TIDMAFM

RNS Number : 9804X

Alpha Fin Markets Consulting plc

02 May 2023

2 May 2023

Alpha Financial Markets Consulting plc

('Alpha', the 'Company' or the 'Group')

Acquisition of Shoreline

Alpha (AIM: AFM), a leading global provider of specialist

consultancy services to the asset management, wealth management and

insurance industries, is pleased to announce that it has completed

the acquisition of 100% of the issued share capital of Shoreline

Consulting Pty Ltd and Shoreline Consolidated Pty Ltd (together,

'Shoreline'), a boutique consultancy that provides services to the

asset and wealth management (AWM) industry in Asia Pacific

(APAC).

Acquisition highlights

-- Alpha acquires Shoreline, a specialist APAC AWM consultancy

headquartered in Sydney, Australia

-- Shoreline's client base, capabilities and company culture are highly complementary to Alpha

-- Strong strategic rationale for the acquisition, which

strengthens Alpha's existing AWM expertise in APAC and creates the

leading specialist AWM consulting firm in the region

-- AUD 8.0m (GBP4.2m) initial cash consideration payable in

three instalments on deal completion and the following two

completion anniversaries, plus a performance-driven earn-out

mechanism of up to AUD 5.0m (GBP2.6m) in cash designed to maximise

growth and fully align management incentivisation.

Background on Shoreline

Shoreline, which is headquartered in Sydney, Australia, was

founded in 2009 with the aim of guiding asset and wealth management

firms in APAC through their strategic transformation programmes.

Shoreline is a 19-person strong consultancy with a client network

that spans the region. The firm's core capabilities include:

product and distribution; operations and outsourcing; data and

analytics; and digital and technology consulting expertise. The

longstanding management team will remain with the business post

acquisition.

Acquisition rationale

Following the acquisition of Shoreline, Alpha is the leading

specialist AWM consultancy in APAC incorporating Shoreline's

complementary client base, employee skill sets and capabilities.

This acquisition enables Alpha to build upon a robust platform and

ensures that the firm can take advantage of opportunities in one of

the fastest growing regions in the AWM sector. The addition of

Shoreline is expected to be earnings enhancing in the year ending

31 March 2024.

Transaction terms

The Group has acquired Shoreline, on a cash and debt-free basis,

for AUD 8.0m (GBP4.2m) initial cash consideration plus a

performance-driven earn-out of up to AUD 5.0m (GBP2.6m) also

payable in cash. The initial cash consideration is payable in

instalments, with AUD 4.9m (GBP2.6m) paid on completion, and AUD

1.7m (GBP0.9m) and AUD 1.4m (GBP0.7m) payable on the first and

second anniversaries of completion, respectively. Any earn-out

tranches are payable by July 2025, 2026 and 2027 respectively. The

maximum potential cash consideration payable by the Group pursuant

to the acquisition, assuming full payment of the earnout, would be

AUD 13.0m (GBP6.8m). The consideration will be funded from the

Group's existing cash resources.

In the twelve months to 31 December 2022, Shoreline generated

unaudited consolidated revenue of AUD 7.5m and adjusted EBITDA of

AUD 1.0m. As at 31 December 2022, Shoreline had AUD 1.4m of

adjusted net assets.

Commenting on the acquisition, Luc Baqué, CEO at Alpha, said:

"We are delighted to announce the acquisition of Shoreline and the

expansion of the Alpha business in APAC. The combination of our two

businesses makes us an excellent partner for clients in the region

and provides the perfect platform for further growth in this

exciting market. Acquisitions of this nature, along with organic

growth, are very much part of Alpha's growth strategy."

Commenting on the acquisition, Paul Tan, Head of APAC - Asset

& Wealth Management Consulting at Alpha, said: "The pace and

need for change amongst asset and wealth managers in APAC continues

to grow strongly. Our acquisition of Shoreline expands Alpha's

specialist offering and presence in the region, particularly in

Australia, at the perfect time to navigate the opportunities in

this expanding market. Shoreline brings a highly complementary

client base, a similar culture and a strong management team. We are

excited to be bringing the Shoreline team into the Alpha fold."

Commenting on the acquisition, John DiBiase, managing partner of

Shoreline, said: "The Shoreline team is delighted to be joining

Alpha. This is great news for our people and our clients, as it

gives us all access to a broader range of services, access to

greater expertise and means we are now part of a truly global

network. We have very similar clients, there are strong parallels

with our services proposition and we are very well culturally

aligned. We look forward to becoming part of the wider Alpha

Group."

Enquiries

Alpha Financial Markets Consulting plc +44 (0)20 7796 9300

Luc Baqué (Chief Executive Officer)

John Paton (Chief Financial Officer)

Investec Bank plc - Nominated Adviser, Joint

Corporate Broker +44 (0)20 7597 4000

Patrick Robb

James Rudd

Harry Hargreaves

Berenberg - Joint Corporate Broker +44 (0)20 3207 7800

Toby Flaux

James Thompson

Alix Mecklenburg-Solodkoff

Camarco - Financial PR +44 (0)20 3757 4980

Edward Gascoigne-Pees

Phoebe Pugh

Prism Cosec - Company Secretary +44 (0) 7581 053148

Sally Chandler

About Alpha:

Headquartered in the UK and quoted on the Alternative Investment

Market (AIM) of the London Stock Exchange, Alpha is a leading

global provider of specialist consultancy services to the asset

management, wealth management and insurance industries.

Alpha has worked with all of the world's top 20 and 80% of the

world's top 50 asset managers by AUM, along with a wide range of

other buy-side firms. It has the largest dedicated team in the

industry, with over 900 consultants globally, operating from 16

client-facing offices spanning the UK, North America, Europe and

APAC.

- ENDS -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQNKDBPABKDBPK

(END) Dow Jones Newswires

May 02, 2023 02:00 ET (06:00 GMT)

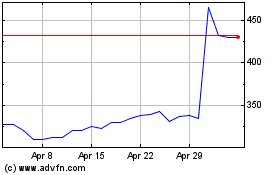

Alpha Financial Markets ... (LSE:AFM)

Historical Stock Chart

From Apr 2024 to May 2024

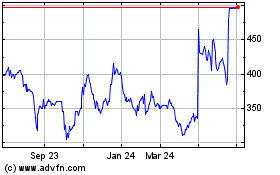

Alpha Financial Markets ... (LSE:AFM)

Historical Stock Chart

From May 2023 to May 2024