TIDMBRSD

RNS Number : 1111Q

Brandshield Systems PLC

13 October 2023

13 October 2023

BrandShield Systems plc

("BrandShield," the "Company," or the "Group")

Result of General Meeting

BrandShield Systems (AIM: BRSD), a leading provider of

cybersecurity solutions for brand oriented digital risk protection,

announces that all resolutions proposed at the Company's General

Meeting held at 11.00 a.m. this morning were duly passed.

Resolution 1 was read on a poll of Independent Shareholders in

accordance with the requirements of the Takeover Code. The table

below sets out the results of the voting on the resolutions:

Resolution (*indicates special Votes for % of shares Votes % of shares

resolution) voted against voted

Resolution 1: to approve the

Rule 9 Waiver. 57,107,384 99.85% 87,439 0.15%

------------ ------------ --------- ------------

Resolution 2: that, pursuant

to section 551 of the CA 2006,

the directors be and are hereby

generally and unconditionally

authorised to allot equity

securities up to the maximum

aggregate nominal amount of

GBP775,000. 110,373,215 99.27% 808,949 0.73%

------------ ------------ --------- ------------

Resolution 3*: to dis-apply

the statutory rights of pre-emption

under Section 561(1) of the

CA 2006, up to a nominal amount

of GBP775,000 pursuant to the

authority conferred by Resolution

2 above. 110,323,983 99.23% 858,181 0.77%

------------ ------------ --------- ------------

Resolution 4*: to approve the

cancellation of the admission

to trading on AIM of the ordinary

shares of nominal value of

1p each in the capital of the

Company and that the directors

of the Company be generally

and unconditionally authorised

to take all actions reasonable

or necessary to effect such

cancellation. 101,990,650 99.17% 858,181 0.83%

------------ ------------ --------- ------------

Allotment of Shares and Warrants

Following the General Meeting the Company has today allotted

47,137,662 Subscription Shares and 914,018 Open Offer Shares, being

the number of Ordinary Shares applied for by Qualifying

Shareholders under the Open Offer (and as notified on 6 October

2023).

In addition, the Company has issued 47,137,662 Subscription

Warrants and 914,018 Open Offer Warrants.

Application has been made for the 47,137,662 Subscription Shares

and 914,018 Open Offer Shares to be admitted to trading on AIM.

Admission is expected to take place on or around Monday 16

October.

Granting of Options, and repricing of Existing Options

A total of 48,203,800 New Options have been granted which

includes the following to Directors and PDMRs:

Name Number of Options Exercise Price

Yoav Keren 16,363,250 See PDMR tables below

------------------ ----------------------

Yuval Zantkeren 16,363,250 See PDMR tables below

------------------ ----------------------

Itai Galmor 10,117,300 See PDMR tables below

------------------ ----------------------

In addition, the exercise price or exercise period for various

Existing Options and Existing Warrants, as more fully detailed in

paragraphs 5.3 and 5.4 of Part I of the Circular, have been

amended.

Total Voting Rights

Following Admission, the Company will have 218,383,554 Ordinary

Shares in issue. Since the Company currently holds no shares in

treasury, the total number of voting rights in the Company will

therefore be 218,383,554. These figures may therefore be used by

Shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change in their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

Cancellation of Admission to trading on AIM

The Company confirms that the cancellation of the admission to

trading on AIM of the Company's ordinary shares will take effect

from 7.00 a.m. on Monday 23 October.

Waiver of Rule 9 of the City Code

The Panel agreed to waive the Concert Party's obligation to make

an offer that would otherwise arise under Rule 9 of the Takeover

Code as a result of the issue of 32,939,572 new ordinary shares to

members of the Concert Party under the Subscription and the

exercise of the Subscription Warrants, New Options and Broker

Warrants held by members of the Concert Party. The Rule 9 Waiver

was subject to Independent Shareholders approving the Waiver

Resolution by way of a poll at the General Meeting. As more than 50

per cent. of the votes were cast in favour, the Waiver Resolution

was duly passed by the Independent Shareholders by way of poll at

the General Meeting.

The Concert Party comprises those acting, or deemed to be

acting, in concert with it, as more fully described in paragraph 7

of Part I ( Letter from the Chairman of BrandShield Systems plc) in

the Circular published on 20 September 2023.

Following Admission, members of the Concert Party will have an

interest in Ordinary Shares equating to an aggregate of 40.91 per

cent. of the issued share capital of the Company. Assuming that

members of the Concert Party exercise all Existing Options, New

Options, Subscription Warrants and Broker Warrants held by them,

then the Concert Party would, in aggregate, hold interests in

Ordinary Shares carrying a maximum of 58.41 per cent. of the issued

share capital of the Company, as set out in the table below.

Concert Ordinary % of Existing Maximum Maximum Maximum

Party Shares held Ordinary Options number of Number of % of

Member post Admission Share and Shares arising Ordinary Ordinary

Capital Existing from exercise Shares held Share

post Warrants of Existing by Concert Capital

Admission Options, Party Member held

Existing by Concert

Warrants, Party

New Options, Member

Subscription (1)

Warrants,

and Broker

Warrants

Yoav

Keren 11,888,670 5.44% 7,885,800 16,363,250 36,137,720 11.65%

---------------- ----------- ----------- ---------------- -------------- ------------

Yuval

Zantkeren 11,888,670 5.44% 7,885,800 16,363,250 36,137,720 11.65%

---------------- ----------- ----------- ---------------- -------------- ------------

Gigi

Levi

Weiss 7,117,397 3.26% - 1,703,771 8,821,168 2.84%

---------------- ----------- ----------- ---------------- -------------- ------------

New Enterprise

Ltd 11,558,235 5.29% 2,603,024 - 14,161,259 4.65%

---------------- ----------- ----------- ---------------- -------------- ------------

Leelavthi

Subbiah 3,275,329 1.50% - - 3,275,329 1.06%

---------------- ----------- ----------- ---------------- -------------- ------------

Harel

Kodesh 1,381,761 0.63% - - 1,381,761 0.45%

---------------- ----------- ----------- ---------------- -------------- ------------

Afterdox

and Afterdox

Partners 10,003,127 4.58% - - 10,003,127 3.22%

---------------- ----------- ----------- ---------------- -------------- ------------

Joseph

Haykov 32,234,152 14.76% - 31,235,801 63,469,953 20.46%

---------------- ----------- ----------- ---------------- -------------- ------------

Subramanian

Subbiah - 0.00% - 7,808,950 7,808,950 2.52%

---------------- ----------- ----------- ---------------- -------------- ------------

Total 89,347,341 40.91% 18,374,624 73,475,022 181,196,987 58.41%

---------------- ----------- ----------- ---------------- -------------- ------------

(1) assuming no options or warrants held by persons other than

members of the Concert Party are exercised.

The full text of the resolutions set out above is set out in the

Notice of General Meeting dated 20 September 2023.

As at 12 October 2023, the Company's issued share capital

consisted of 170,331,874 ordinary shares, carrying one vote per

share, with no shares held by the Company in treasury. In

accordance with the Articles of Association, on a poll every member

present in person or by proxy has one vote for every share

held.

In accordance with the terms of the Panel Waiver, only

Independent Shareholders were entitled to vote on the Waiver

Resolution. Therefore, any votes by members of the Concert Party in

respect of the Waiver Resolution were not taken into account. Votes

withheld are not votes in law and therefore have not been counted

in the calculation of the proportion of the votes for and against

any resolution. Link Group was appointed as the scrutineer for

vote-taking at the General Meeting.

Unless otherwise defined herein, capitalised terms used in this

announcement shall have the same meanings as defined in the

Circular dated 20 September 2023.

Enquiries:

BrandShield Systems plc +44 (0)20 3143

Yoav Keren, CEO 8300

Spark Advisory Partners Limited (Nominated

Adviser) +44 (0)20 3368

Neil Baldwin / Andrew Emmott / James Keeshan 3554

Shore Capital (Broker)

Toby Gibbs / James Thomas (Corporate Advisory) +44 (0)20 7408

Henry Willcocks (Corporate Broking) 4090

Vigo Consulting (Financial Public Relations)

Jeremy Garcia / Kendall Hill +44 (0)20 7390

brandshield@vigoconsulting.com 0237

The notification below, made in accordance with the Market Abuse

Regulation, provides further details in relation to these PDMR

dealings.

Details of t he p erson disc harging managerial responsib

1 ilities / p erson closely associated

a) Name Yoav Keren

-------------------------- ----------------------------------------

Reason for notification

2

--------------------------------------------------------------------

a) Position / status Director

-------------------------- ----------------------------------------

b) I nitial notification Initial

/Amendment

-------------------------- ----------------------------------------

Details of t he issu er, e mission allow a n ce m a r k

3 et participan t, au ct ion plat for m, au ction eer or auc

tion monitor

--------------------------------------------------------------------

a) Name BrandShield Systems Plc

-------------------------- ----------------------------------------

b) LEI 213800K5AXTQDWB6BP80

-------------------------- ----------------------------------------

Details of t he t ransact ion (s): section to be re p eated

4 for ( i) e a ch type of instr u m e n t; (ii) each type of

transac tion; (iii) each date; and ( iv) each place w h ere

transactions have b een condu cted

--------------------------------------------------------------------

a) Description of the Ordinary shares of 1p (GBP0.01) each in

financial instrument, the capital of BrandShield Systems Plc

t ype of instrument ISIN GB00BM97CN29

I d e ntification

code

-------------------------- ----------------------------------------

Nature of the transaction Grant of new options

-------------------------- ----------------------------------------

Price(s) and volumes(s) Price(s) Volume(s)

7,914,690

5.68p 6,933,280

8.52p 326,850

10.5p 40,120

14p 259,750

15p 798,650

20p 89,910

25p 16,363,250

------------

-------------------------- ----------------------------------------

d) Aggregated information

- Aggregated volume 16,363,250

- Aggregated price See table above

-------------------------- ----------------------------------------

e) Date of the transaction 13 October 2023

-------------------------- ----------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ----------------------------------------

Details of t he p erson disc harging managerial responsib

1 ilities / p erson closely associated

a) Name Yuval Zantkeren

-------------------------- ---------------------------------------

Reason for notification

2

-------------------------------------------------------------------

a) Position / status Director

-------------------------- ---------------------------------------

b) I nitial notification Initial

/Amendment

-------------------------- ---------------------------------------

Details of t he issu er, e mission allow a n ce m a r k

3 et participan t, au ct ion plat for m, au ction eer or auc

tion monitor

-------------------------------------------------------------------

a) Name BrandShield Systems Plc

-------------------------- ---------------------------------------

b) LEI 213800K5AXTQDWB6BP80

-------------------------- ---------------------------------------

Details of t he t ransact ion (s): section to be re p eated

4 for ( i) e a ch type of instr u m e n t; (ii) each type of

transac tion;

( iii) each date; and ( iv) each place w h ere transactions

have b een condu cted

-------------------------------------------------------------------

a) Description of the Ordinary shares of 1p (GBP0.01) each

financial instrument, in the capital of BrandShield Systems

t ype of instrument Plc

I d e ntification ISIN GB00BM97CN29

code

-------------------------- ---------------------------------------

Nature of the transaction Grant of new options

-------------------------- ---------------------------------------

Price(s) and volumes(s) Price(s) Volume(s)

7,914,690

5.68p 6,933,280

8.52p 326,850

10.5p 40,120

14p 259,750

15p 798,650

20p 89,910

25p 16,363,250

-------------------------- ---------------------------------------

d) Aggregated information

- Aggregated volume 16,363,250

- Aggregated price See table above

-------------------------- ---------------------------------------

e) Date of the transaction 13 October 2023

-------------------------- ---------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ---------------------------------------

Details of t he p erson disc harging managerial responsib

1 ilities / p erson closely associated

a) Name Itai Galmor

-------------------------- ----------------------------------------

Reason for notification

2

--------------------------------------------------------------------

a) Position / status PDMR

-------------------------- ----------------------------------------

b) I nitial notification Initial

/Amendment

-------------------------- ----------------------------------------

Details of t he issu er, e mission allow a n ce m a r k

3 et participan t, au ct ion plat for m, au ction eer or auc

tion monitor

--------------------------------------------------------------------

a) Name BrandShield Systems Plc

-------------------------- ----------------------------------------

b) LEI 213800K5AXTQDWB6BP80

-------------------------- ----------------------------------------

Details of t he t ransact ion (s)

4 section to be re p eated for ( i) e a ch type of instr u

m e n t; (ii) each type of transac tion; (iii) each date;

and ( iv) each place w h ere transactions have b een condu

cted

--------------------------------------------------------------------

a) Description of the Ordinary shares of 1p (GBP0.01) each in

financial instrument, the capital of BrandShield Systems Plc

t ype of instrument ISIN GB00BM97CN29

I d e ntification

code

-------------------------- ----------------------------------------

Nature of the transaction Grant of new options

-------------------------- ----------------------------------------

Price(s) and volumes(s) Price(s) Volume(s)

5.68p

8.52p 7,318,7002,798,000

-------------------------- ----------------------------------------

d) Aggregated information

- Aggregated volume 10,117,300

- Aggregated price See above

-------------------------- ----------------------------------------

e) Date of the transaction 13 October 2023

-------------------------- ----------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMFXLFFXBLZFBQ

(END) Dow Jones Newswires

October 13, 2023 07:51 ET (11:51 GMT)

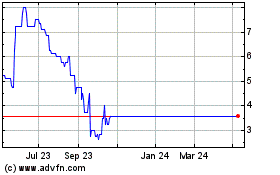

Brandshield Systems (LSE:BRSD)

Historical Stock Chart

From Mar 2025 to Apr 2025

Brandshield Systems (LSE:BRSD)

Historical Stock Chart

From Apr 2024 to Apr 2025