TIDMCHF

RNS Number : 6249M

Chesterfield Resources PLC

15 September 2023

Chesterfield Resources PLC / EPIC: CHF / Market: LSE / Sector:

Mining

15 September 2023

CHESTERFIELD RESOURCES PLC

("Chesterfield" or the "Company")

Interim Results

Chesterfield Resources PLC, the LSE listed mineral exploration

company with projects in Cyprus and Canada, is pleased to announce

its interim results for the six months ended 30 June 2023.

Chairman's review of year to date

During the first half of 2023 Chesterfield continued on its

policy set out late 2022 which is aimed at restructuring the

exploration licence portfolio in both Cyprus and Canada. This work

has been carried out with the aim of reducing the need for

continual equity dilution while preserving as much as possible

shareholder exposure to these licences and their potential value

accretion. The announcement in March of the optioning of the

Adeline Project in Canada to Sterling Metals in exchange for cash

and shares was an important milestone in this restructuring policy.

The agreement with Sterling had an immediate beneficial impact on

Chesterfield's finances, with the payment by Sterling of

CAD$400,000 (GBP244,000), which constitutes half of the cash

payment for the option, with the remainder payable in the event

that Sterling opt to acquire the Adeline licences prior to 30

November 2024. This cash was accompanied by 4.5m shares in Sterling

which were paid to Chesterfield, with a further 4.5m payable on the

same conditions by 30 November 2024. In April, Sterling raised

CAD$6.476m (GBP3.8m) in new equity to fund its exploration plans

for the summer and autumn of 2023, with a total of CAD$2.5m

(GBP1.476m) slated for expenditure on drilling and related work at

Adeline. Any success at Adeline will be reflected in the value of

Sterling shares that Chesterfield holds which in May constituted a

4% stake in the listed Canadian explorer.

Chesterfield rationalised its licence holdings in Cyprus in late

2022, reducing holdings from a total of 26 licences covering 110.42

km2 to 3 licences covering 13.39 km2. The Company has outlined

plans for further exploration work on the retained properties. The

Board would prefer to work with partners on these promising

properties and will update shareholders as and when any formal

arrangements are entered into.

During the first half of 2023, the Board has continued to carry

out extensive work to examine a number of possible options for the

Company to make an investment into new opportunities. The goal is

to find a new area of business activity that will generate

significant shareholder value in the near term and to announce a

new direction in Chesterfield's development by the end of 2023.

Shareholders should note that, subject to the terms that may be

agreed for these opportunities, additional capital raising or

additional shares being issued are possible outcomes of such a

change.

An important part of the current overall strategy is cost

savings, and the results of our efforts in this area should be

clear from the accounts for the period. In addition to the cuts in

exploration and related staffing and other overheads, management

have been able to significantly reduce outgoings both to service

providers and the Board, whose fees have been significantly cut

back to GBP2,500 monthly during the period. With no debts and very

low cash outlays, the Company is in a stable financial condition

for the foreseeable future, and notwithstanding any further

acquisitions or investments should preclude the need for a dilutive

capital raise.

Financials

As is to be expected with an exploration company, for the

six-month period ended 30 June 2023 the Group is reporting a

pre-tax loss of GBP110,963 (six months ended 30 June 2022: loss of

GBP491,607). The Group's net cash balance as at 30 June 2023 was

GBP348,243 (30 June 2022: GBP663,226).

Responsibility Statement

We confirm that to the best of our knowledge:

-- the interim financial statements have been prepared in

accordance with International Accounting Standards 34, Interim

Financial Reporting, as adopted by the UK;

-- give a true and fair view of the assets, liabilities,

financial position and loss of the Company;

-- the Interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- The Interim report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The interim report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Paul Ensor

Executive Chairman

15 September 2023

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For further information please visit

www.chesterfieldresourcesplc.com or contact:

Chesterfield Resources plc Paul Ensor, Executive Tel: +44 (0) 7595

Chairman 219 011

First Equity Limited (Broker) Jason Robertson Tel: +44 (0)207

330 1183

---------------------- ------------------

Panmure Gordon (UK) Limited John Prior & Hugh Tel: +44 (0) 207

(Broker) Rich 886 2500

---------------------- ------------------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 12 months 6 months

to 30 June to 31 December to 30 June

2023 Unaudited 2022 Audited 2022 Unaudited

Notes GBP GBP GBP

------------------------------------ ------ ---------------- ---------------- ----------------

Continuing operations

Revenue - - 45,132

Administration expenses (148,386) (855,899) (536,739)

Other Gains 38,011 - -

Operating Profit/(Loss) (110,375) (855,899) (491,607)

------------------------------------ ------ ---------------- ---------------- ----------------

Impairment - (3,195,730) -

Finance cost (588) (35) -

Other income - 45,132 -

------------------------------------ ------ ---------------- ---------------- ----------------

Loss before taxation (110,963) (4,006,532) (491,607)

------------------------------------ ------ ---------------- ---------------- ----------------

Deferred tax credit - 347,145 -

------------------------------------ ------ ---------------- ---------------- ----------------

Loss for the period (110,963) (3,659,387) (491,607)

------------------------------------ ------ ---------------- ---------------- ----------------

Other comprehensive income

Items that may be reclassified

to profit or loss

Currency translation differences (39,161) 97,040 137,934

Total other comprehensive income

for the period (39,161) 97,040 137,934

------------------------------------ ------ ---------------- ---------------- ----------------

Total comprehensive income for

the period attributable to equity

holders (150,124) (3,562,347) (353,673)

Earnings per share from continuing

operations attributable to the

equity owners of the parent

------------------------------------ ------ ---------------- ---------------- ----------------

Basic and diluted 5 (0.085)p (2.831)p (0.384)p

------------------------------------ ------ ---------------- ---------------- ----------------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at As at

30 June 31 December 30 June

2023 Unaudited 2022 Audited 2022 Unaudited

Notes GBP GBP GBP

----------------------------------- -------- ---------------- -------------- ----------------

Non-Current Assets

Property, plant and equipment - 8,941 25,244

Intangible assets 6 894,336 880,837 5,395,923

Available for Sale Investment 7 494,798 - -

=================================== ======== ================ ============== ================

1,389,134 889,778 5,421,167

----------------------------------- -------- ---------------- -------------- ----------------

Current Assets

Trade and other receivables 143,921 162,435 375,008

Cash and cash equivalents 348,243 304,022 663,226

----------------------------------- -------- ---------------- -------------- ----------------

492,164 466,457 1,038,234

----------------------------------- -------- ---------------- -------------- ----------------

Asset held for sale 8 739,143 1,478,287 -

----------------------------------- -------- ---------------- -------------- ----------------

Total Assets 2,620,441 2,834,522 6,459,401

----------------------------------- -------- ---------------- -------------- ----------------

Non-Current Liabilities

Deferred tax liabilities (33,138) (33,138) (380,283)

----------------------------------- -------- ---------------- -------------- ----------------

Current Liabilities

Trade and other payables (39,576) (103,533) (174,693)

Total Liabilities (72,714) (136,671) (554,976)

----------------------------------- -------- ---------------- -------------- ----------------

Net Assets 2,547,727 2,697,851 5,904,425

----------------------------------- -------- ---------------- -------------- ----------------

Capital and Reserves Attributable

to

Equity Holders of the Company

Share capital 228,328 228,328 228,328

Share premium 8,919,654 8,919,654 8,919,654

Other reserves 186,780 257,838 298,732

Retained losses (6,787,035) (6,707,969) (3,542,289)

----------------------------------- -------- ---------------- -------------- ----------------

Total Equity 2,547,727 2,697,851 5,904,425

----------------------------------- -------- ---------------- -------------- ----------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

Attributable to owners

of the Parent

---- --------- ----------------------------------------------

Share Share Other Retained Total

capital premium reserves losses equity

GBP GBP GBP GBP GBP

--------- ------------

Balance as at 1 January

2022 218,328 8,253,634 160,798 (3,050,682) 5,582,078

---------------------------------------- --------- ---------- ---------- ------------ ------------

Loss for the period - - - (491,607) (491,607)

---------------------------------------- --------- ---------- ---------- ------------ ------------

Other comprehensive income

for the year

Items that may be subsequently

reclassified to profit or

loss

---------------------------------- ---- --------- ---------- ---------- ------------ ------------

Currency translation differences - - 137,934 - 137,934

---------------------------------------- --------- ---------- ---------- ------------ ------------

Total comprehensive income

for the year - - 137,934 (491,607) (353,673)

---------------------------------------- --------- ---------- ---------- ------------ ------------

Share issue 10,000 690,000 - - 700,000

Cost of capital - (23,980) - - (23,980)

---------------------------------------- --------- ---------- ---------- ------------ ------------

Total transactions with

owners, recognised in equity 10,000 666,020 - - 676,020

---------------------------------------- --------- ---------- ---------- ------------ ------------

Balance as at 30 June 2022 228,328 8,919,654 298,732 (3,542,289) 5,904,425

---------------------------------------- --------- ---------- ---------- ------------ ------------

Balance as at 1 January

2023 228,328 8,919,654 257,838 (6,707,969) 2,697,851

---------------------------------------- --------- ---------- ---------- ------------ ------------

Loss for the period - - - (110,963) (110,963)

---------------------------------------- --------- ---------- ---------- ------------ ------------

Other comprehensive income

for the year

Items that may be subsequently

reclassified to profit or

loss

---------------------------------- ---- --------- ---------- ---------- ------------ ------------

Currency translation differences - - (39,161) - (39,161)

---------------------------------------- --------- ---------- ---------- ------------ ------------

Total comprehensive income

for the year - - (39,161) (110,963) (150,124)

======================================== ========= ========== ========== ============ ============

Options expired during the

year - - (31,897) 31,897 -

======================================== ========= ========== ========== ============ ============

Total transactions with

owners, recognised in equity - - (31,897) 31,897 -

---------------------------------------- --------- ---------- ---------- ------------ ------------

Balance as at 30 June 2023 228,328 8,919,654 186,780 (6,787,035) 2,547,727

---------------------------------------- --------- ---------- ---------- ------------ ------------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

6 months 6 months

to 30 June to 30 June

2023 2022 Unaudited

Notes Unaudited GBP

GBP

------------------------------------------- -------- ------------ ----------------

Cash flows from operating activities

Loss before taxation (110,963) (491,607)

Adjustments for:

Depreciation - 2,802

Increase/(decrease) in trade and other

receivables 18,516 (53,009)

Increase/(decrease) in trade and other

payables (63,962) 20,310

Foreign exchange (6,456) 24,022

Net cash used in operations (162,865) (497,482)

-------------------------------------------- -------- ------------ ----------------

Cash flows from investing activities

(Purchase)/Sale of property, plant

& equipment - (4,324)

Sale of exploration assets 244,344 -

Exploration and evaluation activities 6 (37,258) (273,959)

Net cash used in investing activities 207,086 (278,283)

-------------------------------------------- -------- ------------ ----------------

Cash flows from financing activities

Cost of share issue - (23,980)

Share issue - 700,000

-------------------------------------------- -------- ------------ ----------------

Net cash generated from financing

activities - 676,020

-------------------------------------------- -------- ------------ ----------------

Net decrease in cash and cash equivalents 44,221 (99,745)

Cash and cash equivalents at beginning

of period 304,022 762,971

Cash and cash equivalents at end

of period 348,243 663,226

-------------------------------------------- -------- ------------ ----------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

Chesterfield Resources plc is a minerals company exploring

primarily for copper and gold in Canada and Cyprus and listed on

the Standard segment of the Main Market of the London Stock

Exchange.

The Company is domiciled in the United Kingdom and incorporated

and registered in England and Wales, with registration number

10545738. The Company's registered office is 6 Heddon Street,

London W1B 4BT.

2. Basis of Preparation

These condensed interim financial statements are for the six

months ended 30 June 2023 and have been prepared in accordance with

the accounting policies adopted in the Group's most recent annual

financial statements for the year ended 31 December 2022.

The Group have chosen to adopt IAS 34 "Interim Financial

Reporting" in preparing this interim financial information as

adopted by the United Kingdom and the Disclosure and Transparency

Rules of the UK Financial Conduct Authority. They do not include

all the information required in annual financial statements, and

they should be read in conjunction with the consolidated financial

statements for the year ended 31 December 2022 and any public

announcements made by Chesterfield Resources Plc. during the

interim reporting period.

The interim financial information set out above does not

constitute statutory accounts within the meaning of the Companies

Act 2006. It has been prepared on a going concern basis in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards (IFRS) as adopted by

the United Kingdom.

Statutory financial statements for the period ended 31 December

2022 were approved by the Board of Directors on 27 April 2023 and

delivered to the Registrar of Companies. The report of the auditors

on those financial statements was unqualified. The condensed

interim financial statements are unaudited and have not been

reviewed by the Company's auditor.

Going concern

The Directors, having made appropriate enquiries, consider that

adequate resources exist for the Company to continue in operational

existence for the foreseeable future and that, therefore, it is

appropriate to adopt the going concern basis in preparing the

condensed interim financial statements for the period ended 30 June

2023.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's medium

term performance and the factors that mitigate those risks have not

substantially changed from those set out in the Company's 2022

Annual Report and Financial Statements, a copy of which is

available on the Company's website: www.chesterfieldplc.com . The

key financial risks are liquidity risk, credit risk, interest rate

risk and fair value estimation.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in Note 2 of the Company's 2022 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

3. Accounting Policies

A number of new standards, amendments and became effective on 1

January 2023 and have been adopted by the Group. None of these

standards have materially affected the Group.

The same accounting policies, presentation and methods of

computation are followed in the interim consolidated financial

information as were applied in the Group's latest annual audited

financial statements except for those that relate to new standards

and interpretations effective for the first time for periods

beginning on (or after) 1 January 2023, and will be adopted in the

2023 annual financial statements. In addition to these the

following new accounting policies have been adopted:

Assets held for sale

Asset are classified as assets held for sale when their carrying

amount is to be recovered principally through a sale transaction

and a sale is considered highly probable. They are stated at the

lower of carrying amount and fair value less costs to sell.

4. Dividends

No dividend has been declared or paid by the Company during the

six months ended 30 June 2023 (six months ended 30 June 2022:

GBPnil).

5. Loss per Share

The calculation of loss per share is based on a retained loss of

GBP110,963 for the six months ended 30 June 2023 ( six months ended

30 June 2022: GBP491,607 ) and the weighted average number of

shares in issue in the period ended 30 June 2023 of 130,328,311 (

six months ended 30 June 2022: 128,173,615 ).

No diluted earnings per share is presented for the six months

ended 30 June 2023 or six months ended 30 June 2022 as the effect

on the exercise of share options would be to decrease the loss per

share.

6. Intangible assets

The movement in capitalised exploration and evaluation costs

during the period was as follows:

Exploration & Evaluation at Cost and Net Book Value GBP

----------------------------------------------------- ---------

Balance as at 1 January 2023 880,837

Additions 37,258

Foreign exchange (23,759)

As at 30 June 2023 894,336

----------------------------------------------------- ---------

7. Available for sale investment

The movement in available for sale investments during the period

was as follows:

Avaliable for sale investments GBP

------------------------------------- --------

Balance as at 1 January 2023 -

4,500,000 shares in Sterling Metals 494,798

As at 30 June 2023 494,798

------------------------------------- --------

8. Asset held for sale

On 6th March 2023, the Company announced that they had signed an

agreement with Sterling Metals, a TSX-V and OTCQB listed

exploration company, with regard to Chesterfield's Adeline project

in Labrador. Under the agreement Sterling Metals will purchase an

option to acquire full ownership and rights over the project in

exchange for a series of payments of cash and shares for a total

consideration of CAD$800,000 and 9,000,000 shares in Sterling

Metals. Therefore, the Directors have determined that the Adeline

licences be classified as an asset held for sale.

Sterling will pay the total cash consideration in three separate

tranches. As at 30 June 2023, CAD$400,000 (GBP244,000) and and

4,500,000 shares have been received by Chesterfield. A final

tranche of CAD$400,000 (GBP230,000) and 4,500,000 shares are to be

paid on or before 30 November 2024.

The movement in capitalised exploration and evaluation costs

during the period was as follows:

Asset held for sale GBP

------------------------------ ----------

Balance as at 1 January 2023 1,478,287

Partial sale of Adeline (739,142)

As at 30 June 2023 739,143

------------------------------ ----------

The balance of GBP739,143 is the remaining 50% of Adeline which

will be transferred when the final tranche is received by

Chesterfield.

9. Events after the balance sheet date

The Directors believe there to be no significant events after

the reporting date.

10. Approval of interim financial statements

The Condensed interim financial statements were approved by the

Board of Directors on 15 September 2023.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GCGDCLXBDGXU

(END) Dow Jones Newswires

September 15, 2023 05:39 ET (09:39 GMT)

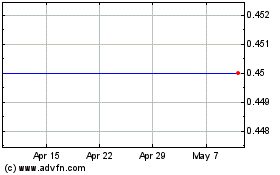

Chesterfield Resources (LSE:CHF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Chesterfield Resources (LSE:CHF)

Historical Stock Chart

From Feb 2024 to Feb 2025