TIDMBOR

RNS Number : 3621V

Borders & Southern Petroleum plc

14 April 2021

14 April 2021

Borders & Southern Petroleum plc

("Borders & Southern" or "the Company")

Audited Results for the 12 month period ended 31 December

2020

Borders & Southern (AIM: BOR), the London based independent

oil and gas exploration company with assets offshore the Falkland

Islands, announces its audited results for the year ended 31

December 2020. Full copies of the Company's Annual Report and

Accounts, including the Company Overview, Chairman's Statement,

Remuneration Committee Report, Directors' Report, Auditor's Report

and full Financial Statements, will be available tomorrow on the

Company's website and posted to Shareholders in May.

Summary

-- Cash Balance on 31 December 2020: $2.18 million (2019: $3.68 million).

-- Administrative expense for the year: $1.0 million (2019: $1.45 million).

-- Operating loss of $1.01 million (2019: $1.37 million)

-- The farm-out process has been extensive and far-reaching -

the Company continues to investigate all possible options for

funding the next drilling programme.

For further information please visit www.bordersandsouthern.com

or contact:

Borders & Southern Petroleum plc

Howard Obee, Chief Executive

Tel: 020 7661 9348

Strand Hanson Limited (Nominated, Financial Adviser & Joint Broker)

James Spinney / Ritchie Balmer / Georgia Langoulant

Tel: 020 7409 3494

Auctus Advisors LLP (Joint Broker)

Jonathan Wright

Tel: 07711 627449

Tavistock (Financial PR)

Simon Hudson / Nick Elwes

Tel: 020 7920 3150

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 (as amended) as it forms part of the

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (as amended). Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Notes to Editors:

Borders & Southern Petroleum plc is an oil & gas

exploration company listed on the London Stock Exchange AIM (BOR).

The Company operates and has a 100% interest in three Production

Licences in the South Falkland Basin covering an area of nearly

10,000 square kilometres. The Company has acquired 2,517 square

kilometres of 3D seismic and drilled two exploration wells, making

a significant gas condensate discovery with its first well.

Competent Person Disclosure:

The technical aspects of this announcement have been reviewed,

verified and approved by Dr Howard Obee in accordance with the

Guidance Note for Mining, Oil and Gas Companies, issued by the

London Stock Exchange in respect of AIM companies. Dr Obee is a

petroleum geologist with more than 30 year's relevant experience.

He is a Fellow of the Geological Society and member of the American

Association of Petroleum Geologists and the Petroleum Exploration

Society of Great Britain.

Chairman's and CEO's review

Borders & Southern's strategic objective is to monetise its

Darwin discovery for the benefit of all its stakeholders. To

achieve this and to initiate the next step, the Company's principal

focus has been to acquire partners and funding for Darwin's

appraisal programme. However, in the past few years, industry and

capital market fundamentals have not helped our progress. 2020

continued in the same vein. But despite the challenge, the Board

believes that the quality of the Darwin project merits the

continuation of its strategy and the Board's commitment remains

undiminished.

The loss from operations in 2020 was $1,046,000 (compared to

$1,370,000 in 2019). The Company has always maintained strong

financial control and a low overhead. However, further cost savings

have been made during the past year, including a reduction in

salaries by 50%. Administrative expense for the year was $1.0

million, compared to $1.47 million in 2019. The cash balance at

year-end was $2.18 million (2019: $3.68 million). The Company

remains debt-free. With a decreasing cash balance, and in the event

that market conditions prevent us from sourcing partner funding, it

may be necessary to raise additional capital in the coming

year.

The farm-out process has been extensive and far reaching. To

assist the marketing, considerable effort has been put into

minimising drilling costs for the next campaign, addressing both

the well designs and the service company costs. Potential savings

of up to 25% have been identified and this has formed the basis of

our current conversations with potential partners.

The project fundamentals are strong. Economic projections are

attractive, the break-even oil price is low (less than $35 per

barrel), sub-surface risks are low, and the environmental footprint

low. As the industry enters the energy transition to a lower carbon

future, we believe that Darwin (with its estimated 460 million

barrels of condensate and LPGs) is a worthy development, comparing

favourably to many global alternatives. Prior to the start of the

next phase of operations, the Company commits to fully integrating

climate change into its business plan. We will define measures,

report transparently, and mitigate our own emissions as far as

practicable.

Outlook for the industry remains challenging, although signs of

optimism are noted. Brent crude has risen during the first quarter

of 2021, approaching $70 per barrel before declining to around $60

later in the quarter. Whilst this has not yet impacted company

expenditure patterns, if the trend were to continue, and energy

demand accelerates as the world comes out of the Covid pandemic

crisis, there will be a need to bring additional resources into

production. Borders & Southern aim to be part of that

production increase.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2020

2020 2019

--------------------------------------------------

$000 $000

-------------------------------------------------- -------- -------------

Administrative expenses (1,046) (1,447)

-------------------------------------------------- -------- -------------

Loss from operations (1,046) (1,447)

Finance income 55 88

Finance expense (11) (11)

Loss before tax (1,002) (1,370)

Tax expense - -

-------- -------------

Loss for the year and total comprehensive

loss for the year attributable to equity owners

of the parent (1,002) (1,370)

-------------------------------------------------- -------- -------------

Basic and diluted loss per share (see note (0.21)

3) cents (0.28) cents

-------------------------------------------------- -------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 December 2020

2020 2019

------------------------------- ----------------- ------------------

$000 $000 $000 $000

------------------------------- ------ --------- ------ ----------

Assets

Non-current assets

Property, plant and equipment 151 118

Intangible assets 292,241 291,765

------------------------------- ------ --------- ------ ----------

Total non-current assets 292,392 291,883

------------------------------- ------ --------- ------ ----------

Current assets

Other receivables 225 233

Cash and cash equivalents 2,184 3,682

------------------------------- ------ --------- ------ ----------

Total current assets 2,409 3,915

------------------------------- ------ --------- ------ ----------

Total assets 294,801 295,798

------------------------------- ------ --------- ------ ----------

Liabilities

Current liabilities

Trade and other payables (240) (235)

------------------------------- ------ --------- ------ ----------

Total net assets 294,561 295,563

------------------------------- ------ --------- ------ ----------

Equity attributable to

the equity owners of the

parent company

Share capital 8,530 8,530

Share premium 308,602 308,602

Other reserves 1,777 1,777

Retained deficit (24,332) (23,330)

Foreign currency reserve (16) (16)

------------------------------- ------ --------- ------ ----------

Total equity 294,561 295,563

------------------------------- ------ --------- ------ ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2020

Foreign

Share Share Other Retained currency

capital premium reserves deficit reserve Total

$000 $000 $000 $000 $000 $000

------------------------------ --------- --------- ---------- --------- ---------- --------

Balance at 1 January 2019 8,530 308,602 1,775 (21,960) (16) 296,931

Loss and total comprehensive

loss for the year - - - (1,370) - (1,370)

Recognition of share-based

payments - - 2 - - 2

------------------------------ --------- --------- ---------- --------- ---------- --------

Balance at 31 December

2019 8,530 308,602 1,777 (23,330) (16) 295,563

Loss and total comprehensive

loss for the year - - - (1,002) - (1,002)

Balance at 31 December

2020 8,530 308,602 1,777 (24,332) (16) 294,561

------------------------------ --------- --------- ---------- --------- ---------- --------

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share capital This represents the nominal value of shares

issued.

Share premium Amount subscribed for share capital in excess

of nominal value.

Other reserves Fair value of options issued less transfers

to retained deficit on expiry.

Retained deficit Cumulative net gains and losses recognised

in the Consolidated Statement of Comprehensive

Income.

Foreign currency Differences arising on the translation of

reserves foreign operation to US dollars.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2020

2020 2019

----------------

$000 $000 $000 $000

--------------------------------------- ------ -------- ------ --------

Cash flow from operating activities

Loss before tax (1,002) (1,370)

Adjustments for: Depreciation 95 92

Share-based payment - 2

Finance costs 11 11

Finance income (54) (88)

Unrealised foreign currency movements 2 27

--------------------------------------- ------ -------- ------ --------

Cash flows used in operating

activities before changes in

working capital (948) (1,326)

Decrease in other receivables 8 29

Increase/(Decrease) in trade

and other payables (61) (176)

--------------------------------------- ------ -------- ------ --------

Net cash outflow from operating

activities (1,000) (1,473)

Cash flows used in investing

activities

Interest received 2 27

Purchase of tangible fixed assets - (11)

Purchase of intangible assets (476) (398)

------ ------

Net cash used in investing activities (474) (382)

--------------------------------------- ------ -------- ------ --------

Cash flows from financing

Cash flows from financing activities

Lease interest (11) (11)

Lease payments (62) (112)

------ ------

(73) (123)

-------- --------

Net decrease in cash and cash

equivalents (1,547) (1,978)

--------------------------------------- ------ -------- ------ --------

Cash and cash equivalents at

the beginning of the year 3,682 5,626

Exchange gain on cash and cash

equivalents 49 34

--------------------------------------- ------ -------- ------ --------

Cash and cash equivalents at

the end of the year 2,184 3,682

--------------------------------------- ------ -------- ------ --------

Notes

1. Accounting policies

Basis of preparation

The financial information for the year ended 31 December 2020

set out in this announcement does not constitute the Company's

statutory accounts. These financial statements included in the

announcement have been extracted from the Group annual financial

statements for the year ended 31 December 2020. The financial

statements have been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards adopted for use in the European Union. However, this

announcement does not itself contain sufficient information to

comply with IFRS.

The auditor has issued its opinion on the Group's financial

statements for the year ended 31 December 2020 which is unmodified

and is available for inspection at the Company's registered address

and will be posted to the Group's website.

2. Going concern

The consolidated financial statements have been prepared on a

going concern basis which assumes the continuity of normal business

activity and the realisation of assets and settlement of

liabilities in the normal course of business.

The Group's board of directors have reviewed the Group's cash

forecasts for a period of no less than twelve months from the date

of approval of the financial statements, the period to 31 March

2022. Based on these forecasts, in the absence of a farm-out, the

directors have identified that further funding may be required to

cover administrative costs and licence fees beyond December

2021.

3. Basic and dilutive loss per share

The calculation of the basic and dilutive loss per share is

based on the loss attributable to ordinary shareholders divided by

the weighted average number of shares in issue during the year. The

loss for the financial year for the group was $1.002 million (2019-

loss $1.370 million) and the weighted average number of shares in

issue for the year was 484.1 million (2019 - 484.1 million). During

the year the potential ordinary shares are anti-dilutive and

therefore diluted loss per share has not been calculated. At the

statement of financial position date, there were 6.1 million (2019

- 6.1 million) potentially dilutive ordinary shares being the share

options.

4. Subsequent date events

There were no subsequent date events requiring disclosure

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UORBRAVUSAAR

(END) Dow Jones Newswires

April 14, 2021 02:00 ET (06:00 GMT)

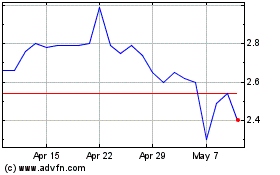

Borders & Southern Petro... (LSE:BOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Borders & Southern Petro... (LSE:BOR)

Historical Stock Chart

From Apr 2023 to Apr 2024