TIDMANG

RNS Number : 0310R

Angling Direct PLC

24 October 2023

24 October 2023

Angling Direct PLC

('Angling Direct', the 'Company' or the 'Group')

Half Year Results

Strong sales growth across UK & Europe coupled with tangible

strategic progress in retail and online

Angling Direct PLC (AIM: ANG), the leading omni-channel

specialist fishing tackle and equipment retailer, is pleased to

announce its unaudited financial results for the six months ended

31 July 2023 (H1 FY24).

EBITDA

GBPm H1 FY24 H1 FY23 % Change

Revenue 43.3 38.9 +11.4%

Retail store sales 24.4 21.9 +11.3%

UK online sales 16.5 15.3 +8.3%

Total UK sales 40.9 37.2 +10.1%

European Online sales 2.4 1.7 +39.9%

Gross profit 15.2 13.4 +13.0%

Gross margin % 35.1% 34.6% +50bps

EBITDA (pre IFRS-16) 2.3 1.9 +26.6%

Profit before tax 1.7 1.1 +52.4%

Basic EPS 1.71p 1.14p +50.0%

Financial highlights:

-- Group revenue increased by 11.4% to GBP43.3m

-- Retail store estate experienced another strong period of

growth with total store sales increasing by 11.3% against H1

FY23

-- Like-for-like store sales increased by 4.9%(1) underpinned by improved conversion

-- UK online sales growth of 8.3% with strong average transaction value growth

-- In Europe, online sales grew by 39.9% with online sales to

our key European territory of Germany growing 61.5%

-- Gross margin increased by 50 bps, with progress in both the UK and Europe

-- Group Pre IFRS 16 EBITDA growth of 26.6% to GBP2.3m (45.7%

excluding cyber recoveries from FY22(2) ):

o UK EBITDA increased by 24.1%(2) to GBP2.8m

o Europe's EBITDA loss reduced by 27.2% to GBP0.5m

-- Positive operating cashflow of GBP5.5m (H1 FY22: GBP2.4m)

-- Strong balance sheet with Group net cash of GBP17.6m at 31

July 2023 (31 January 2023: GBP14.1m, 31 July 2022: GBP17.1m)

-- The Group remains well capitalised and securely positioned to continue investing in strategic opportunities to capture further market share in the UK and Europe

Operational highlights:

-- Launched MyAD, the loyalty and repeat purchase membership

model, in the UK, attracting 110k members from launch in June to

the period end

-- Increased our UK digital reach by signing an exclusive

agreement with "Catch", the fishing peg booking App

-- Gross profit on higher margin own brand products grew by

15.7%, both through the launch of the new entry level brand

"Discover" as well as further progress on our established Advanta

brand

-- Improved in-store retail proposition through new on-shelf

labelling technology, the use of our BAITS assisted selling

programme, and new own brand merchandising

-- Continued new store rollout in the UK in the period with new

locations in Cardiff, (the Company's first store outside of

England) and Goole

Current trading and outlook

-- Cumulative August and September sales were in line with

expectation, up 13.9% versus FY23. This was against a softer

comparative period, with the prolonged extreme temperatures in the

prior year.

-- The Company has gained further market share both in the UK

and Europe and believes that a significant opportunity remains in

both of these markets

-- The Group will continue to invest digitally and physically in

the UK, to further drive market share growth, leveraging its strong

balance sheet to ensure it is well placed competitively as consumer

confidence returns

-- The European market remains a highly competitive landscape,

driven by more intense price competition. The Group has continued

to take market share and will continue to invest prudently, to

ensure it is well positioned once markets and consumer confidence

stabilise

-- The Board remains confident that a combination of continued

UK sales momentum and optimising European growth means that the

Group is well placed to deliver revenue and pre-IFRS 16 EBITDA for

the current year in line with market expectations(3)

Steve Crowe, CEO of Angling Direct, said:

"We are pleased to have achieved robust sales growth during H1

FY24 of 11.4% against a challenging consumer backdrop, highlighting

the strength of our omni-channel model.

In the UK, we achieved strong growth in both retail stores and

online sales which saw total UK sales increase by 10.1%.

Simultaneously we made strong progress on our strategic priorities

in the UK growing our store estate and unveiling our MyAD loyalty

programme which attracted 110,000 members in its first two

months.

Despite the more competitive market conditions in Europe,

European sales in H1 FY24 were 39.9% ahead of H1 FY23,

re-validating the significant growth opportunity that Europe

represents for the business. We are committed to building a

sustainably profitable international business and have taken steps

to develop margin and optimise costs in H1 FY24 and this will

continue into H2 and beyond.

The Board is optimistic about the long-term growth prospects of

the Group, underpinned by its robust balance sheet. The UK angling

market remains resilient, with strong demand for a compelling

product offering alongside quality service. Following positive H1

FY24 results, the Board remains confident that the full year

results will be in line with market expectations(3) and would like

to acknowledge and thank all members of the Angling Direct team for

their efforts and we look forward to sharing continued success in

the future."

(1) Excluding the Reading store which hasn't materially traded

in the period after it suffered a fire in the first week of

February. Total like for like stores grew 2.6% including

Reading.

(2) Excluding insurance recoveries received during H1 FY23 in

respect of the cyber-attack in the FY22 year

(3) Note: Angling Direct believes that consensus market

expectations for the year ending 31 January 2024 are for revenues

of GBP83.0 million and pre-IFRS 16 EBITDA of GBP2.7 million.

Investor Meet Company presentation - 30 October 2023

Management will provide a live presentation via the Investor

Meet Company platform at 2.00 p.m. GMT on 30 October. The

presentation is open to all existing and potential shareholders.

Questions can be submitted pre-event via your Investor Meet Company

dashboard up until 9.00 a.m. the day before the meeting or at any

time during the live presentation. Investors can sign up to

Investor Meet Company for free to meet Angling Direct plc via:

https://www.investormeetcompany.com/angling-direct-plc/register-investor

. Investors who already follow Angling Direct on the Investor Meet

Company platform will automatically be invited.

For further information please contact:

Angling Direct PLC +44 (0) 1603 258 658

Steven Crowe, Chief Executive Officer

Sam Copeman, Chief Financial Officer

Singer Capital Markets - NOMAD and Broker +44 (0) 20 7496 3000

Peter Steel, Alex Bond, James Fischer

(Corporate Finance)

Tom Salvesen (Corporate Broking)

FTI Consulting - Financial PR +44 (0) 20 3727 1000

Alex Beagley

Sam Macpherson

Hannah Butler

About Angling Direct

Angling Direct is the leading omni-channel specialist fishing

tackle retailer in the UK. The Company sells fishing tackle

products and related equipment through its network of retail

stores, located strategically throughout the UK as well as through

its leading digital platform (www.anglingdirect.co.uk .de, .fr and

.nl) and other third-party websites.

Angling Direct is committed to supporting its active customer

base and widening access to the angling community through its

passionate colleagues, store-based qualified coaches, social media

reach and ADTV YouTube channel. The Company currently sells over

28,000 fishing tackle products, including capital items,

consumables, luggage and clothing. Angling Direct also owns and

sells fishing tackle products under its own brands 'Advanta', and

the recently launched entry level offering 'Discover'.

From 1986 to 2002, the Company's founders acquired interests in

a number of small independent fishing tackle shops in Norfolk and,

in 2002, they acquired a significant premise in Norwich, which was

branded Angling Direct. Since 2002, the Company has continued to

acquire or open new stores, taking the total number up to 47 retail

stores. In 2015, the Company opened a 2,800 sq. metres central

distribution centre in Rackheath, Norfolk, where the Company's head

office is also located. In March 2022, Angling Direct opened a

3,940 square metre distribution centre in Venlo, Netherlands to

service its established, and rapidly growing, presence in Europe

with native language websites set up in key regions to address

demand.

Angling Direct PLC

Interim Report - 31 July 2023

Angling Direct PLC

Chief Executive Officer's Review

31 July 2023

The Group is pleased to have continued to grow sales and improve

earnings in the UK and Europe despite the persistent cost of living

pressures facing consumers. This performance is testament to the

resilience of our model and market leading position.

Our growth strategy is centred around becoming Europe's first

choice fishing tackle destination, for all anglers, regardless of

experience or ability. As a result of our increasingly

differentiated, market leading omni-channel trading platform the

Group gained further market share in the period, making good

progress against all of its stated strategic priorities. Encouraged

by the sales growth and market share gains achieved, as well as the

longer-term growth opportunity, the Group maintained its programme

of strategic investment in the UK in H1 FY24 despite the economic

headwinds.

As well as new opportunities, H1 FY24 has presented several

significant challenges, most notably balancing our ambition to

rapidly grow turnover in our key European territories, against

intense price competition. Despite these challenges, the European

market offers a significant medium term growth opportunity

alongside the established UK business where we continue to build an

increasingly modern, contemporary and cash generative omni-channel

business.

We have assumed that the current cost of living pressures will

persist into H2 FY24 and beyond which will inevitably impact many

of our current and potential new customers. During this time, we

will continue to invest in profitable growth in the UK, alongside

prudently investing in our strategic objective to grow a European

business capable of delivering meaningful economic returns as

consumer confidence returns.

The H1 FY24 results reflect the resilience of our model and

continued professionalism and dedication of our colleagues in

providing high quality advice and service to our customers and I

would like to take this opportunity to thank them for their

significant contribution.

Results

Group revenue increased by 11.4% to GBP43.3m for the six months

ended 31 July 2023 (H1 FY23: GBP38.9m). The Company recorded strong

sales growth across both channels in the UK, leveraging existing

infrastructure, as well as new space from the physical retail

estate. Overall H1 FY24 UK revenues grew 10.1% against 3.4% in H2

FY23.

European revenues grew by 39.9% as the Group continued to

optimise its European growth trajectory against a backdrop of

striving to write only profitable business.

Gross profit increased by 13.0% to GBP15.2m (H1 FY23: GBP13.4m)

and gross margin grew 50 bps to 35.1%, 40 bps in the UK and 510 bps

in Europe.

Pre IFRS 16 EBITDA grew by 26.6% to GBP2.3m (H1 FY23: GBP1.9m).

The UK grew 12.2% (24.1% excluding Cyber-attack insurance

recoveries received in H1 FY23 relating to the FY22 cyber incident)

with progression in both stores and online (18.3% growth in stores,

10.0% growth online).

The Company retains a strong net cash position at 31 July 2023

of GBP17.6m (31 July 2022: GBP17.1m), with positive cash generation

in the period having increased working capital investment in retail

space and securing record stock availability, alongside continued

capital expenditure investment in the store portfolio in the

period.

Operational Review

Retail Stores

Total store sales in the period increased 11.3% to GBP24.4m (H1

FY23: GBP21.9m). Like-for-like store sales grew by 4.9% (excluding

Reading, which hasn't materially traded in the period due to a fire

in the first week of February). New space (Washington, Stockton,

Coventry, Cardiff and Goole) contributed GBP1.9m of sales in the

period.

Our evolving "BAITS" assisted selling programme alongside our

new on shelf labelling technology and own brand merchandising has

delivered significant value with in-store conversion in the period

improving 300 bps. To enhance this initiative, we launched MyAD in

June, our loyalty and repeat purchase free to join membership club.

The proposition enables our customers to access a range of products

at preferential pricing, alongside tailored offers based on their

shopping history with Angling Direct. The App based technology will

for the first time enable us to understand our customer base across

both our store and online business with early positive insight.

Bringing these aspects together is designed to support our purpose

of Getting Everyone Fishing, and ensures our customers consistently

get the very best advice and support tailored to their specific

needs and fishing ambitions. This is crucial for driving

conversion, creating satisfied, loyal customers, and prompting

recommendation.

During the period we also started to explore alternative paid

for services in store with the launch of our reel spooling and pole

elastication services.

Since our investment in footfall counting technology in FY22, we

have been able to deploy customer-targeted store colleague working

rotas, which are helping to mitigate significant inflationary wage

pressures from the c10% increase in living wage in April 2023.

Whilst store footfall across the existing estate was broadly flat,

there was significant progress in conversion in the like-for-like

stores (360 bps) underpinning our increase in transaction volumes.

Deployment models more than offset the living wage drag with an

improved colleague cost to sales ratio.

In line with our strategic commitment to being the first choice

omni-channel fishing retailer in all our markets, we continue to

invest in new UK retail stores. Continuing to utilise out-sourced

development contractors we built two new stores in the period,

opening in Cardiff in February and Goole in May. We continue to

seek out opportunities within unserved catchments with one further

store opening targeted for H2 FY24, as well as our Reading store

re-opening.

Alongside this, we are observing an increasing trend where

customers in certain catchments are underserved by existing

retailers, presenting an opportunity for Angling Direct to

penetrate these markets with a reduced footprint. We also continue

to re-evaluate our store refresh and merchandising concepts across

the estate. In the period we re-sited the Guilford store as well as

refreshing our Farlows store.

UK Online

UK online sales in the period grew by 8.3% to GBP16.5m (H1 FY23:

GBP15.3m) as our everyday low-price proposition alongside our focus

on availability during peak season resulted in UK online taking

greater share of the higher ticket capital item market. Website

sessions and customer numbers remained broadly flat against the

more challenging consumer landscape reflected in modestly reduced

conversion and increased pressure on paid advertising bidding

costs.

As part of our drive to grow market share and customer loyalty,

we are continuing to invest in contemporary digital infrastructure

and customer marketing, to ensure we stand apart from our

competitors.

As a precursor to the launch of MyAD in June we continued to

develop our App offering, with c5% of total orders now placed

through the App. Alongside this our paid subscription model AD+

accounted for c17% of the orders in the period, showing the

strength of our repeat custom model despite the increasingly

uncertain consumer and competitive landscape.

During the period we signed an exclusive agreement with "Catch",

the fishery peg booking App. The first stage of this relationship

has focused on transparency of partnership and respective offerings

across our respective platforms, with the emphasis now moving

towards embedding the offer as part of our respective digital

customer journeys.

Alongside these trading initiatives the team has changed its

customer delivery carrier arrangements following a re-tendering

process. The improvements being observed in service (reducing lost

parcels) and unit cost economics have positively impacted the

latter part of the period. Alongside the improvement in average

transaction value, this has significantly improved the carriage and

packing ratio, offsetting the cost of paid advertising and

colleague living wage inflationary pressures.

UK Trading

We are committed to providing the most comprehensive range of

products for major fishing disciplines, ensuring that we always

deliver a variety of choice, value, quality and stock

availability.

The MyAD programme launched in June and attracted 110,000

members by the period end. The early insights from this data are

encouraging, pointing to loyalty, repeat purchase and value for

customers.

The Company's category management process remains firmly

embedded in the business. As stock availability across our sector

returned to more historically normal levels post COVID, depressed

consumer demand in FY23 against the COVID sales spike left many

suppliers with excess inventory positions. Our team has been

nimble, navigating this through buying into ranges and volumes

where AD has more ability to manage its price point.

Higher margin own brand gross profit in the period grew by a

pleasing 15.7% against a backdrop of increasing sales of these

items by 6.4%. The launch of our entry level brand, 'Discover'

later in the period, alongside the strategy of developing ranges in

smaller dimension higher margin categories, underpinned the growth

in the gross profit. Stock availability within own brand ranges

remains at good levels and presents a strong platform from which to

develop further in H2 FY24.

As we deepen our relationships with key suppliers, we have

increasingly secured stocks at favourable trade terms with a view

to enhancing margins, whilst giving supplier partners surety of

volume and cashflow. In conjunction with this, during the period we

formalised our approach to the selling of physical and digital

space to join up with our MyAD strategy. The pipeline and appetite

from key suppliers for further development of this in H2 FY24 and

beyond is strong. Alongside this we continue to grow the number of

innovative products to market exclusively for our customers. These

include the extension of the One More Cast terminal tackle range by

leading angler Ali Hamedi and developing product bundle concepts

with key partners such as Korda fishing tackle and Sticky Baits.

This approach provides further opportunity for us to develop value

levers exclusively through the MyAD offer.

As a result of these strategies alongside the 10.1% increase in

sales, the UK delivered a 40 bps improvement in its gross margin to

35.5%.

Europe

The opportunity for growth of market share within Europe remains

clear, despite the European digital trading landscape intensifying

as a result of competitive pricing and paid advertising costs.

During the period, our team has focused upon optimising trading

and efficiencies to support our first full financial year of

trading directly from The Netherlands.

As a result of these positive advancements, active unique

customer numbers in our key European territories have increased by

41.3% to 25,100, with the conversion rate increasing by 63 bps to

3.13%. European key territory sales increased by 39.9% in H1 FY23

to GBP2.4m (H1 FY22: GBP1.7m).

We are committed and see a significant opportunity to build a

sustainably profitable international business and have taken steps

to develop margin and optimise costs in H1 FY24 until such time

that more normal pricing trends resume. In the period gross margins

improved 510 bps to 27.4%, contribution improved 990 bps to -5.0%,

operating margin improved 1,240 bps to -13.9% and pre IFRS 16

EBITDA losses reduced 27.2% to GBP0.5m.

The Board continues to believe that the full Angling Direct

omni-channel model will be attractive to European customers and

that, in the medium term, bricks and mortar retail stores will

complement our growing online business. We have carefully evaluated

the trading strategies required for this opportunity to create

shareholder value. We are now focused on securing ranges and

locations which deliver these metrics and will continue to monitor

and review our progress against these plans closely over the coming

months.

Environmental and Organisational Development

We remain fully committed to acting responsibly and sustainably

within our environment and communities. We continue to develop our

approach to sustainability with key successes in the period of

particular note around reducing our waste sent to landfill,

reducing plastic packaging within our own brand ranges, and

continuing our roll out of LED lighting in our store estate. We

have also extended our fishing line recycling programme to source

recycling bins for fisheries from suppliers, introduced recycling

points in our 2024 built stores and commenced our angler engagement

programme through our collaboration with the Pike Anglers Club of

Great Britain to discourage warm water pike fishing. To complement

this, we have also commenced sign posting to our communities

through our sustainability digital content a number of established

environmental campaigns which would support the sustainability of

angling.

Within the context of the current highly inflationary

environment, it is more important than ever to ensure we rigorously

scrutinise any incremental organisational investment, whilst

ensuring we appropriately plan and resource for future share growth

in our consolidating markets. In the period, we have continued to

supplement and upskill key capabilities within our digital and IT

development teams.

At the start of the period the Group announced its Board

succession plan with Andy Torrance stepping down from his role as

CEO and appointed Non-executive Chair. Martyn Page consequently

stepped down from his role as Non-Executive Chair and remains on

the Board as a Non-executive Director. These changes facilitated

myself stepping up to CEO and following this we successfully

concluded a CFO search and were delighted to welcome Sam Copeman to

the Board in June at the completion of the AGM. Christian (Chris)

Keen and Nicola (Nicki) Murphy continue as the Company's

Independent Non- Executive Directors. Chris continues as Chair of

the Audit Committee with Nicki moving to Chair of the Remuneration

Committee.

Current trading and Outlook

We remain confident of continued growth and delivery of our

strategic goals. The UK angling market remains resilient, with good

demand for a compelling product offering alongside quality service.

Our customer loyalty programme MyAD will further help to meet the

needs of our customers and at the same time drive loyalty and

repeat purchase. We will continue our investment in the UK in our

people, technology and our physical estate in order to support

further organic growth. This will be augmented by investment in

selective acquisitions and development of exceptional greenfield

sites in the UK. This investment in the UK will be targeted at

driving further market share growth and leveraging our strong

balance sheet to ensure we are best placed competitively as

consumer confidence returns.

Europe retains a more competitive landscape which means growing

profitable digital customer acquisition is challenging as we build

scale. However selective bricks and mortar remains a realistic

target to deliver value within these markets to leverage existing

investments already made. The Group will continue to invest to

drive market share, where prudent to do so, to ensure it is well

positioned as markets stabilise post and the macroeconomic consumer

challenges impacting these markets.

Following strong H1 2024 results, cumulative August and

September sales were in line with expectation, up 13.9% versus

FY23. This was against a softer comparative period, with the

prolonged extreme temperatures in the prior year. The Board remains

confident that the full year results will be in line with consensus

market expectations. The Board would like to acknowledge and thank

all members of the Angling Direct team for their efforts, and we

look forward to sharing continued success in the future.

Angling Direct PLC

Consolidated statements of profit or loss and other comprehensive income

For the period ended 31 July 2023

Audited

Unaudited six months year ended

ended 31 July 31 January

Note 2023 2022 2023

GBP'000 GBP'000 GBP'000

Revenue from contracts with customers 4 43,341 38,898 74,096

Cost of sales of goods (28,149) (25,450) (48,307)

Gross profit 15,192 13,448 25,789

Other income 5111 268 287

Interest revenue calculated using the effective

interest method 140 26 104

Expenses

Administrative expenses (11,820) (10,699) (21,742)

Distribution expenses (1,656) (1,689) (3,260)

Finance costs (246) (225) (509)

Profit before income tax expense 1,721 1,129 669

Income tax expense 7(400) (251) (130)

Profit after income tax expense for the period

attributable to the owners of Angling Direct

PLC 1,321 878 539

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss

Foreign currency translation (81) - 127

Other comprehensive income for the period,

net of tax (81) - 127

Total comprehensive income for the period

attributable to the owners of Angling Direct

PLC 1,240 878 666

Pence Pence Pence

Basic earnings 15 1.71 1.14 0.70

Diluted earnings 15 1.69 1.12 0.69

Angling Direct PLC

Consolidated statements of financial

position

As at 31 July 2023

Audited

year

Unaudited six months ended 31

ended 31 July January

Note 2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles 8 6,007 6,124 6,060

Property, plant and equipment 9 7,916 7,158 7,534

Right-of-use assets 10 11,150 10,771 11,418

Total non-current assets 25,073 24,053 25,012

Current assets

Inventories 20,013 17,564 17,813

Trade and other receivables 751 1,093 447

Income tax refund due - - 58

Prepayments 763 474 603

Cash and cash equivalents 17,624 17,084 14,127

Total current assets 39,151 36,215 33,048

Current liabilities

Trade and other payables 11 11,702 9,398 6,765

Contract liabilities 481 425 727

Lease liabilities 1,809 1,709 1,793

Derivative financial instruments 32 - 51

Income tax 315 566 -

Total current liabilities 14,339 12,098 9,336

Net current assets 24,812 24,117 23,712

Total assets less current liabilities 49,885 48,170 48,724

Non-current liabilities

Lease liabilities 9,583 9,116 9,750

Restoration provision 840 759 801

Deferred tax 910 893 883

Total non-current liabilities 11,333 10,768 11,434

Net assets 38,552 37,402 37,290

Equity

Share capital 12 773 773 773

Share premium 31,037 31,037 31,037

Reserves 543 375 602

Retained profits 6,199 5,217 4,878

Total equity 38,552 37,402 37,290

Angling Direct PLC

Consolidated statements of changes in equity

For the period ended 31 July 2023

Share

Share premium Retained

capital account Reserves profits Total equity

Unaudited six months

ended 31

July GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 February

2023 773 31,037 602 4,878 37,290

Profit after income tax

expense

for the period - - - 1,321 1,321

Other comprehensive

income for

the period, net of tax - - (81) - (81)

Total comprehensive

income for

the period - - (81) 1,321 1,240

Transactions with owners

in

their capacity as

owners:

Share-based payments - - 22 - 22

Balance at 31 July 2023 773 31,037 543 6,199 38,552

Share Share premium Retained

capital account Reserves profits Total equity

Audited year ended

31 January GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

February 2022 773 31,037 266 4,339 36,415

Profit after income

tax expense

for the period - - - 539 539

Other comprehensive

income for

the period, net of

tax - - 127 - 127

Total comprehensive

income for

the period - - 127 539 666

Transactions with

owners in

their capacity as

owners:

Share-based payments - - 209 - 209

Balance at 31

January 2023 773 31,037 602 4,878 37,290

Angling Direct PLC

Consolidated statements of cash flows

For the period ended 31 July 2023

Unaudited six months Audited

ended 31 July year ended

31 January

Note 2023 2022 2023

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit before income tax expense for the period 1,721 1,129 669

Adjustments for:

Depreciation and amortisation 1,787 1,672 3,485

Share-based payments 22 109 209

Net movement in provisions 16 13 30

Net variance in derivative liabilities (19) (1) 50

Interest received (140) (26) (104)

Interest and other finance costs 230 212 429

3,617 3,108 4,768

Change in operating assets and liabilities:

(Increase)/decrease in trade and other receivables (300) (551) 95

(Increase) in inventories (2,252) (1,291) (1,540)

(Increase)/decrease in prepayments (162) 71 (58)

Increase/(decrease) in trade and other payables 4,893 1,227 (965)

(Decrease)/increase in contract liabilities (246) - 84

5,550 2,564 2,384

Interest received 140 26 104

Interest and other finance costs (230) (212) (429)

Income taxes paid - - (513)

Net cash from operating activities 5,460 2,378 1,546

Cash flows from investing activities

Payments for property, plant and equipment 9(1,012) (841) (2,014)

Payments for intangibles 8 (116) (158) (289)

Net cash used in investing activities (1,128) (999) (2,303)

Cash flows from financing activities

Repayment of lease liabilities (885) (899) (1,720)

Net cash used in financing activities (885) (899) (1,720)

Net increase/(decrease) in cash and cash

equivalents 3,447 480 (2,477)

Cash and cash equivalents at the beginning

of the financial period 14,127 16,604 16,604

Effects of exchange rate changes on cash

and cash equivalents 50 - -

Cash and cash equivalents at the end of the

financial period 17,624 17,084 14,127

Angling Direct PLC

Notes to the consolidated financial statements

31 July 2023

Note 1. General information

The financial statements cover Angling Direct PLC as a Group consisting

of Angling Direct PLC ('Company' or 'parent entity') and the entities

it controlled at the end of, or during, the half-year (collectively referred

to in these financial statements as the 'Group'). The financial statements

are presented in British Pound Sterling ('GBP'), which is Angling Direct

PLC's functional and presentation currency.

Angling Direct PLC is a listed public company limited by shares incorporated

under the Companies Act 2006, listed on the AIM (Alternative Investment

Market), a sub-market of the London Stock Exchange. The Company is incorporated

and domiciled in England and Wales within the United Kingdom. The registered

number of the Company is 05151321. Its registered office and principal

place of business is:

2d Wendover Road,

Rackheath Industrial

Estate

Rackheath

Norwich

Norfolk

NR13 6LH

The principal activity of the Group is the sale of fishing tackle through

its websites and stores. The Group's business model is designed to generate

growth by providing excellent customer service, expert advice and ensuring

product lines include a complete range of premium equipment. Customers

range from the casual hobbyist through to the professional angler.

The financial statements were authorised for issue, in accordance with

a resolution of Directors, on 23 October 2023. The Directors have the

power to amend and reissue the financial statements.

Note 2. Significant accounting policies

These financial statements for the interim half-year reporting period

ended 31 July 2023 have been prepared in accordance with the AIM Rules

for Companies, International Accounting Standard IAS 34 'Interim Financial

Reporting' and the Companies Act for for-profit oriented entities.

These interim financial statements do not include all the notes of the

type normally included in annual financial statements. Accordingly, these

financial statements are to be read in conjunction with the annual report

for the year ended 31 January 2023 and any public announcements made by

the Company during the interim reporting period.

The interim consolidated financial information has been prepared on a

going-concern basis.

The principal accounting policies adopted are consistent with those set

out on pages 74 to 100 of the consolidated financial statements of Angling

Direct PLC for the year ending 31 January 2023, except for taxation which

has been accounted for as described in note 7.

New or amended Accounting Standards and Interpretations adopted

The Group has adopted all of the new or amended Accounting Standards and

Interpretations issued by the International Accounting Standards Board

that are mandatory for the current reporting period. There was no impact

on the adoption of these new or amended Accounting Standards and Interpretations

Any new or amended Accounting Standards or Interpretations that are not

yet mandatory have not been early adopted.

Note 3. Segmental reporting

Segment information is presented in respect of the Group's operating

segments, based on the Group's management and internal reporting structure,

and monitored by the Group's Chief Operating Decision Maker (CODM).

Segment results, assets and liabilities include items directly attributable

to a segment as well as those that can be allocated on a reasonable basis.

Unallocated items comprise mainly own brand stock in transit from the

manufacturers, group cash and cash equivalents, taxation related assets

and liabilities, centralised support functions salary and premises costs,

and government grant income.

Geographical segments

The business operated predominantly in the UK. It has three native language

web sites for Germany, France and the Netherlands.

Operating segments

The Group is split into three operating segments (Stores, UK Online and

Europe Online) and a centralised support function (Head Office) for business

segment analysis. In identifying these operating segments, management

follows the route to market for the generation of the customer order

for its products.

Each of these operating segments is managed separately as each segment

requires different specialisms, marketing approaches and resources. Head

Office includes costs relating to the employees, property and other overhead

costs associated with the centralised support functions.

The CODM reviews EBITDA (earnings before interest, tax, depreciation

and amortisation) pre IFRS 16. The accounting policies adopted for internal

reporting to the CODM are consistent with those adopted in the financial

statements, save for IFRS 16. A full reconciliation of pre IFRS 16 EBITDA

to post IFRS 16 EBITDA performance is provided to the CODM.

The information reported to the CODM is on a monthly basis.

At 31 July 2023, GBP24,167,000 of non-current assets are located in the

UK (31 July 2022 GBP22,952,000) and GBP906,000 of non-current assets

are located in the Netherlands (31 July 2022 GBP1,101,000).

Operating segment information

Stores UK Europe Head Office Total

Online Online

31 July 2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 24,382 16,545 2,414 - 43,341

Profit/(loss) before income

tax 2,974 1,838 (518) (2,573) 1,721

EBITDA post IFRS 16 4,482 2,107 (382) (2,593) 3,614

Total assets 19,662 7,435 4,013 33,114 64,224

Total liabilities (7,574) (4,725) (1,224) (12,149) (25,672)

EBITDA Reconciliation

Profit/(loss) before income

tax 2,974 1,838 (518) (2,573) 1,721

Less: Interest income - - - (140) (140)

Add: Interest expense 222 21 15 (12) 246

Add: Depreciation and

amortisation 1,286 248 121 132 1,787

EBITDA post IFRS 16 4,482 2,107 (382) (2,593) 3,614

Less: Costs relating to

IFRS 16 lease liabilities (959) (84) (111) (115) (1,269)

EBITDA pre IFRS 16 3,523 2,023 (493) (2,708) 2,345

UK Europe

Stores Online Online Head office Total

31 July 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 21,897 15,275 1,726 - 38,898

Profit/(loss) before income

tax 2,577 1,620 (707) (2,361) 1,129

EBITDA post IFRS 16 3,859 1,923 (570) (2,212) 3,000

Total assets 25,198 7,588 4,163 23,319 60,268

Total liabilities (12,726) (4,412) (1,116) (4,612) (22,866)

EBITDA Reconciliation

Profit/(loss) before income

tax 2,577 1,620 (707) (2,361) 1,129

Less: Interest income - - - (26) (26)

Add: Interest expense 175 23 19 8 225

Add: Depreciation and amortisation 1,107 280 118 167 1,672

EBITDA post IFRS 16 3,859 1,923 (570) (2,212) 3,000

Less: Costs relating to

IFRS 16 lease liabilities (882) (84) (107) (75) (1,148)

EBITDA pre IFRS 16 2,977 1,839 (677) (2,287) 1,852

Note 4. Revenue from contracts with customers

Disaggregation of revenue

The disaggregation of revenue from contracts with customers is as follows:

Audited year

Unaudited six months ended

ended 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Route to market

Retail store sales 24,382 21,897 41,296

E-commerce 18,959 17,001 32,800

43,341 38,898 74,096

Geographical regions

United Kingdom 40,927 37,172 70,952

Europe and Rest of the World 2,414 1,726 3,144

43,341 38,898 74,096

Timing of revenue recognition

Goods transferred at a point in time 43,341 38,898 74,096

Note 5. Other income

Unaudited Audited year

six months ended 31

ended 31 July January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Net foreign exchange gain/(loss) - 8 -

Insurance claim 86 243 258

Rent income 25 17 29

Other income 111 268 287

The insurance claim income relates to the estimated loss of profit claim

for the fire in the Reading store in respect of the period between February

2023 and 31 July 2023 (2022: Cyber claim insurance income).

Note 6. EBITDA reconciliation (earnings before interest, taxation, depreciation

and amortisation)

The Directors believe that adjusted profit provides additional useful information

for shareholders on performance. This is used for internal performance analysis.

This measure is not defined by IFRS and is not intended to be a substitute

for, or superior to, IFRS measurements of profit. The following table is

provided to show the comparative earnings before interest, tax, depreciation

and amortisation ('EBITDA') after adjusting for rents, dilapidation charges

and associated legal costs, where applicable, relating to IFRS 16 lease liabilities.

Unaudited Unaudited

six months six months Audited

ended ended year ended

31 July 31 July 31 January

2023 2022 2023

EBITDA reconciliation GBP'000 GBP'000 GBP'000

Profit before income tax expense post IFRS

16 1,721 1,129 669

Less: Interest income (140) (26) (104)

Add: Interest expense 246 225 509

Add: Depreciation and amortisation 1,787 1,672 3,485

EBITDA post IFRS 16 3,614 3,000 4,559

Less: costs relating to IFRS 16 lease

liabilities (1,269) (1,148) (2,335)

EBITDA pre IFRS 16 2,345 1,852 2,224

Note 7. Income tax expense

The tax charge for the six months ended 31 July 2023 is recognised based

on management's estimate of the weighted average annual effective tax rate

expected for the full financial year, adjusted for the tax impact of any

discrete items arising in the period. Deferred tax balances are calculated

using tax rates that have been enacted or substantively enacted by the balance

sheet date and that are expected to apply in the period when the liability

is settled or the asset realised.

Note 8. Intangibles

Unaudited six Audited

months ended 31 year ended

July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill - at cost 5,802 5,802 5,802

Less: Impairment (182) (182) (182)

5,620 5,620 5,620

Software - at cost 1,835 1,589 1,720

Less: Accumulated amortisation (1,448) (1,085) (1,280)

387 504 440

6,007 6,124 6,060

Reconciliations

Reconciliations of the written down values at the beginning and end of the

current financial period are set out below:

Goodwill Software Total

Unaudited six months ended 31 July GBP'000 GBP'000 GBP'000

Balance at 1 February 2023 5,620 440 6,060

Additions - 116 116

Amortisation expense - (169) (169)

Balance at 31 July 2023 5,620 387 6,007

Note 9. Property, plant and equipment

Unaudited Audited

six months ended year ended

31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current assets

Land and buildings improvements - at cost 1,002 1,002 1,002

Less: Accumulated depreciation (347) (310) (342)

655 692 660

Plant and equipment - at cost 10,096 8,253 9,158

Less: Accumulated depreciation (3,325) (2,370) (2,836)

6,771 5,883 6,322

Motor vehicles - at cost 15 15 15

Less: Accumulated depreciation (13) (12) (12)

2 3 3

Computer equipment - at cost 1,363 1,263 1,333

Less: Accumulated depreciation (875) (683) (784)

488 580 549

7,916 7,158 7,534

Reconciliations

Reconciliations of the written down values at the beginning and end of the

current financial period are set out below:

Land and

buildings Plant and Motor Computer

improvements equipment vehicles equipment Total

Unaudited six months

ended 31

July GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 February

2023 660 6,322 3 549 7,534

Additions - 943 - 31 974

Exchange differences - (4) - (1) (5)

Depreciation expense (5) (490) (1) (91) (587)

Balance at 31 July 2023 655 6,771 2 488 7,916

Note 10. Right-of-use assets

Audited

Unaudited six months year ended

ended 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current assets

Land and buildings - right-of-use 19,964 17,630 19,235

Less: Accumulated depreciation (8,984) (6,998) (7,984)

10,980 10,632 11,251

Plant and equipment - right-of-use 80 80 80

Less: Accumulated depreciation (59) (53) (56)

21 27 24

Motor vehicles - right-of-use 467 372 433

Less: Accumulated depreciation (329) (277) (304)

138 95 129

Computer equipment - right-of-use 59 59 59

Less: Accumulated depreciation (48) (42) (45)

11 17 14

11,150 10,771 11,418

Reconciliations

Reconciliations of the written down values at the beginning and end of the

current financial period are set out below:

Land and Plant and Motor Computer

buildings equipment vehicles equipment Total

Unaudited six months

ended 31

July GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 February 2023 11,251 24 129 14 11,418

Additions 1,021 - 34 - 1,055

Remeasurement (273) - - - (273)

Exchange differences (19) - - - (19)

Depreciation expense (1,000) (3) (25) (3) (1,031)

Balance at 31 July 2023 10,980 21 138 11 11,150

Note 11. Trade and other payables

Unaudited six Audited

months ended 31 year ended

July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Current liabilities

Trade payables 8,023 6,011 4,543

Accrued expenses 1,287 1,286 1,088

Refund liabilities 56 58 55

Social security and other taxes 1,141 1,158 589

Other payables 1,195 885 490

11,702 9,398 6,765

Contract liabilities has been reported separately on the Statement of financial

position. This was previously reported in other payables.

Note 12. Share capital

Unaudited six months ended 31 July

2023 2022 2023 2022

Shares Shares GBP'000 GBP'000

Ordinary shares of GBP0.01 each - fully

paid 77,267,304 77,267,304 773 773

Note 13. Dividends

There were no dividends paid, recommended or declared during the current

or previous financial period.

Note 14. Contingent liabilities

The Group had no material contingent liabilities as at 31 July 2023, 31 January

2023 and 31 July 2022.

Note 15. Earnings per share

Unaudited Unaudited Audited

six months six months year

ended 31 ended 31 ended 31

July July January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Profit after income tax attributable to the

owners

of Angling Direct PLC 1,321 878 539

Number Number Number

Weighted average number of ordinary shares

used

in calculating basic earnings per share 77,267,304 77,267,304 77,267,304

Adjustments for calculation of diluted

earnings

per share:

Options over ordinary shares 851,266 962,010 900,536

Weighted average number of ordinary shares

used

in calculating diluted earnings per share 78,118,570 78,229,314 78,167,840

Pence Pence Pence

Basic earnings per share 1.71 1.14 0.70

Diluted earnings per share 1.69 1.12 0.69

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FXLLLXBLFFBV

(END) Dow Jones Newswires

October 24, 2023 02:05 ET (06:05 GMT)

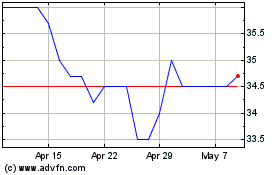

Angling Direct (LSE:ANG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Angling Direct (LSE:ANG)

Historical Stock Chart

From Apr 2023 to Apr 2024