TIDMCHRY

RNS Number : 3120Z

Chrysalis Investments Limited

15 May 2023

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than to professional investors in Belgium, Denmark, the

Republic of Ireland, Luxembourg, the Netherlands, Norway and

Sweden), Canada, Australia, Japan or the Republic of South

Africa.

15 May 2023

Chrysalis Investments Limited ("Chrysalis" or the "Company")

Follow-on Investment in Smart Pension

The Company is pleased to announce a GBP12.5 million follow-on

primary investment into Smart Pension ("Smart").

This investment forms part of a $95 million Series E funding

round led by Aquiline Capital Partners, with participation from

other existing investors including Fidelity International Strategic

Ventures, DWS, Natixis Investment Managers and Barclays.

Proceeds of the round will be deployed to continue to drive

growth in key markets, finance a pipeline of acquisitions (where

the company is already in exclusivity), and crucially provide the

capital to drive Smart towards profitability. On this note, Smart

is already profitable in the UK, via its Master Trust business, and

expects to cross this milestone in its international businesses in

the coming years.

Smart has grown strongly since Chrysalis first invested in June

2021, and has seen growth continue into this year. Smart currently

has GBP5.5 billion of Assets under Management ("AuM") on its

platform, up 17% from GBP4.7 billion at the end of 2022; it is

expected to exceed GBP10 billion by the end of 1H23. Over the

course of 2022, group revenues grew 65% to reach GBP67 million.

If, following completion, the Company's independent Valuation

Committee recommends that the Board apply the "price of recent

investment" approach to the Company's holding in Smart this would

result in a valuation consistent with the Company's current

carrying value as at 31 March 2023.

Following this investment, 84% of the Company's portfolio is

either already profitable or is funded to profitability.

Nick Williamson and Richard Watts (co-portfolio managers)

comment:

"Smart has shown tremendous growth since Chrysalis first

invested in 2021. Its innovative and market-leading pensions

technology offers its customers a highly efficient way to provide

retirement solutions to their savers.

By their nature, pension schemes in accumulation - as Smart's

typically are - bring built-in growth in "annuity" type revenues,

which we know from experience tend to be highly sought after by

financial investors. We believe Smart's platform - Keystone - is

highly efficient and should prove very profitable at scale. This

fresh capital will allow Smart to build that scale rapidly,

expanding its AuM by both organic routes, as well as through

M&A.

We believe completing a round of this size, in difficult

fundraising markets, is testament to the attractiveness of the

technology Smart has developed, and reflective of the opportunity

available in a massive market. "

Andrew Evans (Smart Group CEO & co-founder) and Will Wynne

(Smart Group MD & co-founder) comment:

"We are delighted to be closing this Series E funding round,

which we believe will unlock significant future value for Smart's

shareholders, opening up several exciting growth opportunities that

we are currently exploring.

Nick and Richard have been invaluable in helping us to prepare

for and undertake this funding round. Chrysalis has been a staunch

supporter of Smart since it first invested, and this new capital

will allow us to continue to disrupt the $62 trillion global

retirement market."

-ENDS-

For further information, please

contact:

Media +44 (0) 7976 098 139

Montfort Communications: chrysalis@montfort.london

Charlotte McMullen / Toto Reissland

/

Lesley Kezhu Wang

Jupiter Asset Management:

James Simpson +44 (0) 20 3817 1696

Liberum:

Chris Clarke / Darren Vickers

/ Owen Matthews +44 (0) 20 3100 2000

Numis:

Nathan Brown / Matt Goss +44 (0) 20 7260 1000

Maitland Administration (Guernsey)

Limited:

Chris Bougourd +44 (0) 20 3530 3109

LEI: 213800F9SQ753JQHSW24

A copy of this announcement will be available on the Company's

website at https://www.chrysalisinvestments.co.uk

The information contained in this announcement regarding the

Company's investments has been provided by the relevant underlying

portfolio company and has not been independently verified by the

Company. The information contained herein is unaudited.

This announcement is for information purposes only and is not an

offer to invest. All investments are subject to risk. Past

performance is no guarantee of future returns. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment decision.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. Neither the content of the

Company's website, nor the content on any website accessible from

hyperlinks on its website for any other website, is incorporated

into, or forms part of, this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the

Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUFLFVSEIIFLIV

(END) Dow Jones Newswires

May 15, 2023 02:00 ET (06:00 GMT)

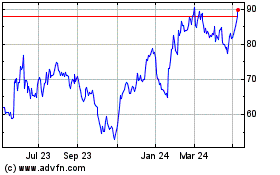

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

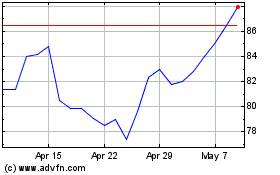

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Apr 2023 to Apr 2024