TIDMCORA

RNS Number : 4384N

Cora Gold Limited

25 September 2023

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

25 September 2023

Cora Gold Limited

('Cora' or 'the Company')

Interim Results for the Six Months Ended 30 June 2023

Cora Gold Limited, the West African focused gold company, is

pleased to announce its unaudited interim results for the six

months ended 30 June 2023.

Highlights

-- During H1 2023:

-- Closed a fundraising for aggregate investments of over

US$19.8 million (see announcement dated 10 March 2023),

comprising:

-- an Equity Financing through the issue of 80,660,559 ordinary

shares of no par value in the capital of the Company ('Ordinary

Shares') at a price of US$0.0487 per Ordinary Share for total gross

proceeds of US$3,928,169.26; plus

-- a Convertible Financing through the issue of convertible loan

notes ('CLN') convertible into Ordinary Shares for a total of

US$15,875,000.

-- Entered into a mandate letter to appoint Atlantique Finance

to act as sole adviser in the structuring and mobilisation of a

medium-term loan of US$70 million in CFA franc ('XOF') to support

funding the development of Cora's flagship Sanankoro Gold Project

in south Mali (see announcement dated 28 June 2023).

-- As at 30 June 2023, the balance of cash and cash equivalents was over US$18.4 million.

-- Post period end, confirmed the extension of certain

convertible loan rights due to mature on 09 September 2023 and as a

result the CLN issued by the Company on 13 March 2023 have an

extended maturity date of 12 March 2024 (see announcement dated 11

September 2023). As at the date of this announcement, the Company

had an unsecured obligation in relation to issued and outstanding

CLN for a total of US$15,250,000, being convertible into Ordinary

Shares in accordance with the Convertible Loan Note Instrument

dated 28 February 2023 as amended.

Bert Monro, Chief Executive Officer of Cora, commented, "I am

very pleased with the ongoing support received from the Company's

long-term shareholders and holders of CLN. Following the recent

promulgation of a new Mining Code in Mali, we look forward to the

government's lifting of its moratorium on issuing new mining

permits such that we may, in due course, progress application for a

mining permit over Cora's flagship Sanankoro Gold Project. In

addition, we look forward to providing progress updates on the

funding of the Sanankoro Gold Project following the appointment of

Atlantique Finance to act as sole adviser in the structuring and

mobilisation of a medium-term loan of US$70 million to support

funding the development of the project."

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement.

For further information, please visit http://www.coragold.com or

contact:

Bert Monro Cora Gold Limited info@coragold.com

Craig Banfield

Cavendish Capital Markets

Derrick Lee Limited

Charlie Beeson (Nomad & Broker) +44 (0)20 7220 0500

---------------------------- ---------------------

Susie Geliher St Brides Partners pr@coragold.com

Isabelle Morris (Financial PR)

Isabel de Salis

---------------------------- ---------------------

Notes

Cora is a West African gold developer with de-risked project

areas within two known gold belts in Mali and Senegal. Led by a

team with a proven track-record in making multi-million-ounce gold

discoveries that have been developed into operating mines, its

primary focus is on developing the Sanankoro Gold Project in the

Yanfolila Gold Belt, south Mali, into an open pit oxide mine. Based

on a gold price of US$1,750/oz and a Maiden Probable Reserve of 422

koz at 1.3 g/t Au, the Project has strong economic fundamentals,

including 52% IRR, US$234 million Free Cash Flow over life of mine

and all-in sustaining costs of US$997/oz.

Consolidated Statement of Financial Position

As at 30 June 2023 and 2022, and 31 December 2022

All amounts stated in thousands of United States dollar

30 June 30 June 31 December

2023 2022 2022

Note(s) US$'000 US$'000 US$'000

Unaudited Unaudited

Non-current assets

Intangible assets 3 23,049 23,954 23,826

________ ________ ________

Current assets

Trade and other receivables 4 51 143 91

Cash and cash equivalents 5 18,494 2,022 461

________ ________ ________

18,545 2,165 552

________ ________ ________

Total assets 41,594 26,119 24,378

________ ________ ________

Current liabilities

Trade and other payables 6 (263) (407) (193)

Convertible loan notes 7 (16,360) - -

________ ________ ________

Total liabilities (16,623) (407) (193)

________ ________ ________

Net current assets 1,922 1,758 359

________ ________ ________

Net assets 24,971 25,712 24,185

________ ________ ________

Equity and reserves

Share capital 8 31,541 28,202 28,202

Retained deficit (6,570) (2,490) (4,017)

________ ________ ________

Total equity 24,971 25,712 24,185

________ ________ ________

The notes form an integral part of the Condensed Consolidated

Financial Statements.

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023 and 2022, and the year

ended 31 December 2022

All amounts stated in thousands of United States dollar (unless

otherwise stated)

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Note(s) US$'000 US$'000 US$'000

Unaudited Unaudited

Expenses

Overhead costs (593) (951) (1,502)

Finance costs (485) - -

Impairment of intangible assets 3 (1,777) (3) (1,012)

________ ________ ________

(2,855) (954) (2,514)

________ ________ ________

Other income

Interest income 243 - -

________ ________ ________

243 - -

________ ________ ________

Loss before income tax (2,612) (954) (2,514)

Income tax - - -

________ ________ ________

Loss for the period (2,612) (954) (2,514)

Other comprehensive income - - -

________ ________ ________

Total comprehensive loss for the (2,612) (954) (2,514)

period ________ ________ ________

Earnings per share from continuing

operations attributable to owners

of the parent

Basic and fully diluted earnings

per share 2 (0.0077) (0.0033) (0.0087)

(United States dollar) ________ ________ ________

The notes form an integral part of the Condensed Consolidated

Financial Statements.

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023 and 2022, and the year

ended 31 December 2022

All amounts stated in thousands of United States dollar

Share Retained Total

capital deficit equity

US$'000 US$'000 US$'000

As at 01 January 2022 28,202 (1,614) 26,588

________ ________ ________

Loss for the year - (2,514) (2,514)

________ ________ ________

Total comprehensive loss for the - (2,514) (2,514)

year ________ ________ ________

Share based payments - share options - 111 111

________ ________ ________

Total transactions with owners,

recognised directly in equity - 111 111

________ ________ ________

As at 31 December 2022 28,202 (4,017) 24,185

________ ________ ________

Unaudited

As at 01 January 2022 28,202 (1,614) 26,588

________ ________ ________

Loss for the period - (954) (954)

________ ________ ________

Total comprehensive loss for - (954) (954)

the period ________ ________ ________

Share based payments - share - 78 78

options ________ ________ ________

Total transactions with owners,

recognised directly in equity - 78 78

________ ________ ________

As at 30 June 2022 Unaudited 28,202 (2,490) 25,712

________ ________ ________

Share Retained Total

capital deficit equity

US$'000 US$'000 US$'000

Unaudited

As at 01 January 2023 28,202 (4,017) 24,185

________ ________ ________

Loss for the period - (2,612) (2,612)

________ ________ ________

Total comprehensive loss for the - (2,612) (2,612)

period ________ ________ ________

Proceeds from shares issued 3,928 - 3,928

Issue costs (589) - (589)

Share based payments - share options - 59 59

________ ________ ________

Total transactions with owners,

recognised directly in equity 3,339 59 3,398

________ ________ ________

As at 30 June 2023 Unaudited 31,541 (6,570) 24,971

________ ________ ________

The notes form an integral part of the Condensed Consolidated

Financial Statements.

Consolidated Statement of Cash Flows

For the six months ended 30 June 2023 and 2022, and the year

ended 31 December 2022

All amounts stated in thousands of United States dollar

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Note(s) US$'000 US$'000 US$'000

Unaudited Unaudited

Cash flows from operating activities

Loss for the period (2,612) (954) (2,514)

Adjustments for:

Share based payments - share options 59 78 111

Finance costs 485 - -

Impairment of intangible assets 3 1,777 3 1,012

Decrease in trade and other receivables 40 65 117

Increase / (decrease) in trade and 70 (163) (377)

other payables ________ ________ ________

Net cash used in operating activities (181) (971) (1,651)

________ ________ ________

Cash flows from investing activities

Additions to intangible assets 3 (1,000) (2,383) (3,264)

________ ________ ________

Net cash used in investing activities (1,000) (2,383) (3,264)

________ ________ ________

Cash flows from financing activities

Proceeds from convertible loan notes

issued 7 15,875 - -

Proceeds from shares issued 8 3,928 - -

Issue costs 8 (589) - -

________ ________ ________

Net cash generated from financing 19,214 - -

activities ________ ________ ________

Net increase / (decrease) in cash

and cash equivalents 18,033 (3,354) (4,915)

Cash and cash equivalents at beginning 5 461 5,376 5,376

of period ________ ________ ________

Cash and cash equivalents at end of 5 18,494 2,022 461

period ________ ________ ________

The notes form an integral part of the Condensed Consolidated

Financial Statements.

Notes to the Condensed Consolidated Financial Statements

For the six months ended 30 June 2023 and 2022, and the year

ended 31 December 2022

All tabulated amounts stated in thousands of United States

dollar (unless otherwise stated)

1. General information

The principal activity of Cora Gold Limited ('the Company') and

its subsidiaries (together the 'Group') is the exploration and

development of mineral projects, with a primary focus in West

Africa. The Company is incorporated and domiciled in the British

Virgin Islands. The address of its registered office is Rodus

Building, Road Reef Marina, P.O. Box 3093, Road Town, Tortola

VG1110, British Virgin Islands.

The condensed consolidated interim financial statements of the

Group for the six months ended 30 June 2023 comprise the results of

the Group and have been prepared in accordance with AIM Rules for

Companies. As permitted, the Company has chosen not to adopt IAS 34

'Interim Financial Reporting' in preparing these interim financial

statements.

The condensed consolidated interim financial statements for the

period 01 January to 30 June 2023 are unaudited. In the opinion of

the directors the condensed consolidated interim financial

statements for the period present fairly the financial position,

and results from operations and cash flows for the period in

conformity with generally accepted accounting principles

consistently applied. The condensed consolidated interim financial

statements incorporate unaudited comparative figures for the

interim period 01 January to 30 June 2022 and extracts from the

audited consolidated financial statements for the year ended 31

December 2022.

The interim report has not been audited or reviewed by the

Company's auditor.

With the exception of the accounting policy set out below

regarding convertible loan notes and related accounting judgements,

the key risks and uncertainties and critical accounting estimates

remain unchanged from 31 December 2022 and the accounting policies

adopted are consistent with those used in the preparation of its

financial statements for the year ended 31 December 2022.

Accounting policy - convertible loan notes

The convertible loan notes, convertible into ordinary shares in

the capital of the Company, issued during the six months ended 30

June 2023 are not for a fixed number of ordinary shares and in the

event that they are not converted then repayment is in cash. In

accordance with IAS 32 'Financial Instruments: Presentation' the

Company's convertible loan notes are classified as financial

liability instruments. Proceeds from the issue of convertible loan

notes are recognised as debt until such time as they are converted

either at the election of the holder or when certain preconditions

are satisfied when they become recognised as equity. See Note 7 for

further details regarding the convertible loan notes.

As at 30 June 2023 and 2022, and 31 December 2022 the Company

held:

-- a 100% shareholding in Cora Gold Mali SARL (registered in the

Republic of Mali; the address of its registered office is Rue 224

Porte 1279, Hippodrome 1, BP 2788, Bamako, Republic of Mali);

-- a 100% shareholding in Cora Exploration Mali SARL (the

address of its registered office is Rue 224 Porte 1279, Hippodrome

1, BP 2788, Bamako, Republic of Mali);

-- a 95% shareholding in Sankarani Ressources SARL (the address

of its registered office is Rue 841 Porte 202, Faladie SEMA, BP

366, Bamako, Republic of Mali). The remaining 5% of Sankarani

Ressources SARL can be purchased from a third party for US$1

million; and

-- Cora Resources Mali SARL (registered in the Republic of Mali;

the address of its registered office is Rue 841 Porte 202, Faladie

SEMA, BP 366, Bamako, Republic of Mali) was a wholly owned

subsidiary of Sankarani Ressources SARL.

2. Earnings per share

The calculation of the basic and fully diluted earnings per

share attributable to the equity shareholders is based on the

following data:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

Net loss attributable to equity shareholders (2,612) (954) (2,514)

_______ _______ _______

Weighted average number of shares for

the purpose of 338,577 289,557 289,557

basic and fully diluted earnings per _______ _______ _______

share (000's)

Basic and fully diluted earnings per

share (0.0077) (0.0033) (0.0087)

(United States dollar) _______ _______ _______

As at 30 June 2023, 2022 and 31 December 2022 the Company's

issued and outstanding capital structure comprised a number of

ordinary shares and share options (see Note 8).

3. Intangible assets

Intangible assets relate to exploration and evaluation project

costs capitalised as at 30 June 2023 and 2022, and 31 December

2022, less impairment.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

As at 01 January 23,826 21,574 21,574

Additions 1,000 2,383 3,264

Impairment (1,777) (3) (1,012)

_______ _______ _______

As at period end 23,049 23,954 23,826

_______ _______ _______

Additions to project costs during the six months ended 30 June

2023 and 2022, and the year ended 31 December 2022 were in the

following geographical areas:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

Mali 984 2,376 3,256

Senegal 16 7 8

_______ _______ _______

Additions to project costs 1,000 2,383 3,264

_______ _______ _______

Impairment of project costs during the six months ended 30 June

2023 and 2022, and the year ended 31 December 2022 relate to the

following terminated projects:

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

Siékorolé (Yanfolila Project

Area, Mali) 791 - -

Tékélédougou (Yanfolila

Project Area, Mali) 514 - -

Farassaba II (Yanfolila Project Area,

Mali) 414 - -

Farani (Yanfolila Project Area, Mali) 53 - -

Tagan (Yanfolila Project Area, Mali) 5 - 891

Winza (Yanfolila Project Area, Mali) - 2 5

Kakadian (Kenieba Project Area, Mali

/ Senegal) - 1 -

Satifara Sud (Kenieba Project Area, - - 116

Mali / Senegal) _______ _______ _______

Impairment of project costs 1,777 3 1,012

_______ _______ _______

Cora's primary focus is on further developing the Sanankoro Gold

Project in Mali and following a review of projects in 2023 the

board of directors decided to terminate all projects in the

Yanfolila Project Area (Mali), being the Farani, Farassaba III,

Siékorolé and Tékélédougou permits. In previous periods, other

projects which were terminated were considered by the directors to

be no longer prospective.

Project costs capitalised as at 30 June 2023 and 2022, and 31

December 2022 related to the following geographical areas:

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

Mali 22,525 23,447 23,318

Senegal 524 507 508

_______ _______ _______

As at period end 23,049 23,954 23,826

_______ _______ _______

4. Trade and other receivables

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

Other receivables - 107 -

Prepayments and accrued income 51 36 91

_______ _______ _______

51 143 91

_______ _______ _______

5. Cash and cash equivalents

Cash and cash equivalents held as at 30 June 2023 and 2022, and

31 December 2022 were in the following currencies:

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

United States dollar (US$) 18,371 7 5

British pound sterling (GBPGBP) 77 1,800 421

CFA franc (XOF) 45 214 34

Euro (EUREUR) 1 1 1

_______ _______ _______

18,494 2,022 461

_______ _______ _______

6. Trade and other payables

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

Trade payables 170 215 58

Other payables - 34 30

Accruals 93 158 105

_______ _______ _______

263 407 193

_______ _______ _______

7. Convertible loan notes

30 June 30 June 31 December

2023 2022 2022

US$'000 US$'000 US$'000

Unaudited Unaudited

Convertible loan notes 16,360 - -

_______ _______ _______

16,360 - -

_______ _______ _______

On 13 March 2023 the Company closed a subscription for:

-- 80,660,559 ordinary shares in the capital of the Company at a

price of US$0.0487 per ordinary share for total gross proceeds of

US$3,928,169.26 (see Note 8); and

-- convertible loan notes ('CLN' or 'Convertible Loan Notes')

convertible into ordinary shares in the capital of the Company in

accordance with the Convertible Loan Note Instrument dated 28

February 2023 for a total of US$15,875,000

(together the 'Fundraising'). Certain directors of the Company

participated in this Fundraising.

As at 30 June 2023 the Company had an unsecured obligation in

relation to issued and outstanding Convertible Loan Notes for a

total of US$15,875,000, being convertible into ordinary shares in

accordance with the Convertible Loan Note Instrument dated 28

February 2023. These Convertible Loan Notes were issued on 13 March

2023 and have a maturity date of 09 September 2023. In the event

that any Convertible Loan Notes are not converted on or prior to

their maturity date then such Convertible Loan Notes are repayable

at a 5% premium to the total amount outstanding under the CLN. As

at 30 June 2023 finance costs of US$485,000 have been accrued in

respect of the 5% premium.

The Convertible Loan Note Instrument dated 28 February 2023 sets

out the terms of the CLN, which are principally as follows:

-- Maturity Date: 09 September 2023.

-- Coupon: 0%.

-- Mandatory Conversion: In the event of conclusion of

definitive binding agreements in respect of senior debt for the

Sanankoro Gold Project and such agreements being unconditional:

-- on or prior to 11 June 2023, at the lower of (a) US$0.0596

per ordinary share, (b) the market price per ordinary share as at

the date of the Mandatory Conversion and (c) the price of any

equity issuance by the Company in the prior 60 days (excluding

shares issued pursuant to the Company's Share Option Scheme or

pursuant to terms of any other agreement entered into prior to 13

March 2023);

-- after 11 June 2023, at the lower of (a) US$0.0542 per

ordinary share, (b) the market price per ordinary share as at the

date of the Mandatory Conversion and (c) the price of any equity

issuance by the Company in the prior 60 days (excluding shares

issued pursuant to the Company's Share Option Scheme or pursuant to

terms of any other agreement entered into prior to 13 March

2023).

-- Voluntary Conversion: At the election of the holder at any

time after 11 June 2023, at US$0.0569 per ordinary share.

-- Repayment: Repayable on Maturity Date, if not converted, or

earlier, at the option of the holder, in the case of a (i) a change

of control of the Company (ii) the merger or sale of the Company

(including the sale of substantially all of the assets), at a 5%

premium to the total amount outstanding under the CLN.

-- Other: CLN are issued fully paid in amount and are fully transferable.

In addition, holders of CLN issued on 13 March 2023 were granted

proportionate participation in a Net Smelter Royalty ('NSR') of 1%

in respect of all ores, minerals, metals and materials containing

gold mined and sold or removed from the Sanankoro Gold Project,

until 250,000 ozs of gold has been produced and sold from the

Sanankoro Gold Project, provided that the Company may purchase and

terminate the NSR, in full and not in part, at any time for a value

of US$3 million.

Prior to the maturity date of 09 September 2023 for the

Convertible Loan Notes issued on 13 March 2023 for a total of

US$15,875,000, the holders of CLN approved amendments to the

Convertible Loan Note Instrument dated 28 February 2023 (see Note

12).

8. Share capital

The Company is authorised to issue an unlimited number of no par

value shares of a single class.

As at 31 December 2021 the Company's issued and outstanding

capital structure comprised:

-- 289,557,159 ordinary shares;

-- share options over 1,225,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022;

-- share options over 4,950,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023;

-- share options over 4,600,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025; and

-- share options over 6,650,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026.

During the six months ended 30 June 2022:

-- on 14 May 2022 share options over 100,000 ordinary shares in

the capital of the Company exercisable at 10.5 pence (British pound

sterling) per ordinary share expiring on 08 December 2026 were

cancelled.

As at 30 June 2022 the Company's issued and outstanding capital

structure comprised:

-- 289,557,159 ordinary shares;

-- share options over 1,225,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022;

-- share options over 4,950,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023;

-- share options over 4,600,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025; and

-- share options over 6,550,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026.

During the six months ended 31 December 2022:

-- on 18 December 2022 share options over 1,225,000 ordinary

shares in the capital of the Company exercisable at 16.5 pence

(British pound sterling) per ordinary share expired.

As at 31 December 2022 the Company's issued and outstanding

capital structure comprised:

-- 289,557,159 ordinary shares;

-- share options over 4,950,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023;

-- share options over 4,600,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025; and

-- share options over 6,550,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026.

During the six months ended 30 June 2023:

-- on 13 March 2023:

-- the Company closed a subscription for:

-- 80,660,559 ordinary shares in the capital of the Company at a

price of US$0.0487 per ordinary share for total gross proceeds of

US$3,928,169.26; and

-- Convertible Loan Notes convertible into ordinary shares in

the capital of the Company in accordance with the Convertible Loan

Note Instrument dated 28 February 2023 for a total of US$15,875,000

(see Note 7)

(together the 'Fundraising'). Certain directors of the Company

participated in this Fundraising.

-- the board of directors granted and approved share options

over 14,350,000 ordinary shares in the capital of the Company

exercisable at 4 pence (British pound sterling) per ordinary share

expiring on 13 March 2028.

As at 30 June 2023 the Company's issued and outstanding capital

structure comprised:

-- 370,217,718 ordinary shares;

-- share options over 4,950,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023;

-- share options over 4,600,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025;

-- share options over 6,550,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026; and

-- share options over 14,350,000 ordinary shares in the capital

of the Company exercisable at 4 pence (British pound sterling) per

ordinary share expiring on 13 March 2028.

In addition, the Company had an unsecured obligation in relation

to issued and outstanding Convertible Loan Notes for a total of

US$15,875,000 (see Note 7).

Movements in capital during the six months ended 30 June 2023

and 2022, and the year ended 31 December 2022 were as follows:

Share options

over number of ordinary shares

(exercise price per ordinary share;

expiring date)

Number 16.5 pence; 8.5 pence; 10 pence; 10.5 pence; 4 pence;

of ordinary 18 December 09 October 12 October 08 December 13 March Proceeds

shares 2022 2023 2025 2026 2028 US$'000

As at 01 January

2022 289,557,159 1,225,000 4,950,000 4,600,000 6,650,000 - 28,202

Cancellation of - - - - (100,000) - -

share options __________ _________ _________ _________ _________ _________ _______

As at 30 June 2022

Unaudited 289,557,159 1,225,000 4,950,000 4,600,000 6,550,000 - 28,802

Expiry of share - (1,225,000) - - - - -

options __________ _________ _________ _________ _________ _________ _______

As at 31 December

2022 289,557,159 - 4,950,000 4,600,000 6,550,000 - 28,202

Subscription 80,660,559 - - - - - 3,928

Issue costs - - - - - - (589)

Granting of share - - - - - 14,350,000 -

options __________ _________ _________ _________ _________ _________ _______

As at 30 June 2023 370,217,718 - 4,950,000 4,600,000 6,550,000 14,350,000 31,541

Unaudited __________ _________ _________ _________ _________ _________ _______

9. Ultimate controlling party

The Company does not have an ultimate controlling party.

As at 30 June 2023 the Company's largest shareholder was

Brookstone Business Inc ('Brookstone') which held 103,329,906

ordinary shares, being 27.91% of the total number of ordinary

shares issued and outstanding. Brookstone is wholly owned and

controlled by First Island Trust Company Ltd as Trustee of The Nodo

Trust, being a discretionary trust with a broad class of potential

beneficiaries. Patrick Quirk, father of Paul Quirk (Non-Executive

Director of the Company), is a potential beneficiary of The Nodo

Trust.

Brookstone, Key Ventures Holding Ltd and Paul Quirk

(Non-Executive Director of the Company) (collectively the

'Investors'; as at 30 June 2023 their aggregated shareholdings

being 31.60% of the total number of ordinary shares issued and

outstanding) have entered into a Relationship Agreement on 18 March

2020 to regulate the relationship between the Investors and the

Company on an arm's length and normal commercial basis. In the

event that Investors' aggregated shareholdings becomes less than

30% then the Relationship Agreement shall terminate. Key Ventures

Holding Ltd is wholly owned and controlled by First Island Trust

Company Ltd as Trustee of The Sunnega Trust, being a discretionary

trust of which Paul Quirk (Non-Executive Director of the Company)

is a potential beneficiary.

10. Contingent liabilities

A number of the Company's project areas have potential net

smelter return royalty obligations, together with options for the

Company to buy out the royalty. At the current stage of

development, it is not considered that the outcome of these

contingent liabilities can be considered probable or reasonably

estimable and hence no provision has been recognised in the

financial statements.

11. Capital commitments

During 2020 and 2021 the Company entered into contracts with a

number of contractors in respect of a Definitive Feasibility Study

('DFS') for the Sanankoro Gold Project. Total estimated costs in

respect of the DFS contractors were approximately US$2,067,000. As

at 30 June 2022, under the terms of the contracts, the Company had

incurred costs of approximately US$1,990,000. The DFS was completed

in 2022.

12. Events after the reporting date

Prior to the maturity date of 09 September 2023 for the

Convertible Loan Notes issued on 13 March 2023 for a total of

US$15,875,000, the holders of CLN approved amendments to the

Convertible Loan Note Instrument dated 28 February 2023 (see Note

7). These amendments resulted in the following principal changes to

the terms of the CLN:

-- Maturity Date: 12 March 2024.

-- Mandatory Conversion: In the event of conclusion of

definitive binding agreements in respect of senior debt for the

Sanankoro Gold Project and such agreements being unconditional:

-- after 09 September 2023, at the lower of (a) US$0.0487 per

ordinary share, (b) the market price per ordinary share as at the

date of the Mandatory Conversion and (c) the price of any equity

issuance by the Company in the prior 60 days (excluding shares

issued pursuant to the Company's Share Option Scheme or pursuant to

terms of any other agreement entered into prior to 13 March

2023).

-- Voluntary Conversion: At the election of the holder at any

time after 09 September 2023, at US$0.0487 per ordinary share.

-- Early Repayment: prior to 09 September 2023, holders of CLN

may elect to request the early repayment of outstanding CLN which

shall be redeemed by the Company for par value of the principal

amount of the CLN plus 5% of the principal amount of the CLN.

The other terms of the CLN, including Coupon and Repayment,

remain unchanged.

Following the above amendments to the Convertible Loan Note

Instrument dated 28 February 2023 certain holders of CLN requested

the early repayment of outstanding CLN for a total principal amount

of US$625,000 plus 5% premium. Accordingly, as at the date of these

condensed consolidated interim financial statements, the Company

had an unsecured obligation in relation to issued and outstanding

CLN for a total of US$15,250,000, being convertible into ordinary

shares in accordance with the Convertible Loan Note Instrument

dated 28 February 2023 as amended. These CLN were issued on 13

March 2023 and have a maturity date of 12 March 2024.

13. Approval of condensed consolidated interim financial statements

The condensed consolidated interim financial statements were

approved and authorised for issue by the board of directors of Cora

Gold Limited on 22 September 2023.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEUFFLEDSEIU

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

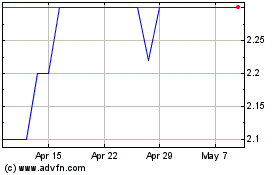

Cora Gold (LSE:CORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cora Gold (LSE:CORA)

Historical Stock Chart

From Apr 2023 to Apr 2024