TIDMCNC

RNS Number : 4777E

Concurrent Technologies PLC

30 June 2023

30 June 2023

Concurrent Technologies Plc

("Concurrent" or the "Company" or the "Group")

Results for the year ended 31 December 2022 and Announcement of

Annual General Meeting

Concurrent Technologies Plc (AIM: CNC), a world leading

specialist in high-end embedded computer products for critical

applications, is pleased to announce its results for the year to 31

December 2022 ("FY22").

Financial Highlights

The global components shortage continued to constrain financial

performance, with management focused on supply chain management to

deliver:

-- Revenue for the year slightly ahead of market expectations at GBP18.3m (2021: GBP20.5m)

-- Gross profit at GBP8.9m (2021: GBP11.4m)

-- Gross margin at 48.6% (2021: 55.9%)

-- EBITDA at GBP2.1m (2021 restated: GBP4.9m)

-- Profit before Tax at GBP0.4m (2021 restated: Profit GBP3.5m)

-- Profit after Tax at GBP1m (2021 restated: GBP2.8m)

-- EPS decreased to 1.35p (2021 restated: 3.84p)

-- Cash in the business at year end GBP4.5m (2021: GBP11.8m)

-- Deliberate use of cash for (i) increased component inventory

to mitigate supply chain issues, and (ii) increased cost base to

create more products and grow the business.

-- Reverting to cash generative as revenues improve in line with

component availability and associated unwinding of inventory

holdings.

-- Prior Period Adjustment to 2020 closing reserves (opening

2021) reduced by GBP1m (closing 2021 by GBP1.1m)

Operational Highlights

-- 80% of order intake was for "new" and "current" products,

whereas in the year to 31 December 2021 ("FY21") 80% was for "last

time buy" or "end of life" products. This is a profound and

necessary transformation, validating the need to focus on enhanced

product development and sales improvement.

-- Eight new products launched.

-- Achieved record order intake of GBP31.5m, surpassing the

prior year of GBP25.2m by 25%, providing excellent revenue

visibility for the future as the availability of components

continues to improve.

-- Received initial purchase orders for Systems.

Prior Period Adjustments

-- Having thoroughly reviewed the application of accounting

policies with the FY22 audit team it has been identified that

historically the Company has over-capitalised development costs.

The effect of this has resulted in adjustments to capitalisation,

amortisation and impairment, ultimately affecting the Net Book

Value of the development assets on the balance sheet. This has also

affected tax and retained earnings, which has resulted in a 2020

restatement of GBP1.1m.

-- The effect of the revised capitalisation has had a minimal

effect on 2021 (+GBP10k to retained earnings), and 2020 had a

positive impact of GBP0.2m.

-- Other Prior Period Adjustments are: leases (understated by an

extension) GBP0.1m; Dilapidations which have been missed previously

GBP0.1m; EPS restated due to incorrect share options previously

included; Financial Instruments note due to erroneous information

previously.

Post Period Highlights

-- Performance in the period to 30 June 2023 ("H1 FY23") is

commensurate with current market expectations and continues to be

limited by key component shortages, which are easing as the year

progresses.

-- Supply chain improvement is evident as the business

transitions into H2 FY23, strengthening confidence in reducing lead

times to customers, and correspondingly improved shipping volumes,

albeit supply chain constraints remain the largest risk to

performance for the remainder of the year.

-- Significant achievements delivered in line with the business strategy in H1 FY23:

-- Execution of a reseller agreement with Alpha Data Parallel

Systems Ltd, enabling the inclusion of their FPGA (Field

Programable Gate Array) cards alongside Concurrent Technologies SBS

(Single Board Computer). Together with the provision of GPGPU

(General Purpose Graphical Processing Until) enabled by the prior

reseller agreement with Eizo Rugged, the Company can now offer a

full range of processing solutions within custom and COTS systems,

enabling access to larger markets and opportunity to more

completely fulfil customer requirements;

-- Launch of the Hermes high-performance processor Plug In Card,

enabling the Company to continue to deliver leading-edge products

to the market, demonstrating the focus on releasing new

products;

-- Execution of a new distribution agreement with CoC-e, who

have deep TSN (Time Sensitive Networking) capability. TSN will now

be a differentiating technical capability in the Company's

portfolio; and

-- Successfully winning the first Systems win in excess of GBP1

million in value since the launch of the revised business

strategy.

-- Order intake expected to be at least in line with prior year,

and therefore the Company will transition into growth as component

supply further improves.

The Company further confirms that its Annual General Meeting

(AGM) will be held on Thursday 24(th) August 2023 at the Company's

offices at Building 1230 (Second Floor), Waterside Drive, Arlington

Business Park, Theale, Berkshire, RG7 4SA at 2:00 p.m. The Notice

of General Meeting will be posted in due course. Shareholders are

encouraged to send in their votes using proxy cards in advance of

the AGM.

Miles Adcock, CEO of Concurrent Technologies Plc, commented:

"2022 was a tough year for the global electronics sector due to

severe constraints on components availability. We entered the year

with a confident strategy for medium to long term growth, and

maintained our focus on targeted investment, partnership, and

transformation. I am proud that we did what we said we would do,

whether launching eight new products, initiating a systems

business, or partnering to enable us to manufacture in the USA. As

a result, we are anticipating a third record year for order intake

in 2023.

The initial progress of our strategy can be seen in the quanta

of order intake, but also that it now contains products and systems

hitherto not part of our portfolio. Additionally, a healthy portion

of our order intake is 'design wins', whereby we benefit from main

production revenue in future years. Our approach to, and appetite

for, securing much larger design wins is building us a solid base

for year-on-year growth. The audit has been a long process this

year, and we have demonstrably resolved unfortunate historic issues

that have existed for some time. Our CFO, Kim Garrod, has done a

great deal to position us for transparent and well-governed

execution in her first year, and we look forward with

confidence."

Enquiries:

Concurrent Technologies Plc

Miles Adcock, CEO +44 (0)1206 752626

Kim Garrod, CFO +44 (0)1206 752626

SEC Newgate (Financial PR)

Bob Huxford +44 (0)20 3757 6880

Alice Cho concurrent@secnewgate.co.uk

Cenkos Securities Plc (NOMAD)

Neil McDonald +44 (0)131 220 9771

Peter Lynch +44 (0)131 220 9772

Extracts from the Strategic Report

Financial 2022 2021 (Restated)

Highlights Revenue GBP18.3m GBP20.5m

========= ================

Gross Profit GBP8.88m GBP11.43m

========= ================

EBITDA GBP2.1m GBP4.9m

========= ================

Profit before tax GBP0.4m GBP3.5m

========= ================

Earnings per share 1.35p 3.84p

========= ================

Dividend per share 0p 2.55p

========= ================

Cash GBP4.5m GBP11.8m

========= ================

Total Assets GBP32.6m GBP29.8m

========= ================

Shareholders' Funds GBP23.2m GBP22.7m

========= ================

The business generated Revenue for the year of GBP18.27m (2021:

GBP20.45m). This converted into Gross Profit of GBP8.88m (2021:

GBP11.43m) whilst the gross margin reduced to 48.6% (2021:

55.9%) reflecting the increased cost of components, created

through the challenges of component supply. We issue a revised

price book every 6 months (since 2022, previously once a year)

to adapt our pricing accordingly. We expect prices to start

to stabilise again as supply becomes more available.

Profit before tax was GBP0.38m (2021 restated: GBP3.45m).

Earnings per share was 1.35 pence (2021 restated: 3.84 pence),

EBITDA (measured as Operating Profit plus Depreciation and

Amortisation) for the Group in 2022 was GBP2.11m (2021 restated:

GBP4.94m). The performance was significantly lower than 2021

as a result of the constraint on our revenue created by the

component supply challenges. We continued to invest in R&D,

talented people and our strategy throughout 2022, and this,

plus reduced gross profit impacted profitability. However,

our backlog is at record levels with a substantial increase

in 2022 order intake. Therefore, revenue will increase once

supply constraints are reduced.

Long-term commitment to R&D continues, spending GBP4.8m in

2022 (2021: GBP3.5m), of which GBP3.7m was capitalised (2021

restated: GBP1.8m). Following full review of all projects,

two projects totalling GBP0.24m have been impaired. Both were

partially impaired in 2020, however on further review in 2022,

a lack of future revenue stream to provide any returns to

the Group became clear and full impairment was undertaken.

A further GBP0.09m was also impaired across several small

projects where future returns were not apparent. These products

are all older products and all costs now impaired refer to

historical costs.

The tax credit in 2022 of GBP0.6m (2021: tax charge GBP0.6m)

is largely the result of our significant investment in R&D.

The Group continues to benefit from R&D tax credits in the

UK and does not anticipate being in a UK cash tax paying position

whilst this incentive continues.

The Group continues to have no debt and its cash balances

at the year-end were GBP4.5m (2021: GBP11.8m). The reduction

in cash is a factor of reduced receipts from revenue and increased

investment in line with strategy. We are confident of improvement

in our cash flow in 2023 as stock unwinds (significant investment

in 2022 to de-risk component challenges), and cash receipts

improve from less constrained revenue. Stock grew considerably

in 2022, with a closing balance of GBP10m (2021: GBP6.4m),

this was as a mitigation against the component challenges,

and has enabled us to be in a better position to deliver revenue

in 2023. This should unwind to a normal level in 2023.

Dividend The Board has agreed no dividend will be paid in 2022, due

to the constrained performance of the business, with a low

profit performance and a significantly reduced cash balance.

Operational During 2022 the Company started shipping several new rugged

Highlights plug-in card products that were based on the latest standards

before competitive alternatives. This enabled the Company

to capitalise on the need for next generation products in,

especially, our home UK and USA markets. To augment our plug

in card products, the Company introduced rugged system level

products that are suitable for deployment in response to a

need from key customers that are looking for application ready

platforms.

Concurrent Technologies Plc continues as an Intel Titanium

Partner during the year, providing the highest level of insight

and product development opportunity.

Future Plans The new financial year of 2023 started with a healthy backlog

and Outlook of GBP26.7M reflecting in part the long-term sales pipeline

the Group enjoys but also in part the willingness of our customers

to order further in advance to provide the maximum opportunity

to manage the supply chain to meet delivery times.

The Group will maintain its policy of investing in R&D to

expand its current range of advanced technology products broadening

out to include deployable systems and integration of third-party

products to complement the hardware and software already developed

internally.

The Board sees opportunities to grow the business organically

by broadening the range of both hardware, software and systems

products within its existing core markets of defence and telecommunications.

In addition, the Board continues to look to recruit key individuals

and skills for both succession and organic growth as well

as for worldwide acquisition opportunities which would assist

the Group in introducing new skills and technologies complementary

and adjacent to its current product ranges. This is with the

aim of increasing the Group's potential share of the total

available market.

Improved product development timescales and cadence, alongside

the introduction of increased production capacity, and development

of system capability, leads the Board to believe the Group

is well positioned to deliver material growth in its main

markets over the coming years. Short term uncertainty in supply

chains will disrupt production in 2023, but the medium-term

outlook is strong, with some good progress milestones achieved

in 2022.

Prior Year We have made certain prior year restatements within the accounts.

Restatement 1) As a result of over capitalisation in previous years an

adjustment has been made to 2021 retained earnings of a GBP1.1m

reduction, representing the reduction in capitalisation of

GBP2.1m with a resulting reduction in accumulated amortisation

of GBP0.7m and an overcharge to the P&L for impairment of

GBP0.3m, resulting in a GBP1.1m reduction in total net book

value (reduction as at 31/12/20 GBP1.1m, with only a minimal

change in 2021).

2) An adjustment to increase the lease right of use asset

and liabilities of GBP0.2m and depreciation of GBP0.1m to

correct the prior position to account for the extension of

the Colchester office lease and correct charges. The impact

to the 2021 profit is a reduction of GBP23k.

3) A dilapidation provision for the Colchester office has

been added, this has increased the PPE asset value and increased

the provisions within the account. The P&L impact in 2021

is an additional charge of GBP0.02m.

4) An adjustment to the weighted average of shares for EPS

has been made. This is a result of certain share options being

included in the calculation incorrectly.

5) Financial instruments have been restated as the total financial

liabilities at amortised cost figure was found to be erroneous,

as it contained items that it should not have contained and

also missed balances that should have been included..

Consolidated Statement of Comprehensive Income

For the year ended 31 December

2022

Year to Year to

31 December 31 December

2022 2021

(restated)

GBP GBP

Revenue 18,274,771 20,450,453

Cost of sales (9,397,449) (9,016,878)

---------------- ---------------

Gross profit 8,877,322 11,433,575

Administrative expenses (8,390,682) (7,896,155)

Operating profit 486,640 3,537,420

Finance costs (104,505) (84,746)

Finance income 546 1,880

Profit before tax 382,681 3,454,554

Tax 604,344 (638,421)

---------------- ---------------

Profit for the year 987,025 2,816,133

================ ===============

Other Comprehensive Income

Amounts which may be reclassified to profit

or loss

Exchange differences on translating foreign

operations 69,463 23,894

Other Comprehensive Income for the year, net

of tax 69,463 23,894

Total Comprehensive Income for the year 1,056,488 2,840,027

================ ===============

Profit for the period attributable to:

---------------- ---------------

Equity holders of the parent 987,025 2,816,133

================ ===============

Total Comprehensive Income attributable to:

---------------- ---------------

Equity holders of the parent 1,056,488 2,840,027

================ ===============

Earnings per share

Basic earnings per share 1.35p 3.84p

Diluted earnings per share 1.35p 3.84p

Consolidated Balance Sheet

For the year ended 31 December

2022

31 December 31 December 31 December

2022 2021 2020

Restated Restated

GBP GBP GBP

ASSETS

Non-current assets

Intangible assets 8,807,290 6,621,166 6,124,291

Property, plant and equipment 2,685,107 1,618,463 1,922,991

Deferred tax assets 350,753 24,139 112,532

11,843,150 8,263,768 8,159,814

Current assets

Inventories 10,090,437 6,425,436 5,533,574

Trade and other receivables 5,439,912 2,988,633 2,356,157

Current tax assets 762,545 258,622 232,988

Cash and cash equivalents 4,512,720 11,839,758 11,765,974

20,805,614 21,512,449 19,888,693

Total assets 32,648,764 29,776,217 28,048,507

------------ ------------ ------------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 2,126,588 1,873,249 1,236,321

Trade and other payables 1,257,820 805,481 909,101

Long term provisions 304,336 223,940 213,792

3,688,744 2,902,670 2,359,214

Current liabilities

Trade and other payables 5,765,262 4,169,672 3,832,367

Short term provisions 18,256 19,300 16,354

Current tax liabilities - 4,817 26,504

5,783,518 4,193,789 3,875,225

Total liabilities 9,472,262 7,096,459 6,234,439

------------ ------------ ------------

Net assets 23,176,502 22,679,758 21,814,068

============ ============ ============

EQUITY

Capital and reserves

Share capital 739,000 739,000 739,000

Share premium account 3,699,105 3,699,105 3,699,105

Capital redemption reserve 256,976 256,976 256,976

Cumulative translation

reserve (27,936) (97,399) (121,293)

Profit and loss account 18,509,357 18,082,076 17,240,280

Equity attributable to

equity holders of the parent 23,176,502 22,679,758 21,814,068

------------ ------------ ------------

Total equity 23,176,502 22,679,758 21,814,068

============ ============ ============

Consolidated Cash Flow Statement

Year to Year to

31 December 31 December

2022 2021

(restated)

GBP GBP

Cash flows from operating activities

Profit before tax for the period 382,681 3,454,554

Adjustments for:

Finance income (546) (1,880)

Finance costs 104,505 84,746

Depreciation 422,047 294,132

Amortisation 1,197,972 1,111,300

Impairment loss 327,526 509,955

Loss on disposal of property, plant and

equipment (PPE) - 27,401

Share-based payment 219,363 12,963

Exchange differences 82,384 46,623

(Increase) in inventories (3,665,001) (891,862)

(Increase) in trade and other receivables (2,451,279) (632,476)

Increase in trade and other payables 2,222,123 354,297

----------- -----------

Cash generated from operations (1,158,225) 4,369,753

Tax received / (paid) 267,884 (40,274)

----------- -----------

Net cash generated from operating activities (890,341) 4,329,479

----------- -----------

Cash flows from investing activities

Interest received 546 1,880

Purchases of property, plant and equipment

(PPE) (1,480,394) (185,878)

Sale of property, plant and equipment (PPE) - 1,500

Capitalisation of development costs and purchases

of intangible assets (3,711,617) (1,950,245)

----------- -----------

Net cash used in investing activities (5,191,465) (2,132,743)

Cash flows from financing activities

Equity dividends paid (1,027,088) (1,907,447)

Repayment of leasing liabilities (94,842) (107,519)

Interest paid (104,505) (84,746)

Sale of treasury shares 2,425 -

----------- -----------

Net cash used in financing activities (1,224,010) (2,099,712)

Effects of exchange rate changes on cash and

cash equivalents (21,222) (23,240)

Net (decrease)/increase in cash (7,327,038) 73,784

Cash at beginning of period 11,839,758 11,765,974

----------- -----------

Cash at the end of the period 4,512,720 11,839,758

=========== ===========

Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

Profit

Capital Cumulative and loss Total

Share Share Redemption Translation account Equity

capital premium reserve reserve (restated) (restated)

GBP GBP GBP GBP GBP GBP

Balance at 1

January 2021 (as

previously stated) 739,000 3,699,105 256,976 (121,293) 18,271,819 22,845,607

Impact of prior

period adjustments - - - - (1,031,539) (1,031,539)

Balance at 1

January 2021 (restated) 739,000 3,699,105 256,976 (121,293) 17,240,280 21,814,068

Profit for the

period (restated) - - - - 2,816,133 2,816,133

Exchange differences

on translating

foreign operations - - - 23,894 - 23,894

--------- ---------- ------------ ------------- ------------ ------------

Total comprehensive

income for the

period (restated) - - - 23,894 2,816,133 2,840,027

Share-based payment - - - - 12,963 12,963

Deferred tax on

share based payment - - - - (79,852) (79,852)

Dividends paid - - - - (1,907,447) (1,907,447)

Balance at 31

December 2021

(restated) 739,000 3,699,105 256,976 (97,399) 18,082,077 22,679,759

========= ========== ============ ============= ============ ============

As at 31 December

2021 (reported) 739,000 3,699,105 256,976 (97,399) 19,142,917 23,740,599

Prior year adjustment - - - - (1,060,841) (1,060,841)

Balance at 31

December 2021

(restated) 739,000 3,699,105 256,976 (97,399) 18,082,076 22,679,758

Profit for the

period - - - - 987,025 987,025

Exchange differences

on translating

foreign operations - - - 69,463 - 69,463

--------- ---------- ------------ ------------- ------------ ------------

Total comprehensive

income for the

period - - - 69,463 987,025 1,056,488

Share-based payment - - - - 219,363 219,363

Deferred tax on

share based payment - - - - 245,555 245,555

Dividends paid - - - - (1,027,088) (1,027,088)

Sale/Purchase

of treasury shares - - - - 2,425 2,425

Balance at 31

December 2022 739,000 3,699,105 256,976 (27,936) 18,509,357 23,176,502

========= ========== ============ ============= ============ ============

NOTES

1. The Group financial statements consolidate those of the

Company and its subsidiaries (together referred to as the 'Group').

The financial information set out in these preliminary results has

been prepared in accordance with international accounting standards

in conformity with the requirements of the Companies Act 2006. The

accounting policies adopted in this results announcement have been

consistently applied to all the years presented.

2. The financial information set out above does not constitute

the Group's statutory accounts for the years ended 31 December 2022

or 2021, but is derived from those accounts. Statutory accounts for

2021 have been delivered to the Registrar of Companies and those

for 2022 are being delivered today. The auditors have reported on

2022 accounts; their report includes a qualified opinion and did

not contain statements under section 498(2) or (3) of the Companies

Act 2006.

3. The calculation of basic earnings per share is based on the

weighted average number of Ordinary Shares in issue during 2022 of

73,363,490 (2021 restated: 73,363,490) after adjustment for

treasury shares on the profit after tax for 2022 of GBP987,025

(2021 restated: GBP2,816,133). The calculation of diluted earnings

per share is the same as for basic earnings per share.

4. The AGM will be held on Thursday 24 August 2023, at the

Company's offices at Building 1230 (Second Floor), Waterside Drive,

Arlington Business Park, Theale, Berkshire, RG7 4SA.

Copies of the Annual Report will be sent to Shareholders and

will also be available from the Company's Registered Office: 4

Gilberd Court, Newcomen Way, Colchester, Essex, CO4 9WN, UK, and on

the Company's website: www.gocct.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FMMMTMTIJMTJ

(END) Dow Jones Newswires

June 30, 2023 02:00 ET (06:00 GMT)

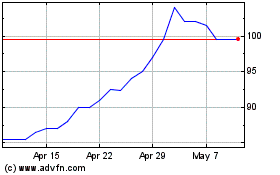

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Dec 2023 to Dec 2024