TIDMBMTO

RNS Number : 2982Y

Braime Group PLC

05 September 2022

Braime Group PLC

("Braime" or the "Company" and together with its subsidiaries

the "Group")

Interim Results for the six months ended 30th June 2022

The Company presents its unaudited interims results for the six

months ended 30 June 2022:

Performance

As set out in our 2021 Annual Report announced on 27(th) April

2022, the directors had significant concerns about the

macro-economic challenges facing the Group. These concerns remain,

however, the directors are very pleased to report that Group sales

revenue for the first six months of 2022 increased by 17% to

GBP21.3m when compared to GBP18.2m for the same period in 2021,

while profit before tax increased to GBP1.6m compared to GBP885,000

for the same period in 2021. The retained profit for the six-month

period includes a further GBP350,000 provision for repairs to our

chain cell area in anticipation of additional costs as previously

announced in June 2022. Profit from operations before exceptional

items was GBP2.1m compared to GBP984,000 for the same six

month-period last year. All sectors of the Group have performed

strongly, following a sustained surge in customer demand, which the

directors attribute to recovery from the covid pandemic alongside

constraints in the supply chain which have driven up prices. The

automotive sector has continued to perform well after the upturn in

the spring of 2021 and the 4B division has also seen strong

performances especially in the USA and Australia.

The performance of the Group has benefited from Sterling

weakening against the US dollar during 2022. A significant

proportion of the Group's income is earned in the USA, and

consequently, Sterling weakening from a rate of 1.348 at the end of

2021 to 1.214 at the end of June 2022 results in an increase in

profit for the Group when reported in Sterling. The results also

include GBP186,000 of profit (shown in other operating income)

derived from the disposal of the Group's property in Lamotte

Warfussee, following the relocation of 4B France's business to its

new warehouse at Villers Bretonneux. Accordingly, the trading

performance of the Group in the first half of the year has

surpassed previous periods.

Dividends

In line with the Group's policy to maintain dividend growth,

balanced alongside the Group's requirement for investment in

capital to support long term growth, the directors have decided to

increase the interim dividend from 4.25p to 4.75p per share. This

dividend will be paid on 14th October 2022 to the Ordinary and 'A'

Ordinary shareholders on the register on the 30th September 2022.

The associated ex-dividend date is 29(th) September 2022.

Braime Pressings Limited

External sales revenue of GBP3.0m in the first 6 months of 2022

was 13% up on the same period last year driven by strong demand

from the automotive sector as well as an increase in steel

commodity prices which has driven up sales prices. Intercompany

sales also increased by GBP666,000 driven by stronger turnover in

the 4B division. The manufacturing division made a profit before

tax of GBP516,000 as a result of the higher demand for its

products.

4B Division

Our distribution division's external sales revenue of GBP18.3m

increased by 18% when compared to GBP15.6m for the same period last

year. Intercompany trading increased by 17% to GBP3.1m compared to

GBP2.6m for the same period in 2021. The division has benefitted

from an increase in demand across most geographical and product

sectors as customers have started to invest in new projects

following the Covid pandemic. The GBP2.8m increase in external

sales has had a positive direct impact on profitability, with

profit after tax for the 4B division for the six-month period

increasing to GBP1.4m as compared to GBP494,000 for the same period

last year.

Balance Sheet

Net assets of the Group as at 30th June 2022 amounted to

GBP17.3m (30th June 2021 - GBP15.4m). Tangible fixed asset

additions in during the period amounted to GBP893,000. Of this,

GBP570,000 relates to the new climate-controlled warehouse at our

Leeds headquarters which became operational in May 2022. Other

capital investments relate to items of manufacturing equipment and

IT expenditure. Intangible fixed asset additions of GBP725,000

relate to the purchase of the exclusive sales rights and customer

lists for a specialised range of electronic components used in the

bulk material handing industry, which complement and enhance the 4B

division's existing products.

Inventory of GBP11.2m has increased by GBP2.1m when compared to

30th June 2021 and increased by GBP1.1m when compared to 31st

December 2021. This is in part due to large increases in raw

material prices, and in part, due to stocking up to meet increased

customer demand and mitigate against turbulence in the supply

chain. Trade receivables of GBP8.5m have increased by GBP1.0m when

compared to 30th June 2021 and increased by GBP2.3m when compared

to 31st December 2021. This increase is a direct consequence of the

rise in revenue in 2022, and in fact, the Group's overall debtor

days are lower than as at June 2021 and the same as at December

2021. Trade payables of GBP6.1m have increased by GBP729,000 when

compared to 30th June 2021 and increased by GBP1.2m when compared

to 31st December 2021 in line with expectations from the increased

purchases of stock.

Cash flow

The net cash position of the Group at the end of June 2022 was

GBP201,000 overdrawn. Cash generated from operations before working

capital movements was GBP2.5m. Working capital (inventory,

receivables and payables) increases for the six-month period came

to GBP1.7m as a consequence of increased trading activity outlined

above. Provisions, which all relate to the Chain Cell project,

increased by GBP115,000, being the net of the additional GBP350,000

mentioned above and amounts utilised during the period, whilst

investment in capital projects gave rise to outflows of GBP1.6m.

Proceeds from disposal of GBP218,000 relate primarily to the sale

of the old French property. The impact on cash of loans movement

was negligible, the Group having repaid GBP233,000 of capital

whilst taking up new loans of GBP236,000. Overall, net cash reduced

by GBP1.2m during the six months to 30th June 2022. The business

has sufficient headroom within its GBP3.5m bank overdraft facility

and management remain focused in ensuring that working capital

requirements, particularly for stock and debtors, are carefully

monitored and controlled.

Principal exchange rates

The Group reports its results in Sterling, its presentational

currency. The Group operates in six other currencies and the

average of the principal exchange rates in use during the half year

and as at 30th June 2022 are shown in the table below, along with

comparatives. As mentioned previously, a significant proportion of

the Group revenues are in the USA, and the Group has incurred

foreign exchange gains from the strengthening of the US dollar

against the Sterling since 31st December 2021. The gain on

translation of overseas assets amounted to GBP604,000 for the

six-month period, as shown in the consolidated statement of

comprehensive income table on page 5.

Avg rate Avg rate Avg rate Closing Closing Closing

Currency Symbol HY 2022 HY 2021 FY 2021 rate rate rate

30th Jun 30th Jun 31st Dec

2022 2021 2021

------------------- ---------- --------- ------------ ------------ ---------- ---------- ------------

Australian Dollar AUD 1.799 1.813 1.838 1.766 1.840 1.859

Chinese Renminbi

(Yuan) CNY 8.354 8.993 8.875 8.137 8.941 8.606

Euro EUR 1.184 1.156 1.165 1.162 1.165 1.191

South African

Rand ZAR 20.015 20.257 20.490 19.896 19.711 21.494

Thai Baht THB 43.586 43.064 44.073 42.926 44.290 44.690

United States

Dollar USD 1.288 1.389 1.374 1.214 1.382 1.348

------------------- ---------- --------- ------------ ------------ ---------- ---------- ------------

Key performance indicators

The Group uses the following key performance indicators to

assess the performance of the Group as a whole and of the

individual businesses:

Key performance indicator Note Half year Half year Full year

2022 2021 2021

----------------------------- ------- ------------ ------------ ------------

Turnover growth 1 17.0% 13.0% 11.0%

Gross margin 2 47.2% 47.2% 48.4%

Operating profit 3 GBP2.09m GBP0.98m GBP2.49m

Stock days 4 164 days 170 days 184 days

Debtor days 5 54 days 59 days 54 days

----------------------------- ------- ------------ ------------ ------------

Notes to KPI's

1. Turnover growth

The Group aims to increase shareholder value by measuring the

year-on-year growth in Group revenue. Revenues are up due to the

strong demand in both the manufacturing and material handling

sectors and a rise in raw material prices.

2. Gross margin

Gross profit (revenue less change in inventories and raw

materials used) as a percentage of revenue is monitored to maximise

profits available for reinvestment and distribution to

shareholders. Gross margin is in line with the same period last

year. This is particularly pleasing given the increase in unit cost

of sales. The directors continue to monitor the margins carefully

for further movement.

3. Operating profit

Sustainable growth in operating profit is a strategic priority

to enable ongoing investment and increase shareholder value.

Operating profits have improved as a direct result of the increase

in sales in both the manufacturing and the 4B division.

4. Stock days

The average value of inventories divided by raw materials and

consumables used and changes in inventories of finished goods and

work in progress expressed as a number of days is monitored to

ensure the right level of stocks are held in order to meet customer

demands whilst not carrying excessive amounts which impacts upon

working capital requirements. Stock days have reduced despite the

absolute value of inventory increasing with as a result of the

strong sales performance in the period. This reflects management's

continued focus on working capital.

5. Debtor days

The average value of trade receivables divided by revenue

expressed as a number of days. This is an important indicator of

working capital requirements. Debtor days at 54 days are below the

standard payment terms of 60 days and have improved from the same

period last year. Management remain focused on reducing this to

improve cash.

Other metrics monitored weekly or monthly include quality

measures (such as customer complaints), raw materials buying

prices, capital expenditure, line utilisation, reportable accidents

and near-misses.

Outlook for the second half of 2022

As advised above, many aspects of our Group profile and the

exchange rate movement in the first six months of 2022 have

contributed to the Group's exceptionally good interim result, a

result which has far exceeded our expectations at the start of the

year.

Some of these factors may continue to benefit the Group for the

remainder of this year. However, at some point, the current global

recession is going to have negative effects on us too. The likely

fall in consumer demand will inevitably reduce the demand for truck

parts, both for new commercial vehicles and for spares, high demand

for which has been driven over the past 12 months by high consumer

demand post the pandemic. Most of the large infrastructure projects

which had been delayed by the pandemic have or are reaching

completion.

Although most of our customers handling, distributing and

processing cereals will continue to benefit from the current very

high commodity prices, ultimately even their new investment will be

more cautious given the increase in the cost of new machinery and

because of higher interest rates where needed to finance

investments. Large areas where investment has been very high in

recent years remain "no go" areas due to the ongoing conflict in

Ukraine.

While thus far, our margins have benefited from our policy of

substantially increasing our stocks ahead of the huge cost increase

in raw materials, the effect of these cost increases will

increasingly feed through and result in lower gross margins. We are

also going to see the direct negative impact of increases in our

own overhead costs following on from much higher energy and freight

costs. The unknown is not a question of if these negative factors

will affect us, but of when, and the degree.

Nevertheless, the Group remains well placed to weather these

adversities. Our main concerns, and principal risks, remain the

Group's exposure to currency fluctuations and the very large

negative impact of much higher costs on our cash flow. Cash flow is

an issue we are focused on and continuously and carefully

monitoring, while still aiming to complete the long-term capex

investments already in progress.

Employees

All our employees in the Group, regardless of location continue

to make a major contribution and we thank them for their

efforts.

For further information please contact:

Nicholas Braime/Cielo Cartwright

0113 245 7491

W. H. Ireland Limited

Katy Mitchell

0113 394 6628

Unaudited Unaudited

Braime Group PLC 6 months 6 months Audited

Consolidated income statement for to to year to

the six months Note 30th June 30th June 31st December

ended 30th June 2022 2022 2021 2021

GBP'000 GBP'000 GBP'000

------------------------------------------- ------- ----------- ----------- ---------------

Revenue 21,308 18,212 36,406

Changes in inventories of finished

goods and work in progress 841 51 869

Raw materials and consumables used (12,099) (9,661) (19,656)

Employee benefits costs (4,859) (4,366) (8,930)

Depreciation expense (738) (655) (1,334)

Other expenses (2,568) (2,597) (4,954)

Other operating income 200 5 88

------------------------------------------- ------- ----------- ----------- ---------------

Profit from operations before exceptional

item 2,085 989 2,489

Exceptional item (350) - (1,217)

------------------------------------------- ------- ----------- ----------- ---------------

Profit from operations 1,735 989 1,272

Finance costs (127) (106) (205)

Finance income - 2 3

------------------------------------------- ------- ----------- ----------- ---------------

Profit before tax 1,608 885 1,070

Tax expense (477) (220) (320)

------------------------------------------- ------- ----------- ----------- ---------------

Profit for the period 1,131 665 750

------------------------------------------- ------- ----------- ----------- ---------------

Profit attributable to:

Owners of the parent 1,123 608 665

Non-controlling interests 8 57 85

------------------------------------------- ------- ----------- ----------- ---------------

1,131 665 750

------------------------------------------- ------- ----------- ----------- ---------------

Basic and diluted earnings per share 2 78.54p 46.18p 52.08p

Unaudited Unaudited

Braime Group PLC 6 months 6 months Audited

Consolidated statement of comprehensive to to year to

income for the six months 30th June 30th June 31st December

ended 30th June 2022 2022 2021 2021

GBP'000 GBP'000 GBP'000

--------------------------------------------------- ----------- ----------- ---------------

Profit for the period 1,131 665 750

--------------------------------------------------- ----------- ----------- ---------------

Items that will not be reclassified subsequently

to profit or loss

Net pension remeasurement gain on post-employment

benefits - - 90

Items that may be reclassified subsequently

to profit or loss

Foreign exchange gains/(losses) on re-translation

of overseas operations 604 (97) 87

Other comprehensive income for the period 604 (97) 177

--------------------------------------------------- ----------- ----------- ---------------

Total comprehensive income for the period 1,735 568 927

--------------------------------------------------- ----------- ----------- ---------------

Total comprehensive income attributable

to:

Owners of the parent 1,735 489 817

Non-controlling interests - 79 110

--------------------------------------------------- ----------- ----------- ---------------

1,735 568 927

--------------------------------------------------- ----------- ----------- ---------------

The foreign currency movements arise on the re-translation of

overseas subsidiaries' opening balance sheets at closing rates.

Unaudited Unaudited Audited

6 months 6 months year to

Braime Group PLC to to 31st

Consolidated balance sheet at 30th June 30th June 30th June December

2022 2022 2021 2021

GBP'000 GBP'000 GBP'000

----------------------------------------------- ----------- ----------- ----------

Non-current assets

Property, plant and equipment 9,142 8,216 8,713

Intangible assets 709 31 25

Right of use assets 534 683 632

Total non-current assets 10,385 8,930 9,370

----------------------------------------------- ----------- ----------- ----------

Current assets

Inventories 11,174 9,083 10,124

Trade and other receivables 8,470 7,472 6,211

Cash and cash equivalents 1,533 1,673 1,463

----------------------------------------------- ----------- ----------- ----------

Total current assets 21,177 18,228 17,798

----------------------------------------------- ----------- ----------- ----------

Total assets 31,562 27,158 27,168

----------------------------------------------- ----------- ----------- ----------

Current liabilities

Bank overdraft 1,734 909 489

Trade and other payables 6,073 5,344 4,895

Other financial liabilities 2,715 2,661 2,902

Corporation tax liability 177 70 41

----------------------------------------------- ----------- ----------- ----------

Total current liabilities 10,699 8,984 8,327

----------------------------------------------- ----------- ----------- ----------

Non-current liabilities

Financial liabilities 2,554 2,479 2,046

Deferred income tax liability 36 276 24

Provision for liabilities 939 - 1,054

----------------------------------------------- ----------- ----------- ----------

Total non-current liabilities 3,529 2,755 3,124

----------------------------------------------- ----------- ----------- ----------

Total liabilities 14,228 11,739 11,451

----------------------------------------------- ----------- ----------- ----------

Total net assets 17,334 15,419 15,717

----------------------------------------------- ----------- ----------- ----------

Capital and reserves

Share capital 360 360 360

Capital reserve 257 257 257

Foreign exchange reserve 523 (270) (89)

Retained earnings 16,387 15,296 15,382

----------------------------------------------- ----------- ----------- ----------

Total equity attributable to the shareholders

of the parent company 17,527 15,643 15,910

Non-controlling interests (193) (224) (193)

----------------------------------------------- ----------- ----------- ----------

Total equity 17,334 15,419 15,717

----------------------------------------------- ----------- ----------- ----------

Unaudited Unaudited Audited

Braime Group PLC 6 months 6 months year to

Consolidated cash flow statement to to 31st December

for the six months Note 30th June 30th June 2021

ended 30th June 2022 2022 2021

GBP'000 GBP'000 GBP'000

----------------------------------------- ------- ----------- ----------- ---------------

Operating activities

Net profit 1,131 665 750

----------------------------------------- ------- ----------- ----------- ---------------

Adjustments for:

Depreciation 738 655 1,334

Foreign exchange gains/(losses) 480 (4) 210

Finance income - (2) (3)

Finance expense 127 106 205

Gain on sale of plant, machinery

and motor vehicles (186) (5) (38)

Adjustment in respect of defined

benefit scheme - - 91

Income tax expense 477 220 320

Income taxes paid (310) (329) (679)

----------------------------------------- ------- ----------- ----------- ---------------

Operating profit before changes

in working capital and provisions 2,457 1,306 2,190

----------------------------------------- ------- ----------- ----------- ---------------

Increase in trade and other receivables (2,278) (1,518) (288)

Increase in inventories (1,050) (219) (1,259)

Increase in trade and other payables 1,664 1,138 179

(Decrease)/increase in provisions (115) - 1,054

(1,779) (599) (314)

----------------------------------------- ------- ----------- ----------- ---------------

Cash generated from operations 678 707 1,876

----------------------------------------- ------- ----------- ----------- ---------------

Investing activities

Purchases of property, plant, machinery

and motor vehicles (1,618) (991) (2,074)

Sale of plant, machinery and motor

vehicles 218 5 73

Interest received - 2 2

----------------------------------------- ------- ----------- ----------- ---------------

(1,400) (984) (1,999)

----------------------------------------- ------- ----------- ----------- ---------------

Financing activities

Proceeds from long term borrowings 236 532 1,145

Repayment of borrowings (233) (234) (452)

Repayment of hire purchase creditors (73) (109) (182)

Repayment of lease liabilities (138) (127) (234)

Bank interest paid (92) (55) (124)

Lease interest paid (29) (37) (65)

Hire purchase interest paid (6) (15) (16)

Dividends paid (118) (112) (173)

----------------------------------------- ------- ----------- ----------- ---------------

(453) (157) (101)

----------------------------------------- ------- ----------- ----------- ---------------

Decrease in cash and cash equivalents (1,175) (434) (224)

Cash and cash equivalents, beginning

of period 974 1,198 1,198

----------------------------------------- ------- ----------- ----------- ---------------

Cash and cash equivalents (including

overdrafts), end of period 3 (201) 764 974

----------------------------------------- ------- ----------- ----------- ---------------

Braime Group PLC

Consolidated statement

of Foreign

changes in equity Share Capital Exchange Retained Minority Total

for the Capital Reserve Reserve Earnings Total Interests Equity

six months ended

30th June 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Balance at 31st

December

2021 360 257 (89) 15,382 15,910 (193) 15,717

Comprehensive income

Profit - - - 1,123 1,123 8 1,131

Other comprehensive

income

Foreign exchange

gain/(loss)

on re-translation

of overseas operations - - 612 - 612 (8) 604

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Total other comprehensive

income - - 612 - 612 (8) 604

Total comprehensive

income - - 612 1,123 1,735 - 1,735

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Transactions with

owners

Dividends - - - (118) (118) - (118)

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Total transactions

with owners - - - (118) (118) - (118)

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Balance at 30th

June 2022 360 257 523 16,387 17,527 (193) 17,334

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Braime Group PLC

Consolidated statement

of Foreign

changes in equity Share Capital Exchange Retained Minority Total

for the Capital Reserve Reserve Earnings Total Interests Equity

six months ended

30th June 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Balance at 31st

December 2020 360 257 (151) 14,800 15,266 (303) 14,963

Comprehensive income

Profit - - - 608 608 57 665

Other comprehensive

income

Foreign exchange

(loss)/gain on re-translation

of overseas

operations - - (119) - (119) 22 (97)

-------------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Total other comprehensive

income - - (119) - (119) 22 (97)

Total comprehensive

income - - (119) 608 489 79 568

-------------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Transactions with

owners

Dividends - - - (112) (112) - (112)

-------------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Total transactions

with owners - - - (112) (112) - (112)

-------------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Balance at 30th

June 2021 360 257 (270) 15,296 15,643 (224) 15,419

-------------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Braime Group PLC

Consolidated statement

of Foreign

changes in equity Share Capital Exchange Retained Minority Total

for the Capital Reserve Reserve Earnings Total Interests Equity

year ended 31st

December

2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Balance at 1st January

2021 360 257 (151) 14,800 15,266 (303) 14,963

Comprehensive income

Profit - - - 665 665 85 750

Other comprehensive

income

Net pension remeasurement

gain recognised

directly in

equity - - - 90 90 - 90

Foreign exchange

losses on

re-translation of

overseas

operations - - 62 - 62 25 87

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Total other comprehensive

income - - 62 90 152 25 177

Total comprehensive

income - - 62 755 817 110 927

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Transactions with

owners

Dividends - - - (173) (173) - (173)

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Total transactions

with owners - - - (173) (173) - (173)

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

Balance at 31st

December

2021 360 257 (89) 15,382 15,910 (193) 15,717

--------------------------- ---------- ---------- ----------- ----------- --------- ------------ ---------

1. Accounting policies

Basis of preparation

The interim financial report has been prepared using accounting

policies that are consistent with those used in the preparation of

the full financial statements to 31st December 2021 and those which

management expects to apply in the Group's full financial

statements to 31st December 2022.

This interim financial report is unaudited. The comparative

financial information set out in this interim financial report does

not constitute the Group's statutory accounts for the period ended

31st December 2021 but is derived from the accounts. Statutory

accounts for the period ended 31st December 2021 have been

delivered to the Registrar of Companies. The auditors have reported

on those accounts. Their audit report was unqualified and did not

contain any statements under Section 498 of the Companies Act

2006.

The Group's condensed interim financial information has been

prepared in accordance with International Financial Reporting

Standards ('IFRS') as adopted for the use in the European Union and

in accordance with IAS 34 'Interim Financial Reporting' and the

accounting policies included in the Annual Report for the year

ended 31st December 2021, which have been applied consistently

throughout the current and preceding periods.

(a) The Group has adopted the following new or amended standards as of 1st January 2022:

-- Annual improvements to IFRS standards 2018-2020 cycle - Minor

amendments to IFRS 1, IFRS 9 and IAS 41 - effective accounting

periods beginning on or after 1st January 2022.

-- Amendments to IFRS 3 - Reference to the Conceptual Framework

- Updates certain references to the Conceptual Framework for

Financial Reporting without changing the accounting requirements

for business combinations - effective accounting periods beginning

on or after 1st January 2022.

-- Amendments to IAS 16 - Property, Plant and Equipment:

Proceeds before Intended Use - Requires amounts received from

selling items produced while the company is preparing the asset for

its intended use to be recognised in profit or loss, and not as an

adjustment to the cost of the asset - effective accounting periods

beginning on or after 1st January 2022.

-- Amendment to IAS 37 Onerous Contracts: Cost of Fulfilling a

Contract - Specifies which costs to include when assessing whether

a contract will be loss-making - effective accounting period

beginning on or after 1st January 2022.

(b) New and amended standards applicable for annual period

beginning on 1st January 2023 and beyond:

-- IFRS 17 Insurance Contracts - Establishes new principles for

the recognition, measurement, presentation and disclosure of

insurance contracts issued, reinsurance contracts held and

qualifying investment contracts with discretionary participation

features issued - effective accounting periods on or after 1st

January 2023.

-- Amendments to IFRS 17 - Initial Application of IFRS 17 &

IFRS 9 - Comparative Information - Helps entities to avoid

temporary accounting mismatches by allowing an option relating to

comparative information about financial assets presented on initial

application of IFRS 17 - effective accounting period beginning on

or after 1st January 2023.

-- Amendments to IAS 1 - Classification of Liabilities as

Current or Non-current - Clarifies that the classification of

liabilities as current or non-current should be based on rights

that exist at the end of the reporting period - effective

accounting periods beginning on or after 1st January 2023.

-- Amendments to IAS 1 and IFRS Practice Statement 2 -

Disclosure of Accounting Policies - Changes requirements from

disclosing 'significant' to 'material' accounting policies and

provides explanations and guidance on how to identify material

accounting policies - effective accounting period beginning on or

after 1st January 2023.

-- Amendments to IAS 8 - Definition of Accounting Estimates -

Clarifies how to distinguish changes in accounting policies from

changes in accounting estimates - effective accounting periods

beginning on or after 1st July 2023.

-- Amendments to IAS 12 - Deferred Tax related to Assets and

Liabilities arising from a Single Transaction - Introduces an

exception to clarify that the 'initial recognition exemption' does

not apply to transactions that give rise to equal taxable and

deductible timing differences - effective accounting periods

beginning on or after 1st January 2023.

The application and interpretations surrounding the new or

amended standards is not expected to have a material impact on the

Group's reported financial performance or position. However, they

may give rise to additional disclosures being made in the financial

statements.

2. Earnings per share and dividends

Both the basic and diluted earnings per share have been

calculated using the net results attributable to shareholders of

Braime Group PLC as the numerator.

The weighted average number of outstanding shares used for basic

earnings per share amounted to 1,440,000 (2021 - 1,440,000). There

are no potentially dilutive shares in issue.

6 months

to

30th June

2022

GBP'000

------------------------------------------------------ ---------------

Dividends paid on equity shares

Ordinary shares

Interim of 8.20p per share paid on 24th May 2022 39

'A' Ordinary shares

Interim of 8.20p per share paid on 24th May 2022 79

------------------------------------------------------ ---------------

Total dividends paid 118

------------------------------------------------------ ---------------

Year to

31st December

2021

GBP'000

------------------------------------------------------ ---------------

Dividends paid on equity shares

Ordinary shares

Interim of 7.80p per share paid on 25th May 2021 37

Interim of 4.25p per share paid on 14th October 2021 20

------------------------------------------------------ ---------------

57

------------------------------------------------------ ---------------

'A' Ordinary shares

Interim of 7.80p per share paid on 25th May 2021 75

Interim of 4.25p per share paid on 14th October 2021 41

------------------------------------------------------ ---------------

116

------------------------------------------------------ ---------------

Total dividends paid 173

------------------------------------------------------ ---------------

3. Cash and cash equivalents

Unaudited Unaudited Audited

6 months 6 months year to

to to 31st December

30th June 30th June 2021

2022 2021

GBP'000 GBP'000 GBP'000

-------------------------- ------------ ------------ ---------------

Cash at bank and in hand 1,533 1,673 1,463

Bank overdrafts (1,734) (909) (489)

-------------------------- ------------ ------------ ---------------

(201) 764 974

-------------------------- ------------ ------------ ---------------

4. Segmental information

Unaudited 6 months to

30th June 2022

Central Manufacturing Distribution Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- -------- -------------- ------------- --------

Revenue

External - 2,986 18,322 21,308

Inter company 939 2,599 3,067 6,605

--------------------------------- -------- -------------- ------------- --------

Total 939 5,585 21,389 27,913

--------------------------------- -------- -------------- ------------- --------

Profit

EBITDA (including exceptional

item) (375) 553 2,295 2,473

Finance costs (58) (19) (50) (127)

Finance income - - - -

Depreciation (294) (18) (426) (738)

Tax expense (15) - (462) (477)

--------------------------------- -------- -------------- ------------- --------

(Loss)/profit for the period (742) 516 1,357 1,131

--------------------------------- -------- -------------- ------------- --------

Assets

Total assets 6,482 7,956 17,124 31,562

Additions to non-current assets 750 8 876 1,634

Liabilities

Total liabilities 2,317 3,637 8,274 14,228

Unaudited 6 months to

30th June 2021

Central Manufacturing Distribution Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- -------- -------------- ------------- --------

Revenue

External - 2,642 15,570 18,212

Inter company 1,006 1,933 2,615 5,554

--------------------------------- -------- -------------- ------------- --------

Total 1,006 4,575 18,185 23,766

--------------------------------- -------- -------------- ------------- --------

Profit

EBITDA 36 517 1,091 1,644

Finance costs (34) (17) (55) (106)

Finance income - - 2 2

Depreciation (296) (19) (340) (655)

Tax expense (16) - (204) (220)

--------------------------------- -------- -------------- ------------- --------

(Loss)/profit for the period (310) 481 494 665

--------------------------------- -------- -------------- ------------- --------

Assets

Total assets 5,512 5,895 15,751 27,158

Additions to non-current assets 379 11 942 1,332

Liabilities

Total liabilities 888 3,141 7,710 11,739

Audited year to

31st December 2021

Central Manufacturing Distribution Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- -------- -------------- ------------- --------

Revenue

External - 5,166 31,240 36,406

Inter company 2,038 4,287 6,704 13,029

--------------------------------- -------- -------------- ------------- --------

Total 2,038 9,453 37,944 49,435

--------------------------------- -------- -------------- ------------- --------

Profit

EBITDA (including exceptional

item) (740) 807 2,539 2,606

Finance costs (69) (37) (99) (205)

Finance income - 1 2 3

Depreciation (608) (34) (692) (1,334)

Tax expense 144 30 (494) (320)

--------------------------------- -------- -------------- ------------- --------

(Loss)/profit for the period (1,273) 767 1,256 750

--------------------------------- -------- -------------- ------------- --------

Assets

Total assets 5,839 6,402 14,927 27,168

Additions to non-current assets 1,219 11 1,298 2,528

Liabilities

Total liabilities 2,109 2,525 6,817 11,451

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FELFBLKLFBBE

(END) Dow Jones Newswires

September 05, 2022 07:20 ET (11:20 GMT)

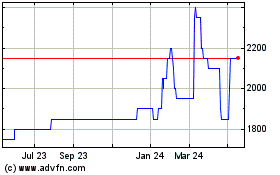

Braime (LSE:BMTO)

Historical Stock Chart

From Nov 2024 to Dec 2024

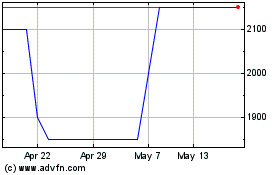

Braime (LSE:BMTO)

Historical Stock Chart

From Dec 2023 to Dec 2024