AIM Sch 1 - N Brown Group Plc (5035E)

November 06 2020 - 3:00AM

UK Regulatory

TIDMBWNG

RNS Number : 5035E

AIM

06 November 2020

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

N Brown Group plc ("N Brown" or the "Company")

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

N Brown Group plc

Griffin House

40 Lever Street

Manchester

M60 6ES

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

https://www.nbrown.co.uk/investors

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

N Brown is a top 10 UK clothing & footwear digital retailer,

focusing on the needs of the under-served customer groups.

N Brown was founded in 1859 and has become a leader in fashion

for plus size and older customers.

The Company and its subsidiaries (the "Group") operate through

a portfolio of 5 main brands: 3 womenswear brands being: JD

Williams, Simply Be and Ambrose Wilson; one menswear brand,

Jacamo; and its recently launched stand-alone homeware brand,

Home Essentials. The Group has over 2,000 employees and is

headquartered in Manchester, with its main distribution centre

being in Oldham.

N Brown also operates a financial services offering for customers.

In order to offer customers convenience and flexibility, the

Group allows customers to pay either immediately or utilise

a credit account for their purchases, spreading the cost of

their purchase over time.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

460,483,231 ordinary shares with a nominal value of 11 1/19

pence each ("Ordinary Shares").

The Ordinary Shares are freely transferrable and have no restrictions

as to transfer placed on them.

The Company holds no Ordinary Shares in treasury.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Capital to be raised on Admission: GBP100 million by way of

a placing and open offer Anticipated market capitalisation

on Admission: GBP262 million

Note: Market capitalisation on Admission is based on the issue

price of the capital to be raised on Admission, being 57 pence

per new Ordinary Share.

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

Approximately TBC per cent.

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Matthew (Matt) Samuel Davies - Independent Non-Executive Chairman

Stephen (Steve) Johnson - Chief Executive Officer

Rachel Claire Izzard - Chief Financial Officer

Lord David Alliance of Manchester CBE - Non-Executive Director

Ronald (Ron) Thomas McMillan - Senior Independent Non-Executive

Director

Margaret Lesley Jones - Independent Non-Executive Director

Richard Moross - Independent Non-Executive Director

Gillian (Gill) Carole Barr - Independent Non-Executive Director

Michael Alexander Nunes Ross - Independent Non-Executive Director

Victoria (Vicky) Grant Mitchell - Independent Non-Executive

Director

Joshua Jacob Moshe Alliance - Proposed Non-Executive Director

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Shareholder Anticipated percentage Anticipated percentage

of the Ordinary of the Ordinary

Shares pre-admission* Shares post-admission*

Lord David Alliance of Manchester 33.8% TBC%

CBE(1)

----------------------- ------------------------

Schroder Investment Management 12.0% TBC%

----------------------- ------------------------

Nigel Alliance OBE (together 11.0% TBC%

with his associates)

----------------------- ------------------------

Hargreaves Lansdown Asset 5.67% TBC%

Management Ltd

----------------------- ------------------------

Norges Bank 3.0% TBC%

----------------------- ------------------------

(1) Total direct and indirect beneficial interest, including

interests of trusts of which Lord David Alliance of Manchester

CBE is a trustee and of which Joshua Alliance is a beneficiary

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

None

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) The Saturday that falls closest to 28 February each year

(ii) N/A

(iii) 27 August 2021 (in respect of the annual report to 27

February 2021)

29 November 2021 (in respect of the half yearly report to 29

August 2021)

26 August 2022 (in respect of the annual report to 26 February

2022)

EXPECTED ADMISSION DATE:

23 December 2020

NAME AND ADDRESS OF NOMINATED ADVISER:

Shore Capital and Corporate Limited

Cassini House

57 St James's Street

London

SW1A 1LD

NAME AND ADDRESS OF BROKER:

Shore Capital Stockbrokers Limited

Cassini House

57 St James's Street

London

SW1A 1LD

Jefferies International Limited

100 Bishopsgate

London

EC2N 4JL

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

A combined prospectus, circular and admission document, together

with information incorporated by reference into it, which contains

full details about the Company and the admission of its Ordinary

Shares, is available to view on the Company's website: https://www.nbrown.co.uk/investors

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

The UK Corporate Governance Code

DATE OF NOTIFICATION:

6 November 2020

NEW/ UPDATE:

New

QUOTED APPLICANTS MUST ALSO COMPLETE THE FOLLOWING:

THE NAME OF THE AIM DESIGNATED MARKET UPON WHICH THE APPLICANT'S

SECURITIES HAVE BEEN TRADED:

Premium listing segment of the official list of the FCA (the

"Official List") and the London Stock Exchange plc's main market

for listed securities (the "Main Market")

THE DATE FROM WHICH THE APPLICANT'S SECURITIES HAVE BEEN SO

TRADED:

10 November 1972

CONFIRMATION THAT, FOLLOWING DUE AND CAREFUL ENQUIRY, THE APPLICANT

HAS ADHERED TO ANY LEGAL AND REGULATORY REQUIREMENTS INVOLVED

IN HAVING ITS SECURITIES TRADED UPON SUCH A MARKET OR DETAILS

OF WHERE THERE HAS BEEN ANY BREACH:

The Company has adhered to the legal and regulatory requirements

applicable to companies admitted to the premium listing segment

of the Official List and the Main Market.

AN ADDRESS OR WEB-SITE ADDRESS WHERE ANY DOCUMENTS OR ANNOUNCEMENTS

WHICH THE APPLICANT HAS MADE PUBLIC OVER THE LAST TWO YEARS

(IN CONSEQUENCE OF HAVING ITS SECURITIES SO TRADED) ARE AVAILABLE:

https://www.nbrown.co.uk/investors

DETAILS OF THE APPLICANT'S STRATEGY FOLLOWING ADMISSION INCLUDING,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY:

The Group has undertaken a detailed review of strategy focused

on returning it to sustainable growth and has built a plan

based on driving profitability through the Retail business,

whilst consolidating the Financial Services business. The Group

communicated its refreshed strategy on 25 June 2020 and set

out an "accelerate" phase driven by five growth pillars which

have been developed to reflect the focus of the business and

the external environment:

1. Distinct brands to attract broader range of customers

2. Improved product to drive customer frequency

3. New Home offering for customers to shop more across categories

4. Enhanced digital experience to increase customer conversion

5. Flexible credit to help customers shop

These growth pillars will be underpinned by people and culture,

data and a sustainable cost base appropriate for a digital

retailer. Further details of the Group's strategy are set out

in its combined prospectus, circular and admission document

which is available at: https://www.nbrown.co.uk/investors

A DESCRIPTION OF ANY SIGNIFICANT CHANGE IN FINANCIAL OR TRADING

POSITION OF THE APPLICANT, WHICH HAS OCCURRED SINCE THE

OF THE LAST FINANCIAL PERIOD FOR WHICH AUDITED STATEMENTS HAVE

BEEN PUBLISHED:

Save as disclosed in the Company's half yearly results announcement

and its combined prospectus, circular and admission document,

both of which were published on 5 November 2020, there has

been no significant change in the financial or trading position

of N Brown since 29 February 2020, being the end of the last

financial period for which audited financial statements have

been published.

A STATEMENT THAT THE DIRECTORS OF THE APPLICANT HAVE NO REASON

TO BELIEVE THAT THE WORKING CAPITAL AVAILABLE TO IT OR ITS

GROUP WILL BE INSUFFICIENT FOR AT LEAST TWELVE MONTHS FROM

THE DATE OF ITS ADMISSION:

The Company's combined prospectus, circular and admission document,

published on 5 November 2020 and which is available at: https://www.nbrown.co.uk/investors

contains the following statement: "In the opinion of the Directors

and the Proposed Director, having made due and careful enquiry,

taking into account the net proceeds of the Capital Raising

and the bank facilities available to the Group, the working

capital available to the Group is sufficient for its present

requirements, that is for at least the next 12 months from

the date of Admission."

DETAILS OF ANY LOCK-IN ARRANGEMENTS PURSUANT TO RULE 7 OF THE

AIM RULES:

None

A BRIEF DESCRIPTION OF THE ARRANGEMENTS FOR SETTLING THE APPLICANT'S

SECURITIES:

Settlement will continue to be through the CREST system for

dealings in ordinary shares held in uncertificated form. Ordinary

Shares can also be dealt in certificated form.

A WEBSITE ADDRESS DETAILING THE RIGHTS ATTACHING TO THE APPLICANT'S

SECURITIES:

https://www.nbrown.co.uk/

INFORMATION EQUIVALENT TO THAT REQUIRED FOR AN ADMISSION DOCUMENT

WHICH IS NOT CURRENTLY PUBLIC:

The Company's combined prospectus, circular and admission document

published on 5 November 2020 is available at: https://www.nbrown.co.uk/investors

A WEBSITE ADDRESS OF A PAGE CONTAINING THE APPLICANT'S LATEST

ANNUAL REPORT AND ACCOUNTS WHICH MUST HAVE A FINANCIAL YEAR

END NOT MORE THEN NINE MONTHS PRIOR TO ADMISSION AND INTERIM

RESULTS WHERE APPLICABLE. THE ACCOUNTS MUST BE PREPARED IN

ACCORDANCE WITH ACCOUNTING STANDARDS PERMISSIBLE UNDER AIM

RULE 19:

https://www.nbrown.co.uk/investors

THE NUMBER OF EACH CLASS OF SECURITIES HELD IN TREASURY:

None

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAUPGUCGUPUURQ

(END) Dow Jones Newswires

November 06, 2020 04:00 ET (09:00 GMT)

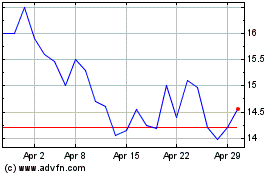

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

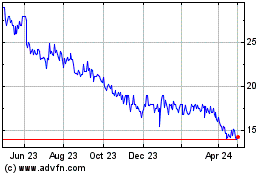

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Apr 2023 to Apr 2024