TIDMCRTM

RNS Number : 7137T

Critical Metals PLC

29 March 2021

Critical Metals plc / EPIC: CRTM / Market: Main Market / Sector:

Closed End Investments

29 March 2021

Critical Metals plc

("Critical Metals" or the "Company")

Interim Results

Critical Metals plc, an investment company established to target

opportunities in the mining sector, is pleased to present its

interim results for the six-month period ended 31st December

2020.

Highlights

-- Listed on the Main Market of the London Stock Exchange in

September 2020, following an GBP0.8m fundraising

-- Engaged in early stage discussions regarding potential future transactions

-- Strand Hanson Limited appointed as Corporate Advisor to guide the Company through the investment/acquisition process in respect of potential targets

-- Post period end, further support received from shareholders

exercising warrants, strengthening the Company's cash position by

c.GBP935,000 in preparation for future opportunities

Chairman's Statement

Critical Metals was formed with the intention of making equity

investments into operators or near-term revenue-generators within

the natural resources sector in the continent of Africa. Our focus

is on commodities which have been identified by several governments

as 'critical minerals', such as antimony, beryllium, caesium,

cobalt, copper, fluorspar, niobium, rare earth elements, tantalum,

titanium, tin, tungsten, and vanadium.

There is increasing uncertainty regarding supply and demand in

the critical metals sector and guaranteeing supply of these metals

is increasingly seen as an economic strategic necessity. This is

the key driver behind the Company's strategy and, over the course

of the period under review, we have been rigorously evaluating a

number of opportunities to ensure that we make the right

acquisition that will build value for shareholders.

Any transaction is deemed likely to be categorised a Reverse

takeover as defined in the Listing Rules and we expect the funding

for any transaction to be derived from existing cash resources, or

the raising of additional capital.

We have now narrowed down our search and are in discussions with

a small number of potential opportunities on which we will provide

further updates on as these discussions progress.

We have experienced further strong support from shareholders in

recent weeks, with the exercise of warrants post period end which

have strengthened our cash position by some GBP935,000,

demonstrating the confidence shareholders have in the Company's

strategy. I am excited about what the second half of the financial

year will hold and a confident that it will be a period of

significant progress for the Company.

Financial Review

For the six months to 31 December 2020, the Company reports a

net loss of GBP152,111 (31 December 2019: GBP17,437). During the

six-month period to 31 December 2020, the Company successfully

completed its admission to the Standard Segment of the Main Market

of the London Stock Exchange, raising gross proceeds of

GBP0.8m.

Directors

The following directors held office during the period:

- Russell Fryer

- Anthony Eastman

- Marcus Edwards-Jones - appointed 29 September 2020

Russell Fryer

Director

26 March 2021

Statement of Comprehensive Income for the 6 months ended 31

December 2020

Notes 6 months 6 months 12 months

to to 31 December to 30 June

31 December 2019 (unaudited) 2020 (audited)

2020 (unaudited)

GBP GBP

----------------------------------- ------ ------------------ ------------------ ----------------

Revenue

Revenue from continuing

operations - - -

------------------ ------------------ ----------------

- - -

Expenditure

Costs associated with listing (64,574) (11,000) (72,172)

Other expenses (87,537) (6,437) (26,121)

------------------ ------------------ ----------------

(152,111) (17,437) (98,293)

Loss on ordinary activities

before taxation (152,111) (17,437) (98,293)

Taxation on loss on ordinary

activities - - -

------------------ ------------------ ----------------

Loss and total comprehensive

income for the year attributable

to the owners of the company (152,111) (17,437) (98,293)

------------------ ------------------ ----------------

Earnings per share (basic

and diluted) attributable

to the equity holders (pence) 3 (0.68) (0.13) (0.71)

------------------ ------------------ ----------------

The statement of comprehensive income has been prepared on the

basis that all operations are continuing operations.

Statement of Financial Position as at 31 December 2020

Notes 31 December 31 December 30 June 2020

2020 (unaudited) 2019 (unaudited) (audited)

GBP GBP GBP

------------------------------ ------ ------------------ ------------------ -------------

CURRENT ASSETS

Trade and other receivables 24,483 1,900 417

Cash at bank and in

hand 630,148 34,342 62,072

------------------ ------------------ -------------

654,631 36,242 62,489

------------------ ------------------ -------------

TOTAL ASSETS 654,631 36,242 62,489

------------------ ------------------ -------------

CURRENT LIABILITIES

Trade and other payables 77,269 6,913 94,016

------------------ ------------------ -------------

TOTAL LIABILITIES 77,269 6,913 94,016

------------------ ------------------ -------------

NET (LIABILITIES)

/ ASSETS 577,362 29,329 (31,527)

------------------ ------------------ -------------

EQUITY

Called up share capital 4 151,503 68,571 71,428

Share premium account 4 749,497 51,429 68,572

Retained earnings (323,638) (90,671) (171,527)

------------------ ------------------ -------------

TOTAL EQUITY 577,362 29,329 (31,527)

------------------ ------------------ -------------

Statement of Changes in Equity for the 6 months to 31 December

2020

Notes Issued

Share Share Retained Total

Capital Premium Earnings Equity

GBP GBP GBP GBP

-------------------------- ------- --------- --------- ---------- ----------

As at 1 July 2019 68,571 51,429 (73,234) 46,766

Total comprehensive loss

for the period - - (17,437) (17,437)

Shares issued during the - - - -

period

--------- --------- ---------- ----------

As at 31 December 2019 68,571 51,429 (90,671) 29,329

--------- --------- ---------- ----------

Total comprehensive loss

for the period - - (80,856) (80,856)

Shares issued during the

period 2,857 17,143 - 20,000

--------- --------- ---------- ----------

As at 30 June 2020 71,428 68,572 (171,527) (31,527)

--------- --------- ---------- ----------

Total comprehensive loss

for the period - - (152,111) (152,111)

Shares issued during the

period 80,075 720,675 - 800,750

Share issue costs - (39,750) - (39,750)

--------- --------- ---------- ----------

As at 31 December 2020 151,503 749,497 (323,638) 577,362

--------- --------- ---------- ----------

Share capital Amount subscribed for share capital at nominal

value.

Share premium Amount subscribed for share capital in excess

of nominal value.

Retained earnings Cumulative other net gains and losses recognised

in the financial statements.

Statement of Cashflow for the 6 months to 31 December 2020

31 December 31 December 30 June

2020 (unaudited) 2019 (unaudited) 2020 (audited)

GBP GBP GBP

------------------------------------ ------------------ ------------------ ----------------

Cash from operating activities

Loss for the year (152,111) (17,437) (98,293)

Adjustments for:

Operating cashflow before

working capital movements

Decrease / (increase) in

trade and other receivables (24,066) 2,636 4,119

(Decrease) / increase in

trade and other payables (16,747) (3,325) 83,778

------------------

Net cash used in operating

activities (192,924) (18,126) (10,396)

------------------ ------------------ ----------------

Cash from financing activities

Proceeds on the issue of

shares 761,000 - 20,000

------------------

Net cash from financing activities 761,000 - 20,000

------------------ ------------------ ----------------

Net increase in cash and

cash equivalents 568,076 (18,126) 9,604

Cash and cash equivalents

at beginning of year 62,072 52,468 52,468

Foreign exchange - - -

------------------ ------------------ ----------------

Cash and cash equivalents

at end of period 630,148 34,342 62,072

------------------ ------------------ ----------------

Notes to the Financial Statements for the 6 months ended 31

December 2020

1. General Information

The condensed consolidated interim financial statements of

Critical Metals plc (the "Company") for the six month period ended

31 December 2020 have been prepared in accordance with Accounting

Standard IAS 34 Interim Financial Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 30 June 2020, which was prepared under International

Financial Reporting Standards (IFRS) as adopted by the European

Union (EU), and any public announcements made by Critical Metals

plc during the interim reporting period and since.

These condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 June 2020 prepared under IFRS have been filed

with the Registrar of Companies. The auditor's report on those

financial statements was unqualified and did not contain a

statement under Section 498(2) of the Companies Act 2006. These

condensed consolidated interim financial statements have not been

audited.

Basis of preparation - going concern

The interim financial statements have been prepared under the

going concern assumption, which presumes that the Group will be

able to meet its obligations as they fall due for the foreseeable

future.

At 31 December 2020 the Group had cash reserves of GBP630,148

(30 June 2020: GBP62,072 / 31 December 2019: GBP34,342).

In assessing whether the going concern assumption is

appropriate, the Directors have taken into account all relevant

information about the current and future position of the Company

over the going concern period of at least 12 months from the date

of approval of the interim financial statements. Critical Metals

plc meets its working capital requirements from its cash and cash

equivalents.

The directors note that COVID-19 has had a significant negative

impact on the global economy. Having prepared budgets and cash flow

forecasts covering the going concern period which have been stress

tested for the negative impact of possible scenarios from COVID-19,

the Directors believe the Group has sufficient resources to meet

its obligations for a period of at least 12 months from the date of

approval of these financial statements.

Taking these matters into consideration, the Directors consider

that the continued adoption of the going concern basis is

appropriate having prepared cash flow forecasts for the relevant

period. The interim financial statements do not reflect any

adjustments that would be required if they were to be prepared

other than on a going concern basis.

Accounting policies

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting period.

Accounting policies that were not relevant in the previous

financial year but are now applicable to the Group are set out

below.

1.1. New and amended standards adopted by the group

A number of new or amended standards became applicable for the

current reporting period. These new/amended standards do not have a

material impact on the Company, and the Company did not have to

change its accounting policies or make retrospective adjustments as

a result of adopting these standards.

2. Segmental analysis

The Company manages its operations in one segment, being seeking

a suitable investment. The results of this segment are regularly

reviewed by the board as a basis for the allocation of resources,

in conjunction with individual investment appraisals, and to assess

its performance.

3. EARNINGS per share

The calculation of the basic and diluted earnings per share is

calculated by dividing the profit or loss for the year by the

weighted average number of ordinary shares in issue during the

year

6 months 6 months 12 months

to 31 December to 31 December to 30 June

2020 2019 2020

------------------------------------ ---------------- ---------------- ------------

Loss for the year from continuing

operations - GBP (152,111) (17,437) (98,293)

Weighted number of ordinary shares

in issue 22,380,252 13,714,286 13,787,666

---------------- ---------------- ------------

Basic earnings per share from

continuing operations - pence (0.68) (0.13) (0.71)

---------------- ---------------- ------------

There is no difference between the diluted loss per share and

the basic loss per share presented. Share options and warrants

could potentially dilute basic earnings per share in the future but

were not included in the calculation of diluted earnings per share

as they are anti-dilutive for the year presented.

4. Share capital and share premium

Number Share Share Total

of Shares Capital Premium GBP

on Issue GBP GBP

----------------------- ---------------------- ---------------------- ----------------------- --------------------

Balance at

30 June

2019 13,714,286 68,571 51,429 120,000

Balance at

31

December

2019 13,714,286 68,571 51,429 120,000

---------------------- ---------------------- ----------------------- --------------------

Ordinary shares of

GBP0.005

each issued at par

on 14 May

2020 571,428 2,857 17,143 20,000

---------------------- ---------------------- ----------------------- --------------------

Balance at

30 June

2020 14,285,714 71,428 68,572 140,000

---------------------- ---------------------- ----------------------- --------------------

Ordinary shares of

GBP0.005

each issued at par

on 29 Sep

2020 16,015,000 80,075 720,675 800,750

Share Issue Expenses

In Period - (39,750) (39,750)

Balance at

31

December

2020 30,300,714 151,503 749,497 901,000

---------------------- ---------------------- ----------------------- --------------------

The Company has only one class of share. All ordinary shares

have equal voting rights and rank pari passu for the distribution

of dividends and repayment of capital.

5. Related party transactions

Remuneration of directors and key management personnel

The remuneration of the Directors during the six-month period to

31 December 2020 amounted to GBP19,000 (31 December 2019:

GBPnil).

Shareholdings in the Company Shares and Warrants held by the

Directors are as follows:

31 December 2020 Shares Warrants

(1)

---------------------------------- ----------- ----------

Russell Fryer 11,221,428 571,428

Anthony Eastman 300,000 1,000,000

Marcus Edwards-Jones - appointed

29 September 2020 - 200,000

----------- ----------

11,521,428 1,771,428

----------- ----------

(1) Exercisable at GBP0.05

31 December 2019 Shares Warrants

---------------------------------- ----------- ---------

Russell Fryer 10,650,000 -

Anthony Eastman 300,000 -

Christopher Ecclestone - resigned

18 March 2020 600,000 -

----------- ---------

11,550,000 -

----------- ---------

6. Events subsequent to PERIOD end

Subsequent to period end, the Company issued 9,809,021 new

ordinary shares as a result of the exercise of 8,900,000 GBP0.10

warrants and 909,021 GBP0.05 warrants resulting in the receipt of

GBP935,451 net funds into the Company.

**ENDS**

For further information on the Company please visit

www.criticalmetals.co.uk or contact:

Russell Fryer Critical Metals plc Tel: +44 (0)20

7236 1177

Rory Murphy / Strand Hanson Limited Tel: +44 (0)20

James Bellman Financial Adviser 7409 3494

Lucy Williams Peterhouse Capital Limited, Tel: +44 (0)20

/ Corporate Broker 7469 0936

Heena Karani Tel: +44 (0)20

7469 0933

Catherine Leftley St Brides Partners Ltd, Tel: +44 (0)20

/ Charlotte Hollinshead Financial PR 7236 1177

About Critical Metals

Critical Metals was formed as an investment company and intends

to make equity investments into operators or near-term production

operators within the natural resources development and production

sector in the continent of Africa. It is envisaged that such

acquisition or acquisitions will trigger a reverse takeover in

accordance with the Listing Rules published by the FCA. The Company

intends to search for acquisition opportunities in the natural

resources sector with known deposits, and more specifically

minerals that are perceived to have strategic importance to future

economic growth. Commodities such as antimony, beryllium, cobalt,

copper, fluorspar, gold, rare earth elements, tin, tungsten,

titanium, and vanadium have been identified by several governments

as 'critical minerals' whereby security of supply is increasingly

seen as a strategic necessity. The Company therefore believes that

the market conditions for these minerals will remain positive in

the short-to-long term.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VQLFLFXLLBBV

(END) Dow Jones Newswires

March 29, 2021 02:00 ET (06:00 GMT)

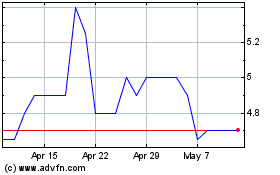

Critical Metals (LSE:CRTM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Critical Metals (LSE:CRTM)

Historical Stock Chart

From Apr 2023 to Apr 2024