal funds and/or through brokerage margin account loans extended to Mr. Spurzem in the ordinary course of business. From time to time, shares of Common Stock held by Mr. Spurzem have been pledged as security for a general purpose bank loan with

Virginia Community Bank. As of the filing of this amendment, 89,173 shares of Common Stock serve as collateral for this loan.

Item 4.

Purpose of Transaction

Mr. Spurzem has acquired shares of Common Stock for investment purposes, and such

purchases have been made in his ordinary course of business.

In pursuing such investment purposes, Mr. Spurzem may

further purchase, hold, vote, trade, dispose or otherwise deal in the Common Stock at times, and in such manner, as he deems advisable to benefit from changes in market prices of such Common Stock, from changes in the Issuer’s operations,

business strategy or prospects, or from the sale or merger of the Issuer. To evaluate such alternatives, Mr. Spurzem will routinely monitor the Issuer’s operations, prospects, business development, management, competitive and strategic

matters, capital structure, and prevailing market conditions, as well as alternative investment opportunities, liquidity requirements of Mr. Spurzem and other investment considerations. Consistent with his investment research methods and

evaluation criteria, Mr. Spurzem may discuss such matters with management or directors of the Issuer, other shareholders, industry analysts, existing or potential strategic partners or competitors, investment and financing professionals,

sources of credit and other investors. Such factors and discussions may materially affect, and result in, Mr. Spurzem’s modifying his ownership of Common Stock, exchanging information with the Issuer pursuant to appropriate confidentiality

or similar agreements, proposing changes in the Issuer’s operations, governance or capitalization, or in proposing one or more of the other actions described below in this Item.

Mr. Spurzem reserves the right to formulate other plans and/or make other proposals, and take such actions with respect to his

investment in the Issuer, including any or all of the actions described below in this Item, or acquire additional Common Stock or dispose of all the Common Stock beneficially owned by him, in the public market or privately negotiated transactions.

Mr. Spurzem may at any time reconsider and change his plans or proposals relating to the foregoing.

On May 16, 2007

and May 25, 2007, Mr. Spurzem sent letters to the President of the Issuer with respect to his interest in the Issuer. Copies of these letters were previously filed as exhibits to Amendment No. 1 to Schedule 13D and are incorporated

herein by reference.

On June 8, 2007, Mr. Spurzem issued a press release announcing a list of questions and

concerns Mr. Spurzem expressed to Thomas R. Rosazza, President, of the Issuer and Mark N. Reed, Director of the Issuer at a meeting on June 6, 2008. A copy of this press release was previously filed as an exhibit to Amendment No. 3 to

Schedule 13D and is incorporated herein by reference.

On or about July 19, 2007, Mr. Spurzem filed a petition for

mandamus in the Circuit Court of Page County, Virginia (the “Court”), in order to obtain the shareholder list of the Issuer. The Issuer responded by filing a demurrer, which the Court overruled after a hearing. Mr. Spurzem

and the Issuer have entered into a settlement agreement and the claim has been dismissed with prejudice.

On December 11,

2007, Mr. Spurzem sent a letter to the President of the Issuer attaching a shareholder proposal for inclusion in the proxy materials of the Issuer for consideration by the company’s shareholders at the 2008 annual meeting. A copy of this

letter and the accompanying proposal were previously filed as exhibits to Amendment No. 3 to Schedule 13D and are incorporated herein by reference.

On June 4, 2012, Mr. Spurzem entered into a transaction with the Issuer in which he exchanged 4,568 shares of Common Stock for 7,830 shares of Blue Ridge Bankshares, Inc. The parties are

discussing the possibility of further purchases of Common Stock by the Issuer from Mr. Spurzem, including a potential purchase by the Issuer of all Common Stock beneficially owned by Mr. Spurzem.

Except as described above or otherwise in this Amendment No. 4 to Schedule 13D, there are no current plans or proposals that

Mr. Spurzem may have that relate to or would result in:

|

|

(A)

|

The acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer;

|

|

|

(B)

|

An extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

|

|

|

|

|

|

|

|

CUSIP NO. 723618104

|

|

SCHEDULE 13D

|

|

PAGE

5

OF 7

|

|

|

(C)

|

A sale or transfer of a material amount of assets of the Issuer or of any of its subsidiaries;

|

|

|

(D)

|

Any change in the present board of directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any

existing vacancies on the board;

|

|

|

(E)

|

Any material change in the present capitalization or dividend policy of the Issuer;

|

|

|

(F)

|

Any other material change in the Issuer’s business or corporate structure;

|

|

|

(G)

|

Changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions that may impede the acquisition of control of the Issuer by any

person;

|

|

|

(H)

|

Causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation

system of a registered national securities association;

|

|

|

(I)

|

A class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934,

as amended; or

|

|

|

(J)

|

Any action similar to any of those enumerated above.

|

Item 5.

Interest in Securities of the Issuer

|

(A)

|

Mr. Spurzem beneficially owns 90,620 shares or 8.70% of the Issuer’s outstanding Common Stock, including 90,220 shares of Common Stock held by the Reporting

Person and 400 shares of Common Stock held by Sandbox, LLC. The Reporting Person is the manager of Sandbox LLC, and, in such capacity, has voting and dispositive power over the securities held by Sandbox LLC.

|

|

(B)

|

Mr. Spurzem has the sole power to vote or to direct the vote and the sole power to dispose or to direct the disposition of all shares of Common Stock identified

pursuant to paragraph (A) above.

|

|

(C)

|

Mr. Spurzem has made the following dispositions of Common Stock during the past sixty days:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date

|

|

Amount of

Common

Stock

|

|

|

Price Per

Share

|

|

|

Where

Effected

|

|

April 16, 2012

|

|

|

568

|

|

|

$

|

17.99

|

|

|

open market

|

|

April 18, 2012

|

|

|

400

|

|

|

$

|

18.48

|

|

|

open market

|

|

May 10, 2012

|

|

|

500

|

|

|

$

|

18.24

|

|

|

open market

|

|

May 11, 2012

|

|

|

2,000

|

|

|

$

|

18.25

|

|

|

open market

|

|

May 17, 2012

|

|

|

200

|

|

|

$

|

18.31

|

|

|

open market

|

|

June 4, 2012

|

|

|

4,568

|

|

|

|

(1

|

)

|

|

private transaction

|

|

(1)

|

Mr. Spurzem received 7,830 shares of Blue Ridge Bankshares, Inc. as consideration for these shares of Common Stock.

|

|

(D)

|

No person other than Mr. Spurzem is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the

shares of the Issuer’s Common Stock beneficially held by Mr. Spurzem, except for the 400 shares of Common Stock held by Sandbox, LLC. The sole member of Sandbox is the Spurzem Family Trust (the Trust) and the minor children of

Mr. Spurzem are the beneficiaries of the Trust.

|

|

|

|

|

|

|

|

CUSIP NO. 723618104

|

|

SCHEDULE 13D

|

|

PAGE

6

OF 7

|

Item 6.

Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Except as otherwise described

herein, there are no agreements, arrangements, understandings or relationships relating to any securities of the Issuer, including Common Stock, including with respect to the transfer of voting thereof.

|

Item 7.

|

Material to be Filed as Exhibits

|

Exhibit A – Letter dated May 16, 2007 from Richard T. Spurzem to Thomas R. Rosazza, President, Pioneer Bankshares, Inc. (previously included

with the Schedule 13D/A (Amendment No. 1) filed with the Securities and Exchange Commission on May 25, 2007 and incorporated herein by reference).

Exhibit B – Letter dated May 25, 2007 from Richard T. Spurzem to Thomas R. Rosazza, President, Pioneer Bankshares, Inc. (previously included with the Schedule 13D/A (Amendment No. 1) filed

with the Securities and Exchange Commission on May 25, 2007 and incorporated herein by reference).

Exhibit C – Press Release dated

June 8, 2007 (previously included with Schedule 13D/A (Amendment No. 3) filed with the Securities and Exchange Commission on January 30, 2008 and incorporated herein by reference).

Exhibit D – Letter dated December 11, 2007 from Richard T. Spurzem to Thomas R. Rosazza, President, Pioneer Bankshares, Inc. (previously

included with Schedule 13D/A (Amendment No. 3) filed with the Securities and Exchange Commission on January 30 2008 and incorporated herein by reference).

Exhibit E – Shareholder Statement and Proposal, submitted to Pioneer Bankshares, Inc. on December 11, 2007 (previously included with Schedule 13D/A (Amendment No. 3) filed with the

Securities and Exchange Commission on January 30, 2008 and incorporated herein by reference).

|

|

|

|

|

|

|

CUSIP NO. 723618104

|

|

SCHEDULE 13D

|

|

PAGE

7

OF 7

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement on

Schedule 13D is true, complete and correct.

|

|

|

|

|

|

|

Date: June 21, 2012

|

|

|

|

/s/ Richard T. Spurzem

|

|

|

|

|

|

Richard T. Spurzem

|

Attention:

Intentional misstatements or omissions of fact constitute Federal criminal violations (

see

18

U.S.C. 1001).

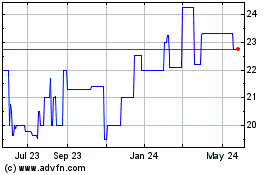

Pioneer Bankshares (PK) (USOTC:PNBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

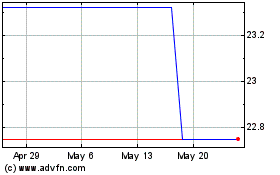

Pioneer Bankshares (PK) (USOTC:PNBI)

Historical Stock Chart

From Nov 2023 to Nov 2024