Critical Metals PLC Notice of AGM (1368Z)

January 09 2024 - 9:09AM

UK Regulatory

TIDMCRTM

RNS Number : 1368Z

Critical Metals PLC

09 January 2024

Critical Metals plc / EPIC: CRTM / Market: Main Market / Sector:

Closed End Investments

9 January 2024

Critical Metals plc

("Critical Metals" or the "Company")

Notice of AGM / Board Changes and Extension of Warrant Term

Critical Metals plc, a mining company established to acquire

mining opportunities in the critical and strategic metals sector,

currently developing the Molulu copper cobalt mine in the

Democratic Republic of Congo ("DRC"), is pleased to inform

shareholders of its Annual General Meeting which will be held at

11am on 2 February 2024 at the offices of Hill Dickinson LLP, The

Broadgate Tower, 20 Primrose Street, London, EC2A 2EW.

The Company also announces that Mr Anthony Eastman,

Non-executive Director of the Company, has stepped down from the

board effective as at close of business today. Mr Eastman will

continue to be involved with the Company through the Company's

relationship with Orana Corporate LLP, of which Mr Eastman is a

partner, which provides the Company with administrative and

corporate accounting services.

Russell Fryer, CEO of Critical Metals said:

"I would like to thank Anthony for his contribution and support

since the Company was admitted to the Main Market in 2020. Anthony

has not only been a fantastic business partner and advisor but also

is an incredible friend to me. We wish him well in his future

endeavours and look forward to working with him as part of his role

at Orana Corporate LLP".

The Company's Notice of AGM and Forms of Proxy will be

dispatched to shareholders shortly and will be available on the

website at www.criticalmetals.co.uk

In addition, the Company announces the extension of the exercise

period of a total of 2,171,428 warrants held by the Directors that

were exercisable on or before 31 December 2023: (i) 400,000

warrants exercisable at 10 pence per share ("10p Warrants"); and

(ii) 1,771,428 warrants exercisable at 5 pence per share ("5p

Warrants") (together the "IPO Warrants") to 31 March 2024 given the

Company was in a closed period ahead of the expiry date due to the

recently announced capital raise.

These IPO Warrants were granted at the time of admission of the

Company's Ordinary Shares to the standard segment of the Official

List and to trading on the Main Market for listed securities of the

London Stock Exchange plc on 29 September 2020 and were extended in

March 2023 and September 2023. The term of these IPO warrants now

have the same exercise period as the GBP0.40 warrants that were

granted in connection with the Company's Re-Admission to the Main

Market on 12 September 2022 and that were extended in September

2023.

All other terms and conditions of the IPO Warrants remain

unchanged. The extensions of the IPO Warrants are a related party

transactions for the purposes of DTR 7.3.3 as one or more directors

is interested in each of these classes of warrants.

For further information contact:

Critical Metals plc

Russell Fryer, CEO Tel: +44 (0)20 7236

1177

Peterhouse Capital Limited - Tel: +44 (0)20 7469 0936 / +44

Corporate Broker (0)20 7220 9797

Lucy William / Charles Goodfellow

----------------------------------------------------------------------------------

St Brides Partners Ltd

Financial PR

Ana Ribeiro/Isabelle Morris Tel: +44 (0)20 7236 1177

----------------------------------------------------------------------------------

About Critical Metals

Critical Metals PLC has acquired a controlling 100% stake in

Madini Occidental Limited, which holds an indirect 70% interest in

the Molulu copper/cobalt project, an ex-producing medium-scale

asset in the Katangan Copperbelt in the Democratic Republic of

Congo. In line with its investment strategy of focusing primarily

on known deposits, targeting projects with low entry costs and the

potential to generate short-term cash flow; the Company intends to

produce 120,000t/per annum of Copper Oxide Ore.

The Company will continue to identify future assets that are in

line with its stated acquisition objective of low CAPEX and OPEX

projects with near-term production, concentrating on minerals that

are perceived to have strategic importance to future economic

growth and generate significant value for shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOAQKCBKPBKDADK

(END) Dow Jones Newswires

January 09, 2024 10:09 ET (15:09 GMT)

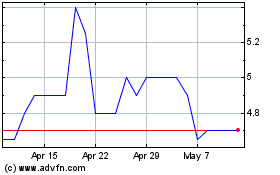

Critical Metals (LSE:CRTM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Critical Metals (LSE:CRTM)

Historical Stock Chart

From Apr 2023 to Apr 2024