TIDMBYG

RNS Number : 0281U

Big Yellow Group PLC

20 November 2023

20 November 2023

Big Yellow Group PLC

("Big Yellow", "the Group" or "the Company")

Results for the Six Months ended 30 September 2023

Six months Six months

Financial metrics ended ended Change

30 September 30 September

2023 2022

Revenue GBP99.6 million GBP93.8 million 6%

Store revenue (1) GBP98.3 million GBP92.8 million 6%

Like-for-like store revenue

(1,2) GBP96.8 million GBP92.5 million 5%

Store EBITDA (1) GBP71.5 million GBP66.8 million 7%

Adjusted profit before tax

(1) GBP53.5 million GBP54.6 million (2%)

EPRA earnings per share (1) 29.0 pence 29.3 pence (1%)

Interim dividend per share 22.6 pence 22.3 pence 1%

Statutory metrics

Profit before tax GBP119.6 million GBP6.8 million GBP112.8m

Cash flow from operating activities

(after net finance costs and

pre-working capital movements)(3) GBP54.3 million GBP55.2 million (2%)

Basic earnings per share 65.3 pence 3.3 pence 62.0p

Store metrics

Store Maximum Lettable Area

("MLA") (1) 6,419,000 6,295,000 2%

Closing occupancy (sq ft) (1) 5,228,000 5,300,000 (1%)

Occupancy growth in the period

(sq ft) (1,4) 140,000 154,000 (9%)

Closing occupancy (1) 81.4% 84.2% (2.8 ppts)

Occupancy - Big Yellow like-for-like

stores (1,5) 84.6% 86.8% (2.2 ppts)

Average achieved net rent per

sq ft (1) GBP33.02 GBP30.55 8%

Closing net rent per sq ft

(1) GBP33.47 GBP31.44 6.5%

(1) See note 20 for glossary of terms

(2) Excluding Aberdeen (acquired June 2022), Harrow and Kingston

North (both opened September 2022) and Kings Cross (opened June

2023).

(3) See reconciliation in Financial Review

(4) In June 2022, the Group acquired a store in Aberdeen with

39,000 sq ft of occupancy. The total increase in the Group's

occupancy for the six months to 30 September 2022 was 193,000 sq

ft.

(5) As per (2), additionally excluding the Armadillo stores

First Half Highlights

-- Revenue growth for the period was 6%, with like-for-like store revenue up by 5%, driven by

increases in average achieved rents

-- Like-for-like occupancy increase of 1.5 ppts from 1 April 2023 and down 2.2 ppts from same

time last year to 84.6% (September 2022: 86.8%). Closing occupancy, reflecting the additional

capacity from recently opened stores, is 81.4% (September 2022: 84.2%)

-- Average achieved net rent per sq ft increased by 8% period on period, closing net rent up

by 6.5% from September 2022

-- Overall store EBITDA was up 7% in the period and the EBITDA margin increased over the six

months to 72.7% (2022: 72.0%); the established store portfolio increased to 75.1% (2022: 74.1%)

with closing occupancy of 85.5% (2022: 88.2%)

-- Cash flow from operating activities (after net finance costs and pre-working capital movements)

decreased by 2% to GBP54.3 million, which reflects our increased borrowing and operating costs

over the period

-- Adjusted profit before tax down 2% to GBP53.5 million, with EPRA earnings per share down 1%

-- Statutory profit before tax of GBP119.6 million compared to GBP6.8 million in the prior period

due to a revaluation surplus of GBP67.2 million in the period (2022: deficit of GBP47.7 million),

reflecting the growth in operating cash flow during the period

-- Interim dividend of 22.6 pence per share declared, an increase of 1%

Investment in new capacity

-- GBP107 million (net of expenses) raised by way of a placing of 6.3% of the Company's issued

share capital to fund the build out of the development pipeline

-- 121,000 sq ft of capacity added in the period with one new store opened in Kings Cross, and

an extension completed at Armadillo Stockton South

-- Acquisition of freehold property in Leicester, taking the pipeline to 11 development sites

and two replacement stores of approximately 0.9 million sq ft (14% of current MLA), of which

11 are in London or within close proximity. 1.2 million sq ft of fully built vacant space

is currently available for future growth

-- Planning consent granted for new store in Wapping (London); we now have seven of our 13 pipeline

stores with planning

Commenting, Nicholas Vetch CBE, Executive Chairman, said:

"We have delivered strong EBITDA growth with the increase in net

achieved rents offsetting the rise in operating costs, with profit

marginally down due to higher interest rates. Our London and South

East stores, representing 74% of revenue, have outperformed those

located in the regions.

The transition to a higher interest rate environment has been

testing but we believe that this has now been largely absorbed into

the business.

Following the recent placing, we have the funding and balance

sheet strength to commence the build out of the next phase of

stores. We believe that this, along with the available space on our

existing platform, will drive a significant increase in revenue and

earnings over the next few years.

The balance sheet will be further strengthened by the sale of

approximately GBP90 million of surplus non-storage assets, which we

expect to complete over the next 18 months.

There is evidence that land prices have been, and are, dropping

materially and this will provide an opportunity to replenish the

pipeline."

- Ends -

ABOUT US

Big Yellow is the UK's brand leader in self storage. Big Yellow

now operates from a platform of 109 stores, including 24 stores

branded as Armadillo Self Storage. We have a pipeline of 0.9

million sq ft comprising 13 proposed Big Yellow self storage

facilities. The current maximum lettable area of the existing

platform (including Armadillo) is 6.4 million sq ft. When fully

built out the portfolio will provide approximately 7.3 million sq

ft of flexible storage space. 99% of our stores and sites by value

are held freehold and long leasehold, with the remaining 1% short

leasehold.

The Group has pioneered the development of the latest generation

of self storage facilities, which utilise state of the art

technology and are located in high profile, accessible, main road

locations. Our focus on the location and visibility of our stores,

with excellent customer service, a market-leading online platform,

and significant and increasing investment in sustainability, has

created in Big Yellow the most recognised brand name in the UK self

storage industry.

For further information, please contact:

Big Yellow Group PLC 01276 477811

Nicholas Vetch CBE, Executive Chairman

Jim Gibson, Chief Executive Officer

John Trotman, Chief Financial Officer

Teneo 020 7260 2700

Charlie Armitstead

Oliver Bell

CHAIRMAN'S STATEMENT

Big Yellow Group PLC, the UK's brand leader in self storage, is

pleased to announce its results for the six months ended 30

September 2023.

We have delivered strong EBITDA growth with the increase in net

achieved rents offsetting the rise in operating costs, with profit

marginally down due to higher interest rates. Our London and South

East stores, representing 74% of revenue, have outperformed those

located in the regions.

Our operating expenses for the six months are up 8% (7% on a

like-for-like basis), principally from a significant increase in

property rates from 1 April. However, we have benefited from rates

provision releases on historic assessments relating to the previous

rating list, so our overall store operating expense for the six

months is up 4%.

The roll-out of our pipeline has continued with the successful

opening of our landmark store in Kings Cross (London) in June 2023,

adding 103,000 sq ft of capacity. Early trading from the store has

been very encouraging, with the store adding 24,000 sq ft of

occupancy by 30 September 2023, and has now reached breakeven at

the EBITDA level. The pipeline is an important driver of our

performance, as illustrated by Camberwell, Bracknell and Battersea,

which opened during the second half of 2020. These three stores, at

a current average occupancy of 78%, are delivering an average

EBITDA margin of 67%, and an EBITDA yield of 8.2% on cost, and we

expect both these metrics to grow over the next 12 months.

Financial results

Revenue for the period was GBP99.6 million (2022: GBP93.8

million), an increase of 6%, with storage income up 7%, offset by

lower growth in non-storage income. Like-for-like store revenue was

up 5%, driven by an increase in average achieved net rent, offset

by a slight fall in average occupancy. Like-for-like store revenue

excludes new store openings and acquired stores. Store EBITDA was

GBP71.5 million, an increase of 7% from the prior period (2022:

GBP66.8 million).

The Group made an adjusted profit before tax in the period of

GBP53.5 million, down 2% from GBP54.6 million for the same period

last year (see note 6). The Group's cash flow from operating

activities (after net finance costs and pre-working capital

movements) also reduced by 2% to GBP54.3 million for the period

(2022: GBP55.2 million). The increase in the profitability from the

stores was more than offset by an increase in the Group's interest

expense for the period, following the rises in interest rates. We

expect the Group's interest expense to reduce in the second half

following the placing in October.

Adjusted diluted EPRA earnings per share were 29.0 pence (2022:

29.3 pence), a decrease of 1%. The Group's statutory profit before

tax for the period was GBP119.6 million, an increase from GBP6.8

million for the same period last year, due to a revaluation surplus

of GBP67 million in the period (2022: deficit of GBP47.7 million),

reflecting the growth in cash flow during the period.

Dividends

The Board has approved an interim dividend of 22.6 pence per

share representing a 1% increase from the prior period (77% of

first half adjusted eps). We expect the dividend for the full year

to be in line with our policy of distributing 80% of full year

adjusted earnings per share. This first half dividend has all been

declared as Property Income Distribution ("PID").

Placing

We have made it clear for many years that we believe that a low

level of debt is appropriate. That belief has been reinforced by

the rise in interest rates over the last 21 months. We believe it

is therefore optimal that future capital expenditure over the

medium term should be funded from equity, cash flow and surplus

land and property sales.

In October 2023, the Group raised GBP107 million (net of

expenses) through a placing of 6.3% of the Company's share capital.

The net proceeds will allow us to expand capacity in London, our

strongest market, and monetise land that we already own. It will

also be marginally accretive to earnings in the short term, and the

Directors expect it to be significantly so over the medium to long

term.

Development pipeline

In June, the Group acquired a 0.8 acre property for development

on Belgrave Gate, central Leicester for GBP1.85 million. We will be

seeking planning permission for a 58,000 sq ft self-storage centre

on the site. The site is currently generating an income of

approximately GBP110,000 per annum, across four short-term rolling

tenancies.

During the period we obtained planning consent for a 132,000 sq

ft self storage centre and 114 flats at appeal on our site in

Wapping, London. We expect that this new store will deliver an

approximately 9% net operating income return on the total capital

deployed of GBP56 million, including the estimated GBP36 million to

be spent on construction. Demolition of the existing buildings on

the self storage site will commence shortly.

In May 2022, we suspended construction on all projects that were

not already on site because conditions in the construction market

were unfavourable. Those conditions have improved considerably with

steelwork and cladding prices falling, and other material prices

stabilising. In addition, we are seeing that main contractors and

specialist sub-contractors are pricing new projects more

competitively.

Following the placing, we will now press on with the

construction of an initial six sites including Farnham Road,

Slough, Wapping, Wembley, Queensbury, Staines, and Slough Bath

Road, all of which have planning consent at an incremental cost of

GBP90 million.

Subject to receipt of planning and vacant possession,

construction will then follow in due course on the remaining sites

we own at a further incremental cost of GBP147 million.

The projected net operating income of the increase in our total

capacity of 902,000 sq ft when stabilised is GBP30.4 million

representing an approximate 13% return on the incremental capital

deployed. On a proforma basis at stabilisation, the projected net

operating income for the 11 new stores and two replacement stores

is GBP33.9 million, a return of approximately 8.7% on the total

development cost of GBP389 million, including land already

acquired.

Capital structure

The Group owns its assets largely freehold, representing some

99% by value of our portfolio which has shielded us from the

significant rise in industrial and warehouse rents that has

occurred over the last 10 years.

In addition, we view rent liabilities as quasi-debt. Once we

have relocated our Farnham Road Slough and Staples Corner stores

(the latter subject to planning) we expect our total rent liability

to fall to approximately GBP1 million per annum.

The Group's interest cover for the period (expressed as the

ratio of cash generated from operations pre-working capital

movements against interest paid) was 5.3 times (2022: 9.3 times).

On a proforma basis (see note 19) following the placing, based on

October's EBITDA and following the repayment of debt, this interest

cover ratio is currently estimated at over 6 times, and also on a

proforma basis, the Group's net debt to EBITDA ratio is now

3.0x.

Net debt was GBP495.3 million at 30 September 2023. Following

the placing, on a proforma basis (see note 19), it was GBP388.3

million, giving the Group undrawn facilities of GBP159 million and

in addition the $225 million bilateral shelf facility with Pricoa.

Following the placing, approximately 50% of our debt is fixed, with

the balance floating, in line with our hedging policy, and our

current average cost of debt is 5.6%.

Outlook

The transition to a higher interest rate environment has been

testing but we believe that this has now been largely absorbed into

the business.

Following the recent placing, we have the funding and balance

sheet strength to commence the build out of the next phase of

stores. We believe that this, along with the available space on our

existing platform, will drive a significant increase in revenue and

earnings over the next few years.

The balance sheet will be further strengthened by the sale of

approximately GBP90 million of surplus non-storage assets, which we

expect to complete over the next 18 months.

There is evidence that land prices have been, and are, dropping

materially and this will provide an opportunity to replenish the

pipeline.

Nicholas Vetch CBE

Executive Chairman

20 November 2023

BUSINESS AND FINANCIAL REVIEW

Store occupancy

We now have a portfolio of 109 open and trading stores, with a

current maximum lettable area of 6.4 million sq ft (2022: 108

stores, MLA of 6.3 million sq ft).

Like-for-like occupancy increased by 1.5 ppts from 1 April 2023

but was down 2.2 ppts from the same time last year. Like-for-like

store revenue growth for the half year was 5%, driven by

improvements in average achieved net rent per sq ft.

Prospect numbers are more in-line with the pre-Covid period on a

like-for-like basis, and activity levels within the business have

consequently been a little bit slower than last year, with move-ins

down 5%, and move-outs down 5% over the period, reflecting less

churn. Our conversion rates over the period have increased, which

is indicative of more needs-driven demand. This trend has continued

post period end, where move-in and move-out activity are down

similar amounts to last year.

Occupancy across all 109 stores increased by 140,000 sq ft over

the six months compared to a gain of 154,000 sq ft in the same

period last year (with an additional 39,000 sq ft of occupancy

acquired with Aberdeen in June 2022). Demand from domestic

customers has been stronger than last year, up 133,000 sq ft.

Business occupancy dropped by 1.6% or 31,000 sq ft, on 1.9 million

sq ft occupied at the beginning of the period and student occupancy

rose by 38,000 sq ft. Our larger rooms, which are occupied in the

main by businesses, remain highly occupied, particularly in London.

68% of our revenue derives from domestic and student customers,

with the balance from our business customers.

As we have experienced over the years, there are businesses who

outgrow us and move to their own accommodation, others cease

operations, some are seasonal, and we continue to replace any

vacated space with new move-ins from online traders, e-tailers and

service providers. We are not seeing any noticeable softening in

demand from businesses, particularly in London, and since the

period end, our business occupancy performance is better than last

year. Over the six months, revenue from national customers

(businesses who occupy space in multiple stores) has increased by

11% compared to the same period last year.

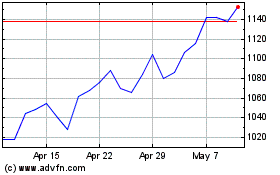

Our third quarter is historically the weakest trading quarter

where we see a loss in occupancy with a return to growth in the

fourth quarter. In the current year, we have lost 117,000 sq ft

(1.8% of maximum lettable area "MLA") since the end of September,

compared to a loss of 141,000 sq ft (2.2% of MLA) at the same stage

last year.

At 30 September, the 76 established Big Yellow stores were 85.5%

occupied compared to 88.2% at the same time last year. The nine

developing Big Yellow stores added 52,000 sq ft of occupancy in the

past six months to reach closing occupancy of 56.5%.

The Armadillo stores, representing 10% of the Group's revenue,

added 27,000 sq ft of occupancy with closing occupancy of 78%,

including an additional 20,000 sq ft of capacity added at Stockton

South. Overall store occupancy was 81.5%.

Rental growth

We continue to manage pricing dynamically, taking account of

room availability, customer demand and local competition, with our

pricing model reducing promotions and increasing asking prices

where individual units are in scarce supply.

In the current trading environment against the backdrop of

higher inflation, we continue to price competitively to win new

customers, and are achieving rental growth from existing customers

broadly in line with inflation. It must be remembered that some 60%

to 70% of our customers move-out within six months, and therefore

do not receive any price increases.

The average achieved net rent per sq ft increased by 8% compared

to the prior period, with closing net rent up 3% compared to 31

March 2023, and up 6.5% from the same time last year. The table

below shows the change in net rent per sq ft for the portfolio by

average occupancy over the six months (on a non-weighted

basis).

Average occupancy Net rent per sq ft Net rent per sq ft

in the six months growth from 1 April growth from 1 April

to 30 September 2023 to 30 September 2022

------------------- ---------------------- ----------------------

75% to 85% 2.6% 4.9%

85 to 90% 3.5% 5.0%

Above 90% 4.7% 5.9%

Security of income

We believe that self storage income is essentially evergreen

income with highly defensive characteristics driven from buildings

with very low obsolescence and relatively low maintenance

requirements. Although our contract with our customers is in theory

as short as a week, we do not rely on any one contract for our

income security. At 30 September 2023 the average length of stay

for existing customers was 30 months (March 2023: 31 months). For

all customers, including those who have moved out of the business

throughout the life of the portfolio, the average length of stay

was 8.8 months (March 2023: 8.7 months). We have seen an increase

in the length of stay of customers who moved out over the six

months, which increased to 9.1 months from 8.6 months for the same

period last year.

37% of our customers by occupied space have been storing with us

for over two years (2022: 38%), and a further 15% of customers have

been in the business for between one and two years (2022: 16%). For

the 52% of customers that have stayed for more than one year, the

average length of stay is 52 months.

Our business customer base is comprised of online retailers, B2B

traders looking for flexible mini-warehousing for e-fulfilment,

service providers, those looking to shorten supply chains, and

businesses looking to rationalise their other fixed costs of

accommodation. For these customers, who typically are looking for

rooms which could be from 50 sq ft to 500 sq ft in facilities that

meet their operational requirements, the only supply in big cities

is from self storage providers.

We saw continued growth in occupancy from our domestic customer

base, with demand across a broad spectrum of uses. Over 70% of our

domestic customers are in the top 3 ACORN categories: Affluent

Achievers, Rising Prosperity, and Comfortable Communities. The

largest element of demand into our business each year is customers

who use us for relatively short periods driven by a need.

We therefore have a very diverse base of domestic and business

customers currently occupying 76,000 rooms. This, together with the

location and quality of our stores, limited growth in new supply,

market-leading brand and digital platform, and customer service,

all contribute to the resilience and security of our income.

We are not seeing any deterioration in rent collection.

Approximately 80% of our customers pay by direct debit, and the

proportion of our billings that is more than 10 days overdue is in

line with last year and lower than pre-Covid. Our bad debt expense

for the period was 0.2%, unchanged from last year.

Supply

New supply and competition is a key risk to our business model,

hence our weighting to London and its commuter towns, where

barriers to entry in terms of competition for land and difficulty

around obtaining planning are highest. Growth in new self storage

centre openings, excluding container operators, over the last five

years has averaged approximately 3% of total capacity per annum. We

continue to see limited new supply growth in our key areas of

operation, with an anticipated twelve stores openings in 2023 and

2024 in London, including our Kings Cross store, representing

around 2.5% to 3% of capacity.

Revenue

Total revenue for the six-month period was GBP99.6 million, an

increase of GBP5.8 million (6%) from GBP93.8 million in the same

period last year with storage income up 7%, offset by lower growth

in non-storage income. Like-for-like store revenue (see glossary in

note 20) was GBP96.8 million, an increase of 5% from the 2022

figure of GBP92.5 million.

Revenue growth for the period in our London stores was 8%, our

south east commuter stores 5%, and our regional stores 3%.

Other sales comprise the selling of packing materials,

insurance/enhanced liability service ("ELS"), and storage related

charges. The Group changed the way it sold contents protections to

its customers on 1 June 2022 to an Enhanced Liability Service

("ELS"), which is subject to VAT at 20% and not Insurance Premium

Tax ("IPT") at 12%, the latter being included in revenue. We

estimate the impact of this on the total revenue and like-for-like

revenue for the six months is 0.35%. For the remainder of the year,

revenue from ELS will be on a comparable basis.

The other revenue earned is tenant income on sites where we have

not started development.

Operating costs

Cost of sales comprises principally direct store operating

costs, including store staff salaries, utilities, business rates,

insurance, a full allocation of the central marketing budget, and

repairs and maintenance.

The table below shows the breakdown of store operating costs

compared to the same period last year, with Armadillo's costs

included in full in both periods:

Period Period ended % of store

ended 30 30 September operating

Category September 2022 costs

2023 GBP000 Change in period

GBP000

Cost of sales (insurance/ELS

and packing materials) 865 1,428 (39%) 3%

Staff costs 7,209 6,999 3% 27%

General & admin 676 695 (3%) 3%

Utilities 862 959 (10%) 3%

Property rates 9,155 7,521 22% 34%

Marketing 3,329 3,292 1% 12%

Repairs and maintenance 2,747 2,314 19% 10%

Insurance 1,697 1,290 32% 6%

Computer costs 509 509 - 2%

----------- -------------- --------- -----------

Total before non-recurring

items 27,049 25,007 8%

Non-recurring items (1,272) (120)

Total per portfolio summary 25,777 24,887 4%

----------- -------------- --------- -----------

Store operating costs have increased by GBP0.9 million (4%). The

non-recurring items in the current period relate principally to the

release of a provision for property rates from the 2017 rating

list, and a reassessment of the Group's bad debt provision. Store

operating costs before these non-recurring items have increased by

GBP2.0 million (8%) compared to the same period last year. New

stores accounted for GBP0.8 million of operating expenses in the

period. Cost of sales have decreased by GBP0.6 million following

the move to selling an ELS rather than insurance (see explanation

in revenue above). The remaining increase is GBP1.8 million (7%),

with commentary below:

- Staff costs have increased by GBP0.2 million (3%), with the salary review of on average 5.5%

(including a 6% increase to those at the lower end of the pay scale), which has been partly

offset by lower bonuses for the six months, which have averaged 8% compared to 11% in the

prior period. Additionally, given the investment we have made in recent years in the automation

of our store operations, particularly in relation to interaction with prospects and customers,

we continue to review every vacancy before making a decision to recruit, and have made savings

from this through the salary line.

- Property rates have increased by GBP1.6 million (22%), following the Rating Revaluation published

in November 2022, the like-for-like increase is 19%, with an additional four months' worth

of rates payable on Kings Cross, which opened in June 2023.

- We continue to see the benefit of our solar retrofit programme on our utilities expense, which

has reduced by 10% compared to the same period last year. Our three year energy contract expired

in September 2023. We have placed a new one year contract from 1 October 2023, which had an

increase in cost of 74% from the expiring contract, albeit part of this increase will be mitigated

through our solar programme. We will review this next summer.

- The repairs and maintenance expense has increased due to higher store numbers, timing of works

in the current period, and an increase in solar panel maintenance costs, with higher numbers

of stores now with solar PVs.

- Overall insurance premiums increased from April and the new contents policy includes Big Yellow

paying for claims up to GBP250,000 in any one loss. As a consequence, GBP215,000 in total

was paid in claims this period (2022: GBP54,000).

The table below reconciles store operating costs per the

portfolio summary to cost of sales in the income statement:

Period Period

ended 30 ended 30

September September

2023 2022

GBP000 GBP000

Direct store operating costs per portfolio

summary (excluding rent) 25,777 24,887

Rent included in cost of sales (total rent

payable is included in portfolio summary) 915 718

Depreciation charged to cost of sales 280 235

Head office operational management costs charged

to cost of sales 832 610

Cost of sales per income statement 27,804 26,450

Store EBITDA

Store EBITDA for the period was GBP71.5 million, an increase of

GBP4.7 million (7%) from GBP66.8 million for the period ended 30

September 2022 (see Portfolio Summary). The overall EBITDA margin

for all stores during the period was 72.7%, up from 72.0% in

2022.

All stores are currently trading profitably at the Store EBITDA

level, with our recently opened store in Kings Cross breaking even

after four months.

Administrative expenses

Administrative expenses in the income statement have decreased

by GBP0.2 million (3%), following a reduction in the accrual for

national insurance on the exercise of share options given the fall

in the Company's share price, partly offset by an increase in the

IFRS 2 charge in the period. Excluding these two items,

administrative expenses have increased by 4%.

Other operating income

In February 2022 the Group experienced a fire at our Cheadle

store, which resulted in a total loss to the store. Buildings all

risk insurance is in place for the full reinstatement value with

the landlord. We also have insurance cover in place for both our

fit-out and four years loss of income. The loss of income booked

during the first six months of the financial year was GBP0.8

million (2022: GBP0.7 million) which is included in other operating

income.

In the prior period the Group acquired the freehold of its

Oxford store, thus extinguishing the asset and liability in

relation to the lease from the previous landlord. This

extinguishment gave rise to a gain of GBP0.2 million, which is

included in other operating income for 2022.

Interest expense on bank borrowings

Interest on bank borrowings during the period was GBP13.6

million, GBP 5.8 million higher than the same period last year, due

to higher average debt levels in the period, coupled with a higher

average cost of debt following the increase in interest rates. The

interest expense will be lower in the second half of the year, as

the placing proceeds were used to repay part of our Revolving

Credit Facility.

Interest capitalised in the period amounted to GBP1.8 million

(2022: GBP1.6 million), arising on the Group's construction

programme.

Profit before tax

The Group's statutory profit before tax for the period was

GBP119.6 million, compared to GBP6.8 million for the same period

last year. The increase in profitability is due to a revaluation

gain in the in the period compared to a loss in the prior period,

which contained an outward shift of cap rates due to the underlying

market conditions.

After adjusting for the revaluation movement of investment

properties and other matters shown in the table below, the Group

made an adjusted profit before tax in the period of GBP53.5

million, down 2% from GBP54.6 million in 2022.

Six months ended Six months ended

30 September 30 September

Profit before tax analysis 2023 2022

GBPm GBPm

---------------------------------- ----------------- -----------------

Profit before tax 119.6 6.8

(Gain)/loss on revaluation of

investment properties (67.2) 47.7

Change in fair value of interest

rate derivatives 1.1 (0.6)

Refinancing costs - 0.7

Adjusted profit before tax 53.5 54.6

Tax - (0.7)

---------------------------------- ----------------- -----------------

Adjusted profit after tax 53.5 53.9

---------------------------------- ----------------- -----------------

The movement in the adjusted profit before tax from the prior

year is shown in the table below:

Movement in adjusted profit before tax GBPm

----------------------------------------------- ------

Adjusted profit before tax for the six months

to 30 September 2022 54.6

Increase in gross profit 4.4

Decrease in administrative expenses 0.2

Decrease in other operating income (0.1)

Increase in net interest payable (5.7)

Increase in capitalised interest 0.1

Adjusted profit before tax for the six months

to 30 September 2023 53.5

Diluted EPRA earnings per share was 29.0 pence (2022: 29.3

pence), a decrease of 1 % from the same period last year.

Taxation

The Group is a Real Estate Investment Trust ("REIT"). We benefit

from a zero-tax rate on our qualifying self storage earnings. We

only pay corporation tax on the profits attributable to our

residual business, comprising primarily of the sale of packing

materials and insurance, and management fees earned by the

Group.

There is a GBP0.9 million tax charge in the residual business

for the period ended 30 September 2023 (six months to 30 September

2022: GBP0.7 million). The current period tax charge is largely

offset in the income statement by an adjustment to the prior year

tax estimate.

Dividends

REIT regulatory requirements determine the level of Property

Income Distribution ("PID") payable by the Group. A PID of 22.6

pence per share is proposed as the total interim dividend, an

increase of 1% from 22.3 pence per share for the same period last

year.

The interim dividend will be paid on 26 January 2024. The

ex-dividend date is 4 January 2024, and the record date is 5

January 2024 .

Cash flow

Cash flows from operating activities (after net finance costs

and pre-working capital movements) have decreased by 2 % to GBP

54.3 million for the period (2022: GBP55.2 million), with a higher

interest expense in the period leading to the reduction. These

operating cash flows are after the ongoing maintenance costs of the

stores, which for this first half were on average approximately GBP

25,000 per store. The Group's net debt has increased over the

period to GBP495.3 million (March 2023: GBP486.6 million), but on a

proforma basis following the placing has reduced to GBP388.3

million.

There are distortive working capital items in the current

period, and therefore the summary cash flow below sets out the free

cash flow pre-working capital movements

Six months Six months

ended 30 ended 30

September September

2023 2022

GBPm GBPm

Cash generated from operations pre-working

capital movements 68.3 63.3

Net finance costs (12.8) (6.9)

Interest on obligations under lease liabilities (0.3) (0.4)

Other operating income received 0.1 0.7

Tax (1.0) (1.5)

----------- -----------

Cash flow from operating activities pre-working

capital movements 54.3 55.2

Working capital movements (3.5) (0.6)

----------- -----------

Cash flow from operating activities 50.8 54.6

Capital expenditure (17.8) (73.5)

Receipt from Capital Goods Scheme - 0.2

Cash flow after investing activities 33.0 (18.7)

Dividends (41.7) (38.7)

Payment of finance lease liabilities (0.9) (0.7)

Issue of share capital 0.9 0.9

Receipt from termination of interest rate

derivatives - 0.4

Loan arrangement fees paid - (1.2)

Increase in borrowings 7.4 58.0

----------- -----------

Net cash outflow (1.3) -

----------- -----------

The Group's interest cover for the period (expressed as the

ratio of cash generated from operations pre-working capital

movements against interest paid) was 5.3 times (2022: 9.3 times),

with the reduction caused by the increase in the interest expense

over the period following the rise in borrowing costs and a higher

average debt level. On a proforma basis (see note 19) following the

placing, based on October's EBITDA and following the repayment of

debt, this interest cover ratio is currently estimated at over 6

times.

GBP2 million of the capital expenditure in the period related to

the acquisition of Leicester, with the balance of GBP15.8 million

principally construction capital expenditure on our new stores in

Kings Cross, Slough Farnham Road, and including an investment in

the solar retrofitting of GBP2.1 million.

Balance sheet

Investment property

The Group's investment properties are carried at the half year

at Directors' valuation. They are valued externally by Jones Lang

Lasalle ("JLL") at the year end. The Directors' valuations reflect

the latest cash flows derived from each of the stores at the end of

September.

In performing the valuations, the Directors consulted with JLL

on the capitalisation rates used in the valuations, which are based

on the JLL model. The Directors, as advised by the valuers,

consider that the prime capitalisation rates have remained stable

since the March 2023 valuation date.

The Directors have made some minor amendments to a couple of the

valuation assumptions, namely the adjustment of stable occupancy

levels on certain stores that are consistently trading ahead of the

previously used assumptions and to certain assumptions on net

achieved rents within the valuations. Other than the above, the

Directors believe the core assumptions used by JLL in the March

2023 valuations are still appropriate at the September valuation

date.

At 30 September 2023 the external valuation of the Group's

properties is shown in the table below:

Analysis of property portfolio Value at Revaluation

30 September movement in the

2023 period

GBPm GBPm

---------------------------------------- -------------- -----------------

Investment property 2,604.7 81.8

Investment property under construction 186.8 (14.6)

---------------------------------------- -------------- -----------------

Investment property total 2,791.5 67.2

---------------------------------------- -------------- -----------------

The revaluation surplus for the open stores in the period was

GBP81.8 million, reflecting the growth in operating cash flow. The

revaluation deficit of GBP14.6 million on the investment property

under construction, is reflective of discussions with JLL and is

largely as a result of a reduction in the value of our land without

self storage planning.

The initial yield on the portfolio is 5.3% (31 March 2023:

5.3%). The Group's annual report and accounts for the year ended 31

March 2023 contains a detailed explanation of the valuation

methodology.

Current development pipeline - with planning

Site Location Status Anticipated

capacity

Wapping, London On the Highway, Planning consent granted, Additional

adjacent to existing demolition of existing 95,000 sq

Big Yellow store building to commence ft

shortly

---------------------- ----------------------------- --------------

Wembley, London Towers Business Discussions ongoing to 70,000 sq

Park secure ft

vacant possession

---------------------- ----------------------------- --------------

Queensbury, Honeypot Lane Site acquired in November 70,000 sq

London 2018 ft

---------------------- ----------------------------- --------------

Staines, London The Causeway Site acquired in December 65,000 sq

2020. Consent also received ft

to develop 9 industrial

units totalling 99,000

sq ft

---------------------- ----------------------------- --------------

Slough Farnham Road Construction commenced Replacement

in Summer 2023 with a for existing

view to opening in Summer leasehold

2024 store

---------------------- ----------------------------- --------------

Slough Bath Road Site acquired in April 90,000 sq

2019 ft

---------------------- ----------------------------- --------------

Newcastle Scotswood Road Planning consent granted 60,000 sq

ft

---------------------- ----------------------------- --------------

Current development pipeline - without planning

Site Location Status Anticipated

capacity

Leicester Belgrave Gate, Site acquired in June 58,000 sq

Central Leicester 2023. Planning discussions ft

underway with Leicester

City Council

------------------- ------------------------------- -------------------

Epsom, London East Street Site acquired in March 58,000 sq

2021. Planning application ft

refused by Epsom and

Ewell Council and an

appeal has been submitted

------------------- ------------------------------- -------------------

Kentish Town, Regis Road Site acquired in April 68,000 sq

London 2021. Planning application ft

refused by Camden Council

and an appeal to be submitted

------------------- ------------------------------- -------------------

West Kensington, Hammersmith Road Site acquired in June 175,000

London 2021. Planning application sq ft

submitted to Hammersmith

and Fulham Council in

February 2023

------------------- ------------------------------- -------------------

Old Kent Road, Old Kent Road Site acquired in June 75,000 sq

London 2022. Planning application ft

submitted to Southwark

Council in August 2023

------------------- ------------------------------- -------------------

Staples Corner, North Circular Site acquired in December Replacement

London Road 2022. Planning discussions for existing

underway with Barnet leasehold

Council store, additional

18,000 sq

ft

------------------- ------------------------------- -------------------

Total - all 902,000

sites sq ft

------------------- ------------------------------- -------------------

The capital expenditure forecast for the remainder of the

financial year (excluding any new site acquisitions) is

approximately GBP17 million, which principally relates to

construction costs on our development sites and the continued

retrofitting of solar panels across the Group's estate.

Financing and treasury

Our financing policy is to fund our current needs through a mix

of debt, equity, and cash flow to allow us to build out, and add

to, our development pipeline and achieve our strategic growth

objectives, which we believe improve returns for shareholders. We

aim to ensure that there are sufficient medium-term facilities in

place to finance our committed development programme, secured

against the freehold portfolio, with debt serviced by our strong

operational cash flows. We maintain a keen watch on medium and

long-term rates and the Group's policy in respect of interest rates

is to maintain a balance between flexibility and hedging of

interest rate risk.

The table below shows the Group's debt position at 30 September

2023:

Debt Expiry Facility Drawn Cost

----------------------------------- ------------------ ----------- ----------- -------

Aviva Loan (fixed rate loan) September 2028 GBP157.4m GBP157.4m 3.4%

M&G loan (GBP35 million fixed

at 4.5%, GBP85 million floating) September 2029 GBP120m GBP120m 6.9%

Revolving bank facility (Lloyds,

HSBC, and Bank of Ireland,

floating) October 2024 GBP270m GBP225m 6.6%

Total GBP547.4m GBP502.4m 5.7%

The Group is well progressed in refinancing our medium-term

revolving credit facility which expires in October 2024 and

anticipate completing this shortly.

In addition to the facilities above, the Group has a $225

million credit approved shelf facility with Pricoa Private Capital

("Pricoa"), to be drawn in fixed sterling notes. The Group can draw

the debt in minimum tranches of GBP10 million over the next two

years with terms of between 7 and 15 years at short notice,

typically 10 days.

The Group was comfortably in compliance with its banking

covenants at 30 September 2023 and is forecast to be for the period

covered by the going concern statement.

The Group's key balance sheet ratios are shown in the table

below, including on a proforma basis (see note 19) following the

placing in October 2023:

30 September

2023 proforma

Ratio 30 September post-placing 30 September

2023 2022

---------------------- ---------------- --------------- ---------------

Net debt to gross

property assets 18% 14% 18%

Net debt to adjusted

net assets 21% 16% 21%

Net debt to market

capitalisation 29% 19%(1) 24%

Net debt to Group

EBITDA ratio 3.8x 3.0x 3.9x

(1) Based on the market capitalisation at 17 November 2023

Net asset value

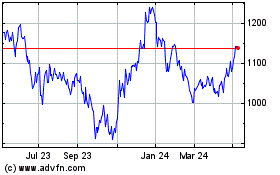

The adjusted net asset value per share is 1,277.5 pence (see

note 13), up 3% from 1,237.3 pence per share at 31 March 2023. The

table below reconciles the movement from 31 March 2023:

Equity shareholders' EPRA adjusted

funds NAV pence per

Movement in adjusted net GBPm share

asset value

----------------------------- --------------------- ---------------

31 March 2023 2,287.2 1,237.3

Adjusted profit after tax 53.5 28.9

Equity dividends paid (41.9) (22.7)

Revaluation movements 67.2 36.3

Movement in purchaser's

cost adjustment 2.9 1.6

Other movements (e.g. share

schemes) 3.2 (3.9)

30 September 2023 2,372.1 1,277.5

----------------------------- --------------------- ---------------

Jim Gibson John Trotman

Chief Executive Officer Chief Financial Officer

20 November 2023

PORTFOLIO SUMMARY

September 2023 September 2022

Big Big Total Total

Yellow Yellow Big Total Big Yellow Big Yellow Big Total

Established Developing Yellow Armadillo Established Developing Yellow Armadillo

Number

of stores 76 9 85 24 109 76 8 84 24 108

----------- ---------- --------- --------- --------- ----------- ---------- --------- --------- ---------

At 30

September:

Total capacity

(sq ft) 4,784,000 627,000 5,411,000 1,008,000 6,419,000 4,784,000 524,000 5,308,000 987,000 6,295,000

Occupied

space (sq

ft) 4,089,000 354,000 4,443,000 785,000 5,228,000 4,221,000 265,000 4,486,000 814,000 5,300,000

Percentage

occupied 85.5% 56.5% 82.1% 77.9% 81.4% 88.2% 50.6% 84.5% 82.5% 84.2%

Net rent

per sq

ft GBP35.67 GBP32.30 GBP35.40 GBP22.44 GBP33.47 GBP33.50 GBP29.45 GBP33.26 GBP21.40 GBP31.44

For the

period:

REVPAF(2) GBP34.33 GBP19.59 GBP32.71 GBP20.17 GBP30.73 GBP32.99 GBP19.02 GBP31.88 GBP20.46 GBP30.05

Average

occupancy 85.5% 55.8% 82.2% 77.9% 81.5% 88.3% 55.5% 85.7% 83.7% 85.4%

Average

annual

net rent

psf GBP35.17 GBP31.55 GBP34.90 GBP22.42 GBP33.02 GBP32.53 GBP28.70 GBP32.33 GBP20.98 GBP30.55

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Self storage

income 72,113 5,225 77,338 8,824 86,162 68,586 3,285 71,871 8,684 80,555

Other storage

related

income

(2) 9,424 764 10,188 1,362 11,550 9,791 550 10,341 1,432 11,773

Ancillary

store rental

Income 532 95 627 10 637 430 84 514 7 521

-------------------- ----------- ---------- --------- --------- --------- ----------- ---------- --------- --------- ---------

Total store

revenue 82,069 6,084 88,153 10,196 98,349 78,807 3,919 82,726 10,123 92,849

Direct

store operating

costs (excluding

depreciation) (19,447) (2,621) (22,068) (3,709) (25,777) (19,384) (1,762) (21,146) (3,741) (24,887)

Short and

long

leasehold

rent(3) (999) - (999) (84) (1,083) (1,063) - (1,063) (85) (1,148)

-------------------- ----------- ---------- --------- --------- --------- ----------- ---------- --------- --------- ---------

Store EBITDA(2) 61,623 3,463 65,086 6,403 71,489 58,360 2,157 60,517 6,297 66,814

Store EBITDA

margin 75.1% 56.9% 73.8% 62.8% 72.7% 74.1% 55.0% 73.2% 62.2% 72.0%

Deemed GBPm

cost GBPm GBPm GBPm GBPm

To 30 September

2023 729.2 199.0 928.2 142.0 1,070.2

Capex to

complete - 1.0 1.0 - 1.0

-------------------- ----------- ---------- --------- --------- ---------

Total 729.2 200.0 929.2 142.0 1,071.2

--------- --------- --------- ---------

(1) The Big Yellow established stores have been open for more

than three years at 1 April 2023, and the developing stores

have been open for fewer than three years at 1 April 2023.

(2) See glossary in note 20.

(3) Rent under IFRS 16 for seven short leasehold properties accounted

for as investment properties under IAS 40.

The table below reconciles Store EBITDA to gross profit in the

income statement:

Period ended 30 September Period ended 30 September

2023 2022

GBP000 GBP000

Gross Gross

profit profit

Store Reconciling per income Reconciling per income

EBITDA items statement Store EBITDA items statement

Store revenue/Revenue(4) 98,349 1,215 99,564 92,849 967 93,816

Cost of sales(5) (25,777) (2,027) (27,804) (24,887) (1,563) (26,450)

Rent(6) (1,083) 1,083 - (1,148) 1,148 -

--------- ------------ ------------- ------------- ------------ -------------

71,489 271 71,760 66,814 552 67,366

(4) See note 2 of the interim statement, reconciling items are

management fees and non-storage income.

(5) See reconciliation in cost of sales section in Business

and Financial Review.

(6) The rent shown above is the cost associated with leasehold

stores, only part of which is recognised within gross profit

in line with finance lease accounting principles. The amount

included in gross profit is shown in the reconciling items

in cost of sales.

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

- the condensed set of financial statements has been prepared in accordance with IAS 34 Interim

Financial Reporting as adopted for use in the UK;

- the interim management report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an indication of important

events that have occurred during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related party transactions

that have taken place in the first six months of the current financial year and that have

materially affected the financial position or performance of the entity during that period;

and any changes in the related party transactions described in the last annual report that

could do so.

By order of the Board

Jim Gibson John Trotman

Chief Executive Officer Chief Financial Officer

20 November 2023

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended 30 September 2023

Six months Six months

ended ended

Year ended

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBP000 GBP000 GBP000

Revenue 2 99,564 93,816 188,829

Cost of sales (27,804) (26,450) (54,307)

Gross profit 71,760 67,366 134,522

Administrative expenses (6,864) (7,091) (14,519)

Operating profit before gains

and losses on property assets 64,896 60,275 120,003

Gain/(loss) on the revaluation

of investment properties 9a 67,165 (47,673) (29,861)

Operating profit 132,061 12,602 90,142

Other operating income 2 762 899 2,185

Investment income - interest

receivable 3 17 1 9

- fair value movement of derivatives 3 - 564 -

Finance costs - interest payable 4 (12,157) (7,313) (16,894)

- fair value movement of derivatives (1,071) - (133)

Profit before taxation 119,612 6,753 75,309

------------- ------------- -----------

Taxation 5 (20) (710) (1,977)

Profit for the period (attributable

to equity shareholders) 119,592 6,043 73,332

------------- ------------- -----------

Total comprehensive income for

the period attributable to equity

shareholders 119,592 6,043 73,332

------------- ------------- -----------

Basic earnings per share 8 65.3p 3.3p 40.1p

Diluted earnings per share 8 64.9p 3.3p 39.8p

Adjusted profit before taxation is shown in note 6 and EPRA

earnings per share is shown in note 8.

All items in the income statement relate to continuing

operations.

CONDENSED CONSOLIDATED BALANCE SHEET

30 September 2023

30 September 30 September

2023 2022 31 March 2023

(unaudited) (unaudited) (audited)

Note GBP000 GBP000 GBP000

Non-current assets

Investment property 9a 2,604,745 2,386,246 2,449,640

Investment property under construction 9a 186,847 268,012 260,720

Right-of-use assets 9a 17,952 18,849 18,148

Plant, equipment, and owner-occupied property 9b 4,159 3,882 4,003

Intangible assets 9c 1,433 1,433 1,433

Investment 9d 588 588 588

2,815,724 2,679,010 2,734,532

Current assets

Derivative financial instruments 12 - 1,013 316

Inventories 483 480 496

Trade and other receivables 10 11,199 8,506 8,314

Cash and cash equivalents 7,069 8,604 8,329

18,751 18,603 17,455

Total assets 2,834,475 2,697,613 2,751,987

Current liabilities

Trade and other payables 11 (50,714) (47,399) (57,275)

Borrowings 12 (3,237) (3,083) (3,159)

Obligations under lease liabilities (2,252) (1,805) (2,020)

(56,203) (52,287) (62,454)

Non-current liabilities

Borrowings 12 (497,076) (473,056) (489,411)

Obligations under lease liabilities (17,333) (18,386) (17,676)

Derivative financial instruments 12 (755) - -

(515,164) (491,442) (507,087)

Total liabilities (571,367) (543,729) (569,541)

Net assets 2,263,108 2,153,884 2,182,446

------------- ------------- --------------

Equity

Called up share capital 18,456 18,422 18,427

Share premium account 291,774 290,771 290,857

Reserves 1,952,878 1,844,691 1,873,162

Equity shareholders' funds 2,263,108 2,153,884 2,182,446

------------- ------------- --------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Six months ended 30 September 2023 (unaudited)

Share Other non-distributable Capital

Share premium reserve redemption Retained

capital account GBP000 reserve earnings Own shares Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2023 18,427 290,857 74,950 1,795 1,797,436 (1,019) 2,182,446

Total comprehensive

income for the period - - - - 119,592 - 119,592

Issue of share capital 29 917 - - - - 946

Credit to equity

for equity-settled

share-based payments - - - - 2,063 - 2,063

Dividends - - - - (41,939) - (41,939)

At 30 September 2023 18,456 291,774 74,950 1,795 1,877,152 (1,019) 2,263,108

Six months ended 30 September 2022 (unaudited)

Share Other non-distributable Capital

Share premium reserve redemption Retained

capital account GBP000 reserve earnings Own shares Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2022 18,397 289,923 74,950 1,795 1,800,329 (1,019) 2,184,375

Total comprehensive

income for the period - - - - 6,043 - 6,043

Issue of share capital 25 848 - - - - 873

Credit to equity

for equity-settled

share-based payments - - - - 1,730 - 1,730

Dividends - - - - (39,137) - (39,137)

At 30 September 2022 18,422 290,771 74,950 1,795 1,768,965 (1,019) 2,153,884

Year ended 31 March 2023 (audited)

Share Other non-distributable Capital

Share premium reserve redemption Retained Own shares

capital account GBP000 reserve earnings GBP000 Total

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2022 18,397 289,923 74,950 1,795 1,800,329 (1,019) 2,184,375

Total comprehensive

income for the year - - - - 73,332 - 73,332

Issue of share capital 30 934 - - - - 964

Credit to equity

for equity-settled

share-based payments - - - - 3,735 - 3,735

Dividends - - - - (79,960) - (79,960)

At 31 March 2023 18,427 290,857 74,950 1,795 1,797,436 (1,019) 2,182,446

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

Six months ended 30 September 2023

Six months Year

Six months ended ended ended

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBP000 GBP000 GBP000

Cash generated from operations 17 64,789 62,660 128,973

Bank interest paid (12,778) (6,907) (16,486)

Interest on obligations under lease liabilities (293) (394) (706)

Interest received 17 - 8

Other operating income received 61 745 2,032

Tax paid (989) (1,517) (1,844)

Cash flows from operating activities 50,807 54,587 111,977

Investing activities

Purchase of non-current assets (17,804) (73,462) (106,413)

Receipt from Capital Goods Scheme - 173 182

Cash flows from investing activities (17,804) (73,289) (106,231)

Financing activities

Issue of share capital 946 873 964

Payment of finance lease liabilities (908) (706) (1,267)

Equity dividends paid (41,741) (38,731) (79,140)

Receipt from termination of interest rate derivatives - 436 436

Loan arrangement fees paid - (1,155) (1,507)

Increase in borrowings 7,440 57,984 74,492

Cash flows from financing activities (34,263) 18,701 (6,022)

Net decrease in cash and cash equivalents (1,260) (1) (276)

Opening cash and cash equivalents 8,329 8,605 8,605

Closing cash and cash equivalents 7,069 8,604 8,329

---------------- ------------- ----------

Notes to the Interim Review

1. ACCOUNTING POLICIES

Basis of preparation

The results for the period ended 30 September 2023 are unaudited

and were approved by the Board on 20 November 2023. The financial

information contained in this report in respect of the year ended

31 March 2023 does not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006. A copy of the

statutory accounts for that year has been delivered to the

Registrar of Companies. The auditor's report on those accounts was

not qualified and did not contain statements under section 498 (2)

or (3) of the Companies Act 2006.

This condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted for

use in the UK.

The annual financial statements of the Group are prepared in

accordance with UK-adopted international accounting standards. As

required by the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority, the condensed set of financial

statements has been prepared applying the accounting policies and

presentation that were applied in the preparation of the Group's

published consolidated financial statements for the year ended 31

March 2023.

The Group has adopted IFRS 17 (Insurance Contracts) during the

period. There has not been a material impact on the Group of the

adoption of this standard.

Valuation of assets and liabilities held at fair value

For those financial instruments held at fair value, the Group

has categorised them into a three-level fair value hierarchy based

on the priority of the inputs to the valuation technique in

accordance with IFRS 13. The hierarchy gives the highest priority

to quoted prices in active markets for identical assets or

liabilities (Level 1) and the lowest priority to unobservable

inputs (Level 3). If the inputs used to measure fair value fall

within different levels of the hierarchy, the category level is

based on the lowest priority level input that is significant to the

fair value measurement of the instrument in its entirety. The fair

value of the Group's outstanding interest rate derivative has been

estimated by calculating the present value of future cash flows,

using appropriate market discount rates, representing Level 2 fair

value measurements as defined by IFRS 13. Investment Property and

Investment Property under Construction have been classified as

Level 3. This is discussed further in note 14.

Going concern

A review of the Group's business activities, together with the

factors likely to affect its future development, performance, and

position, is set out in the Chairman's Statement and the Business

and Financial Review. The financial position of the Group, its cash

flows, liquidity position and borrowing facilities are shown in the

balance sheet, cash flow statement and accompanying notes to the

interim statement. Further information concerning the Group's

objectives, policies, and processes for managing its capital; its

financial risk management objectives; details of its financial

instruments and hedging activities; and its exposures to credit

risk and liquidity risk remain the same and can be found in the

Strategic Report within the Group's Annual Report for the year

ended 31 March 2023.

At 30 September 2023 the Group had available liquidity of

GBP52.0 million, from a combination of cash and undrawn debt

facilities. On 10 October 2023, the Group raised GBP107 million

(net of expenses) through a placing of 6.3% of the Company's issued

share capital. This further increased the liquidity available to

the Group. In addition, the Group has a $225 million shelf facility

in place with Pricoa Private Capital to be drawn in fixed sterling

notes. The Group can draw the debt in minimum tranches of GBP10

million over the next three years with terms of between 7 and 15

years at short notice, typically 10 days. The Group also has land

surplus to its needs which will be realised over the medium term,

generating net cash proceeds estimated currently at over GBP100

million. The Group is cash generative and for the six months ended

30 September 2023, had operational cash flow of GBP50.8 million,

with capital commitments at the balance sheet date of GBP8.0

million.

The Directors have prepared cash flow forecasts for a period of

18 months from the date of approval of these financial statements,

taking into account the Group's operating plan and budget for the

year ending 31 March 2024 and projections contained in the

longer-term business plan which covers the period to March 2027.

After reviewing these projected cash flows together with the

Group's and Company's cash balances, borrowing facilities and

covenant requirements, and potential property valuation movements

over that period, the Directors believe that, taking account of

severe but plausible downsides, the Group and Company will have

sufficient funds to meet their liabilities as they fall due for

that period. The Group is well progressed in refinancing our

medium-term revolving credit facility which expires in October 2024

and anticipate completing this shortly.

In making their assessment, the Directors have carefully

considered the outlook for the Group's trading performance and cash

flows as a result of the current geopolitical and macroeconomic

environment, taking into account the recent trading performance of

the Group. The Directors have also considered the performance of

the business during the Global Financial Crisis and the Covid-19

pandemic. The Directors modelled a number of different scenarios,

including material reductions in the Group's occupancy rates and

property valuations, and assessed the impact of these scenarios

against the Group's liquidity and the Group's banking covenants.

The scenarios considered did not lead to breaching any of the

banking covenants, and the Group retained sufficient liquidity to

meet its financial obligations as they fall due. Consequently, the

Directors continue to adopt the going concern basis in preparing

the half year report.

2. SEGMENTAL INFORMATION

Revenue represents amounts derived from the provision of self

storage accommodation and related services which fall within the

Group's ordinary activities after deduction of trade discounts and

value added tax. The Group's net assets, revenue and profit before

tax are attributable to one activity, the provision of self storage

accommodation and related services. These all arise in the United

Kingdom.

Six months

ended Year ended

30 September Six months 31 March

2023 ended 2023

30 September

(unaudited) 2022 (unaudited) (audited)

GBP000 GBP000 GBP000

Open stores

Self storage income 86,162 80,555 162,911

Insurance income - 3,043 3,047

Enhanced liability service income 8,927 5,906 14,272

Packing materials income 1,631 1,822 3,286

Other income from storage customers 992 1,002 2,010

Ancillary store rental income 637 521 1,213

98,349 92,849 186,739

Other revenue

Non-storage income 1,215 967 2,090

Total revenue 99,564 93,816 188,829

--------------- ------------------- -----------

Non-storage income derives principally from rental income earned

from tenants of properties awaiting development.

The Group has also earned other operating income of GBP0.8

million in the period, which is principally insurance proceeds for

loss of income following the destruction of the Group's Cheadle

store by fire in 2022 (2022: GBP0.9 million).

Further analysis of the Group's operating revenue and costs are

in the Portfolio Summary and the Business and Financial Review. The

seasonality of the business is discussed in note 18.

3. INVESTMENT INCOME

Six months Year ended

Six months

ended 30 ended 30

September September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Bank interest receivable 17 - 8

Unwinding of discount on Capital

Goods Scheme receivable - 1 1

Total 17 1 9

------------ ------------- ----------

Change in fair value of interest

rate derivatives - 564 -

------------ ------------- ----------

Total investment income 17 565 9

------------ ------------- ----------

4. FINANCE COSTS

Six months Year ended

Six months

ended 30 September ended 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Interest on bank borrowings 13,617 7,836 18,156

Capitalised interest (1,753) (1,649) (2,761)

Interest on finance lease obligations 293 394 706

Other interest payable - - 61

Loan refinancing costs - 732 732

------------------- ------------------- ----------

Total interest payable 12,157 7,313 16,894

Fair value movement on derivatives 1,071 - 133

------------------- ------------------- ----------

Total finance costs 13,228 7,313 17,027

5. TAXATION

The Group is a REIT. As a result, the Group does not pay UK

corporation tax on the profits and gains from its qualifying rental

business in the UK if it meets certain conditions. Non-qualifying

profits and gains of the Group are subject to corporation tax as

normal. The Group monitors its compliance with the REIT conditions.

There have been no breaches of the conditions to date.

Six months Year ended

Six months

ended 30 ended 30

September September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Current tax:

- Current year 983 895 2,296

- Prior year (963) (185) (319)

------------

20 710 1,977

------------ ------------- ----------

6. ADJUSTED PROFIT

Six months

ended Year ended

Six months

ended 30 September 31 March

30 September

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Profit before tax 119,612 6,753 75,309

(Gain)/loss on revaluation of investment

properties (67,165) 47,673 29,861

Change in fair value of interest rate

derivatives 1,071 (564) 133

Refinancing fees - 732 732

Adjusted profit before tax 53,518 54,594 106,035

Tax (20) (710) (1,977)

-------------- ------------- ----------

Adjusted profit after tax (EPRA earnings) 53,498 53,884 104,058

-------------- ------------- ----------

Adjusted profit before tax which excludes gains and losses on

the revaluation of investment properties, changes in fair value of

interest rate derivatives, net gains and losses on disposal of

investment property, and material non-recurring items of income and

expenditure have been disclosed as, in the Board's view, this

provides a clearer understanding of the Group's underlying trading

performance.

7. DIVIDS

Six months Six months

ended ended

30 September 30 September

2023 2022

(unaudited) (unaudited)

GBP000 GBP000

Amounts recognised as distributions to equity

holders in the period:

Final dividend for the year ended 31 March

2023 of 22.9p (2022: 21.4p) per share 41,939 39,137

Proposed interim dividend for the year ending

31 March 2024 of 22.6p (2023: 22.3p) per

share 44,086 40,824

------------- -------------

The proposed interim dividend of 22.6 pence per ordinary share

will be paid to shareholders on 26 January 2024. The ex-dividend

date is 4 January 2024, and the record date is 5 January 2024. The

interim dividend is all Property Income Distribution.

8. EARNINGS PER ORDINARY SHARE

The European Public Real Estate Association ("EPRA") has issued

recommended bases for the calculation of certain per share

information and these are included in the following table:

Six months ended Six months ended

30 September 2023 30 September 2022 Year ended

(unaudited) (unaudited) 31 March 2023 (audited)

Earnings Shares Pence Earnings Shares Pence Earnings Shares Pence

GBPm million per share GBPm million per share GBPm million per share

Basic 119.6 183.2 65.3 6.0 182.9 3.3 73.3 183.0 40.1

Dilutive share

options - 1.1 (0.4) - 1.0 - - 1.1 (0.3)

Diluted 119.6 184.3 64.9 6.0 183.9 3.3 73.3 184.1 39.8

Adjustments:

(Gain)/loss on

revaluation of

investment properties (67.2) - (36.5) 47.7 - 25.9 30.0 - 16.2

Change in fair

value of interest

rate derivatives 1.1 - 0.6 (0.5) - (0.3) 0.1 - 0.1

Refinancing fees - - - 0.7 - 0.4 0.7 - 0.4

EPRA - diluted 53.5 184.3 29.0 53.9 183.9 29.3 104.1 184.1 56.5

EPRA - basic 53.5 183.2 29.2 53.9 182.9 29.5 104.1 183.0 56.9

-------- ------- --------- -------- ------- --------- -------- ------- ---------

The calculation of basic earnings is based on profit after tax

for the period. The weighted average number of shares used to

calculate diluted earnings per share has been adjusted for the

conversion of share options.

EPRA earnings and earnings per ordinary share have been

disclosed to give a clearer understanding of the Group's underlying

trading performance.

9. NON-CURRENT ASSETS

a) Investment property

Investment

Investment property Right-of-use

property under construction assets Total

GBP000 GBP000 GBP000 GBP000

At 1 April 2023 2,449,640 260,720 18,148 2,728,508

Additions 7,168 6,839 - 14,007

Adjustment to present value - - 604 604

Reclassification 66,162 (66,102) - 60

Revaluation 81,775 (14,610) - 67,165

Depreciation - - (800) (800)

At 30 September 2023 2,604,745 186,847 17,952 2,809,544

------------ ------------------- ------------ ---------

Capital commitments at 30 September 2023 were GBP 8.0 million

(31 March 2023: GBP6.1 million).

b) Plant, equipment, and owner-occupied property

Fixtures,

Leasehold fittings, and Right-of-use

Freehold improve-ments Plant and office assets

property GBP000 machinery Motor vehicles equipment GBP000 Total

GBP000 GBP000 GBP000 GBP000 GBP000

Cost

At 1 April 2023 2,406 59 647 32 1,691 875 5,710

Additions 19 - 221 - 345 131 716

Reclassification

to investment

property under

construction (60) - - - - - (60)

Retirement of

fully

depreciated

assets - - (70) - (316) - (386)

At 30 September

2023 2,365 59 798 32 1,720 1,006 5,980

Accumulated

depreciation

At 1 April 2023 (682) (20) (210) (32) (340) (423) (1,707)

Charge for the

period (24) (2) (89) - (318) (67) (500)

Retirement of

fully

depreciated

assets - - 70 - 316 - 386

-------------- -------------- ----------- -------------- ------------- ------------- --------

At 30 September

2023 (706) (22) (229) (32) (342) (490) (1,821)

Net book value

-------------- -------------- ----------- -------------- ------------- ------------- --------

At 30 September

2023 1,659 37 569 - 1,378 516 4,159

At 31 March 2023 1,724 39 437 - 1,351 452 4,003

c) Intangible assets

The intangible asset relates to the Big Yellow brand, which was

acquired through the acquisition of Big Yellow Self Storage Company

Limited in 1999. The carrying value of GBP1.4 million remains

unchanged from the prior year as there is considered to be no

impairment in the value of the asset. The asset has an indefinite

life and is tested annually for impairment or more frequently if

there are indicators of impairment.

d) Investment

The Group has an GBP0.6 million investment in Doncaster Security

Operations Centre Limited, a company which provides out-of-hours

monitoring and alarm receiving services, including for the Group's

stores. The investment is carried at cost and tested annually for

impairment.

10. TRADE AND OTHER RECEIVABLES

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Current

Trade receivables 5,466 5,184 5,181

Other receivables 335 310 209

Prepayments and accrued income 5,398 3,012 2,924

11,199 8,506 8,314

------------ ------------- ----------

11. TRADE AND OTHER PAYABLES

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Current

Trade payables 2,845 1,424 4,208

Other payables 18,213 15,612 18,199

Accruals and deferred income 29,656 30,363 34,868

50,714 47,399 57,275

------------- ------------ ----------

12. BORROWINGS

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Aviva loan 3,237 3,083 3,159

Current borrowings 3,237 3,083 3,159

Aviva loan 154,130 157,336 155,768

M&G loan 120,000 120,000 120,000

Bank borrowings 225,000 198,000 216,000

Unamortised debt arrangement costs (2,054) (2,280) (2,357)

------------ ------------- ----------

Non-current borrowings 497,076 473,056 489,411

Total borrowings 500,313 476,139 492,570