TIDMALGW

RNS Number : 0885O

Alpha Growth PLC

29 September 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Alpha Growth plc

Unaudited interim report for period ended

30 June 2023

Chairman's Statement

PERIODED 30 JUNE 2023

I am pleased to announce our unaudited interim financial results

for the period to 30 June 2023.

The key highlights during the period were as follows:

-- 53% increase in revenues compared to equivalent period;

-- Net assets more than doubled compared to net assets as at June 2022;

-- Continuing progress on integrating the insurance businesses

with opportunities identified to enhance profitability;

-- Bought out the minority interests in Northstar Group

(Bermuda) Limited whilst further aligning the interests of Dan Gray

with the Group through a share-to-share exchange; and

-- Released share-based payment reserves following the expiry of

over 25 million options attributable to former directors and

employees.

The relatively small drop in losses reflects the transition and

integration costs associated with Alpha International Life

Assurance Company that are now largely resolved.

We expect our cash flow to improve, and we continue to believe

that we will not require a placing of shares, unless it is for

strategic acquisition and growth purposes.

We continue to advance our buy and build strategy to ensure

continued and substantive ongoing growth of the business. We

continue to be presented with and review potential acquisitions

that are both complementary and supplementary to its existing

businesses which will further enhance free cash flow and move us

close to executing the 2B plan. To this end, the appointment of

Jason Sutherland as a full-time executive has greatly enhanced our

ability to identify and undertake due diligence on potential

targets.

Our strategy continues to insulate us from a lot of the

volatility in capital markets although we appreciate that our share

price performance continues to disappoint. The Directors firmly

believe that the value creation strategy will feed through to the

share price as the Company looks to continue to deliver on their

stated goals.

I would like to take this opportunity to thank the shareholders

for their continued support as we build Alpha Growth into a

significant organisation within its sector.

Gobind Sahney

Chairman

29 September 2023

For more information, please visit www.algwplc.com or contact

the following:

+44 (0) 20 3959

Alpha Growth plc 8600

Gobind Sahney, Executive Chairman info@algwplc.com

+44 (0) 20 3328

Allenby Capital Limited 5656

Amrit Nahal (Sales and Corporate Broking)

Nick Athanas / Piers Shimwell (Corporate

Finance)

UK Investor Relations - Mark Treharne ir@algwplc.com

RESULTS FOR THE PERIOD

INTERIM PERIODED 30 June 2023

The results of the Group have been addressed above in the

Chairman's statement.

Responsibility Statement

We confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting';

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year; and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

CAUTIONARY STATEMENT

This Interim Management Report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

Going Concern

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operation or existence for the

foreseeable future thus we continue to adopt the going concern

basis in preparing these interim financial statements. As detailed

in the Chairman's statement the on-going expected timing of

transactions that the Company plans to be involved in and generate

fees from, continue as planned and therefore should benefit the

Group in the longer term.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties affecting the business

activities of the Group remain those detailed in the Prospectus

dated 15 December 2021, a copy of which is available on the Company

website at www.algwplc.com. The Board considers that these remain a

current reflection of the risks and uncertainties facing the

business for the remaining four months of the financial year.

Gobind Sahney

Director

29 September 2023

Alpha Growth plc

CONSOLIDATED Statement of comprehensive income

INTERIM periodED 30 june 2023

(Unaudited) (Unaudited) (Audited)

Six months Six months 12 months

Ended Ended Ended

30.6.2023 30.6.2022 31.12.2022

Notes GBP GBP GBP

Continuing operations

Revenue from Owned Insurance

Companies 2,222,909 1,463,768 3,424,875

Revenue from Contracts with

Clients 275,801 169,677 346,787

Total revenue 2,498,710 1,633,445 3,771,662

Net movement on DAC/AVIF (29,620) 33,447 (16,729)

Interest expense and investment

costs (4,673) (7,189) (27,838)

Bargain purchase - - 4,106,000

Expenses in managing owned

insurance companies (1,240,409) (1,285,367) (2,336,898)

Operating expenses (1,547,596) (828,971) (2,403,021)

Profit/(loss) before taxation (323,588) (454,635) 3,093,176

Taxation 31,156 - 85,402

Profit/(loss) for the period (292,432) (454,635) 3,178,578

Other comprehensive income

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on foreign

operations (76,650) - 192,270

Total comprehensive income (369,082) (454,635) 3,370,848

Attributable to:

Owners of the Company (358,502) (454,635) 3,178,359

Non-controlling Interests (10,580) - 192,489

(369,082) (454,635) 3,370,848

---------------------------------- ------ ------------ ------------ ------------

Earnings / (loss) per share

from continuing

operations attributable to

the equity owners

Basic earnings / (loss) per

share (pence) 3 (0.1p) (0.1p) 0.7p

Fully diluted earnings / (loss)

per share (pence) 3 (0.1p) (0.1p) 0.4p

Alpha Growth plc

CONSOLIDATED Statement of Financial Position

AS AT 30 june 2023

(Unaudited) (Unaudited) (Audited)

As at As at As at

30.6.2023 30.6.2022 31.12.2022

Note GBP GBP GBP

Assets

Intangible fixed asset 960,285 845,694 939,955

Right of use assets 173,096 258,574 183,672

Annuity contracts 7,091,321 - 7,063,374

Total assets in insurance

business 435,310,844 214,843,900 454,303,995

Trade and other receivables 722,173 347,705 453,266

Cash and cash equivalents 113,281 44,479 218,530

Total assets 444,371,000 216,340,352 463,162,792

Equity and liabilities

Equity attributable to

shareholders

Share capital 4 467,775 431,887 431,887

Share premium 4 6,248,962 5,388,152 5,388,152

Option reserve 669,948 480,674 815,474

Share based payment reserve - 113,390 113,390

Foreign exchange reserve 124,857 201,473 182,748

Retained deficit (787,166) (3,902,468) (505,314)

Total equity attributable

to shareholders 6,724,376 2,713,108 6,426,337

Non-controlling interests - 84,517 282,098

Total equity 6,724,376 2,797,625 6,708,435

-------------------------------- ----- ------------ ------------ ------------

Liabilities

Lease liabilities 202,513 271,239 238,483

Total liabilities in insurance

business 429,900,054 213,091,992 447,956,125

Structured settlements 7,091,242 7,063,374

Trade and other payables 451,269 179,496 1,196,375

Income tax payable 1,546 - -

Total liabilities 437,646,624 213,542,727 456,454,357

-------------------------------- ----- ------------ ------------ ------------

Total equity and liabilities 444,371,000 216,340,352 463,162,792

Company number: 09734404

Alpha Growth plc

CONSOLIDATED Statement of Changes in Equity

INTERIM periodED 30 june 2023

Share Share Option Share-based Foreign Retained Total Non- Total

Capital Premium Reserve Payment Exchange Deficit Attributable Controlling

to

Reserve Reserve Shareholders Interests

GBP GBP GBP GBP GBP GBP GBP GBP GBP

AS AT 31

DECEMBER 2021 431,887 5,404,313 480,674 113,390 - (3,500,925) 2,929,339 89,609 3,018,948

Loss for the

period (449,543) (449,543) (5,092) (454,635)

Foreign exchange

gain

on conversion

of subsidiary - - - - 201,473 - 201,473 - 201,473

Total

comprehensive

income for the

period - - - - 201,473 (449,543) (248,070) (5,092) (253,162)

Share issue

costs - (16,161) - - - - (16,161) - (16,161)

AS AT 30 JUNE

2022 431,887 5,388,152 480,674 113,390 201,473 (3,950,468) 2,665,108 84,517 2,749,625

- -

Profit for the

period - - - - - 3,445,154 3,445,154 188,059 3,633,213

Foreign exchange

loss

on conversion

of subsidiary - - - - (18,725) - (18,725) 9,522 (9,203)

Total

comprehensive

income for the

period - - - - (18,725) 3,445,154 3,426,429 197,581 3,624,010

Employee share

options

issued - - 334,800 - - - 334,800 - 334,800

AS AT 31

DECEMBER 2022 431,887 5,388,152 815,474 113,390 182,748 (505,314) 6,426,337 282,098 6,708,435

Loss for the

period - - - - - (281,852) (281,852) (10,580) (292,432)

Foreign exchange

loss

on conversion

of subsidiary - - - - (57,891) - (57,891) (18,759) (76,650)

Total

comprehensive

income for the

period - - - - (57,891) (281,852) (339,743) (29,339) (369,082)

Shares issued 35,888 860,810 - - - - 896,698 - 896,698

Employee share

options

expired - - (145,526) - - - (145,526) - (145,526)

Exercise of

warrrants - - - (113,390) - - (113,390) - (113,390)

Acquisition of

non-controlling

interests - - - - - - - (252,759) (252,759)

AS AT 30 JUNE

2023 467,775 6,248,962 669,948 - 124,857 (787,166) 6,724,376 - 6,724,376

----------------- -------- ---------- ---------- ------------ --------- ------------ ------------- ------------ ----------

Alpha Growth plc

CONSOLIDATED Statement of Cash Flows

INTERIM PERIODED 30 june 2023

(Unaudited) (Unaudited) (Audited)

6 months 6 months 12 months

Ended Ended Ended

30.6.2023 30.6.2022 31.12.2022

GBP GBP GBP

OPERATING ACTIVITIES

Loss for the period before interest

and taxation (318,915) (447,446) 3,121,014

Adjusted for:

Services settled by way of payment

in shares/options (258,916) - 334,800

Amortisation of intangible assets

and right of use assets 39,150 22,670 116,699

Goodwill on the acquisition (48,004) - -

of non-controlling interests

Income tax paid (2,208) - -

Operating cash outflows before

movements in working capital: (588,894) (424,776) 3,572,513

(Increase)/decrease in trade

and other receivables (268,907) (74,141) (179,702)

Increase in non-tax net assets

in insurance company 905,495 251,316 (4,460,717)

Increase/(decrease) in trade

and other payables (435,760) 117,777 726,657

Net cash used in operating activities (388,066) (129,824) (341,249)

INVESTING ACTIVITIES

Acquisition of intangible asset - - (113,387)

Acquisition of subsidiary (net

of cash acquired) - - 193,493

Acquisition of non-controlling (282,098) - -

interest

Net cash inflow/(outflow) from

investing activities (282,098) - 80,106

--------------------------------------- ------------ ------------ ------------

FINANCING ACTIVITIES

Repayment of leasing liabilities (31,783) 2,130 (30,626)

Interest on leasing liabilities

and loans - (7,189) (19,063)

Loan finance (300,000) - 350,000

Net proceeds from issuance of

shares net of issue costs 896,698 (16,161) (16,161)

Net cash (outflow)/inflow from

financing activities 564,915 (21,220) 284,150

--------------------------------------- ------------ ------------ ------------

Net (decrease)/increase in cash

and cash equivalents (105,249) (151,044) 23,007

Cash and cash equivalents at

beginning of period 218,530 195,523 195,523

Cash and cash equivalents at

end of period 113,281 44,479 218,530

--------------------------------------- ------------ ------------ ------------

Alpha Growth plc

Notes to the Financial Statements

interim results to 30 june 2023

1. Organisation and Trading Activities

The company is incorporated and domiciled in England and Wales

as a public limited company and operates from its registered office

35 Berkeley Square, Mayfair London, United Kingdom W1J 5BF

The principal activity of the Group is the provision of advice

and consultancy services to institutional investors and existing

and prospective holders of Senior Life Settlements through the

management of its funds and the ownership of life insurance

companies.

2. Summary of Significant Accounting Policies

The principal accounting policies adopted and applied in the

preparation of these interim Group Financial statements are set out

below.

These have been consistently applied to all the periods

presented unless otherwise stated:

Basis of accounting

These interim financial statements of Alpha Growth plc (the

"Group") have been prepared in accordance with UK adopted

international accounting standards ("UK-adopted IAS") applied in

accordance with the provisions of the Companies Act 2006.

The interim financial statements have been prepared under the

historical cost convention on the basis of the accounting policies

as set out in the Group's audited annual financial statements and

are presented in GBP GBP the presentational and functional currency

of the Group. The Group has applied IAS 34 in the preparation of

these interim financial statements.

This announcement was approved and authorised by the Board of

directors on 28 September 2023. Copies of this interim report will

be made available on the Company's website at www.algwplc.com .

These condensed interim financial statements for the six months

ended 30 June 2023 are unaudited and do not constitute fully

prepared statutory accounts. The comparative figures for the 12

month period ended 31 December 2022 are extracted from the 2022

audited financial statements. The independent auditor's report on

the 2022 financial statements was not qualified.

Going concern

Any consideration of the foreseeable future involves making a

judgement, at a particular point in time, about future events which

are inherently uncertain.

The Directors have a reasonable expectation that the Group has

sufficient cash and liquid reserves in order to meet any future

obligations and thus to continue operating for the foreseeable

future. For this reason, they continue to adopt the going concern

basis in preparing the Financial Statements.

3. EARNINGS per Share

The basic earnings per share is based on the loss for the period

divided by the weighted average number of shares in issue during

the year. The weighted average number of ordinary shares for the

Company the period ended 30 June 2023 assumes that all shares have

been included in the computation based on the weighted average

number of days since issue. Since the Group has made a loss in the

current and each of the prior periods, the warrants in issue are

not dilutive.

30.6.2023 30.6.2022 31.12.2022

GBP GBP GBP

Profit/(loss) for the period

from continuing operations: (292,432) (454,635) 3,178,578

------------------------------------- ------------ ------------ ------------

Weighted average number of ordinary

shares in issue for basic earnings 447,084,823 431,887,388 431,887,388

Fully diluted average number

of shares in issue 447,084,823 431,887,388 777,100,388

Basic earnings / (loss) per

share (0.1p) (0.1p) 0.7p

Fully diluted earnings / (loss)

per share (0.1p) (0.1p) 0.4p

4. Share capital AND SHARE PREMIUM

Ordinary Share capital Share premium

shares of

GBP0.001

each

Number GBP GBP

At 1 January 2022 431,887,388 431,887 5,404,313

------------------------------ ------------ --------------- --------------

Costs related to listing of

shares issued 15 March 2021 - - (16,161)

At 31 December 2022 431,887,388 431,887 5,388,152

------------------------------ ------------ --------------- --------------

Warrant exercise 18,750,000 18,750 469,640

Share issue 17,137,680 17,138 421,780

Costs of issue - - (30,610)

At 30 June 2023 467,775,068 467,775 6,248,962

------------------------------ ------------ --------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKFBDNBKBACB

(END) Dow Jones Newswires

September 29, 2023 06:00 ET (10:00 GMT)

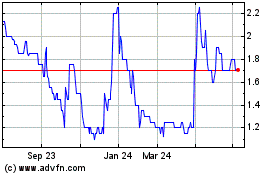

Alpha Growth (LSE:ALGW)

Historical Stock Chart

From Mar 2024 to Apr 2024

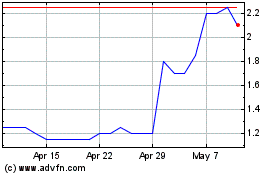

Alpha Growth (LSE:ALGW)

Historical Stock Chart

From Apr 2023 to Apr 2024