Armadale Capital Plc AGM Statement

June 26 2017 - 1:00AM

UK Regulatory

TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

26 June 2017

Armadale Capital Plc ('Armadale' or 'the Company')

AGM Statement

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is holding its annual general meeting

('AGM') at 11.00 am today at 55 Gower Street, London, WC1E 6HQ. At

the meeting Nick Johansen, Director of Armadale, will make the

following statement:

"2016 was a pivotal year for Armadale, which saw the Company

reassess its evolving investment portfolio and ultimately saw the

business shift towards a new project and commodity - graphite. The

rationale behind this move was two-fold: firstly, the directors

became aware of the high growth market for graphite and the

demonstrable opportunities for junior explorers and developers as

evidenced by several companies listed on the ASX; secondly that our

ability to raise sufficient finance to bring our second tier

investment, being the gold project in the Democratic Republic of

Congo, was stymied both by the relative size of the project and the

often uncertain political climate in the country.

"With this in mind, our attention turned towards the strategic

commodity of graphite - and we became aware of a project in the

well-known resource destination of Tanzania, which hosts one of the

world's most prolific high grade coarse flake graphite regions.

Flanked by exploration and development projects with high grade

graphite mineralisation, the board was hopeful that the Mahenge

Liandu Project, which Armadale acquired in July 2016, would yield

similar results. Suffice to say, the Board has not been

disappointed.

"Since initiating exploration activities in July 2016, and

drilling in September 2016, consistently encouraging results have

been returned which have confirmed significant high-grade material

at Mahenge Liandu. The result of this initial drilling programme

was the declaration of a maiden JORC compliant inferred mineral

resource estimate of 40.9Mt @ 9.41% Total Graphitic Carbon ('TGC').

Importantly, at least 32Mt of this resource has an average grade of

10.47% TGC making it one of the largest high-grade resources in

Tanzania. Delivering a resource of this size and grade within six

months of acquiring the project highlights both the potential

commercial viability of Mahenge Liandu but also our commitment to

proving up this high-quality project in as short timeframe as

possible.

"In parallel with the continuing drilling underway at Mahenge

Liandu, the team has also been progressing test work of material

from the Project to demonstrate the quality of graphite to

potential offtake partners. We have now confirmed results of up to

99.99% graphitic carbon for flake size between from 300µm to 500µm,

and purity of above 99.95% for size fractions between 106 µm and

500µm, which are typically used for the production of spherical

graphite. These exceptional results underpin the Project's ability

to produce high quality graphite concentrates, which should be

suitable for a number of applications, positioning us strongly for

commercial negotiations with offtake partners moving forward.

"Looking now to our secondary investment, the Mpokoto Gold

Project in DRC ('Mpokoto'). We were delighted to report in December

2016 that our partners, Kisenge Mining Pty Ltd, formerly known as

African Mining Services, had exercised its option to form a joint

venture with us to develop and operate Mpokoto. Despite the

challenges we faced trying to secure the necessary finance from the

traditional channels open to Armadale to develop Mpokoto, as

referred to above, we believe that this project has value left to

contribute to our overall investment portfolio. With an established

resource of 678,000oz of gold ('Au') at 1.45 g/t Au and a completed

DFS based on a production rate of circa 25,000oz annually over an

initial four-year mine life for the first phase of mining, together

with a defined route to production, we are confident that the

project offers significant potential and we are pleased that KMP

agrees and is able to fund onward development as set out in the

announcement of 5 December 2016.

"Over the past six months, KMP has been focussed on completing a

gap analysis of the project data to determine the required steps to

bring Mpokoto into production as soon as possible. In addition, KMP

has reassessed the mine plan and capital cost estimates with a view

to significantly reducing the capex requirements, and this may

include adopting a staged production plan. KMP has also conducted

an Independent review of the Resource estimate of the deposit which

confirmed the existing Resource statement produced by CSA. The work

currently being undertaken by KMP will enable Phase II of the joint

venture to continue ahead of Mpokoto commencing commercial

production.

"Moving away from our operations and on to corporate matters,

shareholders will be aware that as our commodity and country focus

has shifted, so too has our board evolved to reflect Armadale's

emphasis on graphite and Tanzania. We are now actively seeking a

new UK-based executive to bolster Armadale's corporate presence.

Interviews with several experienced individuals have taken place

and the directors hope to be able to update shareholders in the

near future.

"I would like to take this opportunity to thank our shareholders

for their commitment and support over the past year and reiterate

my optimism for the future of Armadale, with Mahenge Liandu at its

core."

**ENDS**

For further information please visit www.armadalecapitalplc.com

or contact:

Enquiries:

Armadale Capital Plc +44 20 7236 1177

Nick Johansen

Nomad and broker: finnCap Ltd +44 20 7220 0500

Christopher Raggett / Simon Hicks

Joint Broker: Beaufort Securities Limited +44 20 7382 8300

Jon Belliss

Press Relations: St Brides Partners Ltd +44 20 7236 1177

Susie Geliher / Charlotte Page

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant inferred mineral resource estimate of 40.9Mt @ 9.41% TGC.

At least 32Mt of this resource has an average grade of 10.47% TGC,

one of the largest high-grade resources in Tanzania, and work to

date has demonstrated Mahenge Liandu's potential as a commercially

viable deposit with significant tonnage, high-grade coarse flake

and near surface mineralisation (implying a low strip ratio)

contained within one contiguous ore body.

Other assets Armadale has an interest in include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

View source version on businesswire.com:

http://www.businesswire.com/news/home/20170625005053/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

June 26, 2017 02:00 ET (06:00 GMT)

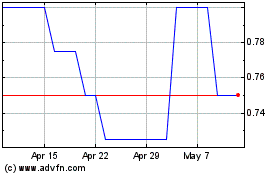

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Apr 2023 to Apr 2024