TIDMBRSD

RNS Number : 6522E

Brandshield Systems PLC

03 July 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

3 July 2023

BrandShield Systems Plc

("BrandShield" or the "Company")

Final Results for the year ended 31 December 2022

BrandShield Systems plc (AIM: BRSD), a leading provider of

cybersecurity solutions for brand oriented digital risk protection

("DRP"), announces its final results for the year ended 31 December

2022 ("FY 2022").

BrandShield specialises in the monitoring, detection and removal

of online threats such as phishing attempts, scams, impersonation,

fraud, counterfeit products and trademark infringements. The

business was established to revolutionise the way companies can

protect their digital assets outside their security perimeter. Ever

since launch, BrandShield has introduced ground-breaking innovative

technologies for Digital Risk Protection powered by artificial

intelligence ("AI"), machine learning and big data analysis to

provide the most automated and relevant solutions for the 21st

century.

Financial highlights

-- 55% increase in revenues to $6.39m ($4.13m in 2021)

-- 61% increase in ARR to $8.42m ($5.22m in 2021)

-- Cash of $2.6m ($1.194m in 2021)

Operational highlights

-- 53 new customers signed in 2022 (53 clients in 2021)

-- Generated strong new business impetus, expanding its presence

in the financial, healthcare, consumer products, and media spaces

via a number of key customer acquisitions

-- Bolstered reputation as a go-to DRP company of choice for

brands operating in the financial services market

-- Prioritised the expansion of its market presence globally via

strategic marketing and sales initiatives, and accordingly entered

new geographies in FY 2022

-- Gained a number of new clients in the crypto space, including

an online gaming client focused on the crypto gaming sub-sector

-- Delivered a strategic partnership with The Sandbox, a leading

decentralised gaming virtual world and a subsidiary of Animoca

Brands, to safeguard the crypto and HFT digital ecosystem

-- Secured a new business mandate with one of the world's

largest consumer electronics brands to protect the business from

illicit trade and unauthorised online sales

Post Period End

-- Strengthened its collaboration with the Pharmaceutical

Security Institute ("PSI") and subsequently published its findings

from its annual pharma fraud disruption programme:

o From January 2022 to January 2023, BrandShield successfully

detected and removed over 430 rogue pharmacies and 7,500 fraudulent

marketplace listings

-- Strong growth trend has continued into 2023 with the May 2023

ARR figure standing at $9.3m, a 47.6% increase in ARR relative to

May 2022

Outlook

The Group is focused on expanding BrandShield's market presence

and bolstering its position as a leading provider of cutting-edge

DRP solutions through securing new mandates to diversify its

growing portfolio of clients alongside targeting further ARR

growth. At a time when cyber-related threats continue to grow, the

importance of Digital Risk Protection has become a necessity for

businesses as they continue to navigate significant technological

and social changes.

BrandShield is committed to building upon the strong customer

traction it delivered in FY 2022 and the Company believes it is

well-placed to meet its future growth objectives.

Yoav Keren, Chief Executive Officer of BrandShield, commented :

"We are pleased to report a strong performance across 2022, with

the Company making significant financial and operational progress.

In addition to generating strong revenues and expanding our

customer base, we also further strengthened our team with a number

of strategic hires as we continue to explore further commercial

opportunities to consolidate our position at the forefront of the

digital risk protection market.

As cyber-related crimes continue to evolve and new threats

emerge, demand for digital risk protection services continues to

rise in tandem, and our highly sophisticated AI-powered solutions

have ensured we remain a go-to choice for brands across the globe

looking to safeguard their online reputations.

Looking ahead, BrandShield remains confident in meeting

expectations for the full year 2023 and in the Company's future

growth prospects."

For further information please visit https://www.brandshield.com/ or contact:

BrandShield Systems plc +44 (0)20 3143

Yoav Keren, CEO 8300

Spark Advisory Partners Limited (Nominated

Adviser) +44 (0)20 3368

Neil Baldwin / Andrew Emmott / James Keeshan 3554

Shore Capital (Broker) +44 (0)20 7408

Toby Gibbs / James Thomas / Rachel Goldstein 4090

(Corporate Advisory)

Henry Willcocks (Corporate Broking)

Vigo Consulting (Financial Public Relations)

Jeremy Garcia / Kendall Hill +44 (0)20 7390

brandshield@vigoconsulting.com 0237

The full Group Annual Report and Financial Statements will be

sent to shareholders later today and is available at

www.brandshield.com .

Extracts from the Annual Report are set out below:

CHAIRMAN'S STATEMENT

Introduction

BrandShield Systems Plc. ("BrandShield" or the "Company") is a

leading cybersecurity company that provides brand oriented digital

risk protection. The Company specialises in the monitoring,

detection and removal of online threats such as phishing attempts,

scams, impersonation, fraud, counterfeit products and trademark

infringements. The business was established to revolutionise the

way companies can protect their digital assets outside their

security perimeter. Ever since launch, BrandShield has introduced

ground-breaking innovative technologies for online brand protection

powered by artificial intelligence ("AI"), machine learning and big

data analysis to provide the most automated and relevant solutions

for the 21st century.

The Group delivered a strong performance during the period,

generating revenues of $6.39m , up 55% from $4.13m in 2021,

underpinned by solid business momentum, including multiple customer

wins across a diverse range of sectors. BrandShield strengthened

its financial foundations during the period, ending FY 2022 with

available cash reserves of $2.6m, which will facilitate its

continued expansion by enhancing the Group's R&D, marketing,

and sales capabilities.

During the period, BrandShield raised a total of GBP4.25m in new

equity and the Company has focused on deploying new capital to

target profitability by increasing investment in marketing and

sales initiatives and accelerating the growth of its customer

footprint as well as Annual Recurring Revenues ("ARR"), a key

performance indicator. BrandShield delivered on its ARR growth

aspirations during the period, with the ARR as at the end of FY

2022 at $8.42m, representing a 61% increase from FY 2021 ($5.22m).

This, alongside the significant expansion of its customer base to

183 (FY 2021: 130), demonstrates the robust operational progress

achieved by the Company in FY 2022.

BrandShield hired 20 new employees across key departments in the

period, including sales directors in the US and UK, to accelerate

client growth in those regions. Expansion in the US remains a

strategic priority for the Group, and North America now constitutes

c.70% of BrandShield's total client base, spanning industries

including financial services, healthcare, consumer goods and media

and entertainment. Moreover, BrandShield recruited a sales director

with the primary responsibility of developing partnership

distribution channels to scale its client base.

Given a very strong Life Time Value to Customer Acquisition Cost

("LTV to CAC") ratio, the Board has been clear in its desire for

the Company to continue to grow aggressively whilst ensuring

profitability is pursued, and it remains a key intention to hit

cash flow positive within our existing resources in 2024.

BrandShield offers a superior product in a largely underserved

market and, therefore, the priority must be on marketplace

consolidation and achieving a leading position in the online brand

protection competitive environment.

BrandShield has minority interests in assets inherited as a

result of the Reverse Takeover ("RTO") transaction conducted with

Two Shields Investments Plc in December 2020. These include

holdings in WeShop Ltd (now renamed Community Social Investment

Ltd) and legacy mining assets, namely Kalahari Key Mineral

Exploitation Company (Pty) Ltd, Leopard Lithium Pty Ltd and

International Geosciences Limited ("IGS"). These assets are

considered non-core and we remain focused on the orderly disposal

of these legacy investments where value can be realised for our

shareholders.

BrandShield's core activities

BrandShield is a fast-growing provider of cyber solutions,

delivering an end-to-end brand oriented digital risk protection

solution to its global customer base. Its software protects

customers from the financial costs and reputational damage caused

by an increasing number of online threats including online scams,

phishing, impersonation, and sale of counterfeit goods. Unlike

traditional solutions, BrandShield's Software as a Service ("SaaS")

operates outside of an organisation's perimeter and therefore

requires no integration. BrandShield's highly developed software

works by detecting potential threats, analysing them, prioritising

them and then taking them down. BrandShield has developed a suite

of proprietary AI-powered software that largely automates the

analysis and prioritisation of fraudulent online cases. The

technology uses big data and algorithms to find networks of

fraudulent online activity and clusters of scammers.

BrandShield's software monitors millions of datapoints across

many types of online platforms including websites, marketplaces,

social media, mobile apps and Pay Per Click ads. The AI and machine

learning nature of the software means that it is continually

improving as it adds new datapoints and identifies new types of

threats. In response to customer demand, BrandShield established

its own in-house online hunting and enforcement team, consisting

mostly of qualified lawyers with experience in IP law. The service

is customised to the requirements of BrandShield's customers and

experiences high success rates.

Strategy

Leveraging capital raised during the period, BrandShield is

committed to driving the continued expansion of its offering

globally, the keystone of the Board's overarching growth strategy.

BrandShield is prioritising achieving profitability and cash flow

positivity and continues to explore opportunities to expand its

customer base, which already includes SMBs and large enterprises

across five continents, demonstrating that the need for brands to

secure external online brand protection services transcends

international borders. As previously mentioned, the number of

clients increased from 130 at year end 2021 to 183 at year end

2022, representing a significant period of growth.

The Company's ARR figure increased from $5.22m for FY 2021 to

$8.42m in the period, a 61% increase year on year, and that upward

trajectory has continued through the start of 2023 with the May

2023 ARR standing at $9.3m.

Cybersecurity is an ever-evolving sector, and this year we

witnessed the emergence of a number of new and highly sophisticated

cyberthreats which have the potential to tarnish the reputation of

brands across the globe and disrupt their day-to-day operations.

BrandShield is focused on ensuring it is positioned at the

forefront of innovation in the digital risk protection services

arena by investing in sales promotion, marketing and R&D

activities to stay ahead of market trends, whilst strategically

recruiting new employees with robust sector knowhow and

experience.

BrandShield demonstrated the effectiveness of the Company's

existing strategy by delivering significant operational and

financial progress across FY 2022. Funding raised during the period

will enable the Company to build on this momentum as it pursues

further commercial opportunities to protect brands worldwide from a

host of digital threats. Alongside this the Company has delivered

significant cost savings as a result of increased efficiencies

delivered through the adoption of the 'BrandShield 3.0' platform by

our clients. This has enhanced automation within the Company's

enforcement processes and allowed a re-structuring to be carried

out within the enforcement function which continues. Cloud based

costs have also been reduced since the period end which has reduced

the Company's operational cash burn significantly.

Across the year, the Company raised a total of GBP4.25m

($5.45m), which will enable BrandShield to continue to execute its

strategy of aggressively targeting client growth whilst aiming for

profitability in the medium to long term. Further, this investment

will allow BrandShield to expand its marketing and sales efforts

and to continue to drive ARR forwards. Given BrandShield's highly

scalable SaaS platform, the Company is focused on the top line

whilst customer conversion continues to be of paramount importance

for 2023. That said, the Company believes it will get cash flow

positive during 2024 without the need for further funding.

Outlook

As we look to the future, BrandShield is focused on securing new

mandates to diversify its growing multi-sector portfolio of clients

alongside targeting further ARR growth. In a time of rapid

technological and social change where more emphasis is placed on a

brand's online identity than ever before, an increasing number of

companies recognise that securing external threat prevention and

elimination assistance, such as that BrandShield offers, is now a

necessity.

From e-commerce and crypto companies to businesses in the

fashion and hospitality spaces, a fast-growing number of brands are

trusting BrandShield to safeguard their reputations by providing

comprehensive digital risk protection from a broad range of

prevalent cyberthreats. With ARR and overall commercial revenue up,

in addition to continued strong backing from investors, BrandShield

is well-placed to deliver on our medium to long term growth

aspirations.

Azriel Moscovici

Chairman

2 July 2023

Introduction

We are pleased to report a strong performance across FY 2022,

with BrandShield delivering excellent financial and operational

progress. Integral to our success is the progress the Company has

made in delivering ARR of $8.42m as at year end, a 61% increase

from FY 2021 ($5.22m), continuing the very strong growth trend.

Encouragingly, that strong growth trend has continued into 2023

with the May ARR figure standing at $9.3m.

This was underpinned by the acquisition of clients across a

number of sectors and the ongoing investment in, and expansion of,

the Company's marketing and sales functions. The Company now

services over 200 clients, adding 53 across 2022, and a further 21

so far in 2023.

Given a very strong LTV to CAC ratio, we have been clear that

BrandShield will continue to focus on aggressive growth within

existing resources with a view to achieving positive cash flow in

Q1 2024. Management believes BrandShield offers a superior product

in a largely unserved market and, therefore, the priority must be

on marketplace consolidation and achieving a leading position in

the digital risk protection competitive environment.

Revenues for FY 2022 increased 55% to $6.39m, compared to FY

2021 $4.13m, with the Group reporting a loss of $7.33m (FY 2021:

loss of $6.30m), which was in-line with management's expectations.

$1.7m of the loss (2021 was $1.9m) can be attributed to share based

payments calculations which do not reflect the actual operating

loss of the Company from its operations of $5.77m (2021:

$4.4m).

The Company added 53 new customers in FY 2022, built across a

growing list of sectors and market-leading brands. These have

included new or extended contracts with companies operating in the

financial services, pharmaceutical, crypto, entertainment, fashion,

sports, and cosmetics sectors.

BrandShield has delivered significant customer traction during

the period, and whilst confidentiality agreements prevent the

Company from disclosing all our successes, including some of the

world's largest and well-known brands, the Company has been able to

announce the following:

-- Delivered a strategic partnership with The Sandbox, a leading

decentralised gaming virtual world and a subsidiary of Animoca

Brands, to safeguard the crypto and HFT digital ecosystem

-- Secured a new business mandate with one of the world's

largest consumer electronics brands to protect the business from

illicit trade and unauthorised online sales

-- Strengthened its collaboration with the Pharmaceutical

Security Institute ("PSI") and subsequently published its findings

from its annual pharma fraud disruption programme:

o From January 2022 to January 2023, BrandShield successfully

detected and removed over 430 rogue pharmacies and 7,500 fraudulent

marketplace listings

-- Gained a number of new clients in the crypto space, including

an online gaming client focused on the crypto gaming sub-sector

-- Generated strong new business impetus, expanding its presence

in the financial, healthcare, consumer products, and media spaces

via a number of key customer acquisitions

-- Bolstered reputation as a go-to digital risk protection

("DRP") company of choice for brands operating in the financial

services market

-- Prioritised the expansion of its market presence globally via

strategic marketing and sales initiatives, and accordingly entered

new geographies in FY 2022

The value that BrandShield can add to our clients was reinforced

by the post period end publication of the Company's annual pharma

fraud report, which was carried out in cooperation with PSI.

Over the 12-month period, BrandShield took down more than 7,500

fraudulent pharmaceutical listings across social media platforms,

websites, and marketplaces, accounting for hundreds of thousands of

dollars' worth of counterfeit drugs.

With the majority of fraudulent marketplace listings originating

in regions including Indonesia, China, and India, and removed

listings containing medicines relating to cancer, diabetes, and

Covid-19 among others, the report highlights both BrandShield's

global reach and the instrumental role the Company performs to

protect individuals from potentially life-threatening online

scams.

Market dynamics

According to global business consultancy group Frost &

Sullivan ("F&S"), the DRP market is on a high growth trajectory

as the number of cyberattacks on organisations' brands, customers,

and employees continues to rise. The DRP market is increasing at a

compound annual growth rate of 39.7% from 2021 to 2026, whilst

F&S expects it to reach $917.7 million by 2026.

Against this favourable macroeconomic backdrop, BrandShield's

prudent strategy is designed to ensure the Company is well poised

to capitalise on the projected long-term global demand for reliable

DRP services. As evidenced by the diverse nature of our new

customer wins in 2022, this surge in demand is sector agnostic, and

BrandShield intends to proactively explore further commercial

opportunities across a range of industries as digital threat

protection grows in importance for brands.

BrandShield has been recognised as the third best provider of

cybersecurity solutions for brand oriented DRP globally in F&S'

2023 Global Digital Risk Protection New Product Innovation and Best

Practices Award. BrandShield scored highly for its ability to stay

sensitive to emerging trends and challenges in the technology

space, and was also praised for its expansion into new markets and

industry verticals, such as blockchain and gaming. F&S'

industry experts commended BrandShield for its comprehensive brand

protection capabilities, noting the highly adaptable features of

the Company's AI-powered technology.

Our unique proposition

We believe that our technology is well placed to lead this

transition as enterprises increase their online protection and move

from focusing on internal cybersecurity to requiring solutions for

external threats, providing comprehensive brand oriented digital

risk protection solutions. BrandShield's market-leading solutions

are underpinned by:

-- A mature product, creating higher barriers to entry;

-- Ongoing investment in R&D to ensure market leadership is maintained;

-- AI/ML powered technology;

-- Strong threat network detection capabilities;

-- Unique image recognition and Optical Character Recognition

("OCR") - focusing on detection of emerging threats on websites,

social media and e-commerce marketplaces; and

-- Big data investigation tools with multi-brand and platform capabilities.

In addition, BrandShield adopts a multi-layered approach to the

detection and mitigation of online threats, which includes Data

Detection, Automated Analysis and Prioritisation, Easy-to-Use

Interface and Highly Automated Takedown Actions.

Strategy

The further expansion of BrandShield's global customer footprint

remains a core growth priority as the Company seeks to increase ARR

from clients in a variety of sectors. This is being primarily

achieved through the expansion of the marketing and sales

activities.

Key pillars of the Company's long-term growth plan include the

following strategic priorities:

-- Continue to invest in and grow the sales and marketing teams;

-- Specific expansion of the sales teams in the US and UK;

-- Establishing a broader marketing footprint;

-- Expansion of advertising, sales promotion and digital marketing campaigns; and

-- Ongoing Business-to-Business public relations and brand building activities.

Product development

Throughout 2022, the Company developed capability enhancements

to its existing platform and expanded its AI protection solution to

provide security against a range of new and evolving threats to

digital assets.

BrandShield 3.0 version was launched during 2022, providing an

enhanced layer of protection against external digital threats such

as web fraud, phishing, social media scams, impersonations and

online-counterfeiting.

BrandShield 3.0 is a completely new version of the BrandShield

platform which was developed in accordance with the latest market

requirements and to meet the most recent digital risk protection

and brand protection challenges. The SaaS technology includes a

completely new and robust infrastructure, and its innovative user

interface is both intuitive and enables more ways to detect threat

networks and carry out immediate takedowns whilst covering more

threats in less time.

In addition, the Company launched NFT Shield(TM) in October

2022, a bespoke AI solution aimed at detecting and removing

illegitimate digital assets. With NFTs now playing a prominent role

in the digital economy, the risk of online asset fraud has become

more evident. In turn, BrandShield, in order to help safeguard an

NFT economy currently worth approximately $3 billion, developed an

AI solution to counter the growing number of fake listings, scams,

and impersonations across NFT marketplaces.

Key hires

The US is an important market for BrandShield, where c.70% of

the Group's clients are based. In 2021, the Company established

physical sales presences in the US as well as the UK, and

BrandShield continued to build on this progress during 2022 by

recruiting sales directors with considerable experience in both

territories to further accelerate growth.

Outlook

The Company performed strongly throughout 2022, achieving

significant financial and operational growth and augmenting its

already strong DRP capabilities through innovative product

launches. Strategic hires have already enabled the Company to

enhance its marketing and sales functions in key regions, and once

fully integrated, will facilitate new business development.

BrandShield's talented employees are the backbone of the

business, and I would like to express my profound thanks to all

staff for their continued hard work and tenacity throughout the

year, which has been pivotal in helping the Company consolidate its

position as a leading provider of cutting-edge DRP solutions.

With a significant and fast-growing global footprint, in

addition to clients across a range of verticals, BrandShield is

well positioned to continue to deploy its highly automated SaaS

offering to capitalise on the high demand for DRP services.

Looking ahead, the Company remains confident in meeting

expectations for the full year 2023 and in the Company's future

growth prospects.

Yoav Keren

Chief Executive Officer

2 July 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

As restated

31 December 31 December 2021

2022

Note $ $

Revenue from contracts with

customers 4 6,396,157 4,127,247

Cost of sales (2,945,050) (1,864,512)

------------- -----------------

Gross profit 3,451,107 2,262,735

Research and Development expenses 6 (2,996,276) (2,721,553)

Sales and Marketing expenses 6 (4,150,684) (2,950,617)

Operating expenses 6 (3,266,657) (2,818,102)

(10,413,617) (8,490,272)

------------- -----------------

Operating loss (6,962,510) (6,227,537)

Depreciation (29,201) (42,464)

Depreciation of the right

of use (249,369) -

Impairment loss (46,952) -

Net finance (expense)/ income 10 (51,874) (33,372)

Loss before income tax (7,339,906) (6,303,373)

------------- -----------------

Income tax expense 11 - -

Loss from continuing operations

attributable to owners (7,339,906) (6,303,373)

Other comprehensive income:

Items that will or may be

reclassified to profit or

loss:

Exchange differences on translation (49,869) (102,319)

------------- -----------------

Total comprehensive loss

attributable to owners (7,389,775) (6,405,692)

============= =================

Basic and diluted earnings

per share attributable to

owners 12 (0.04) (0.05)

============= =================

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

As Restated

31 December 2022 31 December

2021

Note $ $

NON-CURRENT ASSETS

Property, plant and equipment 13 180,777 47,839

Right of use asset - office

lease 25 1,080,599 -

Financial assets at fair

value through profit or

loss 14 3,663,072 4,112,107

------------------- -------------

4,924,448 4,159,946

CURRENT ASSETS

Trade and other receivables 15 2,791,518 825,066

Financial assets at fair

value through profit or

loss 16 18,220 20,534

Other financial assets 14,447 16,218

Cash and cash equivalents 17 2,605,605 1,194,275

Restricted cash 372,707 191,770

Assets classified as held

for sale 18 254,023 337,870

------------------- -------------

6,056,520 2,585,733

------------------- -------------

TOTAL ASSETS 10,980,968 6,745,679

=================== =============

CURRENT LIABILITIES

Short term loan and bank

overdraft 23 2,278,645 1,626,357

Trade and other payables 24 5,969,822 2,807,924

Lease liability- current 25 321,727 -

------------------- -------------

8,570,194 4,434,281

NON-CURRENT LIABILITIES

Lease liability- non current 25 795,557 -

Other payables 30,079 32,230

------------------- -------------

825,636 32,230

------------------- -------------

TOTAL LIABILITIES 9,395,830 4,466,511

------------------- -------------

NET ASSETS 1,585,138 2,279,168

=================== =============

EQUITY

Share capital 21 9,929,842 9,299,228

Share premium 21 32,060,989 27,686,289

Reverse acquisition reserve (20,653,597) (20,653,597)

Other reserves 22 4,685,025 3,214,775

Retained earnings (24,437,121) (17,267,527)

------------- -------------

TOTAL EQUITY 1,585,138 2,279,168

============= =============

The Financial Statements were approved and authorised for issue

by the Board of Directors on July 2, 2023 and were signed on its

behalf by:

........................................................................

A Moscovici - Chairman

COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

31 December 31 December 2021

2022

Note $ $

ASSETS

NON-CURRENT ASSETS

Financial assets at fair value

through profit or loss 14 3,663,072 4,112,107

Investment in subsidiary 19 22,958,375 25,772,709

Loans to related party 20 4,625,778

Property, plant and equipment 13 923 2,072

31,248,148 29,886,888

CURRENT ASSETS

Other receivables and prepayments 15 17,947 215,827

Loans to related parties 20 - 216,240

Financial assets at fair value

through profit or loss 16 18,220 20,534

Other financial assets 14,447 16,218

Cash and cash equivalents 17 230,324 68,721

Restricted cash 1,510 -

Assets classified as held

for sale 18 254,023 337,870

------------ -----------------

536,471 875,410

TOTAL ASSETS 31,784,619 30,762,298

============ =================

EQUITY

Share capital 21 9,929,842 9,299,228

Share premium 21 32,060,989 27,686,289

Other reserves 22 2,003,479 3,863,028

Retained earnings (12,385,406) (10,257,078)

------------ -----------------

TOTAL EQUITY 31,608,904 30,591,467

------------ -----------------

CURRENT LIABLILITIES

Trade and other payables 24 175,715 170,831

------------ -----------------

TOTAL LIABILITIES 175,715 170,831

------------ -----------------

TOTAL EQUITY AND LIABILITIES 31,784,619 30,762,298

============ =================

BrandShield Systems PLC has used the exemption granted under

s408 of the Companies Act 2006 that allows for the non-disclosure

of the Income Statement of the parent company. The after-tax loss

attributable to BrandShield Systems PLC for the twelve months 31

December 2022 was $2,298,640 (2021: $2,352,527). The Financial

Statements were approved and authorised for issue by the Board of

Directors on July 2, 2023 and were signed on its behalf by:

................................................... A Moscovici

- Chairman

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Reverse

Share Share acquisition Other Retained Total

capital premium reserve reserves earnings equity

$ $ $ $ $ $

Balance at 1

January 2021 9,246,267 27,353,294 (20,653,597) 3,101,442 (12,646,446) 6,400,960

--------------- ---------- ----------- ------------- ------------ ------------- ------------

Loss for the

year - - - - (6,303,373) (6,303,373)

Exchange

differences

on

translation - - - 1,023,680 - 1,023,680

--------------- ---------- ----------- ------------- ------------ ------------- ------------

Total

comprehensive

income for

the year - - - 1,023,680 (6,303,373) (5,279,693)

--------------- ---------- ----------- ------------- ------------ ------------- ------------

Exercise of

options - - - (648,132) 648,132 -

Expiry of

options - - - (1,034,160) 1,034,160 -

Share based

payments - - - 1,897,944 - 1,897,944

Issue of share

capital 52,961 332,995 - - - 385,956

--------------- ---------- ----------- ------------- ------------ ------------- ------------

Balance at 31

December 2021 9,299,228 27,686,289 (20,653,597) 4,340,774 (18,393,526) 2,279,168

--------------- ---------- ----------- ------------- ------------ ------------- ------------

Prior year adjustment - - - (1,125,999) 1,125,999 -

-------------------------- ----------- ------------ -------------- ------------- ------------- ------------

Balance at 31 December

2021 as restated 9,299,228 27,686,289 (20,653,597) 3,214,775 (17,267,527) 2,279,168

-------------------------- ----------- ------------ -------------- ------------- ------------- ------------

Loss for the year - - - - (7,339,906) (7,339,906)

Exchange differences

on translation - - - (49,869) - (49,869)

-------------------------- ----------- ------------ -------------- ------------- ------------- ------------

Total comprehensive

income for the year - - - (49,869) (7,339,906) (7,389,775)

-------------------------- ----------- ------------ -------------- ------------- ------------- ------------

Share based payments

cancellation - - - (170,312) 170,312 -

Share based payments - - - 1,690,431 - 1,690,431

Transaction costs - (111,261) - - - (111,261)

Issue of share capital 630,614 4,485,961 - - - 5,116,575

Balance at 31 December

2022 9,929,842 32,060,989 (20,653,597) 4,685,025 (24,437,121) 1,585,138

========================== =========== ============ ============== ============= ============= ============

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Share Share Other Retained

capital premium reserves earnings Total equity

$ $ $ $ $

Balance at 1

January

2021 9,246,267 27,353,294 3,949,949 (9,586,843) 30,962,667

--------------- ---------- ----------- -------------- ------------- -------------

Loss for the

year - - - (2,352,527) (2,352,527)

Exchange

differences

on

translation - - (302,573) - (302,573)

--------------- ---------- ----------- -------------- ------------- -------------

Total

comprehensive

income for

the year - - (302,573) (2,352,527) (2,655,100)

--------------- ---------- ----------- -------------- ------------- -------------

Exercise of

options - - (648,132) 648,132 -

Expiry of

options - - (1,034,160) 1,034,160 -

Issue of share

capital 52,961 332,995 - - 385,956

Share based

payments - - 1,897,944 - 1,897,944

--------------- ---------- ----------- -------------- ------------- -------------

Balance at 31

December

2021 9,299,228 27,686,289 3,863,028 (10,257,078) 30,591,467

--------------- ---------- ----------- -------------- ------------- -------------

Loss for the

year - - - (2,298,640) (2,298,640)

Exchange

differences

on

translation - - (3,379,668) - (3,379,668)

--------------- ---------- ----------- -------------- ------------- -------------

Total

comprehensive

income for

the year - - (3,379,668) (2,298,640) (5,678,308)

--------------- ---------- ----------- -------------- ------------- -------------

Exercise of

options - - - - -

Transaction

costs - (111,261) - - (111,261)

Issue of share

capital 630,614 4,485,961 - - 5,116,575

Share based

payments

cancellation - - (170,312) 170,312 -

Share based

payments - - 1,690,431 - 1,690,431

--------------- ---------- ----------- -------------- ------------- -------------

Balance at 31

December

2022 9,929,842 32,060,989 2,003,479 (12,385,406) 31,608,904

=============== ========== =========== ============== ============= =============

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022

Year ended Year ended

31 December 31 December

2022 2021

Note $ $

Cash flows from operating activities

Loss for the year (7,339,906) (6,303,373)

Adjustments for:

Depreciation 13 29,201 42,464

Depreciation of the right of use 249,369

Fair value adjustment of financial

assets 46,952 -

Share based payment expense, net 27 1,690,431 1,897,944

Net finance expense, from lease 10 51,874 -

Foreign exchange on operations 49,770 (56,515)

Increase in trade and other receivables (1,921,486) (550,924)

Increase in trade and other payables 3,204,713 1,006,810

------------

Net cash outflow from operating activities (3,938,982) (3,963,594)

------------ ------------

Investing activities

Purchase of property, plant and equipment 13 (197,943) (52,970)

Net cash (outflow) / inflow/ from

investing activities (197,943) (52,970)

------------ ------------

Financing activities

Proceeds from issue of exercising warrants

and options 25 - 385,957

Proceeds from issue of ordinary shares 21 5,116,574 -

Share issue costs (111,261) -

Repayment of right of use lease obligations (246,309) -

Proceeds from loans and borrowings 652,288 1,626,357

Net cash inflow from financing activities 5,411,292 2,012,314

------------ ------------

Net (Decrease) / Increase in cash

and cash equivalents 1,274,267 (2,004,250)

Cash and cash equivalents at beginning

of year 1,194,375 3,198,525

Foreign exchange differences on cash 136,963 -

------------ ------------

Cash and cash equivalents at end of

year 17 2,605,605 1,194,275

============ ============

COMPANY STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022

Year ended Year ended

31 December 31 December

2022 2021

Note $ $

Cash flows from operating activities

Loss before income tax (2,298,640) (2,352,527)

Adjustment for:

Depreciation 1,149 -

Fair value adjustment of financial

assets 46,952 -

Share based payments 27 1,690,431 1,897,944

Foreign exchange on operations (76,828) 4,768

(Increase) in trade and other receivables 197,880 (203,256)

Increase in trade and other payables 4,884 10,873

------------- -------------

Net cash outflow from operating

activities (434,172) (642,198)

------------- -------------

Cash flows from investing activities

Purchase of property, plant and equipment - (2,072)

Loans to related parties 20 (4,409,538) -

------------- -------------

Net cash outflow from investing

activities (4,409,538) (2,072)

------------- -------------

Cash flows from financing activities

Proceeds from issue of exercising

warrants and options 21 - 385,957

Share issue costs (111,261) -

Proceeds from issue ordinary shares 21 5,116,574 -

Net cash inflow from financing activities 5,005,313 385,957

------------- -------------

Net decrease in cash and cash equivalents 161,603 (258,313)

Cash and cash equivalents at beginning

of year 68,721 327,034

Foreign exchange differences on cash - -

------------- -------------

Cash and cash equivalents at end

of year 17 230,324 68,721

============= =============

There were no significant non-cash transactions in the year.

Basis of preparation

The consolidated financial statements of BrandShield Systems Plc

have been prepared in accordance with UK-adopted international

accounting standards and in accordance with the requirements of the

Companies Act 2006.

The preparation of consolidated financial statements in

accordance with UK adopted international accounting standards

requires the use of certain critical accounting estimates. It also

requires management to exercise its judgement in the process of

applying the Company's accounting policies. The areas involving a

higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the financial

statements are disclosed in Note 3.

The consolidated financial statements present the results for

the Group and for the Parent Company for the year ended 31 December

2022. The comparative period for the Group and for the Parent

Company is for the twelve months ended 31 December 2021.

The principal accounting policies are set out below and have,

unless otherwise stated, been applied consistently in the financial

statements. The presentational currency of the consolidated

financial statements is US Dollars. The functional currency of the

parent and the subsidiary is Pounds Sterling and New Israeli Shekel

respectively.

Basis of consolidation

Subsidiaries are all entities over which the Group has control.

The Group controls an entity when the Group is exposed to, or has

rights to, variable returns from its involvement with the entity

and has the ability to affect those returns through its power over

the entity. Subsidiaries are fully consolidated from the date on

which control is transferred to the Group. They are deconsolidated

from the date that control ceases. Please refer to note 4 for

information on the consolidation of BrandShield Limited and the

application of the reverse acquisition under accounting principles

IFRS 10. Under IFRS 10, inter-company transactions, balances and

unrealised gains on transactions between group companies are

eliminated. Unrealised losses are also eliminated. When necessary,

amounts reported by subsidiaries have been adjusted to conform with

the Group's accounting policies.

1. ACCOUNTING POLICIES - continued

Going concern

The financial statements have been prepared on the assumption

that the Group will continue as a going concern. Under the going

concern assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations. In assessing

whether the going concern assumption is appropriate, the Directors

take into account all available information for the foreseeable

future, in particular for the twelve months from the date of

approval of the financial statements.

Following the review of ongoing performance and cash flows, the

Directors have a reasonable expectation that the Group has adequate

resources to continue operational existence for the foreseeable

future.

During 2022 the Company raised a total of GBP4.25m in new

equity. The Company has focused on deploying new capital to target

profitability by increasing investment in marketing and sales

initiatives and accelerating the growth of its customer footprint

as well as Annual Recurring Revenues. However, an increased

emphasis has been placed on achieving a cash flow generative

position in 2024. The operational cash burn has been significantly

reduced through various initiatives including the roll out of the

enhanced 'BrandShield 3.0' platform to the Company's clients. This

has allowed greater automation to be achieved leading to wider

re-structuring within certain areas of the Company, particularly

within the enforcement division. Other cost cutting has been

achieved including a reduction in cloud based costs. The Company

also holds legacy investment assets that it is seeking to dispose

of in an orderly way. Opportunities may arise to dispose of these

however the Company is not reliant on this in a going concern

scenario. In addition, the directors have undertaken sensitivity

reviews of the forecasts to model the effects of lower than

budgeted growth and believe that cost reductions would be

achievable if needed (albeit to the detriment of the Group's long

term strategy) if required to avoid the need for a fundraise within

the next 12 months. These measures would include if required the

Directors deferring an element of their salaries. As such, the

Directors consider that the Group will have access to adequate

resources to meet operational requirements for at least 12 months

from the date of approval of these financial statements. On this

basis, the Directors have formed a judgement, at the time of

approving the Financial Statements, that there is a reasonable

expectation that the Group has access to adequate resources to

continue in operational existence for the foreseeable future. For

this reason, the Directors have adopted the going concern basis in

preparing the Financial Statements.

EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

Diluted earnings per share is calculated using the weighted

average number of shares adjusted to assume the conversion of all

dilutive potential ordinary shares.

In accordance with IAS 33 the share options and warrants in

issue do not have a dilutive impact on the earnings per share for

the year ended 31 December 2022 and the year ended 31 December

2021. The total number of potentially dilutive securities are

130,550,399 (2021: 36,786,285).

The weighted average number of shares is adjusted for the impact

of the reverse acquisition as follows:

- Prior to the reverse takeover, the number of shares is based

on BrandShield Limited, adjusted using the share exchange ratio

arising on the reverse takeover; and

- From the date of the reverse takeover, the number of shares is based on the Company

On 4 February 2022, the Company issued 10,714,286 ordinary

shares at 1 pence per share by way of placement raising

GBP1,500,000.

In May 2022, the Company issued 12,500,000 ordinary shares at 1

pence per share by way of placement raising GBP1,000,000.

In November 2022, the Company issued 29,166,667 ordinary shares

at 1 pence per share by way of placement raising GBP1,750,000.

Reconciliations are set out below:

31 December

2022

Weighted

average Per-share

Earnings number of amount

$ shares $

Basic and Diluted EPS (7,339,906) 170,331,874 (0.04)

============ =========== ==========

31 December

2021

Weighted

average Per-share

Earnings number of amount

$ shares $

Basic and Diluted EPS (6,303,373) 116,812,529 (0.05)

============ =========== ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SSEFAEEDSESW

(END) Dow Jones Newswires

July 03, 2023 02:00 ET (06:00 GMT)

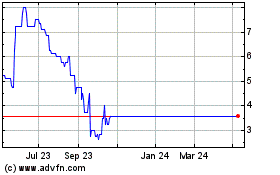

Brandshield Systems (LSE:BRSD)

Historical Stock Chart

From Apr 2024 to May 2024

Brandshield Systems (LSE:BRSD)

Historical Stock Chart

From May 2023 to May 2024