TIDMARCH

RNS Number : 2998C

ARC Capital Holdings Limited

14 October 2015

14 October 2015

For Immediate Release

ARC Capital Holdings Limited

Interim Accounts for the Period Ending 30 June 2015

ARC Capital Holdings Limited ("ARCH" or the "Company") has today

announced the publication of its interim accounts for the period

ending 30 June 2015. The interim report is reproduced below.

The Company's 2015 interim report will also be sent to

registered shareholders shortly and a copy will be available for

inspection on the Company's website

(http://www.arch-fund.com/).

ARCH's shares remain suspended from trading on AIM pending the

appointment of a new Nominated Adviser. A further announcement

relating to this matter will be released in due course.

Enquiries

For further information, please contact:

ARC Capital Holdings Limited

Alpay Ece / Sean Hurst

Tel: +44 (0)20 7845 5950

Edmond de Rothschild Securities (UK) Limited

William Marle

Tel: +44 (0)20 7845 5950

John Armstrong-Denby

Tel: +44 (0)20 7845 5950

Hiroshi Funaki

Tel: +44 (0)20 7845 5960

ARC Capital Holdings Limited

Board Report

(For the six months ended 30 June 2015)

The Board of Directors is pleased to present the interim

financial statements of ARC Capital Holdings Limited ("ARCH") and

its subsidiaries (collectively, the "Fund") for the six months

ended 30 June 2015.

On 23 September 2015, the Fund published its financial report

for the year ending 31 December 2014. Included below is an update

of the Fund's position since the year end which may include certain

events disclosed and discussed in the 31 December 2014 annual

report as post year end events but which are repeated here for

completeness.

In February 2015 shareholders voted in general meeting to remove

the then existing directors and replace them with a new board of

directors. Messrs Steven Feniger and Tian Cho Chu, and Ms Helen

Wong left the Board, and Messrs Alpay Ece, Cosimo Borrelli and Sean

Hurst were appointed as the new Board of ARCH.

Mr Cosimo Borrelli was removed from the Board on 30 March 2015.

Subsequent to this, Borrelli Walsh tendered its resignation as a

consultant to the Board, effective 15 April 2015. The Board has

decided not to appoint a replacement for the Investment Manager or

Borrelli Walsh at this time but to retain specialist consultants in

relation to individual assets when appropriate.

Investments

There have been no material changes to the Fund's investments

since the update that was provided to shareholders in the 2014

annual financial report, save for the following:

Claim against Investment Manager (Orient Home litigation in

England)

On 22 April 2015, the new directors announced that they had

commissioned an independent review of ARCH's litigation against the

Fund's former investment manager, ARC Capital Partners Limited (the

"Investment Manager"), in respect of the Orient Home investment and

had appointed leading international law firm Baker & McKenzie

LLP ("Baker & McKenzie") to undertake the review, and to

provide an opinion on the reasonableness of pursuing such

claim.

The Board announced on 24 September 2015 that, following the

completion of Baker & McKenzie's review and in light of its

advice, the Board had resolved to continue to pursue ARCH's claim

against the Investment Manager. The Fund's legal advisers on this

matter, Stephenson Harwood LLP ("Stephenson Harwood") shall

therefore continue to pursue the claim in the English High

Court.

Funtalk China Holdings (formerly Beijing Pypo)

As stated in the company's annual report, the Board commissioned

an investigation into the acquisition of Funtalk by Fortress in

2011, ARCH's investment in Fortress and the events concerning the

Fortress investment from 2011 to date from Stephenson Harwood, the

same legal adviser acting for ARCH on the claim against the

Investment Manager in respect of Orient Home in England.

The Board will update shareholders in due course.

NAV

ARCH's NAV has decreased by approximately 53.97% from US$0.1184

as at 31 December 2014 to US$0.0545 as at 30 June 2015. As

explained more fully in the Fund's 2014 annual financial reports,

this decrease is primarily due to the accounting treatment of ARCH

Digital Holdings Limited ("ARCH Digital") when producing ARCH's

consolidated balance sheet. Under ARCH's current accounting

policies, even though the investment in Fortress Group Limited

("Fortress") has been written down to nil, the exercise of the Put

Option by PAGAC Fortress Holding I Limited ("PAGAC"), a company

affiliated with the Company's former manager, means that ARCH

Digital's liabilities exceed its assets by approximately US$70.05

million as at 30 June 2015 ($57.8 million as at 31 December 2014).

This liability is growing at the rate of 18% per annum compounding

daily. On consolidation, this net liability has to be recognised in

ARCH's consolidated accounts. However, shareholders should note

that ARCH has not guaranteed ARCH Digital's obligations.

Excluding the net liability of ARCH Digital, the pro forma net

asset value of ARCH is as follows:

30 June 2015 31 December

2014

Total (US$) Per share Total Per share

(US$) (US$) (US$)

--------------------- ------------ ---------- ----------- ----------

Reported NAV 12,430,706 0.0545 27,017,413 0.1184

--------------------- ------------ ---------- ----------- ----------

Adjustment relating

to ARCH Digital 70,052,278 0.3071 57,757,715 0.2532

--------------------- ------------ ---------- ----------- ----------

Pro forma adjusted

NAV 82,482,984 0.3615 84,775,128 0.3716

--------------------- ------------ ---------- ----------- ----------

This pro forma adjusted NAV represents a decrease of

approximately 2.7% compared to the last reported adjusted NAV per

share at the close of business on 31 December 2014 (US$0.3716). It

should be noted that the reported NAV does not reflect the recent

falls in the value of the renminbi which occurred after the balance

sheet date.

Trading on AIM and Nominated Adviser appointment

On 15 September 2015, ARCH announced that its then Nominated

Adviser, Grant Thornton UK LLP, had resigned, following

notification received by the Fund on 14 August 2015. As a

replacement Nominated Adviser had not been appointed at that time,

pursuant to AIM Rule 1, ARCH shares remained suspended from trading

on AIM. The Board of Directors continues its efforts to appoint a

replacement Nominated Adviser and is currently in active

discussions with a party whom it hopes to appoint shortly, however,

if a replacement is not found, the admission of ARCH's ordinary

shares to trading on AIM will be cancelled at 7.00 a.m. on 16

October 2015. A further announcement will be made in due

course.

We sincerely thank the shareholders for their continued support

throughout this difficult period for the Fund.

Sean Hurst & Alpay Ece

Directors

Consolidated Statement of Assets and Liabilities

as at 30 June 2015

30 June 31 December

2015 2014

US$ US$

Note (unaudited) (audited)

Assets

Investments, at fair value 3 7,360,639 7,354,143

(Cost: 30 June 2015: US$170,435,220

31 December 2014: US$170,435,220)

Investment deposits 7 52,284,105 52,248,017

Other assets 9 6,354,030 21,471,845

Cash and cash equivalents 10 42,888,150 31,680,494

Total assets 108,886,924 112,754,499

------------------- -------------------

Liabilities

Deferred tax 6 351,167 350,857

Tax payable 6 13,129,527 13,129,527

Other payables and accruals 11 82,975,524 72,256,702

Total liabilities 96,456,218 85,737,086

------------------- -------------------

Net assets 12,430,706 27,017,413

=========== ===========

Shareholders' equity

Share capital 12 2,281,416 2,281,416

Share premium 12 326,371,746 326,371,746

Accumulated losses (323,225,190) (308,578,458)

Foreign currency translation

reserve 7,002,734 6,942,709

Total shareholders' equity 12,430,706 27,017,413

=========== ===========

Net asset value per share 15(a) 0.05 0.12

=========== ===========

Approved by the Board of Directors on 14 October 2015.

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

Sean Hurst Director

Consolidated Schedule of Investments

as at 30 June 2015

30 June 2015 31 December 2014

Fair % of Fair % of

Cost value net Cost value net

Investment Instrument US$ US$ assets US$ US$ assets

Mobile phone

retail, China

Fortress Common

Group Limited(1) stock 100,800,044 - - 100,800,044 - -

Home decoration

retail, China

Orient Home

Decoration

& Building

Materials

Company Limited

("Orient

Home Retail") Loan 23,245,008 - - 23,245,008 - -

Dairy, China

Ningxia Xiajin

Dairy Co., Common

Ltd. stock - - - - - -

Education,

China

Shaanxi Da Common

De Education(2) stock 30,533,602 - - 30,533,602 - -

Pharmaceutical,

China

Buchang Pharmaceutical Common

Group stock - - - - - -

Others

A domestic

Chinese strategic

investor

("DCSI")(3) Loan 15,856,566 7,360,639 59.21% 15,856,566 7,354,143 27.22%

Total 170,435,220 7,360,639 59.21% 170,435,220 7,354,143 27.22%

========= ========= ===== ========= ========== =====

Notes:

1. On 31 January 2013, the Fund received 388 common shares of

Fortress Group Limited ("Fortress"), the parent of Funtalk China

Holdings Limited ("Funtalk") to settle the outstanding receivable

from Funtalk's management, increasing ARCH's equity interest in

Funtalk from approximately 18.47% to 20.49%, on a fully diluted

basis. The shares received were valued at US$10.8 million which has

been included in the cost of investment as at 30 June 2015. Also

see note 3(i), 11(b) and 16(e).

2. As at 30 June 2015, it was decided by the Board to recognise

the initial deposit received as return of equity. Also see note

3(ii) , 11(a) and 16(d)

3. The name of the investee is not disclosed due to a

confidentiality arrangement. Also see note 3(iii) and 16(a).

Consolidated Statement of Operations

for the period ended 30 June 2015

6 months 6 months

ended ended

30 June 30 June

2015 2014

US$ US$

Note (unaudited) (unaudited)

Investment income

Bank interest and sundry income 43,747 121,866

Total investment income 43,747 121,866

------------------ ------------------

Expenses

Investment management fee 4 - 1,078,756

Consulting Fee 265,656 -

Administration, custodian and

registrar fees 116,081 145,225

Professional fees 1,677,424 1,111,424

Directors' remuneration and

expense reimbursement 5 106,944 99,805

Finance costs 4 -

Impairment loss 8 - 6,612,981

Provision for put option 11 12,294,563 -

Other expenses 236,303 493,590

Total expenses 14,696,975 9,541,781

-------------------- --------------------

Net investment loss (14,653,228) (9,419,915)

-------------------- --------------------

Net loss on investments and

foreign currencies

Net realised gain on investments

before tax - 13,727,143

Income tax expenses 6 - (1,372,714)

Net realised gain on investments - 12,354,429

-------------------- --------------------

Net unrealised gain/(loss) on

investments before tax 6,496 (109,553,657)

Deferred tax credit 6 - 1,519,800

Net unrealised gain/(loss) on

investments 6,496 (108,033,857)

-------------------- --------------------

Net gain/(loss) on investments

and foreign currencies 6,496 (95,679,428)

-------------------- --------------------

Net decrease in net assets from

operations (14,646,732) (105,099,343)

=========== ============

Consolidated Statement of Changes in Net Assets

for the period ended 30 June 2015

Retained Foreign

earnings/ currency

Share Share Tendered (accumulated translation

capital premium Shares losses) reserve Total

US$ US$ US$ US$ US$ US$

At 1 January

2014 2,610,827 354,042,331 - (146,376,886) 7,125,323 217,401,595

Share

repurchase (329,411) (27,670,585) - - - (27,999,996)

Net

investment

loss - - - (9,419,915) - (9,419,915)

Net realised

gain on

investments - - - 12,354,429 - 12,354,429

Net

unrealised

loss on

investments - - - (108,033,857) - (108,033,857)

Foreign

currencies

translation

difference - - - - (447,165) (447,165)

______________ ______________ ______________ ______________ ______________ _______________

At 30 June

2014 2,281,416 326,371,746 - (251,476,229) 6,678,158 83,855,091

=========== =========== =========== =========== =========== ===========

At 1 January

2015 2,281,416 326,371,746 - (308,578,458) 6,942,709 27,017,413

Share

repurchase - - - - - -

Net

investment

loss - - - (14,653,228) - (14,653,228)

Net

unrealised

gain on

investments - - - 6,496 - 6,496

Foreign

currencies

translation

difference - - - - 60,025 60,025

______________ ______________ ______________ ______________ ______________ _______________

At 30 June

2015 2,281,416 326,371,746 - (323,225,190) 7,002,734 12,430,706

=========== =========== =========== =========== =========== ===========

Consolidated Statement of Cash Flows

for the period ended 30 June 2015

6 months 6 months

ended ended

30 June 30 June

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

2015 2014

US$ US$

Note (unaudited) (unaudited)

Cash flows from operating activities

Net decrease in net assets

from operations (14,646,732) (105,099,343)

Adjustments to reconcile net

increase

in net assets from operations

to net cash

provided by operating activities:

- Net realised gain on investments

before tax - (13,727,143)

- Net unrealised(gain)/ loss

on investments before tax (6,496) 109,553,657

- Proceeds from sale of investments - 44,857,143

- (Increase)/decrease in investment

deposits (36,088) 372,537

- Decrease in other assets 15,117,815 992,905

- Impairment loss 8 - 6,612,981

- Provision for put option 11 12,294,563 -

- Increase/(decrease) in deferred

tax liabilities 310 (1,522,999)

- Increase in tax payable - 510,559

- (Decrease)/increase in other

payables and accruals (1,575,741) 230,388

- Foreign currencies translation

difference 60,025 (447,165)

Net cash provided by operating

activities 11,207,656 42,333,520

------------------- --------------------

Cash flows from financing activities

Repurchase of shares 12 - (27,999,996)

Net cash used in financing

activities - (27,999,996)

------------------- -------------------

Net increase in cash and cash

equivalents 11,207,656 14,333,524

Cash and cash equivalents at

beginning of period 31,680,494 19,607,765

Cash and cash equivalents at

end of period 10 42,888,150 33,941,289

=========== ===========

Supplemental cash flow information

- Interest paid (4) -

=========== ===========

Supplemental cash flow information

- Tax paid - 862,154

=========== ===========

1 General

(a) Organisation

ARC Capital Holdings Limited (the "Company") was incorporated

with limited liability in the Cayman Islands as an exempted company

under the Companies Law on 27 July 2005. On 4 April 2006, the

Company changed its name from Asia Retail Consumer Holdings Limited

to ARC Capital Holdings Limited.

The Company is a closed-end investment company trading on the

AIM Market of the London Stock Exchange. The Company's principal

investment objective is to provide its shareholders with capital

appreciation by investing in listed and unlisted companies in the

retail, consumer goods and consumer service sectors principally in

China and in neighbouring Asian countries. The Company finances

these companies for expansion through buy-outs, pre-IPO

opportunities and other equity and mezzanine securities.

The Company was managed by ARC Capital Partners Limited (the

"Investment Manager") until 7 August 2014. The Investment Manager

was responsible for the day-to-day management of the Company's

investment portfolio, including, subject to approval by the

Investment Committee which is appointed by the Investment Manager

and approved by the Company's Board of Directors, the day-to-day

acquisition and disposal of investments in accordance with the

Company's investment objective and policies. On 7 February 2014,

the Investment Manager provided written notice of its resignation,

and its investment management agreement with the Company ended on 7

August 2014, following the conclusion of its 6 month notice period.

As at the date of the report no replacement investment manager has

been appointed nor do the directors intend to make such an

appointment.

On 30 June 2015, the Company announced that it had requested the

suspension of its shares from trading on AIM, pending the

finalisation of its audited annual accounts for the financial year

ending 31 December 2014. Furthermore, on 14 August 2015, ARCH

announced that it had been notified by Grant Thornton UK LLP of its

resignation as Nominated Adviser effective 15 September 2015.

Pursuant to AIM Rule 1, ARCH shares will continue to be

suspended from trading on AIM until a new Nominated Adviser is

appointed. The Board of Directors continues its efforts to appoint

a replacement Nominated Adviser, however, if a replacement is not

found, the admission of ARCH's ordinary shares to trading on AIM

will be cancelled at 7.00 a.m. on 16 October 2015.

1 General (continued)

(b) Investment policy

(i) Change of investment policy

On 31 January 2012, Shareholders voted to change the Company

into a realisation vehicle. Accordingly, the Company's investment

policy has been changed permanently so that no new investments will

be made. The Company's ordinary shares, however, were to continue

to be admitted to trading on AIM.

(ii) Nature of returns to shareholders

All of the Company's existing investments will be realised in

the ordinary course of business. The net proceeds from realisations

will be returned to shareholders, after which the Company will be

wound up. The Company's realisation policy will not result in any

immediate or accelerated sales and investments will only be

realised when, in the opinion of the Board, an appropriate

opportunity presents itself.

(iii) Estimated time of divestment

The estimated time of divestment is between 2012 and 2015.

Prior to 31 January 2012, the Company's Investment Policy was as

follows:

(i) Geographical focus

At least 70% of the Company's gross assets will be invested in

China. Up to a maximum of 30% of the Company's gross assets may

also be invested in Greater China and other countries in Asia,

should the Board consider that such investments offer potentially

attractive returns. Any investment made in countries outside of

Greater China must be approved by the Board.

(ii) Target companies

The Company targets (i) late stage companies with growth, back

up or performance enhancement potential; and (ii) expansion stage

companies with proven management and significant growth

potential.

(iii) Sector focus

The Company invests primarily in listed and unlisted companies

engaged in retailing, providing services that support the retail

industry (such as consumer finance, distribution and logistics),

manufacturing or distributing consumer products or services,

developing or managing property with a focus on retailing, and

other retail and consumer-related firms.

1 General (continued)

(b) Investment policy (continued)

(iv) Types of investment

As a general principle, the Company can engage in all forms of

investment as allowed under the laws of each jurisdiction in which

it operates, utilising instruments and structures that may be

suitable to allow participation in selected investment

opportunities. The Company may invest in equity, quasi-equity or

debt instruments, which may or may not represent shareholding or

management control. Where the Board deems it appropriate, the

Company may also invest up to 20% of its net asset value in other

investment pools, which themselves invest in unlisted and listed

securities in the same target geographic regions and sectors as the

Company.

(v) Diversification limit

The Company aims to achieve a balance in its exposure to

different sectors. Furthermore, no single investment may at the

time of investment exceed 20% of the Company's net asset value.

2 Summary of significant accounting policies

These consolidated financial statements of the Company and its

subsidiaries (collectively "the Fund") are prepared in accordance

with accounting principles generally accepted in the United States

of America ("US GAAP"), which includes the application of the

provision of the AICPA Audit and Accounting Guide for Investment

Companies (the "Guide"). The following are the significant

accounting policies adopted in the preparation of these financial

statements.

(a) Use of estimates

The preparation of consolidated financial statements in

conformity with US GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at

the date of the consolidated financial statements and the reported

amounts of revenues and expense during the reporting period. Actual

results could differ from those estimates.

(b) Principles of consolidation

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

These consolidated financial statements include the financial

statements of the Company and its special purpose vehicles. Special

purpose vehicles ("SPVs") are consolidated from the date on which

control is transferred to the Fund and are deconsolidated from the

date that control ceases. Investments held by the SPVs are not

subject to consolidation and equity accounting as they are

non-investment company investees with the purpose to realise a gain

upon disposal rather than provide services to the Company.

Inter-company transactions and balances have been eliminated on

consolidation.

2 Summary of significant accounting policies (continued)

(c) Investments

(i) Recognition, derecognition and measurement

Regular purchase and sale of investments are accounted for on

the trade day, which is the day the trade is executed. All

investment securities are initially recognised at cost. Costs used

in determining net realised gains or losses on the sale of

investment securities are based on average-cost method. Legal and

due diligence fees and other charges associated with acquiring the

investments are capitalised as part of the cost of the investment

securities.

Transfer of investments is accounted for as a sale when the Fund

has relinquished control over the transferred assets. Any realised

gains or losses from investments are recognised in the consolidated

statement of operations.

Investments are subsequently carried at fair value and changes

in fair value are presented in the consolidated statement of

operations.

(ii) Fair value measurement

The Fund is an investment company under the Guide. As a result,

the Fund records its investments in the consolidated statement of

assets and liabilities at their fair value, with unrealised gains

and losses resulting from changes in fair value recognised in the

consolidated statement of operations.

Fair value is the amount that would be received to sell the

investments in an orderly transaction between market participants

at the measurement date (i.e. the exit price). Fair value of

investments is determined by the Valuation Committee, which is

established by the Board of Directors.

The Valuation Committee uses its best judgement in estimating

fair value. In determining the fair value, the Valuation Committee

engages third party valuation agents to assist in the selection of

valuation techniques and models. However, there are inherent

limitations in any valuation technique due to the lack of

observable inputs. Estimated fair values may differ significantly

from the values that would have been used had a ready market

existed for the securities, and the differences could be material

to the financial statements. Additional information about the level

of market observability associated with investment carried at fair

value is disclosed in Note 3.

2 Summary of significant accounting policies (continued)

(d) Fair value hierarchy

Generally accepted accounting principles establish a fair value

hierarchy that prioritises inputs to measure fair value. The

hierarchy gives the highest priority to unadjusted quoted prices in

active markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable input (Level

3 measurements).

The three levels of the fair value hierarchy are described

below:

Level 1: Inputs to measure fair values are unadjusted quoted

prices in active markets that are accessible at the measurement

date for identical, unrestricted assets or liabilities;

Level 2: Inputs to measure fair values are quoted prices in

markets that are not active, quoted prices for similar assets or

liabilities in active markets, or prices or valuations for which

all significant inputs are observable, either directly or

indirectly;

Level 3: Inputs to measure fair values are both significant to

the fair value measurement and unobservable.

Inputs to measure fair values broadly refer to the assumptions

that market participants use to make valuation decisions, including

assumptions about risk. Inputs may include price information,

volatility statistics, specific and broad credit data, liquidity

statistics, and other factors. An asset or liability's level within

the fair value hierarchy is based on the lowest level of any input

that is significant to the fair value measurement. However, the

determination of what constitutes "observable" requires significant

judgment. The Valuation Committee considers observable data to be

such market data which is readily available, regularly distributed

or updated, reliable and verifiable, not proprietary, and provided

by multiple, independent sources that are actively involved in the

relevant market. The categorisation of an asset or liability within

the hierarchy is based upon the pricing transparency of the asset

or liability and does not necessarily correspond to the Valuation

Committee's perceived risk of that asset or liability.

Securities traded on a securities exchange are stated at the

last reported sales price on the day of valuation. To the extent

these securities are actively traded and valuation adjustments are

not applied, they are categorised in Level 1 of the fair value

hierarchy. Preferred stock and other equities traded on inactive

markets or valued by reference to similar instruments are

categorised in Level 2.

Restricted securities for which quotations are not readily

available are valued at fair value as determined by the Valuation

Committee. Restricted securities issued by publicly traded

companies are generally valued at a discount to similar publicly

traded securities. Depending on the relative significance of

valuation inputs, these instruments may be classified in either

Level 2 or Level 3 of the fair value hierarchy.

2 Summary of significant accounting policies (continued)

(d) Fair value hierarchy (continued)

Investments are classified within Level 3 of the fair value

hierarchy if they are traded infrequently and therefore have little

or no price transparency. Such assets and liabilities include

unlisted equities and convertible bonds. Their fair values are

estimated with reference to the valuation techniques recommended by

the International Private Equity and Venture Capital Valuation

Guidelines. Valuation methodologies utilised by the Valuation

Committee include but are not limited to comparable transactions or

performance multiples, latest round of financing, discounted cash

flow, and are supported by independent valuations of underlying

assets. The selection of appropriate valuation techniques may be

affected by the availability of reliable inputs. In some cases, one

valuation technique may provide the best indication of fair value

while in other circumstances, multiple valuation techniques may be

appropriate. Once an appropriate valuation methodology is

determined for an asset or liability, it will continue to be used

until a more appropriate method is determined.

(e) Cash and cash equivalents

Cash and cash equivalents comprise cash at banks placed with

reputable banking institutions with an original maturity of less

than three months.

(f) Income and expenses

Dividend income is recognised on the ex-dividend date with the

corresponding foreign withholding taxes recorded as an expense.

Withholding taxes on dividends have been provided for in accordance

with the Fund's understanding of the applicable country's tax rules

and rates.

Interest income and all the expenses are accounted for on an

accruals basis. Offering costs are charged to the Company's share

premium account upon the issuance of shares.

(g) Foreign currency translation

Assets and liabilities denominated in foreign currencies are

translated into US$ at the rates of exchange ruling at the

reporting date. Income and expenses denominated in foreign

currencies during the year are translated into US$ at the rates of

exchange ruling at the transaction dates. All exchange differences

arising are included in the consolidated statement of

operations.

The Fund does not isolate that portion of the results of

operations resulting from changes in foreign currency exchange

rates on investments from the fluctuations arising from changes in

market prices of securities held. Such fluctuations are included

with the net realised and unrealised gain or loss from

investments.

2 Summary of significant accounting policies (continued)

(g) Foreign currency translation (continued)

Net realised foreign exchange gains or losses arise from sales

of foreign currencies, currency gains or losses realised between

the trade and settlement dates on securities transactions, and the

difference between the amounts of dividends, interest, and foreign

withholding taxes recorded on the Fund's books and the US$

equivalent of the amounts actually received or paid. Net unrealised

foreign exchange gains and losses arise from changes in the fair

values of assets and liabilities, other than investments in

securities at fiscal period end, resulting from changes in exchange

rates.

If a subsidiary's functional currency is a foreign currency,

translation adjustments result from the process of translating that

entity's financial statements into the reporting currency.

Translation adjustments shall not be included in determining net

income but shall be reported separately and accumulated in a

separate component of equity.

(h) Income taxes

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

Income taxes are accounted for under the asset and liability

method. Deferred tax assets and liabilities are recognised for the

future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and

liabilities and their respective tax bases and operating loss and

tax credit carry forwards. Deferred tax assets and liabilities are

measured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are

expected to be recovered or settled. The effect on deferred tax

assets and liabilities of a change in tax rates is recognised in

the consolidated statement of operations in the period that

includes the enactment date.

The Fund has adopted the authoritative guidance contained in

FASB ASC 740 on accounting for and disclosure of uncertainty in tax

positions, which requires management to determine whether a tax

position of the Fund is more likely than not to be sustained upon

examination, including resolution of any related appeals or

litigation processes, based on the technical merits of the

position. For tax positions meeting the more likely than not

threshold, the tax amount recognised in the consolidated financial

statements is reduced by the largest benefit that has a greater

than 50% likelihood of being realised upon ultimate settlement with

the relevant tax authority. Prior to the adoption of Interpretation

48, the Fund recognised the effect of income tax positions only if

such positions were probable of being sustained.

2 Summary of significant accounting policies (continued)

(i) Share Capital

Ordinary shares are classified as equity. Where any group

company purchases the Company's equity share capital (tendered

shares), the consideration paid, including any directly

attributable incremental costs (net of income taxes) is deducted

from equity attributable to the Company's equity holders until the

shares are cancelled or reissued. Where such ordinary shares are

subsequently reissued, any consideration received, net of any

directly attributable incremental transaction costs and the related

income tax effects, is included in equity attributable to the

Company's equity holders. The holders of tendered shares have no

voting and participation rights.

3 Securities valuation

The following table summarises the changes in fair value of the

Fund's instruments by captions:

Investments Investments Investments

-common -loan -option Total

stock

US$ US$ US$ US$

As at 30 June

2015

Level 1 - - - -

Level 2 - - - -

Level 3 - 7,360,639 - 7,360,639

Total investments - 7,360,639 - 7,360,639

========== =========== =========== ===========

Investments Investments Investments

-common stock -loan -option Total

US$ US$ US$ US$

As at 31

December

2014

Level 1 - - - -

Level 2 - - - -

Level 3 - 7,354,143 - 7,354,143

Total investments - 7,354,143 - 7,354,143

=========== =========== =========== ===========

3 Securities valuation (continued)

The following is a reconciliation of investments for which Level

3 inputs were used in determining fair value:

Investments Investments Investments

-common -loan -option Total

stock

US$ US$ US$ US$

As at 1 January

2014 149,517,000 15,856,566 - 165,373,566

Proceeds from

sales (57,130,390) - - (57,130,390)

Net unrealised

loss on investments (106,113,753) (8,502,423) - (114,616,176)

Net realised

gain on sale

of investments 13,727,143 - - 13,727,143

As at 31 December

2014 - 7,354,143 - 7,354,143

=========== ========== ========== ==========

Net unrealised

gain on investments - 6,496 - 6,496

As at 30 June

2015 - 7,360,639 - 7,360,639

=========== ========== ========== ==========

The following table summarises the net unrealised loss on

investment before tax included in consolidated statement of

operations attributable to Level 3 instruments still held as at 30

June 2015 by caption:

30 June 31 December

2015 2014

Net unrealised gain/(loss) before US$ US$

tax

Investments - common stock - (90,915,753)

Investments - loan 6,496 (8,502,423)

6,496 (99,418,176)

Total ============ ============

3 Securities valuation (continued)

The following table summarises quantitative information about

the valuation techniques and the significant unobservable inputs

used for Level 3 investments:

Fair value

at Significant

30 June Valuation Unobservable

Industry/Type 2015 methodology inputs Inputs

US$

Mobile phone - Recent transaction Not applicable Not applicable

retail(i)

Education(ii) - Recent transaction Not applicable Not applicable

Cost less

Loan receivable(iii) 7,360,639 discount Discount 55%

7,360,639

===========

Fair value Significant

at 31 December Valuation Unobservable

Industry/Type 2014 methodology inputs Inputs

US$

Mobile phone - Recent transaction Not applicable Not applicable

retail(i)

Education(ii) - Recent transaction Not applicable Not applicable

Cost less

Loan receivable(iii) 7,354,143 discount Discount 55%

7,354,143

===========

Note:

(i) Fortress Group Limited

On 31 March 2014 ARCH announced that ARCH Digital Holdings

Limited ("ARCH Digital"), a wholly owned subsidiary of ARCH, had

entered into certain definitive agreements to sell, subject to

shareholder approval, its entire equity stake in Fortress Group

Limited ("Fortress") for a minimum cash consideration of US$137.3

million. Fortress was the 100% shareholder of Funtalk China

Holdings Limited ("Funtalk"). The proposed buyer was Sanpower Group

Co. Ltd. ("Sanpower"). The sale of Fortress was approved at the

ARCH extraordinary general meeting, held on 16 May 2014, but did

not progress to completion as the conditions precedent were not

satisfied. Fortress subsequently entered into an agreement for the

sale of its 100% equity interest in Funtalk ("Fortress Sale").

(i) Fortress Group Limited (continued)

On 27 August 2014, subsequent to the Fortress Sale, ARCH Digital

received a letter from Fortress, which enclosed a notice addressed

to Fortress dated 25 August 2014 (the "Put Option Notice") issued

by PAGAC Fortress Holding I Limited ("PAGAC"), a company affiliated

with PAG, of the exercise by PAGAC of the put option (the "Put

Option") referred to in the shareholder agreement, dated 25 August

2011, that ARCH Digital had entered into at the time of the

privatisation of Funtalk (the "Shareholder Agreement"). If Fortress

did not consummate an exit of Funtalk by 25 August 2014 then PAGAC

would have the right to require Fortress to repurchase PAGAC's

holding in the preferred shares and convertible bonds issued by

Fortress. If Fortress was unable to perform its obligation under

the Put Option, the requirement to repurchase PAGAC's preferred

shares and convertible bonds fell to the shareholders of Fortress,

other than PAGAC, pro-rata, including ARCH Digital.

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

On 2 September 2014, the Fortress Board resolved to repurchase

all of the convertible bonds and 2,093 out of the 4,999 preferred

shares at a cost of approximately US$250 million. Subsequently, on

3 September 2014, ARCH Digital received a notice from PAGAC

notifying ARCH Digital that Fortress had failed to pay the entire

put price with respect to the Put Option and that PAGAC was

exercising its right pursuant to the Shareholder Agreement to

require that ARCH Digital purchase its pro rata portion of the put

securities that were not purchased by Fortress (the "ARCH Digital

Put Option"). The notice relating to the ARCH Digital Put Option

(the "ARCH Digital Put Option Notice") further stated that the

unpaid Put Option price attributable to ARCH Digital was

US$52,322,284, and that ARCH Digital was required to pay this

amount within 10 business days, i.e. no later than 17 September

2014.

ARCH Digital did not have the necessary cash or liquid assets to

pay the unpaid Put Option price attributable to ARCH Digital as

required in the ARCH Digital Put Option Notice. ARCH Digital had,

by a share charge agreement dated 25 August 2011 (the "Share Charge

Agreement"), conferred on PAGAC a security interest over ARCH

Digital's equity holding in Fortress (the "Charged Assets") to

secure, among other things, ARCH Digital's performance of its

obligations under the Shareholder Agreement. If ARCH Digital failed

to perform its obligations under the Shareholder Agreement,

including its obligation with respect to the ARCH Digital Put

Option, PAGAC could enforce its security under the Share Charge

Agreement, including, but not limited to, to receive and retain all

dividends, interest, distributions or assets accruing in respect of

the Charged Assets, and to sell, transfer, grant options over or

otherwise dispose of the Charged Assets. All money received by

PAGAC under the Share Charge Agreement was to be paid in accordance

with that agreement, including towards satisfaction of any amounts

in respect of ARCH Digital's obligations under the Shareholder

Agreement. Any surplus remaining following payment under the Share

Charge Agreement was to be repaid to ARCH Digital.

3 Securities valuation (continued)

(i) Fortress Group Limited (continued)

ARCH Digital did not pay the US$52,322,284 to PAGAC by 17

September 2014 and has not made any payments to PAGAC since the

ARCH Digital Put Option Notice was received from PAGAC on 3

September 2014.

As at 30 June 2015, the Board estimates the fair value of the

investment at nil due to the Put Option raised against ARCH

Digital.

(ii) Shaanxi Da De Education

On 23 November 2013, ARCH entered into a definitive agreement

(the "Framework Agreement") to sell its entire stake in Shannxi Da

De Education for RMB165.2 million (approximately US$27.1

million).

On 1 December 2013, ARCH received an initial payment of RMB75.1

million (approximately US$12.3 million), and was expecting to

receive a final payment of RMB90.1 million (US$14.8 million) no

later than 10 December 2014 to complete the sale. The final payment

has not been received. As a result of the default, pursuant to the

agreement, ARCH Education has the right to: a) Request that the

buyers continue to fulfil their obligations under the Framework

Agreement, or b) Unilaterally terminate the Framework Agreement,

request that the buyers pay contractual overdue penalty of RMB55m

(US$8.9m) and, amongst other parties, ARCH and buyer shall to be

bound by the original investment agreement (the "Original

Investment Agreement") signed on 28 May 2008.

ARCH has commenced legal action in China to pursue recovery of

the amount outstanding and, based upon legal advice received, has

treated the initial payment of RMB 75.1 million (approximately

US$12.3 million) as a payment under the Original Investment

Agreement.

As at 30 June 2015, it was decided by the Board to recognise the

initial deposit received as return of equity and the Board

estimated the fair value of the investment at nil due to the

uncertainty of the recoverability of any future amounts, the timing

of any future receipts even if the outcome of the legal action is

favourable.

3 Securities valuation (continued)

(iii) Loan to DCSI

On 26 August 2013, DCSI negotiated and signed a loan extension

agreement with ARCH that the repayment date is extended to 30 June

2014. The condition for the extension is that DCSI needs to pay

RMB$1M first (part of interest expense). The interest rate is at

8%.

On 30 June 2014, the date that DCSI was granted the extension

to, DCSI has failed to repay the loan. In November 2014, the Board

decided to commence legal action against DCSI in respect of the

overdue loan. On 4 November 2014, a demand letter was sent by the

Company's lawyer but no response has been received from DCSI to

date.

As at 30 June 2015, it was decided by the Board for the write

down of 55% on the investment due to the uncertainty of the

recoverability of the loan, the timing of the repayment and timing

of the outcome of the legal action to remain unchanged.

4 Investment management fee and realisation fee

The Investment Manager was previously entitled to receive an

investment management fee of 2% per annum of the Fund's net asset

value ("NAV") calculated at the beginning of each quarter based on

the average month end NAV of the Fund of the previous quarter and

payable in advance.

From 31 January 2012, the investment management fee was reduced

from 2% to 1% per annum of the Fund's NAV. On 7 February 2014, the

Investment Manager provided written notice of its resignation, and

its investment management agreement ended on 7 August 2014,

following the conclusion of its 6 month notice period.

For the period ended 30 June 2015, the Fund incurred an

investment management fee of US$nil(2014: US$1,078,756), US$606,355

was payable as at 30 June 2015 (2014: US$606,355).

With effect from 31 January 2012, as an incentive to realise the

best possible exit value for the Fund's assets, the Investment

Manager became entitled to receive a realisation fee equal to a

percentage of the net proceeds received by the Fund on the

realisation of each asset (the "Fee Percentage"), to be paid once

the "Company Realisation Value" (being the aggregate net proceeds

received by the Fund on the disposal of the assets) exceeds the

Fund's audited NAV at 31 December 2011. For assets realised in

2013, the Fee Percentage shall be 2.52%, and this will reduce to

2.268% for assets realised in 2014. Thereafter, the Fee Percentage

shall continue to reduce by 10% per annum until the Fund's last

asset is realised. Following its resignation, the Investment

Manager is no longer entitled to any realisation fees.

4 Investment management fee and realisation fee (continued)

On 20 March 2014, Borrelli Walsh Limited ("Borrelli Walsh") was

appointed as a consultant to the Board, with a mandate of providing

independent oversight of the Fund's portfolio and guidance to the

Fund's directors. Borrelli Walsh resigned, effective 15 April

2015.

For the period ended 30 June 2015, the Fund has not accrued a

realisation fee (Nil for the period ended 30 June 2014).

5 Directors' remuneration and expense reimbursement

The Company pays each of its directors an annual fee of

US$29,999, and an additional US$10,000 per annum for chairing any

committee of the Board and an additional US$5,000 per annum for

serving as a regular member of any committee of the Board.

In February 2015, the Company entered into separate 1-year

consulting service agreements with Sean Hurst and Alpay Ece.

Consulting fees are subject to a maximum of US$40,000 each per

annum.

6 Current and deferred income taxes

(a) No provision for Cayman Islands taxes are provided as the

Fund is not currently subject to income tax in the Cayman Islands.

The Fund has obtained an undertaking from the Governor in Cabinet

of the Cayman Islands that for a period of 20 years from 9 August

2005 that:

- no law which is thereafter enacted in the Cayman Islands

imposing any tax to be levied on profits, income, capital gains or

appreciations shall apply to the Fund or its operations; and

- no aforesaid tax or withholding tax, nor estate duty or

inheritance tax shall be payable on or in respect of the share

debentures or other obligations of the Fund.

(b) The Fund may be subject to taxes imposed in other countries

in which it invests. Such taxes are generally based on income

and/or gains generated. Dividend and interest income received by

the Fund may be subject to withholding tax imposed in the country

of origin. This income is recorded gross of such taxes and the

withholding tax, if any, is recognised separately in the

consolidated statement of operations.

The Board has reviewed the structure of the Fund's investment

portfolio and considered the Fund's exposure to Hong Kong and China

profits tax has been properly reflected in the Fund's consolidated

financial statements.

7 Investment deposits

In December 2007, the Fund transferred US$13.6 million to Orient

Group Industrial Co. Ltd. ("Orient Group") as an investment

deposit. In December 2011, the Fund recognised an impairment of

US$2.2 million for the deposit resulting from the intention to

offset the US$11.4 million payable balance included in other

payables.

In December 2010, the Fund transferred US$76.2 million (or

RMB480 million) to Orient Home Company Ltd ("Orient Home"), a

controlled affiliate of Orient Group to invest in Orient Home's

real estate portfolio under the Equity Purchase Agreement dated 10

December 2010 (the "Agreement"). Orient Home failed to fulfil the

terms of the Agreement, and the Fund has not received any repayment

from Orient Home as of the date of this announcement. The Board had

recognised an impairment of US$22.9 million for this investment

deposit in December 2012, representing approximately 30% of the

investment deposit.

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

In May 2013, the Fund's PRC investment vehicle filed a Request

for Arbitration with the China International Economic and Trade

Arbitration Commission ("CIETAC") with respect to the investment

deposit, and in July 2013 was granted an asset preservation order

against Orient Home by the Beijing First Immediate People's Court.

The order has legally preserved a 14% equity interest in Beijing

Taiyanghuo Culture Industry Investment Co., Ltd, which is an equity

investment of Orient Home. The 14% equity interest was believed at

the time to be equivalent to RMB280 million of registered capital.

The Fund was able to obtain the preservation order for RMB280

million with a guarantee obtained from a guaranteeing company,

including pledging certain assets of the Company amounting to

RMB16.8 million (or US$2.8 million) to the guaranteeing company

(see note 9(c)).

Taking account of the face value of the asset preservation order

and the development of the arbitration, further impairment

provision of RMB86 million (US$14.1 million) was made in 2013 to

write down the carrying amount of the investment deposits to RMB250

million (US$41.0 million).

On 16 June 2015, CIETAC ruled that the Orient Home Group shall

be required to refund Shanghai C.P. Jing Cheng Enterprise

Development Co. Ltd. ("Shanghai CP JC") (a subsidiary of ARCH) the

entire RMB480 million deposit (equivalent to approximately US$77.3

million) relating to the acquisition of a majority stake in Orient

Home Industrial Co., Ltd ("Orient Home Property") in December 2010.

CIETAC also ruled that the Orient Home Group shall pay Shanghai CP

JC late payment interest calculated from 5 March 2011 to the actual

payment date, applying the lending interest over the same period as

published by the People's Bank of China, as well as the arbitration

fee of approximately RMB4.4 million (equivalent to approximately

US$0.7 million).

The carrying value of the investment included within ARCH's NAV

as at 31 December 2014 was RMB 250 million (approximately US$41

million), and the Board has resolved to keep this unchanged as at

30 June 2015. See note 17(b) for subsequent events on the

investment deposit with Orient Home.

8 Impairment loss

30 June 30 June

2015 2014

US$ US$

Provision on loan interest receivable

(Note 16(a)) - 2,401,566

Provision on Jiadeli sale proceeds

and dividends (Note 9(a)) _______- 4,211,415

Total impairment loss - 6,612,981

= ========== ===========

9 Other assets

At 30 June 2015 and 31 December 2014, other assets were as

follows:

30 June 31 December

2015 2014

US$ US$

Jiadeli sale proceeds and

dividends (Note 9(a)) - 15,198,562

Properties (Note 9(c)) 2,469,903 2,467,723

Goodbaby private tax escrow

(Note 9(b)) 1,879,000 1,879,000

Others 2,005,127 1,926,560

Total other assets 6,354,030 21,471,845

========== ===========

(a) The Fund sold its entire interest in Shanghai Jiadeli

Supermarket Co., Ltd ("Jiadeli") for RMB1.1billion, with RMB100

million of the consideration withheld by the purchaser for any

post-closing adjustment to the purchase price. Adjustments to the

total purchase price, if any, shall not exceed RMB100 million and

can only be claimed from the withheld amount.

As part of the sale of Jiadeli, it was agreed that a holdback of

RMB100 million would be paid to the Fund 12 months after closing,

subject to adjustments based on the result of a post-closing audit

by the purchaser. The Fund and the purchaser could not agree on the

result of the closing audit. In accordance with the sale and

purchase agreement an independent third-party mediator was

appointed by both parties to resolve the dispute.

In May 2013, the Fund's PRC investment vehicle filed a Request

for Arbitration with CIETAC. A total of 75% impairment was made

against the holdback payment amount as at 31 December 2013, and a

further 25% impairment was made against the holdback payment amount

in March 2014.

9 Other assets (continued)

On 20 April 2015, it was announced that Beijing Second

Intermediate Court had rejected the HNA Group's claim to set aside

the arbitral award in respect of the Jiadeli holdback and a net

RMB81.8 million (equivalent to approximately US$13 million) has

been paid by HNA Group on 12 June 2015. As a consequence of the

receipt, it was decided by the Board to adjust the carrying value

of the Fund as at 31 December 2014. As a result, the total

impairment loss of RMB93 million (equivalent to approximately

US$15.2 million) made previously was written back as of 31 December

2014.

The Board has reached agreement with HNA Group whereby HNA Group

has paid the full amount of the claim (approximately RMB 90

million) plus costs of RMB 3 million. In return, the Company has

waived the interest due under the CIETAC award of 3 June 2014. RMB

93 million was paid by HNA Group to ARCH in China on 12 June 2015

and, after settlement of outstanding fees and expenses (including a

contingency fee of approximately RMB11 million payable to Fund's

Chinese legal counsel under an agreement entered into on 10

December 2013), has resulted in the Fund receiving a net amount of

RMB 81.8 million (equivalent to approximately US$ 13 million),

before any taxes payable in China.

(b) On 11 December 2013, the Fund completed the sale of its

entire holding in Goodbaby Private, a total of approximately US$6.8

million was realised of which approximately US$1.9 million was

deposited as the tax escrow based on the escrow agreement signed on

9 December 2013.

(c) The properties are pledged as part of the guarantee required

to secure the preservation order of RMB280 million as described in

Note 7.

10 Cash and cash equivalents

Cash and cash equivalents at 30 June 31 December

30 June 2015 consisted of: 2015 2014

US$ US$

US$ 16,992,109 18,840,179

RMB 25,895,667 12,839,809

HK$ 374 506

Total cash and cash equivalents 42,888,150 31,680,494

=========== ===========

11 Other payables

At 30 June 2015, other payables and accruals were as

follows:

30 June 31 December

2015 2014

US$ US$

Payable for an investment

(Note 7) 11,391,326 11,391,326

Fortress put option liability

(Note 11(b)) 70,052,278 57,757,715

Other creditors 1,531,920 3,107,661

Total other payables and

accruals 82,975,524 72,256,702

========== ==========

a) On 23 November 2013, the Fund entered into a definitive

agreement to sell its entire stake in Shaanxi Da De Education. The

Fund has received an initial deposit of RMB75.1 million

(approximately US$12.3 million) as at 31 December 2013. The Fund

expected to receive a final payment of RMB90.1 million (US$14.8

million) no later than 10 December 2014 to complete the sale. As at

31 December 2014, it was decided by the Board to recognise the

initial deposit received as return of equity and the Board

estimated the fair value of the investment at nil. The final

payment has not been received by the fund as at 30 June 2015.

b) In August 2011, ARCH Digital Holdings Limited ("ARCH

Digital"), a wholly owned subsidiary of the Fund entered into a

shareholder agreement with Fortress Group Limited ("FGL") at the

time of the privatisation of Funtalk China Holdings Limited

("Funtalk"). In accordance with the shareholder agreement, PAGAC

Fortress Holding I Limited ("PAGAC") issued a notice on 25 August

2014 to exercise its right and option to require FGL as a

purchasing shareholder to repurchase PAGAC's holding in the

preferred shares and convertible bonds issued by FGL. If FGL was

unable to perform its obligation under the put option, the

requirement to repurchase PAGAC's preferred shares and convertible

bonds fell to the shareholders of FGL, other than PAGAC, pro-rata,

including ARCH Digital.

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

The exercise of the put option by PAGAC means that ARCH

Digital's liabilities exceed its assets even though the Fortress

investment has been written down to nil. While the final terms and

consideration for Fortress's sale of Funtalk, and the payment

covered by Fortress to PAGAC for the put option, are not known to

the Board, the Board has decided to recognise the liability of

approximately US$70.1 million under the current accounting

policies. See note 3(i) for details of put option liabilities in

relation to Fortress Group Limited investment.

12 Share capital, share premium and tendered shares

Number Share Share Tendered

of shares capital Premium Shares Total

outstanding US$ US$ US$ US$

As at 1 January

2014 261,082,738 2,610,827 354,042,331 - 356,653,158

Share repurchase

and cancellation (32,941,172) (329,411) (27,670,585) - (27,999,996)

As at 31 December

2014 228,141,566 2,281,416 326,371,746 - 328,653,162

========= ========== ========== ========== ==========

As at 30 June

2015 228,141,566 2,281,416 326,371,746 - 328,653,162

========= ========== ========== ========== ==========

On 31 January 2014, 32,941,172 ordinary shares were repurchased

and cancelled by the Company at a price of US$0.85 per share,

representing approximately 12.6% of the Company's ordinary shares

in issue. The shares were repurchased for a total consideration of

approximately US$28 million.

Following the repurchase and cancellation, the Company has a

total of 228,141,566 ordinary shares in issue as at 30 June

2015.

At 30 June 2015, the total authorised number of ordinary shares

was 500,000,000 (31 December 2014: 500,000,000) with par value of

US$0.01 (31 December 2014: US$0.01) per share.

13 Concentration of market, industry, credit, foreign exchange and liquidity risks

The Fund's activities (including both investments and loans) may

expose it to a variety of risks: mainly market risk, industry risk,

credit risk, foreign exchange risk and liquidity risk.

(a) Market risk

Market risk is the risk that the value of a financial instrument

will fluctuate as a result of changes in market variables such as

interest, foreign exchange rates and equity prices, whether those

changes are caused by factors specific to the particular security

or factors that affect all securities in the markets. Investments

are typically made with a specific focus on Greater China and thus

are concentrated in that region. Political or economic conditions

and the possible imposition of adverse governmental laws or

currency exchange restrictions in that region could cause any of

the Fund's investments and their markets to be less liquid and

prices more volatile. The Fund is exposed to market risk on all of

its investments.

13 Concentration of market, industry, credit, foreign exchange

and liquidity risks (continued)

(b) Industry risk

The Fund's investments may be concentrated in a particular

industry or sector and performance of the particular industry or

sector may have a significant impact on the Fund.

The Fund's investments may also be subject to the risk

associated with investing in private equity securities. Investments

in private equity securities may be illiquid, can be subject to

various restrictions on resale and there can be no assurance that

the Fund will be able to realise the value of such investments in a

timely manner.

(c) Credit risk

Credit risk is the risk that an issuer/counterparty will be

unable or unwilling to meet its commitments to the Fund. Financial

assets that are potentially subject to significant credit risk

consist of cash and cash equivalents, investments in convertible

bonds, investment deposits and receivables.

The maximum credit risk exposure of these items is their

carrying value.

(d) Currency risk

The Fund has assets and liabilities denominated in currencies

other than the US$, the functional currency. The Fund is therefore

exposed to currency risk as the value of assets and liabilities

denominated in other currencies will fluctuate due to changes in

exchange rates.

The table below summarises the Fund's net exposure to each

currency as at 30 June 2015 and 31 December 2014.

30 June 31 December

2015 2014

US$ US$

US$ (71,904,084) (57,006,052)

RMB 84,334,416 84,022,959

HK$ 374 506

Total 12,430,706 27,017,413

========== ==========

13 Concentration of market, industry, credit, foreign exchange

and liquidity risks (continued)

(e) Liquidity risk

The Fund is exposed to liquidity risk as the Fund's investments

are largely illiquid while the majority of the Fund's liabilities

are of short maturity. Illiquid investments include any securities

or instruments which are not actively traded on any major

securities market or for which no established secondary market

exists where the investments can be readily converted into cash.

Reduced liquidity resulting from the absence of an established

secondary market may have an adverse effect on the prices of the

Fund's investments and the Fund's ability to dispose of them where

necessary to meet liquidity requirements. As a result, the Fund may

be exposed to significant liquidity risk.

China currently has foreign exchange restrictions, especially in

relation to the repatriation of foreign funds. Any unexpected

foreign exchange control in China may cause difficulties in the

repatriation of funds. The Fund invests in China and is exposed to

the risk of repatriating funds out of China to meet its obligations

on a timely basis.

14 Related party transactions

(a) During the period, certain directors of the Company were

shareholders and directors of the former Investment Manager, which

provided investment management services to the Company and earned

an investment management fee and a realisation fee (Note 4).

(b) As at 30 June 2015, the former Investment Manager together

with its associated PAG Group entities held 114,272,413 ordinary

shares of the Company (2014: 114,272,413).

15 Financial highlights

(a) Per share operating performance

6 months 6 months ended

ended 30 June 2014

30 June 2015

US$ US$

Net asset value per share,

start of period 0.12 0.83

--------- ---------

Income from investment operations:

- net investment loss (0.07) (0.04)

- net realised and unrealised

loss on

investments and foreign currencies - (0.42)

Total from investment operations (0.07) (0.46)

--------- ---------

Net asset value per share,

end of period 0.05 0.37

===== =====

The net asset value per share is calculated based on the total

number of shares issued and outstanding excluding tendered shares

(Note 12).

(b) Ratios to average net assets and other supplemental information

6 months 6 months

ended ended

30 June 30 June 2014

2015

US$ US$

Ratio of net investment loss

to average net assets (71.3%) (4.6%)

====== ======

Ratio of expenses to average

net assets

Operating expenses before

incentive fees(1) (71.5%) (4.6%)

Incentive fees (2) 0.0% 0.0%

Total expenses (71.5%) (4.6%)

====== ======

Cumulative internal rate of return ("IRR")

since

inception through the year

end (2) (14.5%) (9.7%)

====== ======

Note:

1. The operating expenses before incentive fees include put

option provision of US$12,294,563. If the put option provision is

excluded, the ratio of expenses to average net assets is

(11.69%).

2. The IRR is computed net of all incentive fees (being

performance fees and realisation fees as defined in the Investment

Management Agreement entered into between the Company and the

Investment Manager dated 20 June 2006, as amended on 1 April 2009

and 31 January 2012) based on the Fund's actual dates of the cash

inflows (capital contributions), outflows (cash and stock

distributions) and the ending NAV at the end of the year (residual

value) as of each measurement date.

16 Investment Update

(a) Loan with a Domestic China Strategic Investor (DCSI)

(MORE TO FOLLOW) Dow Jones Newswires

October 14, 2015 11:24 ET (15:24 GMT)

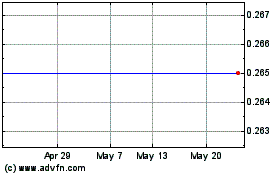

Arc Capital (LSE:ARCH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Arc Capital (LSE:ARCH)

Historical Stock Chart

From Dec 2023 to Dec 2024