TIDMAFN

RNS Number : 9827L

ADVFN PLC

06 January 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR

ANY OTHER JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

ARTICLE 7 OF THE EU REGULATION 596/2014 AS IT FORMS PART OF THE UK

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018.

6 January 2023

ADVFN plc

("ADVFN" or the "Company")

Final Results of Open Offer

The Board of ADVFN is pleased to announce that further to the

announcement published earlier today, after scaling back, the

Company has conditionally raised gross proceeds of approximately

GBP4.52 million through the issue of 13,708,380 new Open Offer

Shares and 4,569,437 Open Offer Warrants at an Issue Price of 33

pence per Open Offer Share in connection with the Open Offer.

Background

On 6 December 2022, ADVFN announced a proposed equity fundraise

of up to approximately GBP6.82 million, before expenses, through an

Open Offer pursuant to which Qualifying Shareholders were able to

subscribe at an Issue Price of 33 pence per Open Offer Share on the

basis of 11 Open Offer Shares for every 14 Existing Ordinary Shares

for an aggregate of up to 20,676,322 Open Offer Shares. Qualifying

Shareholders were also able to apply for Excess Shares through an

Excess Application Facility. On 20 December 2022, the Company

announced that the Board had decided to extend the closing date of

the Open Offer (as permitted by the terms of the Open Offer) to

11.00am on Thursday, 5 January 2023.

Result of Open Offer

As set out in the Open Offer circular, no allocations of Open

Offer Shares will be made to Qualifying Shareholders where such

Open Offer Shares would result in any person or persons acquiring

or increasing control of the Company within the meaning given in

sections 181 and 182 of FSMA, without the relevant regulatory

approval of such acquisition or increase of control having first

been obtained and not having expired prior to such allocation.

Unless the Company is satisfied that such valid approval has been

obtained, the Company will reduce the allocations for Open Offer

Shares to relevant Qualifying Shareholders such that there is no

such acquisition or increase in control of the Company within the

meaning given in sections 181 and 182 of FSMA.

Amit Tauman, a director of the Company, applied for his Basic

Entitlement in full and applied for Excess Shares under the Excess

Application Facility for in aggregate 3,257,151 Offer Shares,

amounting to GBP1,074,860 in aggregate. In addition, his father

Yair Tauman applied for his Basic Entitlement in full and for

Excess Shares for in aggregate 1,800,000 Offer Shares. As described

in the announcement of 6 December 2022, Amit Tauman, together with

his father Yair Tauman, has applied to the FCA for further approval

to hold up to 29.9 per cent. of the Company's issued share capital

(the "FCA Approval") and pending such approval, 2,199,575 Open

Offer Shares have been issued to Amit Tauman and 742,424 Open Offer

Shares have been issued to Yair Tauman. The balance of 1,057,576

Open Offer Shares subscribed by Amit Tauman and 1,057,576 Open

Offer Shares subscribed by Yair Tauman will be subsequently issued

upon the receipt of the FCA Approval. On completion of the Open

Offer, Amit Tauman will be interested in aggregate 4,380,395

Ordinary Shares representing 10.95 per cent. of the Enlarged Issued

Share Capital and his father Yair Tauman will be interested in

aggregate 3,619,104 Ordinary Shares representing 9.04 per cent. of

the Enlarged Issued Share Capital.

In addition, the Company received an application from a

registered nominee under the Open Offer for 3,194,725 Offer Shares

which, if issued in full, would result in an underlying shareholder

holding in excess of 9.9 per cent. of the Company's Enlarged Issued

Share Capital without approval within the meaning given in sections

181 and 182 of FSMA. Accordingly, the Company has reduced the

allocation for Open Offer Shares to the registered nominee to

1,685,634 Open Offer Shares.

Accordingly, following the scaling back of applications to

comply with the provisions of FSMA as described above, a total of

13,708,380 new Ordinary Shares and 4,569,437 Open Offer Warrants

have been issued in connection with the Open Offer, raising a total

of GBP4.52 million. Save as explained above, all Qualifying

Shareholders who have validly applied for Open Offer Shares will

receive their Basic Entitlement and any application made under

Excess Application Facility in full. In addition, as previously

announced, one (1) Open Offer Warrant will be issued for every

three (3) Open Offer Shares successfully subscribed for.

The Open Offer is conditional upon Admission occurring.

Application has been made to the London Stock Exchange for

13,708,380 new Ordinary Shares to be admitted to trading on AIM and

it is expected that Admission will become effective and dealings

will commence in the New Ordinary Shares at 8.00 a.m. on 9 January

2023. The Open Offer Shares shall rank pari passu in all respects

with all other Ordinary Shares then in issue.

Following Admission, the Company will have 40,023,699 Ordinary

Shares in issue and admitted to trading on AIM

This announcement should be read in conjunction with the full

text of the circular issued on 6 December 2022 ("Circular"). All

capitalised/defined terms used in this announcement and not

otherwise defined shall have the meanings given to them in the

Circular.

A copy of this announcement is available on the Company's

website, www.advfnplc.com.

For further information please contact:

ADVFN plc

Amit Tauman (CEO) +44 (0) 203 8794 460

Beaumont Cornish Limited

(Nominated Adviser)

Michael Cornish

Roland Cornish +44 (0) 207 628 3396

Peterhouse Capital Limited

(Broker)

Eran Zucker +44 (0) 207 469 0930

IMPORTANT NOTICES

Beaumont Cornish Limited ("Beaumont Cornish"), which is

authorised and regulated in the United Kingdom by the FCA and is a

member of the London Stock Exchange, is the Company's nominated

adviser for the purposes of the AIM Rules. Beaumont Cornish is

acting exclusively for the Company and will not regard any other

person (whether or not a recipient of this announcement) as a

client and will not be responsible to anyone other than the Company

for providing the protections afforded to its clients nor for

providing advice in relation to the contents of this document or

any other matter referred to herein. Beaumont Cornish's

responsibilities as the Company's nominated adviser under the AIM

Rules for Nominated Advisers are owed to the London Stock Exchange

and not to any other person and in particular, but without

limitation, in respect of their decision to acquire Open Offer

Shares or Open Offer Warrants in reliance on any part of this

announcement. Beaumont Cornish has not authorised the contents of

this announcement for any purpose and no liability whatsoever is

accepted by Beaumont Cornish nor does it make any representation or

warranty, express or implied, as to the accuracy of any information

or opinion contained in this announcement or for the omission of

any information. Beaumont Cornish expressly disclaims all and any

responsibility or liability whether arising in tort, contract or

otherwise which it might otherwise have in respect of this

announcement.

Peterhouse House Capital Limited ("Peterhouse"), which is

authorised and regulated in the United Kingdom by the FCA and is a

member of the London Stock Exchange, is the Company's broker for

the purposes of the AIM Rules. Peterhouse is acting exclusively for

the Company and will not regard any other person (whether or not a

recipient of this announcement) as a client and will not be

responsible to anyone other than the Company for providing the

protections afforded to its clients nor for providing advice in

relation to the contents of this announcement or any other matter

referred to herein. Peterhouse has not authorised the contents of

this announcement for any purpose and no liability whatsoever is

accepted by Peterhouse nor does it make any representation or

warranty, express or implied, as to the accuracy of any information

or opinion contained in this announcement or for the omission of

any information. Peterhouse expressly disclaims all and any

responsibility or liability whether arising in tort, contract or

otherwise which it might otherwise have in respect of this

announcement.

No representation, responsibility or warranty, expressed or

implied, is made by ADVFN plc, Beaumont Cornish, Peterhouse or any

of their respective directors, officers, employees or agents as to

any of the contents of this announcement in connection with the

Open Offer or any other matter referred to in this

announcement.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIKZGGMFVLGFZM

(END) Dow Jones Newswires

January 06, 2023 09:04 ET (14:04 GMT)

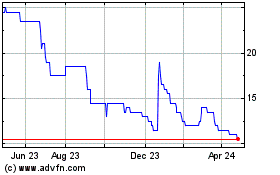

Advfn (LSE:AFN)

Historical Stock Chart

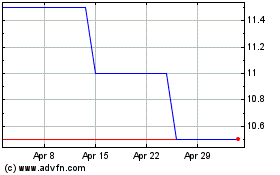

From Jan 2025 to Feb 2025

Advfn (LSE:AFN)

Historical Stock Chart

From Feb 2024 to Feb 2025