TIDMAVCT

RNS Number : 9119N

Avacta Group PLC

28 September 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via a

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

28 September 2023

Avacta Group plc

("Avacta", the "Group" or the "Company")

Interim Results for the Period Ending 30 June 2023

A period of substantial clinical progress and continued

growth

Avacta Group plc (AIM: AVCT), a life sciences company focused on

improving healthcare outcomes through targeted cancer treatments

and diagnostics, is pleased to announce its unaudited interim

results for the six months ending 30 June 2023 ("H1 2023").

Operating highlights

Therapeutics Division - Encouraging clinical progress with

AVA6000 and strong preclinical progress with other programmes

-- Avacta's lead pre|CISION(TM) programme, AVA6000, a tumour

microenvironment activated form of a chemotherapeutic agent,

doxorubicin, made significant progress in a Phase 1 a clinical

trial (ALS-6000-101) during H1 2023, with an excellent safety

profile continuing to be observed through the dose cohorts as

detailed in the Company's announcements.

-- Expansion of dosing into the US under the Group's

Investigational New Drug Application in Avacta's Phase 1

multi-centre trial.

-- Post period, the sixth dose cohort (310 mg/m(2) ) was

successfully completed and escalation to the seventh and final

cohort (385 mg/m(2) ) was approved in September, with a significant

reduction in tumour volume confirmed in a patient with soft tissue

sarcoma.

o In light of the highly positive Phase 1a data, the Company has

adapted its clinical development strategy with the aim of bringing

forward the start of a potentially pivotal Phase 2 study, subject

to receiving the necessary regulatory approvals.

-- Preclinical data regarding AVA3996, the second pre|CISION(TM)

programme, a tumour targeted proteasome inhibitor, were presented

at the American Association of Cancer Research Annual Meeting in

April, supporting confidence in the potential of this molecule to

restrict tumour growth.

-- AffyXell Therapeutics ("AffyXell"), the joint venture between

Avacta and Daewoong Pharmaceutical ("Daewoong") continued to

progress well with the triggering of a second milestone payment.

This will result in an increase in Avacta's shareholding in

AffyXell to approximately 25% from its current 19%, which will be

determined when a formal valuation has been completed as was done

for the first milestone payment.

-- Avacta's Board of Directors has been strengthened with the

appointment of Shaun Chilton as Non-Executive Director in June

2023.

Diagnostics Division - Second acquisition in M&A-led growth

strategy completed and integration progressing well

-- The Group continues to pursue an M&A-led growth strategy

for the Diagnostics Division to support the building of an in-vitro

diagnostics product portfolio for professional use, including those

against infectious respiratory diseases.

-- Avacta's Diagnostics Division completed the acquisition of

Belgium-based Coris Bioconcept SRL on 1 June 2023, for an upfront

consideration of GBP7.3 million with an earnout based on future

business performance of up to GBP3.0 million payable in cash,

adding a broad range of marketed professional-use rapid tests to

the Division:

o This acquisition supports the strategy of acquiring commercial

routes into the diagnostics market and appropriate IP-rich product

portfolios, complementing the acquisition of Launch Diagnostics in

October 2022 has been successfully integrated into the Diagnostics

Division .

o Adjusted EBITDA loss (before non-cash and non-recurring items)

of the Diagnostics Division reduced to GBP0.4 million (H1 2022:

GBP2.6 million; year ended 31 December 2022: GBP5.1 million).

Financial highlights

-- Revenues increased to GBP11.9 million (H1 2022: GBP5.5

million; year ended 31 December 2022: GBP9.7 million).

-- Adjusted EBITDA loss (before non-cash and non-recurring

items) of GBP7.9 million (H1 2022: GBP5.4 million; year ended 31

December 2022: GBP15.1 million).

-- Operating loss from continuing operations of GBP11.9 million

(H1 2022: GBP9.6 million; year ended 31 December 2022: GBP32.6

million).

-- Reported loss from continuing operations of GBP11.5 million

(H1 2022: GBP9.0 million; year ended 31 December 2022: GBP39.5

million).

-- Loss per ordinary share from continuing operations of 4.3p

(H1 2022: 3.6p; year ended 31 December 2022: 15.5p).

-- Cash and short-term deposit balances at 30 June 2023 of

GBP26.0 million (30 June 2022: GBP17.0 million; 31 December 2022:

GBP41.8 million).

Outlook

The continuing success of AVA6000 in the Phase 1a clinical study

is important not only for the potential to improve outcomes for

patients with cancers suitable for treatment with doxorubicin, but

also as a validation of the pre|CISION(TM) platform more widely.

The Company aims to complete the AVA6000 three-weekly dose

escalation safety study and to provide a detailed data read-out

during Q4 2023.

In parallel, the Company will also initiate a fortnightly dosing

safety study in order to determine the dosing regimen for a Phase 2

registrational study in soft tissue sarcoma planned to start during

2024, in advance of previous estimates. Subject to positive data,

this could potentially bring the first pre|CISION(TM) targeted

chemotherapy to market for the benefit of patients with soft tissue

sarcoma towards the end of 2026.

The Company is progressing pre-clinical programmes based on both

the pre|CISION(TM) and Affimer (R) platforms and anticipates

providing detailed updates on these programmes in the coming

months.

The Group's Diagnostics Division is focused on the integration

of its first two acquisitions and finding synergies across the

enlarged division. The Group is aiming to grow the Diagnostics

Division organically and through geographical expansion into the

German market, with the near-term aim of achieving an overall

EBITDA positive position.

Dr Eliot Forster, Chairman of Avacta Group plc added:

"Targeting of cancer therapies to tumour tissue has been a long

sought after goal for many oncology drug companies, clinicians and

patients. There are many potent anti-cancer drugs, the

effectiveness of which is limited by the systemic toxicities and

lack of tolerability for patients.

"The clinical data emerging for our lead pre|CISION(TM) drug,

AVA6000, is ground-breaking. We are seeing a dramatic reduction in

the usual toxicities associated with anthracycline chemotherapy and

we have clear indications that doxorubicin is being released in

active form in the tumour microenvironment.

"Across the board we're proud and encouraged by the momentum

we're seeing in both divisions of this business and see huge

potential value both for patients and investors in the next

period."

Dr Alastair Smith, Chief Executive Officer of Avacta Group plc,

commented:

"I am delighted to report substantial progress across the board

as Avacta's two divisions execute on their strategies.

"In our Therapeutics Division, the pre|CISION(TM) platform is

doing exactly what it was designed to do - target the release of

active chemotherapy to the tumour tissue, minimising systemic

exposure and allowing for dosing at higher and potentially more

efficacious therapeutic levels. We are all hugely excited about its

potential to deliver profound improvements in cancer care for many

patients.

" Not only are the initial safety data emerging from the AVA6000

Phase 1 study, across all dose cohorts, remarkably good, but

targeted release of doxorubicin in the tumour has been confirmed

both by analysis of tumour biopsies and now by clear clinical

responses.

"Even at this early stage and in this patient group, we have a

confirmed, significant reduction in tumour volume in a patient with

soft tissue sarcoma, as well as other positive signals across a

number of patients. This excellent progress means that we are

aiming to accelerate the timetable for the start of the pivotal

Phase 2 efficacy study in soft tissue sarcoma into 2024.

" Avacta's Diagnostic Division also continues to grow and

provide more comprehensive capabilities. We have completed a second

acquisition, that of Coris Bioconcept, and I am very pleased with

the progress and integration of Coris and Launch Diagnostics as the

Division moves closer towards an EBITDA positive position."

For further information from Avacta Group plc, please

contact:

Avacta Group plc Tel: +44 (0) 1904 21 7070

Alastair Smith, Chief Executive www.avacta.com

Officer

Tony Gardiner, Chief Financial

Officer

Michael Vinegrad, Group Communications

Director

Stifel Nicolaus Europe Limited Tel: +44 (0) 207 710 7600

(Nomad and Joint Broker) www.stifel.com

Nicholas Moore / Nick Adams /

Samira Essebiyea / Nick Harland

/ William Palmer-Brown

Peel Hunt (Joint Broker)

James Steel / Chris Golden / Patrick www.peelhunt.com

Birkholm

ICR Consilium

Mary-Jane Elliott / Jessica Hodgson avacta@consilium-comms.com

/ Sukaina Virji

About Avacta Group plc - www.avacta.com

Avacta Group is a UK-based company focused on improving

healthcare outcomes through targeted cancer treatments and

diagnostics.

Avacta has two divisions: an oncology biotech division

harnessing proprietary therapeutic platforms to develop novel,

highly targeted cancer drugs, and a diagnostics division, which is

executing on an M&A led growth strategy to create a

full-spectrum diagnostics business focused on supporting healthcare

professionals and broadening access to testing. Avacta's two

proprietary platforms, Affimer(R) and pre|CISION(TM) underpin its

cancer therapeutics whilst the diagnostics division leverages the

Affimer(R) platform to drive competitive advantage in its

markets.

The pre|CISION(TM) platform modifies chemotherapy to be

activated only in the tumour tissue, reducing systemic exposure and

toxicity. This is achieved by harnessing an enzyme called FAP which

is highly upregulated in most solid tumours compared with healthy

tissues, turning chemotherapy into a "precision medicine". The lead

pre|CISION(TM) programme, AVA6000 a tumour activated form of

doxorubicin, is in Phase 1 studies and has shown dramatic

improvement in safety compared with standard doxorubicin, and early

signs of clinical activity.

Affimer(R) is a novel biologic platform which has significant

technical and commercial advantages compared with antibodies and is

used both to develop advanced immunotherapies and to improve the

performance of immunodiagnostics.

With a balanced business and capital allocation model: a

high-value oncology pipeline supported by a revenue generating,

fast-growing diagnostics business, Avacta seeks to create long-term

shareholder value alongside patient benefit.

To register for news alerts by email go to

www.avacta.com/investors/investor-news-email-alerts/

Chairman and Chief Executive Officer's Statement

Avacta Therapeutics Division Update

Avacta's Therapeutics Division aims to leverage its two

proprietary technology platforms, pre|CISION (TM) and Affimer(R) ,

to develop innovative oncology therapies that make a significant

difference to cancer patients' treatment experience and

outcomes.

AVA6000: a tumour-activated form of doxorubicin

Anthracyclines such as doxorubicin, a generic chemotherapy for

which the broader market is expected to grow to $1.38 billion by

2024, are widely used as part of standard of care in several tumour

types, but their dosing regimen and long-term use is limited by

severe systemic toxicities, in particular, by haematological

toxicities and cardiotoxicities.

Avacta's pre|CISION(TM) tumour-activation platform is designed

to reduce the systemic exposure of healthy tissues to the active

chemotherapy, leading to improved dosing regimens, improved safety

and tolerability for patients and better treatment outcomes.

The ALS-6000-101 Phase 1 clinical trial involves a

dose-escalation Phase 1 study in patients with locally advanced or

metastatic-selected solid tumours, known to be

FAP<ALPHA>-positive, in which cohorts of patients receive

ascending doses of AVA6000 initially at three-weekly intervals to

determine the maximum tolerated dose. For more information visit

www.clinicaltrials.gov (NCT04969835).

Doxorubicin is used as a monotherapy for the treatment of

soft-tissue sarcoma ("STS"), a relatively rare mesenchymal

malignancy which accounts for less than 1% of adult tumours.

Despite the successful advancement of localised therapies such as

surgery and radiotherapy, these tumours can recur, often with

metastatic disease. The American Cancer Society estimates that in

2022 approximately 13,190 new soft tissue sarcomas were diagnosed

and about 5,130 people were expected to die of the disease in the

US.

The Phase 1a three-weekly dose escalation study is being carried

out at several sites in the UK and United States and is now dosing

patients in the seventh and final dose escalation cohort at 385

mg/m(2) , which is approximately 3.5 times the normal dose of

doxorubicin.

The data emerging from the dose escalation study show an

excellent safety profile. In the first six completed dose cohorts,

AVA6000 has been well tolerated by patients, with a marked

reduction in the incidence and severity of the typical toxicities

associated with the standard doxorubicin chemotherapy

administration. Typical toxicities include alopecia,

myelosuppression, nausea, vomiting, mucositis and cardiotoxicity.

Importantly, even at the highest dosing levels, equivalent to

several-fold higher than the normal dose of doxorubicin, the

typical drug-related cardiotoxicity of doxorubicin has not been

observed.

Analysis of a number of tumour biopsies obtained from patients

in different cohorts has also confirmed the release of the active

chemotherapy, doxorubicin, in the tumour tissue. This analysis

shows that AVA6000 targets the release of doxorubicin to the tumour

tissue at therapeutic levels which are much higher than the levels

being detected in the bloodstream at the same timepoint.

Post-period, the Company announced that it had confirmed a

significant reduction in tumour size in a patient on the trial with

a sub-type of STS in which doxorubicin is expected to be effective.

Several other patients have also shown positive responses to the

treatment.

Preliminary clinical data on AVA6000 have demonstrated that the

pre|CISION(TM) modification has resulted in targeted release of the

active drug to the tumour microenvironment, dramatically reducing

the systemic toxicities being observed in patients and resulting in

clinically effective levels of the active drug in the tumour.

In light of AVA6000's continued strong clinical progress, the

Company has reviewed its clinical development strategy with the aim

of accelerating a pivotal Phase 2 study in STS which could lead to

the first regulatory approval for the drug.

The excellent safety profile of AVA6000 opens up the potential

to dose patients more frequently, as well as with higher doses or

more cycles of treatment. In order to determine the recommended

Phase 2 dose, the Company will initiate a short fortnightly dosing

study in place of the much longer multi-arm Phase 1b efficacy study

previously envisaged.

This fortnightly dosing study should be completed by the middle

of 2024 which the Company expects will allow the Phase 2 study to

start much earlier than planned, in 2024.

The Company expects to release detailed Phase 1a data in Q4 2023

following completion of cohort 7.

Pipeline of pre|CISION(TM) chemotherapies

Avacta's pre|CISION(TM) platform is a proprietary chemical

modification that renders the modified chemotherapeutic drug

inactive in the circulation until it enters the tumour

microenvironment, where it is activated by an enzyme called

FAP<ALPHA>. FAP<ALPHA> is in high abundance in most

solid tumours but not in healthy tissues.

The data emerging from the AVA6000 Phase 1a study have validated

the performance of the pre|CISION(TM) platform, opening up the

opportunity to apply it to a broad range of existing chemotherapies

and new, more potent cytotoxins.

The next most advanced pre|CISION(TM) pre-clinical candidate is

AVA3996, a tumour-activated proteasome inhibitor based on an

analogue of Velcade. The global proteasome inhibitors' market size

is expected to be worth $2.3 billion by 2026 and Velcade represents

just over half of that market.

As with all chemotherapies, the benefit of these drugs is

limited by toxicities and tolerability for patients. In the case of

Velcade, there are significant side effects such as peripheral

neuropathy, which has limited its approval, principally in treating

multiple myeloma. A potentially safer proteasome inhibitor, such as

AVA3996, could be used to treat solid tumours.

During the period, the Company presented pre-clinical data

regarding AVA3996 in a poster entitled 'AVA3996, a novel

pre|CISION(TM) medicine, targeted to the tumor microenvironment via

Fibroblast Activation Protein-alpha (FAP- a ) mediated cleavage' ,

at the American Association for Cancer Research ("AACR") 2023

Annual Meeting. The poster and a video explainer are available on

the Company's web site (see

https://avacta.com/avacta-presents-ava3996-pre-clinical-data-at-the-american-association-for-cancer-research-meeting/

).

The Company is continuing its pre-clinical development of

AVA3996 (pre-clinical models of safety, pharmacokinetics and

efficacy) with the aim of an investigational new drug ("IND")

filing in H2 2024.

Affimer(R) immunotherapy programmes

Translation of the Affimer(R) platform into the clinic to

demonstrate the safety and tolerability of this novel therapeutic

protein platform is an important objective for the Company and

represents a key value inflection point for the Affimer(R)

technology.

In the oncology field recent studies have shown that single

cancer immunotherapies, or 'monotherapies', have potentially

limited overall response rates. The Company's Affimer(R)

immunotherapy strategy aims to harness the benefits of the

Affimer(R) platform to build bispecific drug molecules which can

address two drug targets simultaneously, and to use Affimer(R)

molecules to target toxic payloads using conventional and

pre|CISION(TM) linkers.

Whilst the Company is prioritising its pre|CISION (TM)

programmes as the nearest term driver of key value inflection

points for both patients and Avacta shareholders, good progress has

been made in the in-house Affimer(R) programmes which, along with

the Company's commercial collaborations, are a key part of the

in-house research activities.

Avacta will be presenting an update on its lead Affimer (R)

PD-L1/cytokine bispecific programme as a poster presentation at the

AACR - NCI-EORTC International Conference on Molecular Targets and

Cancer Therapeutics (October 11-15, 2023 , Boston, USA). This

information will be made available on the Company's website

following the meeting.

Ongoing Drug Development Collaborations

LG Chem Life Sciences

Avacta has a strategic partnership with LG Chem Life Sciences

focused on the development of a novel PD-L1 checkpoint inhibitor

utilising the Affimer(R) platform incorporating Affimer XT(R)

half-life extension. The partnership also provides LG Chem with

rights to develop and commercialise other Affimer(R) and

non-Affimer biotherapeutics combined with Affimer XT(R) half-life

extension for a range of indications, and Avacta could earn up to

$55 million in milestone payments for each of these new products.

In addition, under the agreement Avacta will earn royalties on all

future Affimer XT(R) product sales by LG Chem.

At the end of June 2022, LG Chem exercised its option to renew

its rights under the ongoing collaboration with Avacta, triggering

a licence renewal fee payment to Avacta of $2 million. LG Chem is

focused on progressing the PD-L1/XT oncology drug candidate towards

the clinic and has commenced pre-clinical studies which are

intended to form the basis of an IND submission.

AffyXell Therapeutics

AffyXell was established in January 2020 by Avacta and Daewoong

as a joint venture to develop novel mesenchymal stem cell ("MSC")

therapies. AffyXell is combining Avacta's Affimer (R) platform with

Daewoong's MSC platform such that the stem cells are genetically

modified to produce and secrete therapeutic Affimer (R) proteins

with immuno-modulatory effects in situ in the patient. The Affimer

(R) proteins are designed to enhance the therapeutic effects of the

MSC creating a novel, next generation cell therapy platform.

Avacta has successfully developed and characterised Affimer (R)

proteins against the second target of interest for AffyXell and has

filed a patent application for the associated intellectual property

triggering the second milestone in the agreement during the

reporting period. The second milestone will result in an increase

in Avacta's shareholding in AffyXell, which currently stands at

19%. The exact shareholding will be determined, as with the first

milestone payment which was achieved in April 2022, following a

formal valuation of AffyXell and is expected to be approximately

25%.

POINT Biopharma Inc.

Early in 2021, Avacta signed a licensing agreement with POINT

Biopharma Inc. ("POINT"), to provide access to Avacta's

pre|CISION(TM) technology for the development of tumour-activated

radiopharmaceuticals.

Under the terms of the agreement, Avacta received an upfront fee

and will receive development milestone payments for the first

radiopharmaceutical FAP<ALPHA>-activated drug totalling $9.5

million. Avacta will also receive milestone payments for subsequent

radiopharmaceutical FAP<ALPHA>-activated drugs of up to $8

million each, a royalty on sales of FAP-activated

radiopharmaceuticals by POINT and a percentage of any sublicensing

income received by POINT.

Avacta is bound by confidentiality clauses in the license

agreement with POINT and is therefore unable to provide a detailed

update on progress outside of the information that has been placed

in the public domain by POINT (POINT has named its pre|CISION based

programmes CanSeek(TM) . See

https://www.pointbiopharma.com/our-products/pipeline ).

Avacta Diagnostics Division Update

Avacta's Diagnostics Division is driving ambitious growth

through an M&A-led strategy with the aim of supporting

healthcare professionals and broadening access to high quality

diagnostics. The strategy is founded on acquiring both the routes

into the diagnostics market and the appropriate IP-rich product

portfolios.

In October 2022, the Company completed its first acquisition,

Launch Diagnostics, a leading independent distributor in the UK in

vitro diagnostics ("IVD") market. This has provided Avacta with

well-established sales channels in the professional, centralised

hospital laboratory testing market in the UK and France. Avacta's

plan to grow the Launch Diagnostics business includes expanding the

company's product portfolio and investing in the sales teams in the

UK and France. The most significant opportunity for growth lies in

the geographical expansion of the business into Germany, which is

Europe's largest diagnostics market. Avacta is actively pursuing

this strategy.

During the reporting period, Avacta completed its second

acquisition, Coris Bioconcept SRL ("Coris"), a developer and

supplier of rapid diagnostic test kits, for an upfront cash

consideration of GBP7.3 million (on a debt-free/cash-free basis and

subject to customary working capital adjustments), with an earnout

based on future business performance, payable in cash, of up to

GBP3.0 million.

Coris, based in Gembloux, Belgium and established in 1996,

develops, manufactures and markets rapid diagnostic test kits,

mainly lateral flow tests, for use by healthcare professionals.

Coris is ISO 13485 certified and markets its products through

distributors in Europe, Asia, South America, Africa and

Oceania.

Operationally, Coris employs 35 members of staff split across

Production, Sales, Marketing, Quality Control, Regulation and

Administration. In March 2023, the business completed the

construction of a new 10,700 ft(2) production, offices and

warehouse facility in Gembloux.

Coris' product portfolio comprises diagnostic tests for

respiratory, gastro-enteric and blood-borne pathogens (bacteria,

viruses and parasites) and for the detection of antibiotic

resistance markers. Antibiotic resistance is a major global

challenge and there are good future growth prospects for the market

for antimicrobial resistance ("AMR") testing and is a key area in

which Avacta expects to grow the Coris business.

The existing Coris management team have remained with the

business and are working closely with Avacta Diagnostics'

businesses to drive growth and margins through improved

distribution channels and an expanded product range. Avacta will

transfer its lateral flow product development activities to Coris

and support that activity through ongoing development of Affimer(R)

reagents for new products or to enhance existing ones.

Avacta Diagnostics intends to continue to pursue a careful and

disciplined M&A strategy focused on expanding routes to market

for professional products, while adding further IVD products

suitable for these markets to our portfolio. Avacta Diagnostics

will focus on integrating the acquired businesses and delivering

the near-term financial performance of both companies, seeking

synergies including the use of Affimers where appropriate and

driving longer term growth through:

- Expansion of the geographical sales footprint;

- Expansion of product portfolios; and

- Improved management of distribution partners.

Financial Review

Revenue

Revenue for the 6 months ended 30 June 2023 increased to

GBP11.89 million compared to the same period in 2022 (H1 2022:

GBP5.52 million; year ended 31 December 2022: GBP9.65 million).

Revenue contribution from the Therapeutics Division was GBP1.99

million (H1 2022: GBP5.44 million; year ended 31 December 2022:

GBP5.48 million) due to achieving a further milestone in our

collaboration with AffyXell (which leads to additional equity in

the joint venture). Revenue from the Diagnostics Division increased

to GBP9.90 million (H1 2022: GBP0.07 million; year ended 31

December 2022: GBP4.17 million) as the reporting period included a

full six months trading for Launch Diagnostics and one month from

the recent acquisition of Coris.

Acquisitions

On 1 June 2023, the Group acquired 100% of the shares and voting

interests in Coris. Coris develops, manufactures and markets rapid

diagnostic test kits, mainly lateral flow tests, for use by

healthcare professionals. Coris is ISO 13485 certified and markets

its products through distributors in Europe, Asia, South America,

Africa and Oceania. Total consideration for Coris included an

initial consideration of GBP7.31 million on a debt-free / cash-free

basis, in addition to a further GBP2.81 million in relation to

customary working capital adjustments, payable in cash upon

completion of the acquisition. There is also additional

consideration of up to GBP3.0 million based on revenue exceeding

certain targets over the next two financial years. The additional

consideration to be paid based on future revenues is estimated to

be GBP1.59 million as at 30 June 2023.

The acquisition of Coris is a further step in the M&A-led

growth strategy for the Group's Diagnostics Division, designed to

build an integrated and differentiated IVD business with global

reach servicing professionals and consumers.

For the period from acquisition to 30 June 2023, Coris

contributed revenue of GBP0.82 million and operating profit of

GBP0.19 million to the Group's results.

Research costs and selling, general and administrative costs

Research costs relating to new diagnostic tests in the

Diagnostics Division and the clinical and pre-clinical development

work of the Affimer(R) and pre|CISION(TM) therapeutics programmes

in the Therapeutics Division were GBP6.01 million (H1 2022: GBP6.00

million; year ended 31 December 2022: GBP11.10 million).

Selling, general and administrative costs have increased to

GBP8.65 million (H1 2022: GBP4.69 million; year ended 31 December

2022: GBP11.23 million) as the Group expands the Diagnostics

Division.

Adjusted EBITDA

The Consolidated Statement of Profit or Loss shows an Adjusted

EBITDA loss position (before non-recurring and non-cash items) of

GBP7.91 million (H1 2022: GBP5.42 million; year ended 31 December

2022: GBP15.09 million).

Other costs and charges

Depreciation has increased to GBP1.28 million (H1 2022: GBP0.88

million; year ended 31 December 2022: GBP1.90 million).

Amortisation expense has remained almost constant at GBP0.44

million (H1 2022: GBP0.41 million; year ended 31 December 2022:

GBP1.05 million) with amortisation of acquired intangible assets

now comprising the majority of the expense, instead of the

comparative period's amortisation of capitalised development

costs.

The share of the costs from the AffyXell joint venture in the

period was GBP0.42 million (H1 2022: GBP0.65 million; year ended 31

December 2022: GBP1.15 million).

Acquisition related expenses during the period amounted to

GBP0.28 million (H1 2022: GBPnil; year ended 31 December 2022:

GBP0.74 million).

Share-based payment charges have reduced to GBP1.55 million (H1

2022: GBP2.29 million; year ended 31 December 2022: GBP7.49

million).

Operating loss

The Group's operating loss increased to GBP11.88 million (H1

2022: GBP9.65 million; year ended 31 December 2022: GBP32.65

million).

Convertible bond costs

During the reporting period there have been two quarterly

amortisation repayments (of GBP2.75 million and GBP2.60 million

respectively in equity) and a further early redemption (of GBP2.85

million in equity) which reduces the original GBP55.00 million

senior unsecured convertible bonds issued in October 2022 at par

value to GBP46.80 million. Subsequent to the period end in July

2023 a third quarterly amortisation of GBP2.60 million in equity

was settled leaving the remaining balance of bonds at par value of

GBP44.20 million. On 20 September 2023, 715,789 new ordinary shares

were issued in settlement of GBP0.85 million of the principal

amount of the unsecured convertible bond, reducing the principal

remaining to GBP43.35 million.

The bond agreement contains embedded derivatives in conjunction

with an ordinary host debt liability. As a result, the convertible

bonds are shown in the Consolidated Statement of Financial Position

in two separate components, being 'Convertible bond - debt' and

'Convertible bond - derivative'. The derivative element has been

measured at fair value using a Monte-Carlo option pricing model,

which estimates the fair value based on the probability-weighted

present value of expected future investment returns, considering

each of the possible outcomes available to the bondholders.

The derivative element, taking into account the amortisations

and early redemption, was revalued as at 30 June 2023 at GBP28.90

million (30 June 2022: GBPnil; 31 December 2022: GBP39.10 million),

which has resulted in a credit within the period of GBP5.86

million.

The debt element of the bond has reduced from GBP18.73 million

at 31 December 2022 to GBP15.68 million at 30 June 2023 (30 June

2022: GBPnil), with an associated non-cash interest expense of

GBP6.85 million.

Loss for the period

The reported loss from continuing operations after taxation was

GBP11.53 million (H1 2022: GBP8.99 million; year ended 31 December

2022: GBP39.54 million).

The basic loss per share from continuing operations was 4.28p

(H1 2022: 3.58p; year ended 31 December 2022: 15.48p).

Cash flow

The Group reported cash and cash-equivalent balances of GBP25.97

million (30 June 2022: GBP17.02 million; 31 December 2022: GBP41.78

million).

There was a cash outflow from operations and working capital

movements of GBP11.19 million (H1 2022: GBP9.43 million; year ended

31 December 2022: GBP15.95 million) and an outflow from investing

activities of GBP7.35 million from the acquisition of Coris and

capital expenditure (H1 2022: inflow of GBP0.09 million; year ended

31 December 2022: outflow of GBP25.04 million). Cash outflow from

financing activities, being principal elements of lease payments

net of amounts received from the exercise of share options amounted

to GBP0.56 million (H1 2022: inflow of GBP0.37 million; year ended

31 December 2022: inflow of GBP56.90 million).

Financial position

Net assets as at 30 June 2023 were GBP22.74 million (30 June

2022: GBP35.98 million; 31 December 2022: GBP18.44 million) of

which cash and cash equivalents amounted to GBP25.97 million (30

June 2022: GBP17.02 million; 31 December 2022: GBP41.78

million).

The IFRS 16 Leases presentation results in the recognition of a

'right-of-use' asset amounting to GBP6.18 million (30 June 2022:

GBP4.65 million; 31 December 2022: GBP5.42 million) in relation to

the Group's leasehold properties and other leased assets, together

with a corresponding lease liability of GBP6.10 million (30 June

2022: GBP4.83 million; 31 December 2022: GBP5.11 million).

Intangible assets increased to GBP33.46 million (30 June 2022:

GBP7.50 million; 31 December 2022: GBP26.32 million) due to the

acquisition of Coris and the recognition of a further GBP7.61

million in goodwill, which is expected to be allocated in part to

other intangible assets as a result of the purchase price

allocation exercise currently being undertaken.

Liabilities in relation to the unsecured senior convertible

bonds issued in October 2022 and subsequent amortisations and

redemptions during the period, result in a fair value of the

derivative element of GBP28.90 million (30 June 2022: GBPnil; 31

December 2022: GBP39.10 million). The convertible bond debt element

at 30 June 2023 was GBP15.68 million (30 June 2022: GBPnil; 31

December 2022: GBP18.73 million).

Dr Eliot Forster Dr Alastair Smith

Chairman Chief Executive Officer

28 September 2023 28 September 2023

Condensed Consolidated Statement of Profit or Loss

for the 6 months ended 30 June 2023

Unaudited Unaudited Audited

6 months 6 months Year ended

Notes ended ended 30 31 December

30 June June 2022 2022

2023

GBP000 GBP000 GBP000

Revenue 4 11,889 5,517 9,653

Cost of sales (5,141) (244) (2,410)

----------- ----------- -------------

Gross profit 6,748 5,273 7,243

Research costs (6,009) (5,999) (11,100)

Selling, general and administrative

expenses (8,646) (4,692) (11,232)

----------- ----------- -------------

Adjusted EBITDA (7,907) (5,418) (15,089)

Amortisation expense (437) (410) (1,050)

Impairment charge - - (5,225)

Share of loss of associate 7 (424) (646) (1,152)

Acquisition related expenses 8 (282) - (735)

Depreciation expense (1,276) (879) (1,904)

Share-based payment charge (1,553) (2,292) (7,490)

-----------

Operating loss (11,879) (9,645) (32,645)

Convertible bond - professional

fees 9 - - (2,287)

Convertible bond - interest

expense 9 (6,847) - (2,606)

Convertible bond - revaluation

of derivative 9 5,862 - (4,100)

Finance income 331 120 91

Finance costs (268) (125) (95)

-----------

Loss before tax (12,801) (9,650) (41,642)

Taxation 1,269 660 2,102

Loss from continuing operations (11,532) (8,990) (39,540)

----------- ----------- -------------

Discontinued operation

Profit from discontinued

operation 1 - 1,055 351

----------- ----------- -------------

Loss for the period (11,532) (7,935) (39,189)

Foreign operations - foreign

currency translation differences (179) (2) 46

----------- ----------- -------------

Other comprehensive income (11,711) (2) 46

----------- ----------- -------------

Total comprehensive loss

for the period (11,711) (7,937) (39,143)

----------- ----------- -------------

Loss per share:

Basic and diluted 5 (4.28p) (3.16p) (15.35p)

Loss per share - continuing

operations

Basic and diluted 5 (4.28p) (3.58p) (15.48p)

Condensed Consolidated Statement of Financial Position

as at 30 June 2023

Unaudited Unaudited Audited as

as at as at at

30 June 30 June 2022 31 December

2023 2022

GBP000 GBP000 GBP000

Assets

Property, plant and

equipment 2,814 2,306 2,380

Right-of-use assets 6 6,175 4,650 5,418

Investment in associate 7 4,539 3,481 2,976

Intangible assets 33,455 7,504 26,324

---------- ------------- ------------

Non-current assets 46,983 17,941 37,098

---------- ------------- ------------

Inventories 3,052 193 1,681

Trade and other receivables 6,770 6,715 5,579

Income tax receivable 4,975 3,595 6,510

Cash and cash equivalents 25,968 17,017 41,781

Current assets 40,765 27,520 55,551

---------- ------------- ------------

Total assets 87,748 45,461 92,649

---------- ------------- ------------

Liabilities

Lease liabilities 6 (4,703) (3,973) (3,753)

Financing liabilities (238) - -

Deferred tax (2,952) - (2,845)

---------- ------------- ------------

Non-current liabilities (7,893) (3,973) (6,598)

---------- ------------- ------------

Trade and other payables (10,805) (4,648) (8,423)

Lease liabilities 6 (1,394) (857) (1,361)

Financing liabilities (339) - -

Convertible bond -

debt 9 (15,679) - (18,729)

Convertible bond -

derivative 9 (28,900) - (39,100)

Current liabilities (57,117) (5,505) (67,613)

---------- ------------- ------------

Total liabilities (65,010) (9,478) (74,211)

---------- ------------- ------------

Net assets 22,738 35,983 18,438

---------- ------------- ------------

Equity attributable

to equity holders

of the Company

Share capital 27,629 25,709 26,685

Share premium 75,698 54,699 62,184

Reserves (4,371) (4,688) (4,434)

Retained earnings (76,218) (39,737) (65,997)

---------- ------------- ------------

Total equity 22,738 35,983 18,438

---------- ------------- ------------

Total equity is wholly attributable to equity holders of the

parent Company.

Approved by the Board and authorised for issue on 28 September

2023.

Dr Alastair Smith Tony Gardiner

Chief Executive Officer Chief Financial Officer

Condensed Consolidated Statement of Changes in Equity

for the 6 months ended 30 June 2023

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Share Share Other Translation Reserve Retained Total

Capital premium reserve reserve for own earnings Equity

shares

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------- ---------- ---------- ---------- ------------ ---------- ---------- ----------

At 1 January

2022 25,472 54,530 (1,729) 4 (2,961) (34,093) 41,223

Loss for the

period - - - - - (7,935) (7,935)

Other comprehensive

income for the

period - - - (2) - - (2)

---------- ---------- ---------- ------------ ---------- ---------- ----------

Total comprehensive

loss for the

period - - - (2) - (7,935) (7,937)

Transactions

with owners

of the company:

Exercise of

options 237 169 - - - - 406

Equity-settled

share based

payment - - - - - 2,291 2,291

At 30 June

2022 25,709 54,699 (1,729) 2 (2,961) (39,737) 35,983

--------------------- ---------- ---------- ---------- ------------ ---------- ---------- ----------

Loss for the

period - - - - - (31,253) (31,253)

Other comprehensive

income for the

period - - - 48 - - 48

------- ------- -------- -------- -------- --------- ---------

Total comprehensive

loss for the

period - - - 48 - (31,253) (31,205)

Transactions with owners

of the company:

Issue of shares 949 7,448 - - - - 8,397

Exercise of

options 27 37 - - - - 64

Transfer of

own shares - - - - 206 (206) -

Equity-settled

share based

payment - - - - - 5,199 5,199

At 31 December

2022 26,685 62,184 (1,729) 50 (2,755) (65,997) 18,438

--------------------- ------- ------- -------- -------- -------- --------- ---------

Loss for the

period - - - - - (11,532) (11,532)

Other comprehensive

income for the

period - - - (179) - - (179)

------- ------- -------- -------- -------- --------- ---------

Total comprehensive

loss for the

period - - - (179) - (11,532) (11,711)

Transactions with owners

of the company:

Exercise of

options 107 117 - - - - 224

Transfer of

own shares - - - - 242 (242) -

Convertible

bond - issue

of shares 837 13,397 - - - - 14,234

Equity-settled

share based

payment - - - - - 1,553 1,553

At 30 June

2023 27,629 75,698 (1,729) (129) (2,513) (76,218) 22,738

--------------------- ------- ------- -------- -------- -------- --------- ---------

Condensed Consolidated Statement of Cash Flows

for the 6 months ended 30 June 2023

Unaudited Unaudited Audited

6 months 6 months Year ended

Note ended ended 31 December

30 June 30 June 2022

2023 2022

GBP000 GBP000 GBP000

Operating cash outflow from operations

10 (11,194) (9,428) (15,953)

Interest received 331 5 75

Interest elements of lease payments (128) (17) (202)

Income tax received/(paid) 2,942 - (168)

Withholding tax paid - (187) (184)

----------

Net cash used in operating activities (8,049) (9,627) (16,432)

---------- ---------- -------------

Cash flows from investing activities

Purchase of plant and equipment (406) (287) (558)

Proceeds from sale of plant and

equipment - 49 50

Acquisition of right of use asset - (165) (165)

Acquisition of subsidiary, net

of cash acquired (6,896) - (24,878)

Purchase of intangible assets (49) (14) (36)

Disposal of discontinued operation,

net of cash disposed of - 666 705

Transaction costs paid, relating

to disposal of discontinued operation - (160) (160)

Net cash (used in) / generated

from investing activities (7,351) 89 (25,042)

---------- ---------- -------------

Cash flows from financing activities

Proceeds from exercise of share

options 224 406 470

Repayment of financing liabilities (49) - -

Principal elements of lease payments (736) (38) (800)

Proceeds from issue of share capital - - 9,016

Transaction costs relate to issue

of share capital - - (618)

Proceeds from issue of convertible

bonds - - 52,250

Transaction costs related to issue

of convertible bonds - - (3,414)

---------- ---------- -------------

Net cash flow (used in) / generated

from financing activities (561) 368 56,904

---------- ---------- -------------

Net (decrease) / increase in cash

and cash equivalents (15,961) (9,170) 15,430

Cash and cash equivalents at the

beginning of the period 41,781 26,191 26,191

Effect of movements in exchange

rates on cash held 148 (4) 160

---------- ---------- -------------

Cash and cash equivalents at

the end of the period 25,968 17,017 41,781

---------- ---------- -------------

Notes to the unaudited condensed consolidated financial

statements

for the 6 months ended 30 June 2023

1) Basis of preparation

Avacta Group plc ('the Company') is a company incorporated in

England and Wales under the Companies Act 2006. These condensed

consolidated interim financial statements ('interim financial

statements') as at and for the 6 months ended 30 June 2023 comprise

the Company and its subsidiaries (together referred to as 'the

Group').

The interim financial statements for the 6 months ended 30 June

2023 are unaudited. This information does not constitute statutory

accounts as defined in Section 435 of the Companies Act 2006. The

financial figures for the year ended 31 December 2022, as set out

in this report, do not constitute statutory accounts but are

derived from the statutory accounts for that financial year. The

statutory accounts for the year ended 31 December 2022 were

prepared under IFRS and have been delivered to the Registrar of

Companies. The auditors reported on those accounts. Their report

was unqualified, did not draw attention to any matters by way of

emphasis and did not include a statement under Section 498 of the

Companies Act 2006.

The Board confirms that, to the best of its knowledge, these

condensed financial statements have been prepared in accordance

with IAS34 Interim Financial Reporting and should be read in

conjunction with the Group's last annual consolidated financial

statements as at and for the year ended 31 December 2022 ('last

annual financial statements'). They do not include all of the

financial information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual financial statements. The

comparative results for the 6 month period ended 30 June 2022 and

the year ended 31 December 2022 include those of a discontinued

operation. This relates to the Animal Health segment, which the

Group sold in its entirety on 15 March 2022. Further details of

this discontinued operation can be found in the financial

statements for the year ending 31 December 2022.

The Board approved these interim financial statements for issue

on 28 September 2023.

2) Use of judgements and estimates and significant accounting policies

The preparation of the interim financial statements requires

management to make judgements and estimates that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Although these

estimates are based on management's best knowledge of the amount,

events or actions, actual events ultimately may differ from those

estimates.

The significant judgements made by management in applying the

Group's accounting policies, and the key sources of estimation

uncertainty were the same as those described in the last annual

financial statements.

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's

consolidated financial statements as at and for the year ended 31

December 2022. A number of new standards were effective from 1

January 2023 but they do not have a material effect on the Group's

financial statements.

3) Segmental reporting

The Group has two distinct operating segments: Diagnostics and

Therapeutics. These are the reportable operating segments in

accordance with IFRS 8 Operating Segments. The Directors recognize

that the operations of the Group are dynamic and therefore this

position will be monitored as the Group develops.

Segment revenue represents revenue from external customers

arising from sale of goods and services, plus inter-segment

revenues. Inter-segment transactions are priced on an arm's length

basis. Segment results, assets and liabilities include items

directly attributable to a segment as well as those that can be

allocated on a reasonable basis.

The Group's revenue from continuing operations to destinations

outside the UK amounted to 47% (6 months to 30 June 2022: 100%;

year to 31 December 2022: 74%). The revenue analysis below is based

on the country of registration of the customer:

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

GBP000

UK 6,323 14 2,532

France 2,248 - 1,296

Rest of Europe 1,285 1 158

North America 21 50 179

South Korea 1,991 5,444 5,481

Rest of World 21 7 7

11,889 5,516 9,653

---------------- --------- --------- -------------

During the six month period ended 30 June 2023, transaction with

one external customer in the Therapeutics segment, amounted

individually to 10% or more of the Group's revenue, being

GBP1,991,000.

During the six month period ended 30 June 2022, transactions

with two external customers, both in the Therapeutics segment,

amounted individually to 10% or more of the Group's revenues from

continuing operations, being GBP3,788,000 and GBP1,656,000

respectively.

During the year 31 December 2022, transactions with two external

customers, both in the Therapeutics segment, amounted individually

to 10% or more of the Group's revenues from continuing operations,

being GBP3,798,000 and GBP1,682,000 respectively.

Operating segment analysis for the six months ended 30 June

2023

Diagnostics Therapeutics Central Total

overheads

(1)

GBP000 GBP000 GBP000 GBP000

Revenue 9,898 1,991 - 11,889

Cost of goods sold (5,133) (8) - (5,141)

------------- ------------- ------------- -------------

Gross profit 4,765 1,983 - 6,748

Research costs (663) (5,346) - (6,009)

Selling, general and administrative

expenses (4,529) (1,185) (2,932) (8,646)

------------- ------------- ------------- -------------

Adjusted EBITDA (427) (4,548) (2,932) (7,907)

Depreciation expense (640) (632) (4) (1,276)

Amortisation expense (431) (4) (2) (437)

Share of loss of associate - (424) - (424)

Acquisition related expenses - - (282) (282)

Share-based payment expense (403) (600) (550) (1,553)

------------- ------------- ------------- -------------

Segment operating loss (1,901) (6,208) (3,770) (11,879)

------------- ------------- ------------- -------------

(1) Central overheads, which relate to operations of the Group

functions, are not allocated to the operating segments.

Operating profit/loss is the measure of profit or loss regularly

reviewed by the Board. Other items comprising the Group's loss

before tax are not monitored on a segmental basis.

The information reported to the Board does not include balance

sheet information at the segment level.

Operating segment analysis for the six months ended 30 June

2022

Diagnostics Therapeutics Central Total Animal

overheads (continuing) health

(1) (discontinued)

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 73 5,444 - 5,517 411

Cost of goods sold (38) (206) - (244) (117)

------------- ------------- ------------- ------------- -------------

Gross profit 35 5,238 - 5,273 294

Research costs (1,136) (4,863) - (5,999) (6)

Selling, general and administrative

expenses (1,466) (1,354) (1,872) (4,692) (233)

------------- ------------- ------------- ------------- -------------

Adjusted EBITDA (2,567) (979) (1,872) (5,418) 55

Depreciation expense (260) (614) (5) (879) (10)

Amortisation expense (410) - - (410) -

Share of loss of associate - (646) - (646) -

Share-based payment expense (492) (1,250) (550) (2,292) -

------------- ------------- ------------- ------------- -------------

Segment operating (loss)/profit (3,729) (3,489) (2,427) (9,645) 45

------------- ------------- ------------- ------------- -------------

(1) Central overheads, which relate to operations of the Group

functions, are not allocated to the operating segments.

Operating profit/loss is the measure of profit or loss regularly

reviewed by the Board. Other items comprising the Group's loss

before tax are not monitored on a segmental basis.

The information reported to the Board does not include balance

sheet information at the segment level.

Operating segment analysis for the year ended 31 December

2022

Diagnostics Therapeutics Central Total Animal health

overheads (continuing) (discontinued)

(1)

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 4,172 5,481 - 9,653 412

Cost of goods sold (2,282) (128) - (2,410) (118)

------------- ------------- ------------- ------------- -------------

Gross profit 1,890 5,353 - 7,243 294

Research costs (2,309) (8,791) - (11,100) -

Selling, general and administrative

expenses (4,706) (2,403) (4,123) (11,232) (240)

------------- ------------- ------------- ------------- -------------

Adjusted EBITDA (5,125) (5,481) (4,123) (15,089) 54

Impairment charge (5,225) - - (5,225) -

Depreciation expense (627) (1,269) (8) (1,904) (11)

Amortisation expense (1,033) (8) (9) (1,050) -

Share of loss of associate - (1,152) - (1,152) -

Acquisition related expenses - - (735) (735) -

Share-based payment expense (1,438) (2,713) (3,339) (7,490) -

------------- ------------- ------------- ------------- -------------

Segment operating (loss)/profit (13,448) (10,983) (8,214) (32,645) 43

------------- ------------- ------------- ------------- -------------

(1) Central overheads, which relate to operations of the Group

functions, are not allocated to the operating segments.

Operating profit/loss is the measure of profit or loss regularly

reviewed by the Board. Other items comprising the Group's loss

before tax are not monitored on a segmental basis.

The information reported to the Board does not include balance

sheet information at the segment level.

4) Revenue

The Group's operations and main revenue streams are those

described in the last annual financial statements. The Group's

revenue is all derived from contracts with customers.

Disaggregation of revenue

In the following table, revenue is disaggregated by its nature.

The table also includes a reconciliation of the disaggregated

revenue with the Group's reportable segments (see Note 3).

Six months ended 30 June 2023

GBP'000 Diagnostics Therapeutics Total

------------------------ ------------ ------------- -------

Nature of revenue

Sale of goods 9,379 - 9,379

Provision of services 519 3 522

Licence-related income - 1,988 1,988

------------------------ ------------ ------------- -------

9,898 1,991 11,889

------------------------ ------------ ------------- -------

Six months ended 30 June 2022

GBP'000 Diagnostics Therapeutics Continuing operations Animal Health (discontinued)

------------------------ ------------ ------------- ---------------------- -----------------------------

Nature of revenue

Sale of goods (2) - (2) 258

Provision of services 75 192 267 153

Licence-related income - 5,252 5,252 -

------------------------ ------------ ------------- ---------------------- -----------------------------

73 5,444 5,517 411

------------------------ ------------ ------------- ---------------------- -----------------------------

Year ended 31 December 2022

GBP'000 Diagnostics Therapeutics Continuing operations Animal Health (discontinued)

------------------------ ------------ ------------- ---------------------- -----------------------------

Nature of revenue

Sale of goods 3,779 - 3,779 259

Provision of services 393 229 622 153

Licence-related income - 5,252 5,252 -

------------------------ ------------ ------------- ---------------------- -----------------------------

4,172 5,481 9,653 412

------------------------ ------------ ------------- ---------------------- -----------------------------

5) Earnings per share

Unaudited Unaudited Audited

GBP'000 6 months 6 months ended Year ended

ended 30 30 June 2022 31 December

June 2023 2022

Loss from continuing operations (11,532) (8,990) (39,540)

Profit/(loss) from discontinued

operations - 1,055 351

Loss for the period (11,532) (7,935) (39,189)

------------ --------------- -------------

Weighted average number

of shares (number) 269,159,631 251,096,503 255,369,066

------------ --------------- -------------

* Basic and diluted loss per ordinary share from

continuing operations (p) (4.28) (3.58) (15.48)

------------ --------------- -------------

-

-

------------ --------------- -------------

* Basic and diluted earnings / (loss) per ordinary

share from discontinued operations (p) - 0.42 0.13

------------ --------------- -------------

-

-

------------ --------------- -------------

* Basic and diluted loss per ordinary share for the

period (p) (4.28) (3.16) (15.35)

------------ --------------- -------------

6) Leases

The Group leases a small number of properties for office and

laboratory use, as well as some laboratory equipment. Information

about leases for which the Group is a lessee is presented

below.

a) Amounts recognised in the balance sheet

Right-of-use assets Property Laboratory Motor Total

equipment Vehicles

GBP'000

As at 1 January 2022 1,577 152 - 1,729

Additions 4,195 - - 4,195

Depreciation charge (327) (9) - (336)

Disposals (938) - - (938)

--------- ----------- ---------- ------

As at 30 June 2022 4,507 143 - 4,650

Additions 301 - 26 327

Acquisitions through

business combinations 160 585 376 1,121

Depreciation charge (523) (46) (27) (596)

Remeasurement of lease

liability (85) - - (85)

Effect of movement in

exchange rates 1 - - 1

--------- ----------- ---------- ------

As at 31 December 2022 4,361 682 375 5,418

Additions - - 275 275

Acquisitions through

business combinations 1,446 - 17 1,463

Depreciation charge (549) (87) (97) (733)

Transfers to property,

plant & equipment - (241) - (241)

Effect of movement in

exchange rates (7) - - (7)

--------- ----------- ---------- ------

As at 30 June 2023 5,251 354 570 6,175

--------- ----------- ---------- ------

Presentation of lease liability

30 June 2023 30 June 2022

GBP000 Property Laboratory Motor Total Property Laboratory Motor Total

equipment vehicles equipment vehicles

Lease liabilities

Current 1,070 135 189 1,394 795 62 - 857

Non-current 4,294 28 381 4,703 3,973 - - 3,973

--------- ----------- ---------- ------ --------- ----------- ---------- ------

5,364 163 570 6,097 4,768 62 - 4,830

--------- ----------- ---------- ------ --------- ----------- ---------- ------

31 December 2022

GBP000 Property Laboratory Motor Total

equipment vehicles

Lease liabilities

Current 941 279 141 1,361

Non-current 3,469 48 236 13,753

--------- ----------- ---------- -------

4,410 327 377 5,114

--------- ----------- ---------- -------

Reconciliation of change in lease liability GBP000

As at 1 January 2022 1,703

Payment of lease liability - principal (216)

Payment of lease liability - interest (101)

Interest expense 125

Additions 4,028

Disposals (969)

-------

As at 30 June 2022 4,570

Payment of lease liability - principal (584)

Payment of lease liability - interest (101)

Interest expense 93

Additions 328

Acquisitions through business combinations 893

Remeasurement of lease liability (85)

As at 31 December 2022 5,114

Payment of lease liability - principal (738)

Payment of lease liability - interest (128)

Interest expense 128

Additions 275

Acquisitions through business combinations 1,453

Effect of movement in exchange rates (7)

-------

As at 30 June 2023 6,097

-------

7) Equity-accounted investees

The Group currently holds a 19% equity interest (6 months to 30

June 2022: 21%; year to 31 December 2022: 19%) in its associate

AffyXell Therapeutics Co., Ltd ('AffyXell') based in South Korea.

AffyXell has been established to develop Affimer(R) proteins which

will be used for the generation of new cell and gene therapies.

The investment in associate is measured using the equity method.

The Group has significant influence as a result of material

transactions with the entity and the provision of essential

technical information, AffyXell Therapeutics Co., Ltd was

established in 2020 to develop Affimer(R) proteins which will be

used for the generation of new cell and gene therapies.

During the period, the investment in associate has increased

with the achievement of a milestone within the collaboration which

will result in the issue of equity to the Group. The exact

shareholding will be determined, as with the first milestone

payment which was achieved in April 2022, following a formal

valuation of AffyXell and is expected to be circa 25%.

Reconciliation of change in value of associate GBP000

As at 1 January 2022 -

Additions 4,128

Share of loss of associate (646)

As at 30 June 2022 3,482

Additions -

Share of loss of associate (506)

As at 31 December 2022 2,976

Additions 1,987

Share of loss of associate (424)

---------

As at 30 June 2023 4,539

---------

8) Acquisition of subsidiary

On 31 May 2023, the Group acquired 100% of the shares and voting

interests in Coris Bioconcept. Coris Bioconcept are a Belgium based

company specialising in developing, manufacturing and marketing

rapid diagnostic tests, for use by healthcare professionals,

through distributors in Europe, Asia, South America, Africa and

Oceania.

The acquisition of Coris Bioconcept was a further step forward

in an M&A-led growth strategy for the Group's Diagnostics

Division, with the vision of building an integrated and

differentiated IVD business with global reach servicing

professionals and consumers.

For the period from acquisition to 30 June 2023, Coris

Bioconcept contributed revenue of GBP815,000 and operating profit

of GBP189,000 to the Group's results.

A. Consideration transferred

GBP000

Cash 10,116

Deferred consideration 1,587

-----------

Total consideration transferred 11,703

In addition, the Group has agreed to pay the selling

shareholders additional consideration based on sales for the year

ended 31 December 2023 and 31 December 2024. For 2023, additional

consideration will be calculated at 100% of sales exceeding EUR5.5

million and for 2024 at 90% of sales exceeding EUR6.5 million. The

additional consideration is capped at EUR3.5 million. Based on an

assessment of forecast future sales, the fair value of this

deferred contingent consideration at the acquisition date was

GBP1,587,000 and at 30 June 2023 is GBP1,583,000.

B. Acquisition-related costs

The Group incurred acquisition-related costs of GBP282,000 on

legal fees and due diligence costs. These costs have been included

in 'Acquisition-related expenses' in the Condensed Consolidated

Statement of Profit or Loss for the 6 months ended 30 June

2023.

C. Identifiable assets acquired and liabilities assumed

The following table summarises the provisionally recognised

amounts of assets acquired and liabilities assumed at the date of

acquisition. A purchase price allocation (PPA) exercise is in

progress to assess the valuation of intangible assets recognised on

acquisition and the associated deferred tax liabilities. At this

stage, the Group expects these intangible assets to relate to the

brand, development project work and customer relationships

acquired. At this stage, these amounts are included within the

Goodwill figure disclosed in D.

GBP000

Property, plant and equipment 366

Right-of-use assets 1,463

Intangible assets 61

Other non-current receivables 12

Inventories 1,287

Trade and other receivables 1,335

Cash and cash equivalents 3,208

Other Trade and other payables (1,576)

Financing liabilities (628)

Lease liabilities (1,454)

----------

Total identifiable net assets acquired 4,074

D. Goodwill

Goodwill arising from the acquisition has been recognised as

follows:

GBP000

Consideration transferred A 11,703

Fair value of identifiable net assets C (4,074)

-----------

Goodwill 7,629

As set out in C, a PPA exercise is underway to value the

intangible assets acquired and therefore allocate, in part, this

goodwill to other intangible assets. The residual goodwill would be

expected to be attributable to the skills and technical talent of

Coris Bioconcept's workforce, and the synergies expected to be

achieved from integrating the company into the Group's Diagnostics

business. None of the goodwill recognised is expected to be

deductible for tax purposes.

9) Convertible bond

In October 2022, the Group issued senior unsecured convertible

bonds ('the Bonds') of GBP55 million to a fund advised by Heights

Capital Ireland LLC, a global equity and equity-linked focussed

investor.

The Bonds were issued at 95% par value with total net proceeds

of GBP52.25 million and accrue interest at an annual rate of 6.5%

payable quarterly in arrears.

The Bonds contain various conversion and redemption features.

The Bonds have a maturity of five years, and are repayable in 20

quarterly amortisation repayments, of principal and interest over

the five-year term, in either cash or in new ordinary shares at the

Group's option. If in shares, the repayment is at the lower of the

conversion price (118.75p) or a 10% discount to the volume weighted

average price ('VWAP') in the five- or ten-day trading period prior

to election date. The conversion price may reset downwards at 18

months, depending on share price performance, and save in limited

circumstances there is a reset price floor of 95p.

Additionally, the bondholder has the option to partially convert

the convertible bond at their discretion, such as occurred on 10

February 2023.

The bond agreement contains embedded derivatives in conjunction

with an ordinary host debt liability. As a result, the convertible

bonds are shown in the Consolidated Statement of Financial Position

in two separate components, being 'Convertible bond - debt' and

'Convertible bond - derivative'. At issuance, the total inception

value was GBP52,500,000, being the 5% issue discount to the

principal amount of the Bonds, with the initial carrying amount of

the debt liability element being the difference between this

inception value of the convertible bond and the fair value at

inception of the derivative element. Given the option of the

bondholder to convert the bond at their discretion, the debt and

derivative liability elements are classified as current

liabilities.

The derivative element has been measured at fair value using a

Monte-Carlo option pricing model, which estimates the fair value

based on the probability-weighted present value of expected future

investment returns, considering each of the possible outcomes

available to the bondholders. This therefore falls under Level 3 of

the fair value hierarchy. At inception, the fair value of the

derivative component was measured at GBP35,000,000, resulting in an

initial carrying amount of the debt liability element of

GBP16,123,000 (net of transaction costs apportioned to the debt

liability element of GBP1,127,000).

During the 6 month period ended 30 June 2023, the following

conversion events occurred:

- On 23 January 2023, 3,068,421 new ordinary shares were issued

in settlement of the quarterly principal of GBP2.75 million and

interest repayment of GBP0.89 million in respect of the convertible

bond, reducing the principal remaining to GBP52.25 million.

- On 10 February 2023, 2,400,000 new ordinary shares were issued

in settlement of a received Notice of Conversion in respect of

GBP2.85 million of the convertible bond, reducing the principal

remaining to GBP49.40 million.

- On 21 April 2023, 2,906,097 new ordinary shares were issued in

settlement of the quarterly principal of GBP2.6 million and

interest repayment of GBP0.80 million in respect of the convertible

bond, reducing the principal remaining to GBP46.80 million.

At each conversion event, the reduction in the host debt and

derivative liabilities is recognised as an addition to equity. The

fair value as at 30 June 2023 was measured to be GBP28,900,000

resulting in a gain on revaluation of the derivative being

recognised of GBP5,862,000.

The debt liability incurred finance costs of GBP6,847,000 during

the period, though reduced to GBP15,679,000 as a result of the

conversion events set out above.

Significant assumptions used in the fair value analysis include

the volatility rate and recovery amount. A volatility of 68.1%

(2022: 67.4%) was used in the determination of the fair value of

the derivative element, a change by 10% in the volatility rate

would result in a change in the fair value of the derivative

element by GBP3,300,000. An estimated recovery amount of 75% (2022:

75%) was also used in the determination of fair value, with a

change by 10% resulting in change in fair value of the derivative

element by GBP1,400,000.

Convertible Convertible

bond - derivative bond - debt

GBP000 GBP000

At inception 35,000 16,123

Interest expense - 2,606

Revaluation of derivative 4,100 -

----------- -----------------

At 31 December 2022 39,100 18,729

Settlement of liability through

issue of shares (4,338) (9,897)

Interest expense - 6,847

Revaluation of derivative (5,862) -

----------- -----------------

At 30 June 2023 28,900 15,679

----------- -----------------

10) Operating cash outflow from operations

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

GBP000 GBP000 GBP000

Cash flow from operating activities

Loss for the period (11,532) (7,935) (39,189)

Adjustments for:

Amortisation 437 435 1,051

Impairment losses - - 5,225

Depreciation 1,276 888 1,961

Net (gain) / loss on disposal

of property, plant and equipment 23 (41) 52

Share of loss of associate 424 646 1,152

Profit on lease modification - - (31)

Equity-settled share-based payment

charges 1,553 2,292 7,490

Gain on sale of discontinued operation - (1,004) (308)

Increase in investment in associate (1,988) (4,127) (4,127)

Net finance costs 653 119 9,000

Taxation (1,270) (660) (2,102)

---------- ----------

Operating cash outflow before

changes in working capital (10,424) (9,387) (19,826)

Decrease / (increase) in inventories (85) (4) 52

Increase in trade and other receivables 144 (953) 2,225

Increase in trade and other payables (829) 916 1,596

---------- ---------- -------------

Operating cash outflow from operations (11,194) (9,428) (15,953)

11) Events after the reporting period

On 21 July 2023, 3,752,652 new ordinary shares were issued in

settlement of the quarterly principal of GBP2.60 million and

interest repayment of GBP0.76 million in respect of the convertible

bond, reducing the principal remaining to GBP44.20 million.

On 20 September 2023, 715,789 new ordinary shares were issued in

settlement of GBP0.85 million of the principal amount of the

unsecured convertible bond, reducing the principal remaining to

GBP43.35 million.

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DGGDCBGDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

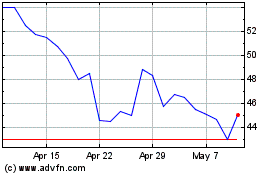

Avacta (LSE:AVCT)

Historical Stock Chart

From Apr 2024 to May 2024

Avacta (LSE:AVCT)

Historical Stock Chart

From May 2023 to May 2024