TIDMBRIG

BLACKROCK INCOME AND GROWTH INVESTMENT TRUST PLC

LEI: 5493003YBY59H9EJLJ16

HALF YEARLY FINANCIAL REPORT FOR THE SIX MONTHSED 30 APRIL 2022

PERFORMANCE RECORD

As at As at

30 April 31 October Change

2022 2021 %

Net assets (£'000)1 44,028 43,468 +1.3

Net asset value per ordinary share (pence) 207.67 203.13 +2.2

Ordinary share price (mid-market) (pence) 187.00 191.00 -2.1

Discount to net asset value2 10.0% 6.0%

FTSE All-Share Index 8430.58 8173.30 +3.1

--------------- --------------- ---------------

Performance (with dividends reinvested)

Net asset value per share2 4.5% 30.4%

Ordinary share price2 0.3% 22.2%

FTSE All-Share Index 3.1% 35.4%

========= =========

For the six For the six

months ended months ended

30 April 2022 30 April 2021

Change

%

Revenue

Net profit after taxation (£'000) 752 699 +7.6

Revenue earnings per ordinary share (pence)3 3.53 3.15 +12.1

--------------- --------------- ---------------

Dividends (pence)

Interim 2.60 2.60 -

========= ========= =========

1 The change in net assets reflects the market movements during the period,

the purchase of the Company's own shares and dividends paid.

2 Alternative Performance Measures, see Glossary in the Half Yearly

Financial Report.

3 Further details are given in the Glossary in the Half Yearly Financial

Report.

Sources: BlackRock and Datastream.

CHAIRMAN'S STATEMENT

Dear Shareholder

OVERVIEW

Recent reports to shareholders were, inevitably, dominated by the COVID-19

pandemic and its inpacts on markets and economies. Direct impacts, lockdowns

and the like have reduced over the recent months, although the receding

pandemic has left behind it a number of related supply constraints, causing

inflation to rise sharply as demand for goods outstripped supply as economic

activity restarted. These effects were then compounded by Russia's invasion of

Ukraine and the resulting humanitarian crisis. Market volatility spiked and

sentiment has been firmly orientated towards fear not greed, with market

participants reducing exposure and seeking safe havens. The West's response to

Russia's invasion has been decisive, applying unprecedented sanctions on

Russian companies and financial institutions, freezing assets and even the

announcement by the UK and the US of a total ban on the import of Russian oil

and gas.

Although many would argue these severe actions have been entirely appropriate,

they have not been without significant cost to Western economies. The resulting

energy supply shock has seen energy prices skyrocket and this, coupled with the

existing post-COVID-19 supply constraints mentioned above, has pushed inflation

to levels not seen in decades in the UK, hitting a 40 year high of 9.1% in May

2022. This has left central banks walking a delicate tightrope act between

intervening to address soaring inflation, while running the risk of curtailing

economic growth. The Bank of England raised interest rates by 0.25 percentage

points to 1% in May 2022 and by a further 0.25 percentage points in June 2022,

with further rate hikes likely later this year, which along with other policy

tightening, points to a likely drop in the rate of inflation over the next half

year or so. Looking into the future though, equity markets have given back much

of the gains made from the economic restart, reflecting the anticipation of

further interest rate hikes, the rapidly rising cost of living and lower

consumer spending, higher operational costs for companies as the price of

commodities and energy rise and, ultimately, lower overall levels of growth for

UK public companies.

Against the turmoil described above, I am pleased to report that our portfolio

has been resilient, outperforming many of its sector peers and the benchmark

return during the period. In addition, it is also positive to see that the

revenue generated by our investment portfolio has risen versus the prior year,

despite the challenges during the period. As you will read in the Investment

Manager's report which follows, our portfolio saw strong performance from our

exposure to commodities and energy. Our financial holdings also performed well

as interest rates rose, and our portfolio managers have added several new

holdings which are well placed to benefit from rising energy prices and the UK

Government's focus on energy security.

PERFORMANCE

During the period, the Company's net asset value per share (NAV) returned 4.5%,

compared with the Company's benchmark, the FTSE All-Share Index (total return),

which returned 3.1%. The Company's share price returned 0.3% (all percentages

in Sterling with dividends reinvested).

Subsequent to the period end and as at 20 June 2022, the net asset value per

share of the Company has decreased by 6.5% from 207.67 pence per share to

194.27 pence per share and the Company's share price has fallen by 5.3% from

187.00 pence to 177.00 pence per share. The Company's Benchmark Index has

decreased by 5.6% over the same period.

Further information on the significant components of overall performance and

the changes to portfolio composition are set out in the Investment Manager's

Report below.

REVENUE PROFIT AND DIVIDS

Revenue profit for the period was 3.53 pence per share (six months to 30 April

2021: 3.15 pence per share), an increase of 12.1% year-on-year. The Board is

pleased to declare an interim dividend of 2.60 pence per share (2021: 2.60

pence per share). This dividend will be paid on 1 September 2022 to

shareholders on the Company's register at the close of business on 22 July 2022

(the ex-dividend date is 21 July 2022).

I am pleased to report that our interim dividend is fully covered by the

revenue generated during the period. After the payment of this year's interim

dividend, the Company will have approximately one year's dividend cover in

revenue reserves.

SHARE CAPITAL

The Directors recognise the importance to investors that the Company's share

price should not trade at a significant discount to NAV, and therefore, in

normal market conditions, may use the Company's share buy back, sale of shares

from treasury and share issuance powers to seek to ensure that the share price

does not differ excessively from the underlying NAV.

Buying back shares at a discount is accretive to NAV and can help narrow the

discount to NAV at which the Company's shares trade. It can also help to

provide additional liquidity. During the period the Company's shares traded at

an average discount of 8.9% and ended the period at 10.0%. At the close of

business on 20 June 2022 the discount had narrowed to 8.9%.

A total of 198,206 ordinary shares were bought back and cancelled during the

period at an average price of 183.65 pence and for a total consideration of £

364,000. No shares were issued or sold from treasury during the period under

review. As at 20 June 2022, 32.3% of the Company's issued ordinary share

capital is held in treasury and may be issued to satisfy any demand for the

Company's shares that may arise.

GEARING

The Company operates a flexible gearing policy which depends on prevailing

conditions and the outlook for the market. Gearing is subject to a maximum

level of 20% of net assets at the time of investment. The Company reduced

levels of gearing during the period under review and at 30 April 2022 the

Company had net gearing of 1.4%. Gearing levels and sources of funding are

reviewed regularly to ensure that the Company has access to the most

competitive borrowing rates available to it. The Company currently has a

two-year unsecured Sterling revolving credit facility of £4,000,000 with ING

Bank (Luxembourg) S.A., which is fully drawn down and is scheduled to mature in

November 2023.

SHAREHOLDER COMMUNICATION

The Board appreciates how important access to regular information is to our

shareholders. To supplement our Company website, we now offer shareholders the

ability to sign up to the Trust Matters newsletter which includes information

on the Company as well as news, views and insights. Further information on how

to sign up is included on the inside cover of the Half Yearly Financial Report.

OUTLOOK

As you will read in their report which follows below, your investment managers

continue to seek out companies that can generate strong, consistent cash flow,

from robust business models which have favourable industry characteristics or

scope for management driven self-help. They are focused on bottom-up stock

selection and are emboldened by the attractive stock-specific opportunities on

offer.

Given the ongoing market volatility our portfolio managers continue to apply

prudent balance to the portfolio which has resulted in resilience and the

protection of shareholder capital during these most challenging times. However,

they also continue to seek exposure to macro trends and growth through those

companies best placed to thrive in the current environment, whilst applying a

degree of caution as the powerful macroeconomic drivers described above play

out through the remainder of the year and beyond.

As we move into an economic and policy environment which is more than usually

changeable, your Board remains fully supportive of our portfolio managers'

approach and to their aim of positioning the portfolio to deliver on the

Company's investment objective.

GRAEME PROUDFOOT

Chairman

22 June 2022

INVESTMENT MANAGER'S REPORT

PERFORMANCE

For the six month period since 31 October 2021, the Company's NAV returned

4.5%, outperforming its benchmark, the FTSE All-Share Index (the Benchmark

Index), which returned 3.1% over the same period (all percentages in Sterling

with dividends reinvested).

INVESTMENT APPROACH

In assembling the Company's portfolio, we adopt a concentrated investment

approach to ensure that our best ideas contribute significantly to returns. We

believe that it is the role of the portfolio overall to generate an attractive

and growing yield alongside capital growth rather than every individual company

within the portfolio. This gives the Company increased flexibility to invest

where returns are most attractive. This approach results in a portfolio which

differs substantially from the index and in any individual year the returns

will vary, sometimes significantly from those of the index. The foundation of

the portfolio, approximately 70%, is in high free cash flow companies that can

sustain cash generation and pay a growing dividend whilst aiming to deliver a

double-digit total return. Additionally, we look to identify and invest 20% of

the portfolio in 'growth' companies that have significant barriers to entry and

scalable business models that enable them to grow consistently. We also look

for turnaround companies, at around 10% of portfolio value, which represent

those companies that are out of favour with the market offering attractive

recovery potential.

MARKET REVIEW

The Benchmark Index rose 3.1% over the six months to 30 April 2022 with Oil &

Gas, Utilities and Basic Materials as top outperformers. The Benchmark Index

was a notable outperformer versus other developed markets indices where a

number of emerging and strengthening headwinds served to put pressure on risk

assets globally. These headwinds include the Omicron COVID-19 variant, Russia's

invasion of Ukraine as well as a general increase in geopolitical tensions,

rising inflation, weakening consumer sentiment and record high energy prices.

The Omicron variant created a ripple effect in developed markets early in the

period and although its impact faded as 2022 has progressed, it continues to

disrupt economic activity, most notably in China where stringent lockdowns are

still enforced affecting global supply chains.

Prior to Russia's invasion of Ukraine, markets had been impacted by the steep

rise in bond yields as investors rapidly repriced the scale and speed of

interest rate rises in response to high and persistent inflation. Supply

constraints have been widespread with the shortage of semiconductors perhaps

the highest profile.

The war has only served to exacerbate those inflationary concerns with key

commodities across energy and agricultural markets rising sharply in price;

security of energy supply becoming a key focus as countries seek to reduce

their dependence on Russia. Market performance was dominated by the strength in

commodities prices which benefitted the Mining and Oil & Gas sectors. These are

relatively large weights in the Benchmark Index contributing to its relative

resilience over this period. Defensive sectors, such as Tobacco and

Pharmaceuticals, also benefitted from greater economic uncertainty. Meanwhile,

long-duration assets were negatively impacted by rising interest rates which

reduce the present value of their growth.

CONTRIBUTORS TO AND DETRACTORS FROM PERFORMANCE

Positive contributors to performance included stock selection in the Consumer

Services, Basic Materials and Consumer Goods sectors and the overweight

positioning to the Health Care sector.

The mining sector performed strongly during the period reflecting strength in

commodity markets and continued capital discipline from the miners as

demonstrated by further large shareholder returns. As a result, the holdings in

Rio Tinto and BHP were significant contributors to the returns of the Company

during the period.

Standard Chartered was also a top contributor to performance benefitting from

increases in interest rates and a return to revenue growth. Mastercard also

contributed to performance after the company reported solid results with strong

payment volumes and an encouraging acceleration in cross-border volume linked

to increased travel. This supports our thesis that growth will accelerate as

the continued structural shift towards digital payments is boosted by a

normalisation in consumer activity post COVID-19.

As economic uncertainty boosted defensive holdings, British American Tobacco

and nutrition ingredients business, Tate & Lyle rose and performed well during

the period. Other positive contributors to performance during the period

included education business, Pearson which received a takeover approach even

though the bid has subsequently fallen away, and Drax Group, the power

generator, benefitting from the disruption in oil and gas markets. Both Tate &

Lyle and Drax Group were recent additions to the Company having been purchased

during the second half of 2021.

Detractors from performance included the underweight positioning to Oil & Gas

given the strength in the oil price and the sector. Holdings in the Industrials

sector also detracted, impacted by the rotation away from growth stocks,

concerns regarding the risk of supply chain shocks and as recessionary fears

emerged. We remain confident that we have invested in franchises that have

built durable competitive advantages, are cash generative and boast strong

balance sheets that are well placed to navigate this challenging operating

environment.

Notable detractors included Hays and Moonpig Group which reflected concerns of

a deterioration in the economic backdrop and consumer weakness given rising

inflationary pressures. Taylor Wimpey was impacted by fears of further costs

associated with the cladding removal bill as well as the impact of rising

inflation and interest rates on their customers and their profitability. Adobe

Systems also fell despite robust operational performance given the increase in

the interest rates which has reduced the premium at which high growth,

technology companies are valued.

TRANSACTIONS

We purchased a new holding in BT Group which is building out the UK's national

fibre network, targeting more than 25 million homes, providing consumers and

businesses with access to high-speed internet. We believe that the regulatory

landscape for the UK telecom industry is improving and that the market

participants are behaving more rationally. We are seeing price rises of

Consumer Prices Index (CPI) +4%, with limited backlash so far and all operators

are following suit. The company has the ability to put through in-contract

price rises in their contract wording, limiting any sticker shock. The average

telecoms bill represents 0.4% of UK household's bills such that the currently

expected 9% price rise equates to a c.£50 increase in the annual bill. There is

a high drop through from these price rises to the company's profits and cash

flow, while the capex investment phase around fibre slows in around 4 years, at

which point we expect a meaningful uplift in free cash flow generation. We also

purchased a new holding in Centrica, the British gas company, as we view it as

a beneficiary of rising energy costs and of the increased focus on security of

supply.

During the period we continued to reduce our Consumer exposure by selling Next

and Tesco and reduced the US exposure with the sale of Analog Devices. We sold

our holding in Oxford Nanopore following the strong share price performance

post Initial Public Offering. We also sold the position in Smiths Group. After

the successful sale of the company's medical division and recent strength in

the share price, the investment case required an acceleration in organic growth

which we believe may prove more challenging given the difficult economic

backdrop. We also materially reduced our position in BP Group given its large

stake in Rosneft, continuing to favour a larger position in Shell.

Ferguson's strong logistics enabled the company to thrive during this period of

disrupted supply chains while high commodity prices boosted revenues and

margins. The strong share price combined with our concern over the

sustainability of this performance prompted us to sell the holding. We used

some of the proceeds of the Ferguson sale to purchase a new holding in Ashtead

Group, the US focused equipment rental company offering attractive structural

growth from continued outsourcing trends in this fragmented industry following

recent share price weakness.

GEARING

Our general approach to gearing is that we aim to run the Company with a modest

and consistent level of gearing to enhance income generation and capital

growth; accordingly, the Company is typically 5-10% geared, however, at 30

April 2022, the Company had employed net gearing of 1.4% to reflect our more

cautious views on markets.

OUTLOOK

We are conscious that, at the time of writing, there is a significant conflict

and human suffering. Whilst we continue to reference the investment

implications of this, we recognise there are also tremendous implications for

humanity. The Russian invasion of Ukraine has contributed not just to the

volatility of 2022, but also to the range of outcomes. The backdrop for global

equities therefore, in our view, is mixed. Although demand remains strong, the

outlook for corporate revenue and earnings growth is likely to worsen over the

course of 2022 as the potential negative jaws of rising oil prices and rates

raise the spectre once again of stagflation. It is still likely that despite

the emerging cost of living crisis, government stimulus continues to be

retracted, and monetary policy is tightened in the face of more persistent

inflationary pressures. It will be incredibly important to focus on companies

with strong, competitive positions that can deliver in this environment and

that trade at attractive valuations.

Central banks, universally across the developed world, have entered 2022 in a

far more hawkish manner and as a result, market expectations for higher rates

and faster quantitative tightening have risen considerably. Time will tell

whether the conflict impacts the growth outlook and therefore the hawkishness

of central banks. It is also more likely we will see increasingly divergent

regional monetary approaches with the US being somewhat more insulated from the

impact of the conflict, than for example, Europe. We still do not know whether

the current inflationary trends are temporary or structural. Within this

calculation one must consider the impact from the significant COVID-19

stimulus, the unwinding of extreme COVID-19 behaviours, a more structural shift

in the cost of labour and the impact on costs from the decarbonisation agenda

or, indeed, a combination of the above. It is difficult to have a high degree

of confidence in the outcome, but we would note, given the uncertainty, there

is a rising risk of a policy mistake; either being too late to tighten and/or

tightening too hard. We expect this, and the geopolitical ramifications of the

Ukraine war, to be the prevailing debate of 2022 and beyond.

The strain on supply chains, caused by strong economic activity overwhelming

COVID-19 afflicted capacity and restricted labour availability, will continue

to provide inflationary pressures which can squeeze companies' margins. As a

reminder, we continue to concentrate the portfolio on businesses with pricing

power and durable, competitive advantages as we see these as best placed to

protect margins and returns over the medium and long term. However, a notable

feature of our conversations with a wide range of corporates in 2021 was the

ease with which they were able to pass on cost increases and protect or expand

margins. Management teams have pointed to robust demand, prioritisation of

security of supply as well as well-publicised supply chain disruption and cost

pressures. However, we believe that as some of the transitory inflationary

pressures start to fade (e.g., commodity prices, supply chain disruption) then

pricing conversations will become more challenging. We are also increasingly

focused on wage inflation which may be more structural and yet, in our

experience, harder to pass on. Corporates have already pointed to wages picking

up, the introduction of bonuses and growing pressure on employee retention

rates as competition for labour intensifies. We therefore believe that employee

retention will be an important differentiator in 2022 given the productivity

benefits of a stable workforce as labour markets tighten further.

The UK stock market has started the year far better than any other developed

market indices, benefitting from a far lower, and thus more attractive,

starting valuation. The Benchmark Index has benefitted from the lack of a

widespread re-rating seen in many other markets as well as its relatively high

exposure to commodities. We continue to see appetite to acquire great market

positions, real assets and/or unlevered free cash flow as highlighted by

takeover approaches for two portfolio holdings - Oxford Instruments and

Pearson. While most companies are paying dividends once more, we note the large

contribution from special dividends that may not persist. That said, as the

highest dividend yielding market in the developed world, we see the fundamental

valuation of the UK as attractive. We also view the outlook for ordinary

dividends for the UK market with optimism as most companies have emerged from

the COVID-19 crisis with appropriate dividend policies.

We continue to have conviction in cash generative companies with durable

competitive advantages, exceptional management teams and underappreciated

growth potential. At present, whilst we are excited by the attractive

stock-specific opportunities on offer, we continue to approach the year with

balance in the portfolio.

ADAM AVIGDORI AND DAVID GOLDMAN

BLACKROCK INVESTMENT MANAGEMENT (UK) LIMITED

22 June 2022

Ten largest investments*

1 = AstraZeneca (2021: 1st)

Sector: Pharmaceuticals & Biotechnology

Market value: £3,637,000

Percentage of portfolio: 8.2% (2021: 7.2%)

AstraZeneca is an Anglo-Swedish multinational pharmaceutical group with its

headquarters in the UK. It is a science-led biopharmaceutical business with a

portfolio of products for major disease areas including cancer, cardiovascular

infection, neuroscience and respiration.

2 + Shell (2021: 3rd)

Sector: Oil & Gas Producers

Market value: £3,161,000

Percentage of portfolio: 7.1% (2021: 4.7%)

Shell is a global oil and gas group. The group operates in both Upstream and

Downstream industries. The Upstream division is engaged in searching for and

recovering crude oil and natural gas, the liquefaction and transportation of

gas. The Downstream division is engaged in manufacturing, distribution and

marketing activities for oil products and chemicals.

3 + Rio Tinto (2021: 7th)

Sector: Mining

Market value: £2,408,000

Percentage of portfolio: 5.4% (2021: 3.7%)

Rio Tinto is a metals and mining group operating in about 36 countries around

the world, producing iron ore, copper, diamonds, gold and uranium.

4 - RELX (2021: 2nd)

Sector: Media

Market value: £2,394,000

Percentage of portfolio: 5.4% (2021: 5.2%)

RELX is a global provider of professional information solutions that includes

publication of scientific, medical, technical and legal journals. It also has

the world's leading exhibitions, conference and events business.

5 - Reckitt Benckiser (2021: 4th)

Sector: Household Goods & Home Construction

Market value: £2,085,000

Percentage of portfolio: 4.7% (2021: 4.5%)

Reckitt Benckiser is a global leader in consumer health, hygiene and home

products. Its products are sold in 200 countries and its 19 most profitable

brands are responsible for 70% of net revenues.

6 + British American Tobacco (2021: 8th)

Sector: Tobacco

Market value: £1,653,000

Percentage of portfolio: 3.7% (2021: 3.7%)

British American Tobacco is one of the world's leading tobacco groups, with

more than 200 brands in the portfolio selling in approximately 180 markets

worldwide.

7 - 3i Group (2021: 6th)

Sector: Financial Services

Market value: £1,534,000

Percentage of portfolio: 3.4% (2021: 3.8%)

3i Group is a leading international investor focused on mid-market Private

Equity and Infrastructure. 3i Group invests in mid-market buyouts, growth

capital and infrastructure. Sectors invested in are business and financial

services, consumer, industrials and energy and health care.

8 + Phoenix Group (2021: 21st)

Sector: Life Insurance

Market value: £1,504,000

Percentage of portfolio: 3.4% (2021: 2.1%)

Phoenix Group is one of the largest providers of insurance services in the

United Kingdom. The group offers a broad range of pensions and savings products

to support people across all stages of the savings life cycle.

9 = Electrocomponents (2021: 9th)

Sector: Support Services

Market value: £1,480,000

Percentage of portfolio: 3.3% (2021: 3.4%)

Electrocomponents is a British-based distributor of industrial and electronics

products. Operating in 80 countries, the group is a global omni-channel

provider of product and service solutions for designers, builders and

maintainers of industrial equipment and operations.

10 + Standard Chartered (2021: 12th)

Sector: Banks

Market value: £1,409,000

Percentage of portfolio: 3.2% (2021: 3.1%)

Standard Chartered is a British multinational banking and financial services

group headquartered in London. It operates a network of more than 1,200

branches and outlets across more than 70 countries; working across some of the

world's most dynamic markets including Asia, Africa and the Middle East.

* The following symbols shown after the portfolio ranking number indicate the

change in the relative ranking of the position in the portfolio compared to its

ranking as at 31 October 2021: + indicates an increase, - indicates a decrease

and = indicates no change.

All percentages reflect the value of the holding as a percentage of total

investments as at 30 April 2022.

Together, the ten largest investments represent 47.8% of total investments (31

October 2021: 43.5%).

Distribution of investments as at 30 April 2022

Analysis of portfolio by sector

% of Benchmark

investments by Index

market value

Support Services 13.8 4.3

Pharmaceuticals & 9.7 10.9

Biotechnology

Household Goods & Home 8.1 1.2

Construction

Oil & Gas Producers 8.0 10.3

Media 7.7 3.2

Mining 7.2 7.6

Life Insurance 6.4 2.6

Financial Services 5.4 4.1

Banks 4.9 7.9

Non-Life Insurance 4.0 0.8

Tobacco 3.7 3.8

Health Care Equipment & 2.8 0.7

Services

Food Producers 2.7 0.6

Electronic & Electrical 2.7 0.9

Equipment

Travel & Leisure 2.6 2.8

General Retailers 1.7 2.8

Personal Goods 1.7 0.4

Fixed Line Telecommunications 1.5 2.0

Electricity 1.4 1.0

Gas, Water & Multiutilities 1.3 2.7

Software & Computer Services 1.0 0.0

Industrial Engineering 0.9 0.6

Real Estate Investment Trusts 0.8 2.7

Sources: BlackRock and Datastream.

Investment size

Number of % of

investments investments by

market value

<£1m 25 30.7

£1m to £2m 13 38.5

£2m to £3m 3 15.5

£3m to £4m 2 15.3

Source: BlackRock.

Investments as at 30 April 2022

Market

value % of

£'000 investments

Support Services

Electrocomponents 1,480 3.3

Rentokil Initial 1,287 2.9

Hays 1,220 2.8

Mastercard1 1,158 2.6

Ashtead Group 593 1.3

Grafton Group 409 0.9

--------------- ---------------

6,147 13.8

========= =========

Pharmaceuticals & Biotechnology

AstraZeneca 3,637 8.2

Sanofi1 680 1.5

--------------- ---------------

4,317 9.7

========= =========

Household Goods & Home Construction

Reckitt Benckiser 2,085 4.7

Taylor Wimpey 959 2.1

Berkeley Group 578 1.3

--------------- ---------------

3,622 8.1

========= =========

Oil & Gas Producers

Shell 3,161 7.1

BP Group 404 0.9

--------------- ---------------

3,565 8.0

========= =========

Media

RELX 2,394 5.4

Pearson 1,041 2.3

--------------- ---------------

3,435 7.7

========= =========

Mining

Rio Tinto 2,408 5.4

BHP 809 1.8

--------------- ---------------

3,217 7.2

========= =========

Life Insurance

Phoenix Group 1,504 3.4

Legal & General Group 1,340 3.0

--------------- ---------------

2,844 6.4

========= =========

Financial Services

3i Group 1,534 3.4

Premier Asset Management Group 526 1.2

IntegraFin 353 0.8

--------------- ---------------

2,413 5.4

========= =========

Banks

Standard Chartered 1,409 3.2

Lloyds Banking Group 778 1.7

--------------- ---------------

2,187 4.9

========= =========

Non-Life Insurance

Direct Line Group 1,088 2.4

Hiscox 728 1.6

--------------- ---------------

1,816 4.0

========= =========

Tobacco

British American Tobacco 1,653 3.7

--------------- ---------------

1,653 3.7

========= =========

Health Care Equipment & Services

Smith & Nephew 1,268 2.8

--------------- ---------------

1,268 2.8

========= =========

Food Producers

Tate & Lyle 1,231 2.7

--------------- ---------------

1,231 2.7

========= =========

Electronic & Electrical Equipment

Schneider Electric1 613 1.4

Oxford Instruments 585 1.3

--------------- ---------------

1,198 2.7

========= =========

Travel & Leisure

Whitbread 806 1.8

Fuller Smith & Turner - A Shares 355 0.8

Patisserie Holdings2 - -

--------------- ---------------

1,161 2.6

========= =========

General Retailers

Moonpig Group 388 0.9

WH Smith 363 0.8

--------------- ---------------

751 1.7

========= =========

Personal Goods

Unilever 745 1.7

--------------- ---------------

745 1.7

========= =========

Fixed Line Telecommunications

BT Group 656 1.5

--------------- ---------------

656 1.5

========= =========

Electricity

Drax Group 619 1.4

--------------- ---------------

619 1.4

========= =========

Gas, Water & Multiutilities

Centrica 558 1.3

--------------- ---------------

558 1.3

========= =========

Software & Computer Services

Adobe Systems1 431 1.0

--------------- ---------------

431 1.0

========= =========

Industrial Engineering

Chart Industries1 425 0.9

--------------- ---------------

425 0.9

========= =========

Real Estate Investment Trusts

Big Yellow Group 365 0.8

--------------- ---------------

365 0.8

========= =========

Total investments 44,624 100.0

========= =========

1 Non-UK listed investments.

2 Company under liquidation.

All investments are in ordinary shares unless otherwise stated. The total

number of investments held at 30 April 2022 was 43 (31 October 2021: 48).

As at 30 April 2022, the Company did not hold any equity interests comprising

more than 3% of any company's share capital.

Interim management report and responsibility statement

The Chairman's Statement and the Investment Manager's Report above give details

of the important events which have occurred during the period and their impact

on the financial statements.

Principal risks and uncertainties

The principal risks faced by the Company can be divided into various areas as

follows:

· Investment performance;

· Income/dividend;

· Gearing;

· Legal & regulatory compliance;

· Operational;

· Political;

· Market; and

· Financial.

The Board reported on the principal risks and uncertainties faced by the

Company in the Annual Report and Financial Statements for the year ended 31

October 2021. A detailed explanation can be found in the Strategic Report on

pages 32 to 35 and in note 16 on pages 85 to 91 of the Annual Report and

Financial Statements which are available on the website maintained by BlackRock

at: www.blackrock.com/uk/brig.

The ongoing COVID-19 pandemic has had a profound impact on all aspects of

society in recent years. The impact of this significant event on the Company's

financial risk exposure is disclosed in note 9.

The Directors have assessed the impact of market conditions arising from the

COVID-19 outbreak on the Company's ability to meet its investment objective.

Based on the latest available information, the Company continues to be managed

in line with its investment objective, with no disruption to its operations.

Certain financial markets have fallen towards the end of the financial period

due primarily to geo-political tensions arising from Russia's invasion of

Ukraine and the impact of the subsequent range of sanctions, regulations and

other measures which impaired normal trading in Russian securities. The Board

and the Investment Manager continue to monitor investment performance in line

with the Company's investment objectives, and the operations of the Company and

the publication of net asset values are continuing.

In the view of the Board, other than those matters noted above, there have not

been any material changes to the fundamental nature of these risks since the

previous report and these principal risks and uncertainties, as summarised, are

as applicable to the remaining six months of the financial year as they were to

the six months under review.

Going concern

The Board remains mindful of the ongoing uncertainty surrounding the potential

duration of the COVID-19 pandemic and its longer term effects on the global

economy and the current heightened geo-political risk. Nevertheless, the

Directors, having considered the nature and liquidity of the portfolio, the

Company's investment objective and the Company's projected income and

expenditure, are satisfied that the Company has adequate resources to continue

in operational existence for the foreseeable future and is financially sound.

For this reason, they continue to adopt the going concern basis in preparing

the financial statements. The Company has a portfolio of investments which are

considered to be readily realisable and is able to meet all of its liabilities

from its assets and income generated from these assets. Ongoing charges

(calculated as a percentage of average daily net assets and using the

management fee and all other operating expenses, excluding finance costs,

direct transaction costs, custody transaction charges, VAT recovered, taxation

and certain non-recurring items) for the year ended 31 October 2021 were

approximately 1.21%.

Related party disclosure and transactions with the Manager

BlackRock Fund Managers Limited (BFM) was appointed as the Company's

Alternative Investment Fund Manager (AIFM) with effect from 2 July 2014. BFM

has, with the Company's consent, delegated certain portfolio and risk

management services, and other ancillary services, to BlackRock Investment

Management (UK) Limited (BIM (UK)). Both BFM and BIM (UK) are regarded as

related parties under the Listing Rules. Details of the management fee payable

are set out in note 3 and note 11 below. The related party transactions with

the Directors are set out in note 10 below.

Directors' responsibility statement

The Disclosure Guidance and Transparency Rules of the UK Listing Authority

require the Directors to confirm their responsibilities in relation to the

preparation and publication of the Interim Management Report and Financial

Statements.

The Directors confirm to the best of their knowledge that:

· the condensed set of financial statements contained within the Half

Yearly Financial Report has been prepared in accordance with the applicable UK

Accounting Standard FRS 104 'Interim Financial Reporting'; and

· the Interim Management Report, together with the Chairman's Statement

and Investment Manager's Report, include a fair review of the information

required by 4.2.7R and 4.2.8R of the FCA's Disclosure Guidance and Transparency

Rules.

The Half Yearly Financial Report has not been audited or reviewed by the

Company's Auditors.

The Half Yearly Financial Report was approved by the Board on 22 June 2022 and

the above responsibility statement was signed on its behalf by the Chairman.

Graeme Proudfoot

For and on behalf of the Board

22 June 2022

Income statement for the six months ended 30 April 2022

Six months ended Six months ended Year ended

30 April 2022 30 April 2021 31 October 2021

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000

Gains on investments held - 1,259 1,259 - 8,714 8,714 - 8,980 8,980

at fair value through

profit or loss

(Losses)/gains on foreign - (1) (1) - 4 4 - (3) (3)

exchange

Income from investments 2 902 - 902 877 303 1,180 1,919 303 2,222

held at fair value through

profit or loss

Other income 2 4 - 4 5 - 5 8 - 8

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total income 906 1,258 2,164 882 9,021 9,903 1,927 9,280 11,207

========= ========= ========= ========= ========= ========= ========= ========= =========

Expenses

Investment management fee 3 (30) (89) (119) (29) (87) (116) (60) (180) (240)

Other operating expenses 4 (129) (3) (132) (146) (3) (149) (284) (6) (290)

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total operating expenses (159) (92) (251) (175) (90) (265) (344) (186) (530)

========= ========= ========= ========= ========= ========= ========= ========= =========

Net profit on ordinary 747 1,166 1,913 707 8,931 9,638 1,583 9,094 10,677

activities before finance

costs and taxation

Finance costs (4) (13) (17) (5) (15) (20) (10) (30) (40)

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Net profit on ordinary 743 1,153 1,896 702 8,916 9,618 1,573 9,064 10,637

activities before taxation

Taxation credit/(charge) 9 - 9 (3) - (3) (16) - (16)

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Net profit on ordinary 6 752 1,153 1,905 699 8,916 9,615 1,557 9,064 10,621

activities after taxation

========= ========= ========= ========= ========= ========= ========= ========= =========

Earnings per ordinary 6 3.53 5.41 8.94 3.15 40.15 43.30 7.10 41.35 48.45

share (pence)

========= ========= ========= ========= ========= ========= ========= ========= =========

The total column of this statement represents the Company's profit and loss

account. The supplementary revenue and capital accounts are both prepared under

guidance published by the Association of Investment Companies (AIC). All items

in the above statement derive from continuing operations. No operations were

acquired or discontinued during the period. All income is attributable to the

equity holders of the Company.

The net profit on ordinary activities for the period disclosed above represents

the Company's total comprehensive income.

Statement of changes in equity for the six months ended 30 April 2022

Called Share Capital

up share premium redemption Capital Special Revenue

capital account reserve reserve reserve reserve Total

Note £'000 £'000 £'000 £'000 £'000 £'000 £'000

For the six

months ended 30

April 2022

(unaudited)

At 31 October 315 14,819 234 11,870 13,843 2,387 43,468

2021

Total

comprehensive

income:

Net profit for - - - 1,153 - 752 1,905

the period

Transactions with

owners, recorded

directly to

equity:

Ordinary shares (2) - 2 - (362) - (362)

purchased for

cancellation

Share purchase - - - - (2) - (2)

costs

Dividends paid1 5 - - - - - (981) (981)

--------------- --------------- --------------- --------------- --------------- --------------- ---------------

At 30 April 2022 313 14,819 236 13,023 13,479 2,158 44,028

========= ========= ========= ========= ========= ========= =========

For the six

months ended 30

April 2021

(unaudited)

At 31 October 326 14,819 223 2,806 15,816 2,411 36,401

2020

Total

comprehensive

income:

Net profit for - - - 8,916 - 699 9,615

the period

Transactions with

owners, recorded

directly to

equity:

Ordinary shares (6) - 6 - (1,071) - (1,071)

purchased for

cancellation

Share purchase - - - - (6) - (6)

costs

Dividends paid2 - - - - - (1,015) (1,015)

--------------- --------------- --------------- --------------- --------------- --------------- ---------------

At 30 April 2021 320 14,819 229 11,722 14,739 2,095 43,924

========= ========= ========= ========= ========= ========= =========

For the year

ended 31 October

2021 (audited)

At 31 October 326 14,819 223 2,806 15,816 2,411 36,401

2020

Total

comprehensive

income:

Net profit for - - - 9,064 - 1,557 10,621

the year

Transactions with

owners, recorded

directly to

equity:

Ordinary shares (11) - 11 - (1,961) - (1,961)

purchased for

cancellation

Share purchase - - - - (12) - (12)

costs

Dividends paid3 - - - - - (1,581) (1,581)

--------------- --------------- --------------- --------------- --------------- --------------- ---------------

At 31 October 315 14,819 234 11,870 13,843 2,387 43,468

2021

========= ========= ========= ========= ========= ========= =========

1 Final dividend paid in respect of the year ended 31 October 2021 of 4.60p

per share, declared on 13 January 2022 and paid on 17 March 2022.

2 Final dividend paid in respect of the year ended 31 October 2020 of 4.60p

per share, declared on 1 February 2021 and paid on 17 March 2021.

3 Interim dividend paid in respect of the six months ended 30 April 2021 of

2.60p per share was declared on 23 June 2021 and paid on 1 September 2021.

Final dividend paid in respect of the year ended 31 October 2020 of 4.60p per

share was declared on 1 February 2021 and paid on 17 March 2021.

For information on the Company's distributable reserves, please refer to note 8

below.

Balance sheet as at 30 April 2022

30 April 30 April 31 October

2022 2021 2021

(unaudited) (unaudited) (audited)

Notes £'000 £'000 £'000

Fixed assets

Investments held at fair value through profit or 9 44,624 47,598 46,080

loss

Current assets

Current tax asset 4 - 11

Debtors 441 380 324

Cash and cash equivalents 3,724 806 1,362

--------------- --------------- ---------------

Total current assets 4,169 1,186 1,697

========= ========= =========

Creditors - amounts falling due within one year

Bank loan (4,000) (4,000) (4,000)

Other creditors (765) (860) (309)

--------------- --------------- ---------------

Total current liabilities (4,765) (4,860) (4,309)

========= ========= =========

Net current liabilities (596) (3,674) (2,612)

--------------- --------------- ---------------

Net assets 44,028 43,924 43,468

========= ========= =========

Capital and reserves

Called up share capital 7 313 320 315

Share premium account 14,819 14,819 14,819

Capital redemption reserve 236 229 234

Capital reserve 13,023 11,722 11,870

Special reserve 13,479 14,739 13,843

Revenue reserve 2,158 2,095 2,387

--------------- --------------- ---------------

Total shareholders' funds 6 44,028 43,924 43,468

========= ========= =========

Net asset value per ordinary share (pence) 6 207.67 200.63 203.13

========= ========= =========

Statement of cash flows for the six months ended 30 April 2022

Six months Six months Year

ended ended ended

30 April 30 April 31 October

2022 2021 2021

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Operating activities

Net profit on ordinary activities before taxation 1,896 9,618 10,637

Add back finance costs 17 20 40

Gains on investments held at fair value through profit or (1,259) (8,714) (8,980)

loss

Losses/(gains) on foreign exchange 1 (4) 3

Sales of investments held at fair value through profit or 10,711 12,841 22,755

loss

Purchases of investments held at fair value through profit or (7,459) (12,212) (21,084)

loss

Increase in other debtors (257) (285) (89)

(Decrease)/increase in other creditors (3) 9 60

Taxation on investment income 16 (3) (27)

--------------- --------------- ---------------

Net cash generated from operating activities 3,663 1,270 3,315

--------------- --------------- ---------------

Financing activities

Ordinary shares purchased for cancellation (300) (1,071) (1,961)

Share purchase costs paid (2) (6) (12)

Interest paid (17) (20) (40)

Dividends paid (981) (1,015) (1,581)

--------------- --------------- ---------------

Net cash used in financing activities (1,300) (2,112) (3,594)

--------------- --------------- ---------------

Increase/(decrease) in cash and cash equivalents 2,363 (842) (279)

Cash and cash equivalents at beginning of period/year 1,362 1,644 1,644

Effect of foreign exchange rate changes (1) 4 (3)

--------------- --------------- ---------------

Cash and cash equivalents at end of period/year 3,724 806 1,362

--------------- --------------- ---------------

Comprised of:

Cash at bank 89 424 63

Cash Fund1 3,635 382 1,299

--------------- --------------- ---------------

3,724 806 1,362

========= ========= =========

1 Cash Fund represents investment in BlackRock Institutional Cash Series

plc - Sterling Liquid Environmentally Aware Fund.

Notes to the financial statements for the six months ended 30 April 2022

1. Principal activity and basis of preparation

The principal activity of the Company is that of an investment trust company

within the meaning of Section 1158 of the Corporation Tax Act 2010.

The financial statements of the Company are prepared on a going concern basis

in accordance with Financial Reporting Standard 104 Interim Financial Reporting

(FRS 104) applicable in the United Kingdom and Republic of Ireland and the

revised Statement of Recommended Practice - 'Financial Statements of Investment

Trust Companies and Venture Capital Trusts' (SORP) issued by the Association of

Investment Companies (AIC) in October 2019 and updated in April 2021 and the

provisions of the Companies Act 2006.

The accounting policies and estimation techniques applied for the condensed set

of financial statements are as set out in the Company's Annual Report and

Financial Statements for the year ended 31 October 2021.

2. Income

Six months Six months Year

ended ended ended

30 April 30 April 31 October

2022 2021 2021

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Investment income:

UK dividends 794 749 1,503

UK scrip dividends - 19 19

UK special dividends 33 45 226

UK REIT dividends 5 4 9

Overseas dividends 70 60 162

--------------- --------------- ---------------

Total investment income 902 877 1,919

========= ========= =========

Other income:

Interest from Cash Fund 4 - 1

Underwriting commission - 5 7

--------------- --------------- ---------------

Total income 906 882 1,927

========= ========= =========

Dividends and interest received in cash during the period amounted to £725,000

and £2,000 respectively (six months ended 30 April 2021: £606,000 and £nil;

year ended 31 October 2021: £1,771,000 and £1,000).

No special dividends have been recognised in capital (six months ended 30 April

2021: £303,000; year ended 31 October 2021: £303,000).

3. Investment management fee

Six months ended Six months ended Year ended

30 April 2022 30 April 2021 31 October 2021

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000

Investment management 30 89 119 29 87 116 60 180 240

fee

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total 30 89 119 29 87 116 60 180 240

========= ========= ========= ========= ========= ========= ========= ========= =========

Under the terms of the investment management agreement, BFM is entitled to a

fee of 0.6% per annum of the Company's market capitalisation. The investment

management fee is allocated 75% to capital reserves and 25% to the revenue

reserve. There is no additional fee for company secretarial and administration

services.

4. Other operating expenses

Six months Six months Year

ended ended ended

30 April 30 April 31 October

2022 2021 2021

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Allocated to revenue:

Custody fees - 1 1

Depositary fees 2 2 5

Audit fees1 15 15 29

Registrars' fee 12 12 24

Directors' emoluments 49 53 100

Marketing fees 7 7 11

Printing and postage fees 20 20 32

Legal and professional fees 3 4 32

London Stock Exchange fee 5 5 10

FCA fee 3 3 7

Other administration costs 13 24 33

--------------- --------------- ---------------

129 146 284

========= ========= =========

Allocated to capital:

Custody transaction costs2 3 3 6

--------------- --------------- ---------------

132 149 290

========= ========= =========

1 No non-audit services were provided by the auditors.

2 For the six month period ended 30 April 2022, expenses of £3,000 (six

months ended 30 April 2021: £3,000; year ended 31 October 2021: £6,000) were

charged to the capital account of the Income Statement. These relate to

transaction costs charged by the custodian on sale and purchase trades.

The transaction costs incurred on the acquisition of investments amounted to £

42,000 for the six months ended 30 April 2022 (six months ended 30 April 2021:

£48,000; year ended 31 October 2021: £86,000). Costs relating to the disposal

of investments amounted to £6,000 for the six months ended 30 April 2022 (six

months ended 30 April 2021: £7,000; year ended 31 October 2021: £14,000). All

transaction costs have been included within capital reserves.

5. Dividend

The Directors have declared an interim dividend of 2.60p per share for the

period ended 30 April 2022 payable on 1 September 2022 to shareholders on the

register on 22 July 2022. The total cost of the dividend based on

21,175,164 ordinary shares in issue at 15 June 2022 was £551,000 (30 April

2021: £566,000).

In accordance with FRS102, Section 32, Events After the End of the Reporting

Period, the interim dividend payable on the ordinary shares has not been

included as a liability in the financial statements, as interim dividends are

only recognised when they have been paid.

6. Earnings and net asset value per ordinary share

Revenue and capital returns per share and net asset value per share are shown

below and have been calculated using the following:

Six months Six months Year

ended ended ended

30 April 30 April 31 October

2022 2021 2021

(unaudited) (unaudited) (audited)

Net revenue profit attributable to ordinary shareholders (£ 752 699 1,557

'000)

Net capital profit attributable to ordinary shareholders (£ 1,153 8,916 9,064

'000)

--------------- --------------- ---------------

Total profit attributable to ordinary shareholders (£'000) 1,905 9,615 10,621

========= ========= =========

Total shareholders' funds (£'000) 44,028 43,924 43,468

========= ========= =========

Earnings per share

The weighted average number of ordinary shares in issue 21,315,326 22,206,362 21,920,081

during the period, on which the earnings per ordinary share

was calculated was:

The actual number of ordinary shares in issue at the period 21,200,636 21,892,990 21,398,842

end, on which the net asset value per ordinary share was

calculated was:

Calculated on weighted average number of ordinary shares:

Revenue earnings per share (pence) - basic and diluted 3.53 3.15 7.10

Capital earnings per share (pence) - basic and diluted 5.41 40.15 41.35

--------------- --------------- ---------------

Total earnings per share (pence) - basic and diluted 8.94 43.30 48.45

========= ========= =========

As at As at As at

30 April 30 April 31

2022 2021 October

(unaudited) (unaudited) 2021

(audited)

Net asset value per ordinary share (pence) 207.67 200.63 203.13

Ordinary share price (mid-market) (pence) 187.00 184.00 191.00

========= ========= =========

There were no dilutive securities at 30 April 2022 (30 April 2021: nil; 31

October 2021: nil).

7. Called up share capital

Ordinary Treasury Total Nominal

shares shares shares value

number number number £'000

Allotted, called up and fully paid share capital

comprised:

Ordinary shares of 1 pence each:

At 31 October 2021 21,398,842 10,081,532 31,480,374 315

Shares purchased for cancellation (198,206) - (198,206) (2)

At 30 April 2022 21,200,636 10,081,532 31,282,168 313

========= ========= ========= ========

=

During the period to 30 April 2022, 198,206 ordinary shares (six months ended

30 April 2021: 618,635; year ended 31 October 2021: 1,112,783) were purchased

and subsequently cancelled for a total consideration including costs of £

364,000 (six months ended 30 April 2021: £1,077,000; year ended 31 October

2021: £1,973,000).

Since the period end and up to 20 June 2022, a further 25,472 ordinary shares

have been bought back and cancelled for a total consideration of £45,600.

8. Reserves

The share premium account and capital redemption reserve are not distributable

reserves under the Companies Act 2006. In accordance with ICAEW Technical

Release 02/17BL on Guidance on Realised and Distributable Profits under the

Companies Act 2006, the special reserve and capital reserve may be used as

distributable profits for all purposes and, in particular, the repurchase by

the Company of its ordinary shares and for payments as dividends. In accordance

with the Company's Articles of Association, the special reserve, capital

reserve and the revenue reserve may be distributed by way of dividend. The

capital reserve arising on the revaluation of investments of £4,735,000 (30

April 2021: gain of £6,138,000; 31 October 2021: gain of £4,762,000) is subject

to fair value movements and may not be readily realisable at short notice, as

such it may not be entirely distributable. The investments are subject to

financial risks; as such the capital reserve (arising on investments sold) and

the revenue reserve may not be entirely distributable if a loss occurred during

the realisation of these investments.

9. Valuation of financial instruments

Market risk arising from price risk

Price risk is the risk that the fair value or future cash flows of a financial

instrument will fluctuate because of changes in market prices (other than those

arising from interest rate risk or currency risk), whether those changes are

caused by factors specific to the individual financial instrument or its

issuer, or factors affecting similar financial instruments traded in the

market. Local, regional or global events such as war, acts of terrorism, the

spread of infectious illness or other public health issue, recessions, climate

change or other events could have a significant impact on the Company and its

investments.

The infectious respiratory illness caused by a novel coronavirus known as

COVID-19 has had a profound impact on all aspects of society over the last two

years. While there is a growing consensus in developed economies that the worst

of the impact is now over, there is an expectation that travel restrictions,

enhanced health screenings at ports of entry and elsewhere, disruption of and

delays in healthcare service preparation and delivery, cancellations, supply

chain disruptions, and lower consumer demand will create ongoing challenges.

While widescale vaccination programmes are now in place in many countries and

are having a positive effect, the impact of COVID-19 continues to affect

adversely the economies of many nations across the entire global economy and

this impact may be greater where vaccination rates are lower, such as in

certain emerging markets. While it is difficult to make timing predictions, it

is expected that the economic effects of COVID-19 will continue to be felt for

a period after the virus itself has moved from being pandemic to endemic in

nature and this in turn may continue to impact investments held by the Company.

Valuation of financial instruments

Financial assets and financial liabilities are either carried in the Balance

Sheet at their fair value (investments) or at an amount which is a reasonable

approximation of fair value (due from brokers, dividends and interest

receivable, due to brokers, accruals, cash and cash equivalents, bank

overdrafts and bank loans). Section 34 of FRS 102 requires the Company to

classify fair value measurements using a fair value hierarchy that reflects the

significance of inputs used in making the measurements. The valuation

techniques used by the Company are explained in the accounting policies note on

page 78 of the Annual Report and Financial Statements for the year ended 31

October 2021.

Categorisation within the hierarchy has been determined on the basis of the

lowest level input that is significant to the fair value measurement of the

relevant asset.

The fair value hierarchy has the following levels:

Level 1 - Quoted market price for identical instruments in active markets

A financial instrument is regarded as quoted in an active market if quoted

prices are readily and regularly available from an exchange, dealer, broker,

industry group, pricing service or regulatory agency and those prices represent

actual and regularly occurring market transactions on an arm's length basis.

The Company does not adjust the quoted price for these instruments.

Level 2 - Valuation techniques using observable inputs

This category includes instruments valued using quoted prices for similar

instruments in markets that are considered less active, or other valuation

techniques where all significant inputs are directly or indirectly observable

from market data.

Level 3 - Valuation techniques using significant unobservable inputs

This category includes all instruments where the valuation technique includes

inputs not based on market data and these inputs could have a significant

impact on the instrument's valuation.

This category also includes instruments that are valued based on quoted prices

for similar instruments where significant entity determined adjustments or

assumptions are required to reflect differences between the instruments and

instruments for which there is no active market. The Investment Manager

considers observable data to be that market data that is readily available,

regularly distributed or updated, reliable and verifiable, not proprietary and

provided by independent sources that are actively involved in the relevant

market.

The level in the fair value hierarchy within which the fair value measurement

is categorised in its entirety is determined on the basis of the lowest level

input that is significant to the fair value measurement. If a fair value

measurement uses observable inputs that require significant adjustment based on

unobservable inputs, that measurement is a Level 3 measurement.

Assessing the significance of a particular input to the fair value measurement

in its entirety requires judgement, considering factors specific to the asset

or liability. The determination of what constitutes 'observable' inputs

requires significant judgement by the Investment Manager.

Fair values of financial assets and financial liabilities

For exchange listed equity investments the quoted price is the bid price.

Substantially all investments are valued based on unadjusted quoted market

prices. Where such quoted prices are readily available in an active market,

such prices are not required to be assessed or adjusted for any price related

risks, including climate risk, in accordance with the fair value related

requirements of the Company's Financial Reporting Framework.

The table below sets out fair value measurements using the FRS 102 fair value

hierarchy.

Level 1 Level 2 Level 3 Total

Financial assets at fair value through profit or £'000 £'000 £'000 £'000

loss

Equity investments at 30 April 2022 (unaudited) 44,624 - - 44,624

Equity investments at 30 April 2021 (unaudited) 47,598 - - 47,598

Equity investments at 31 October 2021 (audited) 46,080 - - 46,080

======== ======== ======== ========

= = = =

There were no transfers between levels for financial assets and financial

liabilities during the period/year recorded at fair value as at 30 April 2022,

30 April 2021 and 31 October 2021. The Company held no Level 3 securities

during the period to 30 April 2022 (period to 30 April 2021: nil; year to 31

October 2021: nil).

10. Related party disclosure

The Board consists of four non-executive Directors, all of whom are considered

to be independent by the Board. None of the Directors has a service contract

with the Company. With effect from 1 November 2021, the Chairman receives an

annual fee of £30,750, the Chairman of the Audit Committee receives an annual

fee of £25,000 and each of the other Directors receives an annual fee of £

21,500.

At the period end and as at 21 June 2022 members of the Board held ordinary

shares in the Company as set out below:

Ordinary Ordinary Ordinary

shares shares shares

21 June 30 April 31 October

2022 2022 2021

Graeme Proudfoot (Chairman) 60,000 60,000 60,000

Nicholas Gold 20,000 20,000 20,000

Charles Worsley1 987,539 987,539 987,539

Win Robbins 12,106 12,106 12,106

========= ========= =========

1 Including a non-beneficial interest of 655,500 ordinary shares.

11. Transactions with the manager and the Investment Manager

BlackRock Fund Managers Limited (BFM) provides management and administration

services to the Company under a contract which is terminable on six months'

notice. BFM has (with the Company's consent) delegated certain portfolio and

risk management services, and other ancillary services, to BlackRock Investment

Management (UK) Limited (BIM (UK)). Further details of the investment

management contract are disclosed in the Directors' Report on pages 43 to 48 in

the Annual Report and Financial Statements for the year ended 31 October 2021.

The investment management fee due for the six months ended 30 April 2022

amounted to £119,000 (six months ended 30 April 2021: £116,000; year ended 31

October 2021: £240,000). At the period end, £180,000 was outstanding in respect

of the investment management fee (as at 30 April 2021: £116,000; as at 31

October 2021: £180,000).

In addition to the above services, BIM (UK) provided the Company with marketing

services. The total fees paid or payable for these services for the six months

ended 30 April 2022 amounted to £7,000 including VAT (six months ended 30 April

2021: £7,000; year ended 31 October 2021: £11,000). Marketing fees of £17,000

including VAT were outstanding at 30 April 2022 (as at 30 April 2021: £20,000;

as at 31 October 2021: £11,000).

The Company holds an investment in the BlackRock Institutional Cash Series plc

- Sterling Liquid Environmentally Aware Fund of £3,635,000 (30 April 2021: £

382,000; 31 October 2021: £1,299,000) which has been presented in the financial

statements as a cash equivalent.

The ultimate holding company of the Manager and the Investment Manager is

BlackRock, Inc., a company incorporated in Delaware USA.

12. Contingent liabilities

There were no contingent liabilities at 30 April 2022 (30 April 2021: nil; 31

October 2021: nil).

13. Publication of non statutory accounts

The financial information contained in this Half Yearly Financial Report does

not constitute statutory accounts as defined in Section 435 of the Companies

Act 2006. The financial information for the six months ended 30 April 2022 and

30 April 2021 has not been audited.

The information for the year ended 31 October 2021 has been extracted from the

latest published audited financial statements, which have been filed with the

Registrar of Companies. The report of the auditor on those accounts contained

no qualification or statement under Sections 498 (2) or (3) of the Companies

Act 2006.

14. Annual results

The Board expects to announce the annual results for the year ended 31 October

2022, in December 2022. Copies of the results announcement can be obtained from

the Secretary on 020 7743 3000 or by email at cosec@blackrock.com. The Annual

Report and Financial Statements should be available in December 2022, with the

Annual General Meeting being held in March 2023.

BlackRock Investment Management (UK) Limited

12 Throgmorton Avenue

London

EC2N 2DL

22 June 2022

ENDS

The half yearly financial report will also be available on the BlackRock

website at http://www.blackrock.com/uk/brig. Neither the contents of the

Manager's website nor the contents of any website accessible from hyperlinks on

the Manager's website (or any other website) is incorporated into, or forms

part of, this announcement.

For further information please contact:

Melissa Gallagher, Managing Director Closed End Funds - Tel: 020 7743 3893

Emma Phillips, Media & Communications, BlackRock Investment Management (UK)

Limited - Tel: 020 7743 2922

Press enquires:

Ed Hooper, Lansons Communications

Tel: 020 7294 3620

E-mail: BlackRockInvestmentTrusts@lansons.com or EdH@lansons.com

END

(END) Dow Jones Newswires

June 22, 2022 07:13 ET (11:13 GMT)

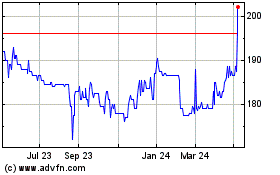

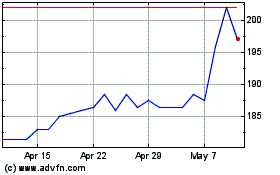

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Apr 2023 to Apr 2024