0001394108

false

true

FY

2022

--12-31

false

true

223016

1739820

58585

0001394108

2022-01-01

2022-12-31

0001394108

2022-12-31

0001394108

2021-12-31

0001394108

2021-01-01

2021-12-31

0001394108

us-gaap:CommonStockMember

2020-12-31

0001394108

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001394108

us-gaap:RetainedEarningsMember

2020-12-31

0001394108

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0001394108

2020-12-31

0001394108

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001394108

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001394108

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001394108

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-01-01

2021-12-31

0001394108

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001394108

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001394108

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001394108

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001394108

us-gaap:CommonStockMember

2021-12-31

0001394108

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001394108

us-gaap:RetainedEarningsMember

2021-12-31

0001394108

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001394108

us-gaap:CommonStockMember

2022-12-31

0001394108

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001394108

us-gaap:RetainedEarningsMember

2022-12-31

0001394108

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001394108

SUIC:ConvertiblePromissoryNote1Member

2017-10-01

0001394108

SUIC:ConvertiblePromissoryNote2Member

2018-12-01

0001394108

SUIC:ConvertiblePromissoryNote3Member

2019-01-29

0001394108

SUIC:ConvertiblePromissoryNote4Member

2019-06-01

0001394108

SUIC:ConvertiblePromissoryNote5Member

2019-07-01

0001394108

SUIC:ConvertiblePromissoryNote6Member

2019-12-01

0001394108

SUIC:ConvertiblePromissoryNote7Member

2020-01-22

0001394108

SUIC:ConvertiblePromissoryNote8Member

2020-06-01

0001394108

SUIC:ConvertiblePromissoryNote9Member

2020-08-25

0001394108

SUIC:ConvertiblePromissoryNote10Member

2020-12-28

0001394108

SUIC:ShortTermDebt1Member

2020-12-31

0001394108

SUIC:ShortTermDebt2Member

2021-03-29

0001394108

SUIC:ShortTermDebt3Member

2021-08-23

0001394108

SUIC:ShortTermDebt4Member

2021-12-16

0001394108

SUIC:ShortTermDebt5Member

2021-12-21

0001394108

2017-01-01

2017-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| |

☑ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal

year

ended December

31, 2022

OR

| |

☐ |

TRANSITION REPORT PURSUANT TO SECTION

13 OR 15 (d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For

transition period ___ to ____

Commission

file number: 000-53737

SUIC

Worldwide Holdings Ltd.

(Name

of registrant in its charter)

| Nevada |

47-2148252 |

| (State or jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

136-20

38th Ave. Unit

3G,

Flushing,

NY 11354

(Address

of principal executive offices)

(929)

391-2550

(Registrant's

telephone number)

SECURITIES

REGISTERED PURSUANT TO SECTION 12(B) OF

THE

EXCHANGE ACT:

None.

SECURITIES

REGISTERED PURSUANT TO SECTION 12(G) OF

THE

EXCHANGE ACT:

None.

Indicate by check mark

if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐

No☑

Check whether the issuer

is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes☐

No☑

Check whether the issuer

(1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or

for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes☑

No☐

Indicate by check mark

whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post such files). Yes☑

No☐

Check if there is no disclosure

of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best

of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ☐

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer ☐ |

Accelerated filer ☐ |

| Non-accelerated

filer ☐ |

Smaller reporting company ☑ |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark

whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐

No☑

As of December 31, 2022,

the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing price

of such shares as reported on the OTC Bulletin Board was approximately $2,689,246.94

(11,443,604 shares, $0.2350 per share).

On December 31, 2022,

there were 33,503,604 shares

of the registrant’s common stock issued and outstanding.

| |

PART

I |

|

|

| Item 1. |

Business |

|

3 |

| Item 1A |

Risk Factors |

|

4 |

| Item 1B. |

Unresolved Staff Comments |

|

6 |

| Item 2. |

Properties |

|

6 |

| Item 3. |

Legal Proceedings |

|

6 |

| Item 4. |

Mine and Safety Disclosures |

|

6 |

| |

|

|

|

| |

PART II |

|

|

| Item 5. |

Market for Registrant’s Common

Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

7 |

| Item 6. |

Selected Financial Data |

|

8 |

| Item 7. |

Management’s Discussion and Analysis

of Financial Condition and Results of Operations |

|

8 |

| Item7A. |

Quantitative and Qualitative Disclosures

About Market Risk |

|

12 |

| Item 8. |

Financial Statements and Supplementary

Financial Data |

|

12 |

| Item 9. |

Changes in and Disagreements With Accountants

on Accounting and Financial Disclosure |

|

12 |

| Item 9A |

Controls and Procedures |

|

12 |

| Item 9B. |

Other Information. |

|

13 |

| |

|

|

|

| |

PART III |

|

|

| Item 10. |

Directors, Executive Officers and Corporate

Governance |

|

14 |

| Item 11. |

Executive Compensation |

|

15 |

| Item 12. |

Security Ownership of Certain Beneficial

Owners and Management and Related Stockholder Matters |

|

16 |

| Item 13. |

Certain Relationships and Related Party

Transactions, and director independence |

|

17 |

| Item 14. |

Principal Accountant Fees and Services |

|

17 |

| |

|

|

|

| |

PART IV |

|

|

| Item 15. |

Exhibits, Financial Statements, Schedules |

|

18 |

| |

SIGNATURES |

|

19 |

Forward-Looking Statements

Statements contained in

this Annual Report include “forward-looking statements” within the meaning of such term in Section 27A of the Securities

Act and Section 21E of the Exchange Act. Forward-looking statements involve known and unknown risks, uncertainties and other factors

which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements

not to occur or be realized. Forward-looking statements made in this Report generally are based on our best estimates of future results,

performances or achievements, predicated upon current conditions and the most recent results of the companies involved and their respective

industries. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,”

“could,” “should,” “project,” “expect,” “believe,” “estimate,”

“anticipate,” “intend,” “continue,” “potential,” “opportunity” or similar

terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions.

Potential risks and uncertainties include, among other things, such factors as:

| |

• |

our heavy reliance on limited number of consumers; |

| |

• |

Strong competition in our industry; |

| |

• |

increases in our raw material costs; and |

| |

• |

an inability to fund our capital requirements. |

Additional disclosures

regarding factors that could cause our results and performance to differ from results or performance anticipated by this annual report

are discussed in Item 1A. “Risk Factors.” Readers are urged to carefully review and consider the various disclosures made

by us in this annual report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors

that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this

annual report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking

statements to reflect changes in our expectations or future events.

PART I

We are a Nevada corporation

incorporated on August 30, 2006, under the name Gateway Certifications, Inc. On November 16, 2009, our corporate name was

changed to American Jianye Greentech Holdings, Ltd. on February 13, 2014, our corporate name was changed to AJ Greentech Holdings, Ltd.

and on July 17, 2017, our corporate name was changed to Sino United Worldwide Consolidated Ltd. On November 9, 2022, our corporate name

was changed to SUIC Worldwide Holdings Ltd.

From November 2009 until

October, 2013, through our China and Taiwan subsidiaries, we were engaged renewable energy business. From October 2013 until September,

2017, through our Taiwan subsidiary, we were engaged in the driving record management system (DMS). Both Subsidiaries was spun off through

stock transfer and debt cancellation for the best interest of shareholder.

From 2018 to present,

the Company focused in products and services that adopt IoT, cloud computing, mobile payments, Big Data, Blockchain and AI, and other

new and exciting business models that will create revolutionary products and services. On August 7, 2021, the Company has acquired 49%

of the registered shares of Midas Touch Technology Co. Ltd., a digital asset management platform and company registered in the U.K. From

2020 to present, the Company through promissory notes and other investments in Beneway Holdings Group (its corporate name was changed

from Sinoway International Corp.), became the major shareholder of Beneway Holdings Group. The company works with Beneway Holdings Group

in several new business ventures with focus on the following fields:

| 1. | Fintech

platform: Through its global digital asset management platform and fintech products, Beneway

Holdings Group connects borrower and lenders, comprising of digital wallets, electronic cards,

P2P lenders, suppliers, manufacturers. Building strategic partnerships by bridging the various

stakeholders and fund partners in providing a holistic financial delivery ecosystem. Three

major financial products are Beneway Flash Pay™, Beneway CQ Pay™ and Beneway

Unified Procurement™ that help merchants to focus on business and marketing development.

The company has signed letters of intent with several entities who are interested to participate

in this business. Please refer to subsequent events. |

| 2. | Food

Supply Chain Integration: Food Industry Supply Chain Integration: Beneway Holdings Group

is working to promote the processes of integration for bringing reputable and distinguished

overseas food product brands to the United States and globally. Food products are supplied

from various origins, including ISO and HACCP-certified central kitchen food processing &

production facilities, and distributed through online and offline smart store equipment systems,

one-stop operation sales services, and facilitated by investments through capital management

and mergers & acquisitions for vertical integration of the supply chain. The company

has signed and shared letters of intents with I.Hart Company Limited, and the established

supply chain integration in Taiwan will support Beneway’s food industry integration

for product distribution through the US as well as globally. Please refer to subsequent events. |

| 3. | Global

Franchise Expansion: With the five established franchise brands under I.Hart Company Limited

and other well-known franchise brands in Asia, Beneway is planning to aggressively achieve

its global franchise goal by fine-tuning the right mix of media-based marketing strategies,

including search engine optimization, paid advertising, leveraging public relations on digital

platforms, and maximizing conversion-based metrics through demographic targeting, geofencing,

pay-per-click advertising, social medial publishing and management, hyper-local franchise

marketing and much more. To maximize the growth and performance of the franchise goals, Beneway

has identified several nationally-renowned franchise marketing and consulting companies to

launch its franchise campaign nationally. |

| 4. | Supply

Chain Integration of other industries: Beneway Holdings Group has identified several other

industries for future expansion: medical and healthcare, high-tech digital AI systems, environmental

protections, and energy related production. This will be accomplished through Beneway Holdings

Group chief marketing plan, known as “The Starry Project”, to build extensive

networks focused on streamlining the distribution of products and increase the sales and

market shares of the products in all 50 states of America. This will all be facilitated through

Beneway’s fintech solutions that allow for fast financing capabilities for business

development, and capital investment dedicated to select mergers and acquisitions in the vertical

integration of our supply chain model. |

Our Business Model and Objectives

The Company will continue

to strengthen our competencies in research and development, venture financing for investing in the private enterprises and the public

sector to develop products and services that adopt IoT, cloud computing, mobile payments, Big Data, Blockchain and AI, and other new

and exciting business models that will create revolutionary products and services. The company has signed four letters of intent with

entities who are interested to work with the company on the share exchange pending up to the merger, stock price and related work. For

more detail please refer to subsequent events.

Competitive

Advantages

The Company focuses on

small and micro-cap companies with traditionally difficult access to capital. We provide specialized consulting services to help companies

operate in the public markets. Our management team is experienced in risk management and exit planning. The Company’s competitive

advantages include a global business network of healthcare, investment and financial professionals who are integrated into the technology

licensing and commercialization departments of universities and institutions. In summary, our services and capital speed up the development

and commercialization of our customers’ products.

Material Agreements

The company has signed several franchise brand

and distribution contracts. Please refer to subsequent events.

Employees

The company currently

has 6 partners and employees in the Taiwan office, 1 director and employee in the Malaysia office and 2 partners and employees in the

U.S. office.

Risks Related to

Our Organization, Structure and Business

You should carefully consider

the risks described below before buying our common stock. If any of the risks described below actually occurs, that event could cause

the trading price of our common stock to decline, and you could lose all or part of your investment.

Downturns in general

economic and market conditions could materially and adversely affect our business.

The IT-communications,

mobile apps and blockchain industries are most susceptible to, and greatly affected by economic downturns and policy uncertainties. We

have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing

industries, including increased expenses as we continue to grow our business. If we do not manage these risks and overcome these difficulties

successfully, our business will suffer.

If we are not able

to compete effectively with other competitors, our prospects for future growth will be jeopardized.

There is significant competition

in both the software industry and the blockchain industry with more established companies. We are not only competing with other software

and blockchain providers but also with companies offering different kind of software and blockchain solutions, which are usually more

established and have greater resources to devote to research and development, manufacturing and marketing than we have. Our competitors

may promote these software and blockchain solutions which are more readily accepted by customers than our products and maybe required

to reduce the prices of our products in order to remain competitive. Our competitors may also seek to use our financial difficulties

in marketing against us.

Our board of directors

may change our investment or operation objectives and strategies without shareholders’ consent.

Our board of directors

determines our major policies, including decisions regarding financing, growth, debt capitalization, distributions

and other material events. Our board of directors may amend or revise these and other policies without a vote of the shareholders. Under

our Articles of Incorporation and Bylaws, our directors generally have a right to vote only on the following matters:

| | • |

the

election or removal of director; |

| | • |

the amendment

of our charter, except that our board of directors may amend our charter without shareholders’ approval to: |

| | • |

change our

name; |

| | • |

change the

name or other designation or the par value of the Common Stock; |

| | • |

increase

or decrease the aggregate number of Common Stock that we have the authority to issue; |

| | • |

increase

or decrease the number of our Common Stock that we have the authority to issue; |

| | • |

effect certain

reverse Common Stock splits; |

| | • |

our liquidation

and dissolution; |

| | • |

our being

a party to a merger, consolidation, sale or other disposition of all or substantially all of our assets or statutory merger or acquisition. |

All

other matters are subject to the discretion of our board of directors.

We

may be unable to attract and retain qualified, experienced, highly skilled personnel, which could adversely affect the implementation

of our business plan.

Our success depends to

a significant degree upon our ability to attract, retain and motivate skilled and qualified personnel. As we become a more mature company

in the future, we may find recruiting and retention efforts more challenging. If we do not succeed in attracting, hiring and integrating

excellent personnel, or retaining and motivating existing personnel, we may be unable to grow effectively. The loss of any key employee

or contractor, including shareholders of our senior management team, and our inability to attract highly skilled personnel with sufficient

experience in our industries could harm our business.

Currency fluctuations

may adversely affect our operating results.

Company generates revenues

and incurs expenses and liabilities in foreign currency. However, it will report its financial results in the United States in U.S. Dollars.

As a result, our financial results will be subject to the effects of exchange rate fluctuations between these currencies. Any events

that result in a devaluation of the foreign currency versus the U.S. Dollar will have an adverse effect on our reported results. We have

not entered into agreements or purchased instruments to hedge our exchange rate risks.

We are not likely

to hold annual shareholder meetings in the near future.

Management does not expect

to hold annual meetings of shareholders in the near future, due to the expense involved. The current members of the Board of Directors

were appointed to that position by the previous directors. If other directors are added to the Board in the future, it is likely that

the current directors will appoint them.

Risks Related

to Our Stockholders and Purchasing Shares of Common Stock

Your percentage

of ownership may become diluted if we issue new Common Stock or other securities.

Our board of directors

is authorized, without your approval, to cause us to issue additional Common Stock to raise capital through the issuance of Common Stock

(including equity or debt securities convertible into Common Stock), and other rights, on terms and for consideration as our board of

directors in its sole discretion may determine. Any such issuance could result in dilution of the equity of our shareholders.

We have not voluntarily

implemented various corporate governance measures.

Federal legislation, including

the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity

of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others

have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The NASDAQ Stock

Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities

exchanges are those that address board of directors’ independence, audit committee oversight and the adoption of a Code of Ethics.

Our board of directors expects to adopt a Code of Ethics at a future board meeting. The Company has not adopted exchange-mandated corporate

governance measures and, since our securities are not listed on a national securities exchange, we are not required to do so. It is possible

that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances

that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible

conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent

directors, decisions concerning matters such as compensation packages to our senior officers and recommendations for director nominees

may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should

bear in mind our current lack of corporate governance measures in formulating their investment decisions.

We may be exposed

to potential risks relating to our internal control over financial reporting.

As directed by Section

404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the SEC has adopted rules requiring public companies to include a report

of management on the Company’s internal control over financial reporting in its annual reports. While we expect to expend significant

resources in developing the necessary documentation and testing procedures required by SOX 404, there is a risk that we will not comply

with all of the requirements imposed thereby. At present, there is no precedent available with which to measure compliance adequately.

In the event we identify significant deficiencies or material weaknesses in our internal control over financial reporting that we cannot

remediate in a timely manner, investors and others may lose confidence in the reliability of our financial statements and our ability

to obtain equity or debt financing could suffer.

We have a large

number of authorized but unissued shares of our common stock.

We have a large number

of authorized but unissued shares of common stock, which our management may issue without further stockholder approval, thereby causing

dilution of your holdings of our common stock. Our management will continue to have broad discretion to issue shares of our common stock

in a range of transactions, including capital-raising transactions, mergers, acquisitions and other transactions, without obtaining stockholder

approval, unless stockholder approval is required. If our management determines to issue shares of our common stock from the large pool

of authorized but unissued shares for any purpose in the future, your ownership position would be diluted without your further ability

to vote on that transaction.

Shares of our common

stock may continue to be subject to illiquidity because our shares may continue to be thinly traded and may never become eligible for

trading on a national securities exchange.

While we may at some point

be able to meet the requirements necessary for our common stock to be listed on a national securities exchange, we cannot assure you

that we will ever achieve a listing of our common stock on a national securities exchange. Our shares will only eligible for quotation

on the OTC Markets, which is not an exchange. Initial listing on a national securities exchange is subject to a variety of requirements,

including minimum trading price and minimum public “float” requirements, and could also be affected by the general skepticism

of such markets concerning companies that are the result of mergers with inactive publicly-held companies. There are also continuing

eligibility requirements for companies listed on public trading markets. If we are unable to satisfy the initial or continuing eligibility

requirements of any such market, then our stock may not be listed or could be delisted. This could result in a lower trading price for

our common stock and may limit your ability to sell your shares, any of which could result in you losing some or all of your investments.

The market valuation

of our business may fluctuate due to factors beyond our control and the value of your investment may fluctuate correspondingly.

The market valuation of

emerging growth companies, such as us, frequently fluctuate due to factors unrelated to the past or present operating performance of

such companies. Our market valuation may fluctuate significantly in response to a number of factors, many of which are beyond our control,

including:

| |

i. |

changes

in securities analysts’ estimates of our financial performance, although there are currently no analysts

covering our stock;

|

| |

ii. |

fluctuations in

stock market prices and volumes, particularly among securities of emerging growth companies;

|

| |

iii. |

changes in market

valuations of similar companies;

|

| |

iv. |

announcements

by us or our competitors of significant contracts, new technologies, acquisitions, commercial relationships, joint ventures or

capital commitments;

|

| |

v. |

variations in

our quarterly operating results;

|

| |

vi. |

fluctuations in

related commodities prices; and

|

| |

vii. |

additions or departures of key personnel. |

As a result, the value

of your investment in us may fluctuate.

We have never paid

dividends on our common stock.

We have never paid cash

dividends on our common stock and do not presently intend to pay any dividends in the foreseeable future. Investors should not look

to dividends as a source of income.

In the interest of reinvesting

initial profits back into our business, we do not intend to pay cash dividends in the foreseeable future. Consequently, any economic

return will initially be derived, if at all, from appreciation in the fair market value of our stock, and not as a result of dividend

payments.

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

Not applicable for smaller

reporting companies.

Our company has a rental

office which is located at 136-20 38th Ave. Unit 3G Flushing, NY 11314, USA. Telephone no. is 929-391-2550.

| ITEM 3. |

LEGAL PROCEEDINGS |

None.

| ITEM 4. |

MINE AND SAFETY DISCLOSURES |

Not Applicable.

PART II

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market for Our Common

Stock

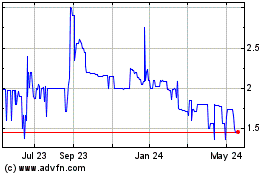

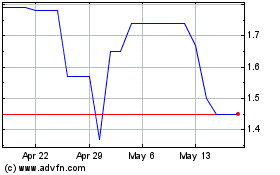

The following table sets

forth, for the periods indicated, the high and low closing prices of our common stock. These prices reflect inter-dealer prices, without

retail mark-up, mark-down or commission, and may not represent actual transactions.

| |

|

|

|

|

Closing

Prices (1) |

| |

|

|

|

|

High |

|

|

|

Low |

|

| |

Year

Ended December 31, 2022 |

|

|

|

|

|

|

|

|

|

| |

1st Quarter |

|

|

$ |

0.4500 |

|

|

$ |

0.4500 |

|

| |

2nd Quarter |

|

|

$ |

0.3500 |

|

|

$ |

0.3100 |

|

| |

3rd Quarter |

|

|

$ |

0.3100 |

|

|

$ |

0.1800 |

|

| |

4th Quarter |

|

|

$ |

0.2360 |

|

|

$ |

0.2000 |

|

| |

Year

Ended December 31, 2021 |

|

|

|

|

|

|

|

|

|

| |

1st Quarter |

|

|

$ |

5.00 |

|

|

$ |

0.50 |

|

| |

2nd Quarter |

|

|

$ |

20.00 |

|

|

$ |

1.97 |

|

| |

3rd Quarter |

|

|

$ |

2.72 |

|

|

$ |

1.01 |

|

| |

4th Quarter |

|

|

$ |

1.35 |

|

|

$ |

0.37 |

|

| (1) |

The above tables set forth the range of high

and low closing prices per share of our common stock as reported by OTC Bulletin Board and the Pink Sheets, as applicable, for the

periods indicated. |

Approximate Number

of Holders of Our Common Stock

On December 31, 2022,

there were approximately 81 stockholders of record of our common stock.

Dividend Policy

The Company has not declared

or paid cash dividends or made distributions in the past, and we do not anticipate that we will pay cash dividends or make distributions

in the foreseeable future. We currently intend to retain and reinvest future earnings, if any, to finance our operations.

Recent Sales of

Unregistered Securities

None.

Repurchase of Equity

Securities.

There is no sale of unregistered

securities during the fiscal year ending December 31, 2022.

Securities Authorized

for Issuance under Equity Compensation Plans

We currently do not have

any equity compensation plans.

| Item 5.03 |

Amendment to Articles of Incorporation

or Bylaws; Change in Fiscal Year |

On

January 24, 2019, we filed a certificate of designation setting forth the rights, preferences and privileges of a new series of preferred

stock designated as the series A convertible preferred stock and series C convertible preferred stock. Each share of series A preferred

stock is convertible into 50 shares of common stock and each share of series C preferred stock is convertible into 20 shares of common

stock.

Please refer to 8-K

filed on January 30, 2019.

On

July 16, 2021, the Company filed a Certificate of Amendment with the Secretary of State of Nevada changing the name of the Company to

SUIC Worldwide Holdings Ltd. The change of name was effective on November 9, 2022 upon FINRA Approval. No other change was made to the

Certificate of Incorporation.

Please refer to 8-K

filed on July 16, 2022.

| ITEM 6. |

SELECTED FINANCIAL DATA |

Not applicable for smaller

reporting companies.

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

This

Annual Report contains forward-looking statements within the meaning of the federal securities laws. These include statements about our

expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as "anticipate," "expect,"

"intend," "plan," "will," "we believe," "management believes" and similar language. The forward-looking

statements are based on the current expectations of the Company and are subject to certain risks, uncertainties and assumptions, including

those set forth in the discussion under "Management's Discussion and Analysis of Financial Condition and Results of Operations"

in this report. Actual results may differ materially from results anticipated in these forward-looking statements. We base the forward-looking

statements on information currently available to us, and we assume no obligation to update them.

Investors

are also advised to refer to the information in our previous filings with the Securities and Exchange Commission (SEC), especially on

Forms 10-K, 10-Q and 8-K, in which we discuss in more detail various important factors that could cause actual results to differ from

expected or historic results. It is not possible to foresee or identify all such factors. As such, investors should not consider any

list of such factors to be an exhaustive statement of all risks and uncertainties or potentially inaccurate assumptions.

Overview

From 2018 to present,

the Company focused in products and services that adopt IoT, cloud computing, mobile payments, Big Data, Blockchain and AI, and other

new and exciting business models that will create revolutionary products and services. On August 7, 2021, the Company has acquired 49%

of the registered shares of Midas Touch Technology Co. Ltd., a digital asset management platform and company is registered in the U.K.

From 2020 to present, the Company through promissory notes and other investments in Beneway Holdings Group (its corporate name was changed

from Sinoway International Corp.), became the major shareholder of Beneway Holdings Group.

Our Business Model

and Objectives

The Company will continue

to strengthen our competencies in research and development, venture financing for investing in the private enterprises and the public

sector to develop products and services that adopt IoT, cloud computing, mobile payments, Big Data, Blockchain and AI, and other new

and exciting business models that will create revolutionary products and services. The company has signed four letters of intent with

entities who are interested to work with the company on the share exchange pending up the merger, stock price and related work. For more

detail please refer to subsequent events.

Competitive

Advantages

The Company focuses on

small and micro-cap companies with traditionally difficult access to capital. We provide specialized consulting services to help companies

operate in the public markets. Our management team is experienced in risk management and exit planning. The Company’s competitive

advantages include a global business network of healthcare, investment and financial professionals who are integrated into the technology

licensing and commercialization departments of universities and institutions. In summary, our services and capital speed up the development

and commercialization of our customers’ products.

Material Agreements

The company has signed

several franchise brand and distribution contracts. Please refer to subsequent events.

Results

of Operations

Years

ended December 31, 2022 and 2021

Revenue

The

Company recognized $221,000 and $379,000 of revenue from continuing operation during the year ended December 31, 2022 and 2021, respectively.

Our revenue from continuing operation were generated from the I.T. management consulting services.

Other

income from Cancellation of Liability

The

Company cancelled the accrued salaries of $30,000 of CEO Yanru Zhou.

Cost

of Revenues

Cost

of revenues from continuing operations were $82,143 and $96,000 for the years ended December 31, 2022 and 2021, respectively. The cost of

revenues were direct fees related to our I.T. management consulting services.

General

and Administrative Expenses

General

and administrative expenses from continuing operations were $64,364 and $266,416 for the years ended December 31, 2022 and 2021, respectively.

The decrease was primarily due to the decrease in professional fees paid for marketing activities.

Bad

Debts expense

Bad

debts expenses was $105,000 and $0 for the year ended December 31, 2022 and 2021 which included the uncollectible accounts of iDrink

Technology Co. Ltd. and of Theresa Hwa.

Interest

expense

Interest

expenses from continuing operation was $21,002 and $18,447 for the year ended December 31, 2022 and 2021 which included the interest

on the convertible promissory notes.

Profits

(Loss) from continuing operations

The

Company generated profits (loss) from continuing operations of ($2,419) and $12,024 for the years ended December 31, 2022 and 2021, respectively.

Net

profits (loss)

As

a result of the foregoing, the Company generated net profit (loss) of operations of $($2,419) and $12,024 for the years ended December

31, 2022 and 2021, respectively.

Liquidity

and Capital Resources

We have funded our operations

to date primarily through operations, and non-related party loans. The Company’s management recognizes that the Company must generate

sales and obtain additional financial resources to continue to develop its operations

As of December 31, 2022,

we had a working capital deficit of $223,015.55. Our current assets on December 31, 2022 were $408,579.46 primarily consisting of accounts

receivables $362,525 and Short Term Investment - Held-For-Trading – iDrink Technology Co. Ltd., Taiwan $30,000, other receivables

$146,078, and cash $16,072. Our current liabilities were $631,613 primarily composed of convertible promissory notes of $287,000, short

term debts $172,734, accrued expenses and other current liabilities of $170,115 and credit card payable of $1,764.

Cash Flow from Operating

Activities

Net cash used in operating

activities was $13,778 during the year ended December 31, 2022, which consisted of our net loss from continuing operation of ($2,419),

primarily enhanced by a change of accounts receivables $23,500 (including write off accounts receivable of $55,000) and loans receivables

$35,574 (which involving non-cash transaction of cancellation of loans receivable of $50,000), a change in accrued expenses of $16,519

(including cancellation of liabilities in amount of $30,000) , and a change of credit card payable of $464.

Net cash used in operating

activities was $168,142 during the year ended December 31, 2021, which consisted of our net profits from continuing operation of $12,024,

offset by a aggregation effect of change of accounts receivables $189,025 and loans receivables $81,900, a change in accrued expenses

of $91,056 and a change of credit card payable of $2,228.

For the Statements

of Cash Flows see F-5.

Cash

Flow from Investing Activities

Cash

Flow from Investing Activities

Net cash used in investing

activities totaled $0 for the year ended December 31, 2022 .

Net cash used in investing

activities totaled $0 for the year ended December 31, 2021.

Cash Flow from Financing

Activities

Net cash used in financing

activities was $0 during the year ended December 31, 2022.

Net cash used in financing

activities was $172,734 during the year ended December 31, 2021, which primarily consisted of proceeds from non-related party loan of

$172,734.

For the Statements

of Cash Flows see F-5.

Off-Balance Sheet Arrangements

There are no off-balance

sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial

condition, revenues, expenses, results of operations, liquidity, capital expenditures or capital resources.

Inflation

We do not

believe our business and operations have been materially affected by inflation

Critical Accounting

Policies and Estimates

This discussion and analysis

of our financial condition and results of operations are based on our financial statements that have been prepared under accounting principle

generally accepted in the United States of America. The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported

amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

A summary of significant

accounting policies is included in Note 3 to the consolidated financial statements included in this Annual Report. Of these policies,

we believe that the following items are the most critical in preparing our financial statements.

Accounts Receivable

and Allowance for Doubtful Accounts

Accounts receivable are

recorded at the invoiced amount, net of an allowance for doubtful accounts. The Company follows paragraph 310-10-50-9 of the FASB Accounting

Standards Codification to estimate the allowance for doubtful accounts. The Company performs on-going credit evaluations of its customers

and adjusts credit limits based upon payment history and the customer’s current credit worthiness, as determined by the review

of their current credit information; and determines the allowance for doubtful accounts based on historical write-off experience, customer

specific facts and economic conditions.

Outstanding account balances

are reviewed individually for collectability. The allowance for doubtful accounts is the Company’s best estimate of the amount

of probable credit losses in the Company’s existing accounts receivable. Bad debt expense is included in general and administrative

expenses, if any. Pursuant to paragraph 310-10-50-2 of the FASB Accounting Standards Codification account balances are charged off against

the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company has

adopted paragraph 310-10-50-6 of the FASB Accounting Standards Codification and determine when receivables are past due or delinquent

based on how recently payments have been received.

Inventories

Inventories consists of

products purchased and are valued at the lower of cost or net realizable value. Cost is determined on the weighted average cost method.

The Company reduces inventories for the diminution of value, resulting from product obsolescence, damage or other issues affecting marketability,

equal to the difference between the cost of the inventory and its estimated net realizable value. Factors utilized in the determination

of estimated net realizable value include (i) current sales data and historical return rates, (ii) estimates of future demand, (iii)

competitive pricing pressures, (iv) new product introductions, (v) product expiration dates, and (vi) component and packaging obsolescence.

The Company evaluates

its current level of inventories considering historical sales and other factors and, based on this evaluation, classify inventory markdowns

in the income statement as a component of cost of goods sold pursuant to Paragraph 420-10-S99 of the FASB Accounting Standards Codification

to adjust inventories to net realizable value. These markdowns are estimates, which could vary significantly from actual requirements

if future economic conditions, customer demand or competition differ from expectations.

Revenue

Recognition

The Company’s

revenue recognition policies are in compliance with ASC 606. Revenue is recognized when the promised goods or services are transferred

to the customer. The amount of revenue recognized should equal the total consideration an entity expects to receive in return for the

goods or services.

Our revenues

are primarily generated by providing professional services and software products, consulting and other professional services to our clients

and are billable to our clients based on the services provided, or achieved outcomes. Revenues are primarily driven by the total value,

scope, and terms of the consulting contracts. We also engage independent contractors to supplement our revenue-generating professionals

on client engagements as needed.

We adopt

a fixed fee billing arrangement and agree to a pre-established fee in exchange for a predetermined set of professional services. We set

the fees based on our estimates of the costs and timing for completing the engagements.

Our quarterly

results are impacted principally by the total value, scope, and terms of our client contracts. Our utilization rate can be affected by

seasonal variations in the demand for our services from our clients.

Our operating

expenses include professional fees, technology costs, software and data hosting expenses, rent and other office related expenses.

Foreign

Currency Translation

The Company follows Section

830-10-45 of the FASB Accounting Standards Codification (“Section 830-10-45”) for foreign currency translation to translate

the financial statements of the foreign subsidiary from the functional currency, generally the local currency, into U.S. Dollars. Section

830-10-45 sets out the guidance relating to how a reporting entity determines the functional currency of a foreign entity (including

of a foreign entity in a highly inflationary economy), re-measures the books of record (if necessary), and characterizes transaction

gains and losses. the assets, liabilities, and operations of a foreign entity shall be measured using the functional currency of that

entity. An entity’s functional currency is the currency of the primary economic environment in which the entity operates; normally,

that is the currency of the environment, or local currency, in which an entity primarily generates and expends cash.

The functional currency

of each foreign subsidiary is determined based on management’s judgment and involves consideration of all relevant economic facts

and circumstances affecting the subsidiary. Generally, the currency in which the subsidiary transacts a majority of its transactions,

including billings, financing, payroll and other expenditures, would be considered the functional currency, but any dependency upon the

parent and the nature of the subsidiary’s operations must also be considered. If a subsidiary’s functional currency is deemed

to be the local currency, then any gain or loss associated with the translation of that subsidiary’s financial statements is included

in accumulated other comprehensive income. However, if the functional currency is deemed to be the U.S. Dollar, then any gain or loss

associated with the re-measurement of these financial statements from the local currency to the functional currency would be included

in the consolidated statements of comprehensive income (loss). If the Company disposes of foreign subsidiaries, then any cumulative translation

gains or losses would be recorded into the consolidated statements of comprehensive income (loss). If the Company determines that there

has been a change in the functional currency of a subsidiary to the U.S. Dollar, any translation gains or losses arising after the date

of change would be included within the statement of comprehensive income (loss).

Based on an assessment

of the factors discussed above, the management of the Company determined the relevant subsidiaries’ local currencies to be their

respective functional currencies.

Foreign currency translation

gains (loss) resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining

accumulated other comprehensive income in the consolidated statement of stockholders’ equity.

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK. |

Not required for smaller

reporting companies.

Most Recent accounting

pronouncements

Refer to note 2 in the

accompanying consolidated financial statements.

Impact of Most Recent

Accounting Pronouncements

There were no recent accounting

pronouncements that have had a material effect on the Company’s financial position or results of operations.

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY

FINANCIAL DATA |

Financial Statements

The full text of our audited

consolidated financial statements as of December 31, 2022 and 2021 begins on page F-1 of this Report.

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

There were no recent changes

in auditor appointment and engagement.

| ITEM 9A. |

CONTROLS AND PROCEDURES. |

Evaluation of disclosure

controls and procedures.

The Company maintains

a set of disclosure controls and procedures designed to ensure that information required to be disclosed by the Company in the reports

filed under the Securities Exchange Act, is recorded, processed, summarized and reported within the time periods specified by the SEC's

rules and forms. Disclosure controls are also designed with the objective of ensuring that this information is accumulated and communicated

to the Company's management, including the Company's chief executive officer and chief financial officer, as appropriate, to allow timely

decisions regarding required disclosure.

During the course of internal

evaluation, following control weaknesses are noted for the fiscal year ended December 31, 2022 that required correction:

| |

• |

no independent director exists in the Board

of Directors, and the directors have little understanding about U.S. GAAP and Sarbanes-Oxley Act 404 requirements in 2022. |

Based upon their evaluation

as of the end of the period covered by this annual report, the Company's chief executive officer and chief financial officer concluded

that, due to the significant deficiencies in internal control over financial reporting described below, the Company's disclosure controls

and procedures are not effective as of December 31, 2022.

Changes in internal

controls.

The term “internal

control over financial reporting” (defined in SEC Rule 13a-15(f)) refers to the process of a company that is designed to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes

in accordance with generally accepted accounting principles. The Company’s management, with the participation of the Chief Executive

Officer and Chief Financial Officer, has evaluated any changes in the Company’s internal control over financial reporting that

occurred during the fourth quarter of the year covered by this annual report, and they have concluded that there was no change to the

Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect,

the Company’s internal control over financial reporting.

Management's Report

on Internal Control over Financial Reporting.

Our management is responsible

for establishing and maintaining adequate internal control over financial reporting for the company in accordance with as defined in

Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable

assurance regarding the (i) effectiveness and efficiency of operations, (ii) reliability of financial reporting and the preparation of

financial statements for external purposes in accordance with generally accepted accounting principles, and (iii) compliance with applicable

laws and regulations. Our internal controls framework is based on the criteria set forth in the Internal Control - Integrated Framework

issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Due to inherent limitations,

internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to

future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance

with the policies and procedures may deteriorate.

A material weakness in

internal controls is a deficiency in internal control, or combination of control deficiencies, that adversely affects the Company’s

ability to initiate, authorize, record, process, or report external financial data reliably in accordance with accounting principles

generally accepted in the United States of America such that there is more than a remote likelihood that a material misstatement of the

Company’s annual or interim financial statements that is more than inconsequential will not be prevented or detected. In the course

of making our assessment of the effectiveness of internal controls over financial reporting, we identified some material weaknesses in

our internal control over financial reporting.

We lack sufficient personnel

with the appropriate level of knowledge, experience and training in the application of accounting operations of our company. This weakness

causes us to not fully identify and resolve accounting and disclosure issues that could lead to a failure to perform timely internal

control and reviews.

Management is currently

reviewing its staffing and systems in order to remedy the weaknesses identified in this assessment. However, because of the above condition,

management’s assessment is that the Company’s internal controls over financial reporting were not effective as of December

31, 2022. Additionally, the Registrant’s management has concluded that the Registrant has a material weakness associated with its

U.S. GAAP expertise.

This Annual Report does

not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial

reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant

to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this

annual report.

| ITEM 9B. |

OTHER INFORMATION. |

None.

PART III

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE

GOVERNANCE. |

The following table sets

forth: (1) names and ages of all persons who presently are and who have been selected as directors and executive officers of the Registrant;

(2) all positions and offices with the Registrant held by each such person; (3) any period during which he or she has served a such.

All directors hold office until the next annual meeting of our shareholders and until their successors have been elected and qualify.

Officers serve at the pleasure of the Board of Directors.

| Name (1) |

|

Age |

|

Title |

| Bill Tan Yee Wei |

|

|

51 |

|

|

Chief Technology Officer, Director |

| Esther Jou |

|

|

27 |

|

|

Chief Executive Officer, Director |

| Yanru Zhou |

|

|

28 |

|

|

Chief Finance Officer |

On Feb 28, 2018, the board

of Director (the “Board”) of the Company appointed Yanru Zhou as Chief Executive Officer of the firm. Ms. Zhou received her

undergraduate education in China.

On December 31, 2019,

the Board of Directors (the “Board”) of the Company appointed Bill Tan Yee Wei as Chief Technology Officer of the firm. Mr.

Wei has more than 18 years of total working experiences in different industries with Lean Manufacturing and Six Sigma Black Belt skills.

He has hands on experiences in Supply Chain Management, Procurement, Quality Assurance, Inventory, Sales, Production, Logistic, Project

Management, Transport Management and Distribution exposure. Mr. Wei has received his Bachelor of Science, Mechanical Engineer degree

at West Virginia University Institute of Technology, WV, USA.

On

November 1, 2021, the Board of the Company appointed Ms. Esther Jou as Director of the firm. Ms. Jou graduated from the University of

Pennsylvania in 2018 and is currently pursuing Master’s degree. She is the manager of the New York office in charge of marketing

roadshow and investor relations.

On

March 30, 2023, the Board of Directors of the Company appointed Ms Esther Jou as Chief Executive Officer of the firm. The Directors have

been presented with the resignation of Ms. Yanru Zhou of her positions as Chief Executive Officer and director.

Nominating, Compensation

and Audit Committees

The Board of Directors

does not have an audit committee, a compensation committee or a nominating committee, due to the small size of the Board. The Board does

also not have an “audit committee financial expert” within the definition given by the Regulations of the Securities and

Exchange Commission.

Section 16(A) Beneficial

Ownership Reporting Compliance

Under U.S. securities

laws, directors, certain executive officers and persons holding more than 10% of our common stock must report their initial ownership

of the common stock, and any changes in that ownership, to the SEC.

Involvement in Certain

Legal Proceedings

To the best of our knowledge,

none of our directors or executive officers has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors,

or has been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final

order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws (except

where not subsequently dismissed without sanction or settlement), or from engaging in any type of business practice, or a finding of

any violation of federal or state securities laws. To the best of our knowledge, no petition under the federal bankruptcy laws or any

state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business

or property of any of our directors or officers, or any partnership in which any of our directors or officers was a general partner at

or within two years before the time of such filing, or any corporation or business association of which any of our directors or officers

was an executive officer at or within two years before the time of such filing. Except as set forth in our discussion below in “Certain

Relationships and Related Transactions, and Director Independence,” none of our directors, director nominees or executive officers

has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required

to be disclosed pursuant to the rules and regulations of the SEC.

Code of Ethics

The Board of Directors

has not adopted a code of ethics applicable to the Company’s executive officers. The Board believes that the small number of individuals

involved in the Company’s management makes such a code unnecessary.

Board Attendance

During 2022, the board

of directors did not hold any meetings. All actions were taken by actions in writing.

| ITEM 11. |

EXECUTIVE COMPENSATION |

The following summary

compensation table indicates the cash and non-cash compensation earned during the years ended December 31, 2022 and December 31, 2021

by each person who served as chief executive officer during the year ended December 31, 2022.

SUMMARY COMPENSATION

TABLE

| |

|

Fiscal |

|

Salary |

|

Bonus |

|

Stock

Awards |

|

All

Other Compensation |

|

Total |

| Name

and Principal Position |

|

Year |

|

($) |

|

($) |

|

($) |

|

($) |

|

($) |

| Yanru Zhou Chief Executive

and Financial Officer (1) |

|

|

2022 |

|

|

|

0 |

|

|

|

0 |

|

|

|

10,000 |

|

|

|

0 |

|

|

|

0 |

|

| (1)

Ms. Yanru Zhou has served as chief executive and financial officer since Feb. 28 2018 to December 31, 2019. She signed a new employment

agreement effective January 1, 2020 whereby she is entitled to a compensation of 10,000 shares of stock of the Company each year. |

| |

| Bill Tan Yee Wei Chief Technology

Officer (2) |

|

|

2022 |

|

|

|

0 |

|

|

|

0 |

|

|

|

5,000 |

|

|

|

0 |

|

|

|

0 |

|

| (2)

Mr. Wei is appointed as Chief Technology Officer on December 31, 2019. He signed an employment agreement effective January 1, 2020

whereby he is entitled to a compensation of 5,000 shares of stock of the Company each year starting from 2021. |

| |

| Esther Jou (3) |

|

|

2022 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

| (3)

Ms. Esther Jou is appointed as Director on November 1, 2021. She waived any compensation for her services. |

Outstanding Equity

Awards at Fiscal Year-End

The following table sets

forth for each named executive officer certain information concerning the outstanding equity awards as of December 31, 2022.

| |

|

Option

awards |

|

|

Stock

awards |

|

Name

and Principal

Position |

|

Number

of

Securities

Underlying

Unexercised

Options

Exercisable |

|

|

Number

of

Securities

Underlying

Unexercised

Options

Unexercisable |

|

|

Option

Exercise

Price

($) |

|

|

Option

Expiration

Date |

|

|

Number

of

Shares

or

Units

of Stock

that

Have Not

Vested |

|

|

Market

Value

of

Shares

or

Units

of

Stock

that

Have

Not

Vested |

|

|

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units

or

Other

Rights

that

Have

Not

Vested |

|

|

Equity

Incentive

Plan

Awards:

Market

or

Payout

Value

of

Unearned

Shares,

Units

or

Other

Rights

that

Have

Not

Vested |

|

Yanru

Zhou

CEO |

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Bill

Tan Yee Wei

CTO |

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Remuneration

of Directors

None of the members

of the Board of Directors receives remuneration for service on the Board.

Executive Employment

Contracts

We have employment agreements

with Yanru Zhou, CEO on Feb. 28, 2018 for 5 years, subject to automatic renewals of another 5 years. She is entitled to a compensation

of 10,000 shares of stock of the Company each year.

Equity Compensation

Plan Information

We do not have any compensation

plan as of December 31, 2022.

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

Security Ownership

of Certain Beneficial Owners and Management

The following table summarizes

certain information regarding the beneficial ownership (as such term is defined in Rule 13d-3 under the Securities Exchange Act of 1934)

of outstanding Registrant Common Stock as of December 31, 2022 by (i) each person known by us to be the beneficial owner of more than

5% of the outstanding Common Stock, (ii) each of our directors, (iii) each of our named executive officers, and (iv) all executive officers

and directors as a group. Except as indicated in the footnotes below, the security and stockholders listed below possess sole voting

and investment power with respect to their shares.

| Name

and Address of Beneficial Owner (1) |

|

Amount

and Nature

of

Beneficial

Ownership

(2) |

|

Percentage

of

Class

(2) |

| Zhou

Yanru |

|

|

5,500,000 |

|

|

|

16.42 |

% |

| Youxin Peng |

|

|

5,500,000 |

|

|

|

16.42 |

% |

| Zhirong Peng |

|

|

5,500,000 |

|

|

|

16.42 |

% |

| North America

Chinese Financial Association |

|

|

2,560,000 |

|

|

|

7.64 |

% |

| Faith and Glory

Charity Foundation |

|

|

3,000,000 |

|

|

|

8.95 |

% |

| All Directors

and Executive Officers as a Group (1 person) |

|

|

22,060,000 |

|

|

|

65.84 |

% |

(1) "Beneficial Owner"

means having or sharing, directly or indirectly (i) voting power, which includes the power to vote or to direct the voting, or (ii) investment

power, which includes the power to dispose or to direct the disposition, of shares of the common stock of an issuer. The definition of

beneficial ownership includes shares, underlying options or warrants to purchase common stock, or other securities convertible into common

stock, that currently are exercisable or convertible or that will become exercisable or convertible within 60 days. Unless otherwise

indicated, the beneficial owner has sole voting and investment power.

(2) For each shareholder,

the calculation of percentage of beneficial ownership is based upon 33,503,604 shares of Common Stock outstanding as of December 31,

2022, and shares of Common Stock subject to options, warrants and/or conversion rights held by the shareholder that are currently exercisable

or exercisable within 60 days, which are deemed to be outstanding and to be beneficially owned by the shareholder holding such options,

warrants, or conversion rights. The percentage ownership of any shareholder is determined by assuming that the shareholder has exercised

all options, warrants and conversion rights to obtain additional securities and that no other shareholder has exercised such rights.

EMPLOYMENT AGREEMENTS

We have employment agreements

with CEO, Yanru Zhou on Feb. 28, 2018 for 5 years, subject to automatic renewals of another 5 years she is entitled to a compensation

of 10,000 shares of stock of the Company each year.

Equity Compensation

Plan Information

As of the date of this

Form 10-K, the Company has not authorized any equity compensation plan, nor has our Board of Directors authorized the reservation or

issuance of any securities under any equity compensation plan.

Changes in Control

There are no arrangements

known to us, including any pledge by any person of our securities, the operation of which may at a subsequent date result in a change

in control of the Company.

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED PARTY

TRANSACTIONS. |

Transactions with

Related Persons

During the year of 2022,

the Company had no advances from related parties.

Director Independence

Currently, we have no

independent directors on our Board of Directors, and therefore have no formal procedures in effect for reviewing and pre-approving any

transactions between us, our directors, officers and other affiliates. We will use our best efforts to insure that all transactions are

on terms at least as favorable to the Company as we would negotiate with unrelated third parties.

| ITEM 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

| |

|

2022 |

|

2021 |

| Audit fees(1) |

|

$ |

6,340 |

|

|

$ |

10,550 |

|

| Audit-related fees |

|

$ |

— |

|

|

$ |

— |

|

| Tax fees(2) |

|

$ |

— |

|

|

$ |

— |

|

| All other fees |

|

$ |

— |

|

|

$ |

— |

|

| Total |

|

$ |

6,340 |

|

|

$ |

10,550 |

|

| |

(1) |

Consists of fees billed for the audit of

our annual financial statements, review of financial statements included in our Quarterly Reports on Form 10-Q and services that

are normally provided by the accountant in connection with statutory and regulatory filings or engagements. |

| |

(2) |

“Tax Fees”

consisted of fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. |

Pre-Approval Policies

and Procedures

Under the Sarbanes-Oxley

Act of 2002, all audit and non-audit services performed by our auditors must be approved in advance by our Board to assure that such

services do not impair the auditors’ independence from us. In accordance with its policies and procedures, our Board pre-approved

the audit service performed by James Pai, CPA., for our financial statements as of and for the year ended December 31, 2022.

PART IV

| ITEM 15. |

EXHIBITS, FINANCIAL

STATEMENTS, SCHEDULES. |

| Exhibit

No. |

|

Description |

| 3.1(1) |

|

Articles of Incorporation |

| 3.2(1) |

|

By-Laws |

| 4.1(1) |

|

Form of Share Certificate |

| 10.1(1) |

|

Private Placement Memorandum |

| 10.2(1) |

|

Subscription Agreement |

| 10.3(1) |

|

Registration Rights Agreement |

| 31.1 |

|

Certification

of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 * |

| 31.2 |

|

Certification

of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 * |

| 32.1 |

|

Certification

of the Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 * |

| 32.2 |

|

Certification

of the Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 * |

| 101 |

|

The following

materials from our Annual Report on Form 10-K for the year ended December 31, 2022, formatted in XBRL (eXtensible Business Reporting

Language): (i) the Consolidated Balance Sheets, (ii) the Consolidated Statements of Operations, (iii) the Consolidated

Statements of Stockholders' Equity (iv) the Consolidated Statements of Cash Flows, and (v) Notes to Consolidated Financial

Statements. * |

(1) Filed as exhibits

to the registrant’s Form SB-2 filed with the Commission on June 29, 2007.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| |

Sino United Worldwide Consolidated Ltd. |

| |

|

| Date: June 30, 2023 |

By: |

/s/ Yanru

Zhou |

| |

|

Yanru

Zhou

Chief Executive Officer |

Pursuant